Global E-learning Market size was valued at USD 206.18 Bn in 2023 and the total E-learning revenue is expected to grow by 15.68% from 2024 to 2030, reaching nearly USD 571.55 Bn.E-learning Market Overview

The delivery of education and training using digital resources is known as E-learning. E-learning is the contemporary way of learning that extensively involves the use of the Internet and various digital resources to deliver education. The E-learning sector has seen its popularity rise due to its ease, effectiveness, and adaptability, and e-learning solutions are being adopted by people. There is a market being driven by several factors including the growing demand for learning that is flexible, individual, and available on demand. E-learning takes significantly advanced in the fields of business, education, and training.To know about the Research Methodology :- Request Free Sample Report The increased use of technology, such as the Internet and smartphones, is helped to drive the growth of the E-Learning market. E-learning methods and technology are important both for educating students and for the professional development of employees in the workforce. The drivers of E-learning involved Instructor-led training(ILT), Video Delivery, Customer Web-based training (WBT), Social learning, and Learning postal delivery. It is easy to set up an electronic business and system an online business even by sitting at home if it takes the required software, a device, and the internet. The applications of technologies develop new standards for corporate learning and training. It helps transform the traditional way of doing things, as quick changes like work by innovative technologies post challenges for organizations.

E-learning Market Market Dynamics:

E-learning Market Drivers: Increasing Demand for Internet-Enabled Devices in E-Learning Market The advantages of e-learning sessions over conventional methods of teaching and learning are driving the expected growth of the global e-learning market. Building a sizable infrastructure and outfitting it with essential furnishings, including benches and chairs, is a requirement for traditional teaching methods. Constructing a physical structure where teachers and students can engage in the process of knowledge transfer, other considerations such as a steady supply of water, electricity, and other necessities cannot be disregarded. Such as professors and students can attend sessions from any location they want, and the expense of construction and installation is reduced in the case of e-learning. Inclusivity and Development in the E-learning Market Making education more accessible is essential if societies are to advance. Learning has been an opportunity reserved for the privileged. The people’s continued upskilling and reskilling are essential for success and development in the information economy, and technology deployment can help to lower the enormous expense of schooling. According to MMR, online courses are one-tenth as expensive as their equivalents offered on-site. Investments in education technology and e-learning are now on the national agenda as countries are eager to accomplish their developmental goals and are aware that a trained workforce is the greatest driver. E-Learning Market Opportunities: Growing number of players to provide market growth The worldwide E-learning Market has seen a significant inflow of new competitors, which is expected to lead to greater growth prospects. Having learned from the mistakes of earlier or present players, each player has something fresh to give the users. As e-learning programs for specialized courses or themes expand, this could lead to increased revenue as enrollment in these programs was previously restricted due to barriers like cost and accessibility. However, these problems can now be resolved as a result of the learning institutions beginning to provide financial aid to the students and possibilities like EMI. E-learning Market Restraints: Growing cases of cheating act as a challenge online learning is to cheating utilizing various techniques or approaches during assessments, regulating the rising number of cheating cases that have been reported is one of the main issues that worldwide market operators must overcome. Therefore, while administering exams, e-learning platforms must create a foolproof method of ensuring that the assessments are secure. Growing Demand for continuous product innovation The E-learning Market is gaining momentum, and vendors need to continuously innovate to differentiate their products and drive service adoption among a broader section of end-users. Cognitive learning technologies are becoming increasingly important and are poised to be game-changers in several learning opportunities. To remain relevant and up-to-date, learning providers are adopting these emerging technologies to extend the lifecycle of their existing products and maximize customer lifetime values.E-learning Market Segment Analysis:

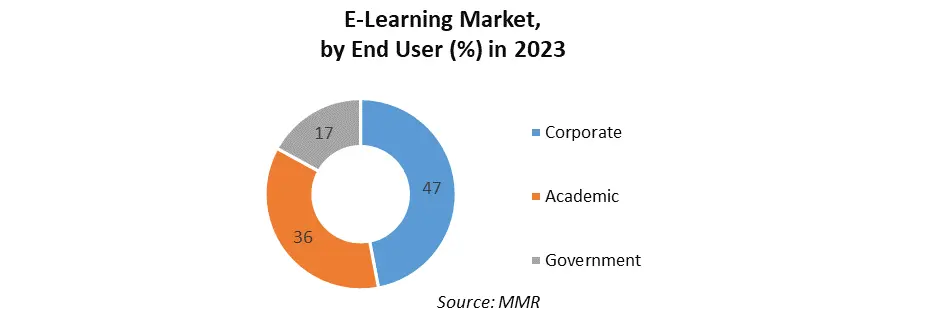

Based on Course: The E-learning Market is segmented into Primary and Secondary Education, Higher Education, Online Certification, Test Preparation and Professional Course. Then users access these solutions from their homes at any time, they are very helpful. These courses are intended to be taken by both professionals and students. Most of the time, customers start and finish these courses whenever they choose because they are not scheduled to be finished within a certain amount of time. Over the forecast term, these elements will support segmental growth. Because they offer a wide variety of courses related to business, the arts, and further basic and secondary education, the content will expand at the fastest CAGR during the forecast period. Based on End User: The E-learning Market is segmented into Corporate, Academic and Government. The Corporate segment dominated the global market with the largest E-Learning market share in 2023. The corporate sector constituted a substantial portion of the market as organizations increasingly recognized the value of continuous learning for employee development. Corporate E-Learning platforms are offering a wide range of training modules, including onboarding, compliance training, skill development, and leadership programs.

E-learning Market Regional Insights:

North America region E-learning market is expected to grow at a high rate during the forecast period. Millions of students receive a high-quality education each year from the Product Type and its participants, even in the most distant corners of the globe, through thousands of online courses. Along with the high caliber of the programs and associated services, the expansion in the United States may also be credited to the player’s extensive use of marketing and promotional tactics to penetrate and thrive in new areas. Many competitors in the e-learning business are determined to dominate by serving customers of different ages. These players also concentrate on combining with and purchasing numerous organizations that share their values to absorb their clientele. By selling their courses affordably, aggressive marketing strategies are also used to promote their goods to a wider consumer base.E-learning Market Scope: Inquire before buying

E-learning Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 206.18 Bn. Forecast Period 2024 to 2030 CAGR: 15.68% Market Size in 2030: US $ 571.55 Bn. Segments Covered: by Provider Content Provider Service Provider by Deployment Mode On-Premise Cloud by Technology Online E-Learning Learning Management System Mobile E-Learning Virtual Classroom Others by Application Government Academic Corporate E-learning Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)E-learning Key Players

North America 1. Aptara Inc. 2. Adobe, Inc. 3. articulate 4. Cisco Systems, Inc. 5. Citrix Systems, Inc. 6. D2L Corporation 7. Google learning 8. oracle corporation 9. coursera 10. skill share 11. edx 12. Udacity 13. Udemy Europe 14. Docebo 15. webanywhere APAC 16. BYJU’S 17. upGrad Education Private Limited 18. Alison Middle East 19. xpertlearning 20. iLearn ME Solutions 21. 360eLearn South America 22. K-12 Frequently Asked Questions: 1] What segments are covered in the Global E-learning Market report? Ans. The segments covered in the E-learning Market report are Provider, Deployment Model, Technology, Application and Region. 2] Which region held the largest E-learning Market share in 2023? Ans. The Asia Pacific region held the largest E-learning Market share in 2023. 3] What is the market size of the Global E-learning Market by 2030? Ans. The E-learning Market size by 2030 is expected to reach US$ 571.55 Bn. 4] What is the forecast period for the Global E-learning Market research? Ans. The forecast period for the E-learning Market research is 2024-2030. 5] What was the Global E-learning Market size in 2023? Ans. The E-learning Market size in 2023 was valued at US$ 206.18 Bn.

1. E-learning Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. E-learning Market: Dynamics 2.1. E-learning Market Trends by Region 2.1.1. North America E-learning Market Trends 2.1.2. Europe E-learning Market Trends 2.1.3. Asia Pacific E-learning Market Trends 2.1.4. Middle East and Africa E-learning Market Trends 2.1.5. South America E-learning Market Trends 2.2. E-learning Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America E-learning Market Drivers 2.2.1.2. North America E-learning Market Restraints 2.2.1.3. North America E-learning Market Opportunities 2.2.1.4. North America E-learning Market Challenges 2.2.2. Europe 2.2.2.1. Europe E-learning Market Drivers 2.2.2.2. Europe E-learning Market Restraints 2.2.2.3. Europe E-learning Market Opportunities 2.2.2.4. Europe E-learning Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific E-learning Market Drivers 2.2.3.2. Asia Pacific E-learning Market Restraints 2.2.3.3. Asia Pacific E-learning Market Opportunities 2.2.3.4. Asia Pacific E-learning Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa E-learning Market Drivers 2.2.4.2. Middle East and Africa E-learning Market Restraints 2.2.4.3. Middle East and Africa E-learning Market Opportunities 2.2.4.4. Middle East and Africa E-learning Market Challenges 2.2.5. South America 2.2.5.1. South America E-learning Market Drivers 2.2.5.2. South America E-learning Market Restraints 2.2.5.3. South America E-learning Market Opportunities 2.2.5.4. South America E-learning Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For E-learning Industry 2.8. Analysis of Government Schemes and Initiatives For E-learning Industry 2.9. E-learning Market Trade Analysis 2.10. The Global Pandemic Impact on E-learning Market 3. E-learning Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. E-learning Market Size and Forecast, by Provider (2023-2030) 3.1.1. Content Provider 3.1.2. Service Provider 3.2. E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 3.2.1. On-Premise 3.2.2. Cloud 3.3. E-learning Market Size and Forecast, by Technology (2023-2030) 3.3.1. Online E-Learning 3.3.2. Learning Management System 3.3.3. Mobile E-Learning 3.3.4. Virtual Classroom 3.3.5. Others 3.4. E-learning Market Size and Forecast, by Application (2023-2030) 3.4.1. Government 3.4.2. Academic 3.4.3. Corporate 3.5. E-learning Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America E-learning Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America E-learning Market Size and Forecast, by Provider (2023-2030) 4.1.1. Content Provider 4.1.2. Service Provider 4.2. North America E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 4.2.1. On-Premise 4.2.2. Cloud 4.3. North America E-learning Market Size and Forecast, by Technology (2023-2030) 4.3.1. Online E-Learning 4.3.2. Learning Management System 4.3.3. Mobile E-Learning 4.3.4. Virtual Classroom 4.3.5. Others 4.4. North America E-learning Market Size and Forecast, by Application (2023-2030) 4.4.1. Government 4.4.2. Academic 4.4.3. Corporate 4.5. North America E-learning Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States E-learning Market Size and Forecast, by Provider (2023-2030) 4.5.1.1.1. Content Provider 4.5.1.1.2. Service Provider 4.5.1.2. United States E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.1.2.1. On-Premise 4.5.1.2.2. Cloud 4.5.1.3. United States E-learning Market Size and Forecast, by Technology (2023-2030) 4.5.1.3.1. Online E-Learning 4.5.1.3.2. Learning Management System 4.5.1.3.3. Mobile E-Learning 4.5.1.3.4. Virtual Classroom 4.5.1.3.5. Others 4.5.1.4. United States E-learning Market Size and Forecast, by Application (2023-2030) 4.5.1.4.1. Government 4.5.1.4.2. Academic 4.5.1.4.3. Corporate 4.5.2. Canada 4.5.2.1. Canada E-learning Market Size and Forecast, by Provider (2023-2030) 4.5.2.1.1. Content Provider 4.5.2.1.2. Service Provider 4.5.2.2. Canada E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.2.2.1. On-Premise 4.5.2.2.2. Cloud 4.5.2.3. Canada E-learning Market Size and Forecast, by Technology (2023-2030) 4.5.2.3.1. Online E-Learning 4.5.2.3.2. Learning Management System 4.5.2.3.3. Mobile E-Learning 4.5.2.3.4. Virtual Classroom 4.5.2.3.5. Others 4.5.2.4. Canada E-learning Market Size and Forecast, by Application (2023-2030) 4.5.2.4.1. Government 4.5.2.4.2. Academic 4.5.2.4.3. Corporate 4.5.3. Mexico 4.5.3.1. Mexico E-learning Market Size and Forecast, by Provider (2023-2030) 4.5.3.1.1. Content Provider 4.5.3.1.2. Service Provider 4.5.3.2. Mexico E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.3.2.1. On-Premise 4.5.3.2.2. Cloud 4.5.3.3. Mexico E-learning Market Size and Forecast, by Technology (2023-2030) 4.5.3.3.1. Online E-Learning 4.5.3.3.2. Learning Management System 4.5.3.3.3. Mobile E-Learning 4.5.3.3.4. Virtual Classroom 4.5.3.3.5. Others 4.5.3.4. Mexico E-learning Market Size and Forecast, by Application (2023-2030) 4.5.3.4.1. Government 4.5.3.4.2. Academic 4.5.3.4.3. Corporate 5. Europe E-learning Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe E-learning Market Size and Forecast, by Provider (2023-2030) 5.2. Europe E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.3. Europe E-learning Market Size and Forecast, by Technology (2023-2030) 5.4. Europe E-learning Market Size and Forecast, by Application (2023-2030) 5.5. Europe E-learning Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom E-learning Market Size and Forecast, by Provider (2023-2030) 5.5.1.2. United Kingdom E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.1.3. United Kingdom E-learning Market Size and Forecast, by Technology (2023-2030) 5.5.1.4. United Kingdom E-learning Market Size and Forecast, by Application (2023-2030) 5.5.2. France 5.5.2.1. France E-learning Market Size and Forecast, by Provider (2023-2030) 5.5.2.2. France E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.2.3. France E-learning Market Size and Forecast, by Technology (2023-2030) 5.5.2.4. France E-learning Market Size and Forecast, by Application (2023-2030) 5.5.3. Germany 5.5.3.1. Germany E-learning Market Size and Forecast, by Provider (2023-2030) 5.5.3.2. Germany E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.3.3. Germany E-learning Market Size and Forecast, by Technology (2023-2030) 5.5.3.4. Germany E-learning Market Size and Forecast, by Application (2023-2030) 5.5.4. Italy 5.5.4.1. Italy E-learning Market Size and Forecast, by Provider (2023-2030) 5.5.4.2. Italy E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.4.3. Italy E-learning Market Size and Forecast, by Technology (2023-2030) 5.5.4.4. Italy E-learning Market Size and Forecast, by Application (2023-2030) 5.5.5. Spain 5.5.5.1. Spain E-learning Market Size and Forecast, by Provider (2023-2030) 5.5.5.2. Spain E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.5.3. Spain E-learning Market Size and Forecast, by Technology (2023-2030) 5.5.5.4. Spain E-learning Market Size and Forecast, by Application (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden E-learning Market Size and Forecast, by Provider (2023-2030) 5.5.6.2. Sweden E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.6.3. Sweden E-learning Market Size and Forecast, by Technology (2023-2030) 5.5.6.4. Sweden E-learning Market Size and Forecast, by Application (2023-2030) 5.5.7. Austria 5.5.7.1. Austria E-learning Market Size and Forecast, by Provider (2023-2030) 5.5.7.2. Austria E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.7.3. Austria E-learning Market Size and Forecast, by Technology (2023-2030) 5.5.7.4. Austria E-learning Market Size and Forecast, by Application (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe E-learning Market Size and Forecast, by Provider (2023-2030) 5.5.8.2. Rest of Europe E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.8.3. Rest of Europe E-learning Market Size and Forecast, by Technology (2023-2030) 5.5.8.4. Rest of Europe E-learning Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific E-learning Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific E-learning Market Size and Forecast, by Provider (2023-2030) 6.2. Asia Pacific E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.3. Asia Pacific E-learning Market Size and Forecast, by Technology (2023-2030) 6.4. Asia Pacific E-learning Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific E-learning Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.1.2. China E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.1.3. China E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.1.4. China E-learning Market Size and Forecast, by Application (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.2.2. S Korea E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.2.3. S Korea E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.2.4. S Korea E-learning Market Size and Forecast, by Application (2023-2030) 6.5.3. Japan 6.5.3.1. Japan E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.3.2. Japan E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.3.3. Japan E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.3.4. Japan E-learning Market Size and Forecast, by Application (2023-2030) 6.5.4. India 6.5.4.1. India E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.4.2. India E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.4.3. India E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.4.4. India E-learning Market Size and Forecast, by Application (2023-2030) 6.5.5. Australia 6.5.5.1. Australia E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.5.2. Australia E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.5.3. Australia E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.5.4. Australia E-learning Market Size and Forecast, by Application (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.6.2. Indonesia E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.6.3. Indonesia E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.6.4. Indonesia E-learning Market Size and Forecast, by Application (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.7.2. Malaysia E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.7.3. Malaysia E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.7.4. Malaysia E-learning Market Size and Forecast, by Application (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.8.2. Vietnam E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.8.3. Vietnam E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.8.4. Vietnam E-learning Market Size and Forecast, by Application (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.9.2. Taiwan E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.9.3. Taiwan E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.9.4. Taiwan E-learning Market Size and Forecast, by Application (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific E-learning Market Size and Forecast, by Provider (2023-2030) 6.5.10.2. Rest of Asia Pacific E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.10.3. Rest of Asia Pacific E-learning Market Size and Forecast, by Technology (2023-2030) 6.5.10.4. Rest of Asia Pacific E-learning Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa E-learning Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa E-learning Market Size and Forecast, by Provider (2023-2030) 7.2. Middle East and Africa E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 7.3. Middle East and Africa E-learning Market Size and Forecast, by Technology (2023-2030) 7.4. Middle East and Africa E-learning Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa E-learning Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa E-learning Market Size and Forecast, by Provider (2023-2030) 7.5.1.2. South Africa E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.1.3. South Africa E-learning Market Size and Forecast, by Technology (2023-2030) 7.5.1.4. South Africa E-learning Market Size and Forecast, by Application (2023-2030) 7.5.2. GCC 7.5.2.1. GCC E-learning Market Size and Forecast, by Provider (2023-2030) 7.5.2.2. GCC E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.2.3. GCC E-learning Market Size and Forecast, by Technology (2023-2030) 7.5.2.4. GCC E-learning Market Size and Forecast, by Application (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria E-learning Market Size and Forecast, by Provider (2023-2030) 7.5.3.2. Nigeria E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.3.3. Nigeria E-learning Market Size and Forecast, by Technology (2023-2030) 7.5.3.4. Nigeria E-learning Market Size and Forecast, by Application (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A E-learning Market Size and Forecast, by Provider (2023-2030) 7.5.4.2. Rest of ME&A E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.4.3. Rest of ME&A E-learning Market Size and Forecast, by Technology (2023-2030) 7.5.4.4. Rest of ME&A E-learning Market Size and Forecast, by Application (2023-2030) 8. South America E-learning Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America E-learning Market Size and Forecast, by Provider (2023-2030) 8.2. South America E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 8.3. South America E-learning Market Size and Forecast, by Technology(2023-2030) 8.4. South America E-learning Market Size and Forecast, by Application (2023-2030) 8.5. South America E-learning Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil E-learning Market Size and Forecast, by Provider (2023-2030) 8.5.1.2. Brazil E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.1.3. Brazil E-learning Market Size and Forecast, by Technology (2023-2030) 8.5.1.4. Brazil E-learning Market Size and Forecast, by Application (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina E-learning Market Size and Forecast, by Provider (2023-2030) 8.5.2.2. Argentina E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.2.3. Argentina E-learning Market Size and Forecast, by Technology (2023-2030) 8.5.2.4. Argentina E-learning Market Size and Forecast, by Application (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America E-learning Market Size and Forecast, by Provider (2023-2030) 8.5.3.2. Rest Of South America E-learning Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.3.3. Rest Of South America E-learning Market Size and Forecast, by Technology (2023-2030) 8.5.3.4. Rest Of South America E-learning Market Size and Forecast, by Application (2023-2030) 9. Global E-learning Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading E-learning Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Aptara Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Adobe, Inc. 10.3. articulate 10.4. Cisco Systems, Inc. 10.5. Citrix Systems, Inc. 10.6. D2L Corporation 10.7. Google learning 10.8. oracle corporation 10.9. coursera 10.10. skill share 10.11. edx 10.12. Udacity 10.13. Udemy 10.14. Docebo 10.15. webanywhere 10.16. BYJU’S 10.17. upGrad Education Private Limited 10.18. xpertlearning 10.19. iLearn ME Solutions 10.20. 360eLearn 10.21. K-12 11. Key Findings 12. Industry Recommendations 13. E-learning Market: Research Methodology 14. Terms and Glossary