Automated Microscopy Market size was valued at USD 8.7 Billion in 2023 and the Automated Microscopy Market revenue is expected to reach USD 12.3 Billion by 2030, at a CAGR of 6.2 % over the forecast period.Automated Microscopy Market Overview

Automated Microscopy Market refers to the utilization of advanced imaging systems equipped with automation capabilities for capturing and analyzing visual data from various specimens. This technology minimizes human intervention, allowing for efficient and precise examination of samples across diverse applications. Automated microscopy systems often integrate sophisticated imaging techniques, data analysis software, and robotics to enhance the speed and accuracy of specimen analysis. The Automated Microscopy Market encompasses a wide range of industries and applications, including healthcare, life sciences, material science, and research. The scope extends to academic institutions, pharmaceutical companies, biotechnology firms, clinical laboratories, and industrial settings where detailed analysis of microscopic structures is crucial.To know about the Research Methodology:-Request Free Sample Report The market includes various types of automated microscopy systems, such as fluorescence microscopy, confocal microscopy, phase-contrast microscopy, and electron microscopy. Automated Microscopys are not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This Automated Microscopy Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Automated Microscopy Market report showcases the Automated Microscopy industry situation with Dynamics, Market Segment, Regional Analysis, and Top competitor's Market Position.

Automated Microscopy Market Dynamics

Rising Need for High-Throughput Screening and Expanding Applications in Healthcare Driving the Automated Microscopy Market Growth The need for high-throughput screening in various industries, especially in drug discovery and genomics research, is fuelling the adoption of automated microscopy systems. These systems enable the rapid analysis of large sample sets. In healthcare, automated microscopy is increasingly utilized for diagnostic purposes. It aids in the detection and analysis of various medical conditions, contributing to improved patient outcomes. Continuous technological advancements in automated microscopy, such as improved imaging resolution, faster data acquisition, and enhanced automation capabilities, are driving market growth. The growing emphasis on research and development across scientific disciplines is boosting the demand for automated microscopy tools. This includes applications in pharmaceuticals, biotechnology, and material sciences. The Automated Microscopy market is witnessing a demand for miniaturized and portable automated microscopy systems, facilitating on-site analysis and in-field applications. This is particularly beneficial in resource-limited settings and point-of-care diagnostics. Telepathology and Remote Imaging and Integration of Artificial Intelligence (AI) Boosting Opportunities in the Automated Microscopy Market The adoption of telepathology and remote imaging solutions is gaining traction, providing opportunities for automated microscopy to be used in virtual diagnostics and consultations. The integration of AI and machine learning in automated microscopy allows for intelligent image analysis, pattern recognition, and the extraction of valuable insights. This presents opportunities for more efficient and accurate data interpretation. As awareness about the benefits of automated microscopy grows, there is significant potential for Automated Microscopy market growth in emerging economies. Increased funding in research activities and healthcare infrastructure development contribute to this opportunity. Collaborations between key players in the automated microscopy market and research institutions or pharmaceutical companies offer opportunities for joint ventures, innovative product development, and expanded Automated Microscopy industry reach. Offering customizable solutions to meet the specific requirements of end-users, such as specialized imaging techniques or application-specific features, is key opportunity for companies in the automated microscopy market. Limited Awareness and Skilled Workforce with Competition from Alternative Technologies pose challenges to the Automated Microscopy Market Limited awareness about the capabilities of automated microscopy and a shortage of skilled professionals capable of operating and maintaining these systems impede Automated Microscopy market growth. Alternative technologies, such as flow cytometry or traditional manual microscopy, compete with automated microscopy. Convincing end-users about the added benefits and cost-effectiveness of automated solutions is a challenge. In healthcare applications, where automated microscopy is used for diagnostics, there are concerns related to the privacy and security of patient data. Compliance with data protection regulations is crucial. The initial investment required for acquiring automated microscopy systems, especially advanced models with cutting-edge features, is significant challenge for smaller research labs or facilities with limited budgets in the Automated Microscopy Market. Integrating automated microscopy systems with existing laboratory setups or workflows pose challenges due to compatibility issues, necessitating additional investments in system integration and training.Automated Microscopy Market Segment Analysis

By Product Type: Market segment analysis reveals that optical microscopes, utilizing visible light, remain a fundamental tool in various industries. They are preferred for their versatility, cost-effectiveness, and ease of use, making them accessible across a broad user base. Industry segmentation highlights that optical microscopes find applications in medical diagnosis, life science research, and drug discovery. Their continued technological advancements enhance imaging capabilities, contributing to Automated Microscopy market growth. Industry segmentation indicates that electron microscopes offer high-resolution imaging, enabling detailed analysis at the nanoscale. Despite being more complex and expensive, they are crucial for applications demanding intricate structural insights. Electron microscopes are extensively used in life science research and pharmaceutical industries, particularly for detailed cellular and molecular examinations. Industry segmentation reveals that scanning probe microscopes provide topographical and material property information at the atomic and molecular levels in the Automated Microscopy Market. Their applications extend to studying surface structures and manipulating nanoscale materials. Commonly utilized in research facilities and nanotechnology, scanning probe microscopes contribute to the understanding of material properties at the microscopic level.By Application: Target Automated Microscopy market analysis indicates that automated microscopy plays a pivotal role in medical diagnosis by facilitating rapid and accurate analysis of biological specimens. It aids in pathology, hematology, and microbiology, enhancing diagnostic capabilities. Consumer demographics show that diagnostic laboratories extensively utilize automated microscopy for disease identification, contributing to efficient and precise medical diagnoses. Target Automated Microscopy market analysis reveals that automated microscopy is integral to life science research, enabling scientists to observe and analyze cellular structures, functions, and dynamics. It supports advancements in genetics, cell biology, and microbiology. Product segmentation emphasizes that research facilities leverage automated microscopy to explore cellular and molecular processes, fostering breakthroughs in various life science disciplines. Target Automated Microscopy market analysis suggests that automated microscopy accelerates drug discovery processes by providing detailed insights into cellular responses to drug compounds. It contributes to the identification of potential drug candidates. Product segmentation highlights that pharmaceutical industries employ automated microscopy in drug development, from target identification to toxicity assessments, streamlining the drug discovery pipeline. By End User: Consumer demographics reveal that diagnostic laboratories heavily rely on automated microscopy for routine diagnostic procedures in the Automated Microscopy Market. The automation of sample analysis enhances efficiency, reduces turnaround time, and improves diagnostic accuracy. Market segment analysis underscores that automated microscopy is a cornerstone in diagnostic laboratories for applications ranging from blood cell analysis to pathology examinations. Consumer demographics reveal that research facilities leverage various types of automated microscopy for in-depth investigations across scientific disciplines. The flexibility and precision offered by automated systems enhance research capabilities. Product segmentation emphasizes that automated microscopy in research facilities supports a wide array of studies, from fundamental biological research to materials science, contributing to scientific advancements. Consumer demographics reveal that the pharmaceutical industry employs automated microscopy at different stages of drug development. It aids in understanding cellular mechanisms, optimizing formulations, and ensuring product quality. Automated Microscopy Industry segmentation highlights that in the pharmaceutical sector, automated microscopy plays a crucial role in research and development, quality control, and validation processes, contributing to the overall efficiency of the industry.

Automated Microscopy Market Regional Analysis

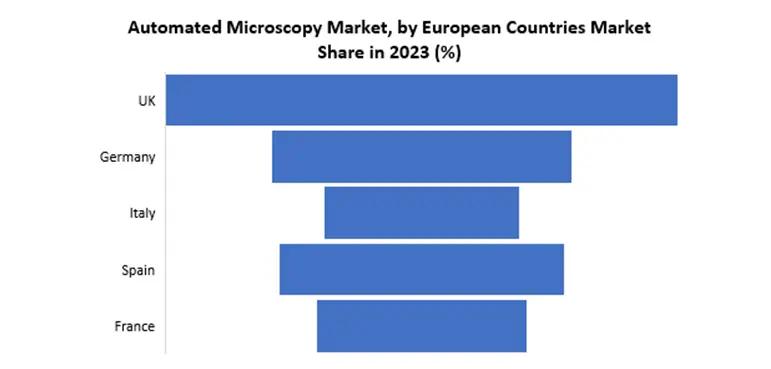

In North America, automated microscopy market dynamics are influenced by the region's advanced healthcare infrastructure and a robust research ecosystem. The geographic analysis highlights a significant demand for automated microscopy in medical diagnosis, life science research, and pharmaceutical development. Regional Automated Microscopy market trends indicate a growing preference for cutting-edge imaging technologies in research facilities and diagnostic laboratories. The adoption of automated microscopy solutions is driven by the need for high-throughput screening and advanced analytical capabilities. Area-specific Automated Microscopy industry dynamics are characterized by collaborations between research institutions and industry players, fostering innovation in automated microscopy applications. Local market influences include regulatory frameworks promoting technological advancements and ensuring patient safety. The market performance by region in North America showcases sustained growth, with the United States leading in research and development activities. The regional market segmentation reveals a diversified landscape, with applications across academic institutions, healthcare facilities, and pharmaceutical companies. The geographic analysis of Asia Pacific emphasizes the region's increasing investments in healthcare infrastructure and rising research activities. Automated microscopy is witnessing a surge in demand, driven by the growing emphasis on life science research and pharmaceutical advancements. Regional market trends include a shift towards adopting automated microscopy in emerging economies for medical diagnostics and drug discovery. The area-specific market dynamics highlight collaborations between global manufacturers and local research institutions to address specific healthcare challenges. Local Automated Microscopy market influences in Asia Pacific are shaped by government initiatives supporting scientific research and advancements in diagnostics. Automated Microscopy Market performance by region reflects a rising trend in the adoption of automated microscopy, particularly in countries like China and India. The market performance by region in Asia Pacific illustrates a dynamic landscape, with diverse applications across diagnostic laboratories, academic research centers, and the pharmaceutical industry. Regional market segmentation reveals opportunities for both established players and emerging local manufacturers. In Europe, the geographic analysis highlights a well-established scientific community and a strong focus on healthcare innovation. The automated microscopy market dynamics are influenced by the region's commitment to advancing life sciences and medical diagnostics. Regional market trends in Europe underscore the adoption of automated microscopy for precision medicine and personalized healthcare. The area-specific market dynamics are shaped by collaborations between academic institutions and industry partners, fostering technological advancements. Local market influences include stringent regulatory standards promoting quality and safety in medical devices. Market performance by region reflects a steady demand for automated microscopy solutions in research institutions, diagnostic labs, and pharmaceutical companies. The market performance by region in Europe demonstrates a mature and competitive landscape. Regional market segmentation reveals specific applications in cancer research, pathology, and drug development, contributing to the overall growth of the automated microscopy market.

Automated Microscopy Market Scope: Inquire before buying

Automated Microscopy Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.7 Bn. Forecast Period 2024 to 2030 CAGR: 6.2% Market Size in 2030: US $ 12.3 Bn. Segments Covered: by Product Type Optical microscope Electron microscope Scanning probe microscope by Application Medical diagnosis Life science research Drug discovery and Pharmaceutical by End User Diagnostic laboratories Research Facilities Pharmaceutical industry Automated Microscopy Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Automated Microscopy Market Key Players Includes

North America: 1. Thermo Fisher Scientific Inc. (USA) 2. Carl Zeiss AG (USA) 3. Nikon Corporation (USA) 4. Bruker Corporation (USA) 5. Olympus Corporation (USA) Asia-Pacific: 1. Hitachi High-Tech Corporation (Japan) 2. JEOL Ltd. (Japan) 3. Keyence Corporation (Japan) 4. Phenom-World B.V. (Netherlands, with global operations) 5. FEI Company (a Thermo Fisher Scientific Company) (USA) Europe: 1. Leica Microsystems GmbH (Germany) 2. DeltaVision OMX (United Kingdom) 3. CrestOptics S.p.A (Italy) 4. NanoEnTek Inc. (United Kingdom) 5. Aurox Ltd. (United Kingdom) Middle East and Africa: 1. A.KRÜSS Optronic GmbH (Germany, with global operations) 2. Optika Srl (Italy) 3. Huvitz Co. Ltd. (South Korea) 4. Laxco, Inc. (USA, with global operations) 5. Media Cybernetics, Inc. (USA, with global operations) Frequently Asked Questions in Automated Microscopys Market: 1. What is automated microscopy? Ans: Automated microscopy involves using advanced imaging systems equipped with automation features to capture and analyze visual data from specimens, reducing the need for manual intervention. 2. What are the key applications of automated microscopy? Ans: Automated microscopy is widely used in medical diagnosis, life science research, drug discovery, and various industries for detailed analysis of biological and material specimens. 3. What are the main types of automated microscopes? Ans: The main types include optical microscopes, electron microscopes, and scanning probe microscopes, each offering unique capabilities for different applications. 4. What are the trends influencing the automated microscopy market? Ans: Current trends include a shift towards live-cell imaging, the development of 3D imaging capabilities, integration of augmented reality, and a focus on sustainability in microscope design. 5. Which regions are key players in the automated microscopy market located? Ans: Key players are distributed globally, with significant presence in North America (USA), Asia Pacific (Japan), Europe (Germany), Middle East and Africa, and South America (USA).

1. Automated Microscopy Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automated Microscopy Market: Dynamics 2.1. Automated Microscopy Market Trends by Region 2.1.1. North America Automated Microscopy Market Trends 2.1.2. Europe Automated Microscopy Market Trends 2.1.3. Asia Pacific Automated Microscopy Market Trends 2.1.4. Middle East and Africa Automated Microscopy Market Trends 2.1.5. South America Automated Microscopy Market Trends 2.2. Automated Microscopy Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automated Microscopy Market Drivers 2.2.1.2. North America Automated Microscopy Market Restraints 2.2.1.3. North America Automated Microscopy Market Opportunities 2.2.1.4. North America Automated Microscopy Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automated Microscopy Market Drivers 2.2.2.2. Europe Automated Microscopy Market Restraints 2.2.2.3. Europe Automated Microscopy Market Opportunities 2.2.2.4. Europe Automated Microscopy Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automated Microscopy Market Drivers 2.2.3.2. Asia Pacific Automated Microscopy Market Restraints 2.2.3.3. Asia Pacific Automated Microscopy Market Opportunities 2.2.3.4. Asia Pacific Automated Microscopy Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automated Microscopy Market Drivers 2.2.4.2. Middle East and Africa Automated Microscopy Market Restraints 2.2.4.3. Middle East and Africa Automated Microscopy Market Opportunities 2.2.4.4. Middle East and Africa Automated Microscopy Market Challenges 2.2.5. South America 2.2.5.1. South America Automated Microscopy Market Drivers 2.2.5.2. South America Automated Microscopy Market Restraints 2.2.5.3. South America Automated Microscopy Market Opportunities 2.2.5.4. South America Automated Microscopy Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automated Microscopy Industry 2.8. Analysis of Government Schemes and Initiatives For Automated Microscopy Industry 2.9. Automated Microscopy Market Trade Analysis 2.10. The Global Pandemic Impact on Automated Microscopy Market 3. Automated Microscopy Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Optical microscope 3.1.2. Electron microscope 3.1.3. Scanning probe microscope 3.2. Automated Microscopy Market Size and Forecast, by Application (2023-2030) 3.2.1. Medical diagnosis 3.2.2. Life science research 3.2.3. Drug discovery and Pharmaceutical 3.3. Automated Microscopy Market Size and Forecast, by End User (2023-2030) 3.3.1. Diagnostic laboratories 3.3.2. Research Facilities 3.3.3. Pharmaceutical industry 3.4. Automated Microscopy Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Automated Microscopy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Optical microscope 4.1.2. Electron microscope 4.1.3. Scanning probe microscope 4.2. North America Automated Microscopy Market Size and Forecast, by Application (2023-2030) 4.2.1. Medical diagnosis 4.2.2. Life science research 4.2.3. Drug discovery and Pharmaceutical 4.3. North America Automated Microscopy Market Size and Forecast, by End User (2023-2030) 4.3.1. Diagnostic laboratories 4.3.2. Research Facilities 4.3.3. Pharmaceutical industry 4.4. North America Automated Microscopy Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Optical microscope 4.4.1.1.2. Electron microscope 4.4.1.1.3. Scanning probe microscope 4.4.1.2. United States Automated Microscopy Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Medical diagnosis 4.4.1.2.2. Life science research 4.4.1.2.3. Drug discovery and Pharmaceutical 4.4.1.3. United States Automated Microscopy Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Diagnostic laboratories 4.4.1.3.2. Research Facilities 4.4.1.3.3. Pharmaceutical industry 4.4.2. Canada 4.4.2.1. Canada Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Optical microscope 4.4.2.1.2. Electron microscope 4.4.2.1.3. Scanning probe microscope 4.4.2.2. Canada Automated Microscopy Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Medical diagnosis 4.4.2.2.2. Life science research 4.4.2.2.3. Drug discovery and Pharmaceutical 4.4.2.3. Canada Automated Microscopy Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Diagnostic laboratories 4.4.2.3.2. Research Facilities 4.4.2.3.3. Pharmaceutical industry 4.4.3. Mexico 4.4.3.1. Mexico Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Optical microscope 4.4.3.1.2. Electron microscope 4.4.3.1.3. Scanning probe microscope 4.4.3.2. Mexico Automated Microscopy Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Medical diagnosis 4.4.3.2.2. Life science research 4.4.3.2.3. Drug discovery and Pharmaceutical 4.4.3.3. Mexico Automated Microscopy Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Diagnostic laboratories 4.4.3.3.2. Research Facilities 4.4.3.3.3. Pharmaceutical industry 5. Europe Automated Microscopy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.3. Europe Automated Microscopy Market Size and Forecast, by End User (2023-2030) 5.4. Europe Automated Microscopy Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Automated Microscopy Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Automated Microscopy Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Automated Microscopy Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Automated Microscopy Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Automated Microscopy Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Automated Microscopy Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Automated Microscopy Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Automated Microscopy Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Automated Microscopy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Automated Microscopy Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Automated Microscopy Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Automated Microscopy Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Automated Microscopy Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Automated Microscopy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Automated Microscopy Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Automated Microscopy Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Automated Microscopy Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Automated Microscopy Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Automated Microscopy Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Automated Microscopy Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Automated Microscopy Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Automated Microscopy Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Automated Microscopy Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Automated Microscopy Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Automated Microscopy Market Size and Forecast, by End User (2023-2030) 8. South America Automated Microscopy Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Automated Microscopy Market Size and Forecast, by Application (2023-2030) 8.3. South America Automated Microscopy Market Size and Forecast, by End User(2023-2030) 8.4. South America Automated Microscopy Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Automated Microscopy Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Automated Microscopy Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Automated Microscopy Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Automated Microscopy Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Automated Microscopy Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Automated Microscopy Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Automated Microscopy Market Size and Forecast, by End User (2023-2030) 9. Global Automated Microscopy Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Automated Microscopy Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Thermo Fisher Scientific Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Carl Zeiss AG (USA) 10.3. Nikon Corporation (USA) 10.4. Bruker Corporation (USA) 10.5. Olympus Corporation (USA) 10.6. Hitachi High-Tech Corporation (Japan) 10.7. JEOL Ltd. (Japan) 10.8. Keyence Corporation (Japan) 10.9. Phenom-World B.V. (Netherlands, with global operations) 10.10. FEI Company (a Thermo Fisher Scientific Company) (USA) 10.11. Leica Microsystems GmbH (Germany) 10.12. DeltaVision OMX (United Kingdom) 10.13. CrestOptics S.p.A (Italy) 10.14. NanoEnTek Inc. (United Kingdom) 10.15. Aurox Ltd. (United Kingdom) 10.16. A.KRÜSS Optronic GmbH (Germany, with global operations) 10.17. Optika Srl (Italy) 10.18. Huvitz Co. Ltd. (South Korea) 10.19. Laxco, Inc. (USA, with global operations) 10.20. Media Cybernetics, Inc. (USA, with global operations) 11. Key Findings 12. Industry Recommendations 13. Automated Microscopy Market: Research Methodology 14. Terms and Glossary