The Global Controlled Release Fertilizers Granules market size reached USD 562.64 Mn in 2022 and is expected to reach USD 976.83 Mn by 2029, growing at a CAGR of 8.2 % during the forecast period. Controlled Release Fertilizers (CRF) are used all over the world in agriculture, horticulture, and professional turf surfaces. Controlled Release Fertilizers are granular fertilizers with a semipermeable membrane that, when applied to the soil, allows moisture to pass and reach the nutrient(s) inside. CRFs use up to 40% less fertilizer than other conventional fertilizers and are often utilized as specialty fertilizers in applications such as agricultural applications, lawns and turf, fruits and vegetables, nurseries and gardens, and so on. Leading market key players are now focusing to build up a strong supply base and strategic partnerships in large agricultural economies like India, China, and Malaysia to boost sales of Controlled Release Fertilizers Granules. The growth of CRF Granules in developing economies is expected to be driven by encouraging government support for boosting the adoption of a variety of fertilizers to enhance production and ensure food safety. Thus. the Growing investments in sustainable and eco-friendly fertilizers are likely to drive demand for such controlled-release fertilizers Granules market throughout the forecast period. Technological advancement is a key trend gaining popularity in the Controlled Release Fertilizers Granules market. Major companies operating in the sector are focused on developing technologically advanced products to strengthen their position. Mergers, acquisitions, and expansion to develop innovative products are some of the key strategies adopted by market key players operating in the global Controlled Release Fertilizers Granules market. The market is highly consolidated with the top 5 companies accounting for more than 60% of global sales. Haifa Group, Kingenta Ecological Engineering Co., LTD., Israel Chemicals Ltd., and The Scotts Miracle-Gro Company dominate the Controlled Release Fertilizers Granules market. Haifa Group is a multinational corporation and a leading supplier of specialty fertilizers, including agricultural and industrial-grade potassium nitrate. It owns three production facilities in Israel, France, and the US. Haifa Group’s global operations span 5 continents in over 100 countries with 16 subsidiaries. Controlled Release Fertilizers Granules Market offers a comprehensive overview of the current market situation and provides a forecast until 2029. This report provides qualitative and quantitative information that highlights important market developments, trends, challenges, competition, and new opportunities within the Controlled Release Fertilizers Granules Market. This report aims to provide a comprehensive presentation of the global market for Controlled Release Fertilizers Granules, with both quantitative and qualitative analysis to help readers develop business/growth strategies, assess the market competitive situation, and analyze their position in the current marketplace. The report also discusses technological trends and new product developments. It includes Porter’s Five Forces analysis, which explains the five forces: buyers' bargaining power, supplier's bargaining power, the threat of new entrants, and the degree of competition in the Controlled Release Fertilizers Granules Market. The report also focuses on the competitive landscape of the Controlled Release Fertilizers Granules Market. The analysis will help the Controlled Release Fertilizers Granules market players to understand the present situation of the market.Controlled Release Fertilizers Granules Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Controlled Release Fertilizers Granules Market Dynamics:

Modern agricultural techniques to drive the Controlled Release Fertilizers Granules Market The practice of modern agricultural techniques has gained popularity as the Controlled Release Fertilizers Granules require the use of various technologies for the coating of these granules. The main features of CRFGs are their coating which enables them to release essential nutrients into the soil. According to the World Bank report, an international financial organization, the global business climate for agriculture is improving as 47 of the 101 nations analyzed over the course of two years implemented 67 regulatory measures to make it easier for farmers to manage insect outbreaks, obtain high-quality seeds, and obtain loans to invest in production. As a result, more people are adopting contemporary agricultural techniques. Crop production is being increased and the negative effects of fertilizers are being reduced by several manufacturers employing efficient technology. As an illustration, Pursell Agri-Tech increased the Southeast's and beyond's reach of its next-generation coating technologies in 2020. The Savannah facility will create biodegradable controlled-release fertilizers in granular form for the turf, ornamental, specialty, and broadacre industries. In September 2022, ICL Group also introduced the fifth version of their Osmocote controlled-release fertilizer. The updated Optimized Trace Element Availability (OTEA) mechanism in Osmocote 5 fits the needs of plants throughout the release program, resulting in improved plant health, color, and growth. For the market for controlled-release fertilizer granules, these technological developments have proven to be fantastic potential. The rise in population across the globe has created a demand for food to drive Controlled Release Fertilizers Granules Market The increasing population all over the world has led to a surge in demand for food, which is expected to increase the consumption of fertilizers. The trend of home gardening and modern agriculture is also proving to be a major factor in the growth of this Controlled Release Fertilizers Granules market during the forecast period. This type of fertilizer is seeing a greater demand in the agricultural sector as the land available for agriculture is less and the amount of food required to meet the global food demand of the population is increasing rapidly. However, the major concerns include the pollution and contamination of soil, as well as their harmful effects on humans and the environment. The governments in this region are focusing on the use of fertilizers that are less harmful to the soil to combat these harmful effects. The rise in population, the shrinking agricultural land because of industrialization and urbanization, low farm yields, environmental and soil degradation, and infrastructure inadequacy are some of the primary reasons that are encouraging farmers to produce more in the limited land area, which is expected to increase the demand for specialty fertilizers. Favorable initiatives taken by various institutions such as the Ministry of Agriculture, Forestry, and Fishery are further expected to bolster Controlled Release Fertilizers Granule market demand during the forecast period. China and India are expected to show considerable growth over the next seven years because of increasing government support and consumer awareness regarding the use of fertilizers to increase yield. Robust Research & Development Activities on Polymer Coatings for Fertilizers to Support Growth of Controlled Release Fertilizers Granules Market The research activities on the development of low-cost or affordable polymer coatings to produce encapsulated or coated Controlled Release Fertilizers Granule are increasing nowadays. Major market players are increasing their purpose that can be utilized in multiple crops CRFs. The increasing prevalence of crop diseases because of the nutrient deficiency within them is also boosting the demand for effective Controlled Release Fertilizers Granule demand. The anticipation of the upcoming environmental and economical crisis in the forthcoming years is motivating consumers (farmers, agriculturists, and others) to improve Controlled-release fertilizer uses to increase nutrient uptake within crops and contribute to decreasing environmental stress and concerns. However, the lack of efficient regulations for controlled-release fertilizers, especially in developing countries may hamper the Controlled Release Fertilizers Granules market growth during the forecast years. Increasing government Support for Controlled Release Fertilizers Granules Higher yields are the focus of the government across various nations and they are constantly emphasizing making use of modern techniques in the agricultural sector which will help in maximizing the efficiency to grow well in the coming years and it will provide good opportunities for the growth of the global Controlled Release Fertilizers Granules market during the forecast period. Governments have traditionally invested more heavily in the agricultural sector, than in any other productive sector of the economy because they are concerned about ensuring an adequate level of farmer income and sufficient and affordable food supplies for their populations. Many governments have broadened the scope of their policies to achieve other goals such as contributing to more competitive and innovative industries and environmentally sustainable production systems that are more resilient to climate change and other risks. In developing countries, where the population is growing at a rapid rate, the concern regarding food security has increased and this is expected to contribute to increasing the demand for Controlled Release Fertilizers Granules within these economies. Increased governmental support for smart fertilizers which majorly include controlled-release and presentation of high subsidy offerings on their use can escalate the use of Controlled Release Fertilizers Granules and ultimately increase the overall market size. Furthermore, the launch of various programs to educate farmers about the positive effects of using Controlled Release Fertilizers Granules can further attract high slow-acting fertilizers market revenue during the forecast period. Market Restraint: The Controlled Release Fertilizers Granules have gained immense importance leading to the growth of the market because of the degrading quality of the soil. The technology used in the production of controlled-release fertilizers granules is somewhat costly. This is a major restraining factor as the majority of the people restrict themselves to using controlled-release fertilizers granules in their farming.Controlled Release Fertilizers Granules Market Segment Analysis:

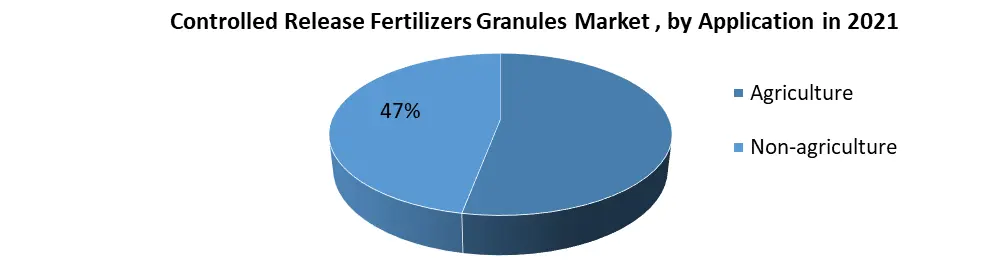

Based on the product Type, the Sulfur Coated Urea segment is expected to grow at a CAGR of 2.5% during the forecast period. Sulfur-coated urea is widely used in agriculture for reducing the harmful effects of fertilizers including crop burn. The increasing need for agriculture sustainability with minimized input cost and crop yield is expected to augment the Controlled Release Fertilizers Granules market growth. The Polymer sulfur-coated urea is expected to generate maximum revenue of about 42% in the coming years. This type of fertilizer helps in solving the issue of intermittent nutrient release because of which the market is expected to grow substantially. The polymer coating is provided in a thin format over the Sulphur coating in this type of fertilizer which helps in the temporary isolation of urea from the environment of the soil and is used extensively in the production of vegetables, nurseries, orchards, and in crops that have a higher value. Based on the Application, the non-agricultural application includes turf & ornamentals, nurseries & greenhouses, and other non-agricultural uses. The application of controlled-release fertilizers in turf is higher, as these are required in lesser quantities and require less labor cost. For instance, in May 2022, Pursell Agri-Tech company develops fertilizers to increase crop yields and entered into terms of building a state-of-the-art manufacturing facility in Savannah, Georgia. The plant will produce controlled-release fertilizers (CRF) for the ornamental, agriculture, turf, and specialty markets.

Controlled Release Fertilizers Granules Market Regional Insights

North America is expected to emerge as the major contributor in terms of revenue in the Controlled Release Fertilizers Granules market during the forecast period. North America holds the largest market share because of the high utilization of controlled-release fertilizers by the horticulture sector of the U.S., Canada, and Mexico. The presence of a large number of significant market key players such as Pursell Agri-Tech, Nutrien, LESCO, and others in the North American market is further attributed to the rising demand for smart and specialty fertilizers. The United States market for controlled-release fertilizers granules is witnessing a strong year-on-year growth rate. In the past few years, there has been an increase in demand for these fertilizers by the agriculture industry of the U.S. for cereals and oilseed production. The above-mentioned factor helps this region continue earning high Controlled Release Fertilizers Granules in the forecast period. Asia-Pacific is the fastest-growing region across the globe in the Controlled Release Fertilizers Granules market. China accounted for the majority share of the overall consumption of controlled-release fertilizers granules followed by India and Japan. The demand for controlled-release fertilizers granules is expected to increase at a faster rate than conventional fertilizers in these countries during the forecast period. Cereals and grains are one of the most important parts of traditional diets in Asia-Pacific and they hold almost a two-third share of the overall calorie intake of an average person. Local farmers and agriculturists are being encouraged to implement sustainable agriculture methods in order to boost productivity through the effective use of specialty fertilizers such as controlled-release fertilizer granules. The abovementioned policies and investments are important factors driving the controlled release fertilizers granules market growth in this region during the forecast period.Controlled Release Fertilizers Granules Market Scope: Inquire before buying

Controlled Release Fertilizers Granules Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 562.64 Mn. Forecast Period 2023 to 2029 CAGR: 8.2% Market Size in 2029: US $ 976.83 Mn. Segments Covered: by Product Type Sulfur-coated urea (SCU) Polymer coated Products Polymer-sulfur-coated urea (PSCU) Others by Application Agriculture Non-agriculture Controlled Release Fertilizers Granules, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Controlled Release Fertilizers Granules Market, Key Players are

1. Allied Nutrients 2. Koch Industries, Inc. 3. Knox Fertilizer Company, Inc. 4. J.R. Simplot Company 5. Haifa Negev technologies LTD. 6. ICL Group 7. ASK Chemicals 8. Kingenta 9. Neufarm GmbH 10. Nutrien Ltd. FAQs: 1. Who are the key players in the market? Ans. Kingenta, Neufarm GmbH, and Nutrien Ltd are the major companies operating in the market. 2. Which Product Type segment dominates the market? Ans. The Polymer-sulfur-coated urea segment accounted for the largest share of the global market in 2022. 3. How big is the market? Ans. The Global market size reached USD 562.64 Mn in 2022 and is expected to reach USD 976.83 Mn by 2029, growing at a CAGR of 8.2 % during the forecast period. 4. What are the key regions in the global market? Ans. Based On the region, the Market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and Latin America. North America dominates the global market. 5. What is the study period of this market? Ans. The Global Market is studied from 2023 to 2029.

1. Controlled Release Fertilizers Granules Market: Research Methodology 2. Controlled Release Fertilizers Granules Market: Executive Summary 3. Controlled Release Fertilizers Granules Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Controlled Release Fertilizers Granules Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Controlled Release Fertilizers Granules Market: Segmentation (by Value USD) 5.1. Controlled Release Fertilizers Granules Market, by Product Type (2022-2030) 5.1.1. Sulfur-coated urea (SCU) 5.1.2. Polymer coated Products 5.1.3. Polymer-sulfur-coated urea (PSCU) 5.1.4. Others 5.2. Controlled Release Fertilizers Granules Market, by Application (2022-2030) 5.2.1. Agriculture 5.2.2. Non-agriculture 5.3. Controlled Release Fertilizers Granules Market, by Region (2022-2030) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Controlled Release Fertilizers Granules Market (by Value USD) 6.1. North America Controlled Release Fertilizers Granules Market, by Product Type (2022-2030) 6.1.1. Sulfur-coated urea (SCU) 6.1.2. Polymer coated Products 6.1.3. Polymer-sulfur-coated urea (PSCU) 6.1.4. Others 6.2. North America Controlled Release Fertilizers Granules Market, by Application (2022-2030) 6.2.1. Agriculture 6.2.2. Non-agriculture 6.3. North America Controlled Release Fertilizers Granules Market, by Country (2022-2030) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Controlled Release Fertilizers Granules Market (by Value USD) 7.1. Europe Controlled Release Fertilizers Granules Market, by Product Type (2022-2030) 7.2. Europe Controlled Release Fertilizers Granules Market, by Application (2022-2030) 7.3. Europe Controlled Release Fertilizers Granules Market, by Industry (2022-2030) 7.4. Europe Controlled Release Fertilizers Granules Market, by Country (2022-2030) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Controlled Release Fertilizers Granules Market (by Value USD) 8.1. Asia Pacific Controlled Release Fertilizers Granules Market, by Product Type (2022-2030) 8.2. Asia Pacific Controlled Release Fertilizers Granules Market, by Application (2022-2030) 8.3. Asia Pacific Controlled Release Fertilizers Granules Market, by Country (2022-2030) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Controlled Release Fertilizers Granules Market (by Value USD) 9.1. Middle East and Africa Controlled Release Fertilizers Granules Market, by Product Type (2022-2030) 9.2. Middle East and Africa Controlled Release Fertilizers Granules Market, by Application (2022-2030) 9.3. Middle East and Africa Controlled Release Fertilizers Granules Market, by Country (2022-2030) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Controlled Release Fertilizers Granules Market (by Value USD) 10.1. South America Controlled Release Fertilizers Granules Market, by Product Type (2022-2030) 10.2. South America Controlled Release Fertilizers Granules Market, by Application (2022-2030) 10.3. South America Controlled Release Fertilizers Granules Market, by Country (2022-2030) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. Allied Nutrients 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Koch Industries, Inc. 11.3. Knox Fertilizer Company, Inc. 11.4. J.R. Simplot Company 11.5. Haifa Negev technologies LTD. 11.6. ICL Group 11.7. ASK Chemicals 11.8. Kingenta 11.9. Neufarm GmbH 11.10. Nutrien Ltd. 12. Industry Recommendation