The Freshwater Fish Market size was valued at US 241.26 Bn in 2023 and market revenue is growing at a CAGR of 2.8 % from 2023 to 2030, reaching nearly USD 292.71 Bn by 2030. Around 51 percent of all fish species are found in freshwater, which is more than 18000 different species. Over the past few years, the demand for freshwater fish has increased steadily due to factors such as the growing population, rising consumer awareness about the health benefits of fish consumption, and growing aquaculture practices. The species that dominate the global market are Salmon, Trout, and Tilapia. During the forecast period, the market is expected to be influenced by rising environmental concerns, consumer preferences, regulations, and emerging trends such as alternative protein sources and technological advancements.To know about the Research Methodology :- Request Free Sample Report The freshwater fish market is poised for robust growth driven by rising global demand, health-conscious consumer trends, and ongoing aquaculture innovation. Increasing populations, particularly in developing regions, boost the consumption of freshwater fish as a dietary staple. Technological advancements in aquaculture, including automation and data analytics, promise improved efficiency and sustainability in production. Consumer preferences for sustainably sourced seafood are incentivizing market players to adopt eco-certifications and responsible practices. Also, growing market access into new regions and globalization efforts are opening up fresh opportunities for market growth.

Freshwater Fish Market Dynamics

Driver Increasing Consumption of Aquatic Foods Drives Market Growth Consumers are becoming more aware of the health benefits associated with consuming freshwater fish, which is increasing the demand for it. The trend towards healthier eating habits and a focus on lean protein sources has led to an increase in preference for freshwater fish because they are perceived as a low-fat and low-calorie protein option. According to the Food and Agricultural Organization (FAO) of the United Nations, around 10 percent of the global population depends on fisheries for their livelihood. In the past few years, aquaculture has grown immensely and provides half of all fish for human consumption. The FAO of the United Nations also found that in 2020 consumption of Tuna increased. More than 7 million metric tons of tuna and tuna-such as species are harvested yearly, of which 66.7 percent are fished at biologically sustainable levels. Tuna accounts for about 20 percent of the value of all marine fisheries caught and over eight percent of all seafood traded globally. The freshwater fish market is experiencing growth alongside these trends, as consumers seek sustainable and healthy protein sources.Increasing Adoption of Sustainable Practices Boosts the Market Growth The adoption of sustainable practices has prioritized the responsible use of natural resources by reducing the negative environmental impacts associated with freshwater fish production. It has minimized water usage, optimized feed efficiency, and reduced pollution and habitat degradation. The Global Environment Facility (GEF), and partners including the United Nations Environment Programme (UNEP), co-financed and implemented a five-year, USD 50 million program known as the Global Sustainable Fisheries Management and Biodiversity in Areas Beyond National Jurisdiction (ABNJ) to ensure more sustainable management of tuna fisheries. This program is led by FAO. In 2022, UNEP designed a national project that was funded by the Global Environment Facility to strengthen aquaculture policy, planning, and management in Palau. This project is expected to guide the development of the aquaculture sector to complement Palau’s legacy of marine biodiversity conservation. The Freshwater Fish Market is striving to integrate similar sustainable practices to ensure the long-term viability of freshwater ecosystems and the species they support. Restrain Overfishing, depletion, and habitat loss concerns limit the Market Growth The overfishing and unsustainable fishing practices on a large scale in some areas have led to a depletion of freshwater fish populations. The growing construction industry, including urbanization and dam construction on a large scale, has destroyed many freshwater habitats, limited natural breeding, and fed grounds for fish. Habitat loss is expected to lead to reduced populations and fish yields. Every year, up to 400 million tons of pollution are dumped into freshwater ecosystems. Agriculture is the largest user of the world’s available freshwater, and as the human population grows, demand is expected to increase. According to a study, nearly one-third of all freshwater fish are threatened with extinction, with 16 freshwater fish species declared extinct in 2020. The challenges facing freshwater fish highlight the urgency of sustainable practices and conservation efforts to protect these vital ecosystems. Future of the Freshwater Fish Market Fish farming in autonomous roaming robotic cages — aquapods are expected to be a big thing in aquaculture in the future. The robotics cages require high investment costs but the technology also saves money. The aquapods grow fish in the open sea. The robots examine and repair nets, which offers a safer and more efficient way of fish farming and operation management. Many companies use sensor technologies to enable the analysis of fish farms. Drones offer live video streaming for farmers to inspect the health of aquatic organisms without taking any risks. Artificial intelligence helps in predictive analysis and offers improved data-based decision-making. All the technological advancements are expected to drive the Freshwater Fish Market in the future.

Freshwater Fish Market Segment Analysis

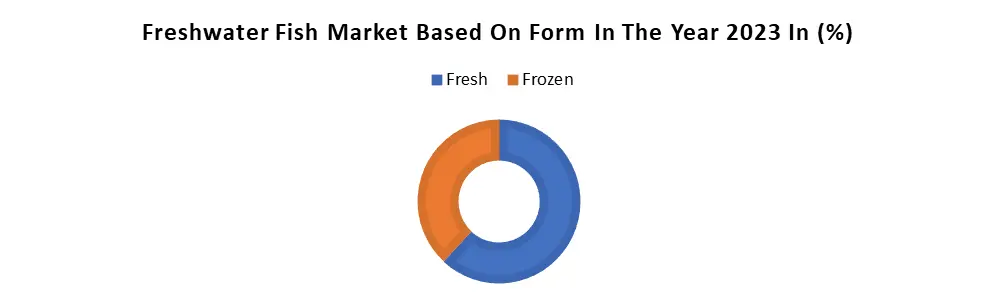

Based on Product, the pelagic segment dominated the product segment of the Freshwater Fish Market in the year 2023. Pelagic fish species, such as salmon and trout, thrive in open-water environments and are well-suited for large-scale commercial fishing operations. These species often have high market demand due to their popularity among consumers for their taste, texture, and nutritional value. Also, pelagic fish are commonly targeted by both commercial and recreational fishermen due to their abundance in certain freshwater bodies. This abundance, coupled with their relatively fast growth rates compared to other freshwater species, makes them attractive targets for commercial exploitation. Advancements in fishing technologies and techniques, such as sonar and trawling methods, have facilitated the efficient capture of pelagic fish, further driving their dominance in the market. This efficiency allows for higher volumes of pelagic fish to be harvested and brought to market, meeting consumer demand more effectively. Therefore, the versatility of pelagic fish in terms of processing and preparation also contributes to their dominance in the Freshwater Fish Market.Based on Form, the fresh fish segment dominated the form segment of the Freshwater Fish Market in the year 2023. Due to the consumer preference, many individuals prioritize the taste, texture, and nutritional benefits of fresh fish over other forms. Fresh fish is perceived as superior in quality compared to frozen or processed alternatives, appealing to health-conscious consumers seeking unadulterated food options. Also, the culinary versatility of fresh fish enables consumers to prepare it in various ways according to their preferences, further driving demand. Advances in supply chain logistics and transportation ensure the efficient distribution of fresh fish from fishing grounds to markets, maintaining its freshness and availability year-round. Moreover, the accessibility of fresh fish in supermarkets, fish markets, and restaurants contributes to its dominance in the Freshwater Fish Market, meeting consumer demand for convenient and high-quality seafood options.

Freshwater Fish Market Regional Insights

Asia Pacific Freshwater Fish Market held the largest share of the global market in 2023. China is a leading player in both freshwater fish production and consumption due to its large-scale aquaculture operations, high levels of domestic consumption, and extensive fish farming practices. The country produces a variety of freshwater fish species such as carp, tilapia, and catfish, among others. Indonesia is the second largest freshwater fish producer after China. The high demand for fish in the local diets and the presence of significant aquaculture activities in countries like India, Thailand, Indonesia, and Vietnam are majorly driving regional market growth.North American Freshwater Fish Market is expected to grow at a high rate during the forecast period. The United States and Canada have substantial aquaculture operations and are majorly contributing to the regional market growth with species such as trout and catfish. In the US alone, freshwater fisheries generate more than USD 37 billion. The aquaculture sector in the region is growing rapidly with trout and catfish being major farmed species. Some farms also produce other freshwater fish such as tilapia. The aquaculture and fishing industries are majorly adopting sustainable practices to address environmental concerns. Sustainable aquaculture farming techniques adopted by the US mainly focus on food production and environmental stewardship. The free OceanReports mapping and planning tool is an advanced technology that analyses ocean neighborhoods. The regulations such as the Magnuson–Stevens Fishery Conservation and Management Act, the primary law that governs marine fisheries management in U.S. federal water ensure the conservation of wild fish populations and the responsible management of aquaculture operations.

Global Freshwater Fish Market Scope: Inquire before buying

Global Freshwater Fish Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 241.26 Bn. Forecast Period 2024 to 2030 CAGR: 2.8% Market Size in 2030: US $ 292.71 Bn Segments Covered: by Product Pelagic Demersal by Form Fresh Frozen by Distribution Channel Offline Online Freshwater Fish Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Freshwater Fish Market Key players

North America 1. True World Foods (US) 2. Trident Seafoods (US) 3. Cooke Aquaculture Inc (Canada) 4. Blue Ridge Aquaculture (US) Europe 1. Mowi (Norway) 2. Thai Union Group PCL (Thailand) 3. Cermaq Group AS (Norway) 4. Stolt Sea Farm (UK) 5. Stehr Group (Australia) 6. Leigh Fisheries (New Zealand) 7. Priory Fishery Ltd. (UK) 8. Austevoll Seafood ASA (Norway) 9. Regal Springs (Switzerland) Asia Pacific 1. Hainan Xiangtai Fishery Co., Ltd (China) Frequently Asked Questions 1] What segments are covered in the Global Freshwater Fish Market report? Ans. The segments covered in the Freshwater Fish Market report are based on Product, Form, Distribution Channel, and Regions. 2] Which region is expected to hold the highest share of the Global Freshwater Fish Market? Ans. The Asia Pacific region is expected to hold the highest share of the Freshwater Fish Market. 3] What is the market size of the Global Freshwater Fish Market by 2030? Ans. The market size of the Freshwater Fish Market by 2030 is expected to reach US$ 292.71Bn. 4] What was the market size of the Global Freshwater Fish Market in 2023? Ans. The market size of the Freshwater Fish Market in 2023 was valued at US$ 241.26 Bn. 5] Key players in the Freshwater Fish Market. Ans. True World Foods (US), Trident Seafoods (US), Cooke Aquaculture Inc (Canada)

1. Freshwater Fish Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Freshwater Fish Market: Dynamics 2.1. Freshwater Fish Market Trends by Region 2.1.1. North America Freshwater Fish Market Trends 2.1.2. Europe Freshwater Fish Market Trends 2.1.3. Asia Pacific Freshwater Fish Market Trends 2.1.4. Middle East and Africa Freshwater Fish Market Trends 2.1.5. South America Freshwater Fish Market Trends 2.2. Freshwater Fish Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Freshwater Fish Market Drivers 2.2.1.2. North America Freshwater Fish Market Restraints 2.2.1.3. North America Freshwater Fish Market Opportunities 2.2.1.4. North America Freshwater Fish Market Challenges 2.2.2. Europe 2.2.2.1. Europe Freshwater Fish Market Drivers 2.2.2.2. Europe Freshwater Fish Market Restraints 2.2.2.3. Europe Freshwater Fish Market Opportunities 2.2.2.4. Europe Freshwater Fish Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Freshwater Fish Market Drivers 2.2.3.2. Asia Pacific Freshwater Fish Market Restraints 2.2.3.3. Asia Pacific Freshwater Fish Market Opportunities 2.2.3.4. Asia Pacific Freshwater Fish Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Freshwater Fish Market Drivers 2.2.4.2. Middle East and Africa Freshwater Fish Market Restraints 2.2.4.3. Middle East and Africa Freshwater Fish Market Opportunities 2.2.4.4. Middle East and Africa Freshwater Fish Market Challenges 2.2.5. South America 2.2.5.1. South America Freshwater Fish Market Drivers 2.2.5.2. South America Freshwater Fish Market Restraints 2.2.5.3. South America Freshwater Fish Market Opportunities 2.2.5.4. South America Freshwater Fish Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Freshwater Fish Industry 2.8. Analysis of Government Schemes and Initiatives For Freshwater Fish Industry 2.9. Freshwater Fish Market Trade Analysis 2.10. The Global Pandemic Impact on Freshwater Fish Market 3. Freshwater Fish Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Freshwater Fish Market Size and Forecast, by Product (2023-2030) 3.1.1. Pelagic 3.1.2. Demersal 3.2. Freshwater Fish Market Size and Forecast, by Form (2023-2030) 3.2.1. Fresh 3.2.2. Frozen 3.3. Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Offline 3.3.2. Online 3.4. Freshwater Fish Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Freshwater Fish Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Freshwater Fish Market Size and Forecast, by Product (2023-2030) 4.1.1. Pelagic 4.1.2. Demersal 4.2. North America Freshwater Fish Market Size and Forecast, by Form (2023-2030) 4.2.1. Fresh 4.2.2. Frozen 4.3. North America Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Offline 4.3.2. Online 4.4. North America Freshwater Fish Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Freshwater Fish Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Pelagic 4.4.1.1.2. Demersal 4.4.1.2. United States Freshwater Fish Market Size and Forecast, by Form (2023-2030) 4.4.1.2.1. Fresh 4.4.1.2.2. Frozen 4.4.1.3. United States Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Offline 4.4.1.3.2. Online 4.4.2. Canada 4.4.2.1. Canada Freshwater Fish Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Pelagic 4.4.2.1.2. Demersal 4.4.2.2. Canada Freshwater Fish Market Size and Forecast, by Form (2023-2030) 4.4.2.2.1. Fresh 4.4.2.2.2. Frozen 4.4.2.3. Canada Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Offline 4.4.2.3.2. Online 4.4.3. Mexico 4.4.3.1. Mexico Freshwater Fish Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Pelagic 4.4.3.1.2. Demersal 4.4.3.2. Mexico Freshwater Fish Market Size and Forecast, by Form (2023-2030) 4.4.3.2.1. Fresh 4.4.3.2.2. Frozen 4.4.3.3. Mexico Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Offline 4.4.3.3.2. Online 5. Europe Freshwater Fish Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.2. Europe Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.3. Europe Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Freshwater Fish Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.4.1.3. United Kingdom Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.4.2.3. France Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.4.3.3. Germany Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.4.4.3. Italy Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.4.5.3. Spain Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.4.6.3. Sweden Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.4.7.3. Austria Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Freshwater Fish Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Freshwater Fish Market Size and Forecast, by Form (2023-2030) 5.4.8.3. Rest of Europe Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Freshwater Fish Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.3. Asia Pacific Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Freshwater Fish Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.1.3. China Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.2.3. S Korea Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.3.3. Japan Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.4.3. India Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.5.3. Australia Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.6.3. Indonesia Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.7.3. Malaysia Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.8.3. Vietnam Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.9.3. Taiwan Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Freshwater Fish Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Freshwater Fish Market Size and Forecast, by Form (2023-2030) 6.4.10.3. Rest of Asia Pacific Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Freshwater Fish Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Freshwater Fish Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Freshwater Fish Market Size and Forecast, by Form (2023-2030) 7.3. Middle East and Africa Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Freshwater Fish Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Freshwater Fish Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Freshwater Fish Market Size and Forecast, by Form (2023-2030) 7.4.1.3. South Africa Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Freshwater Fish Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Freshwater Fish Market Size and Forecast, by Form (2023-2030) 7.4.2.3. GCC Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Freshwater Fish Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Freshwater Fish Market Size and Forecast, by Form (2023-2030) 7.4.3.3. Nigeria Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Freshwater Fish Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Freshwater Fish Market Size and Forecast, by Form (2023-2030) 7.4.4.3. Rest of ME&A Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Freshwater Fish Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Freshwater Fish Market Size and Forecast, by Product (2023-2030) 8.2. South America Freshwater Fish Market Size and Forecast, by Form (2023-2030) 8.3. South America Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Freshwater Fish Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Freshwater Fish Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Freshwater Fish Market Size and Forecast, by Form (2023-2030) 8.4.1.3. Brazil Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Freshwater Fish Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Freshwater Fish Market Size and Forecast, by Form (2023-2030) 8.4.2.3. Argentina Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Freshwater Fish Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Freshwater Fish Market Size and Forecast, by Form (2023-2030) 8.4.3.3. Rest Of South America Freshwater Fish Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Freshwater Fish Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Freshwater Fish Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. True World Foods (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Trident Seafoods (US) 10.3. Cooke Aquaculture Inc (Canada) 10.4. Blue Ridge Aquaculture (US) 10.5. Mowi (Norway) 10.6. Thai Union Group PCL (Thailand) 10.7. Cermaq Group AS (Norway) 10.8. Stolt Sea Farm (UK) 10.9. Stehr Group (Australia) 10.10. Leigh Fisheries (New Zealand) 10.11. Priory Fishery Ltd. (UK) 10.12. Austevoll Seafood ASA (Norway) 10.13. Regal Springs (Switzerland) 10.14. Hainan Xiangtai Fishery Co., Ltd (China) 11. Key Findings 12. Industry Recommendations 13. Freshwater Fish Market: Research Methodology 14. Terms and Glossary