Global Artificial Insemination Market size was valued at USD 5.29 Billion in 2023 and the total Artificial Insemination revenue is expected to grow at 7.8% from 2024 to 2030, reaching nearly USD 8.95 Billion by 2030.Artificial Insemination Market Overview

Artificial insemination (AI) is the process of hosting sperm in a female reproductive tract using artificial means, as different from natural copulation. For animal breeding, particularly in the livestock industry, to improve the genetic quality of offspring and increase group productivity this technique is widely used. Artificial insemination is also used in human-assisted reproduction for couples who come into contact with infertility or other issues preventing natural conception.To know about the Research Methodology:- Request Free Sample Report The Artificial Insemination (AI) market is buzzing with potential, driven by several key factors, such as rising demand for Genetic Awareness, while increasing infertility rates and advancements in assisted reproduction technologies, push human-assisted reproduction (HAR) forward. Additionally, growing awareness of genetic improvement benefits encourages farmers and breeders to optimize their herds. Overall, the AI market offers exciting opportunities for innovation and responsible growth in both animal agriculture and HAR. By addressing challenges like cost, accessibility, and ethical concerns requiring careful consideration and harnessing the potential of technology, stakeholders ensure a sustainable and ethical future for this evolving field. North America retains the top spot, followed by Europe. Asia-Pacific is a fastest growing, while South America and ME&A hold immense potential thanks to increasing livestock production and government initiatives. Within this dynamic landscape, key players like Zoetis, Semex Alliance, Genus ABS, Minitube, Bochemie, and DEVA Holding compete for market share.

Artificial Insemination Market Dynamics:

Growing Genetic Awareness Drives Artificial Insemination (AI) Market With a growing understanding of Genetic Awareness benefits, the Artificial Insemination (AI) market is flourishing because of increased awareness of genetic improvement in animals. The driver currently accounts for a significant Share in the market, estimated at 36% of the market, and shows huge potential for further growth. Increased herd productivity shows AI increases milk yield in cows by up to 10% and meat production in pigs, chickens, and goats by 12.5 % and Improves animal health and welfare like sex-sorted semen, reduces unwanted offspring, and promotes ethical breeding standards AI practices are responsible, the result of this Farmers and breeders are recognizing the value of AI in enhancing the genetic potential of their animals. Sustainability by key players has been playing a major role in Jan 2023, Genus ABS launches sex-sorted semen technology in India, catering to the dairy industry's demand for increased female offspring, reducing emissions and resource use and CJ Genetics and National Institute of Animal Science (Japan) collaborate on advanced reproductive technologies for pigs, focusing on efficient and sustainable production methods in Oct 2023. These recent developments highlight the growing awareness of responsible AI practices and their positive impact on both animal welfare and economic sustainability in the artificial insemination market.Cost, Accessibility, and Technical Limitations By the lack of awareness, Farmers and individuals in certain areas may lack sufficient knowledge about the benefits and potential of AI, hindering its adoption. Implementing Artificial Insemination effectively requires specialized equipment, trained personnel, and logistical support for Infrastructure and expertise, which may not be readily available in all regions. While improving, artificial insemination success rates may vary depending on factors like animal health, semen quality, and individual circumstances and for this artificial insemination procedures and technologies are have high cost, limiting accessibility for smaller farmers and individuals. This approach acknowledges the challenges while highlighting the potential for positive change through responsible artificial insemination market development. It offers a more accurate and ethical presentation of the situation. Human Infertility is New Opportunity that Fuels Artificial Insemination Market Growth The Artificial Insemination Market is experiencing a growing opportunity in the Human Assisted Reproduction (HAR) segment, with a current share of 18.5% of the total Artificial Insemination Market, HAR has seen significant growth. Several factors fuel the market growth like, rising infertility affects 1 in 7 couples globally, creating a substantial demand for assisted conception methods. Technological advancements like Pre-Implantation genetic (PGD), which screens embryos for genetic abnormalities, improve success rates and personalize treatment plans. Growing acceptance towards HAR has become more positive, encouraging individuals and couples to explore these options. This trend has been a tangible growth, with the HAR segment within the AI market growing at a CAGR of 7.8%. By comprehending and leveraging these trends, key players in the Artificial Insemination Market are engaged with a growing and vibrant segment, providing optimism and solutions to individuals and couples aspiring to create families. Some recent developments are highlighting the potential of Human Assisted Reproduction (HAR) like, in Jan 2023, Semex Alliance partnered with Bio-Techne to implement their sperm quality analysis technology, potentially improving HAR success rates. In Nov 2023, Zoetis and Boehringer Ingelheim co-marketed bovine respiratory disease vaccines, indirectly impacting animal health and potentially increasing demand for healthier breeding stock used in HAR.

Artificial Insemination Market Segment Analysis:

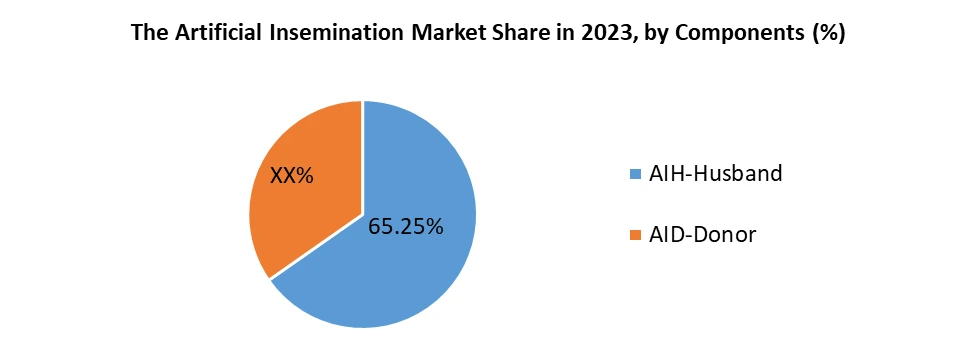

By Type of Insemination, The artificial insemination Market Share is based on Insemination Techniques, Intrauterine Insemination (IUI) holds the dominant position, accounting for 75% of all artificial insemination procedures, and holds 32% of the share of the overall artificial insemination market. Its relatively high success rate, minimally invasive nature, and suitability for various fertility issues. It has been not as much of a disturbing procedure compared to other assisted reproductive technologies, making it a preferred option. Intracervical Insemination Represents a smaller segment at around 20% of all artificial insemination procedures and is estimated to be around 11.65% of the overall artificial insemination market. Primarily limited to situations where IUI is deemed unsuitable due to anatomical issues or specific sperm conditions. The segment has the potential to grow as compared to other artificial insemination procedures, ICI has been attractive in regions with financial constraints like South America and ME&A.By Source, AID-Donor (Artificial Insemination Donor) means taking Sperm from unknown or known donors used in AI procedures. The AID-Donor segment holds the largest market share, estimated to be around 65.25% of the artificial insemination market. The segment caters to various needs, including single women, same-sex couples, couples facing male infertility, and those seeking specific genetic traits. AIH-Husband (Artificial Insemination Husband) Accounts for the remaining 34.75% share. This segment primarily serves couples dealing with mild male factor infertility or wanting to preserve fertility for later use. Different regulations and ethical viewpoints surround Artificial Insemination Donor (AID) and AIH, impacting their respective usage, these are the Factors influencing the Artificial Insemination market share.

Artificial Insemination Market Regional Insights:

North America holds the highest market share in the artificial insemination Market in 2023, with an estimated share of 43% of the global market share. Dominance is driven by the high healthcare spending and awareness of assisted reproduction technologies and artificial insemination market having significant market share by Key players including Zoetis, Semex Alliance, and Genus ABS. With a growing demand for animal products and increasing adoption of artificial insemination in livestock breeding, leading players are Minitube, Bochemie, and DEVA Holds major market shares. Europe holds the second largest market share, estimated at around 28.56% of the artificial insemination market. Artificial Insemination Market Competitive Landscapes: Big Data Meets Dairy: Genus and Lely Join Forces for Precision Breeding On Jan 2023, Partnership to integrate Genus's AI data with Lely's farm management software for improved breeding decisions. Partnership Enhanced data-driven insights for farmers, promoting precision breeding. Empowering farmers with data-driven insights to optimize animal performance and profitability. In Mar 2023, CJ Genetics & National Institute of Animal Science (Japan) Collaborated on research and development of advanced reproductive technologies for pigs. Accelerates innovation in swine AI, potentially benefiting both companies and the Japanese livestock industry. In Nov 2023, Zoetis & Boehringer Ingelheim Animal Health Agreement to co-market bovine respiratory disease vaccines, potentially impacting AI demand for healthier breeding stock. In increased competition in the animal health market, potentially benefiting farmers with wider product choices.Global Artificial Insemination Market Scope: Inquire before buying

Global Artificial Insemination Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2024: US $ 5.29 Bn. Forecast Period 2024 to 2030 CAGR: 7.8% Market Size in 2030: US $ 8.95 Bn. Segments Covered: by Type Intrauterine Intracervical Intravaginal Intratubal by Source AIH-Husband AID-Donor by End User Fertility Clinics & Other Facilities Home Global Artificial Insemination Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Market Key Players:

North America Artificial Insemination Market Key Players 1. Genus ABS (United States) 2. Cargill (United States) 3. Semex Alliance (United States) 4. STgenetics (United States) 5. Select Sires Inc.(United States) 6. Swine Genetics International (United States) 7. Shipley Swine Genetics(United States) 8. Alta Genetics (United States) 9. PIC (Pig Improvement Company) (United States) 10. Zoetis (formerly Pfizer Animal Health)(United States) 11. Elanco Animal Health (United States) 12. Merck Animal Health(United States) 13. Intervet (now part of MSD Animal Health (United States) Europe Artificial Insemination Market Key Players 1. VikingGenetics (Denmark) 2. Topigs Norsvin(Netherlands) 3. Hypor (France) 4. Boehringer Ingelheim Animal Health (Germany) 5. CRV Holding B.V. (Netherlands) Asia Pacific Artificial Insemination Market Key Players 1. Charoen Pokphand Foods PLC (CP) (Thailand) 2. Kitasato Bio-Pharmaceutical Laboratories(Japan) 3. Kobe Livestock Improvement Association(Japan) 4. CJ Genetics (South Korea) FAQs: 1. What are the drivers of the Market? Ans. Rising demand for animal agriculture and human-assisted reproduction (HAR), technological advancements in data integration and AI-powered insights, and growing awareness and acceptance of growing awareness and acceptance are the major drivers of the Artificial Insemination market in the forecast period. 2. Which region is expected to lead the global Market during the forecast period? Ans. North America is expected to lead the global Artificial Insemination Market during the forecast period. 3. What is the projected market size and growth rate of the Market? Ans. The Artificial Insemination Market size was valued at USD 5.29 Billion in 2023 and the total Artificial Insemination Market revenue is expected to grow at a CAGR of 7.8% from 2024 to 2030, reaching nearly USD 8.95 Billion by 2030. 4. What segments are covered in the Artificial Insemination Market report? Ans. The segments covered in the Artificial Insemination Market report are Type, Source, End-use, and Region. 5. What is the study period of the Market? Ans: The Global Artificial Insemination Market is studied from 2023 to 2030.

1. Artificial Insemination Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Artificial Insemination Market: Dynamics 2.1. Artificial Insemination Market Trends by Region 2.1.1. North America Artificial Insemination Market Trends 2.1.2. Europe Artificial Insemination Market Trends 2.1.3. Asia Pacific Artificial Insemination Market Trends 2.1.4. Middle East and Africa Artificial Insemination Market Trends 2.1.5. South America Artificial Insemination Market Trends 2.2. Artificial Insemination Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Artificial Insemination Market Drivers 2.2.1.2. North America Artificial Insemination Market Restraints 2.2.1.3. North America Artificial Insemination Market Opportunities 2.2.1.4. North America Artificial Insemination Market Challenges 2.2.2. Europe 2.2.2.1. Europe Artificial Insemination Market Drivers 2.2.2.2. Europe Artificial Insemination Market Restraints 2.2.2.3. Europe Artificial Insemination Market Opportunities 2.2.2.4. Europe Artificial Insemination Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Artificial Insemination Market Drivers 2.2.3.2. Asia Pacific Artificial Insemination Market Restraints 2.2.3.3. Asia Pacific Artificial Insemination Market Opportunities 2.2.3.4. Asia Pacific Artificial Insemination Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Artificial Insemination Market Drivers 2.2.4.2. Middle East and Africa Artificial Insemination Market Restraints 2.2.4.3. Middle East and Africa Artificial Insemination Market Opportunities 2.2.4.4. Middle East and Africa Artificial Insemination Market Challenges 2.2.5. South America 2.2.5.1. South America Artificial Insemination Market Drivers 2.2.5.2. South America Artificial Insemination Market Restraints 2.2.5.3. South America Artificial Insemination Market Opportunities 2.2.5.4. South America Artificial Insemination Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Artificial Insemination Industry 2.8. Analysis of Government Schemes and Initiatives For Artificial Insemination Industry 2.9. Artificial Insemination Market Trade Analysis 2.10. The Global Pandemic Impact on Artificial Insemination Market 3. Artificial Insemination Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Artificial Insemination Market Size and Forecast, by Type (2023-2030) 3.1.1. Intrauterine 3.1.2. Intracervical 3.1.3. Intravaginal 3.1.4. Intratubal 3.2. Artificial Insemination Market Size and Forecast, by Source (2023-2030) 3.2.1. AIH-Husband 3.2.2. AID-Donor 3.3. Artificial Insemination Market Size and Forecast, by End User (2023-2030) 3.3.1. Fertility Clinics & Other Facilities 3.3.2. Home 3.4. Artificial Insemination Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Artificial Insemination Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Artificial Insemination Market Size and Forecast, by Type (2023-2030) 4.1.1. Intrauterine 4.1.2. Intracervical 4.1.3. Intravaginal 4.1.4. Intratubal 4.2. North America Artificial Insemination Market Size and Forecast, by Source (2023-2030) 4.2.1. AIH-Husband 4.2.2. AID-Donor 4.3. North America Artificial Insemination Market Size and Forecast, by End User (2023-2030) 4.3.1. Fertility Clinics & Other Facilities 4.3.2. Home 4.4. North America Artificial Insemination Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Artificial Insemination Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Intrauterine 4.4.1.1.2. Intracervical 4.4.1.1.3. Intravaginal 4.4.1.1.4. Intratubal 4.4.1.2. United States Artificial Insemination Market Size and Forecast, by Source (2023-2030) 4.4.1.2.1. AIH-Husband 4.4.1.2.2. AID-Donor 4.4.1.3. United States Artificial Insemination Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Fertility Clinics & Other Facilities 4.4.1.3.2. Home 4.4.2. Canada 4.4.2.1. Canada Artificial Insemination Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Intrauterine 4.4.2.1.2. Intracervical 4.4.2.1.3. Intravaginal 4.4.2.1.4. Intratubal 4.4.2.2. Canada Artificial Insemination Market Size and Forecast, by Source (2023-2030) 4.4.2.2.1. AIH-Husband 4.4.2.2.2. AID-Donor 4.4.2.3. Canada Artificial Insemination Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Fertility Clinics & Other Facilities 4.4.2.3.2. Home 4.4.3. Mexico 4.4.3.1. Mexico Artificial Insemination Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Intrauterine 4.4.3.1.2. Intracervical 4.4.3.1.3. Intravaginal 4.4.3.1.4. Intratubal 4.4.3.2. Mexico Artificial Insemination Market Size and Forecast, by Source (2023-2030) 4.4.3.2.1. AIH-Husband 4.4.3.2.2. AID-Donor 4.4.3.3. Mexico Artificial Insemination Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Fertility Clinics & Other Facilities 4.4.3.3.2. Home 5. Europe Artificial Insemination Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.2. Europe Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.3. Europe Artificial Insemination Market Size and Forecast, by End User (2023-2030) 5.4. Europe Artificial Insemination Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.4.1.3. United Kingdom Artificial Insemination Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.4.2.3. France Artificial Insemination Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.4.3.3. Germany Artificial Insemination Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.4.4.3. Italy Artificial Insemination Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.4.5.3. Spain Artificial Insemination Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.4.6.3. Sweden Artificial Insemination Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.4.7.3. Austria Artificial Insemination Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Artificial Insemination Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Artificial Insemination Market Size and Forecast, by Source (2023-2030) 5.4.8.3. Rest of Europe Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Artificial Insemination Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.3. Asia Pacific Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Artificial Insemination Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.1.3. China Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.2.3. S Korea Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.3.3. Japan Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.4.3. India Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.5.3. Australia Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.6.3. Indonesia Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.7.3. Malaysia Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.8.3. Vietnam Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.9.3. Taiwan Artificial Insemination Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Artificial Insemination Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Artificial Insemination Market Size and Forecast, by Source (2023-2030) 6.4.10.3. Rest of Asia Pacific Artificial Insemination Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Artificial Insemination Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Artificial Insemination Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Artificial Insemination Market Size and Forecast, by Source (2023-2030) 7.3. Middle East and Africa Artificial Insemination Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Artificial Insemination Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Artificial Insemination Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Artificial Insemination Market Size and Forecast, by Source (2023-2030) 7.4.1.3. South Africa Artificial Insemination Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Artificial Insemination Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Artificial Insemination Market Size and Forecast, by Source (2023-2030) 7.4.2.3. GCC Artificial Insemination Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Artificial Insemination Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Artificial Insemination Market Size and Forecast, by Source (2023-2030) 7.4.3.3. Nigeria Artificial Insemination Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Artificial Insemination Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Artificial Insemination Market Size and Forecast, by Source (2023-2030) 7.4.4.3. Rest of ME&A Artificial Insemination Market Size and Forecast, by End User (2023-2030) 8. South America Artificial Insemination Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Artificial Insemination Market Size and Forecast, by Type (2023-2030) 8.2. South America Artificial Insemination Market Size and Forecast, by Source (2023-2030) 8.3. South America Artificial Insemination Market Size and Forecast, by End User(2023-2030) 8.4. South America Artificial Insemination Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Artificial Insemination Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Artificial Insemination Market Size and Forecast, by Source (2023-2030) 8.4.1.3. Brazil Artificial Insemination Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Artificial Insemination Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Artificial Insemination Market Size and Forecast, by Source (2023-2030) 8.4.2.3. Argentina Artificial Insemination Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Artificial Insemination Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Artificial Insemination Market Size and Forecast, by Source (2023-2030) 8.4.3.3. Rest Of South America Artificial Insemination Market Size and Forecast, by End User (2023-2030) 9. Global Artificial Insemination Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Artificial Insemination Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Genus ABS (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cargill (United States) 10.3. Semex Alliance (United States) 10.4. STgenetics (United States) 10.5. Select Sires Inc.(United States) 10.6. Swine Genetics International (United States) 10.7. Shipley Swine Genetics(United States) 10.8. Alta Genetics (United States) 10.9. PIC (Pig Improvement Company) (United States) 10.10. Zoetis (formerly Pfizer Animal Health)(United States) 10.11. Elanco Animal Health (United States) 10.12. Merck Animal Health(United States) 10.13. Intervet (now part of MSD Animal Health (United States) 10.14. VikingGenetics (Denmark) 10.15. Topigs Norsvin(Netherlands) 10.16. Hypor (France) 10.17. Boehringer Ingelheim Animal Health (Germany) 10.18. CRV Holding B.V. (Netherlands) 10.19. Charoen Pokphand Foods PLC (CP) (Thailand) 10.20. Kitasato Bio-Pharmaceutical Laboratories(Japan) 10.21. Kobe Livestock Improvement Association(Japan) 10.22. CJ Genetics (South Korea) 11. Key Findings 12. Industry Recommendations 13. Artificial Insemination Market: Research Methodology 14. Terms and Glossary