The Germany Depression Therapeutics Market size was valued at USD 372 million in 2023. The total Germany Depression Therapeutics Market revenue is expected to grow at a CAGR of 3.7% from 2023 to 2030, reaching nearly USD 479 Million.Germany Depression Therapeutics Market

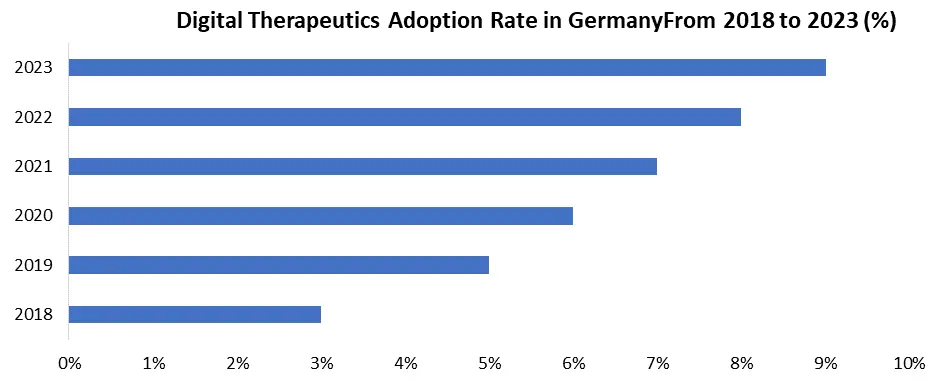

The MMR research report highlights the potential for significant future growth and provides an in-depth analysis of the German depression therapeutics market's promising trajectory. The analysis demonstrates the market's attractiveness in terms of generating income, investment appeal, and excellent growth prospects. It projects this positive consideration until 2030. The field of depression therapeutics presents a high innovation potential with promising opportunities in research and development. These opportunities include the development of non-invasive brain stimulation technology, personalized medical strategies, and the investigation of novel antidepressants. The changing environment provides a rich soil for innovative approaches meant to improve the effectiveness and customization of depression therapies. At the same time, there is a significant increase in the digital health industry, especially in the area of depression treatment. An exciting new investment opportunity is the increasing interest in using digital treatments to address mental health difficulties. There are several options for platforms and apps that support mindfulness exercises, mental behavioral treatment, and better sleep. Ventures that support these innovative approaches are expected to be investigated by investors eager to get into the growing digital health business, helping to advance the standards of mental health care.To know about the Research Methodology :- Request Free Sample Report Integration of Digital Health Solutions The integration of digital health solutions presents significant opportunities for the German depression therapeutics market. According to MMR studies, as of 2023 93% of eHealth professionals in Germany have embraced various telemedicine services, underscoring a substantial level of acceptance within the sector. By offering greater flexibility and convenience, telemedicine and online counseling have completely changed the way patients are treated. In addition to easier access to mental health treatments, it has greatly increased treatment adherence and patient participation. Germany saw a significant increase in the use of video consultations for mental health in 2023, with over 4 million sessions utilized. Compared to previous years, it represented a significant rise, suggesting an increasing trend in the use of Digital mental health services.

Affordability Challenges in the German Depression Therapeutics Market The affordability of depression therapeutics in Germany faces challenges primarily related to the high costs associated with certain medications and the limited insurance coverage for mental health medications. Certain newer antidepressants and alternative therapies like ketamine-based treatments are very expensive, placing a financial burden on patients and straining healthcare budgets. High costs are expected to create unequal access to treatment, potentially widening disparities in mental health outcomes. According to an MMR study, up to 20% of Germans experiencing depression encounter financial barriers that hinder their access to necessary treatment. These obstacles, which include the cost of both medication and psychotherapy, highlight the financial difficulties that a significant percentage of the population faces while trying to take care of their mental health requirements.

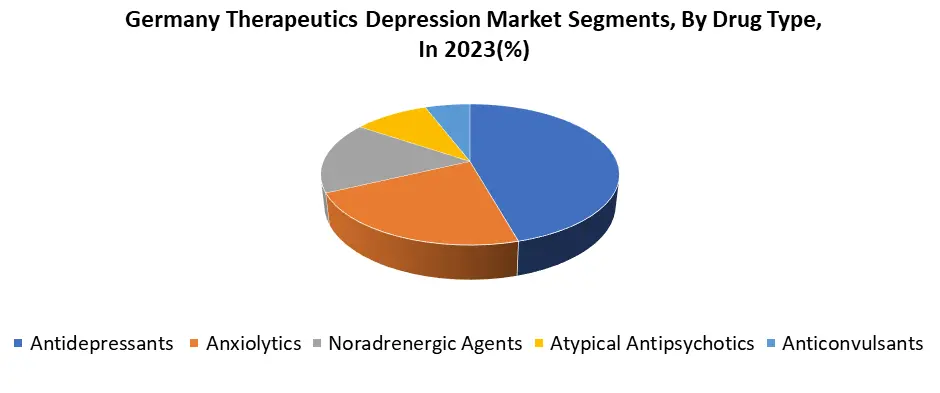

Germany Depression Therapeutics Market Segment Analysis

By Drug Type, the significant market share of 47% held by antidepressants in Germany reflects their crucial role in managing depression, it impacts the market as well as patients. Antidepressants are effective in managing depression symptoms for many patients, leading to improved quality of life, increased productivity, and reduced healthcare costs associated with untreated depression. Continuous research efforts focus on developing novel antidepressants with improved efficacy and fewer side effects, further refining and optimizing treatment options.

Germany Depression Therapeutics Market Scope: Inquiry Before Buying

Germany Depression Therapeutics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 372 Mn. Forecast Period 2024 to 2030 CAGR: 3.7% Market Size in 2030: US $ 479 Mn. Segments Covered: by Drug Type Anxiolytics Noradrenergic Agents Atypical Antipsychotics Antidepressants Anticonvulsants by Therapies Psychotherapy Deep Brain Stimulation Transcranial Magnetic Stimulation Cranial electrotherapy stimulation (CES) Electroconvulsive Therapy (ECT) by Indication Major Depressive Disorder (MDD) Bipolar Disorder Postpartum Depression Premenstrual Dysphoric Disorder (PMDD) Dysthymic Disorder by End-User NGOs Asylums Hospitals Mental Healthcare Centers Key Players in the Germany Depression Therapeutics Market

1. ix Therapeutics 2. Denk Pharma 3. MorphoSys 4. Medigene 5. Ethris 6. DocMorris 7. C21 Healthcare 8. GlaxoSmithKline 9. Eli Lilly 10. Johnson & Johnson 11. Bristol-Myers SquibbFAQs:

1. What are the latest trends in depression treatment in Germany? Ans. There is a shift towards developing novel antidepressants with different mechanisms of action for treatment-resistant cases. Digital therapeutics are gaining traction as complementary tools for personalized care and remote access. 2. Which segments constitute the Depression Therapeutics in Germany? Ans. Drug type, Therapies, Indication, and End User. These are the segments constituted in Germany's ECG Equipment. 3. What is the projected market size & and growth rate of the German Depression Therapeutics Market? Ans. The Germany ECG Equipment Market size was valued at USD 372 Million in 2023. The total Germany ECG Equipment market revenue is expected to grow at a CAGR of 3.7% from 2024 to 2030, reaching nearly USD 479 Million By 2030.

1. Germany Depression Therapeutics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Germany Depression Therapeutics Market: Dynamics 2.1. Germany Depression Therapeutics Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Challenges and Opportunities in the German Depression Therapeutics Market 2.6. Regulatory Landscape of Germany Depression Therapeutics Market 2.7. Technological Advancements in Germany's Depression Therapeutics Market 2.8. Factors Driving the Growth of the Depression Therapeutics Market 2.9. Technological Advancements 2.10. Government Policies Reform for the Healthcare Sector in Germany 2.11. Prevalence of Depression in Germany 2.12. Economic Impact of Depression 2.13. Digital Therapeutics Adoption Rate in Germany 2.14. Successful Implementations in Depression Therapeutics in Germany 2.15. Key Opinion Leader Analysis for Germany Depression Therapeutics Industry 2.16. Germany Depression Therapeutics Market Price Trend Analysis (2022-23) 3. Germany Depression Therapeutics Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030) 3.1. Germany Depression Therapeutics Market Size and Forecast, by Drug Type (2023-2030) 3.1.1. Anxiolytics 3.1.2. Noradrenergic Agents 3.1.3. Atypical Antipsychotics 3.1.4. Antidepressants 3.1.5. Anticonvulsants 3.2. Germany Depression Therapeutics Market Size and Forecast, by Therapies (2023-2030) 3.2.1. Psychotherapy 3.2.2. Deep Brain Stimulation 3.2.3. Transcranial Magnetic Stimulation 3.2.4. Cranial electrotherapy stimulation (CES) 3.2.5. Electroconvulsive Therapy (ECT) 3.3. Germany Depression Therapeutics Market Size and Forecast, by Indication (2023-2030) 3.3.1. Major Depressive Disorder (MDD) 3.3.2. Bipolar Disorder 3.3.3. Postpartum Depression 3.3.4. Premenstrual Dysphoric Disorder (PMDD) 3.3.5. Dysthymic Disorder 3.4. Germany Depression Therapeutics Market Size and Forecast, by End Users (2023-2030) 3.4.1. NGOs 3.4.2. Asylums 3.4.3. Hospitals 3.4.4. Mental Healthcare Centers 4. Germany Depression Therapeutics Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading Germany Depression Therapeutics Market Companies, by market capitalization 4.6. Market Trends and Challenges in China 4.6.1. Technological Advancements 4.6.2. Affordability and Accessibility 4.6.3. Shortage of Skilled Professionals 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players in the Market 4.7.4. Challenges 4.7.5. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. ix Therapeutics 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Potential Impact of Emerging Technologies 5.1.8. Regulatory Accreditations and Certifications Received by Them 5.1.9. Strategies Adopted by Key Players 5.1.10. Recent Developments 5.2. Denk Pharma 5.3. MorphoSys 5.4. Medigene 5.5. Ethris 5.6. DocMorris 5.7. C21 Healthcare 5.8. GlaxoSmithKline 5.9. Eli Lilly 5.10. Johnson & Johnson 5.11. Bristol-Myers Squibb 6. Key Findings 7. Industry Recommendations 8. Germany Depression Therapeutics Market: Research Methodology