Global Embedded SIM (eSIM) Market size was valued at USD 1.10 Bn in 2024 and the total Embedded SIM (eSIM) Market revenue is expected to grow by 21.66% from 2025 to 2032, reaching nearly USD 5.28 Bn by 2032.Embedded SIM (eSIM) Market Overview

An embedded SIM (eSIM) is a programmable chip embedded within devices such as smartphones or tablets during manufacturing. eSIMs, unlike physical SIM cards, enable users to connect to local networks without the need to swap SIM cards by remotely programming them with various mobile network profiles, providing travelers with enhanced convenience and flexibility. An embedded SIM (eSIM) offers unparalleled convenience and flexibility, particularly for travelers, enabling instant connectivity to local mobile networks across multiple countries without the inconvenience of physical SIM cards. The Embedded SIM (eSIM) Market is witnessing significant growth due to its seamless integration and enhanced user experience in global connectivity solutions. With eSIM from providers including Airalo, travelers benefit from prepaid plans with transparent pricing, the freedom to choose the best-suited plan for their needs, and the ability to switch plans seamlessly during their trip. By collaborating with local telecom providers, eSIM users enjoy optimal rates and mobile services while ensuring security, as the eSIM is embedded in the device, reducing the risk of theft.To know about the Research Methodology :- Request Free Sample Report The increasing demand for connected devices across industries such as telecom, automotive, healthcare and electronics helps to boost Embedded SIM (eSIM) Market growth. With the growth of the Internet of Things (IoT), there's a need for easy connectivity solutions. eSIMs solve this by eliminating physical SIM cards and allowing remote setup of SIM profiles. This means devices connect to several networks globally without requiring to switch SIM cards, which is especially useful for IoT devices in different locations. The increasing use of mobile connections in emerging markets and the popularity of smart devices and wearables also contribute to eSIM demand. eSIMs offer better security features such as tamper resistance and remote management, addressing worries about SIM card theft. More people are embracing eSIMs in mobile devices as they provide flexibility in choosing network providers and using mobile services abroad.

Embedded SIM (eSIM) Market Trend

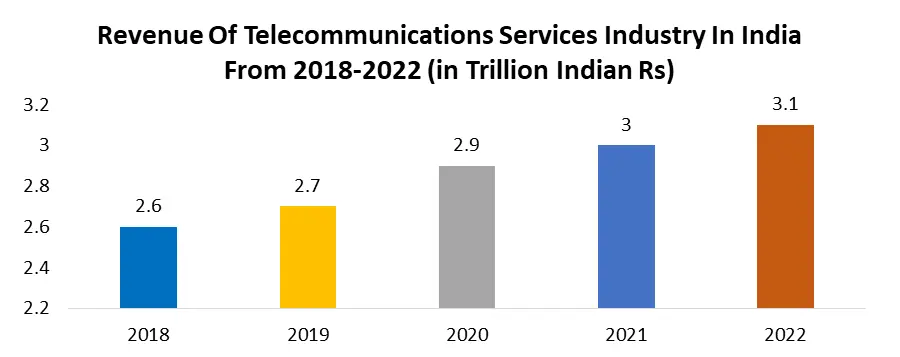

Growing Use of eSIMs in the Telecom Industry eSIM technology, integrated directly into device hardware, represents a substantial departure from traditional physical SIM cards, offering enhanced convenience, flexibility, and environmental sustainability. With eSIMs, users seamlessly switch between mobile carriers without the need for physical card replacement, simplifying device activation and management. This trend is driven by the increasing prevalence of IoT devices, the demand for streamlined connectivity solutions, and the desire for improved user experiences. Major telecom operators and device manufacturers are actively embracing eSIM technology, incorporating it into a wide range of consumer electronics products which boosts the Embedded SIM (eSIM) Market. The regulatory support and industry standards drive the adoption of eSIMs, ensuring interoperability and consumer protection. As a result, the eSIM market is experiencing exponential growth, with forecasts indicating continued expansion in the coming years. The growing use of eSIMs in the telecom industry epitomizes the dominant trajectory of the eSIM market, reshaping how connectivity is managed and experienced across various sectors and use cases.The telecom industry is witnessing a surge in the adoption of eSIM technology, revolutionizing the way consumers and businesses manage their mobile connectivity. eSIMs, integrated into device motherboards, offer unparalleled convenience by eliminating the need for physical SIM cards when switching carriers. With benefits spanning convenience, flexibility, and environmental sustainability, eSIMs are becoming increasingly popular for both personal and professional use. Enabled in all iPhones since 2018 and exclusively in the USA market since 2022, eSIMs are rapidly gaining traction worldwide. Anastasia Ivanets, a seasoned eSIM expert, foresees a promising future for the technology, predicting it to become the norm within the next five years. As telecom continues to evolve, the growing use of eSIMs emphasizes their essential role in shaping the industry's future. The telecommunications services industry in India has seen a steady rise in revenue, boosted by increasing demand for connectivity and digital services. The industry is witnessing a surge in the adoption of eSIMs, enhancing convenience and flexibility for consumers in managing their mobile connections which fuels Embedded SIM (eSIM) Market growth.

Embedded SIM (eSIM) Market Dynamics

Increasing Demand for Connected Devices and The Expansion of The Internet Of Things (IoT) Ecosystem The escalating demand for connected devices and the expansion of the Internet of Things (IoT) ecosystem are reshaping the world facilitating seamless data exchange facilitated by Embedded SIM (eSIM) technology. eSIMs enable effortless connectivity between physical objects, such as sensors and on-device software, and various systems and devices. This interconnected network of eSIM-enabled devices generates substantial value across industries, allowing organizations to seize new opportunities, innovate business models, and unlock revenue streams. Different eSIM connection types accommodate diverse requirements, ranging from intermittent communication with minimal data to high-speed, low-latency transmission. eSIMs streamline the connection of devices ranging from small sensors to large-scale machinery, ushering in a new era of digital intelligence. This facilitates real-time communication between devices and enables automated processes on an unprecedented scale. The Embedded SIM (eSIM) Market is experiencing rapid growth as industries embrace these transformative capabilities for enhanced connectivity and efficiency. With forecasts indicating a rapid acceleration in eSIM deployments, the number of connected devices is poised to surge, surpassing traditional devices such as smartphones and PCs. The proliferation of Internet of Things (IoT) active device connections is driving increased demand for connected devices. This surge is accelerating the expansion of the IoT ecosystem, fostering innovation and integration across various sectors while enhancing efficiency, automation, and connectivity in both consumer and industrial domains.eSIM-enabled devices, spanning from basic sensors to complex, always-connected devices including geo-fenced vehicles, drive a myriad of Verticals, from logistics optimization to remote medical procedures and enhanced security. As eSIM adoption proliferates, the diversity of connection types evolves to provide device needs, with technologies such as 5G offering high-speed, low-latency connectivity for bandwidth-intensive Verticals. eSIM technology extends internet connectivity beyond conventional computing devices, enabling real-time data transmission and remote monitoring and boosting the Embedded SIM (eSIM) Market growth. Integrated into various tools and environments, eSIM-enabled devices streamline daily activities, enhance consumer convenience and offer invaluable data for industrial and enterprise Verticals. As eSIM technology evolves, its impact on industries, societies, and daily lives continues to grow, fostering innovation and advancement in the connected world. The challenge of interoperability and standardization to hamper Market Growth The interoperability issues hinder seamless communication and compatibility between different eSIM-enabled devices and networks. This lack of interoperability leads to fragmentation within the eSIM ecosystem, making it challenging for users to switch between devices or carriers easily. The absence of standardized protocols and specifications across the eSIM ecosystem creates barriers to entry for new players and inhibits innovation. Which hamper Embedded SIM (eSIM) Market growth. Without universally accepted standards, device manufacturers and mobile network operators develop proprietary solutions that are not interoperable with others, exacerbating fragmentation and limiting consumer choice. The interoperability challenges result in increased costs and complexity for stakeholders involved in the eSIM value chain. 1. For instance, device manufacturers need to customize their products to support different eSIM implementations, leading to higher development and testing expenses. The lack of interoperability and standardization impedes regulatory compliance efforts and hinders the adoption of eSIM technology in certain regions or industries.

Embedded SIM (eSIM) Market Segment Analysis

Based on the Application, the market is segmented into Smartphones, Connected Cars, Laptops, M2M, Tablets, Wearables and Others. Smartphones are expected to dominate the Embedded SIM (eSIM) Market during the forecast period. The widespread adoption and prevalent usage of smartphones across the globe. With billions of users worldwide, smartphones have become indispensable tools for communication, productivity, entertainment and accessing digital services. This ubiquity positions smartphones as a central hub for connectivity, making them a natural fit for integrating eSIM technology. Leading smartphone manufacturers, including Apple, Google, and Samsung, have embraced eSIM functionality, integrating it into their flagship devices and expanding its availability across their product lines. This strategic integration by industry giants has significantly boosted the adoption of eSIM technology in smartphones, establishing them as the primary platform for driving Embedded SIM (eSIM) Market growth. The eSIM adoption in smartphones is the enhanced connectivity and flexibility that eSIM technology offers. Unlike traditional physical SIM cards, eSIMs enable users to switch between mobile networks and data plans seamlessly, without the need for physical SIM card swapping. This flexibility is particularly beneficial for travelers who frequently switch between different carriers or require international roaming capabilities. The eSIMs facilitate the seamless activation of new mobile plans, allowing users to onboard onto a network directly from their smartphone. This streamlined process enhances user experience and convenience, aligning with the evolving preferences of smartphone users for hassle-free connectivity solutions. Smartphones equipped with eSIM technology offer support for multiple network profiles simultaneously. While traditional SIM cards typically allow for only one active profile at a time, eSIMs enable users to download and store multiple profiles on their devices. This functionality is particularly beneficial for users who maintain separate personal and business phone numbers or who require access to local mobile networks when traveling abroad. By supporting multiple profiles, smartphones with eSIM technology offer increased versatility and utility to users, further solidifying their dominance in the Embedded SIM (eSIM) Market. The integration of eSIM technology in smartphones extends its influence to other device categories, such as IoT devices and wearables. Many IoT devices, including connected cars, smart meters and industrial sensors, rely on eSIMs for cellular connectivity. Wearables such as smartwatches and fitness trackers increasingly feature eSIM support, allowing them to operate independently of smartphones. This integration emphasizes the central role of smartphones as a hub for managing eSIM-enabled devices and highlights their significance in driving eSIM adoption across multiple use cases. Based on Component, Embedded SIM (eSIM) Market is segmented into Connectivity services, Hardware, Software/Platforms. Connectivity Services dominate the Embedded SIM (eSIM) Market due to the critical role they play in enabling seamless, remote SIM provisioning and lifecycle management across devices. As IoT and M2M applications expand, enterprises rely on connectivity services for real-time carrier switching, global network access, and secure, scalable deployments—eliminating physical SIM logistics. The rise of 5G, smart cities, and connected vehicles further drives demand, as these services ensure uninterrupted, low-latency connectivity. Mobile operators and cloud providers are heavily investing in eSIM orchestration platforms, making connectivity services the revenue powerhouse of the eSIM ecosystem.Embedded SIM (eSIM) Market Regional Insights

North America dominated the Embedded SIM (eSIM) Market in 2024 and is expected to maintain its dominance over the forecast period. The major mobile network operators (MNOs) in the region, such as AT&T, Verizon, and T-Mobile, have been actively embracing eSIM technology, offering it as an alternative to traditional physical SIM cards. This adoption is largely fueled by the desire to streamline device activation processes, enhance user experience, and tap into new revenue streams. The increasing prevalence of eSIM-enabled devices, particularly smartphones, tablets, and wearables, has contributed to the growing acceptance of eSIM technology among consumers in North America. Leading device manufacturers such as Apple, Google, and Samsung have incorporated eSIM support into their latest product offerings, boosting Embedded SIM (eSIM) industry growth. In consumer electronics, eSIM technology is making inroads into other sectors such as automotive, healthcare, and IoT. For example, connected cars equipped with eSIMs enable seamless access to telematics services, navigation, and entertainment content. Also, eSIM-enabled healthcare devices facilitate remote patient monitoring and telemedicine Verticals, driving efficiency and improving patient outcomes. The regulatory developments and industry initiatives have played a pivotal role in promoting the adoption of eSIM technology in North America which fuel the regional Embedded SIM (eSIM) Market growth. 1. For instance, the GSMA's Remote SIM Provisioning (RSP) specification provides a standardized framework for securely provisioning and managing eSIMs, thereby fostering interoperability and driving market growth.Embedded SIM (eSIM) Market Scope: Inquire before buying

Global Embedded SIM (eSIM) Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.10 Bn. Forecast Period 2025 to 2032 CAGR: 21.66% Market Size in 2032: USD 5.28 Bn. Segments Covered: by Component Connectivity services Hardware Software/Platforms by Network Type 5G 4G/LTE NB-IoT/LTE-M by Vertical Automotive Consumer Electronics Energy & Utilities Manufacturing Retail Transportation & Logistics Others by Application Smartphones Connected Cars Laptops M2M Tablets Wearables Others Embedded SIM (eSIM) Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Embedded SIM (eSIM) Key players

Global 1. Gemalto (Thales Digital Identity & Security) (Amsterdam, Netherlands) 2. Giesecke+Devrient (Munich, Germany) 3. IDEMIA (Courbevoie, France) 4. Sierra Wireless (Richmond, British Columbia, Canada) 5. STMicroelectronics (Geneva, Switzerland) North America 1. Sierra Wireless (Richmond, British Columbia, Canada) 2. Cisco Systems (San Jose, California, USA) 3. KORE Wireless (Alpharetta, Georgia, USA) 4. AT&T (Dallas, Texas, USA) 5. T-Mobile (Bellevue, Washington, USA) Europe 1. Gemalto (Thales Digital Identity & Security) (Amsterdam, Netherlands) 2. STMicroelectronics (Geneva, Switzerland) 3. Infineon Technologies (Neubiberg, Germany) 4. Telit Communications (London, United Kingdom) 5. Arm Holdings (Cambridge, United Kingdom) Asia Pacific 1. Samsung Electronics (Seoul, South Korea) 2. Huawei Technologies Co., Ltd. (Shenzhen, China) 3. Xiaomi Corporation (Beijing, China) 4. Oppo (Dongguan, China) 5. Vivo Communication Technology Co. Ltd. (Dongguan, China) 6. Lenovo Group Limited (Beijing, China) 7. LG Electronics Inc. (Seoul, South Korea) 8. Sony Corporation (okyo, Japan) 9. ZTE Corporation (Shenzhen, China) 10. Micromax Informatics Ltd. (Gurugram, India) 11. Tencent Holdings Limited (Shenzhen, China) 12. Alibaba Group Holding Limited (Hangzhou, China)Frequently Asked Questions:

1] What is the growth rate of the Global Embedded SIM (eSIM) Market? Ans. The Global Embedded SIM (eSIM) Market is growing at a significant rate of 21.66% during the forecast period. 2] Which region is expected to dominate the Global Embedded SIM (eSIM) Market? Ans. North America is expected to dominate the Embedded SIM (eSIM) Market during the forecast period. 3] What is the expected Global Embedded SIM (eSIM) Market size by 2032? Ans. The Embedded SIM (eSIM) Market size is expected to reach USD 5.28 Billion by 2032. 4] Which are the top players in the Global Embedded SIM (eSIM) Market? Ans. The major top players in the Global Embedded SIM (eSIM) Market are Gemalto (Thales Digital Identity & Security) (Amsterdam, Netherlands), Giesecke + Devrient (Munich, Germany), IDEMIA (Courbevoie, France), STMicroelectronics (Geneva, Switzerland) and Others. 5] What are the factors driving the Global Embedded SIM (eSIM) Market growth? Ans. The growing adoption of IoT devices and increasing demand for connected devices are expected to drive market growth during the forecast period.

1. Embedded SIM (eSIM) Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Embedded SIM (eSIM) Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Embedded SIM (eSIM) Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Embedded SIM (eSIM) Market: Dynamics 3.1. Embedded SIM (eSIM) Market Trends by Region 3.1.1. North America Embedded SIM (eSIM) Market Trends 3.1.2. Europe Embedded SIM (eSIM) Market Trends 3.1.3. Asia Pacific Embedded SIM (eSIM) Market Trends 3.1.4. Middle East and Africa Embedded SIM (eSIM) Market Trends 3.1.5. South America Embedded SIM (eSIM) Market Trends 3.2. Embedded SIM (eSIM) Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Embedded SIM (eSIM) Market Drivers 3.2.1.2. North America Embedded SIM (eSIM) Market Restraints 3.2.1.3. North America Embedded SIM (eSIM) Market Opportunities 3.2.1.4. North America Embedded SIM (eSIM) Market Challenges 3.2.2. Europe 3.2.2.1. Europe Embedded SIM (eSIM) Market Drivers 3.2.2.2. Europe Embedded SIM (eSIM) Market Restraints 3.2.2.3. Europe Embedded SIM (eSIM) Market Opportunities 3.2.2.4. Europe Embedded SIM (eSIM) Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Embedded SIM (eSIM) Market Drivers 3.2.3.2. Asia Pacific Embedded SIM (eSIM) Market Restraints 3.2.3.3. Asia Pacific Embedded SIM (eSIM) Market Opportunities 3.2.3.4. Asia Pacific Embedded SIM (eSIM) Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Embedded SIM (eSIM) Market Drivers 3.2.4.2. Middle East and Africa Embedded SIM (eSIM) Market Restraints 3.2.4.3. Middle East and Africa Embedded SIM (eSIM) Market Opportunities 3.2.4.4. Middle East and Africa Embedded SIM (eSIM) Market Challenges 3.2.5. South America 3.2.5.1. South America Embedded SIM (eSIM) Market Drivers 3.2.5.2. South America Embedded SIM (eSIM) Market Restraints 3.2.5.3. South America Embedded SIM (eSIM) Market Opportunities 3.2.5.4. South America Embedded SIM (eSIM) Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Embedded SIM (eSIM) Industry 3.8. Analysis of Government Schemes and Initiatives For Embedded SIM (eSIM) Industry 3.9. Embedded SIM (eSIM) Market Trade Analysis 3.10. The Global Pandemic Impact on Embedded SIM (eSIM) Market 4. Embedded SIM (eSIM) Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 4.1.1. Connectivity services 4.1.2. Hardware 4.1.3. Software/Platforms 4.2. Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 4.2.1. 5G 4.2.2. 4G/LTE 4.2.3. NB-IoT/LTE-M 4.3. Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 4.3.1. Automotive 4.3.2. Consumer Electronics 4.3.3. Energy & Utilities Manufacturing 4.3.4. Retail Transportation & Logistics 4.3.5. Others 4.4. Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 4.4.1. Smartphones 4.4.2. Connected Cars 4.4.3. Laptops 4.4.4. M2M 4.4.5. Tablets 4.4.6. Wearables 4.4.7. Others 4.5. Embedded SIM (eSIM) Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Embedded SIM (eSIM) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 5.1.1. Connectivity services 5.1.2. Hardware 5.1.3. Software/Platforms 5.2. North America Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 5.2.1. 5G 5.2.2. 4G/LTE 5.2.3. NB-IoT/LTE-M 5.3. North America Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 5.3.1. Automotive 5.3.2. Consumer Electronics 5.3.3. Energy & Utilities Manufacturing 5.3.4. Retail Transportation & Logistics 5.3.5. Others 5.4. North America Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 5.4.1. Smartphones 5.4.2. Connected Cars 5.4.3. Laptops 5.4.4. M2M 5.4.5. Tablets 5.4.6. Wearables 5.4.7. Others 5.5. North America Embedded SIM (eSIM) Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 5.5.1.1.1. Connectivity services 5.5.1.1.2. Hardware 5.5.1.1.3. Software/Platforms 5.5.1.2. United States Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 5.5.1.2.1. 5G 5.5.1.2.2. 4G/LTE 5.5.1.2.3. NB-IoT/LTE-M 5.5.1.3. United States Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 5.5.1.3.1. Automotive 5.5.1.3.2. Consumer Electronics 5.5.1.3.3. Energy & Utilities Manufacturing 5.5.1.3.4. Retail Transportation & Logistics 5.5.1.3.5. Others 5.5.1.4. United States Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Smartphones 5.5.1.4.2. Connected Cars 5.5.1.4.3. Laptops 5.5.1.4.4. M2M 5.5.1.4.5. Tablets 5.5.1.4.6. Wearables 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 5.5.2.1.1. Connectivity services 5.5.2.1.2. Hardware 5.5.2.1.3. Software/Platforms 5.5.2.2. Canada Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 5.5.2.2.1. 5G 5.5.2.2.2. 4G/LTE 5.5.2.2.3. NB-IoT/LTE-M 5.5.2.3. Canada Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 5.5.2.3.1. Automotive 5.5.2.3.2. Consumer Electronics 5.5.2.3.3. Energy & Utilities Manufacturing 5.5.2.3.4. Retail Transportation & Logistics 5.5.2.3.5. Others 5.5.2.4. Canada Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Smartphones 5.5.2.4.2. Connected Cars 5.5.2.4.3. Laptops 5.5.2.4.4. M2M 5.5.2.4.5. Tablets 5.5.2.4.6. Wearables 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 5.5.3.1.1. Connectivity services 5.5.3.1.2. Hardware 5.5.3.1.3. Software/Platforms 5.5.3.2. Mexico Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 5.5.3.2.1. 5G 5.5.3.2.2. 4G/LTE 5.5.3.2.3. NB-IoT/LTE-M 5.5.3.3. Mexico Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 5.5.3.3.1. Automotive 5.5.3.3.2. Consumer Electronics 5.5.3.3.3. Energy & Utilities Manufacturing 5.5.3.3.4. Retail Transportation & Logistics 5.5.3.3.5. Others 5.5.3.4. Mexico Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Smartphones 5.5.3.4.2. Connected Cars 5.5.3.4.3. Laptops 5.5.3.4.4. M2M 5.5.3.4.5. Tablets 5.5.3.4.6. Wearables 5.5.3.4.7. Others 6. Europe Embedded SIM (eSIM) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.2. Europe Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.3. Europe Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.4. Europe Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 6.5. Europe Embedded SIM (eSIM) Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.5.1.2. United Kingdom Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.5.1.3. United Kingdom Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.5.1.4. United Kingdom Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.5.2.2. France Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.5.2.3. France Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.5.2.4. France Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.5.3.2. Germany Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.5.3.3. Germany Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.5.3.4. Germany Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.5.4.2. Italy Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.5.4.3. Italy Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.5.4.4. Italy Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.5.5.2. Spain Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.5.5.3. Spain Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.5.5.4. Spain Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.5.6.2. Sweden Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.5.6.3. Sweden Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.5.6.4. Sweden Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.5.7.2. Austria Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.5.7.3. Austria Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.5.7.4. Austria Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 6.5.8.2. Rest of Europe Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 6.5.8.3. Rest of Europe Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 6.5.8.4. Rest of Europe Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Embedded SIM (eSIM) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.2. Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.3. Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.4. Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.1.2. China Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.1.3. China Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.1.4. China Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.2.2. S Korea Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.2.3. S Korea Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.2.4. S Korea Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.3.2. Japan Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.3.3. Japan Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.3.4. Japan Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.4.2. India Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.4.3. India Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.4.4. India Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.5.2. Australia Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.5.3. Australia Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.5.4. Australia Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.6.2. Indonesia Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.6.3. Indonesia Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.6.4. Indonesia Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.7.2. Malaysia Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.7.3. Malaysia Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.7.4. Malaysia Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.8.2. Vietnam Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.8.3. Vietnam Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.8.4. Vietnam Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.9.2. Taiwan Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.9.3. Taiwan Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.9.4. Taiwan Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 7.5.10.2. Rest of Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 7.5.10.4. Rest of Asia Pacific Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Embedded SIM (eSIM) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 8.2. Middle East and Africa Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 8.3. Middle East and Africa Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 8.4. Middle East and Africa Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Embedded SIM (eSIM) Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 8.5.1.2. South Africa Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 8.5.1.3. South Africa Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 8.5.1.4. South Africa Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 8.5.2.2. GCC Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 8.5.2.3. GCC Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 8.5.2.4. GCC Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 8.5.3.2. Nigeria Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 8.5.3.3. Nigeria Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 8.5.3.4. Nigeria Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 8.5.4.2. Rest of ME&A Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 8.5.4.3. Rest of ME&A Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 8.5.4.4. Rest of ME&A Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 9. South America Embedded SIM (eSIM) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 9.2. South America Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 9.3. South America Embedded SIM (eSIM) Market Size and Forecast, by Vertical(2024-2032) 9.4. South America Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 9.5. South America Embedded SIM (eSIM) Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 9.5.1.2. Brazil Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 9.5.1.3. Brazil Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 9.5.1.4. Brazil Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 9.5.2.2. Argentina Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 9.5.2.3. Argentina Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 9.5.2.4. Argentina Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Embedded SIM (eSIM) Market Size and Forecast, by Component (2024-2032) 9.5.3.2. Rest Of South America Embedded SIM (eSIM) Market Size and Forecast, by Network Type (2024-2032) 9.5.3.3. Rest Of South America Embedded SIM (eSIM) Market Size and Forecast, by Vertical (2024-2032) 9.5.3.4. Rest Of South America Embedded SIM (eSIM) Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Gemalto (Thales Digital Identity & Security) (Amsterdam, Netherlands) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Giesecke+Devrient (Munich, Germany) 10.3. IDEMIA (Courbevoie, France) 10.4. Sierra Wireless (Richmond, British Columbia, Canada) 10.5. STMicroelectronics (Geneva, Switzerland) 10.6. Sierra Wireless (Richmond, British Columbia, Canada) 10.7. Cisco Systems (San Jose, California, USA) 10.8. KORE Wireless (Alpharetta, Georgia, USA) 10.9. AT&T (Dallas, Texas, USA) 10.10. T-Mobile (Bellevue, Washington, USA) 10.11. Gemalto (Thales Digital Identity & Security) (Amsterdam, Netherlands) 10.12. STMicroelectronics (Geneva, Switzerland) 10.13. Infineon Technologies (Neubiberg, Germany) 10.14. Telit Communications (London, United Kingdom) 10.15. Arm Holdings (Cambridge, United Kingdom) 10.16. Samsung Electronics (Seoul, South Korea) 10.17. Huawei Technologies Co., Ltd. (Shenzhen, China) 10.18. Xiaomi Corporation (Beijing, China) 10.19. Oppo (Dongguan, China) 10.20. Vivo Communication Technology Co. Ltd. (Dongguan, China) 10.21. Lenovo Group Limited (Beijing, China) 10.22. LG Electronics Inc. (Seoul, South Korea) 10.23. Sony Corporation (okyo, Japan) 10.24. ZTE Corporation (Shenzhen, China) 10.25. Micromax Informatics Ltd. (Gurugram, India) 10.26. Tencent Holdings Limited (Shenzhen, China) 10.27. Alibaba Group Holding Limited (Hangzhou, China) 11. Key Findings 12. Industry Recommendations 13. Embedded SIM (eSIM) Market: Research Methodology 14. Terms and Glossary