The Breakfast Cereal Market size was valued at USD 51.76 Billion in 2024 and the total Breakfast Cereal revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 77.64 Billion.Breakfast Cereal Market Overview:

The breakfast cereals market is experiencing a shift towards health and wellness, with consumers prioritizing nutritional value, low sugar content, and natural ingredients. This trend has sparked a rise in demand for products rich in whole grains, fiber, and protein, as well as those catering to specific dietary needs like gluten-free or organic options. Alongside health considerations, convenience remains a key factor driving Breakfast Cereal Market growth, as busy lifestyles fuel the need for quick and easy breakfast solutions. To meet this demand, single-serve packaging, portable formats, and on-the-go snacks are gaining popularity among consumers seeking convenient breakfast choices. The market faces increasing competition from alternative breakfast options such as breakfast bars, yogurt, and smoothies. This has prompted cereal manufacturers to innovate and diversify their product offerings to stay competitive in a crowded marketplace. Marketing plays an important role in influencing consumer preferences and driving sales within this sector. Companies invest in advertising campaigns, branding initiatives, and product innovation to attract consumers and set their products apart from competitors. Tactics such as creative packaging, celebrity endorsements, and social media promotions are commonly employed to engage with consumers and foster brand loyalty.To know about the Research Methodology :- Request Free Sample Report

Breakfast Cereal Market: Dynamics

Driver Increasing Health Awareness boosts the Breakfast Cereal Market growth The changing dynamics of breakfast cereal consumption, including its growing popularity as a snack throughout the day, underscore several key driving factors shaping the market. With consumers reaching for cereal not only during breakfast but also as a convenient option for morning, afternoon, and evening snacks, manufacturers have an opportunity to refine their messaging, flavors, and packaging to better target these occasions The breakfast cereal market is heavily influenced by the consumption habits of global consumers. Breakfast remains the primary occasion for consuming cereal, with a significant 79% of consumers across the typically enjoying it in the morning. Though, there is a growing trend of cereal being consumed as a snack throughout the day, presenting manufacturers with opportunities to enhance their messaging, flavors, and packaging provided for this occasion. Cereal is now being consumed as a snack in the morning almost 28%, afternoon nearly 25%), and evening approximately 19%), as well as during lunch and dinner. The breakfast cereal market has experienced a significant increase in consumption, with 23% of consumers globally having an increase in their cereal intake over the past year. More than half of these consumers attribute their increased consumption to health reasons, highlighting the growing importance of health-conscious choices in the market. Among the countries with the highest recent increases in cereal consumption, such as Vietnam 47%, India 39%, Saudi Arabia 36%, and Thailand 35%, most are located in Asia. This indicates a promising emerging opportunity for cereal manufacturers in this region.Restrain High Competition from Alternatives Limits the Breakfast Cereal Market growth The breakfast cereal market encounters significant competition from alternative breakfast options, which restricts its growth potential. An example of this competition is the emergence of breakfast bars and on-the-go breakfast choices. Breakfast bars, such as granola bars, protein bars, and meal replacement bars, provide consumers with a convenient and portable breakfast solution. These bars often highlight health benefits such as high protein, fiber, and whole grains, appealing to individuals seeking quick and nutritious options for busy mornings. Also, many breakfast bars are marketed as low in added sugars and free from artificial ingredients, addressing concerns about the nutritional value of traditional breakfast cereals. As breakfast bars and similar alternatives gain popularity, divert market share away from traditional breakfast cereals. Consumers choose these alternatives due to their perceived health benefits, convenience, and portability, thereby limiting the growth potential of the breakfast cereal market. Breakfast bars often occupy prominent shelf space in grocery stores and are aggressively marketed as part of a balanced breakfast. This increased visibility and marketing efforts contribute to the competition faced by traditional breakfast cereals. The breakfast cereal market faces stiff competition from alternative breakfast options such as smoothies and yogurt parfaits, particularly among health-conscious consumers. For instance, a study report of MMR found that 30% of consumers who had previously consumed breakfast cereals switched to yogurt-based breakfast options due to perceived health benefits. Opportunities Diversification Of Product Offerings Creates Lucrative Growth Opportunities for Breakfast Cereal Market Growth The expansion of product offerings in the breakfast cereal market provides a strategic pathway for profitable growth. By increasing the variety of cereal options available, companies effectively provide to a wider range of consumer preferences and needs. This segmentation allows them to target different demographics, from health-conscious individuals looking for nutritious choices to those desiring indulgent flavors. Also, diversification enables companies to stay ahead of changing trends and promptly meet evolving consumer demands. Whether it involves introducing innovative ingredients, unique flavors, or functional benefits such as added vitamins, these initiatives help brands remain relevant and competitive. Likewise, limited edition and seasonal offerings generate excitement and attract consumers seeking novelty. Through cross-selling opportunities, companies leverage their diversified product portfolios to boost sales and revenue. The diversification not only fosters brand loyalty but also drives market share growth, positioning cereal companies for sustained growth in a dynamic and competitive Breakfast Cereal industry landscape. The expansion of cereal manufacturers into the gluten-free segment to cater to consumers with dietary restrictions or preferences. For instance, Kellogg's, a leading player in the breakfast cereal market, recognized the growing demand for gluten-free options among consumers who have celiac disease or gluten sensitivity, as well as those who choose to follow a gluten-free diet for health reasons. In response to this trend, Kellogg's diversified its product portfolio by introducing gluten-free versions of popular cereals such as Rice Krispies and Special K.

Breakfast Cereal Market: Segment Analysis

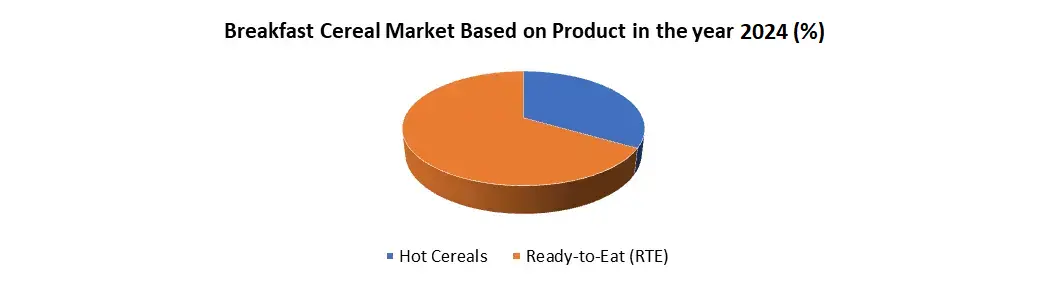

Based on Product The ready-to-eat (RTE) segment dominated the product segment Breakfast Cereal Market in the year 2024. RTE cereals offer convenience and time efficiency, aligning with the fast-paced lifestyles of modern consumers. They provide a quick and hassle-free breakfast option without the need for cooking or preparation, which appeals to busy individuals and families. Ready-to-eat cereals boast a wide range of flavors and varieties, providing to diverse consumer preferences and taste profiles. This extensive selection enhances their popularity among consumers, ensuring widespread appeal across different demographics. The RTE segment has witnessed significant innovation in terms of packaging and product formulations. This includes options with added nutritional benefits such as vitamins, minerals, and fiber. These innovations capitalize on the growing consumer demand for healthier breakfast choices, driving the segment's Breakfast Cereal Market growth.

Breakfast Cereal Market Regional Analysis:

North America Dominated the Breakfast Cereal Market in the year 2024. This region boasts a strong cereal consumption culture, offering a wide array of brands and flavors. Key players in this market, such as Kellogg's, General Mills, and Post Consumer Brands, have consistently held a prominent position, thanks to their popular cereal brands like Frosted Flakes, Cheerios, and Fruity Pebbles. The convenience and quickness of cereal as a breakfast option have made it a favorite among North American consumers, contributing to its widespread popularity. North American cereal companies have continuously led the way in terms of innovation, regularly introducing new flavors, packaging formats, and marketing strategies to stay ahead of the competition. Their extensive marketing and advertising campaigns, targeting both children and adults, have played an important role in establishing brand awareness and fostering loyalty. Additionally, the convenience and variety offered by breakfast cereals make them an ideal choice for busy North American consumers. With well-established distribution networks and a deep cultural connection, breakfast cereal has become a staple in North American breakfasts, symbolizing convenience, nostalgia, and comfort. In response to evolving health and nutrition trends, these companies have introduced healthier options provide to the preferences of health-conscious consumers. The dominance of North America in the breakfast cereal market is attributed to its rich history, relentless innovation, effective marketing strategies, convenience, and cultural significance.Global Breakfast Cereal Market Scope: Inquire before buying

Global Breakfast Cereal Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 51.76 Bn. Forecast Period 2025 to 2032 CAGR: 5.2% Market Size in 2032: USD 77.64 Bn. Segments Covered: by Product Ready-to-eat Hot Cereal by Packaging Type Boxes Pouches Others by Source Wheat Rice Oat Corn Barley Others by Distribution Channel Supermarket E-Commerce Convenience Store Others Global Breakfast Cereal Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Breakfast Cereal Market Key Players

North America 1. General Mills 2. Hometown Food Company 3. Purely Elizabeth 4. Above Food 5. WK Kellogg Co 6. Post Holdings 7. Kraft Heinz 8. Archar Daniels Midland Europe 9. Nestlé 10. Dr. Oetker 11. Weetabix Food Company 12. Nairn's Oatcakes 13. Associated British Foods 14. Tasti Products Ltd. 15. Spoon Cereals 16. Sevenday Cereals International 17. Crespel & Deiters Group 18. W Jordan & Son (Silo) APAC 19. Future Consumer 20. ITC Limited 21. Marico 22. San Miguel Pure Foods International 23. Bagrry's ME 24. Almarai South America 25. Grupo Bimbo Frequently Asked Questions 1] What segments are covered in the Global Market report? Ans. The segments covered in the Breakfast Cereal Market report are based on, Product, Packaging Type, Source, Distribution Channels, and Regions. 2] Which region is expected to hold the highest share of the Global Breakfast Cereal Market? Ans. The North America region is expected to hold the highest share of the Breakfast Cereal Market. 3] What is the market size of the Global Breakfast Cereal Market by 2032? Ans. The market size of the Breakfast Cereal Market by 2032 is expected to reach USD 77.64 Bn. 4] What was the Global Breakfast Cereal Market size in 2024? Ans: The Global Breakfast Cereal Market size was USD 51.76 Billion in 2024. 5] Key players in the Breakfast Cereal Market. Ans. Kellogg Company (USA), General Mills, Inc (USA), PepsiCo, Inc. (USA), Post Holdings, Inc. (USA) and The Kraft Heinz Company (USA)

1. Breakfast Cereal Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Breakfast Cereal Market: Dynamics 2.1. Breakfast Cereal Market Trends by Region 2.1.1. North America Breakfast Cereal Market Trends 2.1.2. Europe Breakfast Cereal Market Trends 2.1.3. Asia Pacific Breakfast Cereal Market Trends 2.1.4. Middle East and Africa Breakfast Cereal Market Trends 2.1.5. South America Breakfast Cereal Market Trends 2.2. Breakfast Cereal Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Breakfast Cereal Market Drivers 2.2.1.2. North America Breakfast Cereal Market Restraints 2.2.1.3. North America Breakfast Cereal Market Opportunities 2.2.1.4. North America Breakfast Cereal Market Challenges 2.2.2. Europe 2.2.2.1. Europe Breakfast Cereal Market Drivers 2.2.2.2. Europe Breakfast Cereal Market Restraints 2.2.2.3. Europe Breakfast Cereal Market Opportunities 2.2.2.4. Europe Breakfast Cereal Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Breakfast Cereal Market Drivers 2.2.3.2. Asia Pacific Breakfast Cereal Market Restraints 2.2.3.3. Asia Pacific Breakfast Cereal Market Opportunities 2.2.3.4. Asia Pacific Breakfast Cereal Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Breakfast Cereal Market Drivers 2.2.4.2. Middle East and Africa Breakfast Cereal Market Restraints 2.2.4.3. Middle East and Africa Breakfast Cereal Market Opportunities 2.2.4.4. Middle East and Africa Breakfast Cereal Market Challenges 2.2.5. South America 2.2.5.1. South America Breakfast Cereal Market Drivers 2.2.5.2. South America Breakfast Cereal Market Restraints 2.2.5.3. South America Breakfast Cereal Market Opportunities 2.2.5.4. South America Breakfast Cereal Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Breakfast Cereal Industry 2.8. Analysis of Government Schemes and Initiatives For Breakfast Cereal Industry 2.9. Breakfast Cereal Market Trade Analysis 2.10. The Global Pandemic Impact on Breakfast Cereal Market 3. Breakfast Cereal Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 3.1.1. Ready-to-eat 3.1.2. Hot Cereal 3.2. Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 3.2.1. Boxes 3.2.2. Pouches 3.2.3. Others 3.3. Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 3.3.1. Wheat 3.3.2. Rice 3.3.3. Oat 3.3.4. Corn 3.3.5. Barley 3.3.6. Others 3.4. Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 3.4.1. Supermarket 3.4.2. E-Commerce 3.4.3. Convenience Store 3.4.4. Others 3.5. Breakfast Cereal Market Size and Forecast, by Region (2024-2032) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Breakfast Cereal Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 4.1.1. Ready-to-eat 4.1.2. Hot Cereal 4.2. North America Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 4.2.1. Boxes 4.2.2. Pouches 4.2.3. Others 4.3. North America Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 4.3.1. Wheat 4.3.2. Rice 4.3.3. Oat 4.3.4. Corn 4.3.5. Barley 4.3.6. Others 4.4. North America Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.1. Supermarket 4.4.2. E-Commerce 4.4.3. Convenience Store 4.4.4. Others 4.5. North America Breakfast Cereal Market Size and Forecast, by Country (2024-2032) 4.5.1. United States 4.5.1.1. United States Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 4.5.1.1.1. Ready-to-eat 4.5.1.1.2. Hot Cereal 4.5.1.2. United States Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 4.5.1.2.1. Boxes 4.5.1.2.2. Pouches 4.5.1.2.3. Others 4.5.1.3. United States Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 4.5.1.3.1. Wheat 4.5.1.3.2. Rice 4.5.1.3.3. Oat 4.5.1.3.4. Corn 4.5.1.3.5. Barley 4.5.1.3.6. Others 4.5.1.4. United States Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 4.5.1.4.1. Supermarket 4.5.1.4.2. E-Commerce 4.5.1.4.3. Convenience Store 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 4.5.2.1.1. Ready-to-eat 4.5.2.1.2. Hot Cereal 4.5.2.2. Canada Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 4.5.2.2.1. Boxes 4.5.2.2.2. Pouches 4.5.2.2.3. Others 4.5.2.3. Canada Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 4.5.2.3.1. Wheat 4.5.2.3.2. Rice 4.5.2.3.3. Oat 4.5.2.3.4. Corn 4.5.2.3.5. Barley 4.5.2.3.6. Others 4.5.2.4. Canada Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 4.5.2.4.1. Supermarket 4.5.2.4.2. E-Commerce 4.5.2.4.3. Convenience Store 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 4.5.3.1.1. Ready-to-eat 4.5.3.1.2. Hot Cereal 4.5.3.2. Mexico Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 4.5.3.2.1. Boxes 4.5.3.2.2. Pouches 4.5.3.2.3. Others 4.5.3.3. Mexico Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 4.5.3.3.1. Wheat 4.5.3.3.2. Rice 4.5.3.3.3. Oat 4.5.3.3.4. Corn 4.5.3.3.5. Barley 4.5.3.3.6. Others 4.5.3.4. Mexico Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 4.5.3.4.1. Supermarket 4.5.3.4.2. E-Commerce 4.5.3.4.3. Convenience Store 4.5.3.4.4. Others 5. Europe Breakfast Cereal Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.2. Europe Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.3. Europe Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.4. Europe Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 5.5. Europe Breakfast Cereal Market Size and Forecast, by Country (2024-2032) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.5.1.2. United Kingdom Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.5.1.3. United Kingdom Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.5.1.4. United Kingdom Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.2. France 5.5.2.1. France Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.5.2.2. France Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.5.2.3. France Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.5.2.4. France Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.3. Germany 5.5.3.1. Germany Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.5.3.2. Germany Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.5.3.3. Germany Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.5.3.4. Germany Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.4. Italy 5.5.4.1. Italy Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.5.4.2. Italy Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.5.4.3. Italy Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.5.4.4. Italy Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.5. Spain 5.5.5.1. Spain Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.5.5.2. Spain Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.5.5.3. Spain Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.5.5.4. Spain Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.6. Sweden 5.5.6.1. Sweden Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.5.6.2. Sweden Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.5.6.3. Sweden Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.5.6.4. Sweden Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.7. Austria 5.5.7.1. Austria Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.5.7.2. Austria Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.5.7.3. Austria Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.5.7.4. Austria Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 5.5.8.2. Rest of Europe Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 5.5.8.3. Rest of Europe Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 5.5.8.4. Rest of Europe Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6. Asia Pacific Breakfast Cereal Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.2. Asia Pacific Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.3. Asia Pacific Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.4. Asia Pacific Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5. Asia Pacific Breakfast Cereal Market Size and Forecast, by Country (2024-2032) 6.5.1. China 6.5.1.1. China Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.1.2. China Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.1.3. China Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.1.4. China Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.2. S Korea 6.5.2.1. S Korea Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.2.2. S Korea Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.2.3. S Korea Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.2.4. S Korea Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.3. Japan 6.5.3.1. Japan Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.3.2. Japan Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.3.3. Japan Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.3.4. Japan Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.4. India 6.5.4.1. India Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.4.2. India Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.4.3. India Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.4.4. India Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.5. Australia 6.5.5.1. Australia Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.5.2. Australia Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.5.3. Australia Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.5.4. Australia Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.6. Indonesia 6.5.6.1. Indonesia Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.6.2. Indonesia Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.6.3. Indonesia Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.6.4. Indonesia Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.7. Malaysia 6.5.7.1. Malaysia Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.7.2. Malaysia Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.7.3. Malaysia Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.7.4. Malaysia Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.8. Vietnam 6.5.8.1. Vietnam Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.8.2. Vietnam Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.8.3. Vietnam Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.8.4. Vietnam Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.9. Taiwan 6.5.9.1. Taiwan Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.9.2. Taiwan Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.9.3. Taiwan Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.9.4. Taiwan Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 6.5.10.2. Rest of Asia Pacific Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 6.5.10.3. Rest of Asia Pacific Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 6.5.10.4. Rest of Asia Pacific Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 7. Middle East and Africa Breakfast Cereal Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 7.2. Middle East and Africa Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 7.3. Middle East and Africa Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 7.4. Middle East and Africa Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 7.5. Middle East and Africa Breakfast Cereal Market Size and Forecast, by Country (2024-2032) 7.5.1. South Africa 7.5.1.1. South Africa Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 7.5.1.2. South Africa Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 7.5.1.3. South Africa Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 7.5.1.4. South Africa Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.2. GCC 7.5.2.1. GCC Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 7.5.2.2. GCC Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 7.5.2.3. GCC Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 7.5.2.4. GCC Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.3. Nigeria 7.5.3.1. Nigeria Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 7.5.3.2. Nigeria Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 7.5.3.3. Nigeria Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 7.5.3.4. Nigeria Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 7.5.4.2. Rest of ME&A Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 7.5.4.3. Rest of ME&A Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 7.5.4.4. Rest of ME&A Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 8. South America Breakfast Cereal Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 8.2. South America Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 8.3. South America Breakfast Cereal Market Size and Forecast, by Source(2024-2032) 8.4. South America Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 8.5. South America Breakfast Cereal Market Size and Forecast, by Country (2024-2032) 8.5.1. Brazil 8.5.1.1. Brazil Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 8.5.1.2. Brazil Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 8.5.1.3. Brazil Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 8.5.1.4. Brazil Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.2. Argentina 8.5.2.1. Argentina Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 8.5.2.2. Argentina Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 8.5.2.3. Argentina Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 8.5.2.4. Argentina Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Breakfast Cereal Market Size and Forecast, by Product (2024-2032) 8.5.3.2. Rest Of South America Breakfast Cereal Market Size and Forecast, by Packaging Type (2024-2032) 8.5.3.3. Rest Of South America Breakfast Cereal Market Size and Forecast, by Source (2024-2032) 8.5.3.4. Rest Of South America Breakfast Cereal Market Size and Forecast, by Distribution Channel (2024-2032) 9. Global Breakfast Cereal Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading Breakfast Cereal Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. General Mills 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Hometown Food Company 10.3. Purely Elizabeth 10.4. Above Food 10.5. WK Kellogg Co 10.6. Post Holdings 10.7. Kraft Heinz 10.8. Archar Daniels Midland 10.9. Nestlé 10.10. Dr. Oetker 10.11. Weetabix Food Company 10.12. Nairn's Oatcakes 10.13. Associated British Foods 10.14. Tasti Products Ltd. 10.15. Spoon Cereals 10.16. Sevenday Cereals International 10.17. Crespel & Deiters Group 10.18. W Jordan & Son (Silo) 10.19. Future Consumer 10.20. ITC Limited 10.21. Marico 10.22. San Miguel Pure Foods International 10.23. Bagrry's 10.24. Almarai 10.25. Grupo Bimbo 11. Key Findings 12. Industry Recommendations 13. Breakfast Cereal Market: Research Methodology 14. Terms and Glossary