The Biotechnology Market size was valued at USD 734.15 Billion in 2023 and the total Biotechnology Market revenue is expected to grow at a CAGR of 12.86% from 2024 to 2030, reaching nearly USD 1712.68 Billion.Biotechnology Market Overview:

Biotechnology is a field of science that involves the use of living organisms, biological systems, or their derivatives to develop or create products, improve processes, or solve problems for various industries. It includes a wide range of applications, including agriculture, medicine, pharmaceuticals, food production, environmental protection, and energy production.To know about the Research Methodology :- Request Free Sample Report By 2030, biotechnology is set to undergo substantial advancement. It holds the potential to address major national challenges, mainly in healthcare. With global healthcare expenditures estimated at approximately US$8 trillion, it's foreseeable that biotechnology market permeate everyday life by 2030. This integration include a wide array of applications, spanning from pharmaceuticals, medicines, and therapeutics to eco-friendly chemicals, fuels, and materials.

Biotechnology Market Dynamics:

The Global Biotechnology Market dynamics are thoroughly studied and explained in the report, which helps reader to understand emerging market trends, drivers, restraints, opportunities, and challenges at global and regional level for the Global Biotechnology industry. Some of the dynamics illustrate below: Growing Demand for Personalized Medicine, R&D Investment, and Chronic Disease Burden Drive Biotechnology Market Growth: Biotechnology products such as gene therapies, cell therapies, and biopharmaceuticals are engineered to pioneer innovative treatments across a spectrum of diseases. These therapies hold the potential to outshine traditional pharmaceuticals by offering enhanced efficacy and fewer side effects. Moreover, they play a pivotal role in enhancing agricultural methods, growing scientific comprehension, furnishing diagnostic tools, and bolstering sustainability efforts. The propulsion of the biotechnology market is steered by several factors, including the rising demand for personalized medicine, amplified investments in R&D, a surge in chronic disease prevalence, burgeoning requests for outsourcing services, and an upsurge in sustainable agriculture demands. The trend of outsourcing biotechnology research and development to contract research organizations is on the rise. Furthermore, biotechnology is instrumental in devising sustainable agricultural practices and elevating crop yields. Governmental backing and funding for biotechnology research are also on the ascent, further stimulating the growth trajectory of the biotechnology market. Tissue Culture and Cell Engineering: Rising Research and Development Trends: The surge in research and development endeavors focused on tissue culture and cell engineering is poised to propel growth in the global biotechnology market in the foreseeable future. A notable example occurred on August 16, 2022, when Bharat Biotech, an India-based manufacturer of vaccines and bio-therapeutics, disclosed phase III clinical trial data for its intranasal COVID-19 vaccine. The vaccine demonstrated safety, tolerability, and immunogenicity among subjects in controlled clinical trials. Additionally, the Drug Controller General of India (DCGI) has granted permission to the firm to conduct a phase-3 clinical trial comparing the immunogenicity and safety of BBV-154 (intranasal) with Covaxin. This trial is authorized to take place at 9 sites across India. Emerging Opportunities in Biotechnology: Sustainable Agriculture, Collaboration, Economics, Personalized Medicine: The biotechnology sector benefits from the growth of healthcare industries in emerging economies like Brazil, India, South Africa, and China. Additionally, environmental sustainability initiatives open avenues for sustainable agriculture practices, biofuel production, and renewable resource utilization. Collaboration and partnerships among academic institutions, industry stakeholders, and government agencies present opportunities for innovation and advancement. Advancements in economics and personalized medicine drive the development of novel diagnostic tools and therapies, enhancing patient outcomes. Technological progress, particularly in synthetic biology, machine learning, and gene editing, propels innovation in the sector. Moreover, increased funding and investment, including venture capital funding, stimulate growth and innovation within the biotechnology market. Recent Trends in the Biotechnology Market Artificial intelligence, synthetic biology, and plant biotechnology have emerged as notable trends in the biotechnology market. The market is witnessing a growing emphasis on artificial intelligence, gene editing, synthetic biology, cell and gene therapies, and plant biotechnology. Artificial intelligence (AI) is reshaping the biotechnology landscape by revolutionizing drug discovery, optimizing clinical trials, and enhancing patient outcomes. Gene editing technologies like CRISPR-Cas9 are driving innovation in the biotechnology market by providing powerful tools for developing novel therapies and treatments. Synthetic biology involves the design and engineering of biological systems for diverse applications, offering immense potential for innovation and advancement. Cell and gene therapies are ushering in a new era of personalized treatments for conditions such as cancer, genetic disorders, and immune system disorders. These trends underscore the dynamic nature of the biotechnology market, highlighting the ongoing pursuit of breakthrough innovations and transformative technologies.Biotechnology Market Segment Analysis

Based on Technology, DNA sequencing segment dominated the biotechnology market in 2023 and is expected to hold the largest of nearly 36.17% global market share over the forecast period. The utilization of sequencing to comprehend diseases has experienced a surge, buoyed by government backing for genetic research. For instance, the University of Pittsburgh Graduate School of Public Health and Washington University School of Medicine in St. Louis secured a USD 10.7 million NIH grant in May 2021 to investigate the genetic underpinnings of Alzheimer's disease. Furthermore, theranostic nanoparticles have gained traction, facilitating swift diagnosis and personalized therapy options for multiple ailments simultaneously. Nanoparticle attributes such as minimal toxicity, diminutive size, and chemical versatility have mitigated the limitations of conventional generic drug delivery methods. Additionally, the field of tissue engineering and regenerative medicine has maintained a significant presence, fueled by public and private investments, substantial healthcare expenditures, and the presence of numerous established and emerging enterprises.By Applications, in 2023, Health segment held the dominant share of in biotechnology market and expected to grow at a CAGR of 13.22% during the forecast period. The growth of the segment is expected to be driven by several factors, including the increasing disease burden, the expanding availability of agri-biotech and bio-services, and technological advancements in the bio-industrial sector. Additionally, significant progress in Artificial Intelligence (AI), machine learning, and big data is anticipated to enhance the adoption of bioinformatics applications, particularly in industries such as food and beverages. Furthermore, collaborative endeavors and partnerships aimed at developing and commercializing new therapeutic platforms and molecules are poised to fuel biotechnology market growth. For instance, in January 2021, Novartis partnered with Alnylam to explore the application of the latter's siRNA technology in the development of targeted therapies for restoring liver function.

Biotechnology Market Regional Analysis:

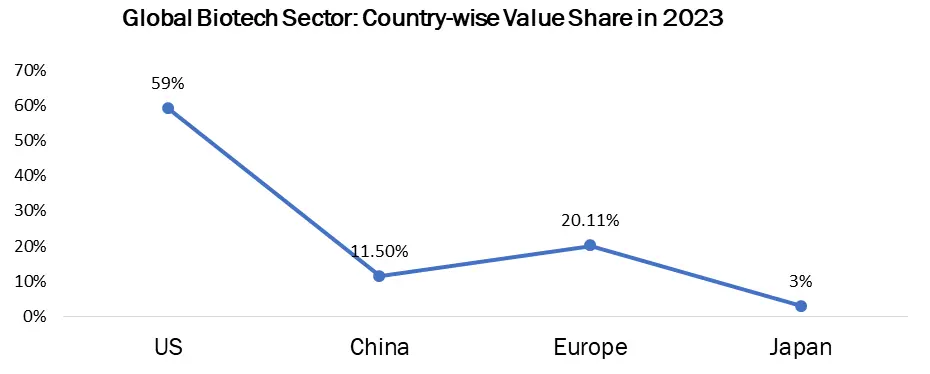

Geographically, Asia Pacific region held the dominant share over nearly 42% in 2023 and is projected to continue its dominance during forecast period. The regional biotechnology market's growth is propelled by various factors, including the presence of key players, extensive research and development endeavors, and substantial healthcare expenditure. Notably, the region demonstrates a significant penetration of genomics, proteomics, and cell biology-based platforms, thereby expediting the adoption of life sciences tools. Furthermore, the increasing prevalence of chronic diseases and the rising adoption of personalized medicine applications for treating life-threatening disorders are poised to positively influence biotechnology market growth in the region. The growth of the regional biotechnology Industry is attributed to escalating investments, enhancements in healthcare infrastructure, favorable government initiatives, and strategic expansion initiatives by key biotechnology market players. For instance, in February 2022, Moderna Inc. unveiled plans for geographic expansion of its commercial network in Asia by establishing new subsidiaries in Malaysia, Singapore, Hong Kong, and Taiwan. Additionally, collaborations in the biopharmaceutical sector, such as the strategic partnership between Kiniksa Pharmaceuticals and Huadong Medicine for the development and commercialization of Kiniksa's ARCALYST and mavrilimumab in the Asia-Pacific region, are expected to significantly contribute to market growth. The Asia Pacific region is poised to exhibit the most rapid biotechnology market growth rate, propelled by increasing investments, enhancements in healthcare infrastructure, favorable government initiatives, and strategic expansion efforts by key biotechnology market players. Such as, in February 2022, Moderna Inc. disclosed plans for geographic expansion of its commercial network in Asia, establishing new subsidiaries in Malaysia, Singapore, Hong Kong, and Taiwan. Furthermore, collaborations in the biopharmaceutical sector, such as the strategic partnership between Kiniksa Pharmaceuticals and Huadong Medicine for the development and commercialization of Kiniksa's ARCALYST and mavrilimumab in the Asia-Pacific region, are expected to contribute significantly to the biotechnology market's growth.Product Launches and Product Expansions: Biotechnology Market 1. In October 2023, Gilead Sciences, Inc. and Assembly Biosciences forged a partnership to develop advanced therapeutics for severe viral diseases. 2. In September 2023, Merck KGaA unveiled collaborations with BenevolentAI and Exscientia, harnessing artificial intelligence for drug discovery in oncology, neurology, and immunology, potentially yielding innovative candidates for clinical development. 3. In November 2022, AstraZeneca announced the addition of Neogene Therapeutics Inc. to its portfolio, both dedicated to pioneering cutting-edge cell therapies for patients with solid tumors. Aligned in their commitment to advancing biotechnological approaches, the integration of TCR-Ts (cell therapy) from Neogene holds the potential to target intracellular markers, including cancer-specific mutations, opening new avenues for therapy previously inaccessible through cell therapies. This strategic collaboration bears significant promise in reshaping the landscape of cancer treatment and personalized medicine.

Biotechnology Market Scope: Inquire before buying

Global Biotechnology Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 734.15 Bn. Forecast Period 2024 to 2030 CAGR: 12.86% Market Size in 2030: US $ 1712.68 Bn. Segments Covered: by Product Type Instruments Reagents and Services Software by Technology Nanobiotechnology Tissue Engineering & Regeneration DNA Sequencing Cell-based Assays Fermentation Others by Application Bioinformatics Food & Agriculture Health Industrial Processing Natural Resources & Environment Others Biotechnology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Biotechnology Market Key Players:

North America Biotechnology Market Top Players: 1. Gilead Sciences, Inc. 2. Bristol-Myers Squibb 3. Biogen 4. Abbott Laboratories 5. Pfizer, Inc. 6. Amgen, Inc. 7. Merck KGaA 8. Johnson & Johnson Services, Inc. 9. Novartis AG Europe Biotechnology Market Top Players: 1. AstraZeneca 2. Sanofi 3. Novo Nordisk A/S 4. Lonza APAC Biotechnology Market Top Players: 1. Biocon 2. Pancea Biotech 3. Bharat Biotech 4. F. Hoffmann-La Roche Ltd. FAQs: 1] Which region is expected to hold the highest share in the Biotechnology Market? Ans. The North American region is expected to hold the highest share in the Biotechnology Market. 2] Who are the top key players in the Biotechnology Market? Ans. AstraZeneca, Biogen, Sanofi are the top key players in the Biotechnology Market. 3] Which segment is expected to hold the largest market share in the Biotechnology Market by 2030? Ans. Health application segment is expected to hold the largest market share in the Biotechnology Market by 2030. 4] What is the market size of the Biotechnology Market by 2030? Ans. The market size of the Biotechnology Market is expected to reach US $ 1712.68 Bn. by 2030. 5] What was the market size of the Biotechnology Market in 2023? Ans. The market size of the Biotechnology Market was worth US $ 734.15 Bn. in 2023.

1. Biotechnology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Biotechnology Market: Dynamics 2.1. Biotechnology Market Trends by Region 2.1.1. North America Biotechnology Market Trends 2.1.2. Europe Biotechnology Market Trends 2.1.3. Asia Pacific Biotechnology Market Trends 2.1.4. Middle East and Africa Biotechnology Market Trends 2.1.5. South America Biotechnology Market Trends 2.2. Biotechnology Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Biotechnology Market Drivers 2.2.1.2. North America Biotechnology Market Restraints 2.2.1.3. North America Biotechnology Market Opportunities 2.2.1.4. North America Biotechnology Market Challenges 2.2.2. Europe 2.2.2.1. Europe Biotechnology Market Drivers 2.2.2.2. Europe Biotechnology Market Restraints 2.2.2.3. Europe Biotechnology Market Opportunities 2.2.2.4. Europe Biotechnology Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Biotechnology Market Drivers 2.2.3.2. Asia Pacific Biotechnology Market Restraints 2.2.3.3. Asia Pacific Biotechnology Market Opportunities 2.2.3.4. Asia Pacific Biotechnology Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Biotechnology Market Drivers 2.2.4.2. Middle East and Africa Biotechnology Market Restraints 2.2.4.3. Middle East and Africa Biotechnology Market Opportunities 2.2.4.4. Middle East and Africa Biotechnology Market Challenges 2.2.5. South America 2.2.5.1. South America Biotechnology Market Drivers 2.2.5.2. South America Biotechnology Market Restraints 2.2.5.3. South America Biotechnology Market Opportunities 2.2.5.4. South America Biotechnology Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Biotechnology Industry 2.8. Analysis of Government Schemes and Initiatives For Biotechnology Industry 2.9. Biotechnology Market Trade Analysis 2.10. The Global Pandemic Impact on Biotechnology Market 3. Biotechnology Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Biotechnology Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Instruments 3.1.2. Reagents and Services 3.1.3. Software 3.2. Biotechnology Market Size and Forecast, by Technology (2023-2030) 3.2.1. Nanobiotechnology 3.2.2. Tissue Engineering & Regeneration 3.2.3. DNA Sequencing 3.2.4. Cell-based Assays 3.2.5. Fermentation 3.2.6. Others 3.3. Biotechnology Market Size and Forecast, by Application (2023-2030) 3.3.1. Bioinformatics 3.3.2. Food & Agriculture 3.3.3. Health 3.3.4. Industrial Processing 3.3.5. Natural Resources & Environment 3.3.6. Others 3.4. Biotechnology Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Biotechnology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Biotechnology Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Instruments 4.1.2. Reagents and Services 4.1.3. Software 4.2. North America Biotechnology Market Size and Forecast, by Technology (2023-2030) 4.2.1. Nanobiotechnology 4.2.2. Tissue Engineering & Regeneration 4.2.3. DNA Sequencing 4.2.4. Cell-based Assays 4.2.5. Fermentation 4.2.6. Others 4.3. North America Biotechnology Market Size and Forecast, by Application (2023-2030) 4.3.1. Bioinformatics 4.3.2. Food & Agriculture 4.3.3. Health 4.3.4. Industrial Processing 4.3.5. Natural Resources & Environment 4.3.6. Others 4.4. North America Biotechnology Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Biotechnology Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Instruments 4.4.1.1.2. Reagents and Services 4.4.1.1.3. Software 4.4.1.2. United States Biotechnology Market Size and Forecast, by Technology (2023-2030) 4.4.1.2.1. Nanobiotechnology 4.4.1.2.2. Tissue Engineering & Regeneration 4.4.1.2.3. DNA Sequencing 4.4.1.2.4. Cell-based Assays 4.4.1.2.5. Fermentation 4.4.1.2.6. Others 4.4.1.3. United States Biotechnology Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Bioinformatics 4.4.1.3.2. Food & Agriculture 4.4.1.3.3. Health 4.4.1.3.4. Industrial Processing 4.4.1.3.5. Natural Resources & Environment 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Biotechnology Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Instruments 4.4.2.1.2. Reagents and Services 4.4.2.1.3. Software 4.4.2.2. Canada Biotechnology Market Size and Forecast, by Technology (2023-2030) 4.4.2.2.1. Nanobiotechnology 4.4.2.2.2. Tissue Engineering & Regeneration 4.4.2.2.3. DNA Sequencing 4.4.2.2.4. Cell-based Assays 4.4.2.2.5. Fermentation 4.4.2.2.6. Others 4.4.2.3. Canada Biotechnology Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Bioinformatics 4.4.2.3.2. Food & Agriculture 4.4.2.3.3. Health 4.4.2.3.4. Industrial Processing 4.4.2.3.5. Natural Resources & Environment 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Biotechnology Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Instruments 4.4.3.1.2. Reagents and Services 4.4.3.1.3. Software 4.4.3.2. Mexico Biotechnology Market Size and Forecast, by Technology (2023-2030) 4.4.3.2.1. Nanobiotechnology 4.4.3.2.2. Tissue Engineering & Regeneration 4.4.3.2.3. DNA Sequencing 4.4.3.2.4. Cell-based Assays 4.4.3.2.5. Fermentation 4.4.3.2.6. Others 4.4.3.3. Mexico Biotechnology Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Bioinformatics 4.4.3.3.2. Food & Agriculture 4.4.3.3.3. Health 4.4.3.3.4. Industrial Processing 4.4.3.3.5. Natural Resources & Environment 4.4.3.3.6. Others 5. Europe Biotechnology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Biotechnology Market Size and Forecast, by Application (2023-2030) 5.4. Europe Biotechnology Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.4.1.3. United Kingdom Biotechnology Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.4.2.3. France Biotechnology Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.4.3.3. Germany Biotechnology Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.4.4.3. Italy Biotechnology Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.4.5.3. Spain Biotechnology Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.4.6.3. Sweden Biotechnology Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.4.7.3. Austria Biotechnology Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Biotechnology Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Biotechnology Market Size and Forecast, by Technology (2023-2030) 5.4.8.3. Rest of Europe Biotechnology Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Biotechnology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Biotechnology Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.1.3. China Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.2.3. S Korea Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.3.3. Japan Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.4.3. India Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.5.3. Australia Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.6.3. Indonesia Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.7.3. Malaysia Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.8.3. Vietnam Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.9.3. Taiwan Biotechnology Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Biotechnology Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Biotechnology Market Size and Forecast, by Technology (2023-2030) 6.4.10.3. Rest of Asia Pacific Biotechnology Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Biotechnology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Biotechnology Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Biotechnology Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Biotechnology Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Biotechnology Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Biotechnology Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Biotechnology Market Size and Forecast, by Technology (2023-2030) 7.4.1.3. South Africa Biotechnology Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Biotechnology Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Biotechnology Market Size and Forecast, by Technology (2023-2030) 7.4.2.3. GCC Biotechnology Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Biotechnology Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Biotechnology Market Size and Forecast, by Technology (2023-2030) 7.4.3.3. Nigeria Biotechnology Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Biotechnology Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Biotechnology Market Size and Forecast, by Technology (2023-2030) 7.4.4.3. Rest of ME&A Biotechnology Market Size and Forecast, by Application (2023-2030) 8. South America Biotechnology Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Biotechnology Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Biotechnology Market Size and Forecast, by Technology (2023-2030) 8.3. South America Biotechnology Market Size and Forecast, by Application(2023-2030) 8.4. South America Biotechnology Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Biotechnology Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Biotechnology Market Size and Forecast, by Technology (2023-2030) 8.4.1.3. Brazil Biotechnology Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Biotechnology Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Biotechnology Market Size and Forecast, by Technology (2023-2030) 8.4.2.3. Argentina Biotechnology Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Biotechnology Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Biotechnology Market Size and Forecast, by Technology (2023-2030) 8.4.3.3. Rest Of South America Biotechnology Market Size and Forecast, by Application (2023-2030) 9. Global Biotechnology Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Biotechnology Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Gilead Sciences, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bristol-Myers Squibb 10.3. Biogen 10.4. Abbott Laboratories 10.5. Pfizer, Inc. 10.6. Amgen, Inc. 10.7. Merck KGaA 10.8. Johnson & Johnson Services, Inc. 10.9. Novartis AG 10.10. AstraZeneca 10.11. Sanofi 10.12. Novo Nordisk A/S 10.13. Lonza 10.14. Biocon 10.15. Pancea Biotech 10.16. Bharat Biotech 10.17. F. Hoffmann-La Roche Ltd. 11. Key Findings 12. Industry Recommendations 13. Biotechnology Market: Research Methodology 14. Terms and Glossary