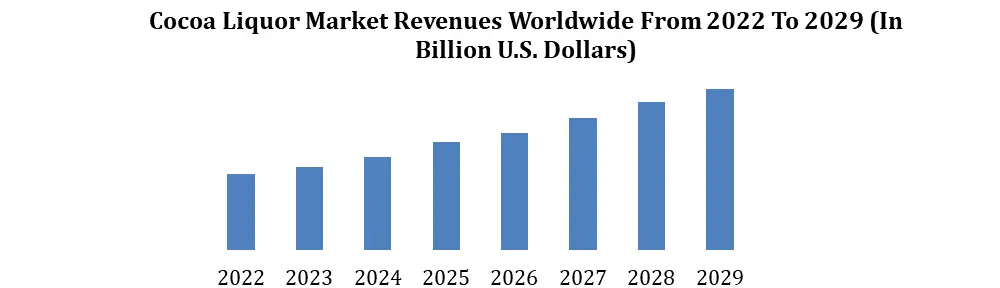

The Global Cocoa Liquor Market was valued at US$ 21.5 Million in 2022 and is expected to reach US$ 31.53 Million by 2029, expanding at a compound annual growth rate (CAGR) of 5.62 percent. Cocoa liquor, also known as cocoa mass, is a key ingredient in the production of chocolate and other cocoa-based products. It is made by grinding cocoa beans into a liquid paste that contains cocoa solids and cocoa butter. The major drivers of the cocoa liquor market are the growth of the chocolate industry, which is a major consumer of cocoa liquor. The report delves into the various factors that drive the growth of the chocolate industry, such as changing consumer preferences, increasing disposable incomes, and the growth of the confectionery industry. The health benefits associated with cocoa consumption, particularly its high antioxidant content, have contributed to cocoa liquor market growth. Cocoa contains polyphenols, which are antioxidants that help to protect against heart disease, cancer, and other chronic diseases. The health benefits of cocoa have led to an increased demand for cocoa-based products, including cocoa liquor, in the food and beverage industry. The segments covered in the report included product type, application, and distribution channel. In terms of geography, the report covers the cocoa liquor industry across regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The dominant region in the cocoa liquor market was Europe, followed by North America. Europe has a strong market for chocolate and confectionery products, which are major applications of cocoa liquor. The presence of major chocolate manufacturers in the region, such as Switzerland and Belgium, also contributes to the dominance of Europe in the market. The report presents a detailed analysis of these factors and their inter-relationships, providing insights into the demand drivers for the cocoa liquor market. It also includes a comprehensive market segmentation analysis, covering key regions, applications, and product types, as well as an analysis of the competitive landscape and key players operating in the marketTo know about the Research Methodology :- Request Free Sample Report

Cocoa Liquor Market Dynamics

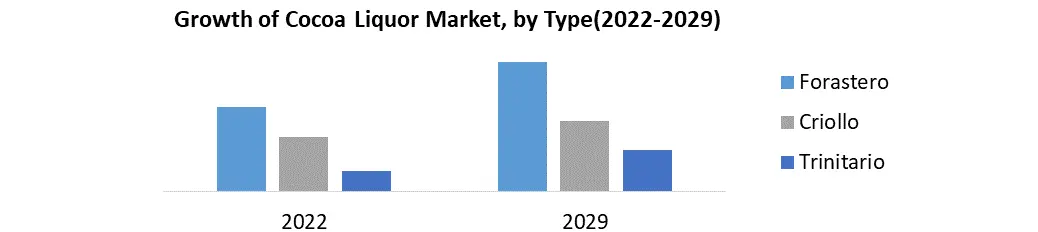

In 2022, over 630,000 tons of Dutch cocoa liquor is estimated to have been sold in the global market. The cocoa liquor market is driven by factors that include the growing demand for chocolate and confectionery products, rising consumer awareness about health benefits, and technological advancements in cocoa processing. These drivers are expected to contribute to the growth of the market in the forecast period. The market presents several opportunities for manufacturers, including the growing demand for premium and artisanal chocolate products, expansion of distribution channels, and increasing demand for natural and organic products. These opportunities are expected to further drive the growth of the market in the forecast period. The report provides a detailed analysis of the market dynamics, including the market drivers and opportunities, helping the clients gain insights into the factors influencing the growth of the market. The global cocoa liquor market is forecasted to reach a xxx volume in the forecast period, based on the increasing demand for cocoa liquor in various applications. The cocoa liquor market is not without its challenges and restraints that may impede its growth. In the report, few challenges have been identified that include the volatility of cocoa prices due to weather conditions, political instability, and supply chain issues. Additionally, the high entry barriers for new players, availability of cheaper alternatives such as carob and palm oil, and sustainability issues such as deforestation, child labour, and poor working conditions for cocoa farmers may limit the growth of the market. It is important for manufacturers to address these challenges by adopting sustainable practices, investing in research and development, and identifying new opportunities for growth. The report provides insights into these challenges and restraints, helping the businesses make informed decisions about their strategies. Growing Demand for Premium Dark Chocolate Products Driving the Cocoa Liquor Market: Key Trends and Insights The cocoa liquor market is witnessing several key trends, including a growing demand for premium chocolate products made from high-quality cocoa liquor, an increasing use of cocoa liquor in food and beverage applications, and rising consumer awareness about the health benefits of cocoa. The market is benefiting from the increasing demand for dark chocolate products and the growing popularity of organic cocoa liquor. These trends are driving the growth of the cocoa liquor market, which is expected to witness steady growth in the forecasted period. The revenue generated from Forastero cocoa liquor is expected to account for 75% of the global cocoa liquor market. Additionally, cocoa liquor wafers are estimated to be the most popular form, with a projected market demand of 50%. These findings highlight the significant market potential for Forastero cocoa liquor and the popularity of cocoa liquor wafers among consumers. Companies in the cocoa liquor market can use this information to tailor their products and strategies to meet consumer demand and maximize revenue.

Cocoa Liquor Market Segment Analysis

By type, the market can be segmented into Forastero, Criollo, and Trinitario liquor. By form, the market can be segmented into cocoa liquor blocks, cocoa liquor wafers, and liquor paste. By application, the market can be segmented into chocolate production, bakery, confectionery, dairy products, and others. Forastero cocoa is estimated to account for more than 67% of market share in 2021, which is expected to witness growth rate of CAGR 2.8% over the forecast period Chocolates and confectionaries will be the largest end-use industry for cocoa liquor, followed by ice-cream production. By the end of 2029, these two industry verticals will account for nearly 50% of the global market volumes. The report covers the market share of each type, form and application of cocoa liquor, as well as consumer preferences and trends for each type. The regional segment of the cocoa liquor market provides insights into the various regions in which cocoa liquor is consumed, including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Cocoa Liquor Market Regional Insights

North America: The report highlights that the North American cocoa liquor market is expected to grow at a significant CAGR during the forecast period due to increasing demand for premium chocolates and healthy dark chocolates. From 2022 to 2029, sales of coca liquor are expected to grow at a CAGR of 3% in the United States. The report also provides insights into consumer preferences and trends in the region, such as the preference for sustainable and ethically sourced cocoa beans. Europe: The Europe is the largest consumer of cocoa liquor in the world and accounts for the majority of the market share. This trend is driven by growing preference for healthy and sustainable food products. Until 2029, Germany will account for 1/6th of the global revenue from cocoa liquor. Asia Pacific: The Asia Pacific cocoa liquor market is expected to grow at a significant growth rate during the forecast period due to increasing demand for chocolate products, especially in countries such as China and India. India's demand for cocoa liquor is expected to grow at a rate of 5.2% each year South America: Latin America is a major producer of cocoa beans and accounts for a significant share of the cocoa liquor market. Brazil is expected to account for 47% of market share in 2023. Consumer expenditure on food and groceries has changed dramatically as income levels have risen. Countries such as Brazil, Mexico, and Ecuador are major consumers of cocoa liquor in Latin America Middle East & Africa: The growing population and increasing disposable incomes are driving the growth of the cocoa liquor market in this region. Countries such as Saudi Arabia, UAE, and South Africa are major consumers of cocoa liquor in the Middle East & Africa region. The report provides a comprehensive analysis of the cocoa liquor market in North America, Europe, Asia-Pacific, South America and Middle East & Africa covering all the key metrics such as market size, market share, growth rate, regulatory landscape, and competitive landscape.Cocoa Liquor Market Competitive Landscape

The cocoa liquor market is highly competitive, with a large number of local, regional, and international players operating in the market. The market is dominated by a few key players, including Barry Callebaut, Cargill, Nestle SA, Olam International, and Blommer Chocolate Company, who account for a significant share of the market. These players compete on the basis of product quality, price, and innovation. They are also focusing on expanding their production capacity, developing sustainable sourcing practices, and strengthening their distribution networks to tap into new markets and meet the growing demand for cocoa liquor worldwide. In October 2021, Hershey India added two new flavors, Blackberry Granules and Guava & Mexican Chili, to its Hershey's Exotic Dark range of premium chocolates. These flavors were curated for the next generation of consumers with an ever-evolving palate and made with whole roasted California almonds. In March 2021, Nestle launched its latest range of Incoa bars that use cocoa fruit pulp as a healthy and eco-friendly sugar substitute. The bars were launched in France and the Netherlands, with plans to introduce them to other markets in Europe. The use of cocoa fruit pulp not only reduces added sugar but also cuts down on product waste in chocolate manufacturing.There are several small and medium-sized enterprises (SMEs) operating in the market, who specialize in producing premium and artisanal chocolate products. These SMEs are known for their high-quality products and unique flavors, and are targeting niche markets to differentiate themselves from the larger players. The report provides a comprehensive analysis of the competitive landscape, including detailed profiles of the key players, their market share, and their business strategies. The report also provides insights into the competitive environment, including industry trends, challenges, and opportunities.

Cocoa Liquor Market Scope: Inquire before buying

Cocoa Liquor Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 21.5 Bn. Forecast Period 2023 to 2029 CAGR: 5.62% Market Size in 2029: US $ 31.53 Bn. Segments Covered: by Type Forastero cocoa liquor Criollo cocoa liquor Trinitario cocoa liquor by Form Blocks Wafers Paste by Application Chocolate production Bakery Confectionery Dairy products Other Cocoa Liquor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cocoa Liquor Market Key Players are:

1. Barry Callebaut - Switzerland 2. Cargill - United States 3. Olam International - Singapore 4. Touton - France 5. Blommer Chocolate Company - United States 6. Nestle SA - Switzerland 7. Puratos Group - Belgium 8. Mars, Incorporated - United States 9. Hershey's - United States 10.Guittard Chocolate Company - United States 11.Lindt & Sprüngli - Switzerland 12.Ferrero Group - Italy 13.Valrhona - France 14.CasaLuker - Colombia 15.Meiji Holdings Co., Ltd. - Japan 16.Fuji Oil Holdings Inc. - Japan 17.Petra Foods Limited - Singapore 18.JB Foods Limited - Singapore 19.Carlyle Cocoa - United Kingdom 20.United Cocoa Processor, Inc. - United States 21.Mondelez International, Inc. - United States 22.Theobroma BV - Netherlands 23.Orkla ASA - Norway 24.Fuji Oil Europe GmbH - Germany 25.Natra S.A. - Spain FAQ Q: What is the market size and growth rate of the Cocoa Liquor market? A: The market was valued at US$ 21.5 Million in 2022 and is expected to reach US$ 31.53 Million by 2029, expanding at a compound annual growth rate (CAGR) of 5.62 percent. Q: What are the major applications of o Cocoa Liquor in the food and beverage industry? A: Cocoa liquor is used in the food and beverage industry as a key ingredient in the production of chocolate products such as chocolate bars, truffles, and baked goods. It is also used as a flavoring agent in beverages such as hot chocolate and coffee Q: Who are the key players operating in the market, and what are their market shares and growth strategies A: The key players in the market include Barry Callebaut AG, Cargill, Inc., Nestle S.A., The Hershey Company, Mars, Inc., and Blommer Chocolate Company. These companies are involved in various growth strategies such as mergers and acquisitions, expanding their production capacities, and developing new products to cater to the changing demands of consumers. Q: What are the future prospects and growth opportunities in the cocoa liquor market? A. The market is expected to grow in the coming years due to increasing demand, rising disposable incomes, changing consumer preferences, and growing awareness about the health benefits of dark chocolate. However, challenges such as climate change, diseases affecting cocoa trees, and unstable prices of cocoa beans could pose risks to the market's growth. The development of new varieties of cocoa liquor with unique flavors and textures is expected to create new growth opportunities for market players.

1. Cocoa Liquor Market: Research Methodology 2. Cocoa Liquor Market: Executive Summary 3. Cocoa Liquor Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Cocoa Liquor Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Cocoa Liquor Market: Segmentation (by Value USD and Volume Units) 5.1. Cocoa Liquor Market, by Type (2022-2029) 5.1.1. Forastero cocoa liquor 5.1.2. Criollo cocoa liquor 5.1.3. Trinitario cocoa liquor 5.2. Cocoa Liquor Market, by Form (2022-2029) 5.2.1. cocoa liquor blocks 5.2.2. cocoa liquor wafers 5.2.3. cocoa liquor paste 5.3. Cocoa Liquor Market, by Application (2022-2029) 5.3.1. Chocolate production 5.3.2. Bakery 5.3.3. Confectionery 5.3.4. Dairy products 5.3.5. Other 5.4. Cocoa Liquor Market, by region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Cocoa Liquor Market (by Value USD and Volume Units) 6.1. North America Cocoa Liquor Market, by Type (2022-2029) 6.1.1. Forastero cocoa liquor 6.1.2. Criollo cocoa liquor 6.1.3. Trinitario cocoa liquor 6.2. North America Cocoa Liquor Market, by Form (2022-2029) 6.2.1. cocoa liquor blocks 6.2.2. cocoa liquor wafers 6.2.3. cocoa liquor paste 6.3. North America Cocoa Liquor Market, by Application (2022-2029) 6.3.1. Chocolate production 6.3.2. Bakery 6.3.3. Confectionery 6.3.4. Dairy products 6.3.5. Other 6.4. North America Cocoa Liquor Market, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Cocoa Liquor Market (by Value USD and Volume Units) 7.1. Europe Cocoa Liquor Market, by Type (2022-2029) 7.2. Europe Cocoa Liquor Market, by Form (2022-2029) 7.3. Europe Cocoa Liquor Market, by Application (2022-2029) 7.4. Europe Cocoa Liquor Market, by Country (2022-2029) 7.4.1. UK 7.4.2. Netherlands 7.4.3. Germany 8. Asia Pacific Cocoa Liquor Market (by Value USD and Volume Units) 8.1. Asia Pacific Cocoa Liquor Market, by Type (2022-2029) 8.2. Asia Pacific Cocoa Liquor Market, by Application (2022-2029) 8.3. Asia Pacific Cocoa Liquor Market, by Form (2022-2029) 8.4. Asia Pacific Cocoa Liquor Market, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 9. Middle East and Africa Cocoa Liquor Market (by Value USD and Volume Units) 9.1. Middle East and Africa Cocoa Liquor Market, by Type (2022-2029) 9.2. Middle East and Africa Cocoa Liquor Market, by Application (2022-2029) 9.3. Middle East and Africa Cocoa Liquor Market, by Form (2022-2029) 9.4. Middle East and Africa Cocoa Liquor Market, by Country (2022-2029) 9.4.1. UAE 9.4.2. South Africa 9.4.3. Saudi Arabia 9.4.4. Morocco 10. South America Cocoa Liquor Market (by Value USD and Volume Units) 10.1. South America Cocoa Liquor Market, by Type (2022-2029) 10.2. South America Cocoa Liquor Market, by Application (2022-2029) 10.3. South America Cocoa Liquor Market, by Form (2022-2029) 10.4. South America Cocoa Liquor Market, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 11. Company Profile: Key players 11.1. Barry Callebaut - Switzerland 12.1.1. Company Overview 12.1.2. Financial Overview 12.1.3. Business Portfolio 12.1.4. SWOT Analysis 12.1.5. Business Strategy 12.1.6. Recent Developments 11.2. Cargill - United States 11.3. Olam International - Singapore 11.4. Touton - France 11.5. Blommer Chocolate Company - United States 11.6. Nestle SA - Switzerland 11.7. Puratos Group - Belgium 11.8. Mars, Incorporated - United States 11.9. Hershey's - United States 11.10. Guittard Chocolate Company - United States 11.11. Lindt & Sprüngli - Switzerland 11.12. Ferrero Group - Italy 11.13. Valrhona - France 11.14. CasaLuker - Colombia 11.15. Meiji Holdings Co., Ltd. - Japan 11.16. Fuji Oil Holdings Inc. - Japan 11.17. Petra Foods Limited - Singapore 11.18. JB Foods Limited - Singapore 11.19. Carlyle Cocoa - United Kingdom 11.20. United Cocoa Processor, Inc. - United States 11.21. Mondelez International, Inc. - United States 11.22. Theobroma BV - Netherlands 11.23. Orkla ASA - Norway 11.24. Fuji Oil Europe GmbH - Germany 11.25. Natra S.A. – Spain 12. Key Findings 13. Industry Recommendation