Managed IT Infrastructure Services Market size was valued at USD 91.17 Bn. in 2022 and Managed IT Infrastructure Services Market revenue is expected to grow by 11.25 % from 2023 to 2029, reaching nearly USD 192.29 Bn.Managed IT Infrastructure Services Market Overview:

Managed IT Infrastructure Services Market is all about administering and managing technology, information, and data in a positive way. Its scope ranges from the desktop to networking, storage, data, security, and cloud-based services not forgetting the people employed to keep everything working. The Managed IT Infrastructure Services Market provides clear boundaries for how business infrastructure manage. The primary goal of Managed IT Infrastructure Services is to minimize downtime and to keep the business as productive as possible. In addition, a fully managed infrastructure turns into effective business processes and allows redirecting the efforts of IT teams to valuable strategic tasks. Furthermore, amplifies business productivity with a versatile managed IT infrastructure services market. Managed Services Market network that helps to maximize network performance to enhance network security, and improve uptime. In March 2022, Verizon Communications Inc. announced that the expansion of its 5G Ultra Wideband network is expected to grow to 182 million people by the end of the year 2022. The company's growth avenues, including 5G mobility, nationwide broadband, mobile edge computing (MEC), business solutions, the value market, and network monetization, with the expectation that these will help the company achieve service and other revenue growth of Market.Managed IT Infrastructure Services Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Managed IT Infrastructure Services Market Drivers:

Increasing Industry helps to increase the demands of Managed IT Infrastructure Services Market Increasing industries are rising demand for IT infrastructures that adapt and scale according to their requirements. To meet these demands, manufacturers, players, and IT firms are collaborating with Market providers. This partnership aims to enhance productivity and accelerate revenue growth through cutting-edge IT services. Demand for Managed IT Infrastructure Services Market In the post-COVID-19 pandemic, there has been an increase in secure IT infrastructure and managed services. Increasing demand for low-cost services, rising need for risk-free IT services, and rising support from government organizations for the IT industry. Support from Government organizations Support from Government organizations is playing a significant role in the growth of the IT industry through their support and incentives. This support is boosting the market of managed IT infrastructure services market across various sectors. Furthermore, the managed IT infrastructure services market is controlled for substantial growth due to these key drivers. The increasing support for technology and the continuous evolution of IT needs in different industries are expected to boost the managed IT infrastructure services market in the forecast period. Increased Efficiency and Cost Reduction through Managed Services The managed IT infrastructure services market is witnessing rapid growth due to the combined benefits of improved cost and operational efficiency, along with the ability to update outdated hardware. This article explores how managed services are transforming businesses by reducing in-house costs, increasing operational excellence, and replacing obsolete hardware. Managed IT infrastructure services market is developing the business landscape by offering significant cost savings and operational improvements. Organizations Having Competitive Environment and Changing Market Demands One of the most significant advantages of managed IT service market is its focus on continuous improvement. Businesses adopting managed IT infrastructure services market benefit from ongoing enhancements to their operational and business processes. This optimization ensures that organizations stay competitive and responsive to changing market demands. The combination of lower costs, an increase in operational excellence, and the ability to update the hardware are the driving forces which are beneficial to the rapid growth of the market. As businesses recognize the potential benefits, the managed IT infrastructure service market is expected to Driving Market Growth in the forecast years. Managed IT Infrastructure Service Market is developing businesses by improving cost efficiency, operational excellence, and hardware compatibility, enhancing their performance, and driving Market growth in the forecast year. Managed IT Infrastructure Services Market Restraints: Reducing profit margins hampers the market The Market growth is hampered by reducing profit margins, integration challenges and some other factors. However, emerging technologies like mobility and cloud computing are reshaping the business landscape. To increase in this dynamic environment, companies must align themselves with these technologies to provide prime customer benefits. However, the market faces difficulties in expanding due to reliability concerns associated with outsourcing critical business infrastructure to external partners. Managed IT Infrastructure Services Market Opportunities: It is a great opportunity that automotive and robotics reduced the dependency on human employees and labor and increased productivity, preventing mistakes from occurring in the processes. In addition, AI, IoT, and digitalization become relevant going forward and define new ways of working. This provides new opportunities to The Market in the forecast period. In market, cloud technology is being used to build new platforms for consumer engagements and for digital transformation. Nearly 73% of enterprises are working in a multi-Cloud environment. However, applying for a cloud environment enhances customer engagement and is an opportunity for enterprises due to their skills and infrastructure. Opportunity for Market Providers with DevOps experience. Also, during the pandemic, the Cloud is gaining more traction. This shift from on-Premise mode to the cloud is providing to be a boon for managed IT Infrastructure service market providers as it opens an array of opportunities in vehicles such as damaged security, managed network, managed data center, It infrastructure, and managed mobility, Managed information and managed communication and collaboration services. Managed IT Infrastructure Services Market Segmentation: Based on the type, The On-premises segment dominated the Market in the year 2022 and is expected to continue its dominance during the forecast period. Furthermore, the cloud-based segment is expected to grow fastly during the forecast period. In this type of scenario, the data is kept in the cloud and is available to all users via the Internet. Cloud-based services are backed up by premium security data centers such as Cloudflare cloud security, AWS cloud security, and others.Managed IT Infrastructure Services Market Based on Types (2022)

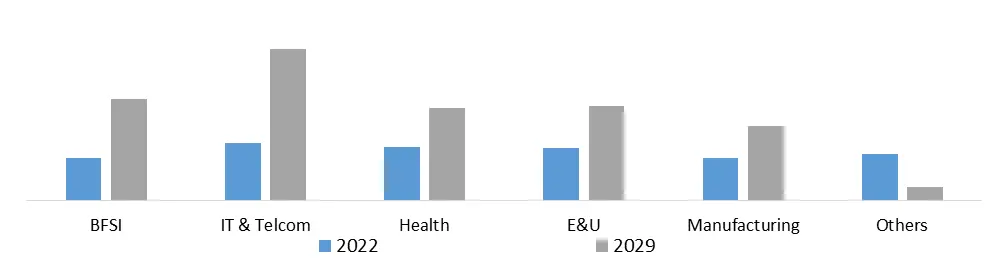

Based on the end-user, The IT and Telecommunications segment dominated the market in the year 2022 and is expected to continue its dominance during the forecast period. Furthermore, the Market for managed IT infrastructure services is driven by factors such as increased business competency and a rising focus on core operations in order to improve customer satisfaction. Furthermore, the banking and financial services and insurance (BFSI), healthcare and manufacturing segments are expected to grow fastly during the forecast period. The growing adoption of Internet of Things (IoT) technology has boosted managed service providers’ ability to provide services that support IoT, boosting the managed IT infrastructure services industry. Furthermore, the market for managed IT infrastructure services is driven by factors such as increased business competency and a rising focus on core operations in order to improve customer satisfaction.

Managed IT Infrastructure Services Market Based on End User (2022 - 2029)

Managed IT Infrastructure Services Market Regional Insights:

The Asia-Pacific region dominated the global market share in the Year 2022 and is expected to continue its dominance during the forecast period. Overall, with the dominance of IT and IT-enabled services in several nations such as China and India, the Asia-Pacific region will grow the fastest with the highest CAGR value during the forecast period. In 2022, the Indian IT and IT-enabled services industry accounted for more than 58% of global services-sourcing enterprises. China also undergoing rapid development and is on track to become the global leader in new developing IT technologies such as IoT technology, AI, autonomous vehicles, and wireless sensor networks. As a result, a rise in managed infrastructure demand is likely to support the APAC market’s growth during the forecast period. The North American region segment is expected to grow fastly during the forecast period. It holds the global services market. Recent technological advances, such as expanded cloud infrastructure and an IoT-enabled ecosystem, have created the platform for new business imperatives in the United States’ IT sector, and public cloud penetration in the US, will help the market grow rapidly.Managed IT Infrastructure Services Market Scope: Inquire Before Buying

Global Managed IT Infrastructure Services Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 91.17 Bn. Forecast Period 2023 to 2029 CAGR: 11.25% Market Size in 2029: US $ 192.29 Bn. Segments Covered: by Type On-premises Cloud by End User IT and Telecommunications banking and Financial services and insurance (BFSI) healthcare manufacturing Transportation & Logistics Retail Other End-Users by Enterprises Size Small & Medium Enterprises Large Enterprises by Service Category Virtualization Networking Storage Servers Managed IT Infrastructure Services Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Managed IT Infrastructure Services Market, Key Players are

1. Accenture Plc, 2. Fujitsu Limited, 3. Lenovo Group Limited, 4. Cisco Systems Inc., 5. Dell Technologies Inc., 6. Happiest Minds Technologies, 7. DXC Technology Corporation, 8. International Business Machines Corporation, 9. Hewlett Packard Enterprise, 10. Telefonaktiebolaget LM Ericsson 11. CSS Corp Pvt Ltd. 12. IBM Corporation 13. Alcatel-Lucent SA 14. Microsoft Corporation 15. Verizon Communications Inc. 16. Citrix Systems Inc. 17. Tata Consultancy Services Limited 18. Deutsche Telekom AG rvice Type Frequently Asked Questions: 1. How big is the Market? Ans. The Market size is reached USD 91.17 billion in 2022 and grow at a CAGR of 11.25% to reach USD 192.29 billion by 2029. 2. Which is the fastest-growing region in Market? Ans. Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2022-2029). 3. What are the major drivers in the market? Ans. Trends that are expected to drive the growth of the market include increasing demand for IT professionals in developed regions, rise in demand for secure IT infrastructure post the COVID-19 pandemic, increasing demand for low-cost services and rising need for risk-free IT services, and rising support from government organizations for IT industry. 4. What are the top players operating in the Market? Ans. The major players in the market are Fujitsu, Cisco, Dell, IBM, Tata Consultancy Services, Canon, AT&T, Citrix, Xerox, Ricoh, Lexmark and Konica Minolta. 5. What segments are covered in the Market? Ans. TheMarket is Segmented based on Type, Application and Region.

1. Managed IT Infrastructure Services Market: Research Methodology 2. Managed IT Infrastructure Services Market: Executive Summary 3. Managed IT Infrastructure Services Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Managed IT Infrastructure Services Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Managed IT Infrastructure Services Market: Segmentation (by Value USD and Volume Units) 5.1. Managed IT Infrastructure Services Market, by Type (2022-2029) 5.1.1. On-premises 5.1.2. Cloud 5.2. Managed IT Infrastructure Services Market, by End-User (2022-2029) 5.2.1. IT and Telecommunications 5.2.2. banking and Financial services and insurance (BFSI) 5.2.3. healthcare 5.2.4. manufacturing 5.2.5. Transportation & Logistics 5.2.6. Retail 5.2.7. Other End-Users 5.3. Managed IT Infrastructure Services Market, by Enterprise Size (2022-2029) 5.3.1. Small & Medium Enterprises 5.3.2. Large Enterprises 5.4. Managed IT Infrastructure Services Market, By Service Category 5.4.1. Virtualization 5.4.2. Networking 5.4.3. Storage 5.4.4. Servers 5.5. Managed IT Infrastructure Services Market, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Managed IT Infrastructure Services Market (by Value USD and Volume Units) 6.1. North America Managed IT Infrastructure Services Market, by Type (2022-2029) 6.1.1. On-premises 6.1.2. Cloud 6.2. North America Managed IT Infrastructure Services Market, by End-User (2022-2029) 6.2.1. IT and Telecommunications 6.2.2. banking and Financial services and insurance (BFSI) 6.2.3. healthcare 6.2.4. manufacturing 6.2.5. Transportation & Logistics 6.2.6. Retail 6.2.7. Other End-Users 6.3. North America Managed IT Infrastructure Services Market, by Enterprise Size (2022-2029) 6.3.1. Small & Medium Enterprises 6.3.2. Large Enterprises 6.4. North America Managed IT Infrastructure Services Market, By Service Category 6.4.1. Virtualization 6.4.2. Networking 6.4.3. Storage 6.4.4. Servers 6.5. North America Managed IT Infrastructure Services Market, by Country (2022-2029) 6.5.1. US 6.5.2. Canada 6.5.3. Mexico 7. Europe Managed IT Infrastructure Services Market (by Value USD and Volume Units) 7.1. Europe Managed IT Infrastructure Services Market, by Type (2022-2029) 7.2. Europe Managed IT Infrastructure Services Market, by End-User (2022-2029) 7.3. Europe Managed IT Infrastructure Services Market, by Enterprise Size (2022-2029) 7.4. Europe Managed IT Infrastructure Services Market, by Service Category (2022-2029) 7.5. Europe Managed IT Infrastructure Services Market, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe Managed IT Infrastructure Services 8. Asia Pacific Managed IT Infrastructure Services Market (by Value USD and Volume Units) 8.1. Asia Pacific Managed IT Infrastructure Services Market, by Type (2022-2029) 8.2. Asia Pacific Managed IT Infrastructure Services Market, by End-User (2022-2029) 8.3. Asia Pacific Managed IT Infrastructure Services Market, by Enterprise Size (2022-2029) 8.4. Asia Pacific Managed IT Infrastructure Services Market, by Service Category (2022-2029) 8.5. Asia Pacific Managed IT Infrastructure Services Market, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Managed IT Infrastructure Services Market (by Value USD and Volume Units) 9.1. Middle East and Africa Managed IT Infrastructure Services Market, by Type (2022-2029) 9.2. Middle East and Africa Managed IT Infrastructure Services Market, by End-User (2022-2029) 9.3. Middle East and Africa Managed IT Infrastructure Services Market, by Enterprise Size (2022-2029) 9.4. Middle East and Africa Managed IT Infrastructure Services Market, by Service Category (2022-2029) 9.5. Middle East and Africa Managed IT Infrastructure Services Market, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Managed IT Infrastructure Services Market (by Value USD and Volume Units) 10.1. South America Managed IT Infrastructure Services Market, by Type (2022-2029) 10.2. South America Managed IT Infrastructure Services Market, by End-User (2022-2029) 10.3. South America Managed IT Infrastructure Services Market, by Enterprise Size (2022-2029) 10.4. South America Managed IT Infrastructure Services Market, by Service Category (2022-2029) 10.5. South America Managed IT Infrastructure Services Market, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Accenture Plc 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Fujitsu Limited, 11.3. Lenovo Group Limited, 11.4. Cisco Systems Inc., 11.5. Dell Technologies Inc., 11.6. Happiest Minds Technologies, 11.7. DXC Technology Corporation, 11.8. International Business Machines Corporation, 11.9. Hewlett Packard Enterprise, 11.10. Telefonaktiebolaget LM Ericsson 11.11. CSS Corp Pvt Ltd. 11.12. IBM Corporation 11.13. Alcatel-Lucent SA 11.14. Microsoft Corporation 11.15. Verizon Communications Inc. 11.16. Citrix Systems Inc. 11.17. Tata Consultancy Services Limited 11.18. Deutsche Telekom AG 12. Key Findings 13. Industry Recommendation