Cloud PBX Market is expected to grow at a CAGR of 16.71 % over the forecast period 2024-2030, to account for US$ 22.01 Bn in 2030.Cloud PBX Market Overview:

A Cloud PBX is one part cloud computing & one part PBX. The act of storing and accessing data over the Internet rather than on a computer or other hard drive is referred to as cloud computing. The term PBX stands for Public Branch Exchange. Voicemail, call blocking, conference calling, call auditing, call records, faxing, and automated messaging will all continue to be available.To know about the Research Methodology :- Request Free Sample Report The MMR report studies the effectiveness of Cloud PBX on a global, regional, and company level. This research analyses historical data and future prospects to depict the Cloud PBX Market size from a global perspective. Cloud PBX Market Trends: The Telco Cloud is Becoming More Popular. Rising Trend of Network Convergence and UC Applications. Cloud Computing and Unified Communications are gaining popularity. The Importance of Migrating from a Traditional PBX to a Cloud-Based PBX

Cloud PBX Market Dynamics:

The research comprehensively studies and explains the dynamics of the Global Cloud PBX Market, allowing readers to better understand emerging market trends, drivers, restraints, opportunities, and challenges on a global and regional level for the Global Cloud PBX Market. The following are some of the drivers their complete explanations are given in the study along with other supporting evidence: Growing Demand for Reducing Infrastructure Costs to Fuel the Industry Growth: The adoption of sophisticated communication services to satisfy the requirement to reduce telecom equipment cost is rapidly growing in the hosted PBX industry. Enterprises are increasingly opting for hosted PBX services to save CAPEX and OPEX, as hosted services require less hardware investment, opening up new market opportunities. In Brazil, there is a rising trend in the delivery of digital services. The government sector in Brazil is expected to increase at a rate of around 15% by 2030, owing to federal agencies' increasing use of contemporary telephony technologies to provide citizens with rapid and reliable digital services. Furthermore, rising demand for VoIP to offset the higher costs of traditional voice calling technologies is a major driver of market growth. Brazilian federal agencies are profiting from hosted PBX services, which help them cut expenses while improving connection. In France, a surge in demand for high system availability is driving the solution segment. In France, the solution segment held over 40% market share in 2023, driven majorly by the gradual shift of enterprises from traditional voice & data services to high-quality hosted PBX services. Hosted PBX solutions are proven to be a profitable avenue for market expansion, as traditional hosted services suffer from regular system failures and sluggish response time, disrupting corporate continuity. The change to IP in the French telecom business has provided new opportunities for market players.Cloud PBX Market Market Segmentation:

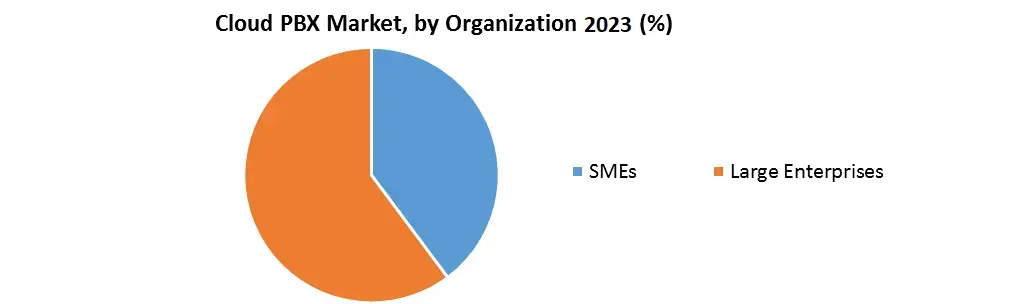

The MMR report covers all segments in the flag computing market such as Service, Organization, and End User The SMEs organization which accounted for about 65% of the Cloud PBX market's revenue share, is predicted to continue to be the leading revenue segment between 2024 and 2030: SMEs organizations are seen as right customers for cloud PBX solutions, for countless reasons. The lower cost of providing enterprise-grade phone system capability is one of the key reasons. SMEs can utilise cloud PBX instead of purchasing and maintaining their own PBX system because they only have to pay a monthly fee that includes phone service, phone system apps, and equipment. Furthermore, cloud PBX offers online PBX management tools that enable organisations to make adjustments to their phone systems without having to contact their provider. IT And Cloud Services segment is projected to grow at the highest CAGR of 17.03% during forecast period. However, it is expected to lose its dominance to BFSI by 2030. Cloud PBX delivers numerous benefits to the BFSI segment, which contains managing multiple office locations with virtual extensions, and improvement of call quality with features like call monitoring and recording. Financial institutions can also use call recording to re-examine discussions to eliminate misunderstandings, as well as noncompliance concerns. The BFSI sector is projected to boost the cloud PBX market because of these benefits.

Cloud PBX Market Market Reginal Overview:

Asia Pacific accounted for the largest xx% market share in 2023, with a market value of US$ xx Mn; the regional market is expected to register a CAGR of 17.45% during the 2024-2030. APAC's various economies are driving growth in a wide range of industries, including infrastructure, industry, technology, and a variety of others. As organisations in the region focus heavily on advanced digital transformation, the Asia Pacific market presents tremendous business opportunities for investing in cloud PBX technology. The growing number of BYOD and internet users in the region is driving up demand for improved mobile and internet services, resulting in more investment in better internet infrastructure. One of the main reasons for the market's strength is increased government assistance in nations like India. MNF Enterprise became the first Australian customer of Cisco's new cloud-based Webex Calling technology in May 2023. The objective of the report is to present a comprehensive analysis of the Global Cloud PBX Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Cloud PBX Market dynamic, structure by analyzing the market segments and projecting the Cloud PBX Market size. Clear representation of competitive analysis of key players by Organization, price, financial position, product portfolio, growth strategies, and regional presence in the Cloud PBX Market make the report investor’s guide.Cloud PBX Market Scope: Inquiry Before Buying

Cloud PBX Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.46 Bn Forecast Period 2024 to 2030 CAGR: 16.71 % Market Size in 2030: US $ 22.01 Bn. Segments Covered: by Service Managed Services Professional Services Network Services IT And Cloud Services by Organization SMEs Large Enterprises by End User BFSI Real Estate Healthcare Retail Cloud PBX Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Microsoft Corporation (U.S.) 2. RingCentral Inc.(U.S) 3. Vonage America Inc.(U.S.) 4. ShoreTel, Inc. (U.S.) 5. Five9 Inc. (U.S.) 6. Nextiva Inc.(U.S.) 7. Avaya Inc.(U.S.) 8. MegaPath Inc.(U.S.) 9. Jive Software Inc. (U.S.) 10.Phone.com (U.S.) 11.XO Communications, LLC 12.VirtualPBX.com, Inc. 13.Digium, Inc. 14.8x8, Inc. 15.Intermedia.net, Inc. 16.TelePacific Communications 17.Megapath 18.Engin 19.Bullseye Telecom 20.Vonage 21.Mitel Networks Corporation 22.Barracuda Networks Inc. 23.Cisco system Inc. 24.D-Link System Inc. 25.Allworx CorporationsFrequently Asked Questions:

1] What segments are covered in the Cloud PBX Market report? Ans. The segments covered in the Cloud PBX Market report are based on Service, Organization and End User 2] Which region is expected to hold the highest share in the Cloud PBX Market? Ans. APAC region is expected to hold the highest share in the market. 3] What is the market size of the Cloud PBX Market by 2030? Ans. The market size of the Cloud PBX Market by 2030 is US$ 22.01 Bn. 4] What is the forecast period for the Cloud PBX Market? Ans. The forecast period for the Cloud PBX Market is 2024-2030. 5] What was the market size of the Cloud PBX Market in 2023? Ans. The market size of the Cloud PBX Market in 2023 was US$ 7.46 Bn.

1. Global Cloud PBX Market: Research Methodology 2. Global Cloud PBX Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Cloud PBX Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Cloud PBX Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Cloud PBX Market Segmentation 4.1. Global Cloud PBX Market, By Service (2023-2030) • Managed Services • Professional Services • Network Services • IT And Cloud Services 4.2. Global Cloud PBX Market, By Organization (2023-2030) • SMEs • Large Enterprises 4.3. Global Cloud PBX Market, By End User (2023-2030) • BFSI • Real Estate • Healthcare • Retail 5. North America Cloud PBX Market (2023-2030) 5.1. North America Cloud PBX Market, By Service (2023-2030) • Managed Services • Professional Services • Network Services • IT And Cloud Services 5.2. North America Cloud PBX Market, By Organization (2023-2030) • SMEs • Large Enterprises 5.3. North America Cloud PBX Market, By End User (2023-2030) • BFSI • Real Estate • Healthcare • Retail 5.4. North America Cloud PBX Market, by Country (2023-2030) • United States • Canada • Mexico 6. European Cloud PBX Market (2023-2030) 6.1. European Cloud PBX Market, By Service (2023-2030) 6.2. European Cloud PBX Market, By Organization (2023-2030) 6.3. European Cloud PBX Market, By End User (2023-2030) 6.4. European Cloud PBX Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Cloud PBX Market (2023-2030) 7.1. Asia Pacific Cloud PBX Market, By Service (2023-2030) 7.2. Asia Pacific Cloud PBX Market, By Organization (2023-2030) 7.3. Asia Pacific Cloud PBX Market, By End User (2023-2030) 7.4. Asia Pacific Cloud PBX Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Cloud PBX Market (2023-2030) 8.1. Middle East and Africa Cloud PBX Market, By Service (2023-2030) 8.2. Middle East and Africa Cloud PBX Market, By Organization (2023-2030) 8.3. Middle East and Africa Cloud PBX Market, By End User (2023-2030) 8.4. Middle East and Africa Cloud PBX Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Cloud PBX Market (2023-2030) 9.1. South America Cloud PBX Market, By Service (2023-2030) 9.2. South America Cloud PBX Market, By Organization (2023-2030) 9.3. South America Cloud PBX Market, By End User (2023-2030) 9.4. South America Cloud PBX Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Microsoft Corporation (U.S.). 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. RingCentral Inc.(U.S) 10.3. Vonage America Inc.(U.S.) 10.4. ShoreTel, Inc. (U.S.) 10.5. Five9 Inc. (U.S.) 10.6. Nextiva Inc.(U.S.) 10.7. Avaya Inc.(U.S.) 10.8. MegaPath Inc.(U.S.) 10.9. Jive Software Inc. (U.S.) 10.10. Phone.com (U.S.) 10.11. XO Communications, LLC 10.12. VirtualPBX.com, Inc. 10.13. Digium, Inc. 10.14. 8x8, Inc. 10.15. Intermedia.net, Inc. 10.16. TelePacific Communications 10.17. Megapath 10.18. Engin 10.19. Bullseye Telecom 10.20. Vonage 10.21. Mitel Networks Corporation 10.22. Barracuda Networks Inc. 10.23. Cisco system Inc. 10.24. D-Link System Inc. 10.25. Allworx Corporations