Global Corn Flakes Market size was valued at USD 1.4 Bn. in 2022 and the total Corn Flakes revenue is expected to grow by 12.9 % from 2023 to 2029, reaching nearly USD 3.27 Bn.Corn Flakes Market Overview:

Cereal Products such as flakes and snacks are the most common foods in the daily diet. Corn flakes are one of the most nutritious foods and are widely consumed as a breakfast across the world. It is widely consumed by end-users because they are rich in proteins, vitamins, and fiber. The increasing demand for healthy food among the young generation driving the demand for corn flakes is across the world. In addition, Ready-to-eat cereals have become a popular breakfast option and it is expected to provide important nutrients to children’s diets. As a result, increasing awareness about children’s diet among parents increases the demand for Corn Flakes, thereby driving the Corn Flakes market growth. According to MMR, Kids who ate more cereal got more riboflavin, calcium, zinc, iron, vitamin D, B-13, b-12, and potassium in their diets than kids who ate less cereal or none at all. They also got slightly more calories, fat, fiber, and sugar.To know about the Research Methodology :- Request Free Sample Report

Corn Flakes Market Dynamics

Increasing awareness about health benefits in adults Rising awareness about health in the population leads to an increase in the intake of Corn Flakes. As more health-conscious people prioritize health and seek out healthier food options. Adults consume cereals with breakfast and this breakfast not only helps in maintaining the cholesterol level of the body but also the presence of minerals and vitamins in them helps to keep the heart healthy. Breakfast cereal, recommended for people with diabetes has a high-fiber, low-sugar option such as bran flakes. Eating the product is efficient for adults as they are low in fat and calories and contain 2% less salt, Iron, niacinamide, vitamin B6, vitamin B2, vitamin B1, folic acid, and vitamin D3, vitamin B12 and are aiming to maintain a balanced diet which helps to manage weight. As a result, the growth of the Corn Flakes Market is increasing rapidly. Growing demand for Corn Flakes amongst children across the world. Corn Flakes have long been a popular choice among children, mild taste, ease of preparation, and crispy texture make it appealing to younger age groups. Parents often choose Corn Flakes for their children due to their perceived nutritional benefits and the convenience of a quick and healthful breakfast option. Corn Flakes are consumed by children to get high vitamin C, zinc, iron, magnesium, and calcium for their growth. Different varieties of flavors are a great boost to increase the demand and growth of the product. Cereals are made with grain. Many parents have busy schedules and can’t able to make breakfast for their children, easy serve cereals is been given to the child. Children of different age groups consume Corn Flakes across the world which leads to growing the demand for Corn Flakes Market.Corn Flakes Market Restraints

Growing Health consequences hampering the Corn Flakes Market Growth Consuming cornflakes on a regular basis is expected to lead to health problems among consumers. Corn Flakes are high in sugar and preservatives which cannot be good for child health. It is high in sugar, and malt flavoring which small child does not require. Too much sugar in any form cause discomfort and diarrhoea causes problems for children to get adequate nutrition. Consumption of flakes results in increasing the risk of diabetes, increasing sugar blood levels, and heart disease which affect people’s health. Corn Flakes increased the risk of heart attack and stroke and have a high glycaemic index which is not good for anyone fighting diabetes. This all aspects hamper the Corn Flakes Market growth.Corn Flakes Market Opportunity

Growing preference for cereal products among end-users is expected to provide lucrative growth opportunities for cornflake manufacturers. New flavors and variations of Corn Flakes can help attract a wider consumer base. Studying and analyzing the potential health benefits of Corn Flakes advanced the opportunities for emerging businesses. Rising awareness of environmental issues, eco-friendly packaging materials, and promoting sustainable practices can help Corn Flakes appeal to consumers who value environmentally conscious products. The advancing power of e-commerce and online platforms expands the reach of Corn Flakes to a global audience. Partnering with online retailers and establishing a strong online presence helps to capture the attention of customers who are convenient for online shopping. Dietary products are trending opportunities for innovation in Corn Flakes Market. Demand for ready-to-eat food is increasing very fast is the major reason, that the demand for cornflakes is increasing rapidly.Corn Flakes Market Segment Analysis:

Based on Consumer Age Groups, The Children segment dominated the global cornflakes market in 2022 with the highest market share and is expected to continue to dominate the market in the forecast period. Children consume cornflakes to get calcium, protein, zinc, etc. The addition of different flavors and variations attracts children to eat more cornflakes, like honey-flavored, chocolate-coated, or fruit-infused Corn Flakes. According to the MMR studies, children consume approximately 60% more Corn Flakes than adults. It is consumed by both adults and children but many companies that sell the Corn Flakes target children.Based on the Product Categories, Vegan product dominated the market in 2022 and is expected to maintain its dominance by the end of the forecast period. Vegan products consumed by people who are lactose intolerant or have milk allergies should not be concerned. People enjoyed vegan products of all dietary preferences. With the rising demand for vegan products and promoting the unique aspects of vegan Corn Flakes, companies attract new customers and retain existing ones. Corn Flakes Market players are manufacturing new products for diet purposes which increases the demand. This factor helps to grow the Corn Flakes Market.

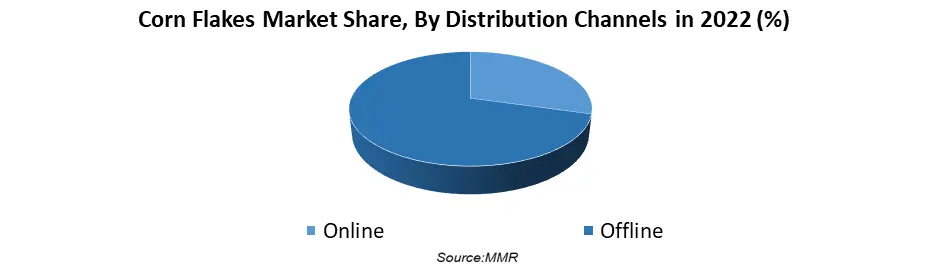

Based on the Distribution Channel, Offline distribution witnessed highest market share of Corn Flakes Market. Offline distribution is dominant in regions with well-established retail infrastructure and consumer shopping habits. As it is easily available in nearby grocery stores, including supermarkets, convenience stores, and hypermarkets, which have historically been the primary distribution channels for Corn Flakes, supporting the segment growth. Overall, offline distribution remains significant for Corn Flakes all across the world. The online segment is expected to grow significantly during the forecast period. The popularity of online distribution and e-commerce has been growing rapidly across the world, and online distribution has become increasingly important where as physical stores provide convenient access to a wide range of products, including breakfast cereals like Corn Flakes.

Corn Flakes Market Regional Insights:

The Corn Flakes Market is dominated by North America in the year 2022 and is expected to be the largest region for Corn Flakes Market in the forecast period. Corn flakes have been a popular breakfast for several decades and continue to be a staple in many households. Kellogg's, one of the largest manufacturers of cornflakes, originated in the United States and has a strong presence in North America followed by Europe. In European, countries like Germany, France, Spain, and the United Kingdom have a long-standing tradition of consuming cornflakes. Kellogg's and other cereal brands have a strong presence in these markets, offering various flavors and variations to consumers. It remains one of the best-selling United States breakfast cereals to this day. The addition of different flavors helps to raise the market. Additionally, emerging markets in Asia, Africa, and South America are also gaining significant raise in the global Corn Flakes Market as the demand for convenient and nutritious breakfast options increases in these regions. Corn flakes are a product that can be taken by both children and adults.Corn Flakes Market Scope: Inquire before buying

Corn Flakes Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 1.4 Bn. Forecast Period 2023 to 2029 CAGR: 12.9% Market Size in 2029: US $ 3.27 Bn. Segments Covered: by Consumer Age Groups Children Adults by Product Categories Vegan Gluten-Free Plant-Based Vegetarian by Distribution Channels Online Offline Corn Flakes Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Corn Flakes Market Key Players

1. Kellogg’s 2. General Mills 3. Mondelez International 4. Kraft Heinz 5. JM Smucker 6. Frito-Lay 7. Seneca Foods 8. Quaker Oats Company 9. Nestle 10. Britannia 11. Ralcorp Holdings 12. Post HoldingsFrequently Asked Questions:

1] What segments are covered in the Global Corn Flakes Market report? Ans. The segments covered in the Corn flakes Market report are based on consumer age groups, product categories, distribution channels, and regions. 2] Which region is expected to hold the highest share in the Global Corn Flakes Market? Ans. the north america & europe region is expected to hold the highest share of the Corn Flakes Market. 3] What is the market size of the Global Corn Flakes Market by 2029? Ans. The market size of the Corn Flakes Market by 2029 is expected to reach US$ 3.27 Bn. 4] What is the forecast period for the Global Corn Flakes Market? Ans. The forecast period for the Corn Flakes Market is 2023-2029. 5] What was the market size of the Global Corn Flakes Market in 2022? Ans. The market size of the Corn Flakes Market in 2022 was valued at US$ 1.4 Bn.

1. Corn Flakes Market: Research Methodology 2. Corn Flakes Market: Executive Summary 3. Corn Flakes Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Corn Flakes Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Corn Flakes Market: Segmentation (by Value USD and Volume Units) 5.1. Corn Flakes Market, by Consumer Age Groups (202-2029) 5.1.1. Children 5.1.2. Adults 5.2. Corn Flakes Market, by Product Categories (2022-2029) 5.2.1. Vegan 5.2.2. Gluten-Free 5.2.3. Plant-Based 5.2.4. Vegetarian 5.3. Corn Flakes Market, by Distribution Channels (2022-2029) 5.3.1. Online 5.3.2. Offline 5.4. Corn Flakes Market, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Corn Flakes Market (by Value USD and Volume Units) 6.1. North America Corn Flakes Market, by Consumer Age Groups (2022-2029) 6.1.1. Children 6.1.2. Adults 6.2. North America Corn Flakes Market, by Product Categories (2022-2029) 6.2.1. Vegan 6.2.2. Gluten-Free 6.2.3. Plant-Based 6.2.4. Vegetarian 6.3. North America Corn Flakes Market, by Distribution Channels (2022-2029) 6.3.1. Online 6.3.2. Offline 6.4. North America Corn Flakes Market, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Corn Flakes Market (by Value USD and Volume Units) 7.1. Europe Corn Flakes Market, by Consumer Age Groups (2022-2029) 7.1.1. Children 7.1.2. Adults 7.2. Europe Corn Flakes Market, by Product Categories (2022-2029) 7.2.1. Vegan 7.2.2. Gluten-Free 7.2.3. Plant-Based 7.2.4. Vegetarian 7.3. Europe Corn Flakes Market, by Distribution Channels (2022-2029) 7.3.1. Online 7.3.2. Offline 7.4. Europe Corn Flakes Market, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Corn Flakes Market (by Value USD and Volume Units) 8.1. Asia Pacific Corn Flakes Market, by Consumer Age Groups (2022-2029) 8.2. Asia Pacific Corn Flakes Market, by Product Categories (2022-2029) 8.3. Asia Pacific Corn Flakes Market, by Distribution Channels (2022-2029) 8.4. Asia Pacific Corn Flakes Market, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Corn Flakes Market (by Value USD and Volume Units) 9.1. Middle East and Africa Corn Flakes Market, by Consumer Age Groups (2022-2029) 9.2. Middle East and Africa Corn Flakes Market, by Product Categories (2022-2029) 9.3. Middle East and Africa Corn Flakes Market, by Distribution Channels (2022-2029) 9.4. Middle East and Africa Corn Flakes Market, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Corn Flakes Market (by Value USD and Volume Units) 10.1. South America Corn Flakes Market, by Consumer Age Groups (2022-2029) 10.2. South America Corn Flakes Market, by Product Categories (2022-2029) 10.3. South America Corn Flakes Market, by Distribution Channels (2022-2029) 10.4. South America Corn Flakes Market, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Kellogg’s 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. General Mills 11.3. Mondelez International 11.4. Kraft Heinz 11.5. JM Smucker 11.6. Frito-Lay 11.7. Seneca Foods 11.8. Quaker Oats Company 11.9. Nestle 11.10. Britannia 11.11. Ralcorp Holdings 11.12. Post Holdings 12. Key Findings 13. Product Categories Recommendation