The Bioherbicides Market size was valued at USD 2.36 Billion in 2024 and the total Bioherbicides Market revenue is expected to grow at a CAGR of 14.6 % from 2025 to 2025, reaching nearly USD 7.02 Billion by 2032. Bioherbicides are environmentally friendly alternatives to chemical herbicides, utilizing naturally occurring organisms or their derivatives to control weed growth in agricultural and non-agricultural settings. The increasing awareness about environmental sustainability and the adverse effects of synthetic chemicals on ecosystems and human health driving the growth of Bioherbicides Market. Factors such as the growing demand for organic food products, stringent regulations on chemical pesticide usage, and the rising adoption of integrated pest management practices are driving the growth of the bioherbicides market. Bioherbicides Market Key players like Marrone Bio Innovations, Valent BioSciences Corporation, and Bayer CropScience, are actively investing in research and development to enhance the efficacy and spectrum of bioherbicides.To know about the Research Methodology :- Request Free Sample Report Recent developments in the Bioherbicides market include the introduction of novel formulations with improved weed control capabilities and the integration of biotechnological advancements such as gene editing and microbial consortia to enhance product performance. Strategic collaborations and partnerships between bioherbicide manufacturers and agricultural biotechnology firms are driving Bioherbicides market growth by facilitating the development of innovative solutions tailored to specific crop and weed species. With increasing emphasis on sustainable agriculture practices and the growing demand for organic and non-GMO crops globally, the bioherbicides market is expected rapid growth during the forecast period.

Bioherbicides Market Dynamics:

Increasing consumer awareness about health and the environment boosting the Bioherbicides Market Rising consumer awareness about health and environmental concerns, there's a growing demand for organic products, including bioherbicides driving the growth of Bioherbicides Market. For instance, in the US, the Organic Trade Association reported a 12% increase in organic food sales in 2020. This trend is driving farmers to seek alternatives to chemical herbicides, thus boosting the market for bioherbicides. The emergence of herbicide-resistant weeds is a significant concern for farmers worldwide. As chemical herbicides become less effective, farmers are turning to bioherbicides for sustainable weed management solutions. In the US, the spread of glyphosate-resistant weeds like Palmer amaranth has prompted farmers to explore bioherbicide options such as biocontrol agents and allelopathic crops. Developing countries are witnessing rapid expansion in agriculture to meet the growing food demand of their populations. With a focus on sustainable farming practices, farmers in these regions are increasingly adopting bioherbicides. For instance, in India, the government's initiatives to promote organic farming and reduce chemical inputs are driving the adoption of bioherbicides among farmers. Comparative Analysis of Organic Cultivation Across CountriesTechnological advancements in biotechnology have led to the development of more effective and targeted bioherbicide products. For example, researchers have genetically engineered crops to produce allelopathic compounds that suppress weed growth, offering a sustainable alternative to chemical herbicides. Companies such as Marrone Bio Innovations and Bayer are investing in biotechnology to develop innovative bioherbicide solutions. Collaboration among stakeholders in the bioherbicide industry, including manufacturers, farmers, researchers, and government agencies, is driving innovation and market growth. Partnerships enable knowledge sharing, technology transfer, and the development of tailored solutions to address specific weed management challenges. For example, partnerships between biotech companies and agricultural universities have led to the commercialization of bioherbicide products with improved efficacy and environmental safety profiles. Longer Application Time and Treatment Duration hindering Market Growth Bioherbicides exhibit limited efficacy and consistency compared to chemical herbicides, with variable performance influenced by environmental factors which hindering the growth of Bioherbicides Market. Bioherbicides typically require longer application times and treatment durations, posing logistical challenges for farmers during busy agricultural seasons. Additionally, their narrow spectrum of weed control and higher development and production costs compared to chemical alternatives further limit their appeal to farmers. Regulatory hurdles, including lengthy registration processes and stringent safety and efficacy requirements, delay market entry and increase the time and cost burden for manufacturers. Lack of awareness and education among farmers, storage and shelf-life challenges, as well as resistance development in target weeds, further impede market growth. Limited availability and distribution channels, especially in regions with underdeveloped agricultural input markets, coupled with stiff competition from conventional herbicides, exacerbate the challenges facing the bioherbicides market. Despite the growing interest in sustainable agriculture and organic farming practices, bioherbicides continue to face stiff competition from conventional chemical herbicides, which offer greater efficacy, convenience, and cost-effectiveness for weed control. The preference for chemical herbicides among farmers, particularly in developing countries, underscores the need for enhanced education and awareness about the benefits of bioherbicides. Moreover, the resistance development in target weed species treated with bioherbicides, alongside limited availability and distribution channels, poses significant barriers to market growth. Addressing these challenges will require collaborative efforts from stakeholders across the agricultural value chain to improve product efficacy, streamline regulatory processes, and enhance access to bioherbicides for farmers worldwide.

Sr. No. State Position Area under organic certification (in Million hector.) 1. China 3rd 3.14 2. USA 7th 2.02 3. India 9th 1.94 4. Brazil 12th 1.18 Bioherbicides Market Segment Analysis:

Based On Mode of Application, Seed treatment dominated the Bioherbicides market in 2024 and is expected to maintain its dominance over the forecast period, as Seed treatment gaining popularity due to their ease of application and early weed control, particularly in crops with extended germination periods. Soil application bioherbicides offer effective weed suppression throughout the crop's growth cycle, favored for their broad-spectrum control and long-lasting effects. Foliar application bioherbicides are widely used for targeted weed management in established crops, providing quick and localized control while minimizing off-target effects. Post-harvest bioherbicides are utilized to prevent weed seed germination and establish clean fields for subsequent planting seasons, contributing to weed management strategies in crop rotation systems. Other modes of application, including pre-emergence and pre-planting treatments, fulfil to specific cropping systems and weed control needs, demonstrating versatility in bioherbicide application methods to address diverse agricultural challenges.Bioherbicides Market Regional Analysis:

Asia-Pacific dominated the Bioherbicides Market in 2024, as the consumption of Bioherbicides, showcasing a distinct shift towards sustainable agricultural practices. In the Asia-Pacific region, driven by agricultural giants like China and India, organic farming witnesses’ remarkable growth driven by increasing demand for healthier food choices and heightened awareness about the adverse impacts of conventional pesticides. This trend is underscored by a significant increase in organic crop cultivation from 3.1 million hectares in 2017 to 3.6 million hectares in 2021, marking a 15.5% growth. North America emerges as a significant consumer of bioherbicides, with rapid growth in demand for organic food products. With an average per capita spending on organic food products reaching USD 109.7 in 2021, the region demonstrates a swift adoption of biological technologies among farmers, propelled by the overarching trend towards sustainable agriculture. Governmental initiatives such as the European Commission's plan to elevate organic agricultural land to 25.0% by 2032, and regulatory measures like the prohibition of chemical pesticides in South American countries like Peru and Argentina, further boosting the utilization of bioherbicides, promising a bright future for the bioherbicides market across diverse regions.

Bioherbicides Industry Ecosystem

Bioherbicides Market Scope : Inquire before buying

Global Bioherbicides Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: US $ 2.36 Bn. Forecast Period 2025 to 2032 CAGR: 14.6% Market Size in 2032: US $ 7.02 Bn. Segments Covered: by Source Microbial Biochemical Others by Formulation Granular Liquid Others by Mode of Application Seed treatment Soil application Foliar Post-harvest Others by Application Agricultural crops Fruits & vegetables Non-agricultural crops Turf & ornamentals Plantation crops Others Bioherbicides Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bioherbicides Market Key Players:

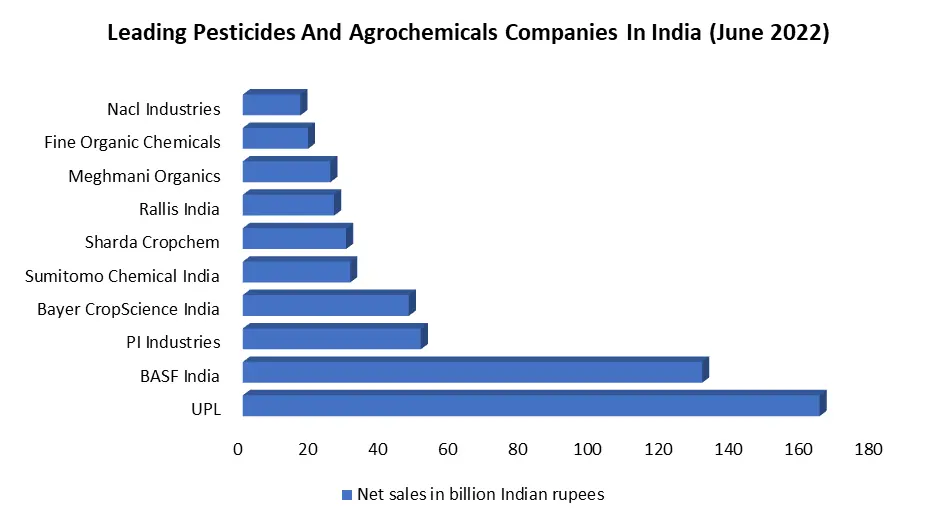

Major Contributors in the Bioherbicides Manufacturing: 1. Marrone Bio Innovations Inc. (MBI), Davis, California, USA 2. Valent BioSciences Corporation, Libertyville, Illinois, USA 3. Certis USA LLC, Columbia, Maryland, USA 4. BioWorks Inc., Victor, New York, USA 5. MycoLogic Inc., Corvallis, Oregon, USA 6. Engage Agro USA, Greenville, South Carolina, USA 7. WeedGuardPlus, Petaluma, California, USA 8. Phyllom BioProducts Corporation, Houston, Texas, USA 9. Vestaron Corporation, Kalamazoo, Michigan, USA 10. Bayer CropScience, Monheim am Rhein, Germany 11. Syngenta, Basel, Switzerland 12. Isagro S.p.A, Milan, Italy 13. Andermatt Biocontrol AG, Grossdietwil, Switzerland 14. AgBioResearch Srl, Italy 15. Hindustan Bio-Tech, Bangalore, India 16. Camson Bio Technologies Limited, Bangalore, India 17. Bharat Group, India 18. UPL, India 19. BASF India, India 20. Sumitomo Chemical India FAQs: 1] Which region is expected to hold the highest share in the Global Bioherbicides Market? Ans. Asia Pacific region is expected to hold the highest share in the Bioherbicides Market. 2] What is the market size of the Global Bioherbicides Market by 2032? Ans. The market size of the Bioherbicides Market by 2032 is expected to reach US$ 7.02 Billion. 3] What is the forecast period for the Global Bioherbicides Market? Ans. The forecast period for the Bioherbicides Market is 2025-2032. 4] What was the Global Bioherbicides Market size in 2024? Ans. The Global Bioherbicides Market size was USD 2.36 Billion in 2024.

1. Bioherbicides Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Bioherbicides Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Source Segment 2.5.3. Vehicle Source Segment 2.5.4. Revenue (2024) 2.5.5. Key Development 2.5.6. Company Location 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. Bioherbicides Market: Dynamics 3.1. Bioherbicides Market Trends 3.2. Bioherbicides Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. Trends and disruptions impacting customer business 3.4. Supply Chain Analysis 3.5. Value Chain Analysis 3.6. Ecosystem Analysis 3.6.1. Manufacturers 3.6.2. Formulators 3.6.3. Distributors 3.6.4. End Users 3.7. Trade Analysis 3.7.1. Import data 3.7.2. Export data 3.8. Supply chain analysis 3.9. Pricing Analysis 3.9.1. Average selling price of Bioherbicides products, by region 3.10. Key stakeholders and buying criteria 3.10.1. Key stakeholders in buying process 3.10.2. Buying criteria for end users 3.11. PORTER’s Five Forces Analysis 3.11.1. Intensity of the Rivalry 3.11.2. Threat of New Entrants 3.11.3. Bargaining Power of Suppliers 3.11.4. Bargaining Power of Buyers 3.11.5. Threat of Substitutes 3.12. Regulatory Landscape by Region 3.12.1. North America 3.12.2. Europe 3.12.3. Asia Pacific 3.12.4. South America 3.12.5. MEA 4. Bioherbicides Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 4.1. Bioherbicides Market Size and Forecast, by Source (2024-2032) 4.1.1. Microbial 4.1.2. Biochemical 4.1.3. Others 4.2. Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 4.2.1. Granular 4.2.2. Liquid 4.2.3. Others 4.3. Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 4.3.1. Seed treatment 4.3.2. Soil application 4.3.3. Foliar 4.3.4. Post-harvest 4.3.5. Others 4.4. Bioherbicides Market Size and Forecast, by Application (2024-2032) 4.4.1. Agricultural crops 4.4.2. Fruits & vegetables 4.4.3. Non-agricultural crops 4.4.4. Turf & ornamentals 4.4.5. Plantation crops 4.4.6. Others 5. North America Bioherbicides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Bioherbicides Market Size and Forecast, by Source (2024-2032) 5.1.1. Microbial 5.1.2. Biochemical 5.1.3. Others 5.2. North America Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 5.2.1. Granular 5.2.2. Liquid 5.2.3. Others 5.3. North America Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 5.3.1. Seed treatment 5.3.2. Soil application 5.3.3. Foliar 5.3.4. Post-harvest 5.3.5. Others 5.4. North America Bioherbicides Market Size and Forecast, by Application (2024-2032) 5.4.1. Agricultural crops 5.4.2. Fruits & vegetables 5.4.3. Non-agricultural crops 5.4.4. Turf & ornamentals 5.4.5. Plantation crops 5.4.6. Others 5.5. North America Bioherbicides Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Bioherbicides Market Size and Forecast, by Source (2024-2032) 5.5.1.1.1. Microbial 5.5.1.1.2. Biochemical 5.5.1.1.3. Others 5.5.1.2. United States Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 5.5.1.2.1. Granular 5.5.1.2.2. Liquid 5.5.1.2.3. Others 5.5.1.3. United States Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 5.5.1.3.1. Seed treatment 5.5.1.3.2. Soil application 5.5.1.3.3. Foliar 5.5.1.3.4. Post-harvest 5.5.1.3.5. Others 5.5.1.4. United States Bioherbicides Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Agricultural crops 5.5.1.4.2. Fruits & vegetables 5.5.1.4.3. Non-agricultural crops 5.5.1.4.4. Turf & ornamentals 5.5.1.4.5. Plantation crops 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Bioherbicides Market Size and Forecast, by Source (2024-2032) 5.5.2.1.1. Microbial 5.5.2.1.2. Biochemical 5.5.2.1.3. Others 5.5.2.2. Canada Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 5.5.2.2.1. Granular 5.5.2.2.2. Liquid 5.5.2.2.3. Others 5.5.2.3. Canada Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 5.5.2.3.1. Seed treatment 5.5.2.3.2. Soil application 5.5.2.3.3. Foliar 5.5.2.3.4. Post-harvest 5.5.2.3.5. Others 5.5.2.4. Canada Bioherbicides Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Agricultural crops 5.5.2.4.2. Fruits & vegetables 5.5.2.4.3. Non-agricultural crops 5.5.2.4.4. Turf & ornamentals 5.5.2.4.5. Plantation crops 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Bioherbicides Market Size and Forecast, by Source (2024-2032) 5.5.3.1.1. Microbial 5.5.3.1.2. Biochemical 5.5.3.1.3. Others 5.5.3.2. Mexico Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 5.5.3.2.1. Granular 5.5.3.2.2. Liquid 5.5.3.2.3. Others 5.5.3.3. Mexico Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 5.5.3.3.1. Seed treatment 5.5.3.3.2. Soil application 5.5.3.3.3. Foliar 5.5.3.3.4. Post-harvest 5.5.3.3.5. Others 5.5.3.4. Mexico Bioherbicides Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Agricultural crops 5.5.3.4.2. Fruits & vegetables 5.5.3.4.3. Non-agricultural crops 5.5.3.4.4. Turf & ornamentals 5.5.3.4.5. Plantation crops 5.5.3.4.6. Others 6. Europe Bioherbicides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.2. Europe Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.3. Europe Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.4. Europe Bioherbicides Market Size and Forecast, by Application (2024-2032) 6.5. Europe Bioherbicides Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.5.1.2. United Kingdom Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.5.1.3. United Kingdom Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.5.1.4. United Kingdom Bioherbicides Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.5.2.2. France Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.5.2.3. France Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.5.2.4. France Bioherbicides Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.5.3.2. Germany Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.5.3.3. Germany Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.5.3.4. Germany Bioherbicides Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.5.4.2. Italy Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.5.4.3. Italy Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.5.4.4. Italy Bioherbicides Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.5.5.2. Spain Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.5.5.3. Spain Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.5.5.4. Spain Bioherbicides Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.5.6.2. Sweden Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.5.6.3. Sweden Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.5.6.4. Sweden Bioherbicides Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.5.7.2. Austria Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.5.7.3. Austria Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.5.7.4. Austria Bioherbicides Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Bioherbicides Market Size and Forecast, by Source (2024-2032) 6.5.8.2. Rest of Europe Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 6.5.8.3. Rest of Europe Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 6.5.8.4. Rest of Europe Bioherbicides Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Bioherbicides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Bioherbicides Market Size and Forecast, by Source (2024-2032) 7.2. Asia Pacific Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 7.3. Asia Pacific Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 7.4. Asia Pacific Bioherbicides Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Bioherbicides Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Bioherbicides Market Size and Forecast, by Source (2024-2032) 7.5.1.2. China Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 7.5.1.3. China Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 7.5.1.4. China Bioherbicides Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Bioherbicides Market Size and Forecast, by Source (2024-2032) 7.5.2.2. S Korea Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 7.5.2.3. S Korea Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 7.5.2.4. S Korea Bioherbicides Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Bioherbicides Market Size and Forecast, by Source (2024-2032) 7.5.3.2. Japan Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 7.5.3.3. Japan Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 7.5.3.4. Japan Bioherbicides Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Bioherbicides Market Size and Forecast, by Source (2024-2032) 7.5.4.2. India Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 7.5.4.3. India Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 7.5.4.4. India Bioherbicides Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Bioherbicides Market Size and Forecast, by Source (2024-2032) 7.5.5.2. Australia Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 7.5.5.3. Australia Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 7.5.5.4. Australia Bioherbicides Market Size and Forecast, by Application (2024-2032) 7.5.6. ASIAN 7.5.6.1. ASIAN Bioherbicides Market Size and Forecast, by Source (2024-2032) 7.5.6.2. ASIAN Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 7.5.6.3. ASIAN Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 7.5.6.4. ASIAN Bioherbicides Market Size and Forecast, by Application (2024-2032) 7.5.7. Rest of Asia Pacific 7.5.7.1. Rest of Asia Pacific Bioherbicides Market Size and Forecast, by Source (2024-2032) 7.5.7.2. Rest of Asia Pacific Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 7.5.7.3. Rest of Asia Pacific Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 7.5.7.4. Rest of Asia Pacific Bioherbicides Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Bioherbicides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Middle East and Africa Bioherbicides Market Size and Forecast, by Source (2024-2032) 8.2. Middle East and Africa Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 8.3. Middle East and Africa Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 8.4. Middle East and Africa Bioherbicides Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Bioherbicides Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Bioherbicides Market Size and Forecast, by Source (2024-2032) 8.5.1.2. South Africa Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 8.5.1.3. South Africa Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 8.5.1.4. South Africa Bioherbicides Market Size and Forecast, by Application (2024-2032) 8.5.2. S GCC 8.5.2.1. GCC Bioherbicides Market Size and Forecast, by Source (2024-2032) 8.5.2.2. GCC Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 8.5.2.3. GCC Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 8.5.2.4. GCC Bioherbicides Market Size and Forecast, by Application (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Bioherbicides Market Size and Forecast, by Source (2024-2032) 8.5.3.2. Egypt Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 8.5.3.3. Egypt Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 8.5.3.4. Egypt Bioherbicides Market Size and Forecast, by Application (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Bioherbicides Market Size and Forecast, by Source (2024-2032) 8.5.4.2. Nigeria Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 8.5.4.3. Nigeria Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 8.5.4.4. Nigeria Bioherbicides Market Size and Forecast, by Application (2024-2032) 8.5.5. Rest of ME &A 8.5.5.1. Rest of ME &A Bioherbicides Market Size and Forecast, by Source (2024-2032) 8.5.5.2. Rest of ME &A Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 8.5.5.3. Rest of ME &A Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 8.5.5.4. Rest of ME &A Bioherbicides Market Size and Forecast, by Application (2024-2032) 9. South America Bioherbicides Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. South America Bioherbicides Market Size and Forecast, by Source (2024-2032) 9.2. South America Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 9.3. South America Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 9.4. South America Bioherbicides Market Size and Forecast, by Application (2024-2032) 9.5. South America Bioherbicides Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Bioherbicides Market Size and Forecast, by Source (2024-2032) 9.5.1.2. Brazil Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 9.5.1.3. Brazil Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 9.5.1.4. Brazil Bioherbicides Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Bioherbicides Market Size and Forecast, by Source (2024-2032) 9.5.2.2. Argentina Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 9.5.2.3. Argentina Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 9.5.2.4. Argentina Bioherbicides Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest of South America Bioherbicides Market Size and Forecast, by Source (2024-2032) 9.5.3.2. Rest of South America Bioherbicides Market Size and Forecast, by Formulation (2024-2032) 9.5.3.3. Rest of South America Bioherbicides Market Size and Forecast, by Mode of Application (2024-2032) 9.5.3.4. Rest of South America Bioherbicides Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Marrone Bio Innovations Inc. (MBI), Davis, California, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.3.1. Total Revenue 10.1.3.2. Segment Revenue 10.1.3.3. Annual Revenue 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Valent BioSciences Corporation, Libertyville, Illinois, USA 10.3. Certis USA LLC, Columbia, Maryland, USA 10.4. BioWorks Inc., Victor, New York, USA 10.5. MycoLogic Inc., Corvallis, Oregon, USA 10.6. Engage Agro USA, Greenville, South Carolina, USA 10.7. WeedGuardPlus, Petaluma, California, USA 10.8. Phyllom BioProducts Corporation, Houston, Texas, USA 10.9. Vestaron Corporation, Kalamazoo, Michigan, USA 10.10. Bayer CropScience, Monheim am Rhein, Germany 10.11. Syngenta, Basel, Switzerland 10.12. Isagro S.p.A, Milan, Italy 10.13. Andermatt Biocontrol AG, Grossdietwil, Switzerland 10.14. AgBioResearch Srl, Italy 10.15. Hindustan Bio-Tech, Bangalore, India 10.16. Camson Bio Technologies Limited, Bangalore, India 10.17. Bharat Group, India 10.18. UPL, India 10.19. BASF India, India 10.20. Sumitomo Chemical India 10.21. Grimmway Farms 10.22. Mondelez International 10.23. Syngenta AG 10.24. Fresh Del Monte Produce 10.25. Westland Horticulture 11. Key Findings and Analyst Recommendations 12. Bioherbicides Market: Research Methodology 12.1. Research Data 12.1.1. Secondary Data 12.1.2. Primary data 12.1.3. Market size estimation 12.1.3.1. Bottom-up approach 12.1.3.2. Top-down approach