Atomic Layer Deposition (ALD) Equipment Market was valued at USD 3.9 Bn in 2023 and is expected to reach USD 7.65 Bn by 2030, at a CAGR of 10.1 % during the forecast period.Atomic Layer Deposition (ALD) Equipment Market Overview

Atomic Layer Deposition (ALD) equipment is specialized machinery used in the process of Atomic Layer Deposition. ALD is a thin-film deposition technique used primarily in semiconductor manufacturing, electronics, energy storage, and other industries where precise, uniform, and conformal thin films are required. ALD equipment facilitates the controlled deposition of atomic layers onto a substrate surface, enabling the creation of ultra-thin films with atomic-level precision. ALD equipment incorporates additional features or subsystems depending on the specific requirements of the application, such as plasma enhancement for certain deposition processes, precursor purification systems to ensure precursor purity, and in-situ monitoring techniques for real-time film characterization.To know about the Research Methodology :- Request Free Sample Report The Atomic Layer Deposition (ALD) equipment market has experienced significant growth in recent years, driven by increasing demand for advanced semiconductor devices, miniaturization of electronic components, and the growing adoption of ALD in various industries such as electronics, energy storage, and medical devices. Technological advancements in ALD equipment have led to the development of next-generation systems with improved process capabilities, higher throughput, and enhanced flexibility. Manufacturers are focusing on innovations such as remote plasma ALD, spatial ALD, and atomic layer etching to address the evolving needs of various industries.

Atomic Layer Deposition (ALD) Equipment Market Dynamic

Semiconductors and Electronics Industry to boost the Atomic Layer Deposition (ALD) Equipment Market Growth The demand from the semiconductor and electronics industries is expected to be the primary driver of atomic layer deposition technology, which is expected to boost the Atomic Layer Deposition (ALD) Equipment Market growth. The semiconductor industry is expected to impact the technology's development directly, any electronics industry development contributes to its advancement. The demand from the semiconductor and electronics industries is expected to be the primary driver of atomic layer deposition technology. While the semiconductor industry is expected to impact the technology's development directly, any electronics industry growth contributes to its advancement. The electronics sector has ups and downs in cycles. The short- to medium-term outlook for the electronic industry is positive. At the end of 2024, there will be around 8.9 billion mobile subscriptions, 8.4 billion mobile broadband subscriptions, and 6.2 billion unique mobile users, according to MMR report. This is expected to boost the development of Atomic Layer Deposition (ALD) Equipment Market. Growth in the sales of consumer electronics and microelectronics is expected to drive up demand for semiconductor ICs. The increased demand for semiconductor ICs raise the manufacturing capabilities of semiconductor device producers, which increase demand for the atomic layer deposition (AID) equipment market. Next-generation semiconductor device production necessitates the deposition of highly conformal (great than 95%) SiO2, SiNx, and SiC films on high aspect-ratio nanostructures at low temperatures (400 °C). Atomic layer deposition is replacing chemical vapor deposition in semiconductor manufacturing, allowing for the development of these Si-based dielectric films. ALD-deposited SiO2 films are already utilized in the production of semiconductor devices. According to Cisco, around 500 billion devices will be connected to the Internet by 2030. Each machine includes sensors that collect data, interact with the environment, and communicate over a network. These applications need miniaturized storage devices and ICs. The increasing amount of data generated from the growing number of connected devices has increased the demand for storage devices, driving s domestic production of electronics in India increased from USD 29 billion in 2014-15 to USD 67 billion in 2020-21, according to data released by the country's national Investment Promotion & Facilitation Agency in March 2022, which is part of the Union Ministry of Commerce and Industry. High Initial Investment cost to limit Atomic Layer Deposition (ALD) Equipment Market growth ALD systems are sophisticated and complex, involving intricate vacuum systems, precursor delivery mechanisms, and precise control systems. The high capital expenditure associated with acquiring ALD equipment acts as a barrier, particularly for small and medium-sized enterprises (SMEs) or startups with limited financial resources. Apart from the initial investment, the operational costs of ALD equipment are substantial. These costs include precursor materials, energy consumption for maintaining vacuum conditions, regular maintenance, and skilled personnel for operation and maintenance. The ongoing operational expenses deter organizations from investing in ALD technology, especially when alternative deposition techniques with lower operational costs are available, which is expected to boost the Atomic Layer Deposition (ALD) Equipment Market growth. Developing and optimizing ALD processes for specific applications is time-consuming and resource-intensive endeavor. Some other thin-film deposition techniques, ALD often requires extensive experimentation and process refinement to achieve the desired film properties, thicknesses, and conformality. This complexity in process development adds to the overall time-to-market and deter companies from adopting ALD for new product development or process integration. The availability of suitable precursor materials is critical for ALD processes. Not all materials are easily converted into ALD-compatible precursors, and the options for precursor materials and are limited for certain applications, which is expected to limit the Atomic Layer Deposition (ALD) Equipment Market growth. The cost and purity of precursor chemicals impact the overall cost-effectiveness of ALD processes. The limited availability and high cost of precursors for certain materials restrict the growth of ALD into new application areas.Atomic Layer Deposition (ALD) Equipment Market Segment Analysis

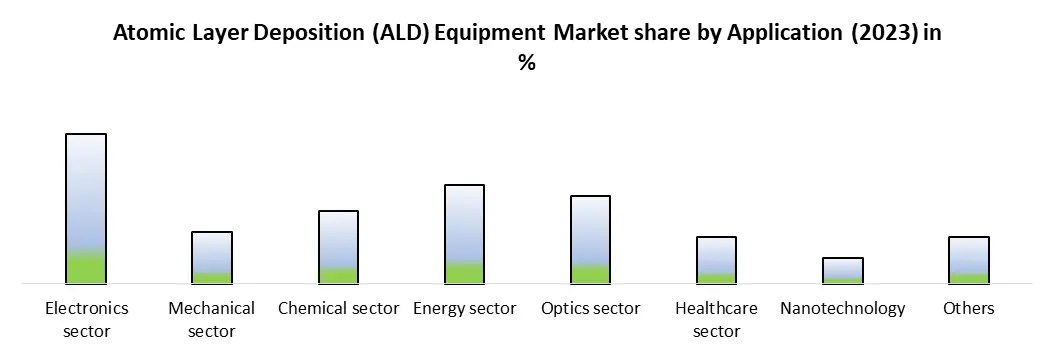

Based on Deposition Method, the market is segmented into Plasma-enhanced ALD, Thermal ALD, Spatial ALD, Roll-to-Roll ALD, Powder ALD, and Others. Plasma-enhanced ALD segment dominated the market in 2023 and is expected to hold the largest Atomic Layer Deposition (ALD) Equipment Market share over the forecast period. PEALD combines the principles of traditional ALD with plasma-enhanced techniques to deposit thin films with enhanced properties, improved film quality, and greater process flexibility. PEALD enables the deposition of thin films with enhanced properties such as improved density, uniformity, adhesion, and electrical properties, which is expected to boost the Atomic Layer Deposition (ALD) Equipment Market growth. The use of plasma allows for better control over film composition, stoichiometry, and crystallinity, leading to superior film quality and performance. PEALD is particularly advantageous for depositing high-quality dielectric films, barrier layers, and functional coatings used in advanced semiconductor devices, displays, photovoltaics, and other applications where precise control over film properties is critical. Based on Application, the Electronics sector, Mechanical sector, Chemical sector, Energy sector, Optics sector, Healthcare sector, Nanotechnology, and Others. Electronics sector segment dominated the market in 2023 and is expected to hold the largest Atomic Layer Deposition (ALD) Equipment Market share over the forecast period. The electronics sector is a major consumer of ALD equipment, particularly in semiconductor manufacturing. ALD plays a crucial role in depositing thin films for various semiconductor devices, including logic and memory chips, microprocessors, sensors, and optoelectronic components. ALD is used to fabricate critical layers such as high-k dielectrics, metal gates, diffusion barriers, and interconnects with atomic-level precision and uniformity, enabling the production of advanced integrated circuits with improved performance, reliability, and energy efficiency. ALD technology is increasingly being utilized in advanced packaging applications to enhance the performance and reliability of semiconductor devices. ALD enables the deposition of thin-film barrier coatings, passivation layers, and dielectric materials for advanced packaging techniques such as wafer-level packaging (WLP), through-silicon vias (TSVs), and fan-out wafer-level packaging (FO-WLP). These packaging technologies enable the integration of multiple components into smaller form factors, improving device performance, power efficiency, and thermal management, which significantly boosts the Atomic Layer Deposition (ALD) Equipment Market growth.

Atomic Layer Deposition (ALD) Equipment Market Regional Insight

Rapid Expansion of Semiconductor Industry to boost the Asia Pacific Atomic Layer Deposition (ALD) Equipment Market growth Asia Pacific, particularly countries such as China, South Korea, Taiwan, and Japan, has emerged as a global semiconductor manufacturing hub. The region accounts for a significant share of global semiconductor production, driven by the increasing demand for electronic devices, automotive electronics, and communication technologies. As semiconductor manufacturers strive to enhance device performance and integrate more complex functionalities into their products, the demand for Atomic Layer Deposition (ALD) equipment for critical processes such as high-k dielectric deposition and metal gate formation continues to rise. The Asia Pacific region is home to a large and rapidly with growing consumer electronics market, which significantly boosts the Atomic Layer Deposition (ALD) Equipment Market growth. With rising disposable incomes, urbanization, and technological advancements, there is a growing demand for smartphones, tablets, laptops, wearables, and other electronic gadgets. ALD technology plays a crucial role in enabling the production of high-performance electronic devices by providing precise and uniform thin-film deposition for advanced semiconductor components, displays, and sensors. Governments across the Asia Pacific region are actively supporting the growth of the semiconductor and electronics industries through various initiatives and policies. For example, China's Made in China 2025 initiative aims to enhance the country's capabilities in high-tech industries, including semiconductor manufacturing. Similarly, South Korea's Semiconductor Industry Promotion Plan includes measures to strengthen the country's semiconductor ecosystem. These initiatives drive investments in research and development, infrastructure, and talent development, fostering the adoption of advanced manufacturing technologies such as ALD.Atomic Layer Deposition (ALD) Equipment Market Scope: Inquire before buying

Global Atomic Layer Deposition (ALD) Equipment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.9 Bn. Forecast Period 2024 to 2030 CAGR: 10.1% Market Size in 2030: US $ 7.65 Bn. Segments Covered: by Deposition Method Plasma-enhanced ALD Thermal ALD Spatial ALD Roll-to-Roll ALD Powder ALD Others by Application Electronics sector Mechanical sector Chemical sector Energy sector Optics sector Healthcare sector Nanotechnology Others Atomic Layer Deposition (ALD) Equipment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Leading Atomic Layer Deposition (ALD) Equipment manufacturers include:

1. ASM International N.V. - Almere, Netherlands 2. Lam Research Corporation - Fremont, California, USA 3. Applied Materials Inc - Santa Clara, California, USA 4. Tokyo Electron Limited (TEL) - Tokyo, Japan 5. Beneq Oy - Vantaa, Finland 6. Oxford Instruments plc - Abingdon, United Kingdom 7. Picosun Group - Espoo, Finland 8. Kurt J. Lesker Company - Jefferson Hills, Pennsylvania, USA 9. SENTECH Instruments GmbH - Berlin, Germany 10. Veeco Instruments Inc. - Plainview, New York, USA 11. Aixtron SE - Herzogenrath, Germany 12. Entegris, Inc. - Billerica, Massachusetts, USA 13. Hitachi High-Tech Corporation - Tokyo, Japan 14. NCD Co., Ltd. - Daejeon, South Korea 15. CVD Equipment Corporation - Central Islip, New York, USA 16. SPTS Technologies Ltd. (A KLA Company) - Newport, United Kingdom 17. Encapsulix SAS - Bernin, France 18. Altatech Semiconductor S.A. - Montbonnot-Saint-Martin, France 19. SEMES Co., Ltd. - Gyeonggi-do, South Korea 20. Beneq Corporation - Plano, Texas, USA 21. SoLayTec - Eindhoven, Netherlands 22. SENTECH Korea Co., Ltd. - Gyeonggi-do, South Korea 23. Molecular Vista - San Jose, California, USA 24. Essai Ltd. - Mid Glamorgan, United Kingdom 25. ULVAC, Inc. - Chigasaki, Kanagawa, Japan Frequently asked Questions: 1. What is Atomic Layer Deposition (ALD) equipment? Ans: ALD equipment is specialized machinery used for Atomic Layer Deposition, a thin-film deposition technique employed primarily in semiconductor manufacturing, electronics, and other industries requiring precise and conformal thin films. 2. How does ALD equipment work? Ans: ALD equipment facilitates the controlled deposition of atomic layers onto a substrate surface by sequentially exposing it to alternating precursor gases, resulting in the creation of ultra-thin films with atomic-level precision. 3. What are the drivers of growth in the ALD equipment market? Ans: Technological advancements, increasing demand for advanced semiconductor devices, and the expansion of ALD into various industries such as electronics, energy storage, and medical devices are driving the growth of the ALD equipment market. 4. Which region is driving growth in the ALD equipment market? Ans: The Asia Pacific region, particularly countries like China, South Korea, Taiwan, and Japan, is driving growth in the ALD equipment market due to its emergence as a global semiconductor manufacturing hub and increasing demand for electronic devices.

1. Atomic Layer Deposition (ALD) Equipment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Atomic Layer Deposition (ALD) Equipment Market: Dynamics 2.1. Atomic Layer Deposition (ALD) Equipment Market Trends by Region 2.1.1. North America Atomic Layer Deposition (ALD) Equipment Market Trends 2.1.2. Europe Atomic Layer Deposition (ALD) Equipment Market Trends 2.1.3. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Trends 2.1.4. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Trends 2.1.5. South America Atomic Layer Deposition (ALD) Equipment Market Trends 2.2. Atomic Layer Deposition (ALD) Equipment Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Atomic Layer Deposition (ALD) Equipment Market Drivers 2.2.1.2. North America Atomic Layer Deposition (ALD) Equipment Market Restraints 2.2.1.3. North America Atomic Layer Deposition (ALD) Equipment Market Opportunities 2.2.1.4. North America Atomic Layer Deposition (ALD) Equipment Market Challenges 2.2.2. Europe 2.2.2.1. Europe Atomic Layer Deposition (ALD) Equipment Market Drivers 2.2.2.2. Europe Atomic Layer Deposition (ALD) Equipment Market Restraints 2.2.2.3. Europe Atomic Layer Deposition (ALD) Equipment Market Opportunities 2.2.2.4. Europe Atomic Layer Deposition (ALD) Equipment Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Drivers 2.2.3.2. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Restraints 2.2.3.3. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Opportunities 2.2.3.4. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Drivers 2.2.4.2. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Restraints 2.2.4.3. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Opportunities 2.2.4.4. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Challenges 2.2.5. South America 2.2.5.1. South America Atomic Layer Deposition (ALD) Equipment Market Drivers 2.2.5.2. South America Atomic Layer Deposition (ALD) Equipment Market Restraints 2.2.5.3. South America Atomic Layer Deposition (ALD) Equipment Market Opportunities 2.2.5.4. South America Atomic Layer Deposition (ALD) Equipment Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Atomic Layer Deposition (ALD) Equipment Industry 2.8. Analysis of Government Schemes and Initiatives For Atomic Layer Deposition (ALD) Equipment Industry 2.9. Atomic Layer Deposition (ALD) Equipment Market Trade Analysis 2.10. The Global Pandemic Impact on Atomic Layer Deposition (ALD) Equipment Market 3. Atomic Layer Deposition (ALD) Equipment Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 3.1.1. Plasma-enhanced ALD 3.1.2. Thermal ALD 3.1.3. Spatial ALD 3.1.4. Roll-to-Roll ALD 3.1.5. Powder ALD 3.1.6. Others 3.2. Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 3.2.1. Electronics sector 3.2.2. Mechanical sector 3.2.3. Chemical sector 3.2.4. Energy sector 3.2.5. Optics sector 3.2.6. Healthcare sector 3.2.7. Nanotechnology 3.2.8. Others 3.3. Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 4.1.1. Plasma-enhanced ALD 4.1.2. Thermal ALD 4.1.3. Spatial ALD 4.1.4. Roll-to-Roll ALD 4.1.5. Powder ALD 4.1.6. Others 4.2. North America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 4.2.1. Electronics sector 4.2.2. Mechanical sector 4.2.3. Chemical sector 4.2.4. Energy sector 4.2.5. Optics sector 4.2.6. Healthcare sector 4.2.7. Nanotechnology 4.2.8. Others 4.3. North America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 4.3.1.1.1. Plasma-enhanced ALD 4.3.1.1.2. Thermal ALD 4.3.1.1.3. Spatial ALD 4.3.1.1.4. Roll-to-Roll ALD 4.3.1.1.5. Powder ALD 4.3.1.1.6. Others 4.3.1.2. United States Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Electronics sector 4.3.1.2.2. Mechanical sector 4.3.1.2.3. Chemical sector 4.3.1.2.4. Energy sector 4.3.1.2.5. Optics sector 4.3.1.2.6. Healthcare sector 4.3.1.2.7. Nanotechnology 4.3.1.2.8. Others 4.3.2. Canada 4.3.2.1. Canada Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 4.3.2.1.1. Plasma-enhanced ALD 4.3.2.1.2. Thermal ALD 4.3.2.1.3. Spatial ALD 4.3.2.1.4. Roll-to-Roll ALD 4.3.2.1.5. Powder ALD 4.3.2.1.6. Others 4.3.2.2. Canada Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Electronics sector 4.3.2.2.2. Mechanical sector 4.3.2.2.3. Chemical sector 4.3.2.2.4. Energy sector 4.3.2.2.5. Optics sector 4.3.2.2.6. Healthcare sector 4.3.2.2.7. Nanotechnology 4.3.2.2.8. Others 4.3.3. Mexico 4.3.3.1. Mexico Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 4.3.3.1.1. Plasma-enhanced ALD 4.3.3.1.2. Thermal ALD 4.3.3.1.3. Spatial ALD 4.3.3.1.4. Roll-to-Roll ALD 4.3.3.1.5. Powder ALD 4.3.3.1.6. Others 4.3.3.2. Mexico Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Electronics sector 4.3.3.2.2. Mechanical sector 4.3.3.2.3. Chemical sector 4.3.3.2.4. Energy sector 4.3.3.2.5. Optics sector 4.3.3.2.6. Healthcare sector 4.3.3.2.7. Nanotechnology 4.3.3.2.8. Others 5. Europe Atomic Layer Deposition (ALD) Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.2. Europe Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 5.3. Europe Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.3.1.2. United Kingdom Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.3.2.2. France Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.3.3.2. Germany Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.3.4.2. Italy Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.3.5.2. Spain Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.3.6.2. Sweden Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.3.7.2. Austria Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 5.3.8.2. Rest of Europe Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.2. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.1.2. China Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.2.2. S Korea Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.3.2. Japan Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.4.2. India Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.5.2. Australia Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.6.2. Indonesia Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.7.2. Malaysia Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.8.2. Vietnam Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.9.2. Taiwan Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 6.3.10.2. Rest of Asia Pacific Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 7.2. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 7.3.1.2. South Africa Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 7.3.2.2. GCC Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 7.3.3.2. Nigeria Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 7.3.4.2. Rest of ME&A Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 8. South America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 8.2. South America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 8.3. South America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 8.3.1.2. Brazil Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 8.3.2.2. Argentina Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Deposition Method (2023-2030) 8.3.3.2. Rest Of South America Atomic Layer Deposition (ALD) Equipment Market Size and Forecast, by Application (2023-2030) 9. Global Atomic Layer Deposition (ALD) Equipment Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Atomic Layer Deposition (ALD) Equipment Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ASM International N.V. - Almere, Netherlands 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Lam Research Corporation - Fremont, California, USA 10.3. Applied Materials, Inc. - Santa Clara, California, USA 10.4. Tokyo Electron Limited (TEL) - Tokyo, Japan 10.5. Beneq Oy - Vantaa, Finland 10.6. Oxford Instruments plc - Abingdon, United Kingdom 10.7. Picosun Group - Espoo, Finland 10.8. Kurt J. Lesker Company - Jefferson Hills, Pennsylvania, USA 10.9. SENTECH Instruments GmbH - Berlin, Germany 10.10. Veeco Instruments Inc. - Plainview, New York, USA 10.11. Aixtron SE - Herzogenrath, Germany 10.12. Entegris, Inc. - Billerica, Massachusetts, USA 10.13. Hitachi High-Tech Corporation - Tokyo, Japan 10.14. NCD Co., Ltd. - Daejeon, South Korea 10.15. CVD Equipment Corporation - Central Islip, New York, USA 10.16. SPTS Technologies Ltd. (A KLA Company) - Newport, United Kingdom 10.17. Encapsulix SAS - Bernin, France 10.18. Altatech Semiconductor S.A. - Montbonnot-Saint-Martin, France 10.19. SEMES Co., Ltd. - Gyeonggi-do, South Korea 10.20. Beneq Corporation - Plano, Texas, USA 10.21. SoLayTec - Eindhoven, Netherlands 10.22. SENTECH Korea Co., Ltd. - Gyeonggi-do, South Korea 10.23. Molecular Vista - San Jose, California, USA 10.24. Essai Ltd. - Mid Glamorgan, United Kingdom 10.25. ULVAC, Inc. - Chigasaki, Kanagawa, Japan 11. Key Findings 12. Industry Recommendations 13. Atomic Layer Deposition (ALD) Equipment Market: Research Methodology 14. Terms and Glossary