Cloud Gaming Market was valued at US$ 2.49 Bn. in 2022. The Global Cloud Gaming Market size is estimated to grow at a CAGR of 44.8 % over the forecast period.Cloud Gaming Market Overview:

The future of the gaming industry is cloud gaming. Without the need for additional hardware configuration, the cloud service is essential in providing clients with a fluid gaming experience across all of their devices. The market growth rate would be fueled by the rising need for a low-latency, creative, and immersive gaming experience. Without needing to download the entire game, players can access external cloud servers directly to play games. The cost of storage and hardware setup is reduced because they can play these games on any type of device. The report explores the Cloud Gaming market segments (Type, Device, End-user, and Region). Data has been provided by market participants, and regions, (North America, Asia Pacific, Europe, Middle East & Africa, and South America). This market report provides a thorough analysis of the rapid advances that are currently taking place across all Technology sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2022. The report investigates the Cloud Gaming market drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Cloud Gaming market’s contemporary competitive scenario.To know about the Research Methodology :- Request Free Sample Report

Cloud Gaming Market Dynamics:

Expensive gaming equipment and consoles: Any standard gaming system today costs between $400 to $5,000 to purchase and assemble. It has been noted that the rising cost of comforting systems is turning away potential clients. Contrarily, the cloud gaming strategy enables consumers to play without paying a lot on equipment and consoles. As a result, this element directly reduces costs, which may in turn propel the market for cloud gaming in the future. The Low-latency Capability of 5G Technology Would Fuel the Growth: Low-latency capabilities of 5G technology give providers further support. With the introduction of 5G, cloud-based gaming is being redesigned to offer a better gaming experience. For instance, many gamers intend to upgrade to 5G technology and spend more money, in order to enjoy a better gaming experience. The low-latency capabilities of 5G technology are therefore forecasted to fuel even more market growth. Issues with Latency and Responsiveness to Limit Market Potential: On a cloud platform, game streaming requires a low latency network with high bitrates and enough bandwidth. However, in some nations, the cost of setting up an internet connection with the necessary performance may be prohibitive. If the proper network and bandwidth requirements are not met, latency and responsiveness may be a problem. Lack of High-Speed Internet Access: Using cloud-based games undoubtedly demands a high-speed transmission (of about 10 Mbps), having reliable internet connectivity in numerous locations across many nations is a key feature. As a result, one of the key things that would prevent the global market for cloud gaming from expanding over the forecast period would be a barrier of high-speed internet connections from the user's perspective.Cloud Gaming Market Trends:

The proliferation of smartphones is being driven by the increasingly digital world we live in. There were 5.2 billion smartphone connections in 2022 and that smartphone adoption would reach 80% in 2025. Game makers are attempting to provide mobile gaming environments for users given the rising popularity of smartphones. In order to improve the gaming experience through high-performance connectivity, network providers are also making investments in mobile gaming. Additionally, consumers can enhance their gaming experience by utilizing top-tier smartphones, cloud computing, and 5G infrastructures on any platform and location. Mobile gaming may offer a low-latency, high-quality gaming experience. Also, out of 106 service providers, 22 had already implemented mobile cloud gaming services as of October 2020, according to Ericsson's data. Globally, there are almost 2.4 billion mobile gamers, according to the MMR findings. As a result, it is forecast that the industry would rise as cloud-based mobile gaming becomes more popular.Cloud Gaming Market Segment Analysis:

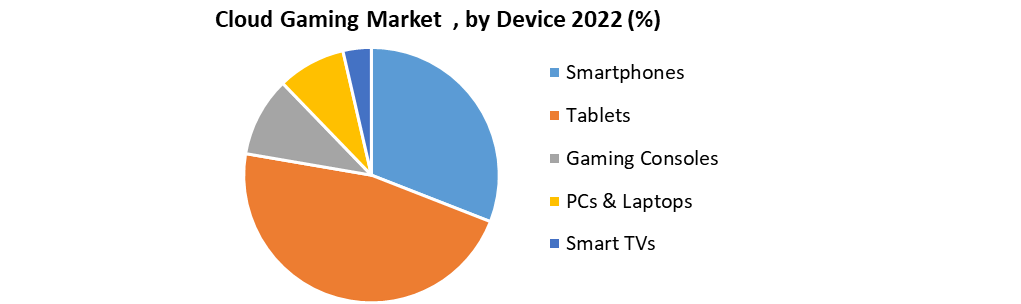

Based on Type, since file streaming is a more affordable option for game producers, it is forecast to grow at the fastest CAGR, over 47%, between 2022 and 2029. File streaming can lower the price of media creation and player patch delivery. Cloud streaming is currently being adopted by many game firms, and this trend is set to continue in the upcoming years. Some companies decide to put their games on private clouds because of the exclusivity and improved user security. Based on Device, the device segment's gaming console sub-segment had the largest revenue share in 2022, accounting for almost 51.0 % market. Because so few people can afford or play computer games, consoles are quite popular. This is because controllers are more convenient than building or buying a computer, which takes time and effort. Over the next several years, the smartphone category is expected to rise at the second-highest CAGR, accounting for more than 11.0% of market revenue. The majority of people own smartphones, which are widely available and affordable. Many customers also own many intelligent devices. In the upcoming years, it is forecast that this aspect would support the segment's growth.

Regional Insights:

The Asia Pacific region held the largest market share accounting for 46.2% in 2022. The North American region is expected to witness significant growth at a CAGR of 39% through the forecast period. Because of the increasing number of 5G infrastructure development activities in the region, the cloud gaming market in Asia Pacific is forecast to grow at a significant rate. Additionally, the affordability of cloud gaming platforms is pushing their use among a variety of new client segments, whose levels of investment in gaming devices vary. China is forecast to dominate the market throughout the forecast period, thanks to rising investments in telecommunications and 5G infrastructure. Japan would experience rapid growth over the course of the forecast term as a result of the presence of significant cloud gaming industry players. North America is expected to significantly increase its market share for cloud gaming. The market growth in North America is forecasted to be aided by the early adoption of cloud technologies, increased demand for online gaming, and extensive access to effective internet infrastructure. The objective of the report is to present a comprehensive analysis of the global Cloud Gaming Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Cloud Gaming Market dynamic, and structure by analyzing the market segments and projecting the Cloud Gaming Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Cloud Gaming Market make the report investor’s guide.Cloud Gaming Market Recent Developments:

October 2021- GeForce RTX 3080, a cutting-edge gaming platform from NVIDIA Corporation, was released. Gamers may enjoy the highest resolutions, lowest latency, and quickest frame rates with the GeForce RTX 3080 subscription. September 2021- Amazon Web Services, Inc. increased the range of services it provides by introducing a membership program geared toward families. With these new additions, customers can upgrade their Luna+ subscription for USD 2.99 per month and receive 36 kid-friendly games, including Wandersong, Overcooked, Adventure Pals, and Spongebob Squarepants.Cloud Gaming Market Scope: Inquire before buying

Global Cloud Gaming Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.49 Bn. Forecast Period 2023 to 2029 CAGR: 44.8% Market Size in 2029: US $ 33.24 Bn. Segments Covered: by Type File Streaming Video Streaming by Device Smartphones Tablets Gaming Consoles PCs & Laptops Smart TVs Head-mounted Displays by End-user Casual Gamers Avid Gamers Lifestyle Gamers Cloud Gaming Market by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players:

1. Amazon Web Services Inc. 2. Apple Inc. 3. Electronics Arts, Inc. 4. Google Inc. 5. Intel Corporation 6. International Business Machines Corporation 7. Microsoft Corporation 8. NVIDIA Corporation 9. Sony Interactive Entertainment LLC 10. Ubitus Inc. 11. Playcloud Inc. 12. Tencent Holdings Ltd. 13. Broadmedia Corporation 14. Blacknut 15. IBM Frequently Asked Questions: 1] What is the forecasted market size and growth rate of the Global Cloud Gaming market? Ans. Forecasted market size US$ 33.24 Bn. till 2029, with a CAGR of 44.8%. 2] What are the key driving factors of the growth of the Global Cloud Gaming market? Ans. Expensive gaming equipment and consoles, The Low-latency Capability of 5G Technology Will Fuel Growth are some of the factors driving the growth of the Cloud Gaming market. 3] Which region is expected to hold the highest share in the global Cloud Gaming Market? Ans. The Asia Pacific region is expected to hold the highest share in the Cloud Gaming market. 4] Which are the leading key players in the global Cloud Gaming market? Ans. Amazon Web Services Inc., Apple Inc., Electronics Arts, Inc., Google Inc., Intel Corporation, International Business Machines Corporation, Microsoft Corporation, NVIDIA Corporation are some of the key players of the Cloud Gaming market. 5] What segments are covered in Global Cloud Gaming? Ans. The Global Cloud Gaming market is segmented in Type, Device, End-user, and Region.

1. Global Cloud Gaming Market Size: Research Methodology 2. Global Cloud Gaming Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Cloud Gaming Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Cloud Gaming Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Cloud Gaming Market Size Segmentation 4.1. Global Cloud Gaming Market Size, by Type (2022-2029) • File Streaming • Video Streaming 4.2. Global Cloud Gaming Market Size, by Device (2022-2029) • Smartphones • Tablets • Gaming Consoles • PCs & Laptops • Smart TVs • Head-mounted Displays 4.3. Global Cloud Gaming Market Size, by End-user (2022-2029) • Casual Gamers • Avid Gamers • Lifestyle Gamers 5. North America Cloud Gaming Market (2022-2029) 5.1. North America Cloud Gaming Market Size, by Type (2022-2029) • File Streaming • Video Streaming 5.2. North America Cloud Gaming Market Size, by Device (2022-2029) • Smartphones • Tablets • Gaming Consoles • PCs & Laptops • Smart TVs • Head-mounted Displays 5.3. North America Cloud Gaming Market Size, by End-user (2022-2029) • Casual Gamers • Avid Gamers • Lifestyle Gamers 5.4. North America Cloud Gaming Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Cloud Gaming Market (2022-2029) 6.1. European Cloud Gaming Market, by Type (2022-2029) 6.2. European Cloud Gaming Market, by Device (2022-2029) 6.3. European Cloud Gaming Market, by End-user (2022-2029) 6.4. European Cloud Gaming Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Cloud Gaming Market (2022-2029) 7.1. Asia Pacific Cloud Gaming Market, by Type (2022-2029) 7.2. Asia Pacific Cloud Gaming Market, by Device (2022-2029) 7.3. Asia Pacific Cloud Gaming Market, by End-user (2022-2029) 7.4. Asia Pacific Cloud Gaming Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Cloud Gaming Market (2022-2029) 8.1. Middle East and Africa Cloud Gaming Market, by Type (2022-2029) 8.2. Middle East and Africa Cloud Gaming Market, by Device (2022-2029) 8.3. Middle East and Africa Cloud Gaming Market, by End-user (2022-2029) 8.4. Middle East and Africa Cloud Gaming Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Cloud Gaming Market (2022-2029) 9.1. South America Cloud Gaming Market, by Type (2022-2029) 9.2. South America Cloud Gaming Market, by Device (2022-2029) 9.3. South America Cloud Gaming Market, by End-user (2022-2029) 9.4. South America Cloud Gaming Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Amazon Web service Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Apple Inc. 10.3. Electronics Arts, Inc. 10.4. Google Inc. 10.5. Intel Corporation 10.6. International Business Machines Corporation 10.7. Microsoft Corporation 10.8. NVIDIA Corporation 10.9. Sony Interactive Entertainment LLC 10.10. Ubitus Inc. 10.11. Playcloud Inc. 10.12. Tencent Holdings Ltd. 10.13. Broadmedia Corporation 10.14. Blacknut 10.15. IBM