Bioprocess Technology Market size was valued at USD 28.80 Billion in 2024 and the total Global Bioprocess Technology Market revenue is expected to grow at a CAGR of 7.4% from 2025 to 2032, reaching nearly USD 50.98 Billion.Global Bioprocess Technology Market Overview

Bioprocess technology involves utilizing living cells or their components to produce a wide array of products across industries such as pharmaceuticals, biofuels, food, and chemicals. Bioprocess Technology includes techniques such as fermentation, cell culture, and purification to optimize production efficiency and sustainability in manufacturing biological products. The increasing need for biopharmaceuticals, biofuels, and sustainable solutions is driving the upward surge of the Bioprocess technology market. This exponential rise is driven by amplified research and development initiatives, a stride forward in biotechnological innovations, and the mounting prevalence of chronic ailments demanding revolutionary pharmaceutical solutions. Bioprocess Technology industry leaders such as Thermo Fisher Scientific, Merck KGaA, Sartorius AG, and Danaher Corporation persist in their commitment, investing substantially in avant-garde technologies and forging strategic collaborations. Thermo Fisher's strategic acquisition of Brammer Bio stands as a testament to its thrust in fortifying gene therapy capabilities, while Merck KGaA's substantial expansion of bioprocessing facilities in Ireland and the United States underscores a resolute industry push towards escalating production capacities. The embrace of single-use technologies, process intensification strategies, and the unwavering adoption of continuous bioprocessing methodologies epitomize a marked shift towards leaner, more resourceful, and environmentally conscious manufacturing paradigms. These advancements underscore the market's evolution towards sustainable and efficient practices, cementing the Bioprocess technology market's trajectory towards robust growth and innovation.To know about the Research Methodology:-Request Free Sample Report

Bioprocess Technology Market Dynamics:

Rising Demand for Biopharmaceuticals Driving Bioprocess Technology Market Growth The escalating need for biologic drugs, such as monoclonal antibodies, drives bioprocess technology market growth. For instance, Roche's drug Avastin, produced by using bioprocessing methods, generated over USD 7 billion in sales in 2020, indicating the market's potential. Technological leaps, such as CRISPR-Cas9 for genome editing, bolster bioprocessing capabilities. These innovations streamline production, exemplified by Editas Medicine's gene-editing therapies advancing towards clinical trials, signaling the sector's growth potential.Bioprocessing's eco-friendly approach aligns with the Bioprocess Technology Market sustainability thrust. Novozymes' enzyme-based technologies for eco-friendly detergents showcase the industry's commitment, fostering bioprocess technology's growth amidst sustainable trends. With a global push for renewable energy, bioprocess technology fulfils to biofuel production. Renewable Energy Group's use of bioprocessing in converting waste oils into biodiesel showcases market growth in eco-friendly fuel solutions. Persistent R&D investments drive innovation in bioprocess technology. Companies such as Ginkgo Bioworks, investing heavily in synthetic biology R&D, demonstrate industry commitment, driving Bioprocess Technology Market growth. Favorable regulations promoting biologics' use fortify market growth. The FDA's expedited approvals for biologics like CAR-T cell therapies exemplify regulatory backing, propelling bioprocess technology market growth. The growing research and development efforts significantly drive the of the market. For instance, as per the report released by the International Federation of Pharmaceutical Manufacturers & Associations, the biopharmaceutical industry's yearly expenditure surpasses that of several key sectors. It outpaces the aerospace and defense industries by 8.1 times, the chemicals industry by 7.2 times, and the software and computer services industry by 1.2 times. The biopharmaceutical sector has consistently maintained its lead in R&D investments, even during periods of economic upheaval and financial downturns. Similarly, Thermo Fisher Scientific's 2021 annual report disclosed a substantial investment in research and development, with expenditures totaling USD 1,406.00 million for that year, marking a 19.05% increase from the preceding period. These escalating R&D expenses within biopharmaceutical enterprises drive the innovation and creation of cutting-edge biopharma products, consequently fostering the robust growth of market. Collaborations such as the partnership between Lonza and Moderna for COVID-19 vaccine production amplify bioprocess technology market influence by leveraging combined expertise for large-scale vaccine manufacturing. Increasing preference for single-use bioprocessing systems due to cost-efficiency and flexibility fuels market growth. Thermo Fisher's Single-Use Technologies Unit's revenue growth underscores this trend's impact on Bioprocess Technology Market growth. Tailored therapies demand sophisticated bioprocessing methods. Illumina's genetic sequencing technology, enabling personalized medicine, emphasizes bioprocess technology's pivotal role in advancing healthcare. Growing biosimilar demand intensifies bioprocess technology applications. Companies such as Pfizer and Biocon's partnership in biosimilar production emphasizes Bioprocess Technology Market growth driven by the need for cost-effective biologics. Stringent regulations Hinders the Bioprocess Technology Market Growth Stringent regulations in bioprocessing present significant barriers to Bioprocess Technology Market growth. The FDA's rigorous approval process for biologics, crucial for ensuring safety and efficacy, often leads to prolonged timelines before product launches, affecting market penetration and growth. The exorbitant costs associated with R&D and production within bioprocess technology pose accessibility challenges. For instance, the development of a single drug, like Genentech's Herceptin, incur costs amounting to billions, signifying the substantial financial hurdles within the industry. The vulnerability of bioprocessing to supply chain disruptions, as evidenced during the COVID-19 pandemic, creates impediments in manufacturing, impacting vaccine production timelines and availability. Protecting intellectual property remains a persistent challenge, as legal battles over patents, such as the ongoing litigation between Amgen and Sanofi regarding cholesterol-lowering biologic drugs, obstruct innovation and Bioprocess Technology Market growth. The intricate nature of bioprocessing technologies necessitates specialized expertise, causing complications in scaling up processes from lab-scale to large-scale manufacturing. stringent environmental regulations, while beneficial for sustainability, heighten complexity and costs associated with waste disposal laws, particularly those concerning biologically hazardous waste disposal, adding operational intricacies. Ethical debates, concerning genetic editing technologies such as CRISPR-Cas9, contribute to uncertainties that impact funding and adoption, subsequently affecting Bioprocess Technology Market growth. The industry's fragmentation and the lack of standardization across regions, evident in varying regulatory frameworks such as those set by the FDA and EMA, complicate global market access. Certain bioprocessing technologies encounter scalability challenges, exemplified by limitations faced by microfluidics-based bioprocessing in meeting commercial demands. Additionally, changes in global trade policies, such as tariffs and trade barriers, have implications on the supply chain and market dynamics. Trade tensions, as seen in disputes between the US and China within the biopharmaceutical sector, disrupt the flow of supply and demand, influencing market stability and growth trajectories.

Bioprocess Technology Market Segment Analysis:

Based on Product Type, the market is segmented into Bioreactors, Filtration System, Separation System, Cell Culture Systems. The bioreactors segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. The core equipment in bioprocessing serves as the central system where cell culture, fermentation, and biologics production take place. With the rising demand for monoclonal antibodies, vaccines, and advanced therapies (such as cell and gene therapies), bioreactors have become indispensable in both research and large-scale manufacturing. The shift toward single-use bioreactors is also fuelling growth, as they reduce contamination risks, improve flexibility, and lower operating costs. Biopharma companies are heavily investing in scalable bioreactor technologies to accelerate time-to-market, which further strengthens this segment’s lead over filtration, separation, and cell culture systems. Based on Scale of Operation the market is segmented into laboratory scale, pilot scale, industrial scale. The industrial scale segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. The commercial production of biologics, including vaccines, monoclonal antibodies, biosimilars, and recombinant proteins, which require large-scale bioprocessing facilities. Industrial-scale operations ensure high-volume output, regulatory compliance, and cost efficiency, making them the backbone of the biopharmaceutical supply chain. The COVID-19 pandemic further accelerated investments in industrial bioprocessing infrastructure, and the ongoing rise in demand for personalized medicine, cell therapies, and chronic disease treatments continues to fuel large-scale adoption.Bioprocess Technology Market Regional Insights:

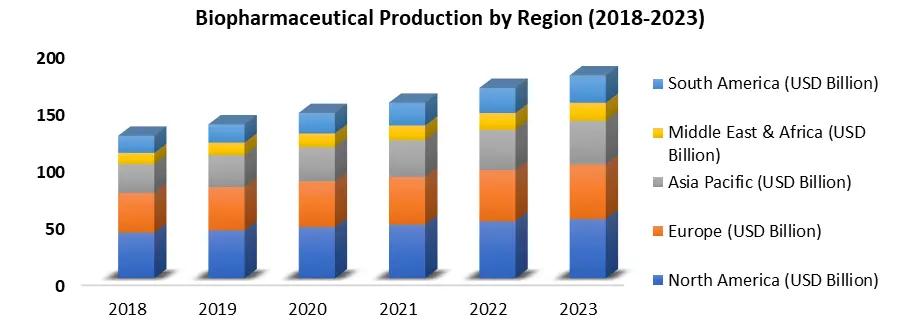

North America Dominance in the Bioprocess Technology Market North America dominated the Bioprocess Technology Market in 2023 as it is key production hub, with a robust presence of biopharmaceutical giants, high R&D investments, and technological advancements. Europe stands out as an emerging Bioprocess Technology utilizing region, with countries such as Germany, France, and the UK leading the production of biopharmaceuticals and industrial enzymes. For instance, Germany's robust biotech sector, including companies such as BioNTech and Bayer, contributes significantly to the region's production capacities. Companies like Moderna and Pfizer drive this consumption pattern, with the U.S. accounting for a substantial portion of global bioprocess technology consumption. Import-export statistics reveal intricate trade dynamics.For example, Asia-Pacific nations such as China and India are rapidly expanding their bioprocess technology exports, capitalizing on lower production costs and skilled labor. Conversely, these countries also import significant biopharmaceuticals and related products, demonstrating a reliance on foreign technologies and expertise. Statistical data showcases these trends vividly, with the European market contributing over 30% of the global bioprocess technology market, while the U.S. dominates the consumption landscape with a market share exceeding 40%. Asia-Pacific's export market has experienced an annual growth rate of over 10%, underscoring its emergence as a key player in the global bioprocess technology trade landscape. Recent Developments:

Date Company Name Development Details 15-12-2023 Thermo Fisher Scientific Thermo Fisher launched a novel bioproduction ecosystem integrating automation and digital technologies for streamlined bioprocessing. 02-08-2023 Sartorius AG Sartorius introduced a single-use fermentation system enhancing flexibility and scalability in bioprocessing for diverse applications. 20-05-2023 Merck KGaA Merck developed a high-efficiency purification technology, elevating downstream processing efficiency in biopharmaceutical production. 10-11-2022 GE Healthcare GE Healthcare unveiled a next-gen bioreactor system enabling intensified cell culture processes for increased bioproduction efficiency. 28-06-2022 Danaher Corporation Danaher Corporation launched an innovative data analytics platform optimizing bioprocess monitoring and control for higher yields. Global Bioprocess Technology Market Scope: Inquire before buying

Global Bioprocess Technology Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 28.80 Bn. Forecast Period 2025 to 2032 CAGR: 7.4% Market Size in 2032: USD 50.98 Bn. Segments Covered: By Product Type Bioreactors Filtration System Separation System Cell Culture System By Scale of Operation Laboratory Scale Pilot Scale Industrial Scale By Application Monoclonal Antibodies Vaccines Recombinant Proteins Gene Therapy By End-User Pharmaceuticals Biotechnology Companies Academic Research Institutions Contract Research Organizations Bioprocess Technology Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bioprocess Technology Market, Key Players:

Major Contributors in the Bioprocess Technology Industry in North America: 1. Amgen Thousand Oaks, California, USA 2. Abec Bethlehem, Pennsylvania, USA 3. Biomarin Pharmaceutical Inc. (BMRN) California, USA 4. United Therapeutics Corp. (UTHR) USA 5. Regeneron Pharmaceuticals USA 6. Kite Pharma USA 7. Gilead Sciences, Inc. USA 8. Genentech, California, USA Leading players in the Europe Bioprocess Technology Market: 1. Sanofi France 2. Roche Holding AG, Switzerland 3. Sartorius, Goettingen, Niedersachsen, Germany 4. FUJIFILM Diosynth Biotechnologies Billingham, United Kingdom 5. Selvita Krakow, Malopolska, Poland 6. Rentschler Biopharma SE, Laupheim, Baden-Württemberg, Germany 7. Bio Company Se, Berlin, Deutschland, Germany 8. Univercells, Bruxelles, Brussels, Belgium 9. acib GmbH, Graz, Styria, Austria Key players driving the Asia-Pacific Bioprocess Technology market: 1. BiOZEEN, Bangalore-Urb, Karnataka, India 2. Sartorius Korea Biotech 판교, Korea (the Republic of) 3. Scigenics (India) Pvt. Ltd. Chennai, Tamil Nadu, IndiaFAQs:

1] What segments are covered in the Global Bioprocess Technology Market report? Ans. The segments covered in the Bioprocess Technology Market report are based on Product, Technology, Application, End-User and Region. 2] Which region is expected to hold the highest share in the Global Market? Ans. North America region is expected to hold the highest share in the Bioprocess Technology market. 3] What is the market size of the Global Bioprocess Technology Market by 2032? Ans. The market size of the Bioprocess Technology Market by 2032 is expected to reach USD 50.98 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2025-2032. 5] What was the market size of the Global Bioprocess Technology Market in 2024? Ans. The market size of the Bioprocess Technology Market in 2024 was valued at USD 28.80 Bn.

1. Bioprocess Technology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Bioprocess Technology Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Bioprocess Technology Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Bioprocess Technology Market: Dynamics 3.1. Bioprocess Technology Market Trends by Region 3.1.1. North America Bioprocess Technology Market Trends 3.1.2. Europe Bioprocess Technology Market Trends 3.1.3. Asia Pacific Bioprocess Technology Market Trends 3.1.4. Middle East and Africa Bioprocess Technology Market Trends 3.1.5. South America Bioprocess Technology Market Trends 3.2. Bioprocess Technology Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Bioprocess Technology Market Drivers 3.2.1.2. North America Bioprocess Technology Market Restraints 3.2.1.3. North America Bioprocess Technology Market Opportunities 3.2.1.4. North America Bioprocess Technology Market Challenges 3.2.2. Europe 3.2.2.1. Europe Bioprocess Technology Market Drivers 3.2.2.2. Europe Bioprocess Technology Market Restraints 3.2.2.3. Europe Bioprocess Technology Market Opportunities 3.2.2.4. Europe Bioprocess Technology Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Bioprocess Technology Market Drivers 3.2.3.2. Asia Pacific Bioprocess Technology Market Restraints 3.2.3.3. Asia Pacific Bioprocess Technology Market Opportunities 3.2.3.4. Asia Pacific Bioprocess Technology Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Bioprocess Technology Market Drivers 3.2.4.2. Middle East and Africa Bioprocess Technology Market Restraints 3.2.4.3. Middle East and Africa Bioprocess Technology Market Opportunities 3.2.4.4. Middle East and Africa Bioprocess Technology Market Challenges 3.2.5. South America 3.2.5.1. South America Bioprocess Technology Market Drivers 3.2.5.2. South America Bioprocess Technology Market Restraints 3.2.5.3. South America Bioprocess Technology Market Opportunities 3.2.5.4. South America Bioprocess Technology Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Bioprocess Technology Industry 3.8. Analysis of Government Schemes and Initiatives For Bioprocess Technology Industry 3.9. Bioprocess Technology Market Trade Analysis 3.10. The Global Pandemic Impact on Bioprocess Technology Market 4. Bioprocess Technology Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Bioreactors 4.1.2. Filtration System 4.1.3. Separation System 4.1.4. Cell Culture System 4.2. Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 4.2.1. Laboratory Scale 4.2.2. Pilot Scale 4.2.3. Industrial Scale 4.3. Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 4.3.1. Monoclonal Antibodies 4.3.2. Vaccines 4.3.3. Recombinant Proteins 4.3.4. Gene Therapy 4.4. Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 4.4.1. Pharmaceuticals 4.4.2. Biotechnology Companies 4.4.3. Academic Research Institutions 4.4.4. Contract Research Organizations 4.5. Bioprocess Technology Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Bioprocess Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Bioreactors 5.1.2. Filtration System 5.1.3. Separation System 5.1.4. Cell Culture System 5.2. North America Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 5.2.1. Laboratory Scale 5.2.2. Pilot Scale 5.2.3. Industrial Scale 5.3. North America Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 5.3.1. Monoclonal Antibodies 5.3.2. Vaccines 5.3.3. Recombinant Proteins 5.3.4. Gene Therapy 5.4. North America Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 5.4.1. Pharmaceuticals 5.4.2. Biotechnology Companies 5.4.3. Academic Research Institutions 5.4.4. Contract Research Organizations 5.5. North America Bioprocess Technology Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 5.5.1.1.1. Bioreactors 5.5.1.1.2. Filtration System 5.5.1.1.3. Separation System 5.5.1.1.4. Cell Culture System 5.5.1.2. United States Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 5.5.1.2.1. Laboratory Scale 5.5.1.2.2. Pilot Scale 5.5.1.2.3. Industrial Scale 5.5.1.3. United States Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Monoclonal Antibodies 5.5.1.3.2. Vaccines 5.5.1.3.3. Recombinant Proteins 5.5.1.3.4. Gene Therapy 5.5.1.4. United States Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Pharmaceuticals 5.5.1.4.2. Biotechnology Companies 5.5.1.4.3. Academic Research Institutions 5.5.1.4.4. Contract Research Organizations 5.5.2. Canada 5.5.2.1. Canada Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 5.5.2.1.1. Bioreactors 5.5.2.1.2. Filtration System 5.5.2.1.3. Separation System 5.5.2.1.4. Cell Culture System 5.5.2.2. Canada Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 5.5.2.2.1. Laboratory Scale 5.5.2.2.2. Pilot Scale 5.5.2.2.3. Industrial Scale 5.5.2.3. Canada Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Monoclonal Antibodies 5.5.2.3.2. Vaccines 5.5.2.3.3. Recombinant Proteins 5.5.2.3.4. Gene Therapy 5.5.2.4. Canada Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Pharmaceuticals 5.5.2.4.2. Biotechnology Companies 5.5.2.4.3. Academic Research Institutions 5.5.2.4.4. Contract Research Organizations 5.5.3. Mexico 5.5.3.1. Mexico Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 5.5.3.1.1. Bioreactors 5.5.3.1.2. Filtration System 5.5.3.1.3. Separation System 5.5.3.1.4. Cell Culture System 5.5.3.2. Mexico Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 5.5.3.2.1. Laboratory Scale 5.5.3.2.2. Pilot Scale 5.5.3.2.3. Industrial Scale 5.5.3.3. Mexico Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Monoclonal Antibodies 5.5.3.3.2. Vaccines 5.5.3.3.3. Recombinant Proteins 5.5.3.3.4. Gene Therapy 5.5.3.4. Mexico Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Pharmaceuticals 5.5.3.4.2. Biotechnology Companies 5.5.3.4.3. Academic Research Institutions 5.5.3.4.4. Contract Research Organizations 6. Europe Bioprocess Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.2. Europe Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.3. Europe Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.4. Europe Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5. Europe Bioprocess Technology Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.5.1.2. United Kingdom Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.5.1.3. United Kingdom Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.5.2.2. France Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.5.2.3. France Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.5.3.2. Germany Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.5.3.3. Germany Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.5.4.2. Italy Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.5.4.3. Italy Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.5.5.2. Spain Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.5.5.3. Spain Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.5.6.2. Sweden Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.5.6.3. Sweden Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.5.7.2. Austria Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.5.7.3. Austria Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 6.5.8.2. Rest of Europe Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 6.5.8.3. Rest of Europe Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Bioprocess Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.2. Asia Pacific Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.3. Asia Pacific Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Bioprocess Technology Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.1.2. China Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.1.3. China Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.2.2. S Korea Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.2.3. S Korea Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.3.2. Japan Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.3.3. Japan Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.4.2. India Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.4.3. India Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.5.2. Australia Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.5.3. Australia Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.6.2. Indonesia Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.6.3. Indonesia Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.7.2. Malaysia Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.7.3. Malaysia Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.8.2. Vietnam Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.8.3. Vietnam Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.9.2. Taiwan Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.9.3. Taiwan Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 7.5.10.3. Rest of Asia Pacific Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Bioprocess Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 8.2. Middle East and Africa Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 8.3. Middle East and Africa Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Bioprocess Technology Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 8.5.1.2. South Africa Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 8.5.1.3. South Africa Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 8.5.2.2. GCC Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 8.5.2.3. GCC Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 8.5.3.2. Nigeria Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 8.5.3.3. Nigeria Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 8.5.4.2. Rest of ME&A Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 8.5.4.3. Rest of ME&A Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 9. South America Bioprocess Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 9.2. South America Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 9.3. South America Bioprocess Technology Market Size and Forecast, by Application(2024-2032) 9.4. South America Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 9.5. South America Bioprocess Technology Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 9.5.1.2. Brazil Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 9.5.1.3. Brazil Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 9.5.2.2. Argentina Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 9.5.2.3. Argentina Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Bioprocess Technology Market Size and Forecast, by Product Type (2024-2032) 9.5.3.2. Rest Of South America Bioprocess Technology Market Size and Forecast, by Scale of Operation (2024-2032) 9.5.3.3. Rest Of South America Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Bioprocess Technology Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Amgen Thousand Oaks, California, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Abec Bethlehem, Pennsylvania, USA 10.3. Biomarin Pharmaceutical Inc. (BMRN) California, USA 10.4. United Therapeutics Corp. (UTHR) USA 10.5. Regeneron Pharmaceuticals USA 10.6. Kite Pharma USA 10.7. Gilead Sciences, Inc. USA 10.8. Genentech, California, USA 10.9. Sanofi France 10.10. Roche Holding AG, Switzerland 10.11. Sartorius, Goettingen, Niedersachsen, Germany 10.12. FUJIFILM Diosynth Biotechnologies Billingham, United Kingdom 10.13. Selvita Krakow, Malopolska, Poland 10.14. Rentschler Biopharma SE, Laupheim, Baden-Württemberg, Germany 10.15. Bio Company Se, Berlin, Deutschland, Germany 10.16. Univercells, Bruxelles, Brussels, Belgium 10.17. acib GmbH, Graz, Styria, Austria 10.18. BiOZEEN, Bangalore-Urb, Karnataka, India 10.19. Sartorius Korea Biotech 판교, Korea (the Republic of) 10.20. Scigenics (India) Pvt. Ltd. Chennai, Tamil Nadu, India 11. Key Findings 12. Industry Recommendations 13. Bioprocess Technology Market: Research Methodology 14. Terms and Glossary