Global Refinery and Petrochemical Filtration size was valued at USD 4.2 Bn in 2023 and is expected to reach USD 6.5 Bn by 2030, at a CAGR of 6.1 % from forecast period 2024 to 2030.Refinery and Petrochemical Filtration Market Overview

The Refinery and Petrochemical Filtration market is experiencing significant growth due to its important role in increasing operational efficiency and product quality in the petroleum and petrochemical industries. The market is driven by increasing demand for efficient filtration solutions, as companies work hard to comply with strict environmental regulations, optimize processes, and deliver high-quality products. System performance is improving by advancements in filtration technologies. This also includes higher capacities, extended filter lifetimes, and enhanced resistance to corrosive environments. This helps reducing maintenance costs and downtime. Moreover, the market is propelled by the industry's focus on safety, product integrity, and sustainability. Filtration systems aid in preventing equipment damage, improving consistency, and safeguarding downstream processes. They also contribute to emissions reduction, resource recovery, and waste minimization, aligning with corporate sustainability goals. As the industry continues to adapt to evolving requirements, the demand for innovative and efficient filtration solutions is anticipated to further expand, presenting opportunities for growth in the Refinery and Petrochemical Filtration market.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics

Emerging Trends in the Refinery and Petrochemical Filtration Market: Advanced Filtration Technologies, Environmental Regulations, Digitalization, and Focus on Operational Efficiency The Refinery and Petrochemical Filtration market is experiencing notable trends that are driving its growth and evolution. Advanced filtration technologies, including advanced filter media and membrane filtration, are enabling higher capacities, improved efficiency, and enhanced resistance to corrosive environments. The market is also influenced by stringent environmental regulations focused on emissions control and sustainability, which are compelling companies to adopt efficient filtration solutions to meet compliance requirements. Digitalization, through the implementation of data analytics and IoT, is playing a important role in real-time monitoring, predictive maintenance, and process optimization within the industry. Additionally, there is a growing emphasis on operational efficiency, with companies actively seeking ways to optimize processes, reduce costs, and boost productivity. This demand is driving the need for filtration systems as it offers exceptional efficiency, reliability, and durability. Collectively, these trends are shaping the Refinery and Petrochemical Filtration market, presenting opportunities for businesses to enhance their operations, ensure regulatory compliance, and achieve sustainable growth. Unveiling Lucrative Opportunities: Growth Potential in the Refinery and Petrochemical Filtration Market The Refinery and Petrochemical Filtration market presents lucrative opportunities for manufacturers to capitalize on emerging trends and expand their market presence. By embracing sustainability practices and offering advanced filtration solutions, manufacturers can meet environmental regulations while minimizing their impact. Technological advancements in filtration systems provide opportunities to develop innovative solutions that enhance efficiency and durability. Emerging markets in regions like Asia-Pacific, Latin America, and Africa should be targeted, where industrialization and infrastructure development are driving demand, can help manufacturers expand their customer base. Additionally, digitalization and integration of technologies like data analytics and IoT offer the chance to provide real-time monitoring and predictive maintenance solutions, improving operational efficiency for customers. By seizing these opportunities and focusing on sustainability, technology, and market expansion, manufacturers can unlock growth potential in the Refinery and Petrochemical Filtration market.Overcoming Challenges for Growth in the Refinery and Petrochemical Filtration Market The Refinery and Petrochemical Filtration market faces challenges that require strategic navigation for sustained growth. Adhering to stringent environmental regulations and compliance requirements poses complexities, necessitating continuous monitoring and adaptation of filtration systems. The high capital expenditure associated with implementing advanced filtration technologies presents a financial burden, highlighting the need for cost-effective solutions that strike a balance between performance and affordability. The market's vulnerability to market volatility, influenced by factors such as crude oil prices and global economic conditions, demands adaptability and responsiveness from manufacturers. Furthermore, competition from alternative technologies and processes requires innovation and differentiation to showcase the unique benefits of filtration solutions. Addressing these challenges involves investing in research and development, focusing on cost-effective approaches, and staying abreast of market trends. By effectively navigating these challenges, the Refinery and Petrochemical Filtration market can unlock growth potential and meet the evolving filtration needs of the industry. Emerging Trends: Sustainability, Digitalization, and Process Optimization in the Refinery and Petrochemical Filtration Market The Refinery and Petrochemical Filtration market is currently witnessing significant trends driven by sustainability, digitalization, and process optimization. Companies operating in the Refinery and Petrochemical Filtration industry are increasing the adoption of environmentally friendly filtration solutions, such as energy-efficient systems and processes that minimize waste generation. The integration of digital technologies, like data analytics, IoT, and automation, is revolutionizing the sector by enabling real-time monitoring, predictive maintenance, and data-driven decision-making for optimizing processes. Manufacturers are giving strong importance on enhancing filtration efficiency and performance through the implementation of innovative technologies like membrane filtration and advanced filter media. Additionally, the integration of smart technologies allows for remote monitoring and control, leading to streamlined operations and improved overall efficiency. These prevailing trends in sustainability, digitalization, and process optimization are reshaping the Refinery and Petrochemical Filtration market, presenting manufacturers with opportunities to enhance their competitiveness, comply with regulatory standards, and achieve operational excellence.

Refinery and Petrochemical Filtration Market Segmentation

By Filter Type: The filter type segment in the Refinery and Petrochemical Filtration market categorizes the products based on different filter variations and technologies. This segment includes cartridge filters, bag filters, and membrane filters. Cartridge filters account for approximately 45% of the market. Due to their high filtration efficiency, easy installation, and low maintenance requirements, they are highly used in the industry. Bag filters represent around 30% of the market. They are known for their cost-effectiveness and ability to handle high flow rates. Membrane filters, although a smaller segment, are gaining traction due to their superior filtration precision and ability to remove even the smallest particles.By Application: The application segment in the Refinery and Petrochemical Filtration market classifies the products based on their specific usage in different processes. This segment includes filtration for refining processes, petrochemical production, and wastewater treatment. Filtration for refining processes holds the largest market share, accounting for approximately 55% of the market. Increasing demand for high-quality refined products and the need to remove impurities and contaminants drive the market. Petrochemical production accounts for around 30% of the market, as filtration is crucial for maintaining product purity and quality. Wastewater treatment is a smaller segment but is witnessing growth due to the rising focus on environmental regulations and sustainability practices. By End-User: The end-user segment in the Refinery and Petrochemical Filtration market categorizes the products based on the industries or sectors they serve. This segment includes oil refineries, petrochemical plants, and chemical manufacturing facilities. Oil refineries hold the largest market share of approximately 50% of the market. Petrochemical plants account for around 35% of the market.

Refinery and Petrochemical Filtration Market Regional Insight

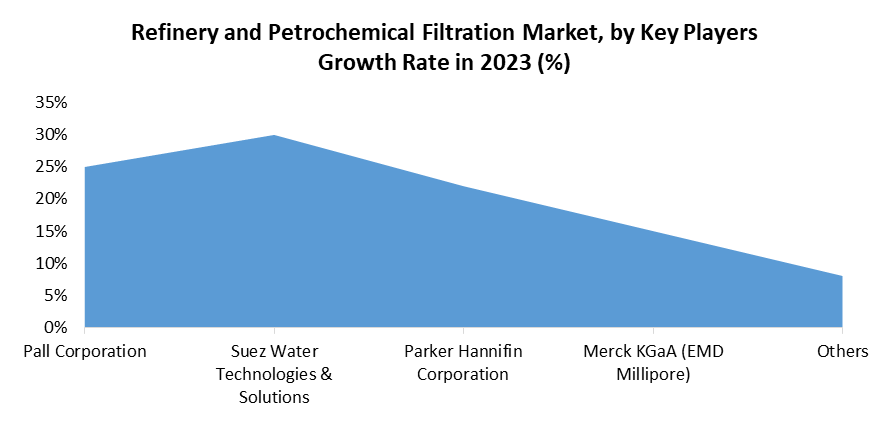

Europe dominates the Refinery and Petrochemical Filtration market, capturing the highest market share of approximately 40% in 2023. The region has a strong industrial base. The region has stringent regulatory standards, and a focus on sustainable practices positions it as the leading market. Germany, France, and the Netherlands are leading the industry leveraging their expertise in filtration technologies and commitment to environmental stewardship. Following closely behind is North America, holding a significant market share of around 30%. The region boasts advanced refining and petrochemical facilities, coupled with a strong emphasis on innovation and technological advancements. The United States and Canada play pivotal roles in driving market growth, with their sophisticated filtration solutions and commitment to operational excellence. Asia Pacific presents substantial growth opportunities, accounting for approximately 20% of the market share in 2023. The rapid industrialization, expanding refining and petrochemical sectors, and increasing investments in infrastructure contribute to the market's growth in the region. China, India, and Japan are key players in this region, experiencing significant growth in the refining and petrochemical industries, offering immense potential for filtration solutions. Latin America holds a notable market share of around 7%. The region's growing oil and gas industry along with the growing demand for petrochemical products, drives the need for effective filtration solutions. Brazil, Mexico, and Argentina have emerged as prominent markets, providing opportunities for filtration manufacturers to cater to the evolving needs of the industry. The Middle East and Africa currently represent a smaller market share of approximately 3% but are witnessing increasing investments in the refining and petrochemical sectors. The region's abundant oil reserves, infrastructure development initiatives, and focus on diversifying their economies create favorable conditions for the growth of the filtration market. Countries such as Saudi Arabia, South Africa, and the United Arab Emirates present potential for filtration solution providers to establish a presence and contribute to the region's development. Refinery and Petrochemical Filtration Market Competitive Landscape The detailed report on the Refinery and Petrochemical Filtration market includes a comprehensive analysis of each company's SWOT analysis, financial performance, and other relevant factors. It provides insights into the companies' internal strengths and weaknesses, external opportunities and threats, and financial stability. The report enables stakeholders to assess the market dynamics, make informed business decisions, and identify growth opportunities. Several major players have emerged in the Refinery and Petrochemical Filtration market, each employing various strategies to enhance their market presence and solidify their positions. These key players include Pall Corporation, Parker Hannifin Corporation, Suez Water Technologies & Solutions, Merck KGaA (EMD Millipore) Nestle, Danone, Lactalis Group, Fonterra Co-operative Group Limited, Royal FrieslandCampina N.V. They have demonstrated their commitment to the industry through substantial investments in research and development initiatives.

Refinery and Petrochemical Filtration Market Scope: Inquire before buying

Global Refinery and Petrochemical Filtration Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.2 Bn. Forecast Period 2024 to 2030 CAGR: 6.1%% Market Size in 2030: US $ 6.5 Bn. Segments Covered: by Filter Type Cartridge filters Coalescer Filter Bag filters Membrane filters Electrostatic Precipitator Filter Press Others by Application Liquid-liquid Separation Liquid-gas Separation Others by End User Oil refineries Petrochemical plants Chemical manufacturing facilities Refinery and Petrochemical Filtration Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Refinery and Petrochemical Filtration Market Key Players are:

1. Pall Corporation 2. Parker Hannifin Corporation 3. Suez Water Technologies & Solutions 4. Merck KGaA (EMD Millipore) 5. Clarcor Industrial Air 6. 3M Company 7. Donaldson Company, Inc. 8. CECO Environmental Corp. 9. Eaton Corporation 10. Filtration Group Corporation 11. Pentair PLC 12. Lenntech BV 13. Alfa Laval AB 14. Graver Technologies 15. Velcon Filters, LLC 16. Ahlstrom-Munksjö Oyj 17. GVS Group 18. Mann+Hummel Group 19. Porvair Filtration Group 20. GEA Group Aktiengesellschaft Frequently Asked Questions: 1] What is the growth rate of the Global Refinery and Petrochemical Filtration Market? Ans. The Global Refinery and Petrochemical Filtration Market is growing at a significant rate of 6.1 % during the forecast period. 2] Which region is expected to dominate the Global Refinery and Petrochemical Filtration Market? Ans. The Europe region is expected to dominate the Refinery and Petrochemical Filtration Market during the forecast period. 3] What is the expected Global Refinery and Petrochemical Filtration Market size by 2030? Ans. The Refinery and Petrochemical Filtration market size is expected to reach USD 6.5 Bn by 2030. 4] Which are the top players in the Global Market? Ans. The major top players in the Global Market are Pall Corporation, Parker Hannifin Corporation, Suez Water Technologies & Solutions, Merck KGaA (EMD Millipore)

1. Refinery and Petrochemical Filtration Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Refinery and Petrochemical Filtration Market: Dynamics 2.1. Refinery and Petrochemical Filtration Market Trends by Region 2.1.1. North America Refinery and Petrochemical Filtration Market Trends 2.1.2. Europe Refinery and Petrochemical Filtration Market Trends 2.1.3. Asia Pacific Refinery and Petrochemical Filtration Market Trends 2.1.4. Middle East and Africa Refinery and Petrochemical Filtration Market Trends 2.1.5. South America Refinery and Petrochemical Filtration Market Trends 2.2. Refinery and Petrochemical Filtration Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Refinery and Petrochemical Filtration Market Drivers 2.2.1.2. North America Refinery and Petrochemical Filtration Market Restraints 2.2.1.3. North America Refinery and Petrochemical Filtration Market Opportunities 2.2.1.4. North America Refinery and Petrochemical Filtration Market Challenges 2.2.2. Europe 2.2.2.1. Europe Refinery and Petrochemical Filtration Market Drivers 2.2.2.2. Europe Refinery and Petrochemical Filtration Market Restraints 2.2.2.3. Europe Refinery and Petrochemical Filtration Market Opportunities 2.2.2.4. Europe Refinery and Petrochemical Filtration Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Refinery and Petrochemical Filtration Market Drivers 2.2.3.2. Asia Pacific Refinery and Petrochemical Filtration Market Restraints 2.2.3.3. Asia Pacific Refinery and Petrochemical Filtration Market Opportunities 2.2.3.4. Asia Pacific Refinery and Petrochemical Filtration Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Refinery and Petrochemical Filtration Market Drivers 2.2.4.2. Middle East and Africa Refinery and Petrochemical Filtration Market Restraints 2.2.4.3. Middle East and Africa Refinery and Petrochemical Filtration Market Opportunities 2.2.4.4. Middle East and Africa Refinery and Petrochemical Filtration Market Challenges 2.2.5. South America 2.2.5.1. South America Refinery and Petrochemical Filtration Market Drivers 2.2.5.2. South America Refinery and Petrochemical Filtration Market Restraints 2.2.5.3. South America Refinery and Petrochemical Filtration Market Opportunities 2.2.5.4. South America Refinery and Petrochemical Filtration Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Refinery and Petrochemical Filtration Industry 2.8. Analysis of Government Schemes and Initiatives For Refinery and Petrochemical Filtration Industry 2.9. Refinery and Petrochemical Filtration Market Trade Analysis 2.10. The Global Pandemic Impact on Refinery and Petrochemical Filtration Market 3. Refinery and Petrochemical Filtration Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 3.1.1. Cartridge filters 3.1.2. Coalescer Filter 3.1.3. Bag filters 3.1.4. Membrane filters 3.1.5. Electrostatic Precipitator 3.1.6. Filter Press 3.1.7. Others 3.2. Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 3.2.1. Liquid-liquid Separation 3.2.2. Liquid-gas Separation 3.2.3. Others 3.3. Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 3.3.1. Oil refineries 3.3.2. Petrochemical plants 3.3.3. Chemical manufacturing facilities 3.4. Refinery and Petrochemical Filtration Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Refinery and Petrochemical Filtration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 4.1.1. Cartridge filters 4.1.2. Coalescer Filter 4.1.3. Bag filters 4.1.4. Membrane filters 4.1.5. Electrostatic Precipitator 4.1.6. Filter Press 4.1.7. Others 4.2. North America Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 4.2.1. Liquid-liquid Separation 4.2.2. Liquid-gas Separation 4.2.3. Others 4.3. North America Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 4.3.1. Oil refineries 4.3.2. Petrochemical plants 4.3.3. Chemical manufacturing facilities 4.4. North America Refinery and Petrochemical Filtration Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 4.4.1.1.1. Cartridge filters 4.4.1.1.2. Coalescer Filter 4.4.1.1.3. Bag filters 4.4.1.1.4. Membrane filters 4.4.1.1.5. Electrostatic Precipitator 4.4.1.1.6. Filter Press 4.4.1.1.7. Others 4.4.1.2. United States Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Liquid-liquid Separation 4.4.1.2.2. Liquid-gas Separation 4.4.1.2.3. Others 4.4.1.3. United States Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Oil refineries 4.4.1.3.2. Petrochemical plants 4.4.1.3.3. Chemical manufacturing facilities 4.4.2. Canada 4.4.2.1. Canada Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 4.4.2.1.1. Cartridge filters 4.4.2.1.2. Coalescer Filter 4.4.2.1.3. Bag filters 4.4.2.1.4. Membrane filters 4.4.2.1.5. Electrostatic Precipitator 4.4.2.1.6. Filter Press 4.4.2.1.7. Others 4.4.2.2. Canada Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Liquid-liquid Separation 4.4.2.2.2. Liquid-gas Separation 4.4.2.2.3. Others 4.4.2.3. Canada Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Oil refineries 4.4.2.3.2. Petrochemical plants 4.4.2.3.3. Chemical manufacturing facilities 4.4.3. Mexico 4.4.3.1. Mexico Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 4.4.3.1.1. Cartridge filters 4.4.3.1.2. Coalescer Filter 4.4.3.1.3. Bag filters 4.4.3.1.4. Membrane filters 4.4.3.1.5. Electrostatic Precipitator 4.4.3.1.6. Filter Press 4.4.3.1.7. Others 4.4.3.2. Mexico Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Liquid-liquid Separation 4.4.3.2.2. Liquid-gas Separation 4.4.3.2.3. Others 4.4.3.3. Mexico Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Oil refineries 4.4.3.3.2. Petrochemical plants 4.4.3.3.3. Chemical manufacturing facilities 5. Europe Refinery and Petrochemical Filtration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.2. Europe Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.3. Europe Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 5.4. Europe Refinery and Petrochemical Filtration Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.4.1.2. United Kingdom Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.4.2.2. France Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.4.3.2. Germany Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.4.4.2. Italy Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.4.5.2. Spain Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.4.6.2. Sweden Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.4.7.2. Austria Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 5.4.8.2. Rest of Europe Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Refinery and Petrochemical Filtration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.2. Asia Pacific Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Refinery and Petrochemical Filtration Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.1.2. China Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.2.2. S Korea Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.3.2. Japan Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.4.2. India Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.5.2. Australia Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.6.2. Indonesia Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.7.2. Malaysia Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.8.2. Vietnam Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.9.2. Taiwan Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Refinery and Petrochemical Filtration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 7.2. Middle East and Africa Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Refinery and Petrochemical Filtration Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 7.4.1.2. South Africa Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 7.4.2.2. GCC Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 7.4.3.2. Nigeria Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 7.4.4.2. Rest of ME&A Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 8. South America Refinery and Petrochemical Filtration Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 8.2. South America Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 8.3. South America Refinery and Petrochemical Filtration Market Size and Forecast, by End User(2023-2030) 8.4. South America Refinery and Petrochemical Filtration Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 8.4.1.2. Brazil Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 8.4.2.2. Argentina Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Refinery and Petrochemical Filtration Market Size and Forecast, by Filter Type (2023-2030) 8.4.3.2. Rest Of South America Refinery and Petrochemical Filtration Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Refinery and Petrochemical Filtration Market Size and Forecast, by End User (2023-2030) 9. Global Refinery and Petrochemical Filtration Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Refinery and Petrochemical Filtration Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Pall Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Parker Hannifin Corporation 10.3. Suez Water Technologies & Solutions 10.4. Merck KGaA (EMD Millipore) 10.5. Clarcor Industrial Air 10.6. 3M Company 10.7. Donaldson Company, Inc. 10.8. CECO Environmental Corp. 10.9. Eaton Corporation 10.10. Filtration Group Corporation 10.11. Pentair PLC 10.12. Lenntech BV 10.13. Alfa Laval AB 10.14. Graver Technologies 10.15. Velcon Filters, LLC 10.16. Ahlstrom-Munksjö Oyj 10.17. GVS Group 10.18. Mann+Hummel Group 10.19. Porvair Filtration Group 10.20. GEA Group Aktiengesellschaft 11. Key Findings 12. Industry Recommendations 13. Refinery and Petrochemical Filtration Market: Research Methodology 14. Terms and Glossary