The Cartesian Coordinate Robot Market size was valued at USD 231.40 Million in 2022 and the total Cartesian Coordinate Robot Market revenue is expected to grow at a CAGR of 19.8 % from 2023 to 2029, reaching nearly USD 481.65 Million.Cartesian Coordinate Robot Market Overview:

The Cartesian coordinate robots are three-axis robots whose principal axis moves in the linear direction that is in a straight line. The escalating adoption of automation across various sectors, including manufacturing, electrical & electronics, and others, is driving substantial growth in the global Cartesian coordinate robots market. This growth is primarily attributed to the exceptional precision and accuracy offered by Cartesian robots, supported by their intricate link-and-gear configurations. These attributes are particularly propelling the materials handling sector, where the robots' unparalleled accuracy proves essential for intricate tasks. The surge in automation uptake is fueled by the emergence of the Industrial Internet of Things. This technological interaction has further improved the Cartesian Coordinate Robot Market potential. However, despite the promising outlook, certain challenges hinder the complete realization of the market's potential. One significant obstacle is the high cost associated with Cartesian robots, which hinders widespread adoption, especially among smaller enterprises with budget constraints. Furthermore, a perceived lack of research and development efforts in the field presents another hurdle to the Cartesian Coordinate Robot Market growth.Cartesian Coordinate Robot Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Cartesian Coordinate Robot Market Dynamics:

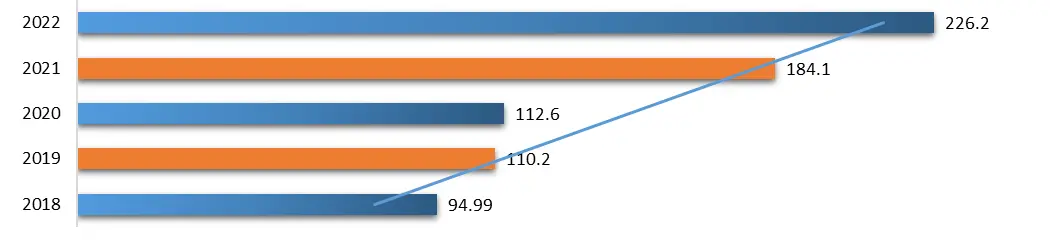

Automation and Industrialization boost the Market growth Automation and industrialization have been significant driving forces in the growth of the Cartesian coordinate robot market. Industries spanning manufacturing, automotive, electronics, and logistics have increasingly embraced automation solutions to enhance operational efficiency and productivity. Cartesian robots, known for their precision and repeatability, have found a pivotal role in executing tasks requiring consistent accuracy. This trend is propelled by the pursuit of streamlined processes, reduced human error, and enhanced output quality. As businesses try to optimize their operations, Cartesian robots offer the ability to perform intricate and repetitive tasks with minimal deviation, ensuring consistent results. Their suitability for tasks like material handling, assembly, packaging, and quality control aligns with the demands of modern industrial workflows. As industries seek to remain competitive in a fast-paced global market, the adoption of Cartesian robots is expected to continue as a strategic choice to achieve higher efficiency, productivity, and precision in various industrial processes.Global Automation and Industrialization are rising from 2018 to 2022.

Rise of Industry 4.0 and IoT drives the Market growth Industry 4.0 signifies a fundamental change in manufacturing principles, marked by the fusion of digital technologies, insights derived from data, and the effortless interlinking of machinery, systems, and operations. This evolution has had a significant influence on the Cartesian coordinate robot market. IoT, a central component of Industry 4.0, involves embedding sensors, connectivity, and data analytics capabilities into physical objects, enabling them to communicate, gather data, and make intelligent decisions. This connectivity extends to Cartesian robots, equipping them with the ability to collect and transmit real-time data about their operations, performance, and environmental conditions. The impact of Industry 4.0 and IoT on the Cartesian robot market. Cartesian robots equipped with sensors and IoT capabilities gather data on factors like movement accuracy, energy consumption, and maintenance needs. This data allows manufacturers to analyze performance trends, identify inefficiencies, and optimize robot utilization for enhanced productivity and cost savings. With IoT-enabled sensors, Cartesian robots monitor their own health and performance parameters. This facilitates predictive maintenance, as anomalies and wear patterns are detected early, reducing downtime and extending the lifespan of the robots. Industry 4.0 and IoT enable remote monitoring and control of Cartesian robots. Manufacturers supervise operations from a distance, make real-time adjustments, and even reprogram robots for different tasks without physical presence, contributing to operational flexibility. Data gathered through IoT sensors allows manufacturers to adapt Cartesian robots to changing production requirements. Insights from real-time data analysis enable rapid adjustments to robot configurations, ensuring optimal performance for specific tasks.

Industrial IoT Worldwide from 2018 to 2022 in (Billion USD)

Limited flexibility limits the Market growth Limited flexibility is a constraint faced by Cartesian coordinate robots in terms of their ability to perform tasks that require complex or non-linear movements. These robots operate along fixed linear axes, meaning their movements are confined to straight lines and predefined paths. While they excel at tasks that involve precise and repetitive linear motions, they struggle when faced with tasks that demand multi-dimensional movements. This limitation was particularly relevant in industries where tasks involve working in three-dimensional spaces, navigating around obstacles, and performing actions that require a combination of rotational and translational movements. For such applications, robots with more advanced kinematic configurations, such as articulated robots, delta robots, offer greater flexibility and dexterity. The constrained movement of Cartesian robots leads to challenges in tasks like assembly, where components need to be maneuvered in various orientations, or tasks like welding, where the robot needs to follow complex contours. Additionally, tasks in cluttered environments require the ability to reach and interact with objects from multiple angles, which is limited to Cartesian robots. While the simplicity and precision of linear motion are advantages of Cartesian robots, businesses need to carefully consider the level of flexibility required for their specific applications. In cases where the tasks demand a high degree of adaptability, other types of robots are better suited to meet the needs of the operation. Integration with AI and Machine Learning creates lucrative growth opportunities for the market growth The integration of Cartesian coordinate robots with artificial intelligence (AI) and machine learning (ML) technologies presents a transformative opportunity in the field of automation. By combining the precise movements of Cartesian robots with the cognitive capabilities of AI and ML, industries unlock enhanced efficiency, adaptability, and decision-making. For instance, consider a manufacturing environment where Cartesian robots are responsible for assembling complex electronic devices. By integrating AI and ML, these robots learn from historical data and adapt their movements based on real-time feedback. Through iterative learning, the robots identify optimal assembly sequences, adjust their motions to accommodate variations in components, and even predict potential issues before they arise. This helps to improve production speed, reduced errors, and higher overall product quality. Moreover, AI-powered vision systems enable Cartesian robots to identify and handle objects of varying shapes and sizes. In a logistics scenario, a Cartesian robot equipped with AI-enhanced vision efficiently sorts packages based on attributes such as size, weight, and destination. As the system processes more data, the robot fine-tunes its sorting strategies, making it increasingly accurate and efficient over time. Machine learning algorithms also offer the potential for predictive maintenance. By monitoring various parameters such as motor performance, temperature, and wear patterns, the Cartesian robot predicts when specific components are likely to fail. This proactive approach allows maintenance teams to schedule repairs or replacements before a breakdown occurs, minimizing downtime and reducing maintenance costs.AI integration enhances human-robot collaboration. Cartesian robots analyze sensor data to detect the presence of human workers nearby and adjust their movements accordingly, ensuring safe interactions and reducing the need for physical barriers.

Cartesian Coordinate Robot Market Segment Analysis:

Based on Type, the 2X-Y-Z Series dominated the type segment of the Cartesian Coordinate Robot Market in the year 2022. 2X-Y-Z Series is known for its exceptional precision, speed, and flexibility in three-dimensional movements. It's equipped with advanced sensors, high-quality actuators, and efficient software control, making it a top choice for applications requiring intricate and precise tasks in various industries. Cartesian Coordinate Robots are known for precise and accurate movement along the X, Y, and Z axes. This makes them suitable for applications that require tight tolerances and high levels of precision, such as electronics assembly, medical device manufacturing, and quality control. The 2X-Y-Z Series offers different end-effectors and tooling options that are easily swapped out, making the robot versatile and suitable for multiple tasks without significant reconfiguration.Cartesian Coordinate Robot Market Based on Type in the year 2022 (%)

Based on the End User, the automotive segment of the end-use industry dominated the Cartesian Coordinate Robot Market in the year 2022. The growing automotive industry is creating a greater need for Cartesian robots, which are robots that move in straight lines, for tasks like welding, painting, and assembling. Cars are made in large quantities, and require high levels of precision and accuracy. Cartesian robots are a good fit for these tasks because they are programmed and controlled easily to do different jobs. Moreover, they are affordable, making them a practical choice for the automotive sector. These robots are helping car manufacturers meet their production demands while maintaining quality and cost-effectiveness. Therefore, the demand for Cartesian Coordinate Robots is very high in the automotive sector.

Cartesian Coordinate Robot Market Based On End User In The Year 2022 (%)

Cartesian Coordinate Robot Regional Insight

North America dominates the Cartesian Coordinate Robot Market in the year 2022. North America, particularly the United States and Canada, has a strong manufacturing sector across various industries, such as automotive, electronics, aerospace, and consumer goods. These industries heavily depend on automation to enhance efficiency, productivity, and quality. Cartesian coordinate robots are widely used in these sectors for tasks like assembly, material handling, and packaging. The region has a history of technological innovation and advancement. North American companies, research institutions, and universities contribute significantly to the development of robotics technology. This innovation-driven environment encourages the adoption of advanced automation solutions like Cartesian coordinate robots. The economic stability of North American countries provides a favorable environment for businesses to invest in automation technologies. The availability of resources, capital, and skilled labor makes it feasible for industries to integrate and utilize Cartesian coordinate robots. The strong collaboration between industries and academia helps drive research and development in the field of robotics and automation. This helps to the creation of innovative solutions that address industry-specific challenges and contribute to the growth of the Cartesian coordinate robot market. To remain globally competitive, North American industries must adopt innovative technologies to streamline processes and produce high-quality products efficiently. Cartesian coordinate robots play a crucial role in achieving these objectives.Cartesian Coordinate Robot Market Scope Table: Inquire Before Buying

Global Cartesian Coordinate Robot Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 231.40 Mn. Forecast Period 2023 to 2029 CAGR: 19.8% Market Size in 2029: US $ 481.65 Mn. Segments Covered: by Type 2X-Y-Z Series XY-X Series 2X-2Y-Z Series by Application Loading and Unloading Workpiece Palletizing and Handling Others by End User Automotive Electrical and Electronics Food and Beverages Chemical and Petrochemicals Others Cartesian Coordinate Robot Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cartesian Coordinate Robot Market Key Players

1. ABB Group (Switzerland) 2. Yaskawa Europe GmbH (Japan) 3. fanuc Corporation(Japan) 4. KUKA AG(Germany) 5. Mitsubishi Electric Corporation (Japan) 6. Stäubli International AG (Switzerland) 7. Universal Robots (Denmark) 8. DENSO Corporation (Japan) 9. Bosch Rexorth (Germany) 10. Hiwin Technologies(Taiwan) 11. Omron Corporation(Japan) 12. Comau S.p.A (Italy) 13. Gudel Group AG (Switzerland) 14. Shibaura Machine CO., LTD (Japan) 15. JANOME Corporation (Japan)Frequently Asked Questions:

1] What segments are covered in the Global Cartesian Coordinate Robot Market report? Ans. The segments covered in the Cartesian Coordinate Robot Market report are based on Type, Application, End User, and Region. 2] Which region is expected to hold the highest share in the Global Cartesian Coordinate Robot Market? Ans. The North American region is expected to hold the highest share of the Cartesian Coordinate Robot Market. 3] What was the market size of the Global Cartesian Coordinate Robot Market by 2029? Ans. The market size of the Cartesian Coordinate Robot Market by 2029 is expected to reach US$ 481.65 Mn. 4] What is the forecast period for the Global Cartesian Coordinate Robot Market? Ans. The forecast period for the Cartesian Coordinate Robot Market is 2023-2029. 5] What is the market size of the Global Cartesian Coordinate Robot Market in 2022? Ans. The market size of the Cartesian Coordinate Robot Market in 2022 is valued at US$ 231.40 Mn.

1. Cartesian Coordinate Robot Market: Research Methodology 2. Cartesian Coordinate Robot Market: Executive Summary 3. Cartesian Coordinate Robot Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Cartesian Coordinate Robot Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Cartesian Coordinate Robot Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Cartesian Coordinate Robot Market Size and Forecast, by Type (2022-2029) 5.1.1. 2X-Y-Z Series 5.1.2. XY-X Series 5.1.3. 2X-2Y-Z Series 5.2. Cartesian Coordinate Robot Market Size and Forecast, by Application (2022-2029) 5.2.1. Loading and Unloading Workpiece 5.2.2. Palletizing and Handling 5.2.3. Others 5.3. Cartesian Coordinate Robot Market Size and Forecast, by End User (2022-2029) 5.3.1. Automotive 5.3.2. Electrical and Electronics 5.3.3. Food and Beverages 5.3.4. Chemical and Petrochemicals 5.3.5. Others 5.4. Cartesian Coordinate Robot Market Size and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Cartesian Coordinate Robot Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Cartesian Coordinate Robot Market Size and Forecast, by Type (2022-2029) 6.1.1. 2X-Y-Z Series 6.1.2. XY-X Series 6.1.3. 2X-2Y-Z Series 6.2. North America Cartesian Coordinate Robot Market Size and Forecast, by Application (2022-2029) 6.2.1. Loading and Unloading Workpiece 6.2.2. Palletizing and Handling 6.2.3. Others 6.3. North America Cartesian Coordinate Robot Market Size and Forecast, by End User (2022-2029) 6.3.1. Automotive 6.3.2. Electrical and Electronics 6.3.3. Food and Breverages 6.3.4. Chemical and Petrochemicals 6.3.5. Others 6.4. North America Cartesian Coordinate Robot Market Size and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Cartesian Coordinate Robot Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Cartesian Coordinate Robot Market Size and Forecast, by Type (2022-2029) 7.1.1. 2X-Y-Z Series 7.1.2. XY-X Series 7.1.3. 2X-2Y-Z Series 7.2. Europe Cartesian Coordinate Robot Market Size and Forecast, by Application (2022-2029) 7.2.1. Loading and Unloading Workpiece 7.2.2. Palletizing and Handling 7.2.3. Others 7.3. Europe Cartesian Coordinate Robot Market Size and Forecast, by End User (2022-2029) 7.3.1. Automotive 7.3.2. Electrical and Electronics 7.3.3. Food and Breverages 7.3.4. Chemical and Petrochemicals 7.3.5. Others 7.4. Europe Cartesian Coordinate Robot Market Size and Forecast, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Cartesian Coordinate Robot Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Cartesian Coordinate Robot Market Size and Forecast, by Type (2022-2029) 8.1.1. 2X-Y-Z Series 8.1.2. XY-X Series 8.1.3. 2X-2Y-Z Series 8.2. Asia Pacific Cartesian Coordinate Robot Market Size and Forecast, by Application (2022-2029) 8.2.1. Loading and Unloading Workpiece 8.2.2. Palletizing and Handling 8.2.3. Others 8.3. Asia Pacific Cartesian Coordinate Robot Market Size and Forecast, by End User (2022-2029) 8.3.1. Automotive 8.3.2. Electrical and Electronics 8.3.3. Food and Breverages 8.3.4. Chemical and Petrochemicals 8.3.5. Others 8.4. Asia Pacific Cartesian Coordinate Robot Market Size and Forecast, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Cartesian Coordinate Robot Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Cartesian Coordinate Robot Market Size and Forecast, by Type (2022-2029) 9.1.1. 2X-Y-Z Series 9.1.2. XY-X Series 9.1.3. 2X-2Y-Z Series 9.2. Middle East and Africa Cartesian Coordinate Robot Market Size and Forecast, by Application (2022-2029) 9.2.1. Loading and Unloading Workpiece 9.2.2. Palletizing and Handling 9.2.3. Others 9.3. Middle East and Africa Cartesian Coordinate Robot Market Size and Forecast, by End User (2022-2029) 9.3.1. Automotive 9.3.2. Electrical and Electronics 9.3.3. Food and Breverages 9.3.4. Chemical and Petrochemicals 9.3.5. Others 9.4. Middle East and Africa Cartesian Coordinate Robot Market Size and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Cartesian Coordinate Robot Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Cartesian Coordinate Robot Market Size and Forecast, by Type (2022-2029) 10.1.1. 2X-Y-Z Series 10.1.2. XY-X Series 10.1.3. 2X-2Y-Z Series 10.2. South America Cartesian Coordinate Robot Market Size and Forecast, by Application (2022-2029) 10.2.1. Loading and Unloading Workpiece 10.2.2. Palletizing and Handling 10.2.3. Others 10.3. South America Cartesian Coordinate Robot Market Size and Forecast, by End User (2022-2029) 10.3.1. Automotive 10.3.2. Electrical and Electronics 10.3.3. Food and Breverages 10.3.4. Chemical and Petrochemicals 10.3.5. Others 10.4. South America Cartesian Coordinate Robot Market Size and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. ABB Group 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Yaskawa Europe GmbH (Japan) 11.3. fanuc Corporation(Japan) 11.4. KUKA AG(Germany) 11.5. Mitsubishi Electric Corporation (Japan) 11.6. Stäubli International AG (Switzerland) 11.7. Universal Robots (Denmark) 11.8. DENSO Corporation (Japan) 11.9. Bosch Rexorth (Germany) 11.10. Hiwin Technologies(Taiwan) 11.11. Omron Corporation(Japan) 11.12. Comau S.p.A (Italy) 11.13. Gudel Group AG (Switzerland) 11.14. Shibaura Machine CO., LTD (Japan) 11.15. JANOME Corporation (Japan) 12. Key Findings 13. Industry Recommendation