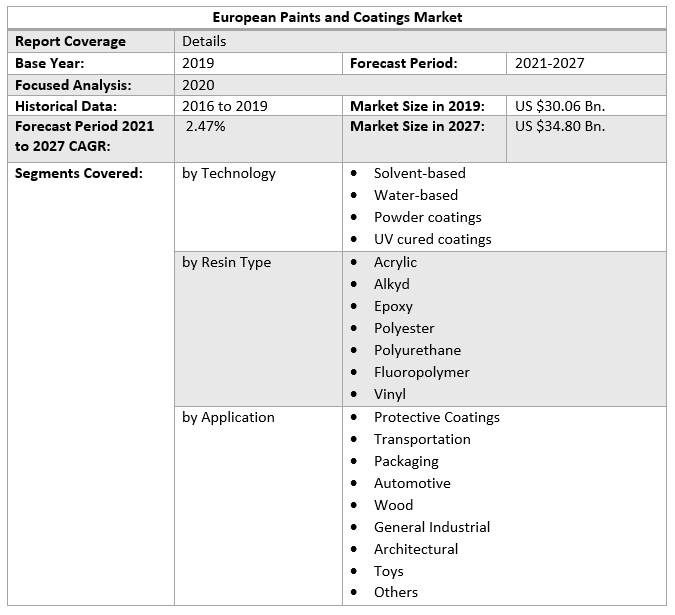

By 2027, the European Paints and Coatings Market is expected to reach US $34.80 billion, thanks to growth in the Technology, Resin Type, and Application segment. The report analyzes market dynamics by region and end-user industries.European Paints and Coatings Market Overview:

The European Paints and Coatings market was valued at US $30.06 Bn. in 2019, and it is expected to reach US $34.80 Bn. by 2027 with a CAGR of 2.47% during the forecast period. Paint is any coloured liquid, liquefiable, or solid lacquer substance that solidifies after being applied in a thin layer to a surface. Most typically, it is used to protect, color, or texture of objects. The majority of paints are either oil-based or water-based, and each has its own set of properties. A coating is a protective layer that is applied to an object's surface, also known as the substrate. The coating can be applied for decorative, functional, or both purposes. Thus, paints and coatings have various applications in different sectors. 2019 is considered as a base year to forecast the market from 2021 to 2027. 2020’s market size is estimated based on real numbers and outputs of the major players across Europe. The past five years trends are considered while forecasting the market through 2027. 2020 is a year of exception and is analyzed especially with the impact of lockdown by region.COVID–19 Influence on European Paints and Coatings Market:

The spread of the COVID-19 virus has caused a suspension in the production of raw materials used in the manufacture of paints and coatings. Paint and coatings manufacturing centers and key raw material suppliers include Germany, Russia, France, the United Kingdom, and Italy. The coronavirus spread in Europe has disrupted the supply of these basic materials. The report gives more details about the influence of each region, allowing users to plan their actions and take substantial steps toward recovery after an epidemic.Key Trends:

• One of the major factors driving the market growth is the increasing demand for architectural coatings. • Nanotechnology in paints and coatings is expected to become a future possibility. • Driven by the rising demand in the building and automobile industries, Germany controlled the European market. European Paints and Coatings Market Dynamics: Premium paints are in higher demand Based on the high level of consumer interest in home décor, architectural paints made and used in Western Europe are purely medium to premium products. Economical products have always been popular in Russia, the Commonwealth of Independent States, and Central and Eastern Europe. Long-term, as the standard of living in emerging economies, improves, consumer preferences for paint quality will shift toward luxury products. Thus, improving living standards and consumer choice for luxury products is expected to drive the European market over the forecast period. Financial slowness and COVID-19's influence on European industries The COVID-19 pandemic affected most European countries, particularly Russia, Italy, Spain, the United Kingdom, France, and Germany. The suspension of activities in many manufacturing sectors has led to a drop in these countries' GDP. As per OECD (Organisation for Economic Co-operation and Development), in the first quarter of 2020, the European Union's (EU) GDP fell by 3.3%. The European passenger car market is expected to remain flat in 2020, following the worldwide trend. The coronavirus spread resulted in a significant drop in new vehicle sales across Europe. The lack of demand in European markets has been increased by declining affordability and the economic recession. Thus, this factor is expected to restrain the growth of the market for a certain period. Emerging nanotechnology The ongoing technological advancements and investments in research and development particularly in the paints and coatings sector to improve its qualities by making it safe and sustainable is providing lucrative growth opportunities for the manufacturers. Environmental concerns and legal policies are very strict The paints and coatings companies suffer many environmental issues, with a growing priority on complying with state and local wastewater discharge standards. During the cleaning and pre-treatment phases, coatings, particularly powder coating operations, generate a significant number of metals, oil & grease, and suspended solids in their wastewater streams. Since of their wastewater streams, coating producers find it difficult to comply with many state and local environmental standards. Due to significant metal contamination, metal finishing companies that use various electroplating methods had trouble complying with standards. As a result, manufacturers are finding it challenging to comply with all criteria.European Paints and Coatings Market Segment Analysis:

Based on Technology, the European Paints and Coatings market is segmented into four types as follows, Solvent-based, Water-based, Powder coatings and UV cured coatings. In 2019, the Solvent-based segment was dominant and held xx% of the overall European market in terms of revenue thanks to the increased use of these paints in the construction and automotive industries. But, leading to an increase in demand for organic products, the water-based segment is expected to grow significantly with a CAGR of xx% during the forecast period. Based on Resin Type, the European paints and coatings market is segmented into seven types as follows, acrylic, alkyd, epoxy, polyester, polyurethane, fluoropolymer, vinyl, and others. In 2019, the Acrylic segment was dominant and held xx% of the overall European market in terms of revenue. The segment is expected to grow at a CAGR of xx% during the forecast period. Acrylics come in a variety of forms, including latex emulsions, lacquers, enamels, and powders. Latex acrylic paint is the most prevalent type of acrylic paint. Acrylic polymer’s main components, acrylic, and methacrylic acid provide a polymer structure with a low tendency to absorb UV radiation, making acrylics more resistant to weathering and oxidation than oil-based paints, alkyds, or epoxies. Acrylics are known for their vibrant colors and long-lasting shine. Acrylic powder coatings, which range from thin-film clear coats to very smooth coats offer a high-performance finish with great weather resistance and high-gloss shades, making them perfect for outdoor applications.To know about the Research Methodology :- Request Free Sample Report Based on Application, the European paints and coatings market is segmented into nine types as follows, protective coatings, transportation, packaging, automotive, wood, general industrial, architectural, toys, and others. In 2019, the Architectural segment was dominant and held xx% of the overall European market in terms of revenue. The segment is expected to grow at a CAGR of xx% during the forecast period. Wall paintings, wood flooring, sculptures, and furniture are all examples of decorative interiors that use architectural coatings. As people are becoming environmentally aware, the coating sector has adapted to create inexpensive quality products, of high quality, have value-added features, and follow worldwide trends. Building fireproof and waterproof coatings will also be in more demand as safety regulations raise. This is concentrating focus on architectural coatings.

European Paints and Coatings Market Regional Insights:

Germany ruled the European market. Factors such as trade conflicts, which result in lower exports, and tariff disputes generated by the US government have an impact on the country's economic growth. Over the forecast period, however, the country is expected to recover from such deviations in economic performance. With the COVID-19 spread in Europe, Germany is one of the most hit countries. The nation's economy experienced a historic downturn in Q1 and Q2 2020 because of the severe impact of COVID-19, with 2.2 % and 10.1 % falls, respectively (quarter-over-quarter). The GDP drop in Q2 2020 was the worst since Germany started calculating quarterly GDP in 1970. With 41 assembly and engine production units, Germany dominates Europe's automotive sector, accounting for one-third of the continent's total automobile production. The country's new car market exceeded three million vehicles in total, but there was a modest decline thanks to the introduction of new WLTP emission control standards, which prevented several manufacturers from registering new automobiles. The country's new car sales/registrations are continuously increasing, reflecting improved economic conditions and consumer confidence. The country's automotive industry has performed well in recent years, with automobile sales increasing from 3,822,060 units in 2018 to 4,017,059 units in 2019. However, due to the COVID-19 pandemic, German car sales fell by more than 35.5 % in the first half of 2020. However, by the end of 2021, it is expected that car sales might have recovered, resulting in a stable contribution to the paints and coatings industry from the country's automotive sector. Germany also has Europe's largest construction sector. The residential construction sector is expected to grow at a steady rate. According to industry professionals, the country's recent positive migration is driving demand for new residential development. 3.6 million migrants are expected to arrive in Germany by 2020, needing the construction of at least 350,000 new homes per year, benefiting the construction sector. However, by 2025, new housing demand would reach over 260,000 per year, and by 2030, it would reach around 246,000. Yet, the German government said in 2018 that it plans to build roughly 1.5 million housing units by 2021. As a result of the expansion of the countries multiple end sectors, demand for paints and coatings is expected to rise during the forecast period.Recent Advancements:

• In September 2020, AkzoNobel has purchased Stahl Performance Powder Coatings and its whole line of solutions for heat-sensitive substrates. AkzoNobel now has immediate access to cutting-edge low-curing technology as a result of this acquisition. The low curing technology, which includes both UV and thermally curing powders, would then allow AkzoNobel to enter the ultra-low cure (80-100°C) domain, enabling the organization to move into new sectors by applying powder to temperature-sensitive substrates such as MDF, plywood, thermoplastics, and composites. • In April 2020, Sherwin Williams has introduced the first products from its Powdura ECO platform, which is the first and only powder coatings line to use a novel polyester resin is made up of 25% pre-consumer recycled plastic. • In February 2020, Industria Chimica Reggiana (ICR) SpA, a manufacturer of paints and coatings for the automobile refinish and light industrial coatings industries have been acquired by PPG Industries. ICR is established in Italy and produces automotive refinish products under the SPRINT brand, such as putties, primers, basecoats, and clear coats. The objective of the report is to present a comprehensive analysis of the European Paints and Coatings market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the European Paints and Coatings market dynamics, structure by analyzing the market segments and project the European Paints and Coatings market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the European Paints and Coatings market make the report investor’s guide.European Paints and Coatings Market Scope: Inquire before buying

European Paints and Coatings Market Key Players

• Akzo Nobel N.V. • Axalta Coating Systems • BASF SE • Beckers Group • Brillux GmbH & Co. KG • Cromology • DAW SE • Fujikura Kasei Co. Ltd. • Hempel A/S • Henkel AG & Co. KGaA • Jotun • J.W. Ostendorf • Kansai Paints Co. Ltd. • Mankiewicz Gebr. & Co. • Metlac Spa • National Paints Factories Co. Ltd • PPG Industries, Inc. • RPM International Inc. • Shawcor • Sika Ag • Teknos Group • The Sherwin-Williams Company • TIGER Coatings GmbH & Co. KG • OthersFrequently Asked Questions:

1. What is the forecast period considered for the European paints and coatings market report? Ans. The forecast period for the European Paints and Coatings market is 2021-2027. 2. Which key factors are hindering the growth of the European paints and coatings market? Ans. The financial slowness and COVID-19's influence on European industries is the key factor expected to hinder the growth of the European Paints and Coatings market during the forecast period. 3. What is the compound annual growth rate (CAGR) of the European paints and coatings market for the next 6 years? Ans. The European Paints and Coatings market is expected to grow at a CAGR of 2.47% during the forecast period (2021-2027). 4. What are the key factors driving the growth of the European paints and coatings market? Ans. The increasing demand for effectively painting different surfaces in a variety of industries, including architecture, construction, and the wood and furniture industries is expected to drive the growth of the market during the forecast period. 5. Which are the major key players covered for the European paints and coatings market report? Ans. Akzo Nobel N.V., Axalta Coating Systems, BASF SE, Beckers Group, Brillux GmbH & Co. KG, DAW SE, Fujikura Kasei Co. Ltd., Hempel A/S, Henkel AG & Co. KGaA, Jotun, J.W. Ostendorf, Kansai Paints Co., Ltd., Mankiewicz Gebr. & Co., Metlac Spa, National Paints Factories Co. Ltd, PPG Industries, Inc., RPM International Inc., Shawcor, Sika Ag, Teknos Group, The Sherwin-Williams Company, TIGER Coatings GmbH & Co. KG, and Others.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: European Paints and Coatings Market Size, by Market Value (US $ Bn.) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.3. Geographical Snapshot of the European Paints and Coatings Market 3.4. Geographical Snapshot of the European Paints and Coatings Market, By Manufacturer share 4. European Paints and Coatings Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the European Paints and Coatings Market 5. Supply Side and Demand Side Indicators 6. European Paints and Coatings Market Analysis and Forecast, 2019-2027 6.1. European Paints and Coatings Products Market Size & Y-o-Y Growth Analysis. 7. European Paints and Coatings Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 7.1.1. Solvent-based 7.1.2. Water-based 7.1.3. Powder coatings 7.1.4. UV cured coatings 7.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 7.2.1. Acrylic 7.2.2. Alkyd 7.2.3. Epoxy 7.2.4. Polyester 7.2.5. Polyurethane 7.2.6. Fluoropolymer 7.2.7. Vinyl 7.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 7.3.1. Protective Coatings 7.3.2. Transportation 7.3.3. Packaging 7.3.4. Automotive 7.3.5. Wood 7.3.6. General Industrial 7.3.7. Architectural 7.3.8. Toys 7.3.9. Others 8. Europe Paints and Coatings Market Analysis and Forecasts, By Country 8.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 8.1.1. U.K 8.1.2. France 8.1.3. Germany 8.1.4. Italy 8.1.5. Spain 8.1.6. Sweden 8.1.7. CIS Countries 8.1.8. Rest of Europe 9. U.K. Paints and Coatings Market Analysis and Forecasts, 2019-2027 9.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 9.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 9.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 10. France Paints and Coatings Market Analysis and Forecasts, 2019-2027 10.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 10.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 10.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 11. Germany Paints and Coatings Market Analysis and Forecasts, 2019-2027 11.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 11.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 11.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 12. Italy Paints and Coatings Market Analysis and Forecasts, 2019-2027 12.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 12.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 12.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 13. Spain Paints and Coatings Market Analysis and Forecasts, 2019-2027 13.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 13.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 13.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 14. Sweden Paints and Coatings Market Analysis and Forecasts, 2019-2027 14.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 14.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 14.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 15. CIS Countries Paints and Coatings Market Analysis and Forecasts, 2019-2027 15.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 15.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 15.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 16. Rest of Europe Paints and Coatings Market Analysis and Forecasts, 2019-2027 16.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2027 16.2. Market Size (Value) Estimates & Forecast By Resin Type, 2019-2027 16.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 17. Competitive Landscape 17.1. Geographic Footprint of Major Players in the European Paints and Coatings Market 17.2. Competition Matrix 17.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Technology and R&D Investment 17.2.2. New Product Launches and Product Enhancements 17.2.3. Market Consolidation 17.2.3.1. M&A by Regions, Investment, and Verticals 17.2.3.2. M&A, Forward Integration and Backward Integration 17.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 17.3. Company Profile: Key Players 17.3.1. Akzo Nobel N.V. 17.3.1.1. Company Overview 17.3.1.2. Financial Overview 17.3.1.3. Geographic Footprint 17.3.1.4. Product Portfolio 17.3.1.5. Business Strategy 17.3.1.6. Recent Developments 17.3.2. Axalta Coating Systems LLC 17.3.3. BASF Coatings 17.3.4. Beckers Group 17.3.5. Brillux GmbH & Co. 17.3.6. DAW SE 17.3.7. Fujikura Kasei Co. Ltd. 17.3.8. Hempel A/S 17.3.9. Henkel AG & Co. 17.3.10. Jotun 17.3.11. J.W. Ostendorf 17.3.12. Kansai Paints Co. 17.3.13. Mankiewicz Gebr. & Co. 17.3.14. Metlac Spa 17.3.15. National Paints Factories Ltd. 17.3.16. PPG Industries Inc. 17.3.17. RPM International Inc. 17.3.18. Shawcor 17.3.19. Sika AG 17.3.20. Teknos Group 17.3.21. The Sherwin-Williams Company 17.3.22. Tiger Coatings GmbH 17.3.23. Others 18. Primary Key Insights