Global Electronics Manufacturing Services Market size was valued at USD 604.28 Bn in 2023 and is expected to reach USD 839.02 Bn by 2030, at a CAGR of 4.8 %.Electronics Manufacturing Services Market Overview

Electronics Manufacturing Services (EMS) represent a pivotal sector within the global electronics industry, offering a broad spectrum of services essential for the design, production, and testing of electronic components and devices. EMS providers are the unsung heroes behind the scenes, facilitating the seamless transition of electronic concepts into tangible products. These companies are commended with the responsibility of optimizing the entire manufacturing process, from sourcing components to final assembly, cost-effectively and efficiently. Their scope of services incorporates everything from printed circuit board (PCB) fabrication to product packaging, permitting original equipment manufacturers (OEMs) to concentrate on innovation and market strategy. EMS providers often operate as vital partners for both startups and well-established companies, offering a flexible and scalable approach that adapts to market demands. The role of EMS in the modern electronics ecosystem is multifaceted. They help streamline the supply chain by procuring components, managing inventory and ensuring the timely delivery of materials to the assembly line, thus mitigating the risks associated with fluctuations in demand or component shortages.To know about the Research Methodology :- Request Free Sample Report EMS companies excel in delivering economies of scale, permitting businesses to reduce their production costs while maintaining product quality and performance standards. Their expertise in lean manufacturing and continuous improvement processes results in the production of high-quality electronics with reduced lead times. With the ever-evolving landscape of electronics, EMS providers are at the forefront of technological advancements, integrating automation, robotics and IoT solutions into their manufacturing processes. This helps improve efficiency, minimize errors, and maintain the competitiveness of the electronics industry. Their commitment to sustainability is becoming increasingly important, with many EMS providers adopting eco-friendly practices, such as lead-free soldering and energy-efficient production methods.

Electronics Manufacturing Services Market Dynamics:

Drivers Increasing Demand for Customized and Complex Electronic Products In today's fast-paced and technology-driven world, consumers and businesses seek electronic devices with specific features and functions tailored to their needs. This diversity of product offerings requires a manufacturing process that adapts and is customized accordingly. EMS providers are well-equipped to handle this diversity, offering the flexibility needed to produce unique electronic products efficiently. Complex electronic products often involve intricate designs and components that require specialized knowledge and technical expertise. EMS providers have the experience and capabilities to handle such intricacies, including surface mount technology, fine-pitch components, and multi-layer printed circuit boards. This expertise is essential for ensuring the proper assembly and functionality of these sophisticated devices. As the demand for customized and complex electronic products fluctuates, EMS providers offer scalability, enabling businesses to ramp up or down their production requirements as needed. This scalability is especially important for companies that face variable demand throughout the product lifecycle, ensuring cost efficiency and reducing excess inventory. Contrary to the misconception that customization equals higher costs, EMS providers specialize in cost-effective manufacturing. By optimizing production processes, minimizing waste, and leveraging economies of scale, they produce complex, customized electronics at a competitive cost, allowing businesses to maintain profitability. EMS providers have stringent quality control measures in place to ensure that complex electronic products meet high industry standards. This includes thorough testing and inspection procedures to detect and rectify defects, ensuring the reliability and safety of these devices. EMS providers often collaborate with original equipment manufacturers (OEMs) to innovate and improve the design and functionality of electronic products. Their expertise and experience in manufacturing various electronic products lead to valuable insights that drive innovation and enhance product performance.Trend

Growing focus on sustainability and environmentally friendly practices Governments worldwide are enacting increasingly stringent environmental regulations to address concerns such as e-waste management, hazardous materials use, and energy consumption. EMS providers must comply with these regulations to avoid legal penalties, making sustainability a necessary aspect of their operations. Consumers are becoming more environmentally conscious and are actively seeking products that are eco-friendly and sustainable. This shift in consumer preferences has prompted electronics manufacturers to partner with EMS providers who demonstrate a commitment to sustainability. Meeting consumer demands for green products has become a market differentiator and a way to enhance brand reputation. The electronics industry generates a substantial amount of electronic waste (e-waste). By adopting environmentally friendly practices, EMS providers contribute to reducing e-waste through measures such as recycling, refurbishment, and responsible disposal. This aligns with the global goal of minimizing the negative environmental impact of discarded electronics. Sustainability practices often go hand in hand with efficiency improvements. Energy-efficient manufacturing processes, lean production, and waste reduction not only reduce environmental impact but also lead to cost savings for EMS providers. This economic benefit encourages the adoption of sustainable practices. Sustainability includes responsible material sourcing, such as using conflict-free minerals and reducing the use of hazardous substances. EMS providers are recognizing the importance of sourcing materials ethically and responsibly, not only to meet regulatory requirements but also to align with corporate social responsibility goals. Restraints Rising volatility in the global supply chain hamper Electronics Manufacturing Services Market Global supply chains are vulnerable to a wide range of disruptions such as natural disasters, geopolitical tensions, trade disputes and unexpected events including the COVID-19 pandemic. These disruptions lead to delays in the accessibility of critical electronic components and materials, causing production bottlenecks and affecting EMS providers' capability to meet customer demands on time. Periodic shortages of electronic components, driven by factors such as increased demand, manufacturing capacity limitations, or geopolitical tensions, lead to extended lead times and increased costs. EMS providers struggle to secure essential components, impacting their production schedules and overall efficiency. The prices of electronic components and raw materials are conditional on fluctuations influenced by market dynamics, supply and demand imbalances and external factors. EMS providers face unanticipated cost increases, eroding profit margins and stimulating their ability to offer competitive pricing to customers.Electronics Manufacturing Services Market Segment Analysis

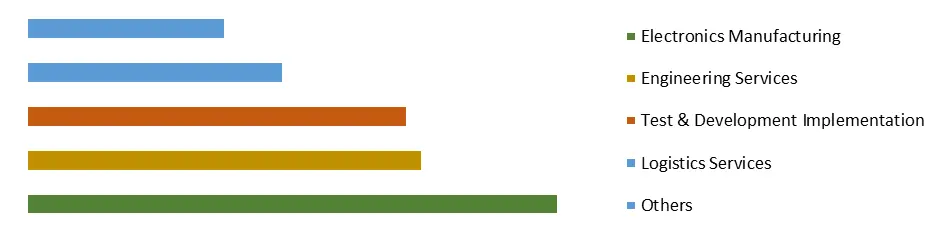

Based on Service, the market is segmented into Electronics Manufacturing, Engineering Services, Test and Development Implementation, Logistics Services and Others. Electronics Manufacturing Service is expected to dominate the Electronics Manufacturing Services Market over the forecast period. EMS providers provide end-to-end solutions, covering a wide spectrum of services, from design and prototyping to assembly, testing and even aftermarket provision. This comprehensive range of services makes them a one-stop shop for original equipment manufacturers (OEMs) and a suitable choice for companies seeking to streamline their supply chain. EMS providers have extensive experience and expertise in electronic manufacturing. They have the knowledge, equipment, and skilled workforce necessary to efficiently produce electronic components and devices, meeting industry standards and quality requirements. As the demand for customized electronic products continues to grow, EMS providers excel in meeting these requirements. They tailor their services to accommodate specific customer needs, ensuring that the end product aligns with the client's unique specifications. EMS providers offer scalable solutions, allowing businesses to adjust production quantities in response to market demand fluctuations. This flexibility ensures cost-effectiveness and minimizes excess inventory, which is a constraint in in-house manufacturing. EMS providers often operate in regions with lower labor costs, which enables cost-effective manufacturing. They leverage economies of scale and efficient production processes to deliver electronic products at competitive prices. EMS providers have established supply chain management expertise, ensuring a smooth flow of materials and components to meet production schedules. Their ability to source components efficiently and manage inventory reduces the risk of shortages or production delays.Global Electronics Manufacturing Services Market Share, By Service in 2023 (%)

Electronics Manufacturing Services Market Regional Insights

Asia Pacific dominated the largest Electronics Manufacturing Services Market share in 2023 and is expected to continue its dominance over the forecast period. Many major electronic component suppliers are based in Asia Pacific, particularly in countries such as Taiwan and South Korea. This proximity streamlines the supply chain, reduces lead times and enhances collaboration between EMS providers and suppliers, which is decisive for efficient production. The region is home to some of the world's largest OEMs such as companies in the consumer electronics, automotive and telecommunications sectors. This concentration of OEMs has led to a consistent demand for EMS services in the region, boosting the industry growth. Some APAC countries have established favorable regulatory environments and tax incentives to attract foreign investments in the electronics manufacturing sector. These policies have encouraged multinational corporations to set up manufacturing operations in the region. APAC EMS providers are known for their flexibility in adapting to changing market demands. They efficiently scale production up or down to accommodate fluctuations in demand, offering agile solutions to OEMs. APAC serves a wide range of industries, including consumer electronics, automotive, healthcare, and aerospace. This diversity allows EMS providers to gain expertise in multiple sectors, expanding their capabilities and adaptability. APAC EMS providers often form strategic partnerships with OEMs, creating long-term collaborative relationships. These partnerships facilitate the development of innovative solutions, efficient production processes, and a deep understanding of customer requirements. With a rapidly growing middle-class population and increased consumer demand for electronic products in the region, APAC offers substantial market potential for EMS providers. This growing demand is a driving force behind the industry's dominance.Global Electronics Manufacturing Services Market Scope: Inquire before buying

Global Electronics Manufacturing Services Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 604.28 Bn. Forecast Period 2024 to 2030 CAGR: 4.8% Market Size in 2030: US $ 839.02 Bn. Segments Covered: by Service Electronics Manufacturing Services Engineering Services Test & Development Implementation Logistics Services Others by Application Computer Consumer Electronics Aerospace & Defense Medical & Healthcare Automotive Others Electronics Manufacturing Services Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Electronics Manufacturing Services Key Players

1. Benchmark Electronics, Inc. 2. Celestica Inc. 3. Creation Technologies 4. ESCATEC 5. Flextronics International Ltd. 6. Foxconn 7. Integrated Microelectronics, Inc. 8. Jabil Circuit, Inc. 9. Key Tronic EMS 10. Kimball International 11. Plexus Corp. 12. Actia Group 13. Asteelflash 14. Venture Corporation 15. Sanmina Corporation Frequently Asked Questions: 1] What is the growth rate of the Global Electronics Manufacturing Services Market? Ans. The Global Electronics Manufacturing Services Market is growing at a significant rate of 4.8 % during the forecast period. 2] Which region is expected to dominate the Global Electronics Manufacturing Services Market? Ans. Asia Pacific is expected to dominate the Electronics Manufacturing Services Market during the forecast period. 3] What is the expected Global Electronics Manufacturing Services Market size by 2030? Ans. The Electronics Manufacturing Services Market size is expected to reach USD 839.02 Bn by 2030. 4] Which are the top players in the Global Electronics Manufacturing Services Market? Ans. The major top players in the Global Electronics Manufacturing Services Market are Benchmark Electronics, Inc., Celestica Inc., Creation Technologies, ESCATEC, Flextronics International Ltd., Foxconn, Integrated Microelectronics, Inc., Jabil Circuit, Inc., Key Tronic EMS, Kimball International, Plexus Corp., Actia Group and Others. 5] What are the factors driving the Global Electronics Manufacturing Services Market growth? Ans. The increasing demand for customized and complex electronic products is expected to drive market growth during the forecast period.

1. Electronics Manufacturing Services Market: Research Methodology 2. Electronics Manufacturing Services Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Electronics Manufacturing Services Market: Dynamics 3.1 Electronics Manufacturing Services Market Trends by Region 3.1.1 North America Electronics Manufacturing Services Market Trends 3.1.2 Europe Electronics Manufacturing Services Market Trends 3.1.3 Asia Pacific Electronics Manufacturing Services Market Trends 3.1.4 Middle East and Africa Electronics Manufacturing Services Market Trends 3.1.5 South America Electronics Manufacturing Services Market Trends 3.2 Electronics Manufacturing Services Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Electronics Manufacturing Services Market Drivers 3.2.1.2 North America Electronics Manufacturing Services Market Restraints 3.2.1.3 North America Electronics Manufacturing Services Market Opportunities 3.2.1.4 North America Electronics Manufacturing Services Market Challenges 3.2.2 Europe 3.2.2.1 Europe Electronics Manufacturing Services Market Drivers 3.2.2.2 Europe Electronics Manufacturing Services Market Restraints 3.2.2.3 Europe Electronics Manufacturing Services Market Opportunities 3.2.2.4 Europe Electronics Manufacturing Services Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Electronics Manufacturing Services Market Market Drivers 3.2.3.2 Asia Pacific Electronics Manufacturing Services Market Restraints 3.2.3.3 Asia Pacific Electronics Manufacturing Services Market Opportunities 3.2.3.4 Asia Pacific Electronics Manufacturing Services Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Electronics Manufacturing Services Market Drivers 3.2.4.2 Middle East and Africa Electronics Manufacturing Services Market Restraints 3.2.4.3 Middle East and Africa Electronics Manufacturing Services Market Opportunities 3.2.4.4 Middle East and Africa Electronics Manufacturing Services Market Challenges 3.2.5 South America 3.2.5.1 South America Electronics Manufacturing Services Market Drivers 3.2.5.2 South America Electronics Manufacturing Services Market Restraints 3.2.5.3 South America Electronics Manufacturing Services Market Opportunities 3.2.5.4 South America Electronics Manufacturing Services Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Technological Road Map 3.7 Analysis of Government Schemes and Initiatives For the Electronics Manufacturing Services Industry 3.8 The Global Pandemic and Redefining of The Electronics Manufacturing Services Industry Landscape 4. Global Electronics Manufacturing Services Market: Global Market Size and Forecast by Segmentation (By Value) (2023-2030) 4.1 Global Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 4.1.1 Electronics Manufacturing 4.1.2 Engineering Services 4.1.3 Test & Development Implementation 4.1.4 Logistics Services 4.1.5 Others 4.2 Global Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 4.2.1 Computer 4.2.2 Consumer Electronics 4.2.3 Aerospace & Defense 4.2.4 Medical & Healthcare Automotive 4.2.5 Others 4.3 Global Electronics Manufacturing Services Market Size and Forecast, by Region (2023-2030) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America Electronics Manufacturing Services Market Size and Forecast by Segmentation (By Value) (2023-2030) 5.1 North America Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 5.1.1 Electronics Manufacturing 5.1.2 Engineering Services 5.1.3 Test & Development Implementation 5.1.4 Logistics Services 5.1.5 Others 5.2 North America Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 5.2.1 Computer 5.2.2 Consumer Electronics 5.2.3 Aerospace & Defense 5.2.4 Medical & Healthcare Automotive 5.2.5 Others 5.3 North America Electronics Manufacturing Services Market Size and Forecast, by Country (2023-2030) 5.3.1 United States 5.3.1.1 United States Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 5.3.1.1.1 Electronics Manufacturing 5.3.1.1.2 Engineering Services 5.3.1.1.3 Test & Development Implementation 5.3.1.1.4 Logistics Services 5.3.1.1.5 Others 5.3.1.2 United States Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 5.3.1.2.1 Computer 5.3.1.2.2 Consumer Electronics 5.3.1.2.3 Aerospace & Defense 5.3.1.2.4 Medical & Healthcare Automotive 5.3.1.2.5 Others 5.3.2 Canada 5.3.2.1 Canada Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 5.3.2.1.1 Electronics Manufacturing 5.3.2.1.2 Engineering Services 5.3.2.1.3 Test & Development Implementation 5.3.2.1.4 Logistics Services 5.3.2.1.5 Others 5.3.2.2 Canada Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 5.3.2.2.1 Computer 5.3.2.2.2 Consumer Electronics 5.3.2.2.3 Aerospace & Defense 5.3.2.2.4 Medical & Healthcare Automotive 5.3.2.2.5 Others 5.3.3 Mexico 5.3.3.1 Mexico Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 5.3.3.1.1 Electronics Manufacturing 5.3.3.1.2 Engineering Services 5.3.3.1.3 Test & Development Implementation 5.3.3.1.4 Logistics Services 5.3.3.1.5 Others 5.3.3.2 Mexico Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 5.3.3.2.1 Computer 5.3.3.2.2 Consumer Electronics 5.3.3.2.3 Aerospace & Defense 5.3.3.2.4 Medical & Healthcare Automotive 5.3.3.2.5 Others 6. Europe Electronics Manufacturing Services Market Size and Forecast by Segmentation (By Value) (2023-2030) 6.1 Europe Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.2 Europe Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 6.3 Europe Electronics Manufacturing Services Market Size and Forecast, by Country (2023-2030) 6.3.1 United Kingdom 6.3.1.1 United Kingdom Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.3.1.2 United Kingdom Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 6.3.2 France 6.3.2.1 France Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.3.2.2 France Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 6.3.3 Germany 6.3.3.1 Germany Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.3.3.2 Germany Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 6.3.4 Italy 6.3.4.1 Italy Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.3.4.2 Italy Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 6.3.5 Spain 6.3.5.1 Spain Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.3.5.2 Spain Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 6.3.6 Sweden 6.3.6.1 Sweden Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.3.6.2 Sweden Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 6.3.7 Austria 6.3.7.1 Austria Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.3.7.2 Austria Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 6.3.8.2 Rest of Europe Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030). 7. Asia Pacific Electronics Manufacturing Services Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2023-2030) 7.1 Asia Pacific Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.2 Asia Pacific Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3 Asia Pacific Electronics Manufacturing Services Market Size and Forecast, by Country (2023-2030) 7.3.1 China 7.3.1.1 China Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.1.2 China Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.2 South Korea 7.3.2.1 S Korea Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.2.2 S Korea Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.3 Japan 7.3.3.1 Japan Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.3.2 Japan Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.4 India 7.3.4.1 India Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.4.2 India Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.5 Australia 7.3.5.1 Australia Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.5.2 Australia Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.6 Indonesia 7.3.6.1 Indonesia Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.6.2 Indonesia Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.7 Malaysia 7.3.7.1 Malaysia Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.7.2 Malaysia Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.8 Vietnam 7.3.8.1 Vietnam Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.8.2 Vietnam Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.9 Taiwan 7.3.9.1 Taiwan Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.9.2 Taiwan Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.10 Bangladesh 7.3.10.1 Bangladesh Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.10.2 Bangladesh Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.11 Pakistan 7.3.11.1 Pakistan Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.11.2 Pakistan Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 7.3.12.2 Rest of Asia PacificElectronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Electronics Manufacturing Services Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2023-2030) 8.1 Middle East and Africa Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 8.2 Middle East and Africa Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 8.3 Middle East and Africa Electronics Manufacturing Services Market Size and Forecast, by Country (2023-2030) 8.3.1 South Africa 8.3.1.1 South Africa Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 8.3.1.2 South Africa Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 8.3.2 GCC 8.3.2.1 GCC Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 8.3.2.2 GCC Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 8.3.3 Egypt 8.3.3.1 Egypt Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 8.3.3.2 Egypt Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 8.3.4 Nigeria 8.3.4.1 Nigeria Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 8.3.4.2 Nigeria Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 8.3.5.2 Rest of ME&A Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 9. South America Electronics Manufacturing Services Market Size and Forecast by Segmentation for Demand and Supply Side (By Value) (2023-2030) 9.1 South America Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 9.2 South America Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 9.3 South America Electronics Manufacturing Services Market Size and Forecast, by Country (2023-2030) 9.3.1 Brazil 9.3.1.1 Brazil Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 9.3.1.2 Brazil Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 9.3.2 Argentina 9.3.2.1 Argentina Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 9.3.2.2 Argentina Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 9.3.2.3 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America Electronics Manufacturing Services Market Size and Forecast, by Service (2023-2030) 9.3.3.2 Rest Of South America Electronics Manufacturing Services Market Size and Forecast, by Application (2023-2030) 10. Global Electronics Manufacturing Services Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Service Segment 10.3.3 Application Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Leading Electronics Manufacturing Services Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Benchmark Electronics, Inc. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Recent Developments 11.2 Celestica Inc. 11.3 Creation Technologies 11.4 ESCATEC 11.5 Flextronics International Ltd. 11.6 Foxconn 11.7 Integrated Microelectronics, Inc. 11.8 Jabil Circuit, Inc. 11.9 Key Tronic EMS 11.10 Kimball International 11.11 Plexus Corp. 11.12 Actia Group 11.13 Asteelflash 11.14 Venture Corporation 11.15 Sanmina Corporation 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary