The Dropshipping Market size was valued at USD 281.35 billion in 2023 and the total Dropshipping Market revenue is expected to grow at a CAGR of 26.1 % from 2024 to 2030, reaching nearly USD 1426.44 billion. Dropshipping is a retail fulfillment method where online stores sell products without stocking inventory. Instead, they rely on third-party suppliers or manufacturers who ship products directly to customers after purchase, eliminating the need for inventory management and upfront investment in stock. The dropshipping market has witnessed exponential growth owing to the surge in e-commerce and digitalization. This model has gained prominence due to its low entry barriers and minimal investment requirements, attracting entrepreneurs and businesses globally. The market is evolving rapidly, driven by technological advancements, shifting consumer behavior, and the ease of setting up online stores. The rise of e-commerce platforms, increasing internet penetration, the preference for convenience in shopping, and the demand for a wide range of products without inventory overhead are significant driving factors. Additionally, the flexibility and scalability of dropshipping attract both new entrants and established businesses.To know about the Research Methodology :- Request Free Sample Report Key growth drivers include the continual rise of online retail, the ability to quickly test and introduce new products to the market, and the global reach facilitated by dropshipping. Furthermore, the model's ability to cater to niche markets, the trend toward subscription-based services, and the ease of integration with various sales channels contribute to the market's growth trajectory. Several trends are shaping the dropshipping market, including the focus on niche markets for specialized products like beauty, health, and hobbies. Subscription box services, personalized product offerings, and the integration of AI-driven tools for order processing and inventory management are emerging trends. Opportunities lie in targeting global markets, collaborations with influencers, omnichannel strategies, and the adoption of advanced technologies for efficient operations. Several market players have made significant strides in the dropshipping landscape. For instance, partnerships between Alibaba.com and Dropified have improved dropshipping services by enhancing integration between online storefronts. Additionally, startup like Flash securing substantial funding signifies investor confidence in the market potential. Moreover, the strategic collaboration between Boohoo and Myntra showcases efforts to expand into new markets, tapping into the growing demand for fashion and lifestyle products. The dropshipping market continues to expand rapidly due to its adaptability, technological advancements, and the shifting landscape of consumer preferences. With continuous innovations and strategic collaborations, the market is poised for substantial growth, offering ample opportunities for businesses to thrive in the e-commerce ecosystem.

Market Dynamics:

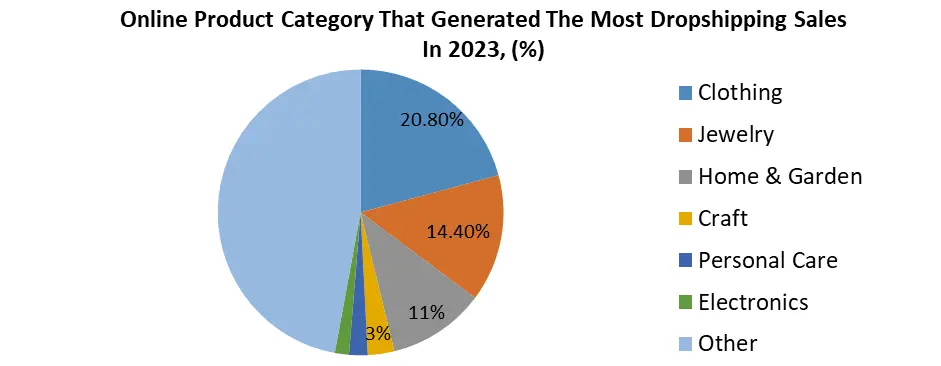

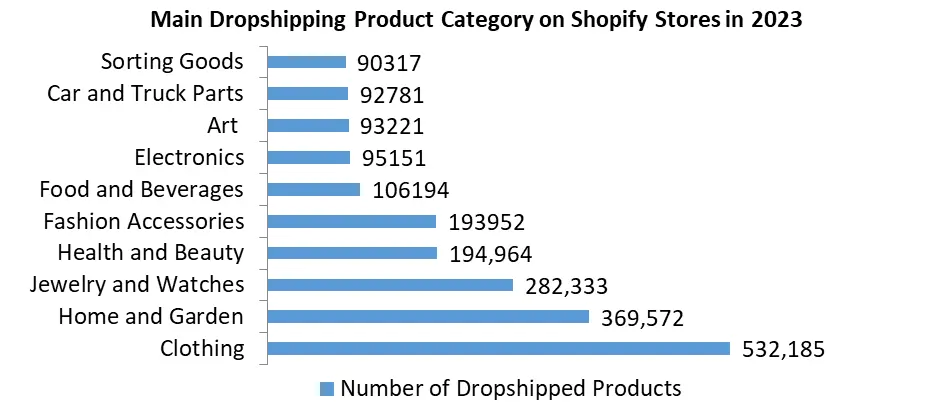

E-commerce Development Fuelling Dropshipping's Global Surge: The continuous development of e-commerce globally acts as a primary driver for the growth of the dropshipping market. With the surge in online shopping trends, dropshipping facilitates easy entry into e-commerce for entrepreneurs. For instance, the $6.31 trillion generated by e-commerce in 2023 shows the immense potential for dropshipping platforms to leverage this dropshipping market development for sustained growth. The global reach and accessibility offered by dropshipping foster market penetration in various regions. For example, with 62.8% of dropshipping stores in the US and the Asia-Pacific region holding 33.92% of the dropshipping market in 2023, it demonstrates diverse geographical coverage, tapping into different consumer markets. Dropshipping presents lucrative opportunities for small business owners, millennials, and Gen Z entrepreneurs. The statistic that 38% of dropshipping store owners are Gen Z and 24% are small business owners exemplifies how this model attracts new entrepreneurial ventures, promoting dropshipping market growth through increased participation and innovation. Evolving consumer preferences for convenient shipping options, eco-friendly practices, and post-pandemic shopping behaviors have a direct impact on the demand for dropshipping services. For instance, the preference for multiple shipping options by 66% of online shoppers and the continuation of online shopping by 51% of individuals post-pandemic highlight how dropshipping aligns with evolving consumer behaviors. Demand for certain product categories, such as apparel and jewelry, significantly drives the growth of the dropshipping market. With apparel accounting for 20.8% and jewelry for 14.4% of all dropshipping sales, it underscores the importance of catering to popular consumer niches to sustain dropshipping market growth. Increasing consumer preference for faster shipping options drives dropshipping market growth. Dropshipping businesses adopting efficient logistics networks or collaborating with fulfillment centers, exemplified by Amazon's FBA (Fulfillment by Amazon) service, meet these demands, enhancing customer satisfaction and boosting market growth. With rising environmental consciousness, consumers prefer eco-friendly products and packaging. Dropshipping companies embracing sustainable practices, like using recycled materials for packaging, resonate well with environmentally conscious consumers. Companies like Package Free Shop highlight how eco-friendly initiatives contribute to dropshipping market growth by attracting a niche consumer base. The ability to collaborate with multiple suppliers globally diversifies product offerings. Brands like Printful exemplify this by providing a wide array of print-on-demand products from various suppliers. This diversification strengthens dropshipping market presence, attracts different consumer segments, and drives overall market growth. These growth drivers collectively contribute to the growth and resilience of the dropshipping market, fostering innovation, geographical development, and alignment with evolving consumer preferences.Innovative Models, Subscription Boxes & Personalized Offerings Drives Market: Dropshipping offers opportunities to target niche markets that traditional retail might overlook. For instance, companies like Beardbrand specialize in niche products (beard grooming) and utilize dropshipping to reach a global audience seeking specific grooming items. This strategy highlights the potential for dropshipping to capitalize on niche markets, catering to unique consumer needs and fostering dropshipping market growth through specialized offerings. The flexibility of dropshipping allows for the easy addition of new products to the inventory without inventory-related risks. Brands like Huel have diversified their product range by adding nutritional products and using dropshipping to reach health-conscious consumers. This capability to expand product lines swiftly drives growth by catering to evolving consumer preferences and widening market reach. Dropshipping businesses can leverage cross-selling and up-selling tactics to boost sales. Companies like Zappos employ cross-selling by suggesting related products at checkout, enhancing the customer shopping experience and driving increased revenue. This strategy harnesses dropshipping's flexibility to expand sales opportunities and foster dropshipping market growth. Dropshipping enables access to global markets without the need for a physical presence. An example is the partnership between international suppliers and retailers like ASOS, utilizing dropshipping to offer a wide range of global fashion products to consumers worldwide. This global growth potential demonstrates how dropshipping can tap into diverse markets, driving dropshipping market growth through increased global reach. The subscription box trend offers a unique growth avenue for dropshipping. Companies like Birchbox curate subscription boxes filled with various beauty products, utilizing dropshipping to source and deliver these items. This recurring revenue model showcases how dropshipping can power subscription-based services, creating consistent revenue streams and fostering market growth. Dropshipping facilitates offering personalized or customizable products, catering to individual consumer preferences. Brands like Vistaprint allow customization of products like business cards or apparel, showcasing dropshipping's capacity to deliver personalized items. This customization capability taps into consumers' desire for unique products, driving Dropshipping Market growth by meeting specific demands. Dropshipping isn't limited to consumer-facing markets; it extends to B2B relationships. Platforms like Alibaba provide B2B dropshipping solutions for businesses sourcing bulk products. This opens up a new avenue for dropshipping market growth by enabling businesses to source products efficiently, streamline operations, and meet industrial needs. Collaborating with influencers or other brands amplifies market reach. The partnership between Gymshark and fitness influencers leverages dropshipping to promote athletic wear, illustrating how influencer collaborations drive market growth by expanding brand visibility and attracting diverse consumer segments. Employing an omnichannel strategy enhances market presence. Companies like Walmart utilize dropshipping to integrate various sales channels, merging online and offline sales seamlessly. This approach drives growth by ensuring consistent brand experiences across channels and reaching consumers through multiple touchpoints. Incorporating AI-driven tools for order processing and inventory management streamlines operations. Businesses like Printify leverage AI for automated product creation and order fulfillment, showcasing how automation enhances efficiency and scalability. Integrating AI-driven solutions fosters market growth by optimizing processes, reducing errors, and supporting business scalability. These opportunities underscore the diverse potential for dropshipping market growth across various industries.

Shipping Complexities and Customer Dissatisfaction Effects of Extended Delivery Times: Relying on third-party suppliers leads to inconsistencies in product quality and shipment reliability. For example, unresolved supplier issues cause delays in delivery or substandard products, affecting customer satisfaction and brand reputation, as seen in instances with unreliable suppliers on platforms like AliExpress. The low barriers to entry in dropshipping contribute to intense competition and dropshipping market saturation. An example is the fierce competition among dropshippers on platforms like Amazon, making it challenging for new entrants to gain visibility and establish a distinct dropshipping market presence. With numerous intermediaries involved, profit margins shrink due to high competition and price undercutting. For instance, excessive competition on platforms like eBay leads to aggressive pricing strategies, impacting profit margins for dropshippers. Shipping complexities, including long delivery times and high shipping costs, pose challenges. An example is the extended delivery periods experienced in international shipping, which dissuades customers and results in negative reviews and reduced customer retention for dropshippers. Inaccurate inventory tracking and stockouts due to supplier discrepancies lead to unfulfilled orders and dissatisfied customers. For instance, sudden stockouts on dropshipping platforms like Oberlo hamper order fulfillment, affecting customer satisfaction. Inherent communication gaps between dropshippers and end-customers arise, leading to difficulties in addressing inquiries, returns, or product-related issues promptly. This communication gap results in customer dissatisfaction, impacting repeat purchases and brand loyalty. Dropshippers must navigate various legalities, including product liability and compliance with consumer protection laws across different dropshipping markets. For instance, selling products without proper certification or meeting regulatory standards leads to legal issues, as observed in instances where dropshippers face lawsuits due to non-compliant products. Reliance on third-party platforms exposes dropshippers to policy changes or account suspensions, affecting business operations and revenue. An example is policy modifications on platforms like Shopify, impacting dropshippers' sales strategies and business continuity. Inconsistent product quality or delayed deliveries tarnish a brand's reputation and erode consumer trust. For instance, negative reviews and feedback due to unreliable product quality significantly impact a dropshipper's credibility. Integrating diverse systems, managing data, and adopting new technologies for order processing is complex and resource-intensive. For example, adapting to new software or technology for order fulfillment, as seen in the challenges faced by dropshippers utilizing advanced inventory management systems. Each challenge or restraint presents hurdles that dropshippers must overcome to sustain growth and success in the competitive e-commerce landscape.

Dropshipping Market Segment Analysis:

Based on Product Type, In the Dropshipping Market segment analysis, various sectors showcase differing dominance levels and future potential. Fashion stands out as one of the dominant segments in 2023, attracting a significant consumer base due to the diverse array of clothing, accessories, and trends. Electronics and Media follow suit, holding a substantial dropshipping market share, driven by the constant demand for gadgets and entertainment devices. However, looking ahead, the Furniture and Appliances segment is anticipated to surge, responding to the rising trend in home improvement and furnishing needs. Additionally, Food and Personal Care exhibits promising growth, given the increasing interest in health-conscious products and subscription box services. The Toys, Hobby, and DIY segment, while significant, might face slower growth compared to others due to niche interests and specific consumer demands. The adoption of dropshipping across these segments varies based on consumer preferences, dropshipping market trends, and the ease of shipping or customization. Fashion and electronics have witnessed extensive applications due to consumer interest, whereas Furniture and Appliances are progressively adopting dropshipping methods to cater to evolving household needs. Food and Personal Care sectors are adopting dropshipping to curate subscription-based services, tapping into recurring revenue models. Despite each segment's unique standing, future dominance might shift towards Furniture and Appliances and Food and Personal Care, driven by evolving consumer habits and lifestyle preferences.

Dropshipping Market Regional Insights:

North America dominated the dropshipping market in 2023 and is expected to grow during the forecast period, particularly the United States, which has asserted dominance, hosting a significant share due to a mature e-commerce landscape and technological advancements. With a substantial number of dropshipping stores and a high percentage of sales, the US remains a primary player in the industry. Asia-Pacific, particularly China, is expected to experience remarkable growth. The region's burgeoning e-commerce market, high population density, and increasing internet penetration create fertile ground for significant dropshipping market development. China, being a major contributor to global e-commerce sales, is expected to leverage its expertise in online retailing to further propel the dropshipping market. For instance, In China, Alibaba's B2B and B2C platforms capitalize on the country's e-commerce prowess, driving substantial growth. Countries like South Korea and Japan in the Asia-Pacific region are also poised for growth due to their tech-savvy populations and growing online consumer base. Europe, with a strong e-commerce infrastructure in countries like the United Kingdom and Germany, holds a substantial share of the dropshipping market. The Middle East and Africa, while showing potential, are in the early stages of dropshipping adoption compared to more established markets. Latin America, led by countries like Brazil, is gradually embracing dropshipping, but challenges like logistics and payment methods hinder rapid growth. Real-time examples include the dominance of the US with established dropshipping stores and high sales volumes. Europe's key players like ASOS and Zalando exhibit strong positions in the dropshipping market. In Africa, South Africa's growing online retail landscape showcases potential for future growth. Latin America, represented by MercadoLibre, signifies emerging opportunities.Competitive Landscape: These recent developments significantly influence the growth of the dropshipping market by revolutionizing e-commerce operations. Collaborations like GrowTal and MerchMixer or Alibaba.com with Dropified streamline dropshipping processes, empowering businesses to efficiently manage their online storefronts. Dropshipping Direct's acquisition of Empire Ecommerce upgrades infrastructure, introducing advanced technology for automated e-commerce solutions, aiding clients in generating passive income. Boohoo's expansion into the Indian dropshipping market through Myntra and Flipkart's partnership with Adani Group strengthens e-commerce platforms, fostering an enlarged customer base. Such alliances improve supply chain infrastructure and offer diverse product catalogs, catering to evolving consumer demands. These initiatives enhance operational efficiency, expand dropshipping market reach, and leverage technology, driving the dropshipping market's growth. By facilitating smoother processes, wider product availability, and improved logistics, these developments aim to create a more robust and scalable dropshipping ecosystem, attracting more businesses and investors to the market.

In April 2023, GrowTal, in partnership with MerchMixer, introduced the GrowTal Shopify Dropship Store, aiming to simplify the setup and promotion of Shopify stores for businesses. This collaboration offers pre-built Shopify stores, streamlining customization and launch processes, while providing access to diverse goods and related services for e-commerce ventures. In November 2023, Dropshipping Direct acquired Empire Ecommerce, enhancing its infrastructure and customer base. This move aims to forge new business alliances while empowering clients with independence and financial autonomy. Dropshipping Direct utilizes advanced technology for automated e-commerce store construction, managing product sourcing, sales, shipping, refunds, and customer inquiries, enabling clients to generate passive income. In February 2023, Alibaba.com partnered with Dropified to enhance dropshipping services. This collaboration allows dropshippers to link Dropified and Alibaba.com, enabling seamless communication between online storefronts for efficient order fulfillment. In December 2023, Flash, an e-commerce startup, secured USD 5.8 million in funding from prominent angel investors and international backers. In December 2023, Boohoo, a trendsetting UK apparel brand, ventured into the Indian market through Myntra, introducing over 1,500 on-trend styles from brands like Boohoo, Dorothy Perkins (DP), and Nasty Gal across various categories on the Myntra Online Brand Store (OBS). In April 2021, Flipkart, India's leading domestic e-commerce platform, formed a strategic partnership with the Adani Group. Adani Logistics, a subsidiary of Adani Ports & Special Economic Zone, collaborated with Flipkart to enhance the latter's supply chain infrastructure, further bolstering its ability to cater to an expanding customer base.

Dropshipping Market Scope:Inquire Before Buying

Global Dropshipping Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 281.35 Bn. Forecast Period 2024 to 2030 CAGR: 26.1% Market Size in 2030: US $ 1426.44 Bn. Segments Covered: by Product Type Toys, Hobby, and DIY Furniture and Appliances Food and Personal Care Electronics and Media Fashion Other by Destination Domestic International by Organization Size Small and Medium-Size Enterprises Large Enterprises Dropshipping Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Dropshipping Market Key Players:

1. Alidropship 2. AliExpress 3. Cin7 Orderhive Inc. 4. DHgate 5. Doba Inc. 6. Dropified 7. Direct Dropship 8. Etsy, Inc. 9. Inventory Source Corporation 10. Megagoods, Inc. 11. Modalyst Inc. 12. Oberlo 13. Printful, 14. Printify Inc. 15. Shopify Inc. 16. Spocket 17. Sumner Communications, Inc. 18. Sunrise Wholesale Merchandise LLC 19. Wholesale Central 20. Wholesale2b Corporation 21. Worldwide Brands FAQs: 1. What are the growth drivers for the Dropshipping Market? Ans. E-commerce development Fuelling Dropshipping's Global Surge and is expected to be the major driver for the Dropshipping Market. 2. What is the major Opportunity for the Dropshipping Market growth? Ans. Innovative Models, Subscription Boxes & Personalized Offerings Drives Market is expected to be the major Opportunity in the Dropshipping Market. 3. Which country is expected to lead the global Dropshipping Market during the forecast period? Ans. The North America expected to lead the Dropshipping Market during the forecast period. 4. What is the projected market size and growth rate of the Dropshipping Market? Ans. The Dropshipping Market size was valued at USD 281.35 billion in 2023 and the total Dropshipping Market revenue is expected to grow at a CAGR of 26.1 % from 2023 to 2030, reaching nearly USD 1426.44 billion. 5. What segments are covered in the Dropshipping Market report? Ans. The segments covered in the Dropshipping Market report are by Product Type, Destination, Organization Size, and Region.

1. Dropshipping Market: Research Methodology 2. Dropshipping Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Dropshipping Market: Dynamics 3.1 Dropshipping Market Trends by Region 3.1.1 North America Dropshipping Market Trends 3.1.2 Europe Dropshipping Market Trends 3.1.3 Asia Pacific Dropshipping Market Trends 3.1.4 Middle East and Africa Dropshipping Market Trends 3.1.5 South America Dropshipping Market Trends 3.2 Dropshipping Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Dropshipping Market Drivers 3.2.1.2 North America Dropshipping Market Restraints 3.2.1.3 North America Dropshipping Market Opportunities 3.2.1.4 North America Dropshipping Market Challenges 3.2.2 Europe 3.2.2.1 Europe Dropshipping Market Drivers 3.2.2.2 Europe Dropshipping Market Restraints 3.2.2.3 Europe Dropshipping Market Opportunities 3.2.2.4 Europe Dropshipping Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Dropshipping Market Drivers 3.2.3.2 Asia Pacific Dropshipping Market Restraints 3.2.3.3 Asia Pacific Dropshipping Market Opportunities 3.2.3.4 Asia Pacific Dropshipping Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Dropshipping Market Drivers 3.2.4.2 Middle East and Africa Dropshipping Market Restraints 3.2.4.3 Middle East and Africa Dropshipping Market Opportunities 3.2.4.4 Middle East and Africa Dropshipping Market Challenges 3.2.5 South America 3.2.5.1 South America Dropshipping Market Drivers 3.2.5.2 South America Dropshipping Market Restraints 3.2.5.3 South America Dropshipping Market Opportunities 3.2.5.4 South America Dropshipping Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives For the Dropshipping Industry 3.8 The Global Pandemic and Redefining of The Dropshipping Industry Landscape 3.9 Technological Road Map 4. Global Dropshipping Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Global Dropshipping Market Size and Forecast, By Product Type (2023-2030) 4.1.1 Toys, Hobby and DIY 4.1.2 Furniture and Appliances 4.1.3 Food and Personal Care 4.1.4 Electronics and Media 4.1.5 Fashion 4.1.6 Other 4.2 Global Dropshipping Market Size and Forecast, By Destination (2023-2030) 4.2.1 Domestic 4.2.2 International 4.3 Global Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 4.3.1 Small and Medium-Size Enterprises 4.3.2 Large Enterprises 4.4 Global Dropshipping Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Dropshipping Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 North America Dropshipping Market Size and Forecast, By Product Type (2023-2030) 5.1.1 Toys, Hobby and DIY 5.1.2 Furniture and Appliances 5.1.3 Food and Personal Care 5.1.4 Electronics and Media 5.1.5 Fashion 5.1.6 Other 5.2 North America Dropshipping Market Size and Forecast, By Destination (2023-2030) 5.2.1 Domestic 5.2.2 International 5.3 North America Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 5.3.1 Small and Medium-Size Enterprises 5.3.2 Large Enterprises 5.4 North America Dropshipping Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Dropshipping Market Size and Forecast, By Product Type (2023-2030) 5.4.1.1.1 Toys, Hobby and DIY 5.4.1.1.2 Furniture and Appliances 5.4.1.1.3 Food and Personal Care 5.4.1.1.4 Electronics and Media 5.4.1.1.5 Fashion 5.4.1.1.6 Other 5.4.1.2 United States Dropshipping Market Size and Forecast, By Destination (2023-2030) 5.4.1.2.1 Domestic 5.4.1.2.2 International 5.4.1.3 United States Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 5.4.1.3.1 Small and Medium-Size Enterprises 5.4.1.3.2 Large Enterprises 5.4.2 Canada 5.4.2.1 Canada Dropshipping Market Size and Forecast, By Product Type (2023-2030) 5.4.2.1.1 Toys, Hobby and DIY 5.4.2.1.2 Furniture and Appliances 5.4.2.1.3 Food and Personal Care 5.4.2.1.4 Electronics and Media 5.4.2.1.5 Fashion 5.4.2.1.6 Other 5.4.2.2 Canada Dropshipping Market Size and Forecast, By Destination (2023-2030) 5.4.2.2.1 Domestic 5.4.2.2.2 International 5.4.2.3 Canada Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 5.4.2.3.1 Small and Medium-Size Enterprises 5.4.2.3.2 Large Enterprises 5.4.3 Mexico 5.4.3.1 Mexico Dropshipping Market Size and Forecast, By Product Type (2023-2030) 5.4.3.1.1 Toys, Hobby and DIY 5.4.3.1.2 Furniture and Appliances 5.4.3.1.3 Food and Personal Care 5.4.3.1.4 Electronics and Media 5.4.3.1.5 Fashion 5.4.3.1.6 Other 5.4.3.2 Mexico Dropshipping Market Size and Forecast, By Destination (2023-2030) 5.4.3.2.1 Domestic 5.4.3.2.2 International 5.4.3.3 Mexico Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 5.4.3.3.1 Small and Medium-Size Enterprises 5.4.3.3.2 Large Enterprises 6. Europe Dropshipping Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 Europe Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.2 Europe Dropshipping Market Size and Forecast, By Destination (2023-2030) 6.3 Europe Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 6.4 Europe Dropshipping Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.4.1.2 United Kingdom Dropshipping Market Size and Forecast, By Destination (2023-2030) 6.4.1.3 United Kingdom Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 6.4.2 France 6.4.2.1 France Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.4.2.2 France Dropshipping Market Size and Forecast, By Destination (2023-2030) 6.4.2.3 France Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.4.3.2 Germany Dropshipping Market Size and Forecast, By Destination (2023-2030) 6.4.3.3 Germany Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.4.4.2 Italy Dropshipping Market Size and Forecast, By Destination (2023-2030) 6.4.4.3 Italy Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.4.5.2 Spain Dropshipping Market Size and Forecast, By Destination (2023-2030) 6.4.5.3 Spain Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.4.6.2 Sweden Dropshipping Market Size and Forecast, By Destination (2023-2030) 6.4.6.3 Sweden Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.4.7.2 Austria Dropshipping Market Size and Forecast, By Destination (2023-2030) 6.4.7.3 Austria Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Dropshipping Market Size and Forecast, By Product Type (2023-2030) 6.4.8.2 Rest of Europe Dropshipping Market Size and Forecast, By Destination (2023-2030). 6.4.8.3 Rest of Europe Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7. Asia Pacific Dropshipping Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 7.1 Asia Pacific Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.2 Asia Pacific Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.3 Asia Pacific Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4 Asia Pacific Dropshipping Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.1.2 China Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.1.3 China Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.2.2 S Korea Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.2.3 S Korea Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.3.2 Japan Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.3.3 Japan Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.4 India 7.4.4.1 India Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.4.2 India Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.4.3 India Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.5.2 Australia Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.5.3 Australia Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.6.2 Indonesia Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.6.3 Indonesia Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.7.2 Malaysia Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.7.3 Malaysia Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.8.2 Vietnam Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.8.3 Vietnam Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.9.2 Taiwan Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.9.3 Taiwan Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.10.2 Bangladesh Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.10.3 Bangladesh Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.11.2 Pakistan Dropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.11.3 Pakistan Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Dropshipping Market Size and Forecast, By Product Type (2023-2030) 7.4.12.2 Rest of Asia PacificDropshipping Market Size and Forecast, By Destination (2023-2030) 7.4.12.3 Rest of Asia Pacific Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 8. Middle East and Africa Dropshipping Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 8.1 Middle East and Africa Dropshipping Market Size and Forecast, By Product Type (2023-2030) 8.2 Middle East and Africa Dropshipping Market Size and Forecast, By Destination (2023-2030) 8.3 Middle East and Africa Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 8.4 Middle East and Africa Dropshipping Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Dropshipping Market Size and Forecast, By Product Type (2023-2030) 8.4.1.2 South Africa Dropshipping Market Size and Forecast, By Destination (2023-2030) 8.4.1.3 South Africa Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Dropshipping Market Size and Forecast, By Product Type (2023-2030) 8.4.2.2 GCC Dropshipping Market Size and Forecast, By Destination (2023-2030) 8.4.2.3 GCC Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Dropshipping Market Size and Forecast, By Product Type (2023-2030) 8.4.3.2 Egypt Dropshipping Market Size and Forecast, By Destination (2023-2030) 8.4.3.3 Egypt Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Dropshipping Market Size and Forecast, By Product Type (2023-2030) 8.4.4.2 Nigeria Dropshipping Market Size and Forecast, By Destination (2023-2030) 8.4.4.3 Nigeria Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Dropshipping Market Size and Forecast, By Product Type (2023-2030) 8.4.5.2 Rest of ME&A Dropshipping Market Size and Forecast, By Destination (2023-2030) 8.4.5.3 Rest of ME&A Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 9. South America Dropshipping Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 9.1 South America Dropshipping Market Size and Forecast, By Product Type (2023-2030) 9.2 South America Dropshipping Market Size and Forecast, By Destination (2023-2030) 9.3 South America Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 9.4 South America Dropshipping Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Dropshipping Market Size and Forecast, By Product Type (2023-2030) 9.4.1.2 Brazil Dropshipping Market Size and Forecast, By Destination (2023-2030) 9.4.1.3 Brazil Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Dropshipping Market Size and Forecast, By Product Type (2023-2030) 9.4.2.2 Argentina Dropshipping Market Size and Forecast, By Destination (2023-2030) 9.4.2.3 Argentina Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Dropshipping Market Size and Forecast, By Product Type (2023-2030) 9.4.3.2 Rest Of South America Dropshipping Market Size and Forecast, By Destination (2023-2030) 9.4.3.3 Rest Of South America Dropshipping Market Size and Forecast, By Organization Size (2023-2030) 10. Global Dropshipping Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Dropshipping Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Alidropship 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.2 AliExpress 11.3 Cin7 Orderhive Inc. 11.4 DHgate 11.5 Doba Inc. 11.6 Dropified 11.7 Direct Dropship 11.8 Etsy, Inc. 11.9 Inventory Source Corporation 11.10 Megagoods, Inc. 11.11 Modalyst Inc. 11.12 Oberlo 11.13 Printful, 11.14 Printify Inc. 11.15 Shopify Inc. 11.16 Spocket 11.17 Sumner Communications, Inc. 11.18 Sunrise Wholesale Merchandise LLC 11.19 Wholesale Central 11.20 Wholesale2b Corporation 11.21 Worldwide Brands 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary