The Fruit Concentrate Market size was valued at USD 46.20 Billion in 2024 and the total Fruit Concentrate revenue is expected to grow at a CAGR of 4.55% from 2025 to 2032, reaching nearly USD 65.95 Billion.Overview of the Fruit Concentrate Market

The Fruit Concentrate is the fruit juice or extract without any water present in it. This product of fruit is dissolvable in water to form fresh fruit juice also it is preservative-free and sugar-free as it is a pure form of pulp or extract which is obtained from real fruit. The Juice from concentrate is cheaper and easily available in the market. The Fruit Concentrate Market is thoroughly elaborated by offering several pieces of information such as Fruit Concentrate market size, key players and their market value, their recent developments as well as their partnerships, mergers, and acquisitions. The graphical representation and structural exclusive information showed the dominating region of the Fruit Concentrate Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Fruit Concentrate Market.To know about the Research Methodology :- Request Free Sample Report

Fruit Concentrate Market Dynamics

Increasing demand for natural and sugar-free fruit by-products is the major driver of the fruit concentrate market With the increasing awareness about health-related issues and concerns consumers seem to be shifting towards healthier options and one of them is fruit concentrate which is dissolvable in water easily as well as it is sugar-free and preservatives free. There is a raising preference toward natural and more minimally preserved or processed food. The Fruit Concentrate Market is blooming and it is a globally spread market these demands are beneficial for the fruit concentrate market as the fruit concentrate is available in various types, fruits and natural real fruit extracts are known to be healthier options for diabetic patients to consume real fruit. The market's expansion is fueled by the demand for natural and healthy products. The global food service industry, encompassing restaurants, cafes, hotels, and catering services, is experiencing substantial growth. Fruit concentrates find wide applications in food service establishments for creating beverages, sauces, dressings, and desserts. The expansion of the food service industry directly impacts the demand for fruit concentrates in the fruit concentrates market. Volatile raw material prices and intense competition are the major restraint in the fruit concentrate market The costs of fruits used in fruit concentrate production fluctuate due to factors like weather conditions, crop diseases, and global supply and demand dynamics. Such price volatility presents challenges for fruit concentrate manufacturers in terms of cost management and pricing strategies. The fruit concentrate market is highly competitive, with numerous players striving for fruit concentrate market share. Intense competition leads to price wars and margin pressures, especially for small and medium-sized companies. Established brands and economies of scale create barriers to entry for new market entrants. Changing consumer preferences and tastes and Supply chain management are the main challenges facing the fruit concentrate market Consumer preferences for fruits and trends change rapidly, necessitating agility and adaptability for fruit concentrate manufacturers. Keeping up with evolving consumer demands, such as preferences for new fruit varieties or flavor combinations, pose a challenge for fruit concentrate market players. Ensuring a consistent and reliable supply of high-quality fruit raw materials is challenging, especially for companies relying on seasonal crops or sourcing fruits from different regions. Efficient supply chain management, including storage, transportation, and processing, is crucial for meeting customer demands and maintaining product quality. Expanding product applications and vast demand for natural and organic products these factors are boosting the opportunities in the fruit concentrate market Fruit concentrates have versatile applications beyond beverages, including bakery, confectionery, dairy, and frozen desserts. Exploring and expanding into new product categories and applications unlock fresh fruit concentrate market opportunities and revenue streams. Increasing consumer awareness of health and wellness has created opportunities for fruit concentrate manufacturers to tap into the demand for natural and organic products. Developing fruit concentrates with clean labels, devoid of additives and artificial ingredients, cater to this growing fruit concentrate market segment. Functional and fortified fruit concentrates and Sustainable sourcing and production are the current trends in the fruit concentrate market The trend towards functional foods and beverages offering health benefits beyond basic nutrition is on the rise. Fruit concentrates fortified with vitamins, minerals, antioxidants, or specific functional ingredients are gaining popularity among health-conscious consumers. Consumers place greater emphasis on sustainability and environmental responsibility. Fruit concentrate manufacturers are adopting sustainable sourcing practices, such as supporting local farmers, implementing eco-friendly production processes, and reducing waste and carbon footprint. Unique and exotic fruit fruits are gaining traction in the fruit concentrate market. Fruit concentrate manufacturers are exploring new flavor profiles and combinations to meet the demand for novel taste experiences and cater to diverse consumer preferences.Segmentation Analysis of the Fruit Concentrate Market

By Fruit Type: Apple concentrate holds a significant share due to its versatile applications in juices, ciders, and various processed foods. Growing demand for natural sweeteners and the popularity of apple-based products contribute to market growth. Price volatility in apple production may impact the concentrate market. High demand in beverages and desserts; orange concentrate remains a dominant player in the market. Rising health consciousness boosts the demand for orange-based products and natural flavors. Seasonal variations and susceptibility to diseases affecting orange crops pose challenges. Lemon concentrate caters to beverages, desserts, and sauces, showing consistent growth. Increasing popularity in the production of lemon-flavored products and health-oriented beverages. Dependence on weather conditions for lemon cultivation impacts the supply chain.By Application: The beverages segment emerges as a leading consumer of fruit concentrates, incorporating various fruit types to enhance flavor profiles in juices, smoothies, and other drinks. Bakery and confectionery products utilize a range of fruit concentrates, such as apple, orange, and specialty fruit types, to infuse natural sweetness and fruitiness into baked goods and sweets. In the Dairy Products category, fruit concentrates find application in flavored yogurts, ice creams, and other dairy-based products. Sauces, Dressings, and Marinades constitute another vital application segment, wherein lemon, apple, and specialty fruit concentrates contribute to the unique taste and aroma of these culinary products. The Frozen Dessert and Sorbets segment relies heavily on a variety of fruit concentrates to create vibrant and flavourful frozen treats. Lastly, the broad category of 'Other' applications underscores the versatility of fruit concentrates, as they are employed in an array of food and beverage products beyond the specified segments, showcasing the adaptability and widespread utility of fruit concentrates in the market.

Regional Analysis of the Fruit Concentrate Market

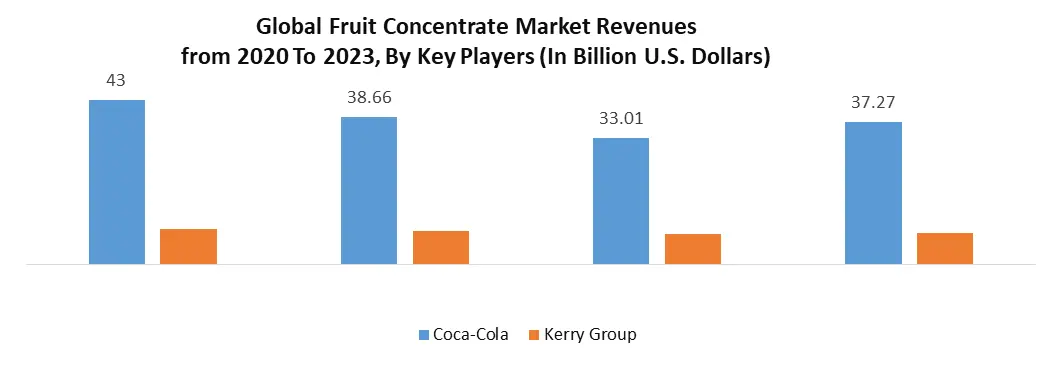

North America boasts significant fruit concentrate production, with the United States and Canada as key contributors. The region benefits from diverse fruit cultivation, including citrus fruits, berries, apples, and more. Favorable climate conditions in certain states and provinces facilitate abundant fruit production and subsequent concentrate manufacturing. Well-established fruit concentrate manufacturing facilities equipped with advanced technologies and stringent quality control measures are present in North America. The region possesses a robust infrastructure for fruit processing and packaging, ensuring efficient manufacturing operations. North American manufacturers often prioritize the development of innovative fruit concentrate products to cater to evolving consumer preferences and dietary trends. Most of the Asian regional countries are known to be tropical countries as some countries come under favorable tropical climate conditions. The Asia-Pacific region is a prominent hub for fruit concentrate production in the fruit concentrate market, driven by countries such as China, India, Thailand, and Vietnam. The region benefits from vast agricultural landscapes and a wide variety of fruits, including tropical varieties like mangoes, pineapples, and bananas. Europe showcases notable fruit concentrate production, with countries like Spain, Italy, Poland, and Germany emerging as key producers. The region benefits from diverse fruit cultivation, encompassing berries, citrus fruits, stone fruits, and apples. Some European countries possess a long history of fruit cultivation and processing, establishing them as significant contributors to the fruit concentrate market. Europe boasts well-established fruit concentrate manufacturing facilities that adhere to stringent quality standards and food safety regulations. Manufacturers in the region emphasize sustainable practices and prioritize the production of high-quality fruit concentrates for both domestic and international markets. Additionally, European manufacturers frequently explore new fruit varieties and innovative processing techniques to meet consumer demands. Competitive Landscape of Fruit Concentrate Market The Coca‑Cola Company is a total beverage company with products sold in more than 200 countries and territories. Coca-Cola is an emerging company that has focused on innovative product launches, sustainability, improved quality of taste, and more concentration on environmentally friendly packaging solutions and reducing plastic waste. Coca-Cola has been vigorously expanding its production as well as catering to changing consumer preferences and trends. The Coca‑Cola Company Announces Participation in dbAccess Global Consumer Conference. Two of The Coca‑Cola Company’s biggest brands in North America are taking major steps to support a circular economy for plastic packaging. DASANI is rolling out bottles made from 100% recycled PET plastic (excluding caps and labels), The Coca-Cola Company announced three goals related to the strategy’s key focus areas. Achieve 100% circular water use – or regenerative water use – across 175 facilities identified as “leadership locations” by . Work with partners to help improve the health of 60 watersheds identified as most critical for the company's operations and agricultural supply chains by . Aim to return a cumulative total of 2 trillion liters of water to nature and communities globally, between. The Coca‑Cola Company announces a strategic partnership with Microsoft to transform global engagement and experiences. Tree Top is a prominent player in the fruit concentrate market. Tree Top is a grower-owned cooperative consisting of nearly 900 apple and pear growers. Founded in 1960 in the heart of Washington's apple country, Tree Top has been at the forefront of producing premium, high-quality juices and apple sauce. Leveraging its fruit expertise and reliable fruit sources, the company now offers the widest range of fruit-based products and solutions to both consumers and leading food and beverage manufacturers worldwide. Tree Top Company has various products which are originally made from real fruit or fruit extracts without sugar and water. Such products are Apple Sauce, Fruit Snacks, and Fruit+Water these are the main products that is made in Tree Top. Tree Top® Partners With DAYTONA 500 CHAMPION Ricky Stenhouse Jr. and the Kroger Racing Team for First Time. Tree Top operates seven production facilities strategically located near the fruit-growing regions in Washington, Oregon, and California. This proximity allows them to create healthful fruit products using simple ingredients. With a commitment to delighting consumers around the world, Tree Top produces a diverse portfolio of fruit-based offerings, meeting the preferences and demands of a global fruit concentrate market.

Global Fruit Concentrate Market Scope: Inquire before buying

Global Fruit Concentrate Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 46.20 Bn. Forecast Period 2025 to 2032 CAGR: 4.55% Market Size in 2032: USD 65.95 Bn. Segments Covered: by Fruit Types Apple Orange Lemon Pineapple Grapes Pear Specialty fruits Other fruits by Applications Beverages Bakery & Confectionery Products Dairy Products Sauces, Dressings, & Marinates Frozen Dessert & Sorbets Other Fruit Concentrate Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Fruit Concentrate Market

1. Coca-Cola Company 2. Tree Top Inc. 3. Welch Foods Inc. 4. PepsiCo, Inc. 5. Archer Daniels Midland Company 6. Kerry Group 7. Ingredion Incorporated 8. Döhler Group 9. SunOpta Inc. 10. Agrana Beteiligungs-AG 11. Symrise AG 12. SVZ International B.V. 13. Kanegrade Ltd. 14. Citrus World, Inc. 15. Welch's 16. Sudzucker AG 17. Diana Food 18. FruitSmart, Inc. 19. Schwan's Company Frequently Asked Questions: 1] What segments are covered in the Global Fruit Concentrate Market report? Ans. The segments covered in the Fruit Concentrate Market report are based on Product, Fruit Type, Application, End User. 2] What is the growth rate of Global Fruit Concentrate Market? Ans: The Global Fruit Concentrate Market is growing at a CAGR of 4.55% during forecasting period 2025-2032. 3] What is the forecast period for the Global Fruit Concentrate Market? Ans. The forecast period for the Global Fruit Concentrate Market is 2025-2032. 4] What is the market size of the Global Fruit Concentrate Market by 2032? Ans. The market size of the Global Fruit Concentrate Market by 2032 is expected to reach USD 65.95 Bn. 5] What was the Global Fruit Concentrate Market size in 2024? Ans: The Global Fruit Concentrate Market size was USD 46.20 Billion in 2024.

1. Fruit Concentrate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Fruit Concentrate Market: Dynamics 2.1. Fruit Concentrate Market Trends by Region 2.1.1. North America Fruit Concentrate Market Trends 2.1.2. Europe Fruit Concentrate Market Trends 2.1.3. Asia Pacific Fruit Concentrate Market Trends 2.1.4. Middle East and Africa Fruit Concentrate Market Trends 2.1.5. South America Fruit Concentrate Market Trends 2.2. Fruit Concentrate Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Fruit Concentrate Market Drivers 2.2.1.2. North America Fruit Concentrate Market Restraints 2.2.1.3. North America Fruit Concentrate Market Opportunities 2.2.1.4. North America Fruit Concentrate Market Challenges 2.2.2. Europe 2.2.2.1. Europe Fruit Concentrate Market Drivers 2.2.2.2. Europe Fruit Concentrate Market Restraints 2.2.2.3. Europe Fruit Concentrate Market Opportunities 2.2.2.4. Europe Fruit Concentrate Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Fruit Concentrate Market Drivers 2.2.3.2. Asia Pacific Fruit Concentrate Market Restraints 2.2.3.3. Asia Pacific Fruit Concentrate Market Opportunities 2.2.3.4. Asia Pacific Fruit Concentrate Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Fruit Concentrate Market Drivers 2.2.4.2. Middle East and Africa Fruit Concentrate Market Restraints 2.2.4.3. Middle East and Africa Fruit Concentrate Market Opportunities 2.2.4.4. Middle East and Africa Fruit Concentrate Market Challenges 2.2.5. South America 2.2.5.1. South America Fruit Concentrate Market Drivers 2.2.5.2. South America Fruit Concentrate Market Restraints 2.2.5.3. South America Fruit Concentrate Market Opportunities 2.2.5.4. South America Fruit Concentrate Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Fruit Concentrate Industry 2.8. Analysis of Government Schemes and Initiatives For Fruit Concentrate Industry 2.9. Fruit Concentrate Market Trade Analysis 2.10. The Global Pandemic Impact on Fruit Concentrate Market 3. Fruit Concentrate Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 3.1.1. Apple 3.1.2. Orange 3.1.3. Lemon 3.1.4. Pineapple 3.1.5. Grapes 3.1.6. Pear 3.1.7. Specialty fruits 3.1.8. Other fruits 3.2. Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 3.2.1. Beverages 3.2.2. Bakery & Confectionery Products 3.2.3. Dairy Products 3.2.4. Sauces, Dressings, & Marinates 3.2.5. Frozen Dessert & Sorbets 3.2.6. Other 3.3. Fruit Concentrate Market Size and Forecast, by Region (2024-2032) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Fruit Concentrate Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 4.1.1. Apple 4.1.2. Orange 4.1.3. Lemon 4.1.4. Pineapple 4.1.5. Grapes 4.1.6. Pear 4.1.7. Specialty fruits 4.1.8. Other fruits 4.2. North America Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 4.2.1. Beverages 4.2.2. Bakery & Confectionery Products 4.2.3. Dairy Products 4.2.4. Sauces, Dressings, & Marinates 4.2.5. Frozen Dessert & Sorbets 4.2.6. Other 4.3. North America Fruit Concentrate Market Size and Forecast, by Country (2024-2032) 4.3.1. United States 4.3.1.1. United States Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 4.3.1.1.1. Apple 4.3.1.1.2. Orange 4.3.1.1.3. Lemon 4.3.1.1.4. Pineapple 4.3.1.1.5. Grapes 4.3.1.1.6. Pear 4.3.1.1.7. Specialty fruits 4.3.1.1.8. Other fruits 4.3.1.2. United States Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 4.3.1.2.1. Beverages 4.3.1.2.2. Bakery & Confectionery Products 4.3.1.2.3. Dairy Products 4.3.1.2.4. Sauces, Dressings, & Marinates 4.3.1.2.5. Frozen Dessert & Sorbets 4.3.1.2.6. Other 4.3.2. Canada 4.3.2.1. Canada Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 4.3.2.1.1. Apple 4.3.2.1.2. Orange 4.3.2.1.3. Lemon 4.3.2.1.4. Pineapple 4.3.2.1.5. Grapes 4.3.2.1.6. Pear 4.3.2.1.7. Specialty fruits 4.3.2.1.8. Other fruits 4.3.2.2. Canada Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 4.3.2.2.1. Beverages 4.3.2.2.2. Bakery & Confectionery Products 4.3.2.2.3. Dairy Products 4.3.2.2.4. Sauces, Dressings, & Marinates 4.3.2.2.5. Frozen Dessert & Sorbets 4.3.2.2.6. Other 4.3.3. Mexico 4.3.3.1. Mexico Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 4.3.3.1.1. Apple 4.3.3.1.2. Orange 4.3.3.1.3. Lemon 4.3.3.1.4. Pineapple 4.3.3.1.5. Grapes 4.3.3.1.6. Pear 4.3.3.1.7. Specialty fruits 4.3.3.1.8. Other fruits 4.3.3.2. Mexico Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 4.3.3.2.1. Beverages 4.3.3.2.2. Bakery & Confectionery Products 4.3.3.2.3. Dairy Products 4.3.3.2.4. Sauces, Dressings, & Marinates 4.3.3.2.5. Frozen Dessert & Sorbets 4.3.3.2.6. Other 5. Europe Fruit Concentrate Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.2. Europe Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 5.3. Europe Fruit Concentrate Market Size and Forecast, by Country (2024-2032) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.3.1.2. United Kingdom Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 5.3.2. France 5.3.2.1. France Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.3.2.2. France Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 5.3.3. Germany 5.3.3.1. Germany Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.3.3.2. Germany Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 5.3.4. Italy 5.3.4.1. Italy Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.3.4.2. Italy Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 5.3.5. Spain 5.3.5.1. Spain Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.3.5.2. Spain Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 5.3.6. Sweden 5.3.6.1. Sweden Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.3.6.2. Sweden Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 5.3.7. Austria 5.3.7.1. Austria Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.3.7.2. Austria Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 5.3.8.2. Rest of Europe Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6. Asia Pacific Fruit Concentrate Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.2. Asia Pacific Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3. Asia Pacific Fruit Concentrate Market Size and Forecast, by Country (2024-2032) 6.3.1. China 6.3.1.1. China Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.1.2. China Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.2. S Korea 6.3.2.1. S Korea Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.2.2. S Korea Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.3. Japan 6.3.3.1. Japan Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.3.2. Japan Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.4. India 6.3.4.1. India Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.4.2. India Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.5. Australia 6.3.5.1. Australia Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.5.2. Australia Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.6. Indonesia 6.3.6.1. Indonesia Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.6.2. Indonesia Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.7. Malaysia 6.3.7.1. Malaysia Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.7.2. Malaysia Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.8. Vietnam 6.3.8.1. Vietnam Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.8.2. Vietnam Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.9. Taiwan 6.3.9.1. Taiwan Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.9.2. Taiwan Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 6.3.10.2. Rest of Asia Pacific Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 7. Middle East and Africa Fruit Concentrate Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 7.2. Middle East and Africa Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 7.3. Middle East and Africa Fruit Concentrate Market Size and Forecast, by Country (2024-2032) 7.3.1. South Africa 7.3.1.1. South Africa Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 7.3.1.2. South Africa Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 7.3.2. GCC 7.3.2.1. GCC Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 7.3.2.2. GCC Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 7.3.3. Nigeria 7.3.3.1. Nigeria Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 7.3.3.2. Nigeria Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 7.3.4.2. Rest of ME&A Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 8. South America Fruit Concentrate Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 8.2. South America Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 8.3. South America Fruit Concentrate Market Size and Forecast, by Country (2024-2032) 8.3.1. Brazil 8.3.1.1. Brazil Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 8.3.1.2. Brazil Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 8.3.2. Argentina 8.3.2.1. Argentina Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 8.3.2.2. Argentina Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Fruit Concentrate Market Size and Forecast, by Fruit Types (2024-2032) 8.3.3.2. Rest Of South America Fruit Concentrate Market Size and Forecast, by Applications (2024-2032) 9. Global Fruit Concentrate Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading Fruit Concentrate Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Coca-Cola Company 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Tree Top Inc. 10.3. Welch Foods Inc. 10.4. PepsiCo, Inc. 10.5. Archer Daniels Midland Company 10.6. Kerry Group 10.7. Ingredion Incorporated 10.8. Döhler Group 10.9. SunOpta Inc. 10.10. Agrana Beteiligungs-AG 10.11. Symrise AG 10.12. SVZ International B.V. 10.13. Kanegrade Ltd. 10.14. Citrus World, Inc. 10.15. Welch's 10.16. Sudzucker AG 10.17. Diana Food 10.18. FruitSmart, Inc. 10.19. Schwan's Compa 11. Key Findings 12. Industry Recommendations 13. Fruit Concentrate Market: Research Methodology 14. Terms and Glossary