Direct Air Carbon Capture Technology Market was valued at USD 3.85 Bn in 2023 and is expected to reach USD 7.53 Bn by 2030, at a CAGR of 10.05 percent during the forecast period.Direct Air Carbon Capture Technology Market Overview

Direct air capture (DAC) technologies enable the extraction of CO2 directly from the atmosphere at any given location, in contrast to carbon capture, which typically occurs at emission points like a steel plant. The captured CO2 is stored permanently in deep geological formations or utilized for various applications. The Direct Air Carbon Capture technology market has witnessed increasing interest and investment as global efforts to address climate change intensify. Governments, businesses, and investors are recognizing the potential of DAC as a crucial tool in achieving carbon neutrality and mitigating the impact of greenhouse gas emissions.To know about the Research Methodology :- Request Free Sample Report Ongoing research and development have led to technological advancements in Direct Air Carbon Capture systems, making them more efficient and cost-effective. Innovations focus on enhancing capture efficiency, reducing energy consumption, and exploring novel materials for the capture process.

Direct Air Carbon Capture Technology Market Dynamics

Climate Change Mitigation to boost Direct Air Carbon Capture Technology Market Growth The primary driver for direct air carbon capture is the urgent need to mitigate climate change. DACC technology offers a potential solution by actively removing carbon dioxide (CO2) from the atmosphere, helping to reduce greenhouse gas emissions. Supportive government policies, regulations, and financial incentives play a crucial role in the development and adoption of DACC technology. Governments implement measures such as carbon pricing or provide grants to encourage the deployment of carbon capture solutions. Many Direct Air Carbon Capture Technology companies are setting ambitious sustainability goals, including achieving carbon neutrality or net-zero emissions. DACC technology is valuable tool for companies aiming to offset their carbon footprint and demonstrate a commitment to environmental responsibility, which significantly boosts the Direct Air Carbon Capture Technology Market growth. Advances in DACC technology, including improvements in efficiency and cost-effectiveness, are critical drivers. As technology evolves, it becomes more viable and attractive to various industries seeking to implement carbon capture solutions. Growing public awareness of climate change issues and increasing pressure on businesses and governments to take meaningful action drive the demand for Direct Air Carbon Capture Technology. Consumers are becoming more environmentally conscious, influencing companies to adopt sustainable practices. The energy-intensive nature of capturing CO2 directly from the air is a distinctive driver shaping the landscape of the Direct Air Carbon Capture Technology Market. Unlike capturing CO2 from concentrated point sources like power stations or cement plants, extracting carbon dioxide from the atmosphere is more challenging due to its dilute nature. This inherent dilution poses a unique set of challenges, making the process more resource-intensive and consequently more expensive. In the current configurations of DAC plants, the role of heat in the overall energy consumption is a pivotal factor influenced by the operating temperature of the technologies employed. Both Single-Stage DAC (S-DAC) and Large-Scale DAC (L-DAC) were initially conceptualized to operate using a combination of heat and electricity. Their flexible configurations allow for adaptable operations, including heat-only or electricity-only modes, providing versatility in addressing the diverse energy needs of different settings. Within the realm of S-DAC, a diverse portfolio of technologies has emerged, each exhibiting variations in energy intensity, operating temperature, and, by extension, cost implications. This diversity underscores the dynamic nature of DAC solutions, offering stakeholders a range of options to tailor implementations based on specific requirements, economic considerations, and environmental objectives. The higher energy requirements for DAC, stemming from the atmospheric dilution factor, have prompted ongoing innovations and refinements in technology to enhance efficiency and reduce costs. Researchers and industry players are continuously exploring ways to optimize energy consumption and elevate the economic viability of DAC solutions, which is significantly expected to boost the Direct Air Carbon Capture Technology Market growth. As the DAC technology market evolves, addressing the energy-intensive aspect becomes a key focal point, driving advancements that contribute to the broader goal of sustainable and cost-effective carbon capture from the atmosphere. High Initial Costs to restrain the Direct Air Carbon Capture Technology Market growth The capital costs associated with establishing and deploying DAC facilities are often substantial. This high initial investment act as a significant barrier, limiting widespread adoption, especially for smaller companies or regions with limited financial resources. DAC processes are energy-intensive, primarily due to the low concentration of CO2 in the atmosphere. This results in higher operational costs, including electricity and heat requirements, which significantly limits the Direct Air Carbon Capture Technology Market growth. Reducing energy consumption and associated costs remains a critical challenge for the scalability and economic viability of DAC technology. Many DAC technologies are still in the early stages of development and deployment. The lack of mature, proven solutions hinder investor confidence and pose uncertainties regarding the long-term reliability and efficiency of these technologies. The transportation and storage of captured CO2 present logistical challenges. Establishing secure and efficient storage facilities, as well as developing infrastructure for transporting CO2 to storage sites, are complex and costly. The regulatory landscape for DAC is still evolving, and navigating the permitting process is time-consuming and complex. Regulatory uncertainties pose challenges for project development and hinder the speed at which DAC facilities is deployed. Innovation in Direct Air Carbon Capture Technology Market Electro swing adsorption (ESA)-DAC is based on an electrochemical cell where a solid electrode adsorbs CO2 when negatively charged and releases it when a positive charge is applied. ESA-DAC is currently being developed in the United States and United Kingdom. Zeolites are now being adopted for DAC thanks to their porous structure suitable for CO2 adsorption. The first operational DAC plant relying on zeolites was commissioned in 2022 in Norway, with plans to scale the technology up to 2 000 tCO2/year by 2025 through the project Removr. Passive DAC relies on accelerating the natural process that transforms calcium hydroxide and atmospheric CO2 into limestone. This process is being engineered in the United States by a company using renewably powered kilns to separate CO2 from limestone.

Direct Air Carbon Capture Technology Market Segment Analysis

Based on Operating Temperature, the market is segmented into Low-Temperature DAC, and High-Temperature DAC. The High-Temperature DAC segment dominated the market in 2023 and is expected to hold the largest Direct Air Carbon Capture Technology Market share over the forecast period. High-Temperature DAC operates at elevated temperature ranges, typically higher than those used in Low-Temperature DAC processes. The specific temperature range vary based on the technology and design of the DAC system. High-temperature DAC processes often involve thermal or chemical reactions that facilitate the capture of CO2. The higher temperatures enhance reaction kinetics and promote more efficient removal of CO2 from the air. The elevated operating temperatures contribute to higher capture rates, allowing for the more effective extraction of CO2 from the air. This is advantageous in achieving higher overall efficiency in the carbon capture process, which boosts the High temperature segment growth in Direct Air Carbon Capture Technology Market. High-Temperature DAC find applications across different industries, including energy production, industrial processes, and the production of low-carbon fuels. The captured CO2 is stored permanently or utilized in various industrial applications. Based on End-use Industry, the market is segmented into Energy Industry, Industrial Sector, Transportation, and Others. Energy Industry segment dominated the market in 2023 and is expected to hold the largest Direct Air Carbon Capture Technology Market share over the forecast period. The Energy Industry segment in the Direct Air Carbon Capture (DAC) Technology Market refers to the application of DAC technology specifically within the energy sector. This segment focuses on capturing carbon dioxide (CO2) emissions directly from the atmosphere in processes related to energy production, such as power plants and other facilities. The integration of DAC technology into the energy industry is aimed at reducing the carbon footprint of energy-related activities and addressing the environmental impact of greenhouse gas emissions. DAC technology is applied to traditional power plants, including those using fossil fuels such as coal, natural gas, or biomass. By capturing CO2 emissions directly from the atmosphere, DAC contributes to lowering the overall carbon intensity of power generation. The primary goal of implementing DAC technology in the energy industry is to reduce carbon emissions. As power plants are significant contributors to CO2 emissions, DAC offers a direct and targeted approach to mitigating the environmental impact of electricity generation.Direct Air Carbon Capture Technology Market Regional Insight

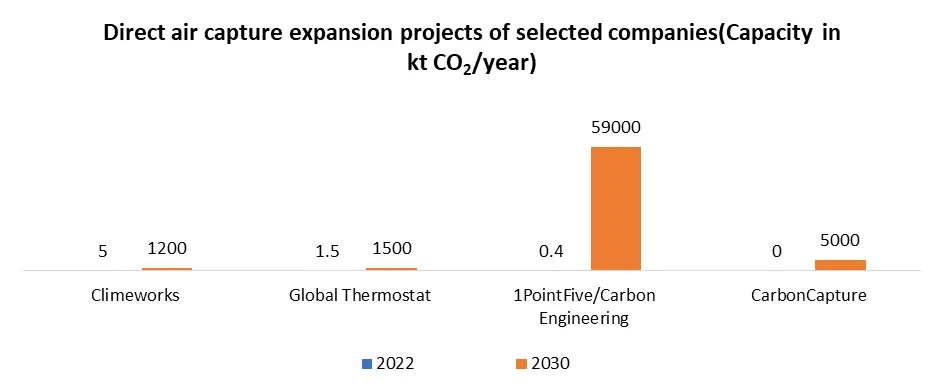

Government Incentives and Policies to boost the North America Direct Air Carbon Capture Technology Market growth The availability of government incentives, tax credits, and supportive policies are significant driver for DAC technology adoption. In North America, federal and state-level incentives encourage businesses to invest in carbon capture technologies. North American countries, particularly the United States and Canada, have set ambitious climate change mitigation goals. DAC technology is seen as a crucial tool in achieving these targets by removing carbon dioxide directly from the atmosphere. A supportive and clear regulatory environment that addresses the challenges and uncertainties related to DAC operations drive investment in the technology. Regulatory frameworks that incentivize carbon capture and storage play a key role. Direct Air Carbon Capture Technology Companies in North America are increasingly adopting sustainability goals, and DAC offers a way to actively contribute to carbon reduction efforts. Corporate commitments to achieving net-zero emissions drive the demand for Direct Air Carbon Capture Technology Market. In 2022, the United States announced significant additional funding under the Inflation Reduction Act (IRA), elevating the 45Q tax credit to USD 180 per ton of CO2 captured for storage through Direct Air Capture (DAC), with a minimal capture threshold of 1 kiloton of CO2 annually. The United States has established a number of policies and programmes to support DAC, including the 45Q tax credit and the California Low Carbon Fuels Standard credit (traded at an average of around USD 65/t CO2 in Q4 2022). The Inflation Reduction Act (IRA) announced in August 2022 expands and extends the 45Q tax credit up to USD 180/t CO2 permanently stored.The European Commission has set a goal to store up to 50 million tons of CO2 per year by 2030, incorporating contributions from DAC. Meanwhile, the United Kingdom's budget for March 2023 allocated up to GBP 20 billion (approximately USD 25 billion) for Carbon Capture, Utilization, and Storage (CCUS) initiatives, including support for DAC. Canada's 2022 federal budget proposed an investment tax credit for CCUS projects, particularly offering around 60% credit for DAC projects when CO2 is stored at a qualified permanent sequestration site. In January 2023, Japan established a carbon capture roadmap with a target of capturing 6 to 12 million tons of CO2 annually by 2030, inclusive of DAC. Currently, 27 DAC plants have been commissioned in Europe, North America, Japan, and the Middle East, primarily operating at a small scale for testing and demonstration purposes. Six DAC projects are presently under construction, with the two largest anticipated to commence operations in 2024 in Iceland (36 kilotons of CO2 per year) and in 2025 in the United States (500 kilotons of CO2 per year, with plans to scale up to 1,000 kilotons of CO2 per year). The surging demand for air-captured CO2, driven by carbon removal and low-emission synthetic hydrocarbon fuel production, has led to numerous announcements for new, larger plants. Currently, plans for at least 130 DAC facilities are in various stages of development, with significant projects underway in the United States (STRATOS, Oxy-CE Kleberg County project, HIF fuels Matagorda County project in Texas, and Bison in Wyoming), the United Kingdom (North-East Scotland DAC project), Norway (Kollsnes DAC project), and Iceland (Mammoth project). Among these, 16 DAC facilities are in advanced development or under construction. If all these planned projects proceed and operate at full capacity, DAC deployment is expected to reach approximately 4.7 million tons of CO2 by 2030, which is expected to boost the Direct Air Carbon Capture Technology Market growth. This represents a substantial increase from today's capture rate, but it still falls short of 7% of the 75 million tons of CO2 needed to align with the Net Zero Emissions (NZE) Scenario. Several other projects are still in early stages, lacking committed funding and, in some instances, even an identified location for deployment.

Direct Air Carbon Capture Technology Market Scope: Inquiry Before Buying

Global Direct Air Carbon Capture Technology Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.85 Bn. Forecast Period 2024 to 2030 CAGR: 10.05% Market Size in 2030: US $ 7.53 Bn. Segments Covered: by Operating Temperature Low-Temperature DAC High-Temperature DAC by End User Industry Energy Industry Industrial Sector Transportation Others Direct Air Carbon Capture Technology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading players in Direct Air Carbon Capture Technology Market:

Global: 1. Carbon Clean Solutions 2. Climeworks North America: 3. Carbon Engineering (Canada) 4. Global Thermostat (United States) 5. Climeworks (United States) 6. Carbon Cure Technologies (Canada) 7. Carbon Clean Solutions (United States) 8. Skytree (United States) 9. Global Thermostat (United States) Europe: 1. Carbon Clean Solutions (United Kingdom) 2. Carbon Clean Solutions (Netherlands) 3. Skytree (Switzerland) 4. CarbonCure Technologies (United Kingdom) 5. Climeworks (Italy) 6. Soletair Power (Finland) Asia: 1. Green Energy Storage (Japan) 2. LanzaTech (China) 3. Green Energy Storage (South Korea) Frequently Asked Questions: 1. What is Direct Air Carbon Capture (DAC) technology? Ans: DAC technology enables the extraction of CO2 directly from the atmosphere at any location, addressing climate change by actively removing carbon dioxide. 2. What are some notable government initiatives supporting DAC globally? Ans: Initiatives include the United States' 45Q tax credit, the European Commission's CO2 storage goals, the UK's budget allocation for CCUS initiatives, and Japan's carbon capture roadmap. 3. Why do high initial costs act as a restraint on DAC market growth? Ans: Establishing DAC facilities involves substantial capital costs, limiting adoption, especially for smaller companies or regions with limited financial resources. 4. What is the significance of the energy industry in the DAC market? Ans: The Energy Industry segment focuses on applying DAC technology to reduce carbon emissions from energy production, contributing to lower overall carbon intensity. 5. What are the primary drivers for adopting DAC technology? Ans: The urgent need for climate change mitigation, supportive government policies, and corporate sustainability goals drive the adoption of DAC technology.

1. Direct Air Carbon Capture Technology Market: Research Methodology 2. Direct Air Carbon Capture Technology Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Direct Air Carbon Capture Technology Market: Dynamics 3.1. Direct Air Carbon Capture Technology Market Trends by Region 3.1.1. North America Direct Air Carbon Capture Technology Market Trends 3.1.2. Europe Direct Air Carbon Capture Technology Market Trends 3.1.3. Asia Pacific Direct Air Carbon Capture Technology Market Trends 3.1.4. Middle East and Africa Direct Air Carbon Capture Technology Market Trends 3.1.5. South America Direct Air Carbon Capture Technology Market Trends 3.2. Direct Air Carbon Capture Technology Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Direct Air Carbon Capture Technology Market Drivers 3.2.1.2. North America Direct Air Carbon Capture Technology Market Restraints 3.2.1.3. North America Direct Air Carbon Capture Technology Market Opportunities 3.2.1.4. North America Direct Air Carbon Capture Technology Market Challenges 3.2.2. Europe 3.2.2.1. Europe Direct Air Carbon Capture Technology Market Drivers 3.2.2.2. Europe Direct Air Carbon Capture Technology Market Restraints 3.2.2.3. Europe Direct Air Carbon Capture Technology Market Opportunities 3.2.2.4. Europe Direct Air Carbon Capture Technology Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Direct Air Carbon Capture Technology Market Drivers 3.2.3.2. Asia Pacific Direct Air Carbon Capture Technology Market Restraints 3.2.3.3. Asia Pacific Direct Air Carbon Capture Technology Market Opportunities 3.2.3.4. Asia Pacific Direct Air Carbon Capture Technology Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Direct Air Carbon Capture Technology Market Drivers 3.2.4.2. Middle East and Africa Direct Air Carbon Capture Technology Market Restraints 3.2.4.3. Middle East and Africa Direct Air Carbon Capture Technology Market Opportunities 3.2.4.4. Middle East and Africa Direct Air Carbon Capture Technology Market Challenges 3.2.5. South America 3.2.5.1. South America Direct Air Carbon Capture Technology Market Drivers 3.2.5.2. South America Direct Air Carbon Capture Technology Market Restraints 3.2.5.3. South America Direct Air Carbon Capture Technology Market Opportunities 3.2.5.4. South America Direct Air Carbon Capture Technology Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Direct Air Carbon Capture Technology Market 3.8. Analysis of Government Schemes and Initiatives For the Direct Air Carbon Capture Technology Market 3.9. The Global Pandemic Impact on the Direct Air Carbon Capture Technology Market 4. Direct Air Carbon Capture Technology Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 4.1.1. Low-Temperature DAC 4.1.2. High-Temperature DAC 4.2. Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 4.2.1. Energy Industry 4.2.2. Industrial Sector 4.2.3. Transportation 4.2.4. Others 4.3. Direct Air Carbon Capture Technology Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Direct Air Carbon Capture Technology Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 5.1.1. Low-Temperature DAC 5.1.2. High-Temperature DAC 5.2. North America Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 5.2.1. Energy Industry 5.2.2. Industrial Sector 5.2.3. Transportation 5.2.4. Others 5.3. North America Direct Air Carbon Capture Technology Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 5.3.1.1.1. Low-Temperature DAC 5.3.1.1.2. High-Temperature DAC 5.3.1.2. United States Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 5.3.1.2.1. Energy Industry 5.3.1.2.2. Industrial Sector 5.3.1.2.3. Transportation 5.3.1.2.4. Others 5.3.2. Canada 5.3.2.1. Canada Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 5.3.2.1.1. Low-Temperature DAC 5.3.2.1.2. High-Temperature DAC 5.3.2.2. Canada Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 5.3.2.2.1. Energy Industry 5.3.2.2.2. Industrial Sector 5.3.2.2.3. Transportation 5.3.2.2.4. Others 5.3.3. Mexico 5.3.3.1. Mexico Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 5.3.3.1.1. Low-Temperature DAC 5.3.3.1.2. High-Temperature DAC 5.3.3.2. Mexico Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 5.3.3.2.1. Energy Industry 5.3.3.2.2. Industrial Sector 5.3.3.2.3. Transportation 5.3.3.2.4. Others 6. Europe Direct Air Carbon Capture Technology Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.2. Europe Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 6.3. Europe Direct Air Carbon Capture Technology Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.3.1.2. United Kingdom Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 6.3.2. France 6.3.2.1. France Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.3.2.2. France Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.3.3.2. Germany Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.3.4.2. Italy Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.3.5.2. Spain Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.3.6.2. Sweden Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.3.7.2. Austria Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 6.3.8.2. Rest of Europe Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7. Asia Pacific Direct Air Carbon Capture Technology Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.2. Asia Pacific Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3. Asia Pacific Direct Air Carbon Capture Technology Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.1.2. China Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.2.2. S Korea Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.3.2. Japan Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.4. India 7.3.4.1. India Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.4.2. India Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.5.2. Australia Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.6.2. Indonesia Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.7.2. Malaysia Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.8.2. Vietnam Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.9.2. Taiwan Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 7.3.10.2. Rest of Asia Pacific Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 8. Middle East and Africa Direct Air Carbon Capture Technology Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 8.2. Middle East and Africa Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 8.3. Middle East and Africa Direct Air Carbon Capture Technology Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 8.3.1.2. South Africa Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 8.3.2.2. GCC Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 8.3.3.2. Nigeria Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 8.3.4.2. Rest of ME&A Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 9. South America Direct Air Carbon Capture Technology Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 9.1. South America Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 9.2. South America Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 9.3. South America Direct Air Carbon Capture Technology Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 9.3.1.2. Brazil Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 9.3.2.2. Argentina Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Direct Air Carbon Capture Technology Market Size and Forecast, By Operating Temperature (2023-2030) 9.3.3.2. Rest Of South America Direct Air Carbon Capture Technology Market Size and Forecast, By End-use Industry (2023-2030) 10. Global Direct Air Carbon Capture Technology Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Direct Air Carbon Capture Technology Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Carbon Clean Solutions 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Climeworks 11.3. Carbon Engineering (Canada) 11.4. Global Thermostat (United States) 11.5. Climeworks (United States) 11.6. Carbon Cure Technologies (Canada) 11.7. Carbon Clean Solutions (United States) 11.8. Skytree (United States) 11.9. Global Thermostat (United States) 11.10. Carbon Clean Solutions (United Kingdom) 11.11. Carbon Clean Solutions (Netherlands) 11.12. Skytree (Switzerland) 11.13. CarbonCure Technologies (United Kingdom) 11.14. Climeworks (Italy) 11.15. Soletair Power (Finland) 11.16. Green Energy Storage (Japan) 11.17. LanzaTech (China) 11.18. Green Energy Storage (South Korea) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary