The Ophthalmic Lasers Market size was valued at USD 610.32 Million in 2023 and the total Ophthalmic Lasers revenue is expected to grow at a CAGR of 5.72 % from 2024 to 2030, reaching nearly USD 900.86 Million by 2030. Ophthalmic lasers are medical devices that emit focused beams of light used in various eye surgeries and treatments, including corrective procedures for vision problems like refractive errors and conditions such as glaucoma or diabetic retinopathy. The ophthalmic lasers market is experiencing significant growth driven by advancements in laser technology, increasing prevalence of eye disorders, and rising demand for minimally invasive surgical procedures. With a growing aging population and higher incidences of conditions such as cataracts, diabetic retinopathy, and age-related macular degeneration, there's a heightened need for precise and efficient treatment options.To know about the Research Methodology :- Request Free Sample Report The adoption of ophthalmic lasers is boosted by their ability to offer superior outcomes, reduced recovery times, and enhanced patient safety compared to traditional surgical methods. Ophthalmic lasers market Key players continually innovating to improve laser systems' efficacy, precision, and versatility. Recent developments include the introduction of femtosecond lasers for cataract surgery by companies like Johnson & Johnson Vision, Alcon, and ZEISS, offering surgeons greater control and precision during procedures. Additionally, strategic collaborations and partnerships among industry leaders, such as the alliance between Ellex Medical Lasers and Topcon Corporation to develop advanced ophthalmic laser systems, further contribute to market expansion and technological advancements in the field.

Ophthalmic Lasers Market Dynamics:

Rising prevalence of eye disorders globally is driving demand for advanced ophthalmic laser treatments The rising prevalence of eye disorders such as cataracts, glaucoma, and diabetic retinopathy is driving the demand for advanced treatment options. Innovations in laser technology, exemplified by the development of femtosecond lasers and selective laser trabeculoplasty (SLT) lasers, are enhancing treatment efficacy and expanding the range of treatable eye conditions. Additionally, the growing geriatric population, particularly in developed regions, is contributing to increased demand for ophthalmic lasers due to higher rates of age-related eye conditions. Patients are increasingly opting for minimally invasive procedures like LASIK and photocoagulation, driving the adoption of ophthalmic lasers for quicker recovery times and reduced risk.The expansion of teleophthalmology services and increasing healthcare expenditure in emerging economies are supporting the adoption of advanced ophthalmic technologies. Growing awareness about the benefits of early detection and treatment of eye conditions, coupled with stringent regulatory approvals and favourable reimbursement policies, incentivizes healthcare providers to invest in advanced laser technologies. Integration of ophthalmic laser systems with advanced imaging and diagnostic technologies, as well as strategic collaborations between ophthalmic device manufacturers and healthcare providers, are driving innovation and market expansion, leading to improved treatment outcomes and accessibility to laser-based therapies for patients worldwide.

High Cost of Equipment Restricts Access to Advanced Ophthalmic Laser Technology The ophthalmic lasers market faces a multitude of restraints and challenges that impact its growth and adoption. The high cost of equipment presents a significant barrier, particularly for smaller clinics and healthcare facilities, limiting access to advanced technology and potentially restricting treatment options for patients. Stringent regulatory compliance requirements, exemplified by lengthy approval processes for new laser devices, delay market entry and innovation, prolonging product development timelines and hindering manufacturers' ability to introduce novel solutions to meet evolving clinical needs. Challenges related to training and skill requirements for ophthalmic laser procedures pose significant obstacles. Specialized expertise is essential for mastering laser techniques, such as photocoagulation for retinal diseases, leading to difficulties in recruiting and retaining skilled healthcare professionals. This learning curve contributes to limited access to qualified practitioners and may result in disparities in patient care quality across different settings. Additionally, limited reimbursement coverage from public and private payers for ophthalmic laser procedures further complicates matters, discouraging providers from offering these services or investing in advanced laser technology due to financial constraints and reimbursement uncertainties.

Ophthalmic Lasers Market Segment Analysis:

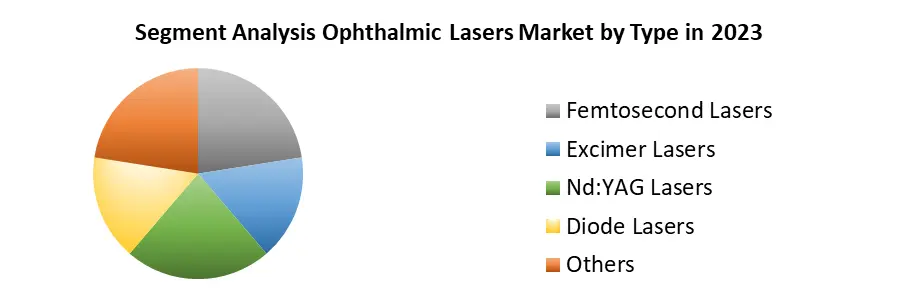

Based on Type, Femtosecond lasers dominated the Ophthalmic Lasers Market in 2023, they are widely adopted for refractive surgeries like LASIK due to their high precision and minimal tissue damage, making them popular in ophthalmic clinics and surgical centers. Excimer lasers are primarily used for corneal reshaping procedures to correct refractive errors, such as myopia, hyperopia, and astigmatism, with a long history of successful outcomes and widespread adoption. Nd:YAG lasers find application in posterior capsulotomy and peripheral iridotomy for treating conditions like posterior capsule opacification and angle-closure glaucoma. Diode lasers are versatile, offering applications in retinal photocoagulation for diabetic retinopathy and retinal vein occlusion, as well as in laser trabeculoplasty for glaucoma management. Other types of ophthalmic lasers cater to niche applications, such as photodynamic therapy for age-related macular degeneration, contributing to the overall diversity and versatility of laser-based treatments in ophthalmology.

Ophthalmic Lasers Market Regional Insights:

North America Dominated the Ophthalmic Lasers Market North America dominated the Ophthalmic Lasers Market in 2023, the region emerges as a significant hub, driven by advanced technological infrastructure and a robust research ecosystem. For instance, companies such as Johnson & Johnson Vision and Alcon dominate the market with their cutting-edge laser technologies, contributing substantially to the region's production capacity. When it comes to utilization, Asia-Pacific stands out as a leading region, driven by a rising population and increasing healthcare expenditure. Countries such as China and India witness significant demand for ophthalmic lasers due to the rising prevalence of eye disorders and the expanding elderly population. Regional import-export data reveals intricate trade dynamics, with North America often exporting advanced laser equipment to emerging markets in Asia-Pacific and South America, while simultaneously importing raw materials from regions such as Europe. This trade flow facilitates technology advancement and market growth. For example, Carl Zeiss Meditec AG, a prominent player based in Europe, supplies ophthalmic laser systems to various regions globally, contributing to the international trade landscape. The ophthalmic lasers market's regional insights underscore a complex interplay of production capabilities, consumption patterns, and trade dynamics, shaping the industry's growth trajectory in diverse geographical regions.Ophthalmic Lasers Market Scope: Inquire before buying

Global Ophthalmic Lasers Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 610.32 Mn. Forecast Period 2024 to 2030 CAGR: 5.72% Market Size in 2030: US $ 900.86 Mn. Segments Covered: by Type Femtosecond Lasers Excimer Lasers Nd:YAG Lasers Diode Lasers Others by Application Refractive Error Correction Cataract Removal Glaucoma Treatment Diabetic Retinopathy Treatment AMD Treatment Other Applications Ophthalmic Lasers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Ophthalmic Lasers Market Key Players:

Major Contributors in the Ophthalmic Lasers Industry in North America: 1. Bausch + Lomb - Bridgewater, New Jersey, United States 2. Iridex Corporation- Mountain View, California, United States 3. Lightmed - San Clemente, California, United States 4. LKC Technologies - Gaithersburg, Maryland, United States 5. Quantel Medical - Bozeman, Montana, United States Leading Figures in the European and Asian Ophthalmic Lasers Sector: 1. Alcon - Geneva, Switzerland 2. ZEISS - Oberkochen, Germany 3. Lumenis - Yokneam, Israel 4. Optotek Medical - Ljubljana, Slovenia 5. Meditec AG - Jena, Germany 6. Ziemer Ophthalmic Systems - Port, Switzerland 7. Keeler Ltd. - Windsor, United Kingdom 8. NIDEK Co., Ltd. - Gamagori, Japan 9. Ellex Medical Lasers - Adelaide, Australia FAQs: 1] What Major Key players in the Global Ophthalmic Lasers Market report? Ans. The Major Key players covered in the Ophthalmic Lasers Market report are Iridex Corporation, Lightmed, LKC Technologies, Quantel Medical, Alcon, ZEISS, Lumenis. 2] Which region is expected to hold the highest share in the Global Ophthalmic Lasers Market? Ans. North America region is expected to hold the highest share in the Ophthalmic Lasers Market. 3] What is the market size of the Global Ophthalmic Lasers Market by 2030? Ans. The market size of the Ophthalmic Lasers Market by 2030 is expected to reach US$ 900.86 Million. 4] What is the forecast period for the Global Ophthalmic Lasers Market? Ans. The forecast period for the Ophthalmic Lasers Market is 2024-2030. 5] What was the market size of the Global Ophthalmic Lasers Market in 2023? Ans. The market size of the Ophthalmic Lasers Market in 2023 was valued at US$ 610.32 Million.

1. Ophthalmic Lasers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Ophthalmic Lasers Market: Dynamics 2.1. Ophthalmic Lasers Market Trends by Region 2.1.1. North America Ophthalmic Lasers Market Trends 2.1.2. Europe Ophthalmic Lasers Market Trends 2.1.3. Asia Pacific Ophthalmic Lasers Market Trends 2.1.4. Middle East and Africa Ophthalmic Lasers Market Trends 2.1.5. South America Ophthalmic Lasers Market Trends 2.2. Ophthalmic Lasers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Ophthalmic Lasers Market Drivers 2.2.1.2. North America Ophthalmic Lasers Market Restraints 2.2.1.3. North America Ophthalmic Lasers Market Opportunities 2.2.1.4. North America Ophthalmic Lasers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Ophthalmic Lasers Market Drivers 2.2.2.2. Europe Ophthalmic Lasers Market Restraints 2.2.2.3. Europe Ophthalmic Lasers Market Opportunities 2.2.2.4. Europe Ophthalmic Lasers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Ophthalmic Lasers Market Drivers 2.2.3.2. Asia Pacific Ophthalmic Lasers Market Restraints 2.2.3.3. Asia Pacific Ophthalmic Lasers Market Opportunities 2.2.3.4. Asia Pacific Ophthalmic Lasers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Ophthalmic Lasers Market Drivers 2.2.4.2. Middle East and Africa Ophthalmic Lasers Market Restraints 2.2.4.3. Middle East and Africa Ophthalmic Lasers Market Opportunities 2.2.4.4. Middle East and Africa Ophthalmic Lasers Market Challenges 2.2.5. South America 2.2.5.1. South America Ophthalmic Lasers Market Drivers 2.2.5.2. South America Ophthalmic Lasers Market Restraints 2.2.5.3. South America Ophthalmic Lasers Market Opportunities 2.2.5.4. South America Ophthalmic Lasers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Ophthalmic Lasers Industry 2.8. Analysis of Government Schemes and Initiatives For Ophthalmic Lasers Industry 2.9. Ophthalmic Lasers Market Trade Analysis 2.10. The Global Pandemic Impact on Ophthalmic Lasers Market 3. Ophthalmic Lasers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 3.1.1. Femtosecond Lasers 3.1.2. Excimer Lasers 3.1.3. Nd:YAG Lasers 3.1.4. Diode Lasers 3.1.5. Others 3.2. Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 3.2.1. Refractive Error Correction 3.2.2. Cataract Removal 3.2.3. Glaucoma Treatment 3.2.4. Diabetic Retinopathy Treatment 3.2.5. AMD Treatment 3.2.6. Other Applications 3.3. Ophthalmic Lasers Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Ophthalmic Lasers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 4.1.1. Femtosecond Lasers 4.1.2. Excimer Lasers 4.1.3. Nd:YAG Lasers 4.1.4. Diode Lasers 4.1.5. Others 4.2. North America Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 4.2.1. Refractive Error Correction 4.2.2. Cataract Removal 4.2.3. Glaucoma Treatment 4.2.4. Diabetic Retinopathy Treatment 4.2.5. AMD Treatment 4.2.6. Other Applications 4.3. North America Ophthalmic Lasers Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Femtosecond Lasers 4.3.1.1.2. Excimer Lasers 4.3.1.1.3. Nd:YAG Lasers 4.3.1.1.4. Diode Lasers 4.3.1.1.5. Others 4.3.1.2. United States Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Refractive Error Correction 4.3.1.2.2. Cataract Removal 4.3.1.2.3. Glaucoma Treatment 4.3.1.2.4. Diabetic Retinopathy Treatment 4.3.1.2.5. AMD Treatment 4.3.1.2.6. Other Applications 4.3.2. Canada 4.3.2.1. Canada Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Femtosecond Lasers 4.3.2.1.2. Excimer Lasers 4.3.2.1.3. Nd:YAG Lasers 4.3.2.1.4. Diode Lasers 4.3.2.1.5. Others 4.3.2.2. Canada Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Refractive Error Correction 4.3.2.2.2. Cataract Removal 4.3.2.2.3. Glaucoma Treatment 4.3.2.2.4. Diabetic Retinopathy Treatment 4.3.2.2.5. AMD Treatment 4.3.2.2.6. Other Applications 4.3.3. Mexico 4.3.3.1. Mexico Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Femtosecond Lasers 4.3.3.1.2. Excimer Lasers 4.3.3.1.3. Nd:YAG Lasers 4.3.3.1.4. Diode Lasers 4.3.3.1.5. Others 4.3.3.2. Mexico Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Refractive Error Correction 4.3.3.2.2. Cataract Removal 4.3.3.2.3. Glaucoma Treatment 4.3.3.2.4. Diabetic Retinopathy Treatment 4.3.3.2.5. AMD Treatment 4.3.3.2.6. Other Applications 5. Europe Ophthalmic Lasers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.2. Europe Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 5.3. Europe Ophthalmic Lasers Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Ophthalmic Lasers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Ophthalmic Lasers Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Ophthalmic Lasers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Ophthalmic Lasers Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 8. South America Ophthalmic Lasers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 8.2. South America Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 8.3. South America Ophthalmic Lasers Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Ophthalmic Lasers Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Ophthalmic Lasers Market Size and Forecast, by Application (2023-2030) 9. Global Ophthalmic Lasers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Ophthalmic Lasers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Bausch + Lomb - Bridgewater, New Jersey, United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Iridex Corporation - Mountain View, California, United States 10.3. Lightmed - San Clemente, California, United States 10.4. LKC Technologies - Gaithersburg, Maryland, United States 10.5. Quantel Medical - Bozeman, Montana, United States 10.6. Alcon - Geneva, Switzerland 10.7. ZEISS - Oberkochen, Germany 10.8. Lumenis - Yokneam, Israel 10.9. Optotek Medical - Ljubljana, Slovenia 10.10. Meditec AG - Jena, Germany 10.11. Ziemer Ophthalmic Systems - Port, Switzerland 10.12. Keeler Ltd. - Windsor, United Kingdom 10.13. NIDEK Co., Ltd. - Gamagori, Japan 10.14. Ellex Medical Lasers - Adelaide, Australia 11. Key Findings 12. Industry Recommendations 13. Ophthalmic Lasers Market: Research Methodology 14. Terms and Glossary