Global Textile Recycling Market size was valued at USD 6.89 Bn in 2023 and Textile Recycling Market revenue is expected to reach USD 10.57 Bn by 2030, at a CAGR of 6.3 % over the forecast period (2024-2030)Textile Recycling Market Overview

Textile recycling is the process of repurposing used textiles and clothing to minimize waste and promote sustainability. The textile recycling industry has been increasing the demand and consumption of textiles due to the global population growth and living standards improvement, most of the solid recyclable waste in the textile industry refers to natural and synthetic fiber materials during the manufacturing process. The major wastes generated by this sector are fiber wastes, scraps, hard fibers, beaming wastes, off-cuts, packaging, and spools Dyeing, printing, and finishing processes use up to 200 water per kilogram of fiber, making wastewater the largest waste in this sector by volume. 100 billion garments are produced annually, and around 8% of recycled textile products are placed in landfill. Textile recycling helps in the protection of the environment as well Recycled clothing industry reduces landfill space.To know about the Research Methodology :- Request Free Sample Report

Textile Recycling Market Dynamics

Textile Recycling Drives Growth in Sustainable Fashion Industry Textile recycling plays a pivotal role in safeguarding the environment by curbing landfill waste and mitigating potential hazards. Recycled clothes alleviate landfill space pressure, thereby reducing the threat posed to the environment and water sources, which is a significant driver for market growth. Synthetic fiber-based textiles and fabrics like wool decompose slowly, releasing methane and contributing to global warming. Recycling these fabrics significantly reduces such environmental risks. Reduced chemical and dye usage in the recycling process further minimizes adverse manufacturing effects. The accessibility of cost-effective raw materials from recycled fabrics makes it an appealing feature for manufacturers. According to MMR Report, nearly 5% of total landfill space in the US is occupied by textile waste, despite the textile recycling industry recycling around 3.8 billion pounds of post-consumer textile waste annually. This accounts for approximately 15% of all post-consumer textile waste. On average, each US citizen discards 70 pounds of textiles per year. the post-consumer textile recycling industry has resulted in the recycling or reuse of billions of pounds of clothing, household textiles, shoes, and accessories, contributing to environmental sustainability. Harnessing Environmental and Economic Potential to Boost Market Growth The textile recycling market offers significant environmental and economic benefits by circumventing polluting and energy-intensive processes used in manufacturing textiles from fresh materials. Increasing recognition of the importance of textile impacts with one of the most polluting industries worldwide. With an expected 100 billion garments produced annually, textile recycling addresses a critical challenge towards achieving a zero-landfill society. In the European Union, approximately 50% of collected textiles are recycled, while another 50% is reused or exported. Textile waste management in landfills contributes to greenhouse gas emissions and global warming. Manufacturers recycle 75% of pre-consumer textile waste, but only 15% of post-consumer textile waste is recycled, with Eco-conscious consumers considered significant contributors. According to U.S. EPA, around 17 million tons of textile municipal solid waste (MSW) generated in 2021, about 5.8% of total MSW generation. Oxam, a British charitable organization, estimates 70% of their clothing donations end up in Africa. To reduce greenhouse gas emissions, efforts are made to increase textile recycling. In the UK. People consume 2 million tons of Recycled clothing industry; 0.5 million tons are recycled. 1 million tons is still disposed of in Europe, one can find textile waste of around 14 million tons out of which, a quarter of 5 million tons are recycled. Eco friendly clothing is Environmentally conscious fashion emphasizing sustainability, using ethical practices and materials, minimizing environmental impact, and promoting eco-friendly production and consumption. Ecological Solution to the Global Textile Waste Crisis Several brands have become influential drivers in combating textile waste, aligning with conscious consumers demanding change. Patagonia's Worn Wear platform and physical stores encourage buying, trading, and selling second-hand goods, extending garment lifespans and diverting textiles from landfills. H&M's extensive recycling services across 4,200 stores collect and repurpose unwanted clothing, amassing 15,000 tons for reuse in 2022, and significantly use Textile waste reduction strategies. Ecoalf pioneers by creating high-quality textiles from ocean waste and recycled materials, exemplifying Sustainable fashion recycling without compromising quality. Madewell's partnership with Cotton's Blue Jeans Go Green transforms donated jeans into housing insulation, diverting 415 tons of waste. The North Face's Clothes the Loop program not only accepts but repurposes unwanted apparel, fostering sustainability and social impact through Soles4Souls. Individuals and businesses can contribute by recycling textiles at partner retailers, hosting clothing swaps, renting attire for special occasions, and donating to organizations like ThredUp and The Salvation Army. Embracing circular economy principles, these Sustainable brands drive innovation and conscious consumption, transforming the textile industry. This proactive stance not only addresses environmental concerns but also presents a competitive advantage in a market increasingly valuing sustainability. Textile waste in landfills poses a global challenge. Natural fibers take years to decompose, while man-made fibers don't break down at all. Woolen clothes decompose, releasing methane and carbon dioxide, contributing to global warming. Landfilled synthetic fabrics emit nitrous oxide, a potent greenhouse gas. Toxic substances contaminate groundwater and soil. In US, 75% of pre-consumer textile waste is recycled, but only 15% of post-consumer waste is recycled. Consumers discard around 70 pounds of clothing and textile waste annually, generating 13 million tons of textile waste in America each year. Recycling clothing and reusing second-hand garments, with 70% of the world's population already using second-hand clothes. The US textile recycling industry creates 17,000 jobs and diverts 2.5 billion pounds of post-consumer textile waste annually. Trends in Textile Recycling Market The future of textile recycling Textile recycling, circularity, and clothing reuse have huge demand in the market. Organizations like the Ellen MacArthur Foundation have big ideas and plans for creating a new textile economy based on the principles of a circular economy, a real impact on the fashion industry. The accessible donation and the rate of recycling into new, wearable items. the majority of textiles are recyclable, they found 85% still end up in landfills and only 15% are recycled each year. It also found that the average American throws out 70 pounds of fabric per year, and the amount of Zero-waste fashion is increasing. Textile Recycling Market Opportunities The Opportunity to Invest in Strategies That Transform the Waste Management and Recycling Industry The investment opportunity in transforming the waste management and recycling industry holds great promise in the current market landscape. With an increasing focus on environmental sustainability and rising waste generation, investors can play a crucial role in shaping a greener future. By channeling resources into cutting-edge waste management technologies, textile recycling innovations, and circular economy practices, businesses can not only reduce their environmental footprint but also tap into a rapidly expanding market. This investment avenue offers the potential for cost savings, improved operational efficiency, and enhanced brand reputation. Moreover, it aligns with growing consumer demand for eco-friendly solutions, making it a strategic move for long-term success. Rising awareness of the impact of fast fashion The textile recycling industry has been facing major challenges such as low collection rates, textile waste, high cost of recycling, and lack of demand for recycled clothes, but fast fashion is a major contributor to these challenges and makes it difficult to recycle textile waste. This industry has a high volume of textile waste. Fast fashion is a main business module that produces trendy textiles at low cost Textile Recycling Market Restraint The Environmental Crisis Caused by Textile Waste The textile recycling market grapples with substantial obstacles due to escalating consumer waste. Annually, the average US consumer discards 81.5 pounds of clothing, generating an overwhelming 11.3 million tons of textile waste. Shockingly, in 2022 alone, 23 million tons ended up in landfills, constituting 5.8% of total waste, with textiles taking over 200 years to decompose in such settings. Only 15% of used textiles are theoretically recycled, with a significant portion shipped overseas, often landing in foreign landfills due to inadequate waste management systems. The surge in fast fashion exacerbates this crisis consumer behavior drives increased clothing purchases, doubling discarded clothing within two decades, largely fueled by retailers producing cheap, short-lived garments. This relentless production to meet rapid Upcycled fashion trends results in a staggering environmental toll, demanding copious resources like 2,700 liters of water for a single cotton shirt. Disposing of textiles in landfills squanders resources and generates methane gas and toxic leachates, polluting groundwater and soil. These mounting challenges, stemming from excessive waste and the ecological impact of clothing production and disposal, hinder the effectiveness of the textile recycling market, posing a formidable restraint to its operations. Textile recycling faces Restraints in the market, with low demand compared to other recycled materials, high recycling costs, technical complexities, lack of infrastructure, and limited awareness. The perception of lower quality and the absence of recycled textiles in some markets hinder demand. The complex sorting and cleaning process contributes to higher costs. Moreover, recycling blended fibers and diverse materials poses technical difficulties. Additionally, inadequate government support and investment create a lack of recycling facilities, and insufficient education contributes to limited awareness among consumers and businesses about the advantages of textile recycling.Textile Recycling Market Segment Analysis

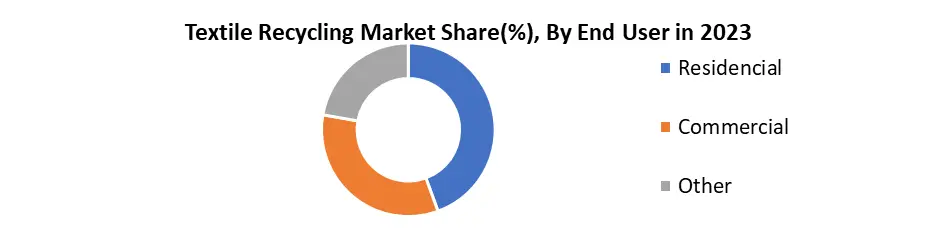

Based on Type, The textile recycling market is segmented by type into natural fibers, synthetic fibers, and blended fibers. The natural fibers segment is dominating the market, accounting for over 60% of the global market. People are increasingly demanding sustainable products, including recycled textiles made from natural fibers. Also, Natural fibers are widely available, which makes them more cost-effective to recycle than synthetic fibers.Based on End User, The textile recycling market is mainly dominated by the residential segment, accounting for over 52% of the global market. This is attributed to the large volume of textile waste generated by households and their increasing awareness of environmental impact. Commercial businesses form the second-largest segment market share, driven by their sustainability initiatives and government regulations. The other segment, comprising industries with smaller textile waste volumes the market, partly due to limited awareness and higher recycling costs.

Textile Recycling Market Regional Analysis

Asia Pacific region held the largest market share of the Textile recycling market in 2022. The region has the largest population in the globe which leads to a high generation of textile waste which is leading to increased environmental awareness and implementation of sustainable practices including textile recycling. The presence of a strong textile manufacturing industry in countries like China, India, and Bangladesh fosters a well-established supply chain for collecting and recycling post-production textile waste. Europe dominated the second largest market share in 2022 and is expected to grow at a significant CAGR during the forecast period. The regional market growth is driven by the establishment of major industry players and developed recycling infrastructure makes the textile recycling process easy and more efficient to recycle. The generation of textile waste is problematic as incineration and landfills both inside and outside Europe are their primary end destinations. Textile Recycling Market Competitive Landscape The textile recycling market's competitive landscape is characterized by intense rivalry among key players vying for market share. Established recycling companies leverage their experience and infrastructure to maintain a strong foothold. Emerging players focus on technological innovations and partnerships to gain a competitive edge. Collaboration with fashion brands, Upcycled fashion trends and retailers for sustainable sourcing is a key trend. Mergers and acquisitions are prevalent strategies to expand geographical presence and enhance capabilities. Also, companies are investing in R&D to develop advanced recycling techniques. American Textile Recycling Service stands out as a prominent player in the United States, offering comprehensive recycling services. With its established presence and advanced infrastructure, it holds a competitive advantage in the region. Anandi Enterprises is a key player in India's textile recycling market, providing similar services and gaining a strong foothold in the country. Both companies compete on various levels, such as operational efficiency, customer base, and technological advancements the market is witnessing increased competition, driving players to strive for sustainability-driven solutions.Textile Recycling Market Scope : Inquire Before Buying

Global Textile Recycling Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.9 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 4.19 Bn. Segments Covered: by Material Cotton Polyester Wool Polyamide Others by Source Apparel Waste Home Furnishing Waste Automotive Waste Others by Process Mechanical Chemical Thermal Textile Recycling Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Textile Recycling Market key players include

1. Leigh fibers inc 2. usha yarns ltd 3. Khaloom Textiles India Pvt. Ltd. 4. American Textile Recycling Service 5. Suez Environment S.A. 6. Prokotex 7. Fabscrap 8. Salvation Army 9. martex fiber southern corp. 10. Soex Group 11. Worn again technologies 12. Birla Cellulose 13. BLS Ecotech 14. The Woolmark Company 15. Ecotex Group 16. Boer Group Recycling Solutions 17. Collect GmbH 18. Textile Recycling International 19. Collect GmbH, 20. Patagonia, Frequently Asked Questions 1] What is the growth rate of the Global Textile Recycling Market? Ans. The Global Textile Recycling Market is growing at a significant rate of 6.3 % over the forecast period. 2] Which region is expected to dominate the Global Textile Recycling Market? Ans. Asia Pacific region is expected to dominate the Textile Recycling Market over the forecast period. 3] What is the expected Global Textile Recycling Market size by 2030? Ans. The market size of the Textile Recycling market is expected to reach USD 10.57 Bn by 2030. 4] Who are the top players in the Global Textile Recycling Industry? Ans. The major key players in the Global Textile Recycling market are Leigh fibers inc, Usha yarns ltd, gebrueder Otto GmBH & co. Kg, Hyosung, Martex Fiber Southern Corp., Khaloom Textiles India Pvt. Ltd, Suez Environment S.A., Global Recycling 5] What segments are covered in the Global Textile Recycling Market report? Ans. The segments covered in the Market report are based on Type, Source, Process and Region.

1. Textile Recycling Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Textile Recycling Market: Dynamics 2.1. Textile Recycling Market Trends by Region 2.1.1. North America Textile Recycling Market Trends 2.1.2. Europe Textile Recycling Market Trends 2.1.3. Asia Pacific Textile Recycling Market Trends 2.1.4. Middle East and Africa Textile Recycling Market Trends 2.1.5. South America Textile Recycling Market Trends 2.2. Textile Recycling Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Textile Recycling Market Drivers 2.2.1.2. North America Textile Recycling Market Restraints 2.2.1.3. North America Textile Recycling Market Opportunities 2.2.1.4. North America Textile Recycling Market Challenges 2.2.2. Europe 2.2.2.1. Europe Textile Recycling Market Drivers 2.2.2.2. Europe Textile Recycling Market Restraints 2.2.2.3. Europe Textile Recycling Market Opportunities 2.2.2.4. Europe Textile Recycling Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Textile Recycling Market Drivers 2.2.3.2. Asia Pacific Textile Recycling Market Restraints 2.2.3.3. Asia Pacific Textile Recycling Market Opportunities 2.2.3.4. Asia Pacific Textile Recycling Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Textile Recycling Market Drivers 2.2.4.2. Middle East and Africa Textile Recycling Market Restraints 2.2.4.3. Middle East and Africa Textile Recycling Market Opportunities 2.2.4.4. Middle East and Africa Textile Recycling Market Challenges 2.2.5. South America 2.2.5.1. South America Textile Recycling Market Drivers 2.2.5.2. South America Textile Recycling Market Restraints 2.2.5.3. South America Textile Recycling Market Opportunities 2.2.5.4. South America Textile Recycling Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Textile Recycling Industry 2.8. Analysis of Government Schemes and Initiatives For Textile Recycling Industry 2.9. Textile Recycling Market Trade Analysis 2.10. The Global Pandemic Impact on Textile Recycling Market 3. Textile Recycling Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Textile Recycling Market Size and Forecast, by Material (2023-2030) 3.1.1. Cotton 3.1.2. Polyester 3.1.3. Wool 3.1.4. Polyamide 3.1.5. Others 3.2. Textile Recycling Market Size and Forecast, by Source (2023-2030) 3.2.1. Apparel Waste 3.2.2. Home Furnishing Waste 3.2.3. Automotive Waste 3.2.4. Others 3.3. Textile Recycling Market Size and Forecast, by Process (2023-2030) 3.3.1. Mechanical 3.3.2. Chemical 3.3.3. Thermal 3.4. Textile Recycling Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Textile Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Textile Recycling Market Size and Forecast, by Material (2023-2030) 4.1.1. Cotton 4.1.2. Polyester 4.1.3. Wool 4.1.4. Polyamide 4.1.5. Others 4.2. North America Textile Recycling Market Size and Forecast, by Source (2023-2030) 4.2.1. Apparel Waste 4.2.2. Home Furnishing Waste 4.2.3. Automotive Waste 4.2.4. Others 4.3. North America Textile Recycling Market Size and Forecast, by Process (2023-2030) 4.3.1. Mechanical 4.3.2. Chemical 4.3.3. Thermal 4.4. North America Textile Recycling Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Textile Recycling Market Size and Forecast, by Material (2023-2030) 4.4.1.1.1. Cotton 4.4.1.1.2. Polyester 4.4.1.1.3. Wool 4.4.1.1.4. Polyamide 4.4.1.1.5. Others 4.4.1.2. United States Textile Recycling Market Size and Forecast, by Source (2023-2030) 4.4.1.2.1. Apparel Waste 4.4.1.2.2. Home Furnishing Waste 4.4.1.2.3. Automotive Waste 4.4.1.2.4. Others 4.4.1.3. United States Textile Recycling Market Size and Forecast, by Process (2023-2030) 4.4.1.3.1. Mechanical 4.4.1.3.2. Chemical 4.4.1.3.3. Thermal 4.4.2. Canada 4.4.2.1. Canada Textile Recycling Market Size and Forecast, by Material (2023-2030) 4.4.2.1.1. Cotton 4.4.2.1.2. Polyester 4.4.2.1.3. Wool 4.4.2.1.4. Polyamide 4.4.2.1.5. Others 4.4.2.2. Canada Textile Recycling Market Size and Forecast, by Source (2023-2030) 4.4.2.2.1. Apparel Waste 4.4.2.2.2. Home Furnishing Waste 4.4.2.2.3. Automotive Waste 4.4.2.2.4. Others 4.4.2.3. Canada Textile Recycling Market Size and Forecast, by Process (2023-2030) 4.4.2.3.1. Mechanical 4.4.2.3.2. Chemical 4.4.2.3.3. Thermal 4.4.3. Mexico 4.4.3.1. Mexico Textile Recycling Market Size and Forecast, by Material (2023-2030) 4.4.3.1.1. Cotton 4.4.3.1.2. Polyester 4.4.3.1.3. Wool 4.4.3.1.4. Polyamide 4.4.3.1.5. Others 4.4.3.2. Mexico Textile Recycling Market Size and Forecast, by Source (2023-2030) 4.4.3.2.1. Apparel Waste 4.4.3.2.2. Home Furnishing Waste 4.4.3.2.3. Automotive Waste 4.4.3.2.4. Others 4.4.3.3. Mexico Textile Recycling Market Size and Forecast, by Process (2023-2030) 4.4.3.3.1. Mechanical 4.4.3.3.2. Chemical 4.4.3.3.3. Thermal 5. Europe Textile Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.2. Europe Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.3. Europe Textile Recycling Market Size and Forecast, by Process (2023-2030) 5.4. Europe Textile Recycling Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.4.1.2. United Kingdom Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.4.1.3. United Kingdom Textile Recycling Market Size and Forecast, by Process (2023-2030) 5.4.2. France 5.4.2.1. France Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.4.2.2. France Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.4.2.3. France Textile Recycling Market Size and Forecast, by Process (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.4.3.2. Germany Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.4.3.3. Germany Textile Recycling Market Size and Forecast, by Process (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.4.4.2. Italy Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.4.4.3. Italy Textile Recycling Market Size and Forecast, by Process (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.4.5.2. Spain Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.4.5.3. Spain Textile Recycling Market Size and Forecast, by Process (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.4.6.2. Sweden Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.4.6.3. Sweden Textile Recycling Market Size and Forecast, by Process (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.4.7.2. Austria Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.4.7.3. Austria Textile Recycling Market Size and Forecast, by Process (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Textile Recycling Market Size and Forecast, by Material (2023-2030) 5.4.8.2. Rest of Europe Textile Recycling Market Size and Forecast, by Source (2023-2030) 5.4.8.3. Rest of Europe Textile Recycling Market Size and Forecast, by Process (2023-2030) 6. Asia Pacific Textile Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.2. Asia Pacific Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.3. Asia Pacific Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4. Asia Pacific Textile Recycling Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.1.2. China Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.1.3. China Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.2.2. S Korea Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.2.3. S Korea Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.3.2. Japan Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.3.3. Japan Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.4. India 6.4.4.1. India Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.4.2. India Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.4.3. India Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.5.2. Australia Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.5.3. Australia Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.6.2. Indonesia Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.6.3. Indonesia Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.7.2. Malaysia Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.7.3. Malaysia Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.8.2. Vietnam Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.8.3. Vietnam Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.9.2. Taiwan Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.9.3. Taiwan Textile Recycling Market Size and Forecast, by Process (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Textile Recycling Market Size and Forecast, by Material (2023-2030) 6.4.10.2. Rest of Asia Pacific Textile Recycling Market Size and Forecast, by Source (2023-2030) 6.4.10.3. Rest of Asia Pacific Textile Recycling Market Size and Forecast, by Process (2023-2030) 7. Middle East and Africa Textile Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Textile Recycling Market Size and Forecast, by Material (2023-2030) 7.2. Middle East and Africa Textile Recycling Market Size and Forecast, by Source (2023-2030) 7.3. Middle East and Africa Textile Recycling Market Size and Forecast, by Process (2023-2030) 7.4. Middle East and Africa Textile Recycling Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Textile Recycling Market Size and Forecast, by Material (2023-2030) 7.4.1.2. South Africa Textile Recycling Market Size and Forecast, by Source (2023-2030) 7.4.1.3. South Africa Textile Recycling Market Size and Forecast, by Process (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Textile Recycling Market Size and Forecast, by Material (2023-2030) 7.4.2.2. GCC Textile Recycling Market Size and Forecast, by Source (2023-2030) 7.4.2.3. GCC Textile Recycling Market Size and Forecast, by Process (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Textile Recycling Market Size and Forecast, by Material (2023-2030) 7.4.3.2. Nigeria Textile Recycling Market Size and Forecast, by Source (2023-2030) 7.4.3.3. Nigeria Textile Recycling Market Size and Forecast, by Process (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Textile Recycling Market Size and Forecast, by Material (2023-2030) 7.4.4.2. Rest of ME&A Textile Recycling Market Size and Forecast, by Source (2023-2030) 7.4.4.3. Rest of ME&A Textile Recycling Market Size and Forecast, by Process (2023-2030) 8. South America Textile Recycling Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Textile Recycling Market Size and Forecast, by Material (2023-2030) 8.2. South America Textile Recycling Market Size and Forecast, by Source (2023-2030) 8.3. South America Textile Recycling Market Size and Forecast, by Process(2023-2030) 8.4. South America Textile Recycling Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Textile Recycling Market Size and Forecast, by Material (2023-2030) 8.4.1.2. Brazil Textile Recycling Market Size and Forecast, by Source (2023-2030) 8.4.1.3. Brazil Textile Recycling Market Size and Forecast, by Process (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Textile Recycling Market Size and Forecast, by Material (2023-2030) 8.4.2.2. Argentina Textile Recycling Market Size and Forecast, by Source (2023-2030) 8.4.2.3. Argentina Textile Recycling Market Size and Forecast, by Process (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Textile Recycling Market Size and Forecast, by Material (2023-2030) 8.4.3.2. Rest Of South America Textile Recycling Market Size and Forecast, by Source (2023-2030) 8.4.3.3. Rest Of South America Textile Recycling Market Size and Forecast, by Process (2023-2030) 9. Global Textile Recycling Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Textile Recycling Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Leigh fibers inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. usha yarns ltd 10.3. Khaloom Textiles India Pvt. Ltd. 10.4. American Textile Recycling Service 10.5. Suez Environment S.A. 10.6. Prokotex 10.7. Fabscrap 10.8. Salvation Army 10.9. martex fiber southern corp. 10.10. Soex Group 10.11. Worn again technologies 10.12. Birla Cellulose 10.13. BLS Ecotech 10.14. The Woolmark Company 10.15. Ecotex Group 10.16. Boer Group Recycling Solutions 10.17. Collect GmbH 10.18. Textile Recycling International 10.19. Collect GmbH 10.20. Patagonia 11. Key Findings 12. Industry Recommendations 13. Textile Recycling Market: Research Methodology 14. Terms and Glossary