ePharmacy Market was valued at US$ 85.08 Bn in 2022 and is expected to reach US$ 275.90 Bn by 2029, at a CAGR of 18.3% during a forecast period.ePharmacy Market Overview:

The global epharmacy market was valued at US$ 85.08 Bn in 2022. Increased adoption of modern technologies has resulted in digitalization in the healthcare sector, which has provided the market with considerable potential opportunities. E-commerce platforms have gained popularity due to their ease of use, on-time and high-quality services, and the expanding use of the internet. The pharmaceutical distribution industry's future growth will be driven by its ability to capture a larger consumer base and meet unmet demands. The exponentially growing number of internet users also contributes to the growing use of e-pharmacies for pharmaceutical dispensing.To know about the Research Methodology :- Request Free Sample Report

ePharmacy Market Dynamics:

The industry is being propelled forward by rising internet penetration around the world, improved digitalization of healthcare services, and an increase in the number of tech-savvy consumers. The market is also benefiting from rising consumer demand for online shopping, as well as an increased focus on convenience. Furthermore, the adoption of digital technology and e-commerce in the healthcare sector is expected to drive overall growth, as it provides simple access to chronic elderly patients from nuclear families, as well as patients who are unable to leave their homes. The market's growth is being aided by the increasing adoption of smartphones. Smartphone penetration reached 65.0 % and is expected to reach 80.0 % by 2025, according to The Mobile Economy 2022. The growth of the healthcare industry, combined with high operational costs, has necessitated the introduction of ePharmacy solutions to reduce operational costs. The rising prevalence of chronic diseases is driving up demand for a variety of healthcare products, including pharmaceuticals. This indicates that internet drug purchasing is becoming more popular around the world. The market is expected to develop in response to the growing geriatric population. Some of the causes driving expansion include ease of operation, more digitalization, and an increase in the number of people registering under Medicare. According to figures published by the Kaiser Family Foundation in June 2021, over 26 million people are enrolled in a Medicare Advantage plan, accounting for 42.0 % Medicare population. Furthermore, increased funding, increased investments, and rising strategic efforts being done by many funding agencies, the government, and businesses are all contributing to market growth. The market's growth is being stifled by the presence of some fraudulent internet pharmacies. These unlicensed pharmacies sell drugs that have not been approved by the FDA, increasing the risk of receiving counterfeit and contaminated prescriptions with wrong active ingredients. For example, according to an FDA warning issued in 2022, some online pharmacies were caught engaging in illegal activity and violating the United States Federal Food, Drug, and Cosmetic Act, which included points such as the sale of unapproved prescription drugs and the sale of prescription drugs without a prescription.ePharmacy Market Segment Analysis:

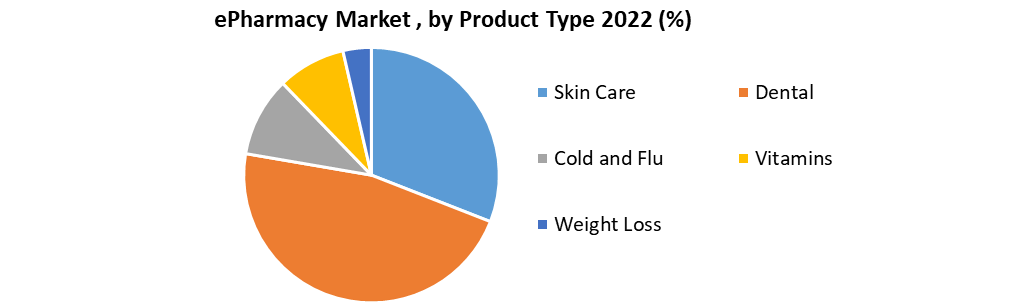

The global ePharmacy market is segmented into drug type, and product type. Based on drug type, about 2022, over-the-counter medicines brought in USD 40 billion in income. Over-the-counter pharmaceuticals provide primary medications for a wide range of health issues, allowing patients to skip hospital visits. As a result, increased public awareness and education regarding basic drug treatment will spur market growth. With a surge in dermal OTC product sales, the category will grow as the prevalence of various dermatological disorders rises. Furthermore, the affordability of OTC medications will continue to increase consumer preference, resulting in increased revenue for the market. Based by product type, the weight loss segment is expected to develop at a 14 % until 2029, owing to an increased emphasis on and demand for physical activity among adults. Furthermore, rising demand for weight reduction goods among obese people to reduce the burden of associated health risks such high blood pressure, coronary heart disease, and osteoarthritis would affect product demand. As a result, consumer preference for online pharmacies will have a beneficial impact on industry growth in the coming years due to convenience and favorable offerings.

Regional Insights:

North America held the xx% share in 2022 and it is projected to continue its dominance during the forecast period. Dominance is attributed to the complete dependence of the general population on home delivery services like over-the-counter medical products and nutrition supplements, vitamin tablets, cosmetics, and others. An increase in healthcare expenditure and the number of patients opting for home care treatment facilities are also expected to boost the market growth in the region. Many new key players are entering the market as the healthcare sector is offering huge potential to online health retailers because of its increased demand for healthcare products and services. Some of the start-ups are bringing in various transformations to introduce different levels of value additions. For instance, online pharmacies require consumers to submit prescriptions online. Additionally, some of the startups are also arranging the prescription physically collected from the customer’s location. Established stores can earn profits by accepting ads or announcing third-party blogs and newsletters. They are selecting to enrol with Google Ad-sense or directly, which can negotiate with the advertisers. The objective of the report is to present a comprehensive analysis of the global ePharmacy market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global ePharmacy market dynamics, structure by analyzing the market segments and project the global ePharmacy market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global ePharmacy market make the report investor’s guide.ePharmacy Market Scope: Inquire before buying

Global ePharmacy Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 85.08 Bn. Forecast Period 2023 to 2029 CAGR: 18.3% Market Size in 2029: US $ 275.90 Bn. Segments Covered: by Drug Type Prescription Drugs Over the counter (OTC) Drugs by Product Type Skin Care Dental Cold and Flu Vitamins Weight Loss Other Product Types by Operating Platform App Website by Business Model Pharmacy Direct Global ePharmacy Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. The Kroger Co. 2. Walgreens Boots 3. Walmart Stores, 4. PlanetRx 5. Express Scripts Holding 6. Giant Eagle 7. Optum Rx 8. PlanetRx 9. Rowlands Pharmacy 10. CVS Health 11. Express Scripts Holding 12. DocMorris 13. Banner Health 14. Medlife International 15. Albertsons Companies Inc. 16. Axelia SolutionsFrequently Asked Questions:

1. Which region has the largest share in Global ePharmacy Market? Ans: North America region holds the highest share in 2022. 2. What is the growth rate of Global ePharmacy Market? Ans: The Global ePharmacy Market is growing at a CAGR of 18.3 % during forecasting period 2023-2029. 3. What segments are covered in Global ePharmacy market? Ans: Global ePharmacy Market is segmented into drug type, product type and region. 4. Who are the key players in Global ePharmacy market? Ans: The important key players in the Global ePharmacy Market are – The Kroger Co., Walgreens Boots , Walmart Stores, PlanetRx, Express Scripts Holding , Giant Eagle, Optum Rx, PlanetRx, Rowlands Pharmacy, CVS Health, Express Scripts Holding, DocMorris, Banner Health. 5. What is the study period of this market? Ans: The Global ePharmacy Market is studied from 2022 to 2029.

1. Global ePharmacy Market: Research Methodology 2. Global ePharmacy Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global ePharmacy Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global ePharmacy Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global ePharmacy Market Segmentation 4.1 Global ePharmacy Market, by Drug Type (2022-2029) • Prescription Drugs • Over the counter (OTC) Drugs 4.2 Global ePharmacy Market, by Product Type (2022-2029) • Skin Care • Dental • Cold and Flu • Vitamins • Weight Loss • Other Product Types 4.3 Global ePharmacy Market, by Operating Platform (2022-2029) • App • Website 4.4 Global ePharmacy Market, by Business Model (2022-2029) • Pharmacy • Direct 5. North America ePharmacy Market(2022-2029) 5.1 North America ePharmacy Market, by Drug Type (2022-2029) • Prescription Drugs • Over the counter (OTC) Drugs 5.2 North America ePharmacy Market, by Product Type (2022-2029) • Skin Care • Dental • Cold and Flu • Vitamins • Weight Loss • Other Product Types 5.3 North America ePharmacy Market, by Operating Platform (2022-2029) • App • Website 5.4 North America ePharmacy Market, by Business Model (2022-2029) • Pharmacy • Direct 5.5 North America ePharmacy Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe ePharmacy Market (2022-2029) 6.1. European ePharmacy Market, by Drug Type (2022-2029) 6.2. European ePharmacy Market, by Product Type (2022-2029) 6.3. European ePharmacy Market, by Operating Platform (2022-2029) 6.4. European ePharmacy Market, by Business Model (2022-2029) 6.5. European ePharmacy Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific ePharmacy Market (2022-2029) 7.1. Asia Pacific ePharmacy Market, by Drug Type (2022-2029) 7.2. Asia Pacific ePharmacy Market, by Product Type (2022-2029) 7.3. Asia Pacific ePharmacy Market, by Operating Platform (2022-2029) 7.4. Asia Pacific ePharmacy Market, by Business Model (2022-2029) 7.5. Asia Pacific ePharmacy Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa ePharmacy Market (2022-2029) 8.1 Middle East and Africa ePharmacy Market, by Drug Type (2022-2029) 8.2. Middle East and Africa ePharmacy Market, by Product Type (2022-2029) 8.3. Middle East and Africa ePharmacy Market, by Operating Platform (2022-2029) 8.4. Middle East and Africa ePharmacy Market, by Business Model (2022-2029) 8.5. Middle East and Africa ePharmacy Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America ePharmacy Market (2022-2029) 9.1. South America ePharmacy Market, by Drug Type (2022-2029) 9.2. South America ePharmacy Market, by Product Type (2022-2029) 9.3. South America ePharmacy Market, by Operating Platform (2022-2029) 9.4. South America ePharmacy Market, by Business Model (2022-2029) 9.5. South America ePharmacy Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 The Kroger Co. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Walgreens Boots 10.3 Walmart Stores, 10.4 PlanetRx 10.5 Express Scripts Holding 10.6 Giant Eagle 10.7 Optum Rx 10.8 PlanetRx 10.9 Rowlands Pharmacy 10.10 CVS Health 10.11 Express Scripts Holding 10.12 DocMorris 10.13 Banner Health 10.14 Medlife International 10.15 Albertsons Companies Inc. 10.16 Axelia Solutions