The Whole Exome Sequencing Market size was valued at USD 1.6 Billion in 2022 and the total revenue is expected to grow at a CAGR of 21.06 % from 2023 to 2029, reaching nearly USD 6.1 Billion. Whole exome sequencing is a genetic test analysing for all protein-coding genes It is crucial for disease identification. It sequences exons, comprising 1% of DNA, detecting variants such as SNVs, indels, and CNVs. WES surpasses Sanger sequencing in versatility and cost-effectiveness, unveiling novel disease associations. However, it not detect non-coding region variants or mosaicism, limiting its scope. The growth of whole exome sequencing market drives numbers of factors such as affordable sequencing tech, robust clinical evidence, and rising personalized medicine demand. Also rise in clinical use stems from compelling evidence diagnosing genetic disorders. The rising demand for personalized medicine aligns with Whole Exome Sequencing capabilities to uncover treatment-influencing genetic variants. The Applications span clinical diagnostics, drug discovery, and agriculture, fostering its market growth.To know about the Research Methodology :- Request Free Sample Report Whole exome sequencing market diverse applications highlight its versatility in diagnosing genetic disorders, advancing drug development, enabling personalized medicine, and contributing to agricultural and animal research. This market is segmented by application, technology, and end user, reflecting its broad impact across various sectors, from pharmaceuticals to research institutions and diagnostic laboratories. North America dominates the Whole Exome Sequencing market, claiming over 40% of the global share. This leadership stems from extensive adoption fueled by well-funded research institutions and pharmaceutical companies in the region, showcasing a robust infrastructure and commitment to advancing genetic research and personalized medicine. Whole Exome Sequencing Market Competitive Landscapes: The Global Whole Exome Sequencing market is expected to be highly competitive active presence of numerous market players. Major companies are striving to introduce cost-efficient and advanced implant-focused products to meet the increasing demand, consequently fostering overall market growth. Key players are adopting various business strategies, including technical partnerships and mergers and acquisitions (M&A) to remain competitive in the Whole Exome Sequencing market. For instance, November 2019, Thermo Fisher Scientific has introduced the Ion Torrent Genexus, a revolutionary sequencing technology that, according to the company, enables a sample-to-report automated process with essentially no hands-on procedures and results in a single day at a cheap cost. October 2019, Illumina Inc. unveiled the NextSeqTM 1000 and NextSeqTM 2000 Sequencing Systems, which include more than 75 improvements in system design, and chemistry, as well as in integrated informatics for rapid secondary analysis. January 2020, The "Genome India Project" was started by the Department of Biotechnology (DBT) (GIP). The goal of the initiative is to collect 10,000 genetic samples from Indian residents in order to create a reference genome. Precision health, rare genetic illnesses, the mutation spectrum of genetic and complex diseases in the Indian population, genetic epidemiology of multifactorial lifestyle diseases, and translational research are some of the areas of attention for this project.

Whole Exome Sequencing Market Dynamics:

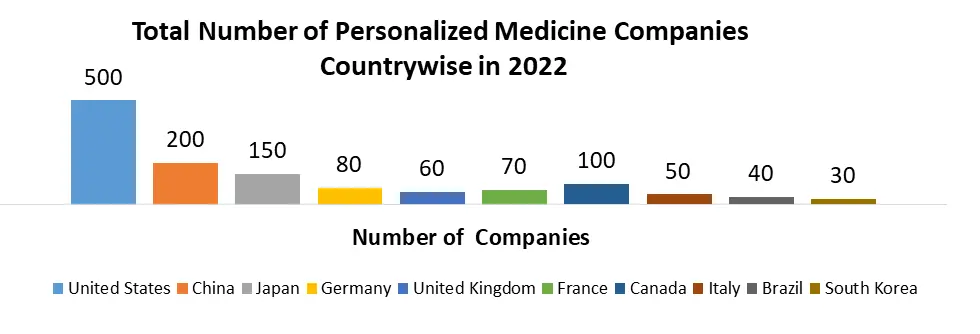

Increasing Adoption in Personalized Medicine The adoption of personalized medicine is driving the growth of the whole exome sequencing market and revolutionizing healthcare by incorporating individual genetic makeup, lifestyle, and environmental factors into treatment decisions. Whole Exome Sequencing Market plays a important role in this paradigm shift, facilitating the identification of genetic biomarkers that forecast patient responses to treatment. For instance, it pinpoint specific genetic variants, enabling tailored approaches, such as identifying individuals likely to respond positively to particular cancer drugs. Moreover, Whole Exome Sequencing Market contributes to the development of targeted therapies by identifying patients with specific genetic mutations that precisely targeted. This precision medicine approach has been reshaping drug development, enhancing efficacy and minimizing adverse effects. whole exome sequencing is also employed for real-time monitoring of patients, identifying those at risk of treatment-related side effects. This information empowers healthcare providers to customize treatment plans, mitigating risks and optimizing patient outcomes. The demand for personalized medicine, driving the whole exome sequencing market has been drive by several factors. Firstly, the increasing cost of healthcare is prompting providers to seek cost-effective solutions that risecpatient outcomes. Personalized medicine achieves this by tailoring treatments, resulting in better outcomes and reduced healthcare expenditures. Secondly, the decreasing cost of DNA sequencing has led to an influx of genetic data, fueling research in personalized medicine. This surge in available data is instrumental in advancing the understanding and applications of whole exome sequencing market. Lastly, the growing preference for patient-centered care is pushing for more personalized healthcare approaches, aligning with the principles of personalized medicine.Growing Demand for Genomic Data Interpretation The rising demand for genomic data interpretation is drive by the exponential growth in genomic data generated through next-generation sequencing (NGS) technologies. This upward trajectory is fueled by several important factors reshaping the genomics landscape. Firstly, the marked reduction in the cost of NGS has democratically opened access to genomic sequencing, resulting in a significant uptick in data generation by researchers and clinicians. The newfound affordability of this technology has instigated a proliferation of genomic data, creating an increasing need for interpretation services. Secondly, NGS plays a crucial role in diagnosing a spectrum of genetic disorders, pinpointing cancer mutations, and tailoring personalized treatment strategies. The growth of clinical applications of NGS contribute substantially to the increasing demand for genomic data interpretation services, essential for extracting meaningful insights from the vast pool of genetic information. Additionally, the intricate nature and extensive variation within the human genome pose a challenge in identifying genetic variants linked to diseases or traits. This complexity necessitates specialized interpretation skills, thereby intensifying the demand for experts in genomic data analysis. Lastly, the relative novelty of the field of genomic data interpretation has led to a shortage of skilled professionals, further accentuating the challenges faced by the industry. The high demand for expertise in interpreting genomic data underscores the pressing need for workforce development and training programs to meet the growing demands of the genomics landscape. High Cost of Production and Stringent Regulatory Approvals The high cost of Whole Exome Sequencing (WES) poses a significant barrier to accessing this technology, despite its increasing importance in diagnosing genetic disorders, identifying cancer mutations, and tailoring personalized treatment plans.. Several factors contribute to the elevated cost of whole exome sequencing, including the expense of sequencing itself, which constitutes the most costly aspect of the process. Additionally, the large volume of data generated by whole exome sequencing necessitates intricate and labor-intensive analysis, further adding to the overall cost. The interpretation of whole exome sequencing results requires specialized expertise in genetics and genomics, contributing to the expense of the test. To mitigate these cost challenges, various strategies are being employed. Companies are actively developing more affordable and efficient sequencing technologies, aiming to make whole exome sequencing more accessible. Standardizing whole exome sequencing protocols is another approach increasing efficiency and reducing costs. The development of automated data analysis tools is also underway, decreasing reliance on manual labor and further lowering expenses. Moreover, training more genetic counselors is crucial for aiding patients in comprehending WES results and making informed decisions about their care. Lastly, increasing access to whole exome sequencing contribute to cost reduction by increasing the overall volume of tests performed. Efforts to make WES more affordable are essential to ensuring that this cutting-edge technology is accessible to a broader demographic, fostering inclusivity in genomic healthcare.

Whole Exome Sequencing Market Segment Analysis:

By Product, the sequencer segment dominated the global Whole Exome Sequencing market with the highest market share in 2022. The segment is further expected to grow during the forecast period. Sequencers are devices that are used to sequence DNA or RNA. They are also used in a variety of applications, including WES, cancer research, and drug discovery. The growth of Whole Exome Sequencing market depends on rising genetic diseases, personalized medicine adoption, and the need for early diagnosis. Key players such as Illumina, Thermo Fisher Scientific, Agilent Technologies, BGI Genomics, and Berry Genomics dominate, focusing on R&D, partnerships, and acquisitions. Competition remains fierce, with innovative products crucial for success. The increasing embrace of personalized medicine, and the surging demand for early diagnosis and treatment options segment is expected to continue to increase the Whole Exome Sequencing market growth during the forecast period. By Application, the diagnostics segment dominated the global Whole Exome Sequencing market with the highest market share in 2022. The segment is further expected to grow a during the forecast period. Whole Exome Sequencing market increasingly sought after as a diagnostic tool for various genetic diseases, such as cancer, Mendelian disorders, and infectious diseases. Also Whole Exome Sequencing market for diagnostics is fueled by the surging prevalence of genetic diseases, the expanding adoption of personalized medicine, and the heightened need for early diagnosis and treatment. This underscores Whole Exome Sequencing market important role in advancing precision medicine and improving outcomes for individuals facing diverse genetic health challenges. The drug discovery and development segment is the second largest application segment of the Whole Exome Sequencing market. This growth is being driven by the increasing demand for personalized medicine, the rising cost of drug development, and the need to improve the success rate of clinical trials. The increasing drug development costs, and the imperative to enhance clinical trial success rates are growth factors of this market. Whole Exome Sequencing market emerges as a key tool in advancing precision medicine and optimizing the efficiency of drug discovery processes. The agriculture and animal research segment is the smallest application segment of the Whole Exome Sequencing market. The application of this segment are improve crop yields, to breed livestock with desired traits, and to study the genetic basis of diseases. The growth of this segment is being driven by the increasing demand for food, the need to improve agricultural sustainability, and the growing interest in personalized animal health care. the agriculture and animal research segment is expected to continue to increase the Whole Exome Sequencing market growth during the forecast period.

Whole Exome Sequencing Market Regional Insights:

The North American region led the global market with the highest market share in 2022. The region is further expected to grow during the forecast period and maintain its dominance by 2029. The increasing number of robust infrastructures for genomics research and a high adoption rate of advanced sequencing technologies are expected to be the major factors driving regional growth. As well as biotechnology and pharmaceutical companies, are actively engaged in whole exome sequencing projects and increased funding for genomics research and the presence of key market players contribute to market growth. Also this factors driving regional growth. The United States is expected to be the key region for the Whole Exome Sequencing Market. The country’s continuous investments in Academic institutions, research centers, and biotechnology companies are a major factor supporting regional growth. In the country Increasing investment in precision medicine and personalized genomics has driven regional growth. The rising use of exome sequencing in clinical diagnostics addresses rare genetic disorders such as autism spectrum disorder and cystic fibrosis. It plays a important role in personalized medicine, tailoring treatments based on individual genetic information for improved efficacy. Substantial investments in pharmaceutical and biotechnology research employ exome sequencing to identify drug targets and formulate personalized treatments. In addition, increasing adoption of exome sequencing in clinical diagnostics is expected to further boost the market growth. As well as market gaining traction in diagnosing genetic disorders due to its efficacy in identifying variants causing diverse conditions. Growing awareness of its benefits and technological advancements make WES increasingly accessible and valuable in personalized healthcare. Canada, further expected to be a significant player in the North American healthcare landscape, also contributes to the regional growth of the market. The Canadian healthcare industry is marked by a diversified and growing demand for personalized medicine which uses an individual's genetic information to tailor their treatment. Also whole Exome Sequencing used to identify genetic variants that contribute to these diseases, which help to develop more effective treatments. In addition Canada is fostering market growth through government initiatives, investing in technology development. This support is anticipated to expedite advancements and expansion in the Canadian Whole Exome Sequencing market.The Asia-Pacific region, with countries such as China, India, and Japan, is emerging as a vital player in the market. The increasing genetic diseases, the growing adoption of personalized medicine and increasing availability of government funding are expected to be the major factors driving the demand for Whole Exome Sequencing. High genetic disease rates applications are witnessing substantial growth of market. Moreover, the region's economic growth is leading to greater healthcare expenditure, which, in turn, boosts market growth. Also Personalized medicine grows, relying on WES. Early diagnosis demand rises, improving outcomes. Government funding fuels are applications of Whole Exome Sequencing market. China, in particular, is becoming a hub for Whole Exome Sequencing production due to its large population base and low manufacturing costs, thereby supporting market growth. This growth is being driven by the increasing prevalence of genetic diseases in China, as well as the growing adoption of personalized medicine.

Whole Exome Sequencing Market Scope:Inquire Before Buying

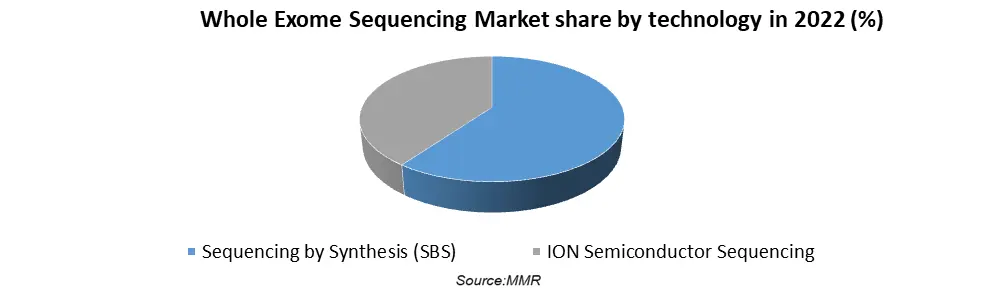

Global Whole Exome Sequencing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 1.6 Bn. Forecast Period 2023 to 2029 CAGR: 21.06% Market Size in 2029: US $ 6.1 Bn. Segments Covered: by Product Kits Sequencer Services by Technology Sequencing by Synthesis(SBS) ION Semiconductor Sequencing by Application Diagnostics Drug Discovery and Development Agriculture and Animal Research by End-User Research Centers and Government Institutes Hospitals and Diagnostics Centers Pharmaceuticals & Biotechnology Companies Whole Exome Sequencing Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Whole Exome Sequencing Market Key Players:

1. Thermo Fisher Scientific Inc., 2. QIAGEN, Illumina, Inc. 3. Beckman Coulter, Inc. 4. Eurofins Scientific 5. Eurofins Scientific 6. ExoDx (a part of Bio-Techne) 7. OUNDATION MEDICINE 8. GeneFirst Limited 9. CeGaT GmbH 10. Meridian, Merck KGaA 11. SOPHiA GENETICS 12. Azenta U.S. Inc. 13. CD Genomics 14. Twist Bioscience 15. PerkinElmer Genomics (A Subsidiary of PerkinElmer Inc.) 16. GeneDx, LLC 17. Psomagen 18. Integrated DNA Technologies, Inc. FAQs: 1. What are the growth drivers for the Whole Exome Sequencing market? Ans. Growing Demand for Genomic Data Interpretation is expected to be the major driver for the Whole Exome Sequencing market. 2. What is the major restraint on the Whole Exome Sequencing market growth? Ans. High Cost of Production and Stringent Regulatory Approvals are expected to be the major restraining factors for the Whole Exome Sequencing market growth. 3. Which region is expected to lead the global Whole Exome Sequencing market during the forecast period? Ans. North America is expected to lead the global Whole Exome Sequencing market during the forecast period. 4. What is the projected market size & and growth rate of the Whole Exome Sequencing Market? Ans. The Whole Exome Sequencing Market size was valued at USD 1.6 Billion in 2022 and the total Whole Exome Sequencing revenue is expected to grow at a CAGR of 21.06 % from 2023 to 2029, reaching nearly USD 6.1 Billion. 5. What segments are covered in the Whole Exome Sequencing Market report? Ans. The segments covered in the Whole Exome Sequencing market report are Product, Technology, Application, End user and Region.

1. Whole Exome Sequencing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 1.4. Whole Exome Sequencing Market Trends by Region 1.4.1. Global Whole Exome Sequencing Market Trends 1.4.2. North America Whole Exome Sequencing Market Trends 1.4.3. Europe Whole Exome Sequencing Market Trends 1.4.4. Asia Pacific Whole Exome Sequencing Market Trends 1.4.5. Middle East and Africa Whole Exome Sequencing Market Trends 1.4.6. South America Whole Exome Sequencing Market Trends 1.4.7. Preference Analysis 1.5. Whole Exome Sequencing Market Dynamics by Region 1.5.1. North America 1.5.1.1. North America Whole Exome Sequencing Market Drivers 1.5.1.2. North America Whole Exome Sequencing Market Restraints 1.5.1.3. North America Whole Exome Sequencing Market Opportunities 1.5.1.4. North America Whole Exome Sequencing Market Challenges 1.5.2. Europe 1.5.2.1. Europe Whole Exome Sequencing Market Drivers 1.5.2.2. Europe Whole Exome Sequencing Market Restraints 1.5.2.3. Europe Whole Exome Sequencing Market Opportunities 1.5.2.4. Europe Whole Exome Sequencing Market Challenges 1.5.3. Asia Pacific 1.5.3.1. Asia Pacific Whole Exome Sequencing Market Drivers 1.5.3.2. Asia Pacific Whole Exome Sequencing Market Restraints 1.5.3.3. Asia Pacific Whole Exome Sequencing Market Opportunities 1.5.3.4. Asia Pacific Whole Exome Sequencing Market Challenges 1.5.4. Middle East and Africa 1.5.4.1. Middle East and Africa Whole Exome Sequencing Market Drivers 1.5.4.2. Middle East and Africa Whole Exome Sequencing Market Restraints 1.5.4.3. Middle East and Africa Whole Exome Sequencing Market Opportunities 1.5.4.4. Middle East and Africa Whole Exome Sequencing Market Challenges 1.5.5. South America 1.5.5.1. South America Whole Exome Sequencing Market Drivers 1.5.5.2. South America Whole Exome Sequencing Market Restraints 1.5.5.3. South America Whole Exome Sequencing Market Opportunities 1.5.5.4. South America Whole Exome Sequencing Market Challenges 1.6. PORTER’s Five Forces Analysis 1.7. PESTLE Analysis 1.8. Value Chain Analysis 1.9. Regulatory Landscape by Region 1.9.1. Global 1.9.2. North America 1.9.3. Europe 1.9.4. Asia Pacific 1.9.5. Middle East and Africa 1.9.6. South America 1.10. Whole Exome Sequencing Clinical Trial Analysis for Whole Exome Sequencing 1.11. Key Opinion Leader Analysis For the Whole Exome Sequencing Industry 1.12. Analysis of Government Schemes and Initiatives For Whole Exome Sequencing Industry 1.13. The Global Pandemic Impact on Whole Exome Sequencing Market 2. Whole Exome Sequencing Market: Global Market Size and Forecast by Segmentation (2022-2029) 2.1. Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 2.1.1. Kits 2.1.2. Sequencer 2.1.3. Services 2.2. Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 2.2.1. Sequencing by Synthesis(SBS) 2.2.2. ION Semiconductor Sequencing 2.3. Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 2.3.1. Diagnostics 2.3.2. Drug Discovery and Development 2.3.3. Agriculture and Animal Research 2.4. Whole Exome Sequencing Market Size and Forecast, by End User (2022-2029) 2.4.1. Research Centers and Government Institutes 2.4.2. Hospitals and Diagnostics Centers 2.4.3. Pharmaceuticals & Biotechnology Companies 2.5. Whole Exome Sequencing Market Size and Forecast, by Region (2022-2029) 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 3. North America Whole Exome Sequencing Market Size and Forecast by Segmentation (2022-2029) 3.1. North America Whole Exome Sequencing Market Size and Forecast, by Products (2022-2029) 3.1.1. Kits 3.1.2. Sequencer 3.1.3. Services 3.2. North America Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 3.2.1. Sequencing by Synthesis(SBS) 3.2.2. ION Semiconductor Sequencing 3.3. North America Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 3.3.1. Diagnostics 3.3.2. Drug Discovery and Development 3.3.3. Agriculture and Animal Research 3.4. North America Whole Exome Sequencing Market Size and Forecast, by End User (2022-2029) 3.4.1. Research Centers and Government Institutes 3.4.2. Hospitals and Diagnostics Centers 3.4.3. Pharmaceuticals & Biotechnology Companies 3.5. North America Whole Exome Sequencing Market Size and Forecast, by Country (2022-2029) 3.5.1. United States 3.5.1.1. United States Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 3.5.1.1.1. Kits 3.5.1.1.2. Sequencer 3.5.1.1.3. Services 3.5.1.2. United States Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 3.5.1.2.1. Sequencing by Synthesis(SBS) 3.5.1.2.2. ION Semiconductor Sequencing 3.5.1.3. United States Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 3.5.1.3.1. Diagnostics 3.5.1.3.2. Drug Discovery and Development 3.5.1.3.3. Agriculture and Animal Research 3.5.1.4. United States Whole Exome Sequencing Market Size and Forecast, by End User (2022-2029) 3.5.1.4.1. Research Centers and Government Institutes 3.5.1.4.2. Hospitals and Diagnostics Centers 3.5.1.4.3. Pharmaceuticals & Biotechnology Companies 3.5.2. Canada 3.5.2.1. Canada Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 3.5.2.1.1. Kits 3.5.2.1.2. Sequencer 3.5.2.1.3. Services 3.5.2.2. Canada Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 3.5.2.2.1. Sequencing by Synthesis(SBS) 3.5.2.2.2. ION Semiconductor Sequencing 3.5.2.3. Canada Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 3.5.2.3.1. Diagnostics 3.5.2.3.2. Drug Discovery and Development 3.5.2.3.3. Agriculture and Animal Research 3.5.2.4. Canada Whole Exome Sequencing Market Size and Forecast, by End User (2022-2029) 3.5.2.4.1. Research Centers and Government Institutes 3.5.2.4.2. Hospitals and Diagnostics Centers 3.5.2.4.3. Pharmaceuticals & Biotechnology Companies 3.5.3. Mexico 3.5.3.1. Mexico Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 3.5.3.1.1. Kits 3.5.3.1.2. Sequencer 3.5.3.1.3. Services 3.5.3.2. Mexico Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 3.5.3.2.1. Sequencing by Synthesis(SBS) 3.5.3.2.2. ION Semiconductor Sequencing 3.5.3.3. Mexico Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 3.5.3.3.1. Diagnostics 3.5.3.3.2. Drug Discovery and Development 3.5.3.3.3. Agriculture and Animal Research 3.5.3.4. Mexico Whole Exome Sequencing Market Size and Forecast, by End User (2022-2029) 3.5.3.4.1. Research Centers and Government Institutes 3.5.3.4.2. Hospitals and Diagnostics Centers 3.5.3.4.3. Pharmaceuticals & Biotechnology Companies 4. Europe Whole Exome Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. Europe Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.2. Europe Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.3. Europe Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.4. Europe Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 4.5. Europe Whole Exome Sequencing Market Size and Forecast, by Country (2022-2029) 4.5.1. United Kingdom 4.5.1.1. United Kingdom Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.5.1.2. United Kingdom Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.5.1.3. United Kingdom Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.5.1.4. United Kingdom Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 4.5.2. France 4.5.2.1. France Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.5.2.2. France Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.5.2.3. France Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.5.2.4. France Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 4.5.3. Germany 4.5.3.1. Germany Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.5.3.2. Germany Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.5.3.3. Germany Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.5.3.4. Germany Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 4.5.4. Italy 4.5.4.1. Italy Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.5.4.2. Italy Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.5.4.3. Italy Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.5.4.4. Italy Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 4.5.5. Spain 4.5.5.1. Spain Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.5.5.2. Spain Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.5.5.3. Spain Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.5.5.4. Spain Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 4.5.6. Sweden 4.5.6.1. Sweden Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.5.6.2. Sweden Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.5.6.3. Sweden Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.5.6.4. Sweden Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 4.5.7. Austria 4.5.7.1. Austria Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.5.7.2. Austria Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.5.7.3. Austria Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.5.7.4. Austria Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 4.5.8. Rest of Europe 4.5.8.1. Rest of Europe Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 4.5.8.2. Rest of Europe Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 4.5.8.3. Rest of Europe Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 4.5.8.4. Rest of Europe Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5. Asia Pacific Whole Exome Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Asia Pacific Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.2. Asia Pacific Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.3. Asia Pacific Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.4. Asia Pacific Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5. Asia Pacific Whole Exome Sequencing Market Size and Forecast, by Country (2022-2029) 5.5.1. China 5.5.1.1. China Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.1.2. China Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.1.3. China Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.1.4. China Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.2. S Korea 5.5.2.1. S Korea Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.2.2. S Korea Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.2.3. S Korea Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.2.4. S Korea Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.3. Japan 5.5.3.1. Japan Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.3.2. Japan Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.3.3. Japan Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.3.4. Japan Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.4. India 5.5.4.1. India Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.4.2. India Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.4.3. India Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.4.4. India Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.5. Australia 5.5.5.1. Australia Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.5.2. Australia Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.5.3. Australia Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.5.4. Australia Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.6. Indonesia 5.5.6.1. Indonesia Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.6.2. Indonesia Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.6.3. Indonesia Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.6.4. Indonesia Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.7. Malaysia 5.5.7.1. Malaysia Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.7.2. Malaysia Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.7.3. Malaysia Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.7.4. Malaysia Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.8. Vietnam 5.5.8.1. Vietnam Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.8.2. Vietnam Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.8.3. Vietnam Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.8.4. Vietnam Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.9. Taiwan 5.5.9.1. Taiwan Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.9.2. Taiwan Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.9.3. Taiwan Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.9.4. Taiwan Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 5.5.10. Rest of Asia Pacific 5.5.10.1. Rest of Asia Pacific Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 5.5.10.2. Rest of Asia Pacific Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 5.5.10.3. Rest of Asia Pacific Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 5.5.10.4. Rest of Asia Pacific Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 6. Middle East and Africa Whole Exome Sequencing Market Size and Forecast (by Value in USD Million) (2022-2029) 6.1. Middle East and Africa Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 6.2. Middle East and Africa Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 6.3. Middle East and Africa Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 6.4. Middle East and Africa Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 6.5. Middle East and Africa Whole Exome Sequencing Market Size and Forecast, by Country (2022-2029) 6.5.1. South Africa 6.5.1.1. South Africa Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 6.5.1.2. South Africa Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 6.5.1.3. South Africa Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 6.5.1.4. South Africa Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 6.5.2. GCC 6.5.2.1. GCC Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 6.5.2.2. GCC Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 6.5.2.3. GCC Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 6.5.2.4. GCC Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 6.5.3. Nigeria 6.5.3.1. Nigeria Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 6.5.3.2. Nigeria Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 6.5.3.3. Nigeria Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 6.5.3.4. Nigeria Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 6.5.4. Rest of ME&A 6.5.4.1. Rest of ME&A Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 6.5.4.2. Rest of ME&A Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 6.5.4.3. Rest of ME&A Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 6.5.4.4. Rest of ME&A Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 7. South America Whole Exome Sequencing Market Size and Forecast by Segmentation (2022-2029 7.1. South America Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 7.2. South America Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 7.3. South America Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 7.4. South America Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 7.5. South America Whole Exome Sequencing Market Size and Forecast, by Country (2022-2029) 7.5.1. Brazil 7.5.1.1. Brazil Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 7.5.1.2. Brazil Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 7.5.1.3. Brazil Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 7.5.1.4. Brazil Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 7.5.2. Argentina 7.5.2.1. Argentina Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 7.5.2.2. Argentina Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 7.5.2.3. Argentina Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 7.5.2.4. Argentina Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 7.5.3. Rest Of South America 7.5.3.1. Rest Of South America Whole Exome Sequencing Market Size and Forecast, by Products(2022-2029) 7.5.3.2. Rest Of South America Whole Exome Sequencing Market Size and Forecast, by Technology (2022-2029) 7.5.3.3. Rest Of South America Whole Exome Sequencing Market Size and Forecast, by Application (2022-2029) 7.5.3.4. Rest Of South America Whole Exome Sequencing Market Size and Forecast, by End User(2022-2029) 8. Global Whole Exome Sequencing Market: Competitive Landscape 8.1. MMR Competition Matrix 8.2. Competitive Landscape 8.3. Key Players Benchmarking 8.3.1. Company Name 8.3.2. Product Segment 8.3.3. End-user Segment 8.3.4. Revenue (2022) 8.3.5. Company Locations 8.4. Market Analysis by Organized Players vs. Unorganized Players 8.4.1. Organized Players 8.4.2. Unorganized Players 8.5. Leading Whole Exome Sequencing Market Companies, by market capitalization 8.6. Market Structure 8.6.1. Market Leaders 8.6.2. Market Followers 8.6.3. Emerging Players 8.7. Mergers and Acquisitions Details 9. Company Profile: Key Players 10. Thermo Fisher Scientific Inc., 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.1.11. QIAGEN, Illumina, Inc. 10.1.12. Beckman Coulter, Inc. 10.1.13. Eurofins Scientific 10.1.14. Eurofins Scientific 10.1.15. ExoDx (a part of Bio-Techne) 10.1.16. OUNDATION MEDICINE 10.1.17. GeneFirst Limited 10.1.18. CeGaT GmbH 10.1.19. Meridian, Merck KGaA 10.1.20. SOPHiA GENETICS 10.1.21. Azenta U.S. Inc. 10.1.22. CD Genomics 10.1.23. Twist Bioscience 10.1.24. PerkinElmer Genomics (A Subsidiary of PerkinElmer Inc.) 10.1.25. GeneDx, LLC 10.1.26. Psomagen 10.1.27. Integrated DNA Technologies, Inc. 11. Key Findings 12. Industry Recommendations 13. Whole Exome Sequencing Market: Research Methodology 14. Terms and Glossary