Dried Vegetable Market size was valued at USD 16.41 Bn. in 2023 and the total Dried Vegetable Market revenue is expected to grow by 5.6 % from 2024 to 2030, reaching nearly USD 24.03 Bn.Dried Vegetable Market Overview:

Vegetable undergoes drying to prolong their shelf life and intensify its flavour. The market encompasses the worldwide trade of dried vegetables, which undergo processing to eliminate moisture and prolong their shelf life. Drying, an ancient preservation technique involves extracting water from vegetables while preserving their original nutritional composition. Dried vegetables find extensive usage across different sectors, including food processing, convenience food production, and retail.To know about the Research Methodology :- Request Free Sample Report Dried vegetables offer numerous advantages in comparison to fresh vegetables. Their extended shelf-life curbs food wastage and enables consumers to relish vegetables even when they are not in season. Dried vegetables sustain alike levels of calories, proteins, fats, carbohydrates, fibres, and sugars as their fresh counterparts. Ongoing research indicates that some compounds activated during the drying process in specific foods may offer additional protection against particular types of cancer. Dehydrated foods exhibit versatility and can be utilized in various ways. They can be consumed as snacks, added to salads, oatmeal, baked goods, and smoothies, or rehydrated in liquid for inclusion in recipes. Their lightweight nature and nutrient density make them a favoured choice among hikers and travellers. Dried Vegetable Market Scope and Research Methodology The Dried Vegetable Market report is a withal representation of innovation, policy support, increased competition, and environmental concerns by global and local players holding Dried Vegetable Market in different countries. The report covered Market structure by comparative analysis of key players, and market followers, which makes this report insightful to the Dried Vegetable Market outlook. The Dried Vegetable Market report aims to outlook the market size based on segments, regional distribution and industry competition. The bottom-up approach has been used to estimate and forecast market size and market growth. The report provides a detailed examination of the key players in the industry, including revenue. The report covers the global, regional and local level analysis of the Dried Vegetable Market with the factors restraining, driving and challenging the market growth during the forecast period.

Dried Vegetable Market Dynamics:

Dried Vegetable Market Drivers Growing Awareness about the Nutritional Benefits and Longer Shelf Life of Dried Vegetables The increasing awareness among consumers regarding the nutritional benefits and longer shelf life of dried vegetables is a significant driving force in the Dried Vegetable Market. As individuals prioritize their health and search for convenient and durable food choices, dried vegetables have gained considerable popularity. Consumer awareness regarding the nutritional benefits of dried vegetables is increasing. Dried Vegetables retain vital nutrients such as vitamins, minerals, and fibre. For instance, dried tomatoes are abundant in lycopene, an antioxidant that has been linked to a reduced risk of certain cancers. The extended shelf life of dried vegetables compared to their fresh counterparts is appealing to consumers. For example, a package of dried mixed vegetables stored in a pantry for several months provides a convenient and reliable nutrient source when fresh vegetables are not readily available. consumers become more aware of the nutritional advantages and extended shelf life of dried vegetables, there is expected to be substantial growth in the demand for these products. Manufacturers and retailers are responding to this demand by expanding their range of dried vegetable products and actively promoting their advantages through marketing and educational campaigns. Dried Vegetable Market Restraint Maintaining Quality Standards During the Drying Process Hinders Market Growth Maintaining high-quality standards while drying vegetables is a big challenge for the dried vegetable market. It's difficult to ensure that dried vegetables are always consistent in quality, taste, and nutrition. Vegetables have different moisture levels and textures, making it tough to dry them, in the same way, every time. This leads to variations in the quality of the dried vegetables. Additionally, the drying process changes the taste, colour, and nutrients of the vegetables. Too much heat exposure can reduce the vitamins and antioxidants, affecting their nutritional value and possibly discouraging health-conscious consumers. Maintaining food safety during drying is very important which requires strict hygiene standards. Any compromise in quality or safety can undermine customer trust and hinder Dried Vegetable Market growth. Dried Vegetable Market Opportunity Development of innovative and value-added dried vegetable products The dried vegetable market has experienced significant growth due to increased consumer demand for convenient, nutritious, and long-lasting food options. A key opportunity in this market lies in the development of innovative and value-added dried vegetable products. Manufacturers can take advantage of this opportunity by introducing new offerings that cater to emerging consumer trends, expanding their customer base, and further driving market growth. This involves transforming traditional dried vegetables into new forms, flavours, and packaging while retaining their nutritional benefits. By exploring new flavours, forms, and packaging options, manufacturers can meet evolving consumer demands for convenience, nutrition, and variety. Examples include flavoured vegetable chips and vegetable powders, which offer unique and healthier options. These innovations not only differentiate products in a competitive market but also appeal to niche consumer segments, expanding the customer base. Embracing these opportunities requires research and development, investment in production technologies, and a deep understanding of consumer preferences. Seizing this market opportunity allows the dried vegetable industry to thrive and meet the changing needs of consumers seeking nutritious and convenient food choices. Dried Vegetable Market Segment Analysis: Based on Type, Air drying has dominated the dried vegetable market in 2023 and is expected to continue its dominance during the forecast period as it is a traditional method that involves natural air circulation to gradually remove moisture from the vegetables. It is a cost-effective technique that preserves the vegetables' taste and nutrients, although it may result in some loss of colour and texture. Followed by Freeze drying, a method that involves freezing the vegetables and then placing them in a vacuum environment to remove moisture. This process helps retain the vegetables' original texture, flavor, and nutritional content. Spray drying is expected to grow at good CAGR during the forecast period as it involves converting the vegetable puree or extract into a fine mist, which is then dried by hot air. While Drum drying utilizes a heated drum to dry vegetables into flakes or powder. The vegetables are spread thinly on the drum's surface and exposed to high temperatures, resulting in rapid drying. Each drying method offers unique advantages and applications, and their selection depends on factors such as the desired final product, preservation of nutrients, and cost considerations. The choice of drying method can impact the quality, texture, and shelf stability of the dried vegetable products in the dried vegetable market.Dried Vegetable Market ,by Type (%) In 2023

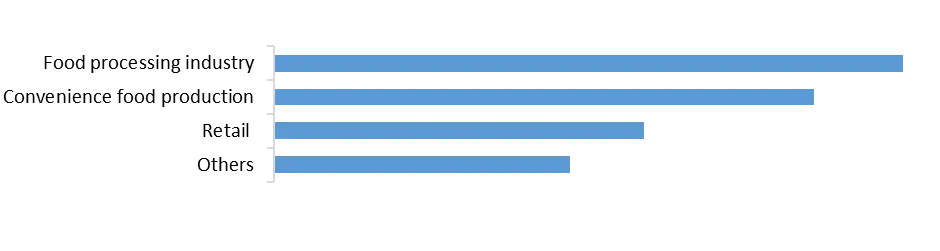

Based on End-use Industry, the food processing industry dominated the market share with 46% in 2023 as it is a significant consumer of dried vegetables as they are used as ingredients in various food products. Dried vegetables add flavor, texture, and nutritional value to processed foods such as soups, sauces, ready-to-eat meals, and snack products. While Convenience food production is another key sector that uses dried vegetables extensively. These products, which include instant noodles, dehydrated soups, and meal kits, rely on dried vegetables for ease of preparation, extended shelf life, and enhanced taste. Supermarkets, hypermarkets, and specialty stores play a crucial role in the dried vegetable market by providing consumers with a wide selection of dried vegetable products. These retail channels satisfy the increasing demand for healthier and more convenient food choices. Dried vegetables are also utilized in pharmaceuticals and nutraceuticals, where they are incorporated into dietary supplements, powders, and capsules due to their concentrated nutrients and potential health advantages. The diverse range of end-use industries contributes to the rising demand and growth of dried vegetables as they cater to the diverse preferences and requirements of consumers in various sectors.

Dried Vegetable Market Share, By End-use Industry in 2023 (%)

Dried Vegetable Market Regional Insights:

North America dominated the market in 2023 and is expected to continue its dominance. Thanks to the increasing demand for healthy and convenient food options has led to the consistent growth in Dried vegetables have become popular due to the focus on plant-based diets and snacking trends. In the United States, consumers are increasingly preferring organic and non-GMO dried vegetables, seeking natural and sustainable choices. In Europe, the desire for healthier alternatives and long-lasting food products drives the dried vegetable market. The region's diverse culinary culture presents opportunities for value-added dried vegetables products, such as seasonings or gourmet blends for cooking. European consumers are also showing interest in locally sourced and sustainable dried vegetable options. The Asia-Pacific region, including countries like China, Japan, and India, offers a significant market for dried vegetables. Traditional ingredients like dried mushrooms and seaweed are extensively used in Chinese dishes and snacks. The region's growing urban population and busy lifestyles have created a demand for convenient and healthy food options, leading to opportunities in dried vegetable products like crisps or noodles that cater to health-conscious consumers. The dried vegetable market in South America is experiencing growth due to the region's abundant agricultural resources and culinary diversity. Countries such as Mexico and Brazil have a strong demand for dried vegetables, particularly chilli peppers, corn, and beans. These regional insights highlight the diverse opportunities in the dried vegetable market, driven by cultural preferences, dietary trends, and consumer demands. Manufacturers and suppliers can leverage this information to develop customized strategies and products tailored to each region's specific requirements, thereby driving market growth and meeting consumer expectations.Dried Vegetable Market Regional Insights by % (2023)

Competitive Landscape: The global dried vegetable market is comprised of prominent companies such as Nestle SA, Olam International Ltd., B&G Foods Inc., Harmony House Foods Inc., and Sensient Technologies Corporation. These companies have made their mark in the industry by offering a wide range of dried vegetable products, benefiting from brand recognition and strong distribution networks. The dried vegetable market exhibits fragmentation, housing both multinational corporations and regional players. Local and regional manufacturers tend to cater to specific regional preferences, while larger companies possess wider market reach, enabling them to provide diverse dried vegetable options. To stay ahead, companies are investing in research and development to create innovative dried vegetable products. They focus on introducing new flavours, blends, and packaging choices to meet evolving consumer preferences. Differentiation through unique formulations, organic or non-GMO certifications, and value-added offerings like seasonings or mixes also play a vital role in the competitive landscape. As consumer demand for natural and sustainable products rises, companies emphasize quality assurance and sustainable sourcing practices. This includes certifications for organic, non-GMO, and fair-trade products, along with efforts to reduce environmental impact and support ethical sourcing. The competitive landscape varies across regions, with local players often holding strong market positions in their respective areas. Global companies focus on expanding distribution networks and establishing partnerships to capture dried vegetable market share in different geographical regions.

Global Dried Vegetable Market Scope : Inquire Before Buying

Global Dried Vegetable Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 16.41 Bn. Forecast Period 2024 to 2030 CAGR: 5.6% Market Size in 2030: US $ 24.03 Bn. Segments Covered: by Vegetable Type Leafy vegetables Root vegetables Legumes Brassica vegetables Others by Type Freeze Dried Air Dried Spray Dried Drum Dried Vacuum Dried by Distribution Channel Direct sales (B2B) Retail sales (B2C) E-commerce by Delivery Options Home Delivery In-Store Pickup by End Use Industry Food processing industry Convenience food production Retail Others Dried Vegetable Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Dried Vegetable Market, Key Players are

1. BCFoods 2. FuQiang Dehydrated Vegetables Co. 3. Harmony House Foods, Inc. 4. Jain Irrigation Systems 5. Jaworski Vegetable Drying Plant 6. Kanghua 7. Kerry Group plc 8. Krusha Premium Industries Pvt. Ltd. 9. Maharaja Dehydration 10. Mercer Foods, LLC 11. Natural Dehydrated Vegetables 12. Nestle SA 13. Olam 14. Richfield 15. Rosun Dehydration 16. Seawind Foods 17. Sensient Technologies Corporation 18. Silva International 19. Steinicke 20. ZhongliFrequently Asked Questions:

1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Vegetable Type, Type, Distribution Channel, Delivery Options, End-use Industry and Region. 2] Which region is expected to hold the highest share of the Global Market? Ans. The Asia Pacific region is expected to hold the highest share of the Market. 3] What is the market size of the Global Market by 2030? Ans. The market size of the Dried Vegetable Market by 2030 is expected to reach US$ 24.03 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2024-2030 5] What was the market size of the Global Market in 2023? Ans. The market size of the Dried Vegetable Market in 2023 was valued at US$ 16.41 Bn.

1. Dried Vegetable Market: Research Methodology 2. Dried Vegetable Market: Executive Summary 3. Dried Vegetable Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Dried Vegetable Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Dried Vegetable Market: Segmentation (by Value USD and Volume Units) 5.1. Dried Vegetable Market, by Vegetable Type (2023-2030) 5.1.1. Leafy vegetables 5.1.2. Root vegetables 5.1.3. Legumes 5.1.4. Brassica vegetables 5.1.5. Others 5.2. Dried Vegetable Market, by Type (2023-2030) 5.2.1. Freeze Dried 5.2.2. Air Dried 5.2.3. Spray Dried 5.2.4. Drum Dried 5.2.5. Vacuum Dried 5.3. Dried Vegetable Market, by Distribution Channel (2023-2030) 5.3.1. Direct sales (B2B) 5.3.2. Retail sales (B2C) 5.3.3. E-commerce 5.4. Dried Vegetable Market, by Delivery Options (2023-2030) 5.4.1. Home Delivery 5.4.2. In-Store Pickup 5.5. North America Dried Vegetable Market, by End-use Industry (2023-2030) 5.5.1. Food processing industry 5.5.2. Convenience food production 5.5.3. Retail 5.5.4. Others 5.6. Dried Vegetable Market, by Region (2023-2030) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Dried Vegetable Market (by Value USD and Volume Units) 6.1. North America Dried Vegetable Market, by Vegetable Type (2023-2030) 6.1.1. Leafy vegetables 6.1.2. Root vegetables 6.1.3. Legumes 6.1.4. Brassica vegetables 6.1.5. Others 6.2. North America Dried Vegetable Market, by Type (2023-2030) 6.2.1. Freeze Dried 6.2.2. Air Dried 6.2.3. Spray Dried 6.2.4. Drum Dried 6.2.5. Vacuum Dried 6.3. North America Dried Vegetable Market, by Distribution Channel (2023-2030) 6.3.1. Direct sales (B2B) 6.3.2. Retail sales (B2C) 6.3.3. E-commerce 6.4. North America Dried Vegetable Market, by Delivery Options (2023-2030) 6.4.1. Home Delivery 6.4.2. In-Store Pickup 6.5. North America Dried Vegetable Market, by End-use Industry (2023-2030) 6.5.1. Food processing industry 6.5.2. Convenience food production 6.5.3. Retail 6.5.4. Others 6.6. North America Dried Vegetable Market, by Country (2023-2030) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Dried Vegetable Market (by Value USD and Volume Units) 7.1. Europe Dried Vegetable Market, by Vegetable Type (2023-2030) 7.2. Europe Dried Vegetable Market, by Type (2023-2030) 7.3. Europe Dried Vegetable Market, by Distribution Channel (2023-2030) 7.4. Europe Dried Vegetable Market, by Delivery Option (2023-2030) 7.5. Europe Dried Vegetable Market, by End-use Industry (2023-2030) 7.6. Europe Dried Vegetable Market, by Country (2023-2030) 7.6.1. UK 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Sweden 7.6.7. Austria 7.6.8. Rest of Europe 8. Asia Pacific Dried Vegetable Market (by Value USD and Volume Units) 8.1. Asia Pacific Dried Vegetable Market, by Vegetable Type (2023-2030) 8.2. Asia Pacific Dried Vegetable Market, by Type (2023-2030) 8.3. Asia Pacific Dried Vegetable Market, by Distribution Channel (2023-2030) 8.4. Asia Pacific Dried Vegetable Market, by Delivery Options (2023-2030) 8.5. Asia Pacific Dried Vegetable Market, by End-use Industry (2023-2030) 8.6. Asia Pacific Dried Vegetable Market, by Country (2023-2030) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Indonesia 8.6.7. Malaysia 8.6.8. Vietnam 8.6.9. Taiwan 8.6.10. Bangladesh 8.6.11. Pakistan 8.6.12. Rest of Asia Pacific 9. Middle East and Africa Dried Vegetable Market (by Value USD and Volume Units) 9.1. Middle East and Africa Dried Vegetable Market, by Vegetable Type (2023-2030) 9.2. Middle East and Africa Dried Vegetable Market, by Type (2023-2030) 9.3. Middle East and Africa Dried Vegetable Market, by Distribution Channel (2023-2030) 9.4. Middle East and Africa Dried Vegetable Market, by Delivery Options (2023-2030) 9.5. Middle East and Africa Dried Vegetable Market, by End-use Industry (2023-2030) 9.6. Middle East and Africa Dried Vegetable Market, by Country (2023-2030) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Egypt 9.6.4. Nigeria 9.6.5. Rest of ME&A 10. South America Dried Vegetable Market (by Value USD and Volume Units) 10.1. South America Dried Vegetable Market, by Vegetable Type (2023-2030) 10.2. South America Dried Vegetable Market, by Type (2023-2030) 10.3. South America Dried Vegetable Market, by Distribution Channel (2023-2030) 10.4. South America Dried Vegetable Market, by Delivery Options (2023-2030) 10.5. South America Dried Vegetable Market, by End-use Industry (2023-2030) 10.6. South America Dried Vegetable Market, by Country (2023-2030) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Rest of South America 11. Company Profile: Key players 11.1. BCFoods 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Dingneng 11.3. Dongfeng 11.4. Eurocebollas 11.5. Feida 11.6. Fuqiang 11.7. Garlico Industries 11.8. Harmony House Foods, Inc. 11.9. Jain Irrigation Systems 11.10. Jaworski 11.11. Kanghua 11.12. Kerry Group plc 11.13. Krusha Premium Industries Pvt. Ltd. 11.14. Maharaja Dehydration 11.15. Mercer Foods, LLC 11.16. Natural Dehydrated Vegetables 11.17. Nestle SA 11.18. Olam 11.19. Richfield 11.20. Rosun Dehydration 11.21. Seawind Foods 11.22. Sensient Technologies Corporation 11.23. Silva International 12. Key Findings 13. Length Recommendation