Global Legumes Market size was valued at USD 11.8 Bn in 2022 and is expected to reach USD 17.17 Bn by 2029, at a CAGR of 5.5%.Legumes Market Overview

Legumes, encompassing various species within the Fabaceae family, offer a diverse range of nutritionally rich seeds in dehiscent and indehiscent fruits. These legume variants vary in shape and size, from elongated pods to massive 2-meter-long fruits like those found in the monkey ladder plant. In the Legumes Market, these diverse offerings contribute to an extensive range of protein-rich seeds and essential amino acids, catering to various consumer needs and preferences. Amongst these, peanuts and carobs stand distinct, choosing not to naturally open upon maturation, yet holding a treasure trove of nourishment within. Legumes, including the likes of snow peas, edamame, and green beans, present a spectrum of culinary possibilities, often harvested while still succulent to grace our tables with their vibrant flavors.To know about the Research Methodology :- Request Free Sample Report In their culinary charm, legumes serve as a beacon of sustenance, offering not only food for both humans and animals but also yielding oils, fibers, and raw materials vital for various industries. Their unparalleled nutritional richness high protein content and housing of essential amino acids make them a beacon in plant-based diets, presenting a versatile, affordable, and widely available alternative to meat. Beyond their dietary significance, legumes, through their unique ability to fix nitrogen in association with friendly soil bacteria, confer environmental benefits. This symbiotic relationship Categories nodules within their roots, acting as miniature nitrogen factories, enriching the soil and reducing the reliance on commercial nitrogen applications, thereby mitigating the ecological footprint in agriculture. As crops such as lentils, chickpeas, and peas intertwine with grain rotations, they offer a suite of advantages disease control, pest management, and enhanced nutrient values benefiting not only themselves but also the companion crops, exemplifying the interwoven harmony within ecosystems. The life cycle of legumes, from precise harvesting methods ensuring ideal moisture content for storage to post-harvest care, reflects a story of preservation and precision. Harvest timing, crucial in the Legumes Market, is an art, balancing the risk of premature harvesting with underdeveloped crops against potential losses due to excessive dryness from delayed harvesting. This meticulous process highlights the importance of preserving quality in the legume supply chain. The storage facilities, a sanctuary for these precious yields, demand careful maintenance of moisture levels and temperatures to thwart spoilage and maintain quality. Be it the vigilant monitoring of moisture content in pulses like peas, chickpeas, and lentils or the strategic use of aeration to cool and dry the seeds, the narrative of preservation extends far beyond the harvest, portraying a saga of safeguarding End User's bounty for sustained nourishment and longevity.

Legumes Market Trend

Growing Embrace of Regenerative Farming and Sustainable Practices Elevates Legumes' Role in Reducing Carbon Footprint in Agriculture The rising adoption of regenerative farming and sustainable practices marks a significant trend in the Legumes market. This movement stems from a collective awareness of the environmental impact of conventional agriculture and a pursuit of more eco-friendly farming methods. Legumes play a pivotal role in this shift due to their inherent capacity for nitrogen fixation. Through a symbiotic relationship with specific bacteria in their roots, legumes convert atmospheric nitrogen into a usable Category, enriching the soil with this essential nutrient. This natural process not only enhances soil fertility but also diminishes the dependence on synthetic nitrogen-based fertilizers, pivotal in reducing greenhouse gas emissions during production. Legumes serve as a sustainable crop option within crop rotation systems, a vital aspect in the Legumes Market promoting soil health and ecological sustainability. Legumes' nitrogen-fixing capacity enhances soil health, curbing reliance on chemicals and lowering farming's environmental impact. When integrated into crop rotations, they bolster soil structure, prevent erosion, and sustain soil moisture, fostering lasting agricultural sustainability. Legumes, with their deep root systems, aid in carbon sequestration by trapping and storing atmospheric carbon in the soil. This process helps in offsetting carbon emissions, contributing to efforts aimed at mitigating climate change. The current trend in the Legumes Market involves a growing emphasis on sustainable and regenerative agriculture. Legumes stand out as a key component in this movement due to their ability to enhance soil health, reduce reliance on synthetic inputs, aid in carbon sequestration, and play a crucial role in reducing the carbon footprint associated with agriculture.Legumes Market Dynamics

Driver Increasing Demand for Plant-Based Protein to boost Legumes Market growth The burgeoning global appetite for plant-based proteins stands as a paramount catalyst propelling the growth trajectory of the Legumes Market. This shift in dietary preferences mirrors a collective consciousness toward health, sustainability, and environmental stewardship. Traditional reliance on animal proteins for essential amino acids is evolving. Diverse plant-based sources, notably legumes like lentils, chickpeas, beans, and peas, rival this belief. These powerhouses offer a nutrient-packed profile, abundant in protein, fiber, vitamins, minerals, and phytonutrients, reshaping nutritional norms. Their potential in fostering weight loss, particularly among individuals grappling with conditions like type 2 diabetes or cardiovascular disease, showcases the efficacy of plant-centric diets in promoting healthier lifestyles. The merits of embracing plant proteins extend beyond personal health to environmental conservation. The adverse health implications linked with red meat consumption, specifically its contribution to heart disease and type 2 diabetes due to saturated fat content. Conversely, plant-based diets showcase an impressive ability to positively impact cholesterol levels. This is evidenced by indicating that plant-based diets, among diets with red or white meat, exhibit the most beneficial effects on LDL or bad cholesterol. Embracing legumes and plant-based diets over red meat has been associated with improved blood pressure, a crucial aspect in reducing the risk of heart disease, a focus highlighted by the Centers for Disease Control and Prevention (CDC). This dietary shift holds significance within the Legumes Market, emphasizing health benefits and altering consumption patterns. In tandem with health and sustainability benefits, legumes and plant-based proteins signify a paradigm shift in the nutritional landscape, steering away from traditional beliefs centered on animal protein as the dietary centerpiece. Aligning with recommended daily protein allowances, these plant-based sources offer an array of culinary possibilities, enriching meals with high-quality proteins, whether through lentils as the star of a veggie burger or chickpeas elevating the allure of hummus. The integration of legumes into daily meals signifies a holistic nutrition approach, featuring plant proteins in diverse snacks and meals. In the Legumes Market, this shift emphasizes balanced nutrition, promoting nutrient-rich vegetables, fruits, and whole grains alongside protein intake. It challenges the notion that meal satisfaction relies solely on substantial meat portions, focusing on diverse and nutrient-dense food choices. As perceptions evolve, the culinary landscape diversifies, offering abundant opportunities to seamlessly incorporate high-quality plant proteins into everyday diets, reshaping not just individual health but also the broader narrative of sustainable living and conscious consumption. The increasing demand for plant-based proteins serves as a pivotal growth driver for the legumes market, sparking a paradigm shift in dietary choices that converge health, sustainability, and culinary innovation. This trajectory not only promotes individual well-being but also addresses environmental concerns, ushering in an era where legumes and plant proteins emerge as the cornerstone of a more nourished, balanced, and eco-conscious world. Legumes, rich in protein, starch, and fiber, witness escalating demand as key ingredients. This surge stems from the preference for plant-based protein sources, driving the legume market. Flour mixes, meat alternatives, gluten-free products, and nutraceuticals, among others, benefit from legume inclusion, catering to diverse segments including baked goods, snack items, packaging for drug delivery and others.Opportunity Technological advancements and innovations in processing and value addition Technological advancements and innovations in processing and value addition stand as the cornerstone of the burgeoning opportunity within the legumes market. These advancements are revolutionizing the landscape by addressing critical limitations faced in regions like Zambia, where crop productivity suffers due to diseases, insects, soil quality, and drought. Pioneered by initiatives like the Michigan State University-led project, novel tools and platCategorys are redefining legume enhancement. The project's focus on enhancing photosynthesis efficiency not only aims to propel productivity but also offers a lifeline amid shifting climatic challenges. This endeavor leverages cutting-edge technologies from the Center for Advanced Algal and Plant Phenotyping (CAAPP), unraveling unprecedented insights into plant health and resilience. The Photosynth nature, a game-changer in plant phenotyping, provides affordable yet advanced instruments for real-time measurements related to photosynthesis, aiding researchers and farmers worldwide. Simultaneously, the Dynamic Environmental Phenotyping Imager (DEPI) replicates field conditions in specialized chambers, unveiling intricate plant responses to diverse weather scenarios. These technological strides enable rapid field trials, accelerating the identification of resilient gene platCategorys in beans and cowpeas under environmental stresses. The collaborative effort spans across continents, with teams in Zambia and Michigan utilizing these platforms to decode the genetic makeup facilitating improved plant platforms. With such groundbreaking technology, the Legumes Market not only foresees amplified yields but also anticipates a paradigm shift toward sustainable and resilient agricultural practices, paving the way for enhanced food security and economic empowerment in regions facing agricultural challenges. Restrain Challenges in Pest Management and Disease Control Impact on Legumes Market Viability Pest infestation and diseases directly affect the quantity and quality of legume yields. In severe cases, they lead to crop failures or substantial reductions in harvests. This poses a financial burden on farmers and impacts market supply, potentially leading to price fluctuations. To combat these issues, farmers adopt intensive pest and disease management strategies. These measures often involve the use of pesticides, fungicides, or other chemical interventions. These methods are costly, and excessive reliance on chemical control leads to environmental concerns and resistance among pests. Developing disease-resistant varieties demands significant investment in research and development. This includes breeding programs aimed at creating legume strains that are more resilient to prevalent diseases and pests. These programs are time-consuming and costly, affecting the accessibility of improved varieties for small-scale farmers. Over reliance on chemical interventions for pest and disease control poses concerns about the long-term sustainability of agricultural practices. The excessive use of chemicals not only impacts soil health, water quality, and biodiversity but also disrupts the ecological balance within agricultural landscapes. In the Legumes Market, this reliance underscores the need for sustainable pest management practices to maintain the health of agricultural ecosystems.

Legumes Market Segment Analysis

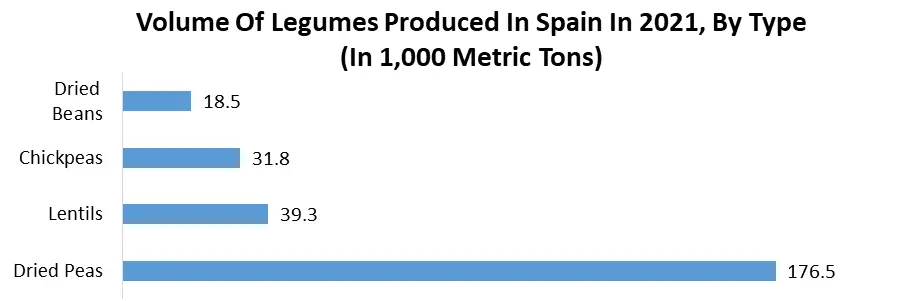

Based on Type, Beans dominate the Legumes Market in 2022 and are expected to continue their dominance over the forecast period. Beans are nutritional powerhouses, packed with protein, fiber, vitamins, and minerals. They offer an excellent plant-based protein source, appealing to health-conscious consumers seeking meat alternatives or balanced diets. Beans are incredibly versatile in the kitchen. They are cooked in diverse ways - soups, stews, salads, dips, and as standalone dishes. This adaptability in various recipes makes them an essential ingredient in many cuisines globally, enhancing their market demand. Beans have a strong presence in diets worldwide. They're a staple in numerous cuisines, from Latin American dishes like black beans to Middle Eastern hummus made from chickpeas. This broad usage contributes to their widespread consumption. Beans are grown and distributed widely, making them easily accessible in most regions. Their availability in different varieties of kidney beans, black beans, navy beans, etc. ensures a diverse market offering. Many cultures have integrated beans into their traditional diets for centuries. This historical significance has solidified beans' place in culinary practices, ensuring their continued demand which boosts the Legumes Market growth. Beans often serve as a cost-effective protein source compared to meat or other protein alternatives, making them popular in regions where affordability is a concern. Beans stand out for their high protein content, containing all nine essential amino acids crucial for the body's repair and maintenance. While many legumes lack complete proteins, beans, particularly soybeans, possess this essential feature. Beyond protein, beans offer an array of health advantages. They're a treasure trove of folate, vital for healthy red blood cells and fetal neural tube development during pregnancy. Rich in antioxidants like polyphenols, beans combat free radicals, potentially reducing disease risks. Spain is a significant producer of legumes, with an annual volume reaching substantial figures. The country's legumes market showcases a consistent production volume, contributing significantly to both domestic consumption and export activities, positioning Spain as a notable player in the global Legumes Market.

Legumes Market Regional Insights

Asia Pacific held the largest share in 2022 and is expected to dominate the market during the forecast period. The Asia-Pacific region stands as a vital hub for the Legumes Market, attributing its significance to diverse factors. Legumes play a crucial role in this region, addressing nutritional needs, agricultural sustainability, and economic balance. While staple cereal crops enjoy self-sufficiency in many nations, the availability of legumes remains low, leading to substantial imports, particularly impacting affordability for rural and urban families. Despite the dominance of a few legumes in commercial markets like soybean, groundnut, chickpea, and lentil, numerous indigenous varieties such as adzuki bean, horse gram, and moth bean remain underexplored. The Seminar on Processing and Utilization of Legumes, hosted in Japan by the Asian Productivity Organization, highlighted the significance of legumes in household food security, soil enhancement, and agricultural diversification across Asian countries. The Asia-Pacific region's increased focus on boosting legume production signifies a pivotal change in agricultural strategies. Legumes, once considered secondary crops, now garner acknowledgment for their pivotal role in food security, notably as a primary protein source, augmenting the dietary needs of diverse rural and urban populations. In the Legumes Market, this shift underscores the significance of legumes in addressing nutritional demands and fostering food security across demographics. With a population exceeding three billion, the Asia-Pacific region stands as a significant hub for nutritional resources, where legumes fulfill essential dietary needs by providing protein, fat and vital micronutrients to rural and urban communities. Countries like China, India, Myanmar and Vietnam have seen a surge in legume production, driven by expanded cultivation and enhanced productivity. Soybean cultivation in China and India has played a crucial part in addressing food crises, such as India's shortage of edible oil. India's pulse production plays a pivotal role in the Asia-Pacific region's influence on the Legumes Market. With India being a major pulse producer, its contributions significantly impact global trade dynamics. The country's robust production not only addresses local consumption needs but also reflects its export potential. Collaborative efforts in research, innovation, and policy within this region drive agricultural productivity and ensure nutritional security across diverse populations.Legumes Market Competitive Landscape The Competitive Landscape of the Legumes market covers the number of key companies, company size, their strengths, weaknesses, barriers and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers and substitute products that drive the profitability of the companies in the Legumes industry. The global Legumes markets include several market players at the country, regional and global levels. Some of the key players are Cargill, Archer , Daniels Midland Company (ADM), Bunge Limited, Louis Dreyfus Company (LDC), Olam International, Ingredion Incorporated, The Scoular Company, SunOpta Inc., AGT Food and Ingredients, Sun Agro, Bonduelle and others. Many companies conducted research and development activities to increase their product portfolio and fulfil Legumes Market. For instance, In 2022, Cargill made significant progress in its legume development efforts. The company invested in new research and development, expanded its legume production capacity, and launched new legume-based products. Cargill is committed to developing new and innovative legume varieties with improved yields, disease resistance, and nutritional value. In 2022, the company made significant progress in this area. For example, Cargill developed a new variety of chickpea that is resistant to drought and heat stress. This new variety is expected to help farmers in India and other developing countries increase their chickpea yields and improve their livelihoods.

Legumes Market Scope : Inquire Before Buying

Global Legumes Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 11.8 Bn. Forecast Period 2023 to 2029 CAGR: 5.5% Market Size in 2029: USD 17.17 Bn. Segments Covered: by Type Beans Lentils Chickpeas Peas Soybeans Others by Category Conventional Organic by End User Food and Beverage Animal Feed Pharmaceutical Others by Distribution Channel Supermarkets/Hypermarkets Online Retail Specialty Stores Others Legumes Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Legumes Key Players

1. Cargill 2. Archer Daniels Midland Company (ADM) 3. Bunge Limited 4. Louis Dreyfus Company (LDC) 5. Olam International 6. Ingredion Incorporated 7. The Scoular Company 8. SunOpta Inc. 9. AGT Food and Ingredients 10. Sun Agro 11. Bonduelle 12. Emsland Group 13. Bean Growers Australia 14. Arbel 15. Diefenbaker Seed Processors 16. Sleaford Quality Foods Ltd. 17. Farmer’s Cooperative 18. Earth Expo Company 19. S&W Seed Company 20. Hancock Farm & Seed Company 21. Pulse Australi Frequently Asked Questions: 1] What is the growth rate of the Global Legumes Market? Ans. The Global Legumes Market is growing at a significant rate of 5.5% during the forecast period. 2] Which region is expected to dominate the Global Legumes Market? Ans. Asia Pacific is expected to dominate the Legumes Market during the forecast period. 3] What is the expected Global Legumes Market size by 2029? Ans. The Legumes Market size is expected to reach USD 17.17 Bn by 2029. 4] Which are the top players in the Global Legumes Market? Ans. The major top players in the Global Legumes Market are Cargill, Archer , Daniels Midland Company (ADM), Bunge Limited, Louis Dreyfus Company (LDC), Olam International, Ingredion Incorporated, The Scoular Company, SunOpta Inc., AGT Food and Ingredients, Sun Agro, Bonduelle and others. 5] What are the factors driving the Global Legumes Market growth? Ans. The growing focus on sustainable agriculture, as legumes contribute to soil health and reduce the carbon footprint and increasing demand for plant-based protein sources, coupled with increased consumer awareness regarding health benefits and nutritional value are expected to drive market growth during the forecast period.

1.Legumes Market: Research Methodology 2. Legumes Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Legumes Market: Dynamics 3.1 Legumes Market Trends by Region 3.1.1 North America Legumes Market Trends 3.1.2 Europe Legumes Market Trends 3.1.3 Asia Pacific Legumes Market Trends 3.1.4 Middle East and Africa Legumes Market Trends 3.1.5 South America Legumes Market Trends 3.2 Legumes Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Legumes Market Drivers 3.2.1.2 North America Legumes Market Restraints 3.2.1.3 North America Legumes Market Opportunities 3.2.1.4 North America Legumes Market Challenges 3.2.2 Europe 3.2.2.1 Europe Legumes Market Drivers 3.2.2.2 Europe Legumes Market Restraints 3.2.2.3 Europe Legumes Market Opportunities 3.2.2.4 Europe Legumes Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Legumes Market Drivers 3.2.3.2 Asia Pacific Legumes Market Restraints 3.2.3.3 Asia Pacific Legumes Market Opportunities 3.2.3.4 Asia Pacific Legumes Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Legumes Market Drivers 3.2.4.2 Middle East and Africa Legumes Market Restraints 3.2.4.3 Middle East and Africa Legumes Market Opportunities 3.2.4.4 Middle East and Africa Legumes Market Challenges 3.2.5 South America 3.2.5.1 South America Legumes Market Drivers 3.2.5.2 South America Legumes Market Restraints 3.2.5.3 South America Legumes Market Opportunities 3.2.5.4 South America Legumes Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives For the Legumes Industry 3.7 The Global Pandemic and Redefining of The Legumes Industry Landscape 3.8 Technological Road Map 4. Global Legumes Market: Global Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 4.1 Global Legumes Market Size and Forecast, by Type (2022-2029) 4.1.1 Beans 4.1.2 Lentils 4.1.3 Chickpeas 4.1.4 Peas 4.1.5 Soybeans 4.1.6 Others 4.2 Global Legumes Market Size and Forecast, by Category (2022-2029) 4.2.1 Conventional 4.2.2 Organic 4.3 Global Legumes Market Size and Forecast, by End User (2022-2029) 4.3.1 Food and Beverage 4.3.2 Animal Feed 4.3.3 Pharmaceutical 4.3.4 Others 4.4 Global Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1 Supermarkets/Hypermarkets 4.4.2 Online Retail 4.4.3 Specialty Stores 4.4.4 Others 4.5 Global Legumes Market Size and Forecast, by Region (2022-2029) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Legumes Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 5.1 North America Legumes Market Size and Forecast, by Type (2022-2029) 5.1.1 Beans 5.1.2 Lentils 5.1.3 Chickpeas 5.1.4 Peas 5.1.5 Soybeans 5.1.6 Others 5.2 North America Legumes Market Size and Forecast, by Category (2022-2029) 5.2.1 Conventional 5.2.2 Organic 5.3 North America Legumes Market Size and Forecast, by End User (2022-2029) 5.3.1 Food and Beverage 5.3.2 Animal Feed 5.3.3 Pharmaceutical 5.3.4 Others 5.4 North America Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.1 Supermarkets/Hypermarkets 5.4.2 Online Retail 5.4.3 Specialty Stores 5.4.4 Others 5.5 North America Legumes Market Size and Forecast, by Country (2022-2029) 5.5.1 United States 5.5.1.1 United States Legumes Market Size and Forecast, by Type (2022-2029) 5.5.1.1.1 Beans 5.5.1.1.2 Lentils 5.5.1.1.3 Chickpeas 5.5.1.1.4 Peas 5.5.1.1.5 Soybeans 5.5.1.1.6 Others 5.5.1.2 United States Legumes Market Size and Forecast, by Category (2022-2029) 5.5.1.2.1 Conventional 5.5.1.2.2 Organic 5.5.1.3 United States Legumes Market Size and Forecast, by End User (2022-2029) 5.5.1.3.1 Food and Beverage 5.5.1.3.2 Animal Feed 5.5.1.3.3 Pharmaceutical 5.5.1.3.4 Others 5.5.1.4 United States Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.1.4.1 Supermarkets/Hypermarkets 5.5.1.4.2 Online Retail 5.5.1.4.3 Specialty Stores 5.5.1.4.4 Others 5.5.2 Canada 5.5.2.1 Canada Legumes Market Size and Forecast, by Type (2022-2029) 5.5.2.1.1 Beans 5.5.2.1.2 Lentils 5.5.2.1.3 Chickpeas 5.5.2.1.4 Peas 5.5.2.1.5 Soybeans 5.5.2.1.6 Others 5.5.2.2 Canada Legumes Market Size and Forecast, by Category (2022-2029) 5.5.2.2.1 Conventional 5.5.2.2.2 Organic 5.5.2.3 Canada Legumes Market Size and Forecast, by End User (2022-2029) 5.5.2.3.1 Food and Beverage 5.5.2.3.2 Animal Feed 5.5.2.3.3 Pharmaceutical 5.5.2.3.4 Others 5.5.2.4 Canada Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.2.4.1 Supermarkets/Hypermarkets 5.5.2.4.2 Online Retail 5.5.2.4.3 Specialty Stores 5.5.2.4.4 Others 5.5.3 Mexico 5.5.3.1 Mexico Legumes Market Size and Forecast, by Type (2022-2029) 5.5.3.1.1 Beans 5.5.3.1.2 Lentils 5.5.3.1.3 Chickpeas 5.5.3.1.4 Peas 5.5.3.1.5 Soybeans 5.5.3.1.6 Others 5.5.3.2 Mexico Legumes Market Size and Forecast, by Category (2022-2029) 5.5.3.2.1 Conventional 5.5.3.2.2 Organic 5.5.3.3 Mexico Legumes Market Size and Forecast, by End User (2022-2029) 5.5.3.3.1 Food and Beverage 5.5.3.3.2 Animal Feed 5.5.3.3.3 Pharmaceutical 5.5.3.3.4 Others 5.5.3.4 Mexico Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.3.4.1 Supermarkets/Hypermarkets 5.5.3.4.2 Online Retail 5.5.3.4.3 Specialty Stores 5.5.3.4.4 Others 6. Europe Legumes Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 6.1 Europe Legumes Market Size and Forecast, by Type (2022-2029) 6.2 Europe Legumes Market Size and Forecast, by Category (2022-2029) 6.3 Europe Legumes Market Size and Forecast, by End User (2022-2029) 6.4 Europe Legumes Market Size and Forecast, by Distribution Channel (2022-2029 6.5 Europe Legumes Market Size and Forecast, by Country (2022-2029) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Legumes Market Size and Forecast, by Type (2022-2029) 6.5.1.2 United Kingdom Legumes Market Size and Forecast, by Category (2022-2029) 6.5.1.3 United Kingdom Legumes Market Size and Forecast, by End User (2022-2029) 6.5.1.4 United Kingdom Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.2 France 6.5.2.1 France Legumes Market Size and Forecast, by Type (2022-2029) 6.5.2.2 France Legumes Market Size and Forecast, by Category (2022-2029) 6.5.2.3 France Legumes Market Size and Forecast, by End User (2022-2029) 6.5.2.4 France Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.3 Germany 6.5.3.1 Germany Legumes Market Size and Forecast, by Type (2022-2029) 6.5.3.2 Germany Legumes Market Size and Forecast, by Category (2022-2029) 6.5.3.3 Germany Legumes Market Size and Forecast, by End User (2022-2029) 6.5.3.4 Germany Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.4 Italy 6.5.4.1 Italy Legumes Market Size and Forecast, by Type (2022-2029) 6.5.4.2 Italy Legumes Market Size and Forecast, by Category (2022-2029) 6.5.4.3 Italy Legumes Market Size and Forecast, by End User (2022-2029) 6.5.4.4 Italy Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.5 Spain 6.5.5.1 Spain Legumes Market Size and Forecast, by Type (2022-2029) 6.5.5.2 Spain Legumes Market Size and Forecast, by Category (2022-2029) 6.5.5.3 Spain Legumes Market Size and Forecast, by End User (2022-2029) 6.5.5.4 Spain Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.6 Sweden 6.5.6.1 Sweden Legumes Market Size and Forecast, by Type (2022-2029) 6.5.6.2 Sweden Legumes Market Size and Forecast, by Category (2022-2029) 6.5.6.3 Sweden Legumes Market Size and Forecast, by End User (2022-2029) 6.5.6.4 Sweden Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.7 Austria 6.5.7.1 Austria Legumes Market Size and Forecast, by Type (2022-2029) 6.5.7.2 Austria Legumes Market Size and Forecast, by Category (2022-2029) 6.5.7.3 Austria Legumes Market Size and Forecast, by End User (2022-2029) 6.5.7.4 Austria Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Legumes Market Size and Forecast, by Type (2022-2029) 6.5.8.2 Rest of Europe Legumes Market Size and Forecast, by Category (2022-2029). 6.5.8.3 Rest of Europe Legumes Market Size and Forecast, by End User (2022-2029) 6.5.8.4 Rest of Europe Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7. Asia Pacific Legumes Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 7.1 Asia Pacific Legumes Market Size and Forecast, by Type (2022-2029) 7.2 Asia Pacific Legumes Market Size and Forecast, by Category (2022-2029) 7.3 Asia Pacific Legumes Market Size and Forecast, by End User (2022-2029) 7.4 Asia Pacific Legumes Market Size and Forecast, by Distribution Channel (2022- 7.5 Asia Pacific Legumes Market Size and Forecast, by Country (2022-2029) 7.5.1 China 7.5.1.1 China Legumes Market Size and Forecast, by Type (2022-2029) 7.5.1.2 China Legumes Market Size and Forecast, by Category (2022-2029) 7.5.1.3 China Legumes Market Size and Forecast, by End User (2022-2029) 7.5.1.4 China Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.2 South Korea 7.5.2.1 S Korea Legumes Market Size and Forecast, by Type (2022-2029) 7.5.2.2 S Korea Legumes Market Size and Forecast, by Category (2022-2029) 7.5.2.3 S Korea Legumes Market Size and Forecast, by End User (2022-2029) 7.5.2.4 S Korea Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.3 Japan 7.5.3.1 Japan Legumes Market Size and Forecast, by Type (2022-2029) 7.5.3.2 Japan Legumes Market Size and Forecast, by Category (2022-2029) 7.5.3.3 Japan Legumes Market Size and Forecast, by End User (2022-2029) 7.5.3.4 Japan Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.4 India 7.5.4.1 India Legumes Market Size and Forecast, by Type (2022-2029) 7.5.4.2 India Legumes Market Size and Forecast, by Category (2022-2029) 7.5.4.3 India Legumes Market Size and Forecast, by End User (2022-2029) 7.5.4.4 India Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.5 Australia 7.5.5.1 Australia Legumes Market Size and Forecast, by Type (2022-2029) 7.5.5.2 Australia Legumes Market Size and Forecast, by Category (2022-2029) 7.5.5.3 Australia Legumes Market Size and Forecast, by End User (2022-2029) 7.5.5.4 Australia Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.6 Indonesia 7.5.6.1 Indonesia Legumes Market Size and Forecast, by Type (2022-2029) 7.5.6.2 Indonesia Legumes Market Size and Forecast, by Category (2022-2029) 7.5.6.3 Indonesia Legumes Market Size and Forecast, by End User (2022-2029) 7.5.6.4 Indonesia Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.7 Malaysia 7.5.7.1 Malaysia Legumes Market Size and Forecast, by Type (2022-2029) 7.5.7.2 Malaysia Legumes Market Size and Forecast, by Category (2022-2029) 7.5.7.3 Malaysia Legumes Market Size and Forecast, by End User (2022-2029) 7.5.7.4 Malaysia Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.8 Vietnam 7.5.8.1 Vietnam Legumes Market Size and Forecast, by Type (2022-2029) 7.5.8.2 Vietnam Legumes Market Size and Forecast, by Category (2022-2029) 7.5.8.3 Vietnam Legumes Market Size and Forecast, by End User (2022-2029) 7.5.8.4 Vietnam Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.9 Taiwan 7.5.9.1 Taiwan Legumes Market Size and Forecast, by Type (2022-2029) 7.5.9.2 Taiwan Legumes Market Size and Forecast, by Category (2022-2029) 7.5.9.3 Taiwan Legumes Market Size and Forecast, by End User (2022-2029) 7.5.9.4 Taiwan Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Legumes Market Size and Forecast, by Type (2022-2029) 7.5.10.2 Bangladesh Legumes Market Size and Forecast, by Category (2022-2029) 7.5.10.3 Bangladesh Legumes Market Size and Forecast, by End User (2022-2029) 7.5.10.4 Bangladesh Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.11 Pakistan 7.5.11.1 Pakistan Legumes Market Size and Forecast, by Type (2022-2029) 7.5.11.2 Pakistan Legumes Market Size and Forecast, by Category (2022-2029) 7.5.11.3 Pakistan Legumes Market Size and Forecast, by End User (2022-2029) 7.5.11.4 Pakistan Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Legumes Market Size and Forecast, by Type (2022-2029) 7.5.12.2 Rest of Asia Pacific Legumes Market Size and Forecast, by Category (2022-2029) 7.5.12.3 Rest of Asia Pacific Legumes Market Size and Forecast, by End User (2022-2029) 7.5.12.4 Rest of Asia Pacific Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 8. Middle East and Africa Legumes Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 8.1 Middle East and Africa Legumes Market Size and Forecast, by Type (2022-2029) 8.2 Middle East and Africa Legumes Market Size and Forecast, by Category (2022-2029) 8.3 Middle East and Africa Legumes Market Size and Forecast, by End User (2022-2029) 8.4 Middle East and Africa Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 8.5 Middle East and Africa Legumes Market Size and Forecast, by Country (2022-2029) 8.5.1 South Africa 8.5.1.1 South Africa Legumes Market Size and Forecast, by Type (2022-2029) 8.5.1.2 South Africa Legumes Market Size and Forecast, by Category (2022-2029) 8.5.1.3 South Africa Legumes Market Size and Forecast, by End User (2022-2029) 8.5.1.4 South Africa Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.2 GCC 8.5.2.1 GCC Legumes Market Size and Forecast, by Type (2022-2029) 8.5.2.2 GCC Legumes Market Size and Forecast, by Category (2022-2029) 8.5.2.3 GCC Legumes Market Size and Forecast, by End User (2022-2029) 8.5.2.4 GCC Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.3 Egypt 8.5.3.1 Egypt Legumes Market Size and Forecast, by Type (2022-2029) 8.5.3.2 Egypt Legumes Market Size and Forecast, by Category (2022-2029) 8.5.3.3 Egypt Legumes Market Size and Forecast, by End User (2022-2029) 8.5.3.4 Egypt Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.4 Nigeria 8.5.4.1 Nigeria Legumes Market Size and Forecast, by Type (2022-2029) 8.5.4.2 Nigeria Legumes Market Size and Forecast, by Category (2022-2029) 8.5.4.3 Nigeria Legumes Market Size and Forecast, by End User (2022-2029) 8.5.4.4 Nigeria Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Legumes Market Size and Forecast, by Type (2022-2029) 8.5.5.2 Rest of ME&A Legumes Market Size and Forecast, by Category (2022-2029) 8.5.5.3 Rest of ME&A Legumes Market Size and Forecast, by End User (2022-2029) 8.5.5.4 Rest of ME&A Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 9. South America Legumes Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 9.1 South America Legumes Market Size and Forecast, by Type (2022-2029) 9.2 South America Legumes Market Size and Forecast, by Category (2022-2029) 9.3 South America Legumes Market Size and Forecast, by End User (2022-2029) 9.4 South America Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 9.5 South America Legumes Market Size and Forecast, by Country (2022-2029) 9.5.1 Brazil 9.5.1.1 Brazil Legumes Market Size and Forecast, by Type (2022-2029) 9.5.1.2 Brazil Legumes Market Size and Forecast, by Category (2022-2029) 9.5.1.3 Brazil Legumes Market Size and Forecast, by End User (2022-2029) 9.5.1.4 Brazil Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 9.5.2 Argentina 9.5.2.1 Argentina Legumes Market Size and Forecast, by Type (2022-2029) 9.5.2.2 Argentina Legumes Market Size and Forecast, by Category (2022-2029) 9.5.2.3 Argentina Legumes Market Size and Forecast, by End User (2022-2029) 9.5.2.4 Argentina Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Legumes Market Size and Forecast, by Type (2022-2029) 9.5.3.2 Rest Of South America Legumes Market Size and Forecast, by Category (2022-2029) 9.5.3.3 Rest Of South America Legumes Market Size and Forecast, by End User (2022-2029) 9.5.3.4 Rest Of South America Legumes Market Size and Forecast, by Distribution Channel (2022-2029) 10. Global Legumes Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Type Segment 10.3.3 End User Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Legumes Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Cargill 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Recent Developments 11.2 Archer Daniels Midland Company (ADM) 11.3 Bunge Limited 11.4 Louis Dreyfus Company (LDC) 11.5 Olam International 11.6 Ingredion Incorporated 11.7 The Scoular Company 11.8 SunOpta Inc. 11.9 AGT Food and Ingredients 11.10 Sun Agro 11.11 Bonduelle 11.12 Emsland Group 11.13 Bean Growers Australia 11.14 Arbel 11.15 Diefenbaker Seed Processors 11.16 Sleaford Quality Foods Ltd. 11.17 Farmer’s Cooperative 11.18 Earth Expo Company 11.19 S&W Seed Company 11.20 Hancock Farm & Seed Company 11.21 Pulse Australi 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary