The Enterprise Asset Management Market size was valued at USD 5.10 Bn in 2023 and the market is expected to reach USD 9.39 Bn by 2030 at a CAGR of 9.1%.Enterprise Asset Management Market Overview

Enterprise Asset Management incorporates the management and maintenance of physical assets owned by a company throughout the entire lifecycle of an asset, from capital planning, procurement, installation, performance, maintenance, compliance, and risk management, through to asset disposal. The increasing demand for enterprise asset management systems arises from the substantial capital requirements of borrowers. The reliability of assets or equipment significantly impacts asset performance and the quality of an organization's products and services. Consequently, the heightened emphasis on asset maintenance and management directly influences customer satisfaction. Human resources management is deemed the most valuable asset, accompanied by its distinct set of challenges. To meet evolving customer demands, organizations must continually adapt their products or services, effectively managing various variables. These encompass challenges such as heightened global competition, fulfillment of industry and government regulations, the adoption of green and sustainable practices, workplace health and safety, and increased operational costs. This combination of factors contributes to the rise of Industry 4.0. Companies leverage technological advancements for both the production of innovative products and the utilization of data analytics. This provides valuable insights into consumer behavior and local market trends, ultimately enhancing sales performance in specific regions. Manufacturers in enterprise asset management use data-driven knowledge to enhance and refine their product development processes.To know about the Research Methodology :- Request Free Sample Report

Enterprise Asset Management Market Dynamics

Increasing need for asset management and optimization Enterprises are increasingly recognizing the significance of enhancing the lifespan and efficiency of their assets to achieve superior operational effectiveness and cost-efficiency. Enterprise Asset Management market solutions equip businesses with tools for expecting maintenance needs, scheduling preventive measures, and managing the entire lifecycle of assets. This results in heightened asset utilization and a reduction in downtime. In the contemporary business landscape, companies deal with a diverse range of assets, ranging from physical equipment to software licenses. Enterprise Asset Management (EAM) solutions play a vital role in shortening complicated processes, merging data from diverse sources, and offering insights to enable informed decision-making in asset management. The evolution of the Enterprise Asset Management sector is marked by the adoption of cloud computing, and artificial intelligence (AI). Cloud-based solutions deliver scalability and accessibility, while IoT sensors contribute real-time data for predictive maintenance and precise asset tracking. AI is leveraged to automate tasks, streamline workflows, and derive valuable insights from asset data. High cost in the use of Enterprise Asset Management systems Introducing Enterprise Asset Management market solutions requires substantial initial spending on software licenses, hardware enhancements, and implementation services. This financial commitment becomes a hurdle for small and medium-sized enterprises operating on constrained budgets. The shift to a new management system has the potential to interrupt current workflows and demands extensive training for employees. Disabling the feeling of embracing change and ensuring widespread user acceptance present important challenges. The efficient implementation and management of Enterprise Asset Management systems call for skilled professionals proficient in asset management, technology, and data analysis. Identifying qualified personnel, mainly in specialized industries, has been a challenging task. Use of emerging technologies in the enterprise asset management market The utilization of real-time data from asset sensors is set to revolutionize maintenance strategies, by enhancing resource allocation, and propelling automation, resulting in noteworthy cost reductions and heightened asset efficiency in the enterprise asset management market. Analytics powered by artificial intelligence (AI) will enquire deeper into asset data, facilitating predictive maintenance, and automated decision-making, ultimately boosting asset performance and longevity through the use of enterprise asset management systems. Cloud-based Enterprise Asset Management solutions provide scalability, accessibility, and swift updates, while edge computing places processing capabilities closer to assets, facilitating real-time decision-making and minimizing delays. These providers of enterprise asset management systems are actively crafting solutions tailored to specific industries such as utilities, healthcare, transportation, and manufacturing, addressing the distinct asset management requirements and compliance standards of each sector. Lack of skilled professionals in the Enterprise Asset Management Market Efficient implementation and administration of Enterprise Asset Management systems require proficient individuals with a skill set encompassing asset management, technology, and data analysis. The identification of qualified personnel for enterprise asset management systems can pose a challenge, particularly in specialized industries. These systems house sensitive information about company assets and operations and require proper safety from cyber-attacks. Guaranteeing data security and compliance with regulations presents a considerable challenge, demanding robust security protocols and persistent vigilance. The swiftly evolving landscape of technology can swiftly render current EAM solutions outdated. Companies must be ready for ongoing updates and financial commitments to remain competitive.Enterprise Asset Management Market Segment Analysis

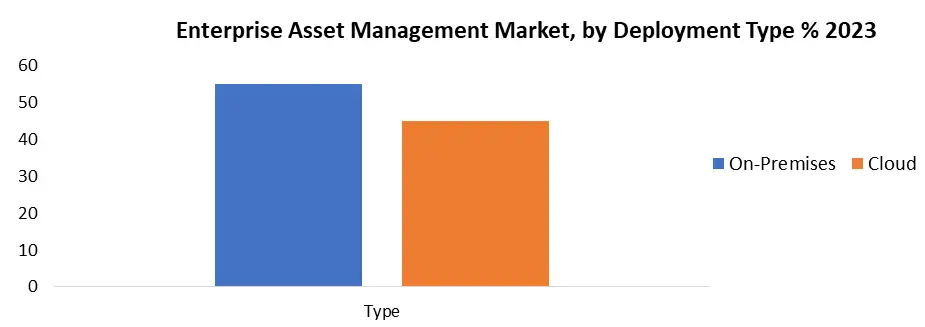

Based on Components, Extensive capabilities, strong features, scalability, an interface that is easy for users, and solutions tailored to specific industries. Enterprise Asset Management has types of management that asset lifecycles, overseeing inventory, handling work orders, managing labor, predictive maintenance, utilizing analytics, and incorporating integration platforms. The improving processes for managing assets, increasing operational efficiency, refining maintenance schedules, minimizing downtime, and optimizing the lifespan and value of assets have grown the enterprise asset management market significantly. Moreover, a notable shift towards adopting advanced digital technologies such as cloud computing, the Internet of Things (IoT), and artificial intelligence (AI) is boosting the market growth. A heightened emphasis on optimizing assets and improving overall performance and growing necessity to adhere to regulatory requirements.Implementation of services, training and consulting services, support and maintenance services, data migration services, and customization services boosted the growth of the enterprise asset management market. Ensuring successful implementation, and optimized utilization of enterprise asset management systems and services. Lack of in-house expertise in implementing and managing EAM systems and the need for ongoing support and maintenance of customization requirements for specific industry needs are challenging factors. Data migration challenges the desire for best practices and optimization strategies. Based on Deployment Type, Companies possessing strong IT infrastructure may discover that utilizing it for deploying Enterprise Asset Management (EAM) is a more budget-friendly approach, avoiding the need for additional investments in cloud infrastructure in the management market. Fears related to data privacy and security breaches can drive industries bound by strict regulations or dealing with sensitive data to favor on-premises deployment. Entities aiming for absolute control over their data and aiming to steer clear of possible vendor dependencies might opt for on-premises solutions. Cloud-based Enterprise Asset Management (EAM) seamlessly adjusts its capacity to match either expansion or evolving requirements, disproving the necessity for initial investments in hardware and complicated infrastructure enhancements. Pricing models based on subscriptions provide clear and anticipated costs, alleviating the responsibility of maintaining IT infrastructure. Thus opting for pay-as-you-go alternatives additionally fine-tunes spending in the enterprise asset management system. The deployment process is swift and effective compared to on-premises solutions, and automatic updates guarantee users access to the most recent features and bug fixes.

Enterprise Asset Management Market Regional Analysis

North American region has shown dominance in the enterprise asset management market. The North America Enterprise Asset Management market is doing well because of the adoption of new cloud-based technology and AI-powered predictive analysis. The growing IT industry and infrastructure provide better integration of enterprise asset management systems while providing software solutions. The other industrial sectors such as airlines, railroads, and transportation companies use this system to optimize the routes while ensuring safety and efficiency. Another use of the enterprise asset management systems is in the healthcare and hospital facilities, where the need for maintaining and tracking the record of patient health is a must. This facility also uses the EAM systems for keeping a track record of the inventory while boosting overall efficiency. With the rise in technological advancement, the enterprise asset management market system is expected to become more popular in use and boost the growth of the market.Europe maintains a significant position in the global Enterprise Asset Management (EAM) market. The continent's robust and diverse industrial sector fuels a strong demand for effective asset management solutions. Strict regulations in various European industries underscore the necessity for reliable Enterprise Asset Management systems to ensure compliance and safety standards. The increasing focus on environmental sustainability is driving the adoption of the Enterprise Asset Management market to enhance energy efficiency and minimize environmental impact. A noticeable trend in Europe involves the preference for integrated Enterprise Asset Management platforms that seamlessly incorporate asset management with other enterprise software functionalities. Within the energy sector, companies are leveraging the Enterprise Asset Management market for the efficient management of power plants, grids, and renewable energy infrastructure. The centralization of predictive maintenance and asset health monitoring is becoming crucial to optimize overall asset performance and mitigate downtime costs. Competitive Landscape The Enterprise Asset Management market is dominated by numerous medium-sized players operating in different countries. These players are focused on technological development and new policies for loans in the market. Companies in the regions are increasingly drawn towards the investment and growth of the more diverse industrial sector. The purpose of providing loans to the companies is for merger & and acquisition, economic growth, and expansion of the facilities. IBM Maximo Asset Management is a mature and robust solution with deep industry expertise, particularly in utilities and manufacturing. They offer on-premises, cloud, and hybrid deployment options. IFS Enterprise Asset Management Systems is a cloud-native solution known for its flexibility and rapid implementation. They offer industry-specific pre-configured options and focus on user experience. AI-powered analytics are being used for predictive maintenance, anomaly detection, and automated decision-making, improving asset performance and reducing downtime.

Enterprise Asset Management Market Scope : Inquire before buying

Global Enterprise Asset Management Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 5.10 Bn. Forecast Period 2024 to 2030 CAGR: 9.1% Market Size in 2030: US$ 9.39 Bn. Segments Covered: by Components Software Services by Deployment Type Cloud On-Premises by Organization Size Small & Medium Organizations Large Enterprises by Industry Government Healthcare Oil and Gas Transportation and Logistics Energy and Utilities Manufacturing Others Enterprise Asset Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Key Players in the Enterprise Asset Management Market

1. IBM Corporation 2. ABB 3. CGI Group, Inc. 4. eMaint 5. Dude Solutions, Inc. 6. IFS AB 7. Infor 8. Ramco Systems 9. SAP SE 10. Vesta Partners, LLC 11. Schneider Electric SA 12. Oracle Corporation 13. CARL International SA 14. AssetWorks LLC 15. Ultimo Software Solutions Bv 16. MAINTENANCE CONNECTION 17. AVEVA Group plc 18. Aptean 19. UpKeep Maintenance Management 20. RFgen Software 21. FUJITSU FAQs: 1. What are the benefits of the Enterprise Asset Management? Ans. Cost reduction, inventory optimization, and improved asset management systems are the benefits of Enterprise Asset Management systems. 2. What is the major restraint for the Enterprise Asset Management market growth? Ans. Strong Competition and the high cost of use and implementation of the Enterprise Asset Management systems is expected to be the major restraining factor for the Enterprise Asset Management market growth. 3. Is the Enterprise Asset Management system a reliable source of asset management? Ans. Yes, Enterprise Asset Management systems are used by many companies to manage and keep their data secure from cyber threats and other cyber attacks 4. What is the projected market size & and growth rate of the Enterprise Asset Management Market? Ans. The Enterprise Asset Management Market size was valued at USD 5.10 Billion in 2023 and the total Enterprise Asset Management revenue is expected to grow at a CAGR of 9.1 % from 2024 to 2030, reaching nearly USD 9.39 Billion by 2030. 5. What are the key challenges in the Enterprise Asset Management Market? Ans. The key challenge in the Enterprise Asset Management Market is the lack of skilled professionals in the market.

1. Enterprise Asset Management Market: Research Methodology 2. Enterprise Asset Management Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Enterprise Asset Management Market: Dynamics 3.1. Enterprise Asset Management Market Trends by Region 3.1.1. North America Enterprise Asset Management Market Trends 3.1.2. Europe Enterprise Asset Management Market Trends 3.1.3. Asia Pacific Enterprise Asset Management Market Trends 3.1.4. Middle East and Africa Enterprise Asset Management Market Trends 3.1.5. South America Enterprise Asset Management Market Trends 3.2. Enterprise Asset Management Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Enterprise Asset Management Market Drivers 3.2.1.2. North America Enterprise Asset Management Market Restraints 3.2.1.3. North America Enterprise Asset Management Market Opportunities 3.2.1.4. North America Enterprise Asset Management Market Challenges 3.2.2. Europe 3.2.2.1. Europe Enterprise Asset Management Market Drivers 3.2.2.2. Europe Enterprise Asset Management Market Restraints 3.2.2.3. Europe Enterprise Asset Management Market Opportunities 3.2.2.4. Europe Enterprise Asset Management Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Enterprise Asset Management Market Drivers 3.2.3.2. Asia Pacific Enterprise Asset Management Market Restraints 3.2.3.3. Asia Pacific Enterprise Asset Management Market Opportunities 3.2.3.4. Asia Pacific Enterprise Asset Management Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Enterprise Asset Management Market Drivers 3.2.4.2. Middle East and Africa Enterprise Asset Management Market Restraints 3.2.4.3. Middle East and Africa Enterprise Asset Management Market Opportunities 3.2.4.4. Middle East and Africa Enterprise Asset Management Market Challenges 3.2.5. South America 3.2.5.1. South America Enterprise Asset Management Market Drivers 3.2.5.2. South America Enterprise Asset Management Market Restraints 3.2.5.3. South America Enterprise Asset Management Market Opportunities 3.2.5.4. South America Enterprise Asset Management Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis For Enterprise Asset Management Market Industry 3.7. Analysis of Government Schemes and Initiatives For Allogeneic Cell Therapy Industry 3.8. The Global Pandemic Impact on Enterprise Asset Management Market 4. Enterprise Asset Management Market: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 4.1. Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 4.1.1. Software 4.1.2. Services 4.2. Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 4.2.1. Cloud 4.2.2. On-Premises 4.3. Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 4.3.1. Small & Medium Organization 4.3.2. Large Enterprise 4.4. Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 4.4.1. Government 4.4.2. Healthcare 4.4.3. Oil & Gas 4.4.4. Transportation & Logistics 4.4.5. Energy & Utilities 4.4.6. Manufacturing 4.4.7. Others 4.5. Enterprise Asset Management Market Size and Forecast, by Region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Enterprise Asset Management Market Size and Forecast by Segmentation (by Value) (2023-2030) 5.1. North America Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 5.1.1. Software 5.1.2. Services 5.2. North America Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 5.2.1. Cloud 5.2.2. On-Premises 5.3. North America Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 5.3.1. Small & Medium Organization 5.3.2. Large Enterprise 5.4. North America Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 5.4.1. Government 5.4.2. Healthcare 5.4.3. Oil & Gas 5.4.4. Transportation & Logistics 5.4.5. Energy & Utilities 5.4.6. Manufacturing 5.4.7. Others 5.5. North America Enterprise Asset Management Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 5.5.1.1.1. Software 5.5.1.1.2. Services 5.5.1.2. United States Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 5.5.1.2.1. Cloud 5.5.1.2.2. On-Premises 5.5.1.3. United States Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 5.5.1.3.1. Small & Medium Organization 5.5.1.3.2. Large Enterprise 5.5.1.4. United States Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 5.5.1.4.1. Government 5.5.1.4.2. Healthcare 5.5.1.4.3. Oil & Gas 5.5.1.4.4. Transportation & Logistics 5.5.1.4.5. Energy & Utilities 5.5.1.4.6. Manufacturing 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 5.5.2.1.1. Software 5.5.2.1.2. Services 5.5.2.2. Canada Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 5.5.2.2.1. Cloud 5.5.2.2.2. On-Premises 5.5.2.3. Canada Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 5.5.2.3.1. Small & Medium Organization 5.5.2.3.2. Large Enterprise 5.5.2.4. Canada Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 5.5.2.4.1. Government 5.5.2.4.2. Healthcare 5.5.2.4.3. Oil & Gas 5.5.2.4.4. Transportation & Logistics 5.5.2.4.5. Energy & Utilities 5.5.2.4.6. Manufacturing 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 5.5.3.1.1. Software 5.5.3.1.2. Services 5.5.3.2. Mexico Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 5.5.3.2.1. Cloud 5.5.3.2.2. On-Premises 5.5.3.3. Mexico Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 5.5.3.3.1. Small & Medium Organization 5.5.3.3.2. Large Enterprise 5.5.3.4. Mexico Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 5.5.3.4.1. Government 5.5.3.4.2. Healthcare 5.5.3.4.3. Oil & Gas 5.5.3.4.4. Transportation & Logistics 5.5.3.4.5. Energy & Utilities 5.5.3.4.6. Manufacturing 5.5.3.4.7. Others 6. Europe Enterprise Asset Management Market Size and Forecast by Segmentation (by Value) (2023-2030) 6.1. Europe Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.2. Europe Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.3. Europe Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.4. Europe Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 6.5. Europe Enterprise Asset Management Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.5.1.2. United Kingdom Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.5.1.3. United Kingdom Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.5.1.4. United Kingdom Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 6.5.2. France 6.5.2.1. France Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.5.2.2. France Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.5.2.3. France Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.5.2.4. France Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Germany Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.5.3.3. Germany Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.5.3.4. Germany Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.5.4.2. Italy Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.5.4.3. Italy Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.5.4.4. Italy Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Spain Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.5.5.3. Spain Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.5.5.4. Spain Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Sweden Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.5.6.3. Sweden Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.5.6.4. Sweden Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 6.5.7. Austria 6.5.7.1. Austria Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Austria Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.5.7.3. Austria Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.5.7.4. Austria Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Rest of Europe Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 6.5.8.3. Rest of Europe Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 6.5.8.4. Rest of Europe Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7. Asia Pacific Enterprise Asset Management Market Size and Forecast by Segmentation (by Value) (2023-2030) 7.1. Asia Pacific Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.2. Asia Pacific Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.3. Asia Pacific Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.4. Asia Pacific Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5. Asia Pacific Enterprise Asset Management Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.1.2. China Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.1.3. China Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.1.4. China Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.2.2. S Korea Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.2.3. S Korea Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.2.4. S Korea Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Japan Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.3.3. Japan Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.3.4. Japan Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.4. India 7.5.4.1. India Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.4.2. India Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.4.3. India Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.4.4. India Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.5.2. Australia Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.5.3. Australia Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.5.4. Australia Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.6.2. Indonesia Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.6.3. Indonesia Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.6.4. Indonesia Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.7.2. Malaysia Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.7.3. Malaysia Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.7.4. Malaysia Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.8.2. Vietnam Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.8.3. Vietnam Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.8.4. Vietnam Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.9.2. Taiwan Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.9.3. Taiwan Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.9.4. Taiwan Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 7.5.10.2. Rest of Asia Pacific Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 7.5.10.3. Rest of Asia Pacific Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 7.5.10.4. Rest of Asia Pacific Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 8. Middle East and Africa Enterprise Asset Management Market Size and Forecast by Segmentation (by Value) (2023-2030) 8.1. Middle East and Africa Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 8.2. Middle East and Africa Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 8.3. Middle East and Africa Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 8.4. Middle East and Africa Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 8.5. Middle East and Africa Enterprise Asset Management Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 8.5.1.2. South Africa Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 8.5.1.3. South Africa Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 8.5.1.4. South Africa Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 8.5.2. GCC 8.5.2.1. GCC Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 8.5.2.2. GCC Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 8.5.2.3. GCC Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 8.5.2.4. GCC Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Nigeria Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 8.5.3.3. Nigeria Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 8.5.3.4. Nigeria Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 8.5.4.2. Rest of ME&A Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 8.5.4.3. Rest of ME&A Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 8.5.4.4. Rest of ME&A Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 9. South America Enterprise Asset Management Market Size and Forecast by Segmentation (by Value) (2023-2030) 9.1. South America Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 9.2. South America Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 9.3. South America Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 9.4. South America Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 9.5. South America Enterprise Asset Management Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 9.5.1.2. Brazil Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 9.5.1.3. Brazil Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 9.5.1.4. Brazil Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 9.5.2.2. Argentina Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 9.5.2.3. Argentina Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 9.5.2.4. Argentina Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Enterprise Asset Management Market Size and Forecast, by Component (2023-2030) 9.5.3.2. Rest Of South America Enterprise Asset Management Market Size and Forecast, by Deployment Type (2023-2030) 9.5.3.3. Rest Of South America Enterprise Asset Management Market Size and Forecast, by Organisation Size (2023-2030) 9.5.3.4. Rest Of South America Enterprise Asset Management Market Size and Forecast, by Industry (2023-2030) 10. Global Enterprise Asset Management Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Enterprise Asset Management Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. IBM Corporation 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. ABB 11.3. CGI Group, Inc. 11.4. eMaint 11.5. Dude Solutions, Inc. 11.6. IFS AB 11.7. Infor 11.8. Ramco Systems 11.9. SAP SE 11.10. Vesta Partners, LLC 11.11. Schneider Electric SA 11.12. Oracle Corporation 11.13. CARL International SA 11.14. AssetWorks LLC 11.15. Ultimo Software Solutions Bv 11.16. MAINTENANCE CONNECTION 11.17. AVEVA Group plc 11.18. Aptean 11.19. UpKeep Maintenance Management 11.20. RFgen Software 11.21. FUJITSU 12. Key Findings 13. Industry Recommendations