Agricultural Drone Market size was valued at USD 6.01 Bn in 2024, and the total Agricultural Drone Market revenue is expected to grow at a CAGR of 30.70% from 2025 to 2032, reaching nearly USD 51.18 Bn by 2032.Agricultural Drone Market Overview

An agricultural drone is an unmanned aerial vehicle (UAV) equipped with advanced sensors, cameras, and spraying systems designed to optimize farming operations. It enables precision agriculture by monitoring crop health, spraying fertilizers/pesticides, mapping fields, and analyzing soil conditions, improving efficiency, yield, and sustainability. The demand for agricultural drones is rising due to their ability to enhance farm productivity, reduce labor costs, and support precision farming. Meanwhile, supply is increasing as manufacturers develop more advanced, affordable, and regulatory-compliant drones to meet growing farmer needs. The Asia-Pacific dominated the agricultural drone market in 2024, driven by large-scale farming in China, Japan, and India. Key players include DJI (China), XAG (China), Parrot (France), AgEagle (U.S.), and Yamaha Motor (Japan), leading in innovation and market share. The report covered the Agricultural Drone Market's segments (Type, Component, Payload Capacity, Application, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2019 to 2024. The report investigates the Agricultural Drone Market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Agricultural Drone Market's contemporary competitive scenario.To know about the Research Methodology:-Request Free Sample Report

Agricultural Drone Market Dynamics

Precision Farming Demand and AI Integration to Boost Agricultural Drone Market Growth

The agricultural drone market is driven by the increasing need for precision farming, enabling efficient crop monitoring, soil analysis, and targeted spraying. AI-managed drones provide real time data analytics, improve yield adaptation and reduce input costs. Government subsidy (e.g., India’s Kisan Drone Scheme) and labor shortages further accelerate adoption. Advanced sensors (multispectral, LiDAR) enhance field mapping accuracy, while autonomous drone streamlines operations. Along with prominent players such as DJI and XAG leading innovation, permanent farming and smart agricultural fuel demand. Demand and climate challenges of global food push farmers towards drone-based solutions, making them essential for modern agriculture.High Costs and Regulatory Hurdles Limit Widespread Drone to Restrain Agricultural Drone Market

Despite the development, the agricultural drone market faces restrictions including high early investment (drone, sensor, software) and operating costs. Limited battery life (20–40 minutes) restrictions massive use, while complex rules (BVLOS restriction, pilot licensing) delayed deployment. Data security concerns and obstructing adopting lack of technical expertise among farmers. In developing areas, poor connectivity and infrastructure limit. Additionally, resistance to new technologies in traditional agricultural communities slows down the market. These challenges should be addressed to unlock the full capacity of agricultural drones.Drone-as-a-Service (DaaS) and Emerging Markets to Create Agricultural Drone Market Opportunity

The Drone-as-a-Service (DaaS) model presents a major opportunity, allowing small farmers to access drone technology affordably. Emerging markets (Africa, Latin America) offer untapped potential due to increasing agritech investments. Advances in swarm drone technology and solar-powered drones could enhance efficiency. AI and 5G integration will enable real-time data processing, while government initiatives (e.g., FAA/EASA approvals) will expand commercial use. Partnerships between agritech firms and drone manufacturers (e.g., John Deere & Blue River) will drive innovation. Sustainable farming trends and carbon credit incentives may further boost adoption, positioning drones as a key tool in future agriculture.Agricultural Drone Market Segment Analysis

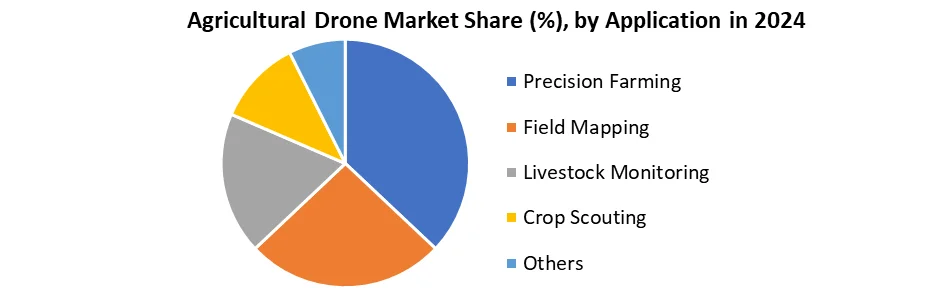

Based on Payload Capacity, the Agricultural Drone Market is segmented into Lightweight drones (up to 2kg), Medium-weight drones (2 to 10kg), and Heavy-weight drones (Above 10kg –up to 25kg). Medium-weight drones (2 to 10kg) segment dominated the Agricultural Drone Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance is due to an optimal balance between payload capacity, strength, and operational efficiency. These drones are versatile enough to handle key farming tasks like crop spraying, multispectral imaging, and field mapping, while remaining cost-effective for small to mid-sized farms. Unlike lightweight drones (limited to basic scouting) or heavy-weight drones (expensive and complex), medium-weight models offer longer flight times, higher spray capacity (5–10L), and compatibility with advanced sensors, making them ideal for precision agriculture. Prominent players like DJI (Agras T30/T40) and XAG (P Series) dominate this segment, with automatic spraying and adoption through AI-operated analytics. Their widespread use in Asia (China, India) and North America strengthens their market dominance.Based on Application, Agricultural Drone Market is segmented into Precision Farming, Field Mapping, Livestock Monitoring, Crop Scouting and Others. Precision Farming segment dominated the Agricultural Drone Market in 2024 and is expected to hold the largest market share over the forecast period. The precision farming segment leads the agricultural drone market, as drones equipped with multispectral sensors, AI analytics, and variable-rate spraying systems enable data-driven decisions to maximize crop yields while minimizing input costs. Unlike standalone applications like field mapping or livestock monitoring, precision farming integrates real-time crop health analysis, targeted pesticide/fertilizer application, and irrigation management into a unified system – delivering measurable ROI for farmers. Key players like DJI, XAG, and AgEagle focus on this segment through smart spraying drones and farm management software, with adoption strongest in row-crop farms (corn, soybeans) and orchards. Government subsidies for precision agriculture further accelerate growth, making it the core application driving drone demand globally.

AgriCultural Drone Market Regional Analysis

Asia-Pacific (APAC) Region Dominate the Agricultural Drone Market Dominance by China, India, and Japan led the global agricultural drone market in 2024, which is the largest stake for accurate agricultural technologies, government subsidies, and acute labor deficiency in agriculture. China stands as the world's largest market, with companies such as DJI and Zag Pioneering have a cost -effective spray drones used in millions of hectares. India accelerates adoption among small farmers for crop monitoring and chemical spraying with its peasant drone subsidy scheme. Japan's aging population is a demand for further fuel. Additionally, APAC is required by favorable rules, expansion of agritech startups, and durable farming practices, as the fastest-growing area. North America and Europe remain important markets, but high drone costs and more mechanized APAC in volume due to the current form of infrastructure. The region's dominance is expected to be strong with AI-managed drone and herd technology.Agricultural Drone Market Competitive Landscape

DJI’s agricultural drone division is projected to generate USD 1.2–1.5 billion, fueled by its Agras T50/T25 series and expansion in Latin America and Southeast Asia. XAG follows with an estimated USD 800 million–USD 1 billion, leveraging its P100 Pro and V40 models in key markets like China, India, and Australia. Both companies benefit from soaring demand for chemical application drones, accounting for 70% of their ag-drone revenue. While DJI leads in broad-scale farming, XAG gains traction in high-value crops (orchards, vineyards) with precision solutions. Their combined revenue reflects over 65% market share, leaving competitors like AgEagle (USD 50M) and Parrot (USD 30M) far behind.Agricultural Drone Market Recent Trend

1. Rising Adoption of Precision Farming • Drones equipped with multispectral, thermal, and hyperspectral sensors help farmers monitor crop health, soil conditions, and irrigation needs. • AI-powered analytics enable data-driven decision-making, optimizing pesticide, fertilizer, and water usage. 2. Government Support & Subsidies • Countries like India, China, and the U.S. are promoting drone use in agriculture through subsidies and training programs. • Example: India’s “Kisan Drone” scheme provides financial aid to farmers for drone purchases. 3. Shift Toward Autonomous & AI-Integrated Drones • AI and machine learning are being used for real-time crop disease detection, yield prediction, and automated spraying. • Companies like DJI, AgEagle, and Parrot are launching fully autonomous drones for field mapping and spraying. 4. Increased Use of Spraying Drones • LiDAR and GPS-enabled drones are improving spraying accuracy, reducing chemical wastage by up to 30%. • China leads in spraying drone adoption, with companies like XAG and DJI dominating the market.Agricultural Drone Market Recent Development

Date Company Country Recent Development 15 May 2024 DJI China Launched Agras T50 drone with 50kg payload & AI-spraying system. 3 April 2024 XAG China Signed MoU with Syngenta for precision pesticide solutions in Indonesia. 22 March 2024 AgEagle USA Completed acquisition of senseFly (eBee drones) for $23 million. 12 February 2024 Parrot France Unveiled Bluegrass 2.0 with 4K multispectral imaging for vineyards. 18 January 2024 John Deere USA Integrated drone-collected data into See & Spray Ultimate weed control system. Agricultural Drone Market Scope: Inquire before buying

Agricultural Drone Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 6.01 Bn. Forecast Period 2025 to 2032 CAGR: 30.70% Market Size in 2032: USD 51.18 Bn. Segments Covered: by Type Fixed Wing Drones Rotary Drone Blades Hybrid Drones by Component Frames Controller Systems Propulsion Systems Camera Systems Navigation Systems by Payload Capacity Lightweight drones (up to 2kg) Medium-weight drones (2 to 10kg) Heavy-weight drones (Above 10kg –up to 25kg) by Application Precision Farming Field Mapping Livestock Monitoring Crop Scouting Others Agricultural Drone Market Key Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Agricultural Drone Market Key Players

North America 1. AgEagle Aerial Systems Inc. – USA (Wichita, Kansas) 2. PrecisionHawk – USA (Raleigh, North Carolina) 3. Trimble Inc. – USA (Sunnyvale, California) 4. Sentera LLC – USA (Minneapolis, Minnesota) 5. John Deere-USA 6. Harris Aerial – USA (Fort Pierce, Florida) Europe 1. Parrot Drone SAS (France) 2. senseFly (Switzerland, now part of AgEagle – but EU-developed) 3. Delair (France) 4. Aerones (Latvia) Asia Pacific 1. DJI (China) 2. XAG (China) 3. TTA (Thailand) 4. Nileworks (Japan) 5. Kray Technologies (Russia) 6. Flying Labs (India) Middle East and Africa 1. FlySight (UAE) 2. Aerial Vision (South Africa) 3. DroneScan (South Africa) South America 1. AGX Drones (Brazil) 2. XMobots (Brazil)Frequently Asked Questions:

1. What are agricultural drones? Ans: Agricultural drones are unmanned aerial vehicles designed for farming tasks such as crop monitoring, soil analysis, and precise application of fertilizers and pesticides. 2. What are the main types of agricultural drones? Ans: The market is segmented into fixed-wing drones, rotary drone blades, and hybrid drones, with fixed-wing drones dominating due to their ability to cover large areas efficiently. 3. What are the top manufacturers of agricultural drones? Ans: Major manufacturers include DJI, XAG, Garuda Aerospace, Yamaha, IO TechWorld, and others, with a focus on advancing technology for precision agriculture. 4. What recent developments are there in the agricultural drone market? Ans: Recent advancements include the introduction of new drones, government initiatives promoting drone usage, and the establishment of standard operating procedures for pesticide application via drones.

1. Agricultural Drone Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Agricultural Drone Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Service Segment 2.2.4. Application Segment 2.2.5. Revenue (2024) 2.2.6. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Agricultural Drone Market: Dynamics 3.1. Agricultural Drone Market Trends 3.2. Agricultural Drone Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Agricultural Drone Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Agricultural Drone Market Size and Forecast, By Type (2024-2032) 4.1.1. Fixed Wing Drones 4.1.2. Rotary Drone Blades 4.1.3. Hybrid Drones 4.2. Agricultural Drone Market Size and Forecast, By Component (2024-2032) 4.2.1. Frames 4.2.2. Controller Systems 4.2.3. Propulsion Systems 4.2.4. Camera Systems 4.2.5. Navigation Systems 4.3. Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 4.3.1. Lightweight drones (up to 2kg) 4.3.2. Medium-weight drones (2 to 10kg) 4.3.3. Heavy-weight drones (Above 10kg –up to 25kg) 4.4. Agricultural Drone Market Size and Forecast, By Application (2024-2032) 4.4.1. Precision Farming 4.4.2. Field Mapping 4.4.3. Livestock Monitoring 4.4.4. Crop Scouting 4.4.5. Others 4.5. Agricultural Drone Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Agricultural Drone Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Agricultural Drone Market Size and Forecast, By Type (2024-2032) 5.1.1. Fixed Wing Drones 5.1.2. Rotary Drone Blades 5.1.3. Hybrid Drones 5.2. North America Agricultural Drone Market Size and Forecast, By Component (2024-2032) 5.2.1. Frames 5.2.2. Controller Systems 5.2.3. Propulsion Systems 5.2.4. Camera Systems 5.2.5. Navigation Systems 5.3. North America Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 5.3.1. Lightweight drones (up to 2kg) 5.3.2. Medium-weight drones (2 to 10kg) 5.3.3. Heavy-weight drones (Above 10kg –up to 25kg) 5.4. North America Agricultural Drone Market Size and Forecast, By Application (2024-2032) 5.4.1. Precision Farming 5.4.2. Field Mapping 5.4.3. Livestock Monitoring 5.4.4. Crop Scouting 5.4.5. Others 5.5. North America Agricultural Drone Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Agricultural Drone Market Size and Forecast, By Type (2024-2032) 5.5.1.1.1. Fixed Wing Drones 5.5.1.1.2. Rotary Drone Blades 5.5.1.1.3. Hybrid Drones 5.5.1.2. United States Agricultural Drone Market Size and Forecast, By Component (2024-2032) 5.5.1.2.1. Frames 5.5.1.2.2. Controller Systems 5.5.1.2.3. Propulsion Systems 5.5.1.2.4. Camera Systems 5.5.1.2.5. Navigation Systems 5.5.1.3. United States Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 5.5.1.3.1. Lightweight drones (up to 2kg) 5.5.1.3.2. Medium-weight drones (2 to 10kg) 5.5.1.3.3. Heavy-weight drones (Above 10kg –up to 25kg) 5.5.1.4. United States Agricultural Drone Market Size and Forecast, By Application (2024-2032) 5.5.1.4.1. Precision Farming 5.5.1.4.2. Field Mapping 5.5.1.4.3. Livestock Monitoring 5.5.1.4.4. Crop Scouting 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Agricultural Drone Market Size and Forecast, By Type (2024-2032) 5.5.2.1.1. Fixed Wing Drones 5.5.2.1.2. Rotary Drone Blades 5.5.2.1.3. Hybrid Drones 5.5.2.2. Canada Agricultural Drone Market Size and Forecast, By Component (2024-2032) 5.5.2.2.1. Frames 5.5.2.2.2. Controller Systems 5.5.2.2.3. Propulsion Systems 5.5.2.2.4. Camera Systems 5.5.2.2.5. Navigation Systems 5.5.2.3. Canada Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 5.5.2.3.1. Lightweight drones (up to 2kg) 5.5.2.3.2. Medium-weight drones (2 to 10kg) 5.5.2.3.3. Heavy-weight drones (Above 10kg –up to 25kg) 5.5.2.4. Canada Agricultural Drone Market Size and Forecast, By Application (2024-2032) 5.5.2.4.1. Precision Farming 5.5.2.4.2. Field Mapping 5.5.2.4.3. Livestock Monitoring 5.5.2.4.4. Crop Scouting 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Agricultural Drone Market Size and Forecast, By Type (2024-2032) 5.5.3.1.1. Fixed Wing Drones 5.5.3.1.2. Rotary Drone Blades 5.5.3.1.3. Hybrid Drones 5.5.3.2. Mexico Agricultural Drone Market Size and Forecast, By Component (2024-2032) 5.5.3.2.1. Frames 5.5.3.2.2. Controller Systems 5.5.3.2.3. Propulsion Systems 5.5.3.2.4. Camera Systems 5.5.3.2.5. Navigation Systems 5.5.3.3. Mexico Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 5.5.3.3.1. Lightweight drones (up to 2kg) 5.5.3.3.2. Medium-weight drones (2 to 10kg) 5.5.3.3.3. Heavy-weight drones (Above 10kg –up to 25kg) 5.5.3.4. Mexico Agricultural Drone Market Size and Forecast, By Application (2024-2032) 5.5.3.4.1. Precision Farming 5.5.3.4.2. Field Mapping 5.5.3.4.3. Livestock Monitoring 5.5.3.4.4. Crop Scouting 5.5.3.4.5. Others 6. Europe Agricultural Drone Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.2. Europe Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.3. Europe Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.4. Europe Agricultural Drone Market Size and Forecast, By Application (2024-2032) 6.5. Europe Agricultural Drone Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.5.1.2. United Kingdom Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.5.1.3. United Kingdom Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.5.1.4. United Kingdom Agricultural Drone Market Size and Forecast, By Application (2024-2032) 6.5.2. France 6.5.2.1. France Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.5.2.2. France Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.5.2.3. France Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.5.2.4. France Agricultural Drone Market Size and Forecast, By Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.5.3.2. Germany Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.5.3.3. Germany Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.5.3.4. Germany Agricultural Drone Market Size and Forecast, By Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.5.4.2. Italy Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.5.4.3. Italy Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.5.4.4. Italy Agricultural Drone Market Size and Forecast, By Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.5.5.2. Spain Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.5.5.3. Spain Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.5.5.4. Spain Agricultural Drone Market Size and Forecast, By Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.5.6.2. Sweden Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.5.6.3. Sweden Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.5.6.4. Sweden Agricultural Drone Market Size and Forecast, By Application (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.5.7.2. Russia Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.5.7.3. Russia Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.5.7.4. Russia Agricultural Drone Market Size and Forecast, By Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Agricultural Drone Market Size and Forecast, By Type (2024-2032) 6.5.8.2. Rest of Europe Agricultural Drone Market Size and Forecast, By Component (2024-2032) 6.5.8.3. Rest of Europe Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 6.5.8.4. Rest of Europe Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Agricultural Drone Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.3. Asia Pacific Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.4. Asia Pacific Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Agricultural Drone Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.1.2. China Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.1.3. China Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.1.4. China Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.2.2. S Korea Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.2.3. S Korea Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.2.4. S Korea Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.3.2. Japan Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.3.3. Japan Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.3.4. Japan Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.4. India 7.5.4.1. India Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.4.2. India Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.4.3. India Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.4.4. India Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.5.2. Australia Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.5.3. Australia Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.5.4. Australia Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.6.2. Indonesia Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.6.3. Indonesia Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.6.4. Indonesia Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.7.2. Malaysia Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.7.3. Malaysia Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.7.4. Malaysia Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.8.2. Philippines Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.8.3. Philippines Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.8.4. Philippines Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.9.2. Thailand Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.9.3. Thailand Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.9.4. Thailand Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.10.2. Vietnam Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.10.3. Vietnam Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.10.4. Vietnam Agricultural Drone Market Size and Forecast, By Application (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Agricultural Drone Market Size and Forecast, By Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Agricultural Drone Market Size and Forecast, By Component (2024-2032) 7.5.11.3. Rest of Asia Pacific Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 7.5.11.4. Rest of Asia Pacific Agricultural Drone Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Agricultural Drone Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Agricultural Drone Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Agricultural Drone Market Size and Forecast, By Component (2024-2032) 8.3. Middle East and Africa Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 8.4. Middle East and Africa Agricultural Drone Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Agricultural Drone Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Agricultural Drone Market Size and Forecast, By Type (2024-2032) 8.5.1.2. South Africa Agricultural Drone Market Size and Forecast, By Component (2024-2032) 8.5.1.3. South Africa Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 8.5.1.4. South Africa Agricultural Drone Market Size and Forecast, By Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Agricultural Drone Market Size and Forecast, By Type (2024-2032) 8.5.2.2. GCC Agricultural Drone Market Size and Forecast, By Component (2024-2032) 8.5.2.3. GCC Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 8.5.2.4. GCC Agricultural Drone Market Size and Forecast, By Application (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Agricultural Drone Market Size and Forecast, By Type (2024-2032) 8.5.3.2. Egypt Agricultural Drone Market Size and Forecast, By Component (2024-2032) 8.5.3.3. Egypt Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 8.5.3.4. Egypt Agricultural Drone Market Size and Forecast, By Application (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Agricultural Drone Market Size and Forecast, By Type (2024-2032) 8.5.4.2. Nigeria Agricultural Drone Market Size and Forecast, By Component (2024-2032) 8.5.4.3. Nigeria Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 8.5.4.4. Nigeria Agricultural Drone Market Size and Forecast, By Application (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Agricultural Drone Market Size and Forecast, By Type (2024-2032) 8.5.5.2. Rest of ME&A Agricultural Drone Market Size and Forecast, By Component (2024-2032) 8.5.5.3. Rest of ME&A Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 8.5.5.4. Rest of ME&A Agricultural Drone Market Size and Forecast, By Application (2024-2032) 9. South America Agricultural Drone Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Agricultural Drone Market Size and Forecast, By Type (2024-2032) 9.2. South America Agricultural Drone Market Size and Forecast, By Component (2024-2032) 9.3. South America Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 9.4. South America Agricultural Drone Market Size and Forecast, By Application (2024-2032) 9.5. South America Agricultural Drone Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Agricultural Drone Market Size and Forecast, By Type (2024-2032) 9.5.1.2. Brazil Agricultural Drone Market Size and Forecast, By Component (2024-2032) 9.5.1.3. Brazil Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 9.5.1.4. Brazil Agricultural Drone Market Size and Forecast, By Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Agricultural Drone Market Size and Forecast, By Type (2024-2032) 9.5.2.2. Argentina Agricultural Drone Market Size and Forecast, By Component (2024-2032) 9.5.2.3. Argentina Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 9.5.2.4. Argentina Agricultural Drone Market Size and Forecast, By Application (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Agricultural Drone Market Size and Forecast, By Type (2024-2032) 9.5.3.2. Colombia Agricultural Drone Market Size and Forecast, By Component (2024-2032) 9.5.3.3. Colombia Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 9.5.3.4. Colombia Agricultural Drone Market Size and Forecast, By Application (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Agricultural Drone Market Size and Forecast, By Type (2024-2032) 9.5.4.2. Chile Agricultural Drone Market Size and Forecast, By Component (2024-2032) 9.5.4.3. Chile Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 9.5.4.4. Chile Agricultural Drone Market Size and Forecast, By Application (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Agricultural Drone Market Size and Forecast, By Type (2024-2032) 9.5.5.2. Rest Of South America Agricultural Drone Market Size and Forecast, By Component (2024-2032) 9.5.5.3. Rest Of South America Agricultural Drone Market Size and Forecast, By Payload Capacity (2024-2032) 9.5.5.4. Rest Of South America Agricultural Drone Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. AgEagle Aerial Systems Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. PrecisionHawk 10.3. Trimble Inc. 10.4. Sentera LLC 10.5. Harris Aerial 10.6. Parrot Drone SAS (France) 10.7. SenseFly 10.8. John Deere 10.9. Delair 10.10. Aerones 10.11. DJI 10.12. XAG 10.13. TTA 10.14. Nileworks 10.15. Kray Technologies 10.16. Flying Labs 10.17. FlySight 10.18. Aerial Vision 10.19. DroneScan 10.20. AGX Drones 10.21. XMobots 11. Key Findings 12. Industry Recommendations 13. Agricultural Drone Market: Research Methodology