Dyslipidaemia Drug Market is worth USD 13.58 billion in 2022 and is estimated to grow at a CAGR of 3.5% in the forecast period. The forecast revenue hints at a growth of around 17.76 billion USD by 2029. Dyslipidaemia refers to abnormal amounts of lipids (fats and/or triglycerides) in the blood. Elevated low-density lipoprotein cholesterol (LDL-C) is associated with increased risk of cardiovascular diseases. The global increase in cardiovascular diseases has ensured that the market sustains in future. As cases have increased, there is a need for effective therapies to manage the increasing fat levels. Factors like age, sedentary lifestyle and poor eating habits all affect the body in a negative way and cause an increase in cholesterol levels. These upon saturation causes Dyslipidaemia which needs to be treated as early as possible. Mainly, drugs used in cholesterol include Statins, the most commonly prescribed drug for cholesterol. It works by inhibiting HMG-CoA reductase, an enzyme that plays a key role in cholesterol synthesis. Fibrates are also used as an excellent option in replacement with statins. Fibrates help lower triglyceride levels and raise HDL-C levels. It is often added to statins or used for patients who cannot tolerate statin therapy. Bile acid tracers are used to prevent reabsorption and to increase urinary cholesterol levels. Thus, the dyslipidaemia drug market is competitive and dynamic, which is clearly evident by the numerous companies entering the market. Pharmaceutical giants like Pfizer, Merck & Co, AstraZeneca, Novartis, Sanofi and AbbVie all dominate the market share and are amongst the leading players in Dyslipidaemia Drugs MarketDyslipidaemia Drug Market Snapshot

To know about the Research Methodology :- Request Free Sample Report North America holds nearly 1/3rd of the market share and is expected to grow that share in future. US has been the leading and dominant country with its technological prowess in this industry. US has seen the wrath of rising cases and thus is leading the manufacturing of drugs like Statins and Fibrates. Other countries Japan and Germany are utilising their well-developed health infrastructure to attain a larger share of the market. Increase in Cardiovascular Disease Is Growing the Dyslipidaemia Drug Market One of the major reasons for the growth in Dyslipidaemia drug market has been the increasing cases of cardiovascular diseases. The increase in number of heart attacks and strokes have ensured that people increase their awareness which has directly boosted the drug sales in the market. Many countries like US, are facing issues regarding its aged population which become another challenge as dyslipidaemia is common in aging population. Thus, the number of cases has shoot up which has created a huge demand for the drugs to control these rising cases. Also, earlier not many people were aware of Dyslipidaemia, but nowadays a technology has advanced, more people of aware of its symptoms and causes. Thus, the awareness amongst the people have driven them towards the growth of the market. This has also reduced the gap between patients and drugs. The lifestyle of todays’ world is equally contributing to this disease. Sedentary lifestyles and unhealthy diet along with lack of physical activity, have increased the risk of cholesterol and cardiovascular diseases. The spending on research and development also has helped the market growth. Many drugs are being tested which can work better than existing drugs and provide rapid relief in serious cases. The development of novel drug classes, such as PCSK9 inhibitors is one such example. Government initiatives aimed at promoting cardiovascular health, including dyslipidaemia management, have helped raise awareness and drive the adoption of preventive measures and treatment options. In some countries, governments have set a cap on maximum price that can be charged for dyslipidaemia drugs. Patent expirations of key dyslipidaemia drugs have facilitated the entry of generic versions into the market and thus have provided huge opportunities for growth Variations in Treatment Poses Huge Challenge in Dyslipidaemia Drug Market One of the major challenges in dyslipidaemia drug market is regarding Variability in treatment. Each person suffering from dyslipidaemia has certain symptoms which makes his/her treatment complex than usual. Thus, tailoring treatment plans to individual patient can often be challenging as the risk increases. Also, patients suffering from dyslipidaemia tend to have more complex issues like hypertension, diabetes, and obesity which further makes the treatment complex. Thus, there is no fix treatment which creates huge variations in the market. Normally, treatment guidelines for dyslipidaemia are periodically updated based on the condition of the patient. Thus, keeping up with regular checkups, diagnosis and treatments can be a challenging task for the healthcare practioneers. The treatment for dyslipidaemia is a long serving treatment and require major changes in diet and lifestyle. This often makes it difficult for patients to bind which leads to suboptimal treatment outcomes and increased cardiovascular risk. Non-adherence can increase medication complexity and side effects can cause further damage to the patients. Also, another important challenge for dyslipidaemia drug market has been affordability. The cost of the treatments and drugs often act as huge barriers for the consumers. It particularly hampers lower-income regions or patients without adequate insurance coverage. This directly affects the market as it fails to reach to the mass audience. Despite the increasing number of cases of dyslipidaemia, there is still a lack of awareness among the general population which is a major cause for underdiagnosis. As people are lesser diagnosed, the drugs fail to reach its optimal potential which poses a huge challenge for the dyslipidaemia drug market Combination Therapy Governing the Trend in Dyslipidaemia Drug Market There is an increased focus on Combination Therapies as it is considered to be the best possible treatment against dyslipidaemia. Combining different drug classes, such as statins with PCSK9 inhibitors or ezetimibe, has shown positive signs and also efficacy in lowering lipid levels and reducing cardiovascular risk is displayed by such combination therapies. Pharmaceutical companies have been investing in the development of novel drug classes targeting dyslipidaemia. For example, PCSK9 inhibitors represent a new class of drugs that have shown promising results in lowering LDL-C levels. Not only pharmaceutical companies but also non-pharmacological interventions are visible in dyslipidaemia management. Lifestyle modifications, including dietary changes, increased physical activity, and weight management, are being recognized as essential components of comprehensive treatment plans. As, technology has progressed the use of digital health solutions have also increased. Mobile applications are being developed to monitor the lipid levels, medication adherence, and lifestyle modifications. Also, smart devices are being used which are integrated into dyslipidaemia management. Along with smart devices, also the use of biomarkers to personalize the treatment is seen. Advancements in genetics and molecular biology have helped the dyslipidaemia drug market synthesize specific drug therapies for patients. The utilisation of AI and Big Data also has the capacity to transform the dyslipidaemia market. These technologies help analyse large volumes of data, identify patterns, and optimize treatment strategies based on patient characteristics and would be a crucial process in future.

Dyslipidaemia Drug Market Segmentation

Dyslipidaemia Drug Market Segmentation, by Drug Class Statin, Bile Acid Sequestrants, Fibrates and Nicotinic Acid are major drugs used in the dyslipidaemia drug market. Statin is the most prescribed drug and thus has a substantial market share in this segment. Fibrates also is used as an alternative and in combination with statin, which is increasing its market share and indicating huge growth in the segment.Dyslipidaemia Drug Market Share,by Drug Class in 2022

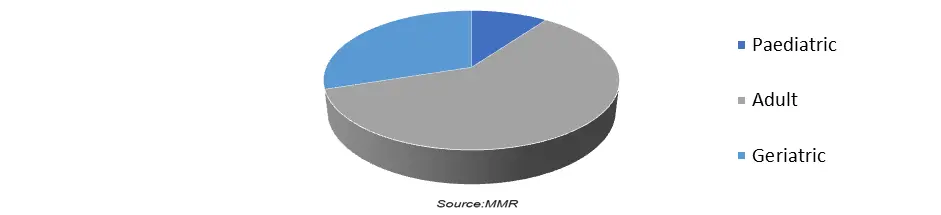

Dyslipidaemia Drug Market Segmentation, by Distribution Channel Hospital Pharmacy, Retail Pharmacy and Online are main distribution channels in dyslipidaemia drug market. Hospital pharmacies patients hold a highest share of the market as most of the patients are treated in hospitals Retail pharmacies do have a market share but is slightly less than that of Hospital pharmacies. Online distribution is still an emerging market and would take many years to actually flourish. Dyslipidaemia Drug Market Segmentation, by Age Group Paediatric, Adult and Geriatric are the 3 major segments in dyslipidaemia drug market. Adult has dominated this segment as dyslipidaemia is mostly prevalent in adults. Adults have nearly 70% of the market share and is expected to increase. The least number of percent is seen is Paediatrics, as this disorder rarely affects smalls children.

Dyslipidameia Drug Market Share, by Age Group in 2022

Dyslipidaemia Drug Market Segmentation, by Region

North America is leading the market as it is an emerging hotspot of patients suffering from dyslipidaemia. A survey estimated that nearly 38% of adults in the US have high cholesterol and nearly all of them are aware of their situatations and taking proactive steps to control it. Thus, these show positive signs for dyslipidaemia market and also is a major reason for US to lead the market share. Europe has also been a dominant player in the dyslipidaemia drug market. Germany, UK, France have showed huge growth as their well-developed health infrastructure and manufacturing capacities help them sustain. Germany has been 2nd after US, and also is suffering from ageing population and high-risk patients. Asia Pacific has been the fastest growing market and the major reason behind its growth is its increased population. The economies in this region are progressing which is providing huge manufacturers a great marketplace which in turn is increasing its market share in global context. Middle East has invested heavily in its healthcare infrastructure and is expected to become a huge market in future. South America on the other hand is representing an emerging market for dyslipidaemia drugs. The region experiences a growing burden of dyslipidaemia due to urbanization, sedentary lifestyles, and dietary changes. Thus, many South American manufacturers are starting to develop facilities for the drug production Competitive Landscape The market is dynamic and competitive, with each changing innovation the market flips. Thus, research, development, distribution and branding all become very important for the companies. The market is filled with established pharmaceutical companies like Pfizer, Merck & Co., AstraZeneca, and Novartis, who have a strong presence in the dyslipidaemia market. These companies offer a range of dyslipidaemia drugs and leverage their diverse network, brand image and huge finances to earn a good market share in dyslipidaemia market. Several smaller and mid-sized pharmaceutical companies are entering the market like Alnylam pharmaceuticals and Amarin corporation, who are focusing on innovating the drug treatment. These emerging players are utilising their technology and are focusing on a smaller segment rather than a global market. Patent expirations has offered huge opportunities for companies to leverage the formulation and manufacture huge quantity of drugs. Large companies can often utilise economies of scale to reduce price of the drugs. Strategic Collaborations and Partnerships are at the heart of the market. Partnerships like Alnylam Pharmaceuticals and Sanofi have showed huge signs of progress, thus indicating the importance of collaboration in dyslipidaemia drug marketDyslipidaemia Drugs Market Scope : Inquire Before Buying

Global Dyslipidaemia Drugs Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 13.58 Bn. Forecast Period 2023 to 2029 CAGR: 3.5% Market Size in 2029: US $ 17.76 Bn. Segments Covered: by Drug Class Statin Bile Acid Sequestrants Fibrates Nicotinic Acid by Distribution Channel Hospital Pharmacy Retail Pharmacy Online by Age Group Paediatric Adult Geriatric Dyslipidaemia Drugs Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Dyslipidaemia Drugs Market, Key Players are

1. Pfizer Inc. - USA 2. Merck & Co., Inc. – USA 3. Bristol Myers Squibb (BMS) - USA 4. Regeneron Pharmaceuticals, Inc. - USA 5. Mylan N.V. - USA 6. Amgen Inc. - USA 7. Eli Lilly and Company - USA 8. AbbVie Inc. - USA 9. GlaxoSmithKline plc - United Kingdom 10. AstraZeneca - United Kingdom/Sweden 11. Novartis International AG - Switzerland 12. Sanofi - France 13. Boehringer Ingelheim - Germany 14. Teva Pharmaceutical Industries Ltd. - Israel 15. Sun Pharmaceutical Industries Ltd. - India 16. Lupin Limited - India 17. Dr. Reddy's Laboratories Ltd. - India 18. Torrent Pharmaceuticals Limited - India 19. Cipla Limited - India 20. Cadila Healthcare Limited - India 21. Biocon Limited - India 22. Ranbaxy Laboratories Limited (acquired by Sun Pharma) - India 23. Wockhardt Limited – India 24. Daiichi Sankyo Company, Limited - Japan 25. Takeda Pharmaceutical Company Limited - JapanFAQ

Q.1) What is the CAGR of the Dyslipidaemia Drugs Market? Ans: The CAGR for Dyslipidaemia Drugs Market is 3.5%. Q.2) Which are the leading companies in Dyslipidaemia Drugs Market? Ans: Pfizer, AstraZeneca and Sanofi are some of the leading companies in the Dyslipidaemia Drugs Market. Q.3) Which region shows maximum potential in Dyslipidaemia Drugs Market? Ans: North America is expected to grow exponentially and is likely to dominate Dyslipidaemia Drugs Market in future. Q.4) Which is the leading region in Dyslipidaemia Drugs Market? Ans: Asia Pacific leads the market of Dyslipidaemia Drugs Market significantly. Q.5) What was the forecasted period of this report? Ans: The forecasted period for the Dyslipidaemia Drugs Market research was 2023 – 2029.

1. Dyslipidaemia Drugs Market: Research Methodology 2. Dyslipidaemia Drugs Market: Executive Summary 3. Dyslipidaemia Drugs Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Dyslipidaemia Drugs Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Dyslipidaemia Drugs Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Dyslipidaemia Drugs Market Size and Forecast, by Drug Class (2022-2029) 5.1.1. Statin 5.1.2. Bile Acid Sequestrants 5.1.3. Fibrates 5.1.4. Nicotinic Acid 5.2. Dyslipidaemia Drugs Market Size and Forecast, by Distribution Channel (2022-2029) 5.2.1. Hospital Pharmacy 5.2.2. Retail Pharmacy 5.2.3. Online 5.3. Dyslipidaemia Drugs Market Size and Forecast, by Application (2022-2029) 5.3.1. Paediatric 5.3.2. Adult 5.3.3. Geriatric 5.4. Dyslipidaemia Drugs Market Size and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Dyslipidaemia Drugs Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Dyslipidaemia Drugs Market Size and Forecast, by Drug Class (2022-2029) 6.1.1. Statin 6.1.2. Bile Acid Sequestrants 6.1.3. Fibrates 6.1.4. Nicotinic Acid 6.2. North America Dyslipidaemia Drugs Market Size and Forecast, by Distribution Channel (2022-2029) 6.2.1. Hospital Pharmacy 6.2.2. Retail Pharmacy 6.2.3. Online 6.3. North America Dyslipidaemia Drugs Market Size and Forecast, by Application (2022-2029) 6.3.1. Paediatric 6.3.2. Adult 6.3.3. Geriatric 6.4. North America Dyslipidaemia Drugs Market Size and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Dyslipidaemia Drugs Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Dyslipidaemia Drugs Market Size and Forecast, by Drug Class (2022-2029) 7.1.1. Statin 7.1.2. Bile Acid Sequestrants 7.1.3. Fibrates 7.1.4. Nicotinic Acid 7.2. Europe Dyslipidaemia Drugs Market Size and Forecast, by Distribution Channel (2022-2029) 7.2.1. Hospital Pharmacy 7.2.2. Retail Pharmacy 7.2.3. Online 7.3. Europe Dyslipidaemia Drugs Market Size and Forecast, by Application (2022-2029) 7.3.1. Paediatric 7.3.2. Adult 7.3.3. Geriatric 7.4. Europe Dyslipidaemia Drugs Market Size and Forecast, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Dyslipidaemia Drugs Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Dyslipidaemia Drugs Market Size and Forecast, by Drug Class (2022-2029) 8.1.1. Statin 8.1.2. Bile Acid Sequestrants 8.1.3. Fibrates 8.1.4. Nicotinic Acid 8.2. Asia Pacific Dyslipidaemia Drugs Market Size and Forecast, by Distribution Channel (2022-2029) 8.2.1. Hospital Pharmacy 8.2.2. Retail Pharmacy 8.2.3. Online 8.3. Asia Pacific Dyslipidaemia Drugs Market Size and Forecast, by Application (2022-2029) 8.3.1. Paediatric 8.3.2. Adult 8.3.3. Geriatric 8.4. Asia Pacific Dyslipidaemia Drugs Market Size and Forecast, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Dyslipidaemia Drugs Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Dyslipidaemia Drugs Market Size and Forecast, by Drug Class (2022-2029) 9.1.1. Statin 9.1.2. Bile Acid Sequestrants 9.1.3. Fibrates 9.1.4. Nicotinic Acid 9.2. Middle East and Africa Dyslipidaemia Drugs Market Size and Forecast, by Distribution Channel (2022-2029) 9.2.1. Hospital Pharmacy 9.2.2. Retail Pharmacy 9.2.3. Online 9.3. Middle East and Africa Dyslipidaemia Drugs Market Size and Forecast, by Application (2022-2029) 9.3.1. Paediatric 9.3.2. Adult 9.3.3. Geriatric 9.4. Middle East and Africa Dyslipidaemia Drugs Market Size and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Dyslipidaemia Drugs Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Dyslipidaemia Drugs Market Size and Forecast, by Drug Class (2022-2029) 10.1.1. Statin 10.1.2. Bile Acid Sequestrants 10.1.3. Fibrates 10.1.4. Nicotinic Acid 10.2. South America Dyslipidaemia Drugs Market Size and Forecast, by Distribution Channel (2022-2029) 10.2.1. Hospital Pharmacy 10.2.2. Retail Pharmacy 10.2.3. Online 10.3. South America Dyslipidaemia Drugs Market Size and Forecast, by Application (2022-2029) 10.3.1. Paediatric 10.3.2. Adult 10.3.3. Geriatric 10.4. South America Dyslipidaemia Drugs Market Size and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Pfizer 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Merck & Co., Inc. – USA 11.3. Bristol Myers Squibb (BMS) - USA 11.4. Regeneron Pharmaceuticals, Inc. - USA 11.5. Mylan N.V. - USA 11.6. Amgen Inc. - USA 11.7. Eli Lilly and Company - USA 11.8. AbbVie Inc. - USA 11.9. GlaxoSmithKline plc - United Kingdom 11.10. AstraZeneca - United Kingdom/Sweden 11.11. Novartis International AG - Switzerland 11.12. Sanofi - France 11.13. Boehringer Ingelheim - Germany 11.14. Teva Pharmaceutical Industries Ltd. - Israel 11.15. Sun Pharmaceutical Industries Ltd. - India 11.16. Lupin Limited - India 11.17. Dr Reddy's Laboratories Ltd. - India 11.18. Torrent Pharmaceuticals Limited - India 11.19. Cipla Limited - India 11.20. Cadila Healthcare Limited - India 11.21. Biocon Limited - India 11.22. Ranbaxy Laboratories Limited (acquired by Sun Pharma) - India 11.23. Wockhardt Limited – India 11.24. Daiichi Sankyo Company, Limited - Japan 11.25. Takeda Pharmaceutical Company Limited - Japan 12. Key Findings 13. Industry Recommendation