Application Security Market was valued at USD 8.34 Billion in 2022, and it is expected to reach USD 24.56 Billion by 2029, exhibiting a CAGR of 16.68% during the forecast period (2023-2029)Application Security Market Overview:

Currently, application security requires continuous real-time assessment for context, visibility, and control as part of the overall security solution. Digital transformation and cloud adoption are key driving initiatives in the IT industry. Businesses are constantly striving to do more and do it faster than their competition, and the current digital transformation movement places the responsibility on speed and application security. Cloud migration, microservices, and container adoption are driving application modernization. Application security is the process of making apps more secure by identifying, addressing, and strengthening app security. It is the process of developing, adding, and testing security features within applications to avoid security vulnerabilities against threats like unauthorized access and modification. The process involves several proactive actions to find vulnerabilities and patch them before hackers have a chance to take advantage of them. The main benefits of application security for businesses include protecting critical data from leaks, preserving customer data security to increase consumer confidence, and enhancing trust from important lenders and investors. Application security is software applications, which are integral a component of an organization’s success. The organizations must shift left and adopt a developer-first approach to application security to reduce relegating security to afterthought status. Organizations that depend on software development require a solution, which accomplishes two essential things to adapt and survive. One is risk-appropriate security, which measures and the second is an even distribution of functions across the stack. In many organizations, application security is beginning to become integrated into developer workflows, which creates both opportunities and challenges. As organizations strive to make AppSec an enabler, which helps developers in creating secure software quickly, developer-first AppSec programs help businesses to make their digital transformation journey safer and faster.To know about the Research Methodology :- Request Free Sample Report

Research Methodology

The main approach used to calculate accurate market size is the bottom-up market sizing approach, where a macro and micro view of all the potential customers, revenue, and the current market is considered as a whole. On the other hand, Secondary research is conducted to identify the segment specifications, and qualitative and quantitative data along with the factors responsible for the growth of the market. The secondary source referred for the research are press releases, company annual reports, government websites, and research papers related to the market. The Application Security Market report delivers an assessment of the market for the forecast period. The report encompasses various segments like Solution, Testing Type, Deployment, End-Users, and an analysis of the trends and factors, which are playing a substantial role in the market. In the report, the market outlook section mainly covers fundamental market dynamics like drivers, restraints, opportunities, and challenges faced by the industry. In the report, Porter examines competition, new entrants in the market, supplier power, end-user power, and the threats of substitutes for services in the market. PESTLE identifies factors like political, economic, sociocultural, technological, legal, and environmental that may affect an organization and its competitive standing.Application Security Market Dynamics

Cyber Risk Managed Services drive the need for Application Security Many organizations are trying to reach out to their consumers through all possible mediums, which include Web and Mobile applications. Most have inadequately secured their applications, which is leading to cyber-attacks. In the current technology development environment, the traditional approach of securing applications is not an effective way of handling security. A requirement for a much more radical approach that must be robust, scalable, and able to connect with the dynamics of application boosting the need for application security solutions across the many IT organization. A selection of the right tools, which can effectively identify the vulnerabilities is an important component of the digital transformation adoption approach. Many organizations fail to prioritize application security, leaving their entire environment at risk. In large organizations, managing thousands of applications is sensible to adopt risk-based application security management. Multi-Faceted Approach Boosts the Security Solution Adoption The application development stage starts by gathering the requirement and performing analysis followed by design, code, testing, and deployment into the production environment. Organizations need to incorporate security at strategic phases that will help identify gaps and vulnerabilities early on and also provide layered protection to look software development lifecycle holistically. Securing applications is a multi-faceted activity, which has required knowledge of application behavior and its various functionalities. Application security helps to enable the early identification of vulnerabilities and reduces the attack vector of an application. Increasing Adoption of Security Tools Nowadays, solutions providers offer a new generation of AppSec tools built with CI/CD integration. Modern tools empower scanning activities to shift left in the development lifecycle. Despite the traditional software development platforms releasing security capabilities, modern security application tools are helping to make AppSec, which is a first-class citizen in the developer tooling ecosystem. AppSec is an emerging opportunity, which helps to make security a core part of automated development workflows. A more modern approach is assisting to avoid security gates, which are also requiring assessments and approvals instead of focusing on building security guardrails that define the security requirements. Security breaches are on the rise The current digital infrastructure is based on communication between business applications and data, which can share over several devices, and platforms. Organizational data is becoming the target for cybercriminals. The adoption of web applications is a growing focus for cybercriminals. Web applications have shown up as a vector to which cybercriminals have gradually turned their attention over the past year. Most businesses have embraced some set of digital transformation initiatives that drive the chances of security breaches. Sensitive data gets conceded on a seemingly daily basis and breaches create negative publicity and lead to huge financial losses that drive the need for application security. Customer, partner, and employee-facing applications are critical drivers for the adoption of the application security application platform. Many organizations are adopting modern software development life cycles (SDLC), which are enabled by Agile and DevOps for the achievement of velocity to accelerate business models, enhanced customer experiences, and new revenue opportunities, and improved operational efficiencies. Unused apps are a big security threat The largest issue is underutilized online and mobile applications. Customers and businesses are frequently observed carrying applications that are rarely utilized or go unused for long periods. This form of software provides a bigger risk. According to a Google survey, 25% of apps on average smartphone applications are underutilized but not dormant. These programmers can still establish a connection, scan files and photographs, and unwittingly send critical data to their mother ship. As a result, to limit dangers, it is vital to delete those programmers and utilize application security solutions.Application Security Market Segment Analysis

By solution, the web application security segment held the dominant share in 2022. The wide application of web application security in protecting online services or websites from threats or breaches is mainly responsible for the integration of application security solutions. The goal of web application security is to protect content across websites, which contain sensitive information. Accessing vulnerabilities and identifying hazards is easier with web application tools. As security breaches rise, enterprise web application security is increasingly important and has a big impact on market growth. As new trajectories emerge and attacks increase in frequency and sophistication, organizations require a robust, integrated web application security platform. Vendors want to ensure that each tool works with the others to seamlessly detect and defend against a diversity of attack vectors while sharing information, which can help to improve threat prevention capabilities.Based on the testing type, the application security market report covers the market size numbers of each sub-segment and also provides an analysis of the segment, which has a dominant share. The number of cyber-attacks against software applications has emphasized security as an important factor in software development. Now security-integrated development lifecycles are being widely adapted over the adoption of traditional software development lifecycle (SDLC) procedures. The protection capabilities of the traditional perimeter devices such as Web Application Firewall (WAF), and Intrusion Prevention/Detection Systems (IPS/IDS) have become insufficient because of their lack of insight into application logic and configuration. Run-time Application Self Protection (RASP) operates within the application, developing application context and helping to provide accurate attack visibility and blocking without accidentally stopping legitimate request that looks similar to an attack. RASP implants security into the running application where it resides on the server. It intercepts all calls to the system to safeguard they are secure. RASP can also be applied to Web and non-web applications, which does not affect the application design. It effectively leverages protection mechanisms during the entire application development process.

Application Security Market Regional Insights

North America held the more than 22% share in 2022 in the application security market. In the region, financial crimes against banks and other financial services institutions are increasing rapidly. There have been multiple cases in North America, which have been a victim of cyber-attack. It is negatively impacted most of the end-user industries like the government, BFSI, and others. The government's influence also boosts the usage of application security solutions. An increase in the number of security breaches that target business applications is some of the prominent factors behind the market growth. Asia Pacific Region Is an Emerging Market Place for Application Security Integration As digital transformation requires that software be built faster, application security is required during the entire process to understand and reduce software security risk. Despite increased awareness of application security concerns, security leaders and practitioners in the Asia Pacific region continue to wrestle with challenges and increasing vulnerabilities from emerging threats. Many organizations are continuing to struggle with understanding and dealing with application security, particularly at a strategic level. The Asia Pacific application security market growth will be accelerated by the presence of the number of internet users, the adoption of IoT devices, and industry rules for the security of business processes. The report gives a clear analysis of the integration of the application security platform by the countries like China, India, Japan, South Korea, and ASEAN countries. The objective of the report is to present a comprehensive analysis of the global Application Security Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Application Security Market dynamic, and structure by analyzing the market segments and projecting the Application Security Market size. Clear representation of competitive analysis of key players by segment Solution and regional presence in the Application Security Market make the report investor’s guide.Application Security Market Scope: Inquire before buying

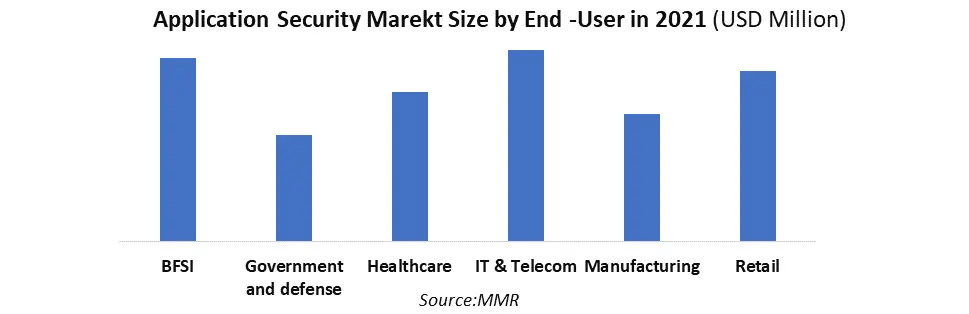

Application Security Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 8.34 Bn. Forecast Period 2023 to 2029 CAGR: 16.68% Market Size in 2029: US $ 24.56 Bn. Segments Covered: by Solution • Web Application Security • Mobile Application Security by Testing Type • Static Application Security Testing (SAST) • Dynamic Application Security Testing (DAST) • Interactive Application Security Testing (IAST) • Runtime Deployment Self-Protection (RASP) by Deployment • Cloud • On-premise by End-Users • BFSI • Government and defense • Healthcare • IT & Telecom • Manufacturing • Retail Application Security Market, By Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina and Rest of South America)Application Security Market, Key Players are:

• IBM(US) • Hewlett Packard(US) • Qualys, Inc(US) • WhiteHat Security, Inc(US) • Veracode(US) • Oracle Corporation(US) • Fortinet Inc.(US) • Synopsys Inc(US) • Lookout(US) • Cisco Security Systems(US) • Checkmarx(US) • Rapid7(US) • Onapsis(US) • NowSecure(US) • HCL(India) • MicroFocus(UK) • Capgemini(France) • Pradeo( France) Frequently Asked Questions: 1] What segments are covered in the Global Application Security Market report? Ans. The segments covered in the Application Security Market report are based on Solution, Testing Type, Deployment, and End-Users. 2] Which region is expected to hold the highest share in the Global Application Security Market? Ans. The North America region is expected to hold the highest share in the Application Security Market. 3] What is the market size of the Global Application Security Market by 2029? Ans. The market size of the Application Security Market by 2029 is expected to reach USD 24.56 Bn. 4] What is the forecast period for the Global Application Security Market? Ans. The forecast period for the Application Security Market is 2023-2029. 5] What was the market size of the Global Application Security Market in 2022? Ans. The market size of the Application Security Market in 2022 was valued at USD 8.34 Bn.

1. Global Application Security Market Size: Research Methodology 2. Global Application Security Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Application Security Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Application Security Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Application Security Market Size Segmentation 4.1. Global Application Security Market Size, by Solution (2023-2029) • Web Application Security • Mobile Application Security 4.2. Global Application Security Market Size, by Testing Type (2023-2029) • Static Application Security Testing (SAST) • Dynamic Application Security Testing (DAST) • Interactive Application Security Testing (IAST) • Runtime Application Self-Protection (RASP) 4.3. Global Application Security Market Size, by Deployment (2023-2029) • Cloud • On-premise 4.4. Global Application Security Market Size, by End-Users (2023-2029) • BFSI • Government and defense • Healthcare • IT & Telecom • Manufacturing • Retail 5. North America Application Security Market (2023-2029) 5.1. North America Application Security Market Size, by Solution (2023-2029) • Web Application Security • Mobile Application Security 5.2. North America Application Security Market Size, by Testing Type (2023-2029) • Static Application Security Testing (SAST) • Dynamic Application Security Testing (DAST) • Interactive Application Security Testing (IAST) • Runtime Application Self-Protection (RASP) 5.3. North America Application Security Market Size, by Deployment (2023-2029) • Cloud • On-premise 5.4. North America Application Security Market Size, by End-Users (2023-2029) • BFSI • Government and defense • Healthcare • IT & Telecom • Manufacturing • Retail 5.5. North America Application Security Market, by County(2023-2029) • United States • Canada 6. European Application Security Market (2023-2029) 6.1. European Application Security Market, by Solution (2023-2029) 6.2. European Application Security Market, by Testing Type (2023-2029) 6.3. European Application Security Market, by Deployment (2023-2029) 6.4. European Application Security Market, by End-Users (2023-2029) 6.5. European Application Security Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Application Security Market (2023-2029) 7.1. Asia Pacific Application Security Market, by Solution (2023-2029) 7.2. Asia Pacific Application Security Market, by Testing Type (2023-2029) 7.3. Asia Pacific Application Security Market, by Deployment (2023-2029) 7.4. Asia Pacific Application Security Market, by End-Users (2023-2029) 7.5. Asia Pacific Application Security Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Application Security Market (2020-2029) 8.1. Middle East and Africa Application Security Market, by Solution (2023-2029) 8.2. Middle East and Africa Application Security Market, by Testing Type (2023-2029) 8.3. Middle East and Africa Application Security Market, by Deployment (2023-2029) 8.4. Middle East and Africa Application Security Market, by End-Users (2023-2029) 8.5. Middle East and Africa Application Security Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Application Security Market (2020-2029) 9.1. South America Application Security Market, by Solution (2023-2029) 9.2. South America Application Security Market, by Testing Type (2023-2029) 9.3. South America Application Security Market, by Deployment (2023-2029) 9.4. South America Application Security Market, by End-Users (2023-2029) 9.5. South America Application Security Market, by Country (2023-2029) • Brazil • Mexico • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. IBM 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Hewlett Packard 10.3. Qualys, Inc 10.4. WhiteHat Security, Inc 10.5. Veracode 10.6. Oracle Corporation 10.7. Fortinet Inc. 10.8. Synopsys Inc 10.9. HCL 10.10. Cisco Security Systems 10.11. Checkmarx 10.12. MicroFocus 10.13. Capegemini 10.14. Rapid7 10.15. Onapsis 10.16. NowSecure 10.17. Pradeo 10.18. Lookout