The Global Cloud-native Development Market size was valued at USD 547.61 Bn. in 2022 and the total Cloud-native Development revenue is expected to grow by 23.12 % from 2023 to 2029, reaching nearly USD 2348.40 Bn.Cloud-native Development Market Overview:

Cloud-native development has emerged as a pivotal paradigm, revolutionizing the way applications are created and managed, with a primary focus on harnessing the full potential of cloud computing. This approach centers on the utilization of containerized microservices, emphasizing agility, scalability, and automation, thereby departing from the conventional monolithic development model. The Cloud-Native Development market is poised for rapid growth, fueled by the growing adoption of cloud technologies, the imperative for scalable and agile application development, and the burgeoning demand for digital transformation across industries. Organizations are increasingly recognizing the myriad advantages offered by cloud-native development, ranging from accelerated time-to-market and improved resource utilization to heightened reliability. This modern approach to application development not only streamlines processes but also confers a competitive advantage in the dynamic business landscape. Notably, it stands out as a premier method for application modernization, which increases the Cloud-native development industry demand.One of the key advantages of cloud-native development market applications lies in their scalability. Unlike the cumbersome and costly process of scaling on-premises infrastructure, cloud-native development enables painless scalability. Rapid adjustments whether up or down, made based on specific requirements without the need for substantial investments in additional hardware and IT resources. The microservices architecture further facilitates targeted scaling, allowing developers to scale only the necessary components of an application. Cloud-native development market trend is the resilience inherent in cloud-native applications is a testament to their ability to operate continuously without downtime during feature updates. Microservices, by design, allow for independent components, ensuring that updates to one part of the system do not adversely affect the overall performance. This architecture contributes to higher availability and an improved user experience, especially during peak times when applications can be easily scaled. Moreover, cloud-native development embraces agile strategies like Continuous Deployment (CD) and DevOps, empowering developers to rapidly build and release software products. Automation becomes a cornerstone in this process, expediting the build, testing, and deployment phases and enhancing overall business efficiency, which drive the Cloud-native development market growth during the forecast period. Cloud-native development market report covered the detailed analysis of Cloud-native development market completion and analysis of business strategy. New product development by Cloud-native development service provider, detailed analysis of Cloud-native development market key player’s mergers acquisition and benchmarking.

To know about the Research Methodology :- Request Free Sample Report

Cloud-native Development Market Dynamics:

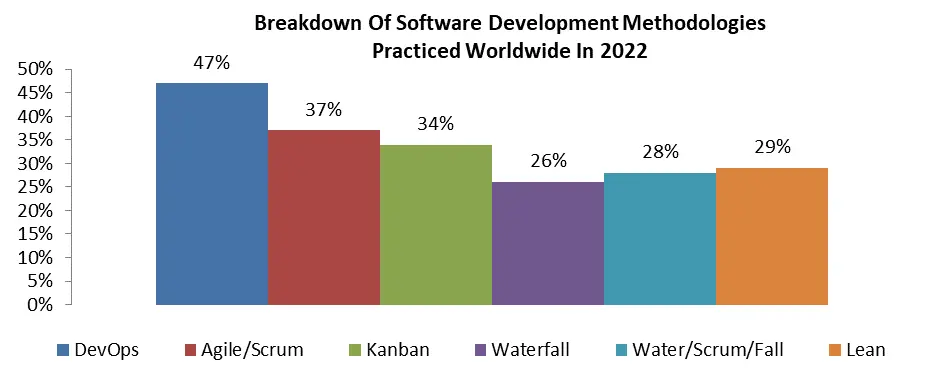

Enhanced Productivity with DevOps and AI Integration In Cloud-Native Development Driving the Market Growth Organizations are increasingly adopting cloud-native development to modernize their operations, rapidly creating and deploying digital solutions, thus remaining competitive and satisfying evolving customer demands which drive the growth of the Cloud-native Development Market. For example, a retail giant transitioning to online sales relies on cloud-native principles to navigate this transformation. Cost efficiency is a significant motivator as cloud-native development leverages containerization and microservices to reduce infrastructure costs, optimizing resource allocation and yielding substantial savings. Scalability and flexibility are the major driving factors, with cloud-native applications seamlessly scaling to handle growing workloads, providing unmatched adaptability in real-time resource management. Enhanced developer productivity is a game-changer for the Cloud-native Development Market, with DevOps practices and automation tools streamlining development and deployment, boosting developer efficiency, and decreasing time-to-market. Imagine a software company benefiting from automated CI/CD pipelines. The adoption of hybrid and multi-cloud strategies further propels the need for cloud-native development market solutions capable of seamless operation across diverse cloud environments, guaranteeing peak performance and resource utilization. Integration of AI and machine learning into cloud-native applications is a burgeoning trend, offering innovation prospects across diverse sectors, including healthcare, finance, and e-commerce. Serverless computing simplifies cloud-native development by abstracting infrastructure management, empowering developers to focus solely on coding, curtailing operational overhead, and optimizing costs. Cloud-native solutions aid organizations in meeting regulatory compliance prerequisites by furnishing features like encryption, access controls, and audit trails, ensuring data security and legal adherence. Enterprises actively pursue digital transformation, and cloud-native development equips them to swiftly construct and deploy digital solutions. Cloud-native development market technologies allow resource optimization, driving cost savings through containerization and microservices. Cloud-native applications readily scale to meet burgeoning demands, ensuring flexibility in resource allocation. DevOps practices and automation tools expedite development, heightening developer productivity and reducing time-to-market. Cloud-native applications' intrinsic resilience diminishes downtime, elevating the user experience. Cloud-native application development not only capitalizes on the cloud's scalability and performance but also its cost-efficiency, security, and developer-friendliness, making it an imperative choice for organizations seeking agility, savings, and innovation in the ever-evolving digital landscape.

Cloud-native Development Market Restraint

Financial Challenges of Cloud-Native Implementation and Recruiting and Retaining Cloud-Native Expertise in Competitive Market hindering the market growth The abundance of choices within the cloud-native ecosystem encompasses PaaS, Kubernetes, service mesh, DevOps, app development tools, and cloud providers which affects the growth of the Cloud-native Development Market. For instance, the realm of Kubernetes alone offers over 200+ Certified Service Providers and numerous Kubernetes-certified distributions, leading to decision paralysis. Ensuring the compatibility of selected tools with security and compliance requirements, especially concerning cloud providers and deployment models, further complicates the selection process amidst the ever-expanding universe of cloud services, exemplified by Azure's 290k platform combinations. Architectural complexity emerges as another substantial restraint, with 51% of leaders identifying it as a primary challenge. Cloud-native development necessitates breaking down monolithic applications into intricate microservices, involving dynamic end-user elements and sophisticated backends running on Kubernetes across multiple clouds, often relying on diverse event-driven technologies and RESTful APIs. These intricate interactions underscore the complexity inherent in cloud-native applications, far surpassing the intricacies of previous distributed computing models. Establishing and maintaining infrastructure constitute a critical hurdle acknowledged by both industry cloud-native development market leaders and laggards. The misconception that cloud-native merely entails containerization or Kubernetes orchestration belies the intricacies involved in setting up an infrastructure that seamlessly incorporates microservices and leverages native cloud services from providers like AWS or Azure. Complex considerations, such as scalability, resilience, and cost control, underscore the maturity of cloud-native development market top organizations, highlighting the need for scalable, globally distributed infrastructure. While vendors offer streamlined configurations, the practical implementation remains challenging, particularly for large-scale enterprises. Budget constraints present a formidable barrier, with cloud-native infrastructure implementation costing organizations hundreds of thousands to millions of dollars and consuming extensive timeframes. Justifying this investment and navigating the associated risks, especially for first-time adopters, requires meticulous calculation and the ability to convince risk-averse organizations of the long-term benefits, as cloud-native architectures ultimately yield cost-efficient operations. Securing the requisite skill set poses another considerable challenge, as cloud-native development demands a diverse talent pool, from cloud and database architects to security experts. Recruiting such specialized skills in a competitive job in the Cloud-native Development Market is challenging, and retaining them proves even harder due to attractive offers from tech giants. Outdated technologies hamper innovation, making it essential to transition to cloud-native equivalents, which necessitates substantial effort and resources. Complexity in comprehending cloud-native concepts, particularly for non-technical stakeholders, contributes to the challenge of adoption. The numerous dependencies within cloud-native architectures necessitate a deep understanding, which is daunting without expert guidance.Cloud-Native Development Market Opportunities

AI and Machine Learning Integration offers Growth Potential for Cloud-Native Solutions Emerging Cloud-Native Development Market are witnessing a rise in the adoption of cloud-native development, offering substantial growth prospects for businesses looking to fulfill digital transformation needs which offer a growth opportunity to Cloud-Native Development Market. Hybrid and multi-cloud strategies are on the rise, creating openings for cloud-native solutions that navigate diverse cloud environments, effectively addressing the evolving demands of organizations. The growth of IoT and edge computing is fueling demand for cloud-native applications capable of efficiently processing data at the edge, ushering in innovative possibilities. The integration of AI and machine learning into cloud-native applications presents a growing trend, promising the development of intelligent, data-driven solutions that enhance business efficiencies. The pivotal roles played by API management and data analytics in elevating cloud-native application performance make them indispensable components of this evolving ecosystem. As businesses increasingly recognize the benefits of cloud-native technologies, staying abreast of these trends is crucial to building and deploying modern, scalable, and secure applications that align with the dynamic demands of today's technology landscape.Cloud-native Development Market Segment Analysis:

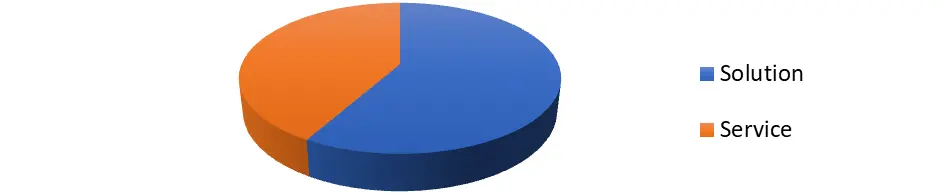

Based on Type, Solution segment is expected to dominate the Cloud-native Development Market in during the forecast period. Cloud-native solutions encompass a range of software and tools tailored to facilitate the development, deployment, and management of cloud-native applications. These solutions find extensive applications in sectors like information technology, enabling developers to build and scale applications efficiently. Cloud-Native Services is a fast-growing segment in the Cloud-native Development Market and provides a suite of support, consulting, and maintenance offerings essential for the successful implementation and operation of cloud-native solutions. These services play an essential role in sectors such as healthcare, where specialized expertise is required to ensure compliance and integration with existing systems. The adoption of Cloud-Native Solutions is driven by the need for innovation and agility, while Cloud-Native Services cater to organizations seeking guidance and support in their cloud-native journey.Cloud-native Development Market, by Type (%) in 2022

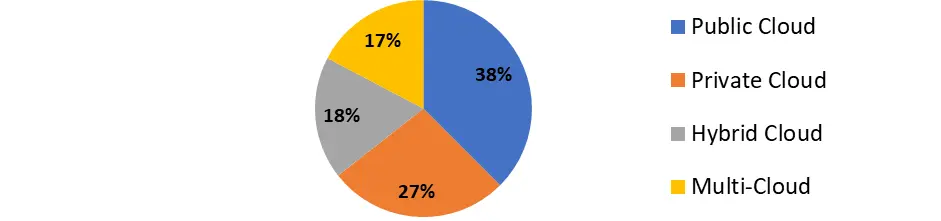

Based on Deployment Model, Public Cloud deployment segment dominated the Cloud-native Development Market as it is used across various sectors that are increasingly leveraging cloud-native solutions to enhance scalability, accessibility, and cost-efficiency. This model finds widespread adoption in industries such as e-commerce, where the dynamic nature of demand necessitates rapid scaling of resources. On the other hand, Private Cloud deployment is prevalent among organizations with stringent data security and compliance requirements, including those in the healthcare and finance sectors. The Private Cloud offers greater control over data and infrastructure while still benefiting from cloud-native technologies. Hybrid Cloud deployment is gaining momentum as it combines the best of both Public and Private Clouds. This model is favored by businesses seeking to strike a balance between scalability and data security, making it suitable for industries like manufacturing and logistics. Multi-cloud adoption is on the rise as organizations look to avoid vendor lock-in and optimize cloud resources. This approach is particularly relevant in sectors such as entertainment and media, where diverse cloud services strategically utilized.Cloud-native Development Market, by Deployment Model (%) in 2022

Cloud-native Development Market Regional Insights:

North America dominated the Cloud-native Development Market in 2022 led by the United States. The US Cloud-native Development Market dominance is attributed to a robust IT ecosystem, widespread digitalization, and a thriving startup culture, with major players like AWS, Microsoft Azure, and Google Cloud driving innovation. In Europe, countries like the United Kingdom, Germany, and France lead the charge in cloud-native development. Stricter data privacy regulations, such as GDPR, have necessitated cloud-native solutions that prioritize data security and compliance. Asia Pacific, with nations like India, China, and Singapore, is witnessing a surge in cloud-native adoption driven by digital transformation initiatives. Rapid urbanization and a burgeoning middle class are propelling demand for cloud-native applications across various industries. Middle East and Africa are gradually embracing cloud-native solutions, with countries like the United Arab Emirates and South Africa incorporating these technologies to enhance various sectors, from finance to healthcare. South America, including countries like Brazil and Argentina, is also entering the cloud-native arena, driven by a need to streamline operations and improve customer experiences. Cloud-native Development Market report covered the detailed analysis of country wise Cloud-native Development Market analysis.Competitive Landscape Cloud-native Development Market:

The Cloud-Native Development Market is highly competitive, driven by industry leaders and key service providers dedicated to advancing their offerings. Amazon Web Services (AWS) leads with AWS Proton, simplifying microservices deployment. Microsoft Azure collaborates with Docker to streamline container development and introduces Azure Arc for cross-environment Kubernetes management. Google Cloud Platform (GCP) gains ground with Kubernetes Engine and partners with Elastic for enhanced data analytics. IBM, through Red Hat OpenShift, enhances cloud-native development and recently acquired BoxBoat Technologies for container and DevOps expertise. Oracle expands Oracle Cloud Infrastructure (OCI) and partners with NVIDIA for GPU-powered AI/ML. Docker collaborates with AWS, Azure, and GCP for seamless containerization and launches Docker Desktop for Mac with Apple Silicon support. VMware's Tanzu platform excels in hybrid and multi-cloud, while Pivotal, now part of VMware, partners with Microsoft Azure and Google Cloud, bolstering cloud-native tools like Spring Boot and Spring Cloud for Java developers. These market leaders compete and collaborate, driving innovation through partnerships, acquisitions, and product advancements, shaping the evolving cloud-native landscape.Cloud-native Development Market Scope : Inquire Before Buying

Global Cloud-native Development Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 547.61 Bn. Forecast Period 2023 to 2029 CAGR: 23.12% Market Size in 2029: US $ 2348.40 Bn. Segments Covered: by Type Solution Service by Deployment Model Public Cloud Private Cloud Hybrid Cloud Multi-Cloud by Organization Size Small and Medium-sized Enterprises (SMEs) Large Enterprises by End-User IT and Telecom BFSI Healthcare Government Others Cloud-native Development Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Cloud-native Development Market, Key Players are

1. Alibaba Cloud 2. Amazon Web Services (AWS) 3. Canonical (Ubuntu) 4. Cognizant 5. Docker 6. GitLab 7. Google Cloud Platform (GCP) 8. Huawei Cloud 9. IBM 10. Infosys 11. Jenkins 12. Microsoft Azure 13. NEC Corporation 14. NTT Data 15. Oracle 16. Pivotal 17. Red Hat 18. Samsung SDS 19. SAP 20. SUSE 21. Tech Mahindra 22. VMware 23. Wipro Frequently Asked Questions: 1] What segments are covered in the Global Cloud-native Development Market report? Ans. The segments covered in the Cloud-native Development Market report are based on Type, Deployment Model, Organization Size, End-User, and Region. 2] Which region is expected to hold the highest share of the Global Cloud-native Development Market? Ans. The North America region is expected to hold the highest share of the Cloud-native Development Market. 3] What is the market size of the Global Cloud-native Development Market by 2029? Ans. The market size of the Cloud-native Development Market by 2029 is expected to reach US$ 2348.40 Bn. 4] What is the forecast period for the Global Cloud-native Development Market? Ans. The forecast period for the Cloud-native Development Market is 2022-2029. 5] What was the market size of the Global Cloud-native Development Market in 2022? Ans. The market size of the Cloud-native Development Market in 2022 was valued at US$ 547.61 Bn.

1. Cloud-native Development Market: Research Methodology 2. Cloud-native Development Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Cloud-native Development Market: Dynamics 3.1. Cloud-native Development Market Trends by Region 3.1.1. Global Cloud-native Development Market Trends 3.1.2. North America Cloud-native Development Market Trends 3.1.3. Europe Cloud-native Development Market Trends 3.1.4. Asia Pacific Cloud-native Development Market Trends 3.1.5. Middle East and Africa Cloud-native Development Market Trends 3.1.6. South America Cloud-native Development Market Trends 3.2. Cloud-native Development Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cloud-native Development Market Drivers 3.2.1.2. North America Cloud-native Development Market Restraints 3.2.1.3. North America Cloud-native Development Market Opportunities 3.2.1.4. North America Cloud-native Development Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cloud-native Development Market Drivers 3.2.2.2. Europe Cloud-native Development Market Restraints 3.2.2.3. Europe Cloud-native Development Market Opportunities 3.2.2.4. Europe Cloud-native Development Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cloud-native Development Market Drivers 3.2.3.2. Asia Pacific Cloud-native Development Market Restraints 3.2.3.3. Asia Pacific Cloud-native Development Market Opportunities 3.2.3.4. Asia Pacific Cloud-native Development Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cloud-native Development Market Drivers 3.2.4.2. Middle East and Africa Cloud-native Development Market Restraints 3.2.4.3. Middle East and Africa Cloud-native Development Market Opportunities 3.2.4.4. Middle East and Africa Cloud-native Development Market Challenges 3.2.5. South America 3.2.5.1. South America Cloud-native Development Market Drivers 3.2.5.2. South America Cloud-native Development Market Restraints 3.2.5.3. South America Cloud-native Development Market Opportunities 3.2.5.4. South America Cloud-native Development Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Deployment Model Roadmap 3.6. Regulatory Landscape by Region 3.6.1. Global 3.6.2. North America 3.6.3. Europe 3.6.4. Asia Pacific 3.6.5. Middle East and Africa 3.6.6. South America 3.7. Key Opinion Leader Analysis For Cloud-native Development Industry 3.8. Analysis of Government Schemes and Initiatives For Cloud-native Development 3.9. The Global Pandemic Impact on Cloud-native Development Market 4. Cloud-native Development Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. Cloud-native Development Market Size and Forecast, by Type (2022-2029) 4.1.1. Solution 4.1.2. Service 4.2. Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 4.2.1. Public Cloud 4.2.2. Private Cloud 4.2.3. Hybrid Cloud 4.2.4. Multi-Cloud 4.3. Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 4.3.1. Small and Medium-sized Enterprises (SMEs) 4.3.2. Large Enterprises 4.4. Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 4.4.1. IT and Telecom 4.4.2. BFSI 4.4.3. Healthcare 4.4.4. Government 4.4.5. Others 4.5. Cloud-native Development Market Size and Forecast, by Region (2022-2029) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Cloud-native Development Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. North America Cloud-native Development Market Size and Forecast, by Type (2022-2029) 5.1.1. Solution 5.1.2. Service 5.2. North America Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 5.2.1. Public Cloud 5.2.2. Private Cloud 5.2.3. Hybrid Cloud 5.2.4. Multi-Cloud 5.3. North America Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 5.3.1. Small and Medium-sized Enterprises (SMEs) 5.3.2. Large Enterprises 5.4. North America Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 5.4.1. IT and Telecom 5.4.2. BFSI 5.4.3. Healthcare 5.4.4. Government 5.4.5. Others 5.5. North America Cloud-native Development Market Size and Forecast, by Country (2022-2029) 5.5.1. United States 5.5.1.1. United States Cloud-native Development Market Size and Forecast, by Type (2022-2029) 5.5.1.1.1. Solution 5.5.1.1.2. Service 5.5.1.2. United States Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 5.5.1.2.1. Public Cloud 5.5.1.2.2. Private Cloud 5.5.1.2.3. Hybrid Cloud 5.5.1.2.4. Multi-Cloud 5.5.1.3. United States Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 5.5.1.3.1. Small and Medium-sized Enterprises (SMEs) 5.5.1.3.2. Large Enterprises 5.5.1.4. United States Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 5.5.1.4.1. IT and Telecom 5.5.1.4.2. BFSI 5.5.1.4.3. Healthcare 5.5.1.4.4. Government 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Cloud-native Development Market Size and Forecast, by Type (2022-2029) 5.5.2.1.1. Solution 5.5.2.1.2. Service 5.5.2.2. Canada Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 5.5.2.2.1. Public Cloud 5.5.2.2.2. Private Cloud 5.5.2.2.3. Hybrid Cloud 5.5.2.2.4. Multi-Cloud 5.5.2.3. Canada Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 5.5.2.3.1. Small and Medium-sized Enterprises (SMEs) 5.5.2.3.2. Large Enterprises 5.5.2.4. Canada Cloud-native Development Market Size and Forecast, byEnd-User (2022-2029) 5.5.2.4.1. IT and Telecom 5.5.2.4.2. BFSI 5.5.2.4.3. Healthcare 5.5.2.4.4. Government 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Cloud-native Development Market Size and Forecast, by Type (2022-2029) 5.5.3.1.1. Solution 5.5.3.1.2. Service 5.5.3.2. Mexico Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 5.5.3.2.1. Public Cloud 5.5.3.2.2. Private Cloud 5.5.3.2.3. Hybrid Cloud 5.5.3.2.4. Multi-Cloud 5.5.3.3. Mexico Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 5.5.3.3.1. Small and Medium-sized Enterprises (SMEs) 5.5.3.3.2. Large Enterprises 5.5.3.4. Mexico Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 5.5.3.4.1. IT and Telecom 5.5.3.4.2. BFSI 5.5.3.4.3. Healthcare 5.5.3.4.4. Government 5.5.3.4.5. Others 6. Europe Cloud-native Development Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Europe Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.2. Europe Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.3. Europe Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 6.4. Europe Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 6.5. Europe Cloud-native Development Market Size and Forecast, by Country (2022-2029) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.5.1.2. United Kingdom Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.5.1.3. United Kingdom Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 6.5.1.4. United Kingdom Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 6.5.2. France 6.5.2.1. France Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.5.2.2. France Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.5.2.3. France Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 6.5.2.4. France Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 6.5.3. Germany 6.5.3.1. Germany Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.5.3.2. Germany Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.5.3.3. Germany Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 6.5.3.4. Germany Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 6.5.4. Italy 6.5.4.1. Italy Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.5.4.2. Italy Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.5.4.3. Italy Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 6.5.4.4. Italy Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 6.5.5. Spain 6.5.5.1. Spain Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.5.5.2. Spain Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.5.5.3. Spain Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 6.5.5.4. Spain Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 6.5.6. Sweden 6.5.6.1. Sweden Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.5.6.2. Sweden Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.5.6.3. Sweden Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 6.5.6.4. Sweden Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 6.5.7. Austria 6.5.7.1. Austria Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.5.7.2. Austria Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.5.7.3. Austria Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 6.5.7.4. Austria Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Cloud-native Development Market Size and Forecast, by Type (2022-2029) 6.5.8.2. Rest of Europe Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 6.5.8.3. Rest of Europe Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 6.5.8.4. Rest of Europe Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7. Asia Pacific Cloud-native Development Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.2. Asia Pacific Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.3. Asia Pacific Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.4. Asia Pacific Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5. Asia Pacific Cloud-native Development Market Size and Forecast, by Kamal (2022-2029) 7.5.1. China 7.5.1.1. China Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.1.2. China Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.1.3. China Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.1.4. China Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.2. S Korea 7.5.2.1. S Korea Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.2.2. S Korea Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.2.3. S Korea Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.2.4. S Korea Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.3. Japan 7.5.3.1. Japan Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.3.2. Japan Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.3.3. Japan Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.3.4. Japan Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.4. India 7.5.4.1. India Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.4.2. India Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.4.3. India Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.4.4. India Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.5. Australia 7.5.5.1. Australia Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.5.2. Australia Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.5.3. Australia Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.5.4. Australia Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.6. Indonesia 7.5.6.1. Indonesia Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.6.2. Indonesia Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.6.3. Indonesia Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.6.4. Indonesia Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.7. Malaysia 7.5.7.1. Malaysia Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.7.2. Malaysia Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.7.3. Malaysia Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.7.4. Europe Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.8. Vietnam 7.5.8.1. Vietnam Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.8.2. Vietnam Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.8.3. Vietnam Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.8.4. Vietnam Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.9. Taiwan 7.5.9.1. Taiwan Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.9.2. Taiwan Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.9.3. Taiwan Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 7.5.9.4. Taiwan Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Cloud-native Development Market Size and Forecast, by Type (2022-2029) 7.5.10.2. Rest of Asia Pacific Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 7.5.10.3. Rest of Asia Pacific Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 7.5.10.4. Rest of Asia Pacific Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 8. Middle East and Africa Cloud-native Development Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Cloud-native Development Market Size and Forecast, by Type (2022-2029) 8.2. Middle East and Africa Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 8.3. Middle East and Africa Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 8.4. Middle East and Africa Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 8.5. Middle East and Africa Cloud-native Development Market Size and Forecast, by Country (2022-2029) 8.5.1. South Africa 8.5.1.1. South Africa Cloud-native Development Market Size and Forecast, by Type (2022-2029) 8.5.1.2. South Africa Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 8.5.1.3. South Africa Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 8.5.1.4. South Africa Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 8.5.2. GCC 8.5.2.1. GCC Cloud-native Development Market Size and Forecast, by Type (2022-2029) 8.5.2.2. GCC Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 8.5.2.3. GCC Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 8.5.2.4. GCC Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 8.5.3. Nigeria 8.5.3.1. Nigeria Cloud-native Development Market Size and Forecast, by Type (2022-2029) 8.5.3.2. Nigeria Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 8.5.3.3. Nigeria Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 8.5.3.4. Nigeria Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Cloud-native Development Market Size and Forecast, by Type (2022-2029) 8.5.4.2. Rest of ME&A Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 8.5.4.3. Rest of ME&A Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 8.5.4.4. Rest of ME&A Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 9. South America Cloud-native Development Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 9.1. South America Cloud-native Development Market Size and Forecast, by Type (2022-2029) 9.2. South America Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 9.3. South America Cloud-native Development Market Size and Forecast, by Organization Size (2022-2029) 9.4. South America Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 9.5. South America Cloud-native Development Market Size and Forecast, by Country (2022-2029) 9.5.1. Brazil 9.5.1.1. Brazil Cloud-native Development Market Size and Forecast, by Type (2022-2029) 9.5.1.2. Brazil Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 9.5.1.3. Brazil Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 9.5.1.4. Brazil Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 9.5.2. Argentina 9.5.2.1. Argentina Cloud-native Development Market Size and Forecast, by Type (2022-2029) 9.5.2.2. Argentina Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 9.5.2.3. Argentina Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 9.5.2.4. Argentina Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Cloud-native Development Market Size and Forecast, by Type (2022-2029) 9.5.3.2. Rest Of South America Cloud-native Development Market Size and Forecast, by Deployment Model (2022-2029) 9.5.3.3. Rest Of South America Cloud-native Development Market Size and Forecast, by Organization Size(2022-2029) 9.5.3.4. Rest Of South America Cloud-native Development Market Size and Forecast, by End-User (2022-2029) 10. Global Cloud-native Development Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Cloud-native Development Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Alibaba Cloud 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Amazon Web Services (AWS) 11.3. Canonical (Ubuntu) 11.4. Cognizant 11.5. Docker 11.6. GitLab 11.7. Google Cloud Platform (GCP) 11.8. Huawei Cloud 11.9. IBM 11.10. Infosys 11.11. Jenkins 11.12. Microsoft Azure 11.13. NEC Corporation 11.14. NTT Data 11.15. Oracle 11.16. Pivotal 11.17. Red Hat 11.18. Samsung SDS 11.19. SAP 11.20. SUSE 11.21. Tech Mahindra 11.22. VMware 11.23. Wipro 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary