Carbon Capture, Utilization and Storage Market was valued at USD 2.76 Billion in 2023, and is expected to reach USD 7.39 Billion by 2030, exhibiting a CAGR of 15.1% during the forecast period (2024-2030) The global carbon capture, utilization and storage market is expected to get boost from large consumer base in developed as well as developing economies. North America and Europe are developed markets with well-established systems for dealing with industrial gases as better infrastructure for industrial gases could provide better processing, storage and transport facilities that could help lower cost of production. Developing regions such as Asia-Pacific, the Middle East and Africa, are fast-growing markets. The carbon capture, utilization and storage market globally is witnessing increases in growth due to technological advancements, high industrial activity, large investments and high demand for industrial processes, leading to a rise in industrial gas market. The carbon capture, utilization, and storage market consist of sales of carbon capture, utilization, and storage technologies by business entities (organizations, sole traders, and partnerships) that are engaged in providing clean and efficient energy solutions. Carbon capture, utilization, and storage (CCUS) involves a number of methods and technologies for removing carbon dioxide from flue gas and the atmosphere, recycling it for use, and establishing safe and long-term storage choices. CCUS reduces global carbon dioxide emissions, helps mitigate global warming and reduces the cost of tackling the climate crisis.To know about the Research Methodology:- Request Free Sample Report

Carbon Capture, Utilization and Storage Market Trends

Carbon Dioxide Supply to Greenhouses: Carbon capture, utilization and storage companies should consider supplying to greenhouses. It is important for the owners of greenhouses to regulate the levels of CO2 in greenhouses. Carbon dioxide manufacturers are exploring opportunities to supply industrial greenhouses. The essential process of photosynthesis for plant growth requires CO2. Throughout any given day, there is a variation in the levels of CO2 concentration depending on the time of day, the season, and the number of CO2 producing industries. Hence, it is important for the levels of CO2 to be regulated within the greenhouse, the carbon dioxide level may reduce to 150-200 parts per million in the daytime in a sealed greenhouse. Artificial Intelligence (AI) in Carbon Reduction: Carbon capture, utilization and storage companies should focus on investing in AI based technology that will drive innovation and cater to a wider customer base. AI’s ability to deliver deep insights into multiple aspects of a company’s carbon footprint and quick cost-cutting offers a promising route to accelerating sustainable transformation and reducing expenses in a time of need. Companies are leveraging artificial intelligence to create separation materials for Co2 which are more efficient and can reduce the current costs of carbon capture. Using molecular generative AI modeling, IBM identified several hundred molecular structures that could enable more efficient and cheaper alternatives to existing separation membranes for capturing CO₂ emitted in industrial processes.Carbon Capture, Utilization and Storage Market Dynamics

Carbon Capture Providing Financially Lucrative Opportunities to Drive the Carbon Capture, Utilization and Storage Market Growth Carbon capture provides financially lucrative opportunities and is expected to drive the Carbon Capture, Utilization and Storage Market. CO2 production through carbon capture costs more than conventional production, making it difficult for companies using this method to compete in the market. However, the increasing carbon price plays a major role in opening up new lucrative opportunities for carbon capture and utilization (CCU). Companies with sustainable practices and products have increased access to various financing options. As carbon pricing increasingly impacts the profitability of these companies and plants, companies that are using CCU technology as leverage have the additional funds to invest in innovation and R&D. Supportive Government Initiatives to Drive the Carbon Capture, Utilization and Storage Market Growth The Carbon Capture, Utilization and Storage Market is expected to be supported by government initiatives in the forecast period. For example, in February 2022, the US Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management (FECM) announced up to $96 million in federal funding for projects that will develop point-source carbon capture technologies for natural gas power plant and industrial applications capable of capturing at least 95% of carbon dioxide (CO2) emissions generated. At the United Nations Climate Change Conference in Glasgow (COP26), a group of 50 countries pledged to create climateresilient and low-carbon health systems in response to mounting evidence of climate change's impact on people's health. Increase in Investments to Drive the Carbon Capture, Utilization and Storage Market Growth The increase in investments in carbon capture, utilization, and storage is expected to contribute to the growth of the Carbon Capture, Utilization and Storage Market. Companies operating in the sector are investing more to be a leader in the market. For example, in February 2022, Chevron U.S.A. Inc., a subsidiary of Chevron Corporation announced it had made a new investment in Carbon Clean, a global leader in cost-effective industrial carbon capture. As part of this new investment, Chevron and Carbon Clean is seeking to develop a carbon capture pilot for Carbon Clean’s CycloneCC technology on a gas turbine in San Joaquin Valley, California. Growing Demand from the Oil and Gas Industry to Drive the Carbon Capture, Utilization and Storage Market Growth The Carbon Capture, Utilization and Storage Market was supported by growing demand from oil and gas industry, due to growing applications of carbon dioxide for enhanced oil recovery process (EOR). The process is a tertiary crude oil production process which allows the producers to produce 30-60% more oil than through primary and secondary recovery processes. Gas injection EOR which uses carbon dioxide is the most commonly practiced oil recovery process, with around 60% of total EOR process in the US is conducted by gas injection. The process involves the use of gases such as natural gas, nitrogen, or carbon dioxide that expand in a reservoir to push additional oil to a production wellbore, or dissolve other gases that dissolve in the oil to lower its viscosity and improve its flow rate. Implementation of COP26 to Limit Global Warming to Drive the Carbon Capture, Utilization and Storage Market Growth The implementation of the United Nations Climate Change Conference, more commonly referred to as COP26 is expected to drive the demand for carbon capture utilization and storage. Innovation is making carbon capture viable for a huge number of businesses globally. To accelerate adoption, 5 billion tons of carbon dioxide must be removed from the atmosphere by 2050. But to meet net zero ambitions by 2050, there needs to be a 500-fold increase in global CCUS equipment capacity. By the time World Energy Outlook-2021 was published in mid-October 2021, more than 120 countries announced new targets for emissions reductions by 2030, and governments representing about 70% of global carbon dioxide (CO2) emissions had pledged to bring those emissions to net zero by 2050. Carbon Capture, Utilization and Storage Market Restraints High Capital Cost to Restraint the Carbon Capture, Utilization and Storage Market Growth The high cost for capturing, and transporting carbon dioxide is a major challenge in the market. Carbon dioxide can be transported in gas form via various means including railway, ship and pipelines. Transporting carbon dioxide requires more energy compared with other alternatives and increases overall cost of production. The carbon dioxide for ship transport and compression for pipeline transport requires abundant electrical energy. For example, capital costs per net MW of electricity with CO2 capture are on average 14% higher than for the bituminous coal plants. Globally, government agencies have formulated various regulations for the proper storage and transportation of carbon dioxide. These regulations also affect the cost of transportation. The high cost of transportation is expected to affect profit margins of carbon capture, utilization and storage companies and limit the growth of the market. Russian-Ukrainian War to Restraint the Carbon Capture, Utilization and Storage Market Growth The Russia-Ukraine war is expected to hamper the growth of the carbon capture market during the forecast. The political turmoil between the two nations has led to material shortage and supply disruptions, causing anxiety among manufacturers due to fear of shortage of supplies. Russia's invasion of Ukraine is expected to increase fossil fuel demand and carbon emissions, which means more companies will need carbon credits to offset their emissions, eventually resulting in higher carbon prices. The US imposed sanctions on Russian fossil fuels, while the UK said it will stop buying Russian oil. The EU announced plans to cut Russian gas imports by 80% 2023 and phase out the rest, including coal and oil, by 2027. The volatility impacted carbon markets around the world, including regional carbon markets Alternative energy sources are likely to mean shipping in more seaborne LNG and ramping up coal-fired power generation, all of which are more emission intensive options, thus, impacting the market in the forecast period. The detailed analysis of the Russian-Ukrainian war is covered in the Carbon Capture, Utilization and Storage Market report.Carbon Capture, Utilization and Storage Market Segment Analysis

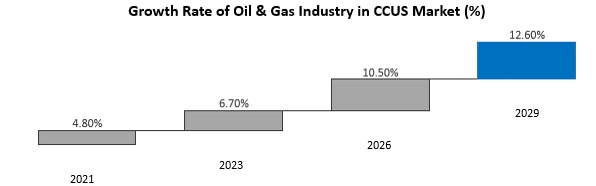

Based on Service, capture service held the highest market share in 2023 and is expected to dominate the service segment during the forecast period. The capture market consists of sales of services by entities that are used to capture carbon dioxide before it enters the atmosphere. The carbon dioxide is separated from other gases produced in industrial processes, such as those at coal and natural-gas-fired power generation plants or steel or cement factories.Post-combustion, in terms of value and volume is expected to be the dominant technology in capture service of the Carbon Capture, Utilization and Storage Market. The post-combustion market consists of sales of post-combusted carbon capture by entities that capture carbon using post-combustion technology. This is the process of capturing carbon dioxide from a flue gas produced after a carbon-based fuel, such as coal or natural gas, has combusted. In this process, exhaust gases from burning fossil fuels are channeled into a capturing container. A liquid solvent or other separation methods then acts as a filter and carbon is separated and absorbed from the other gases. Based on Technology, Bio-energy CCS accounted for the third-largest market share, in terms of value and volume and dominated the technology segment in 2023. Bio-energy CCS is expected to hold the highest revenue share of the Carbon Capture, Utilization and Storage Market during the forecast period. BECCS (bio-energy carbon capture and storage) is a technique that uses biomass to collect and store carbon from the atmosphere, which is then utilised in different processes such as combustion, fermentation, and pyrolysis to extract energy in usable forms such as heat, electricity, and biofuels. The carbon absorbed during the conversion process can subsequently be sequestered in landfills or used to manufacture other compounds. The main factor influencing the deployment of bio-energy CCS is that it produces negative carbon emissions, since it takes carbon from the atmosphere and releases, it in a controlled environment where it can be tapped and used for a variety of purposes. The most difficult aspect of adopting BECCS technology is locating an appropriate geographic site to build the combustion and sequestration facility. Because carbon emissions during bio-mass transportation can make the combustion process less effective, it is likely to be located near the source of biomass with fewer transportation needs. Based on End-User, Oil & Gas industry held the largest Carbon Capture, Utilization and Storage Market share in 2021 and is expected to dominate the end-user segment during the forecast period. In terms of value and volume, the majority of CO2 recovered from natural gas plants is used in the Oil & gas end-use industry section of the carbon capture, utilisation, and storage market. Carbon capture and storage is a cutting-edge technology that can achieve significant reductions in CO2 emissions while minimising the environmental effect of industrial activities across the world. One of the primary drivers of the carbon capture, utilisation, and storage market is the application of carbon capture, utilisation, and storage in oil and gas processing. The majority of CO2 extracted in 2021 came from natural gas processing facilities. Natural gas output will increase at a 2.7% annual rate between 2012 and 2040, accounting for over 30% of global energy generation by that time. The deployment of carbon capture, utilization, and storage in this industry will help create a viable pathway for a sustainable environment.

Carbon Capture, Utilization and Storage Market Regional Insights

North America dominated the Carbon Capture, Utilization and Storage Market in 2023, with the largest revenue share and is expected to hold the highest market share during the forecast period. North America Carbon Capture, Utilization and Storage Market is estimated to grow at a significant CAGR of 10.8% over the forecast period. U.S. dominated the North America Carbon Capture, Utilization and Storage Market in 2023 and is expected to witness the highest growth during the forecast period. The growing demand for clean technology, accompanied with the growing use of CO2 in EOR practices, is likely to drive the Carbon Capture, Utilization and Storage Market in the United States. Chemical production, hydrogen production, fertilizer production, natural gas processing, and power generating are among the industries where CO2 is captured and injected in the United States. Furthermore, the country has a first large-scale carbon capture plant. In February 2018, the United States passed significant financial incentives for carbon capture, utilization, and storage (CCUS) that will make capture from the lowest capture-cost sources economically viable. With approximately 50% government financing for pipelines, over 19 million metric ton of carbon dioxide per year could be captured and transported profitably. With the development of shale gas techniques and less interest in the carbon capturing by the new government, it is expected that the carbon capture, utilization, and storage (CCUS) market is likely to grow at a significant rate in the country. Asia Pacific region was the second largest region in the Carbon Capture, Utilization and Storage Market in 2023, grew at a CAGR of 3.7%. Asia Pacific Carbon Capture, Utilization and Storage Market is expected to grow at the fastest rate of 17.2% and is expected to hold the second- largest revenue share of the Carbon Capture, Utilization and Storage Market during the forecast period. In the Asia-Pacific region, China held the largest market share in 2023 and is expected to grow at a significant rate during the forecast period. China, the world's biggest CO2 emitter, pledged to reach carbon neutrality by around 2060. To achieve this target, as much as 1.82 billion tonnes of CO2 needs to be cut via CCUS each year by that time, according to a study conducted by a research institute affiliated to China's environment ministry. China also recognizes that carbon capture and storage is the only clean technology that can be applied to decarbonize major industries and has the added significant potential to create new revenue streams, which enable economic growth. As a result of China’s carbon neutrality pledge, various Chinese Government ministries have become more active in building understanding of CCS’s role in decarbonization, laying the groundwork for policy development. Among many other factors, above mentioned factors are expected to drive the growth of Asia Pacific Carbon Capture, Utilization and Storage Market during the forecast period.Carbon Capture, Utilization and Storage Market Scope: Inquire before buying

Carbon Capture, Utilization and Storage Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.76 Bn. Forecast Period 2023 to 2030 CAGR: 15.1% Market Size in 2030: US $ 7.39 Bn. Segments Covered: by Service Capture Transportation Utilization Storage by Technology Chemical Looping Solvents & Sorbents Bio-Energy CCS Direct Air Capture by End-User Oil & Gas Power Generation Chemicals & Petrochemicals Cement Iron & Steel Others Carbon Capture, Utilization and Storage Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Carbon Capture, Utilization and Storage Market, Key Players are

North America 1. Halliburton 2. Mitsubishi Heavy Industries Ltd 3. exxon mobil corporation 4. Fluor Corporation 5. Honeywell International Inc 6. Schlumberger Limited 7. C-Capture Ltd 8. Tandem Technical 9. Elysian Carbon Management 10. Carbon GeoCapture Europe 11. Royal Dutch Shell PLC 12. Siemens AG 13. Total Energies SE 14. Equinor ASA 15. Aker Solutions 16. royal dutch shell plc 17. Linde Plc 18. TotalEnergies SE 19. Carbicrete 20. Carbon Centric APAC 21. Hitachi Ltd 22. JGC Holdings Corporation 23. Japan CCS 24. Carbon EX 25. Tanda (Shenzhen) 26. Powered Carbon 27. SINOTECH Middle East and Africa 28. Zero Carbon Ventures 29. Octavia Carbon Frequently Asked Questions: 1] What is the growth rate of the Global Carbon Capture, Utilization and Storage Market? Ans. The Global Carbon Capture, Utilization and Storage Market is growing at a significant rate of 15.1% during the forecast period. 2] Which region is expected to have the highest growth rate in the Global Carbon Capture, Utilization and Storage Market? Ans. The Asia Pacific region is expected to hold the highest growth rate in the Carbon Capture, Utilization and Storage Market during the forecast period. 3] What is the market size of the Global Market by 2030? Ans. The market size of the Carbon Capture, Utilization and Storage Market by 2030 is expected to reach USD 7.39 Bn. 4] What are the major key players of the Global Market? Ans. The major key players of the Global Market are Halliburton, Royal Dutch Shell PLC, Siemens AG, General Electric, and Hitachi Ltd. 5] What factors are driving the growth of the Global Market in 2023? Ans. Increasing demand for CO2 in EOR techniques and rising environmental awareness to increase natural gas demand are the major factors expected to drive the Global Market during the forecast period.

1. Carbon Capture, Utilization and Storage Market: Research Methodology 2. Carbon Capture, Utilization and Storage Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Carbon Capture, Utilization and Storage Market: Dynamics 3.1 Carbon Capture, Utilization and Storage Market Trends by Region 3.1.1 Global Carbon Capture, Utilization and Storage Market Trends 3.1.2 North America Carbon Capture, Utilization and Storage Market Trends 3.1.3 Europe Carbon Capture, Utilization and Storage Market Trends 3.1.4 Asia Pacific Carbon Capture, Utilization and Storage Market Trends 3.1.5 Middle East and Africa Carbon Capture, Utilization and Storage Market Trends 3.1.6 South America Carbon Capture, Utilization and Storage Market Trends 3.2 Carbon Capture, Utilization and Storage Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Carbon Capture, Utilization and Storage Market Drivers 3.2.1.2 North America Carbon Capture, Utilization and Storage Market Restraints 3.2.1.3 North America Carbon Capture, Utilization and Storage Market Opportunities 3.2.1.4 North America Carbon Capture, Utilization and Storage Market Challenges 3.2.2 Europe 3.2.2.1 Europe Carbon Capture, Utilization and Storage Market Drivers 3.2.2.2 Europe Carbon Capture, Utilization and Storage Market Restraints 3.2.2.3 Europe Carbon Capture, Utilization and Storage Market Opportunities 3.2.2.4 Europe Carbon Capture, Utilization and Storage Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Carbon Capture, Utilization and Storage Market Market Drivers 3.2.3.2 Asia Pacific Carbon Capture, Utilization and Storage Market Restraints 3.2.3.3 Asia Pacific Carbon Capture, Utilization and Storage Market Opportunities 3.2.3.4 Asia Pacific Carbon Capture, Utilization and Storage Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Carbon Capture, Utilization and Storage Market Drivers 3.2.4.2 Middle East and Africa Carbon Capture, Utilization and Storage Market Restraints 3.2.4.3 Middle East and Africa Carbon Capture, Utilization and Storage Market Opportunities 3.2.4.4 Middle East and Africa Carbon Capture, Utilization and Storage Market Challenges 3.2.5 South America 3.2.5.1 South America Carbon Capture, Utilization and Storage Market Drivers 3.2.5.2 South America Carbon Capture, Utilization and Storage Market Restraints 3.2.5.3 South America Carbon Capture, Utilization and Storage Market Opportunities 3.2.5.4 South America Carbon Capture, Utilization and Storage Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Carbon Capture, Utilization and Storage Industry 3.8 The Global Pandemic and Redefining of The Carbon Capture, Utilization and Storage Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Carbon Capture, Utilization and Storage Trade Analysis (2017-2023) 3.11.1 Global Import of Carbon Capture, Utilization and Storage 3.11.2 Global Export of Carbon Capture, Utilization and Storage 3.12 Global Carbon Capture, Utilization and Storage Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Carbon Capture, Utilization and Storage Manufacturers: Global Installed Capacity 3.12.4 Analysis by Size of Manufacturer 4. Global Carbon Capture, Utilization and Storage Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Global Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 4.1.1 Capture 4.1.2 Transportation 4.1.3 Utilization 4.1.4 Storage 4.2 Global Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 4.2.1 Chemical Looping 4.2.2 Solvents & Sorbents 4.2.3 Bio-Energy CCS 4.2.4 Direct Air Capture 4.3 Global Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 4.3.1 Oil & Gas 4.3.2 Power Generation 4.3.3 Chemicals & Petrochemicals 4.3.4 Cement 4.3.5 Iron & Steel 4.3.6 Others 4.4 Global Carbon Capture, Utilization and Storage Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Carbon Capture, Utilization and Storage Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 North America Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 5.1.1 Capture 5.1.2 Transportation 5.1.3 Utilization 5.1.4 Storage 5.2 North America Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 5.2.1 Chemical Looping 5.2.2 Solvents & Sorbents 5.2.3 Bio-Energy CCS 5.2.4 Direct Air Capture 5.3 North America Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 5.3.1 Oil & Gas 5.3.2 Power Generation 5.3.3 Chemicals & Petrochemicals 5.3.4 Cement 5.3.5 Iron & Steel 5.3.6 Others 5.4 North America Carbon Capture, Utilization and Storage Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 5.4.1.1.1 Capture 5.4.1.1.2 Transportation 5.4.1.1.3 Utilization 5.4.1.1.4 Storage 5.4.1.2 United States Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 5.4.1.2.1 Chemical Looping 5.4.1.2.2 Solvents & Sorbents 5.4.1.2.3 Bio-Energy CCS 5.4.1.2.4 Direct Air Capture 5.4.1.3 United States Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 5.4.1.3.1 Oil & Gas 5.4.1.3.2 Power Generation 5.4.1.3.3 Chemicals & Petrochemicals 5.4.1.3.4 Cement 5.4.1.3.5 Iron & Steel 5.4.1.3.6 Others 5.4.2 Canada 5.4.2.1 Canada Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 5.4.2.1.1 Capture 5.4.2.1.2 Transportation 5.4.2.1.3 Utilization 5.4.2.1.4 Storage 5.4.2.2 Canada Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 5.4.2.2.1 Chemical Looping 5.4.2.2.2 Solvents & Sorbents 5.4.2.2.3 Bio-Energy CCS 5.4.2.2.4 Direct Air Capture 5.4.2.3 Canada Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 5.4.2.3.1 Oil & Gas 5.4.2.3.2 Power Generation 5.4.2.3.3 Chemicals & Petrochemicals 5.4.2.3.4 Cement 5.4.2.3.5 Iron & Steel 5.4.2.3.6 Others 5.4.3 Mexico 5.4.3.1 Mexico Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 5.4.3.1.1 Capture 5.4.3.1.2 Transportation 5.4.3.1.3 Utilization 5.4.3.1.4 Storage 5.4.3.2 Mexico Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 5.4.3.2.1 Chemical Looping 5.4.3.2.2 Solvents & Sorbents 5.4.3.2.3 Bio-Energy CCS 5.4.3.2.4 Direct Air Capture 5.4.3.3 Mexico Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 5.4.3.3.1 Oil & Gas 5.4.3.3.2 Power Generation 5.4.3.3.3 Chemicals & Petrochemicals 5.4.3.3.4 Cement 5.4.3.3.5 Iron & Steel 5.4.3.3.6 Others 6. Europe Carbon Capture, Utilization and Storage Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 Europe Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.2 Europe Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 6.3 Europe Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 6.4 Europe Carbon Capture, Utilization and Storage Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.4.1.2 United Kingdom Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 6.4.1.3 United Kingdom Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 6.4.2 France 6.4.2.1 France Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.4.2.2 France Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 6.4.2.3 France Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.4.3.2 Germany Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 6.4.3.3 Germany Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.4.4.2 Italy Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 6.4.4.3 Italy Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.4.5.2 Spain Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 6.4.5.3 Spain Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.4.6.2 Sweden Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 6.4.6.3 Sweden Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.4.7.2 Austria Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 6.4.7.3 Austria Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 6.4.8.2 Rest of Europe Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030). 6.4.8.3 Rest of Europe Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7. Asia Pacific Carbon Capture, Utilization and Storage Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 7.1 Asia Pacific Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.2 Asia Pacific Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.3 Asia Pacific Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4 Asia Pacific Carbon Capture, Utilization and Storage Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.1.2 China Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.1.3 China Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.2.2 S Korea Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.2.3 S Korea Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.3.2 Japan Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.3.3 Japan Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.4 India 7.4.4.1 India Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.4.2 India Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.4.3 India Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.5.2 Australia Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.5.3 Australia Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.6.2 Indonesia Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.6.3 Indonesia Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.7.2 Malaysia Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.7.3 Malaysia Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.8.2 Vietnam Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.8.3 Vietnam Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.9.2 Taiwan Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.9.3 Taiwan Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.10.2 Bangladesh Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.10.3 Bangladesh Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.11.2 Pakistan Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.11.3 Pakistan Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 7.4.12.2 Rest of Asia PacificCarbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 7.4.12.3 Rest of Asia Pacific Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 8. Middle East and Africa Carbon Capture, Utilization and Storage Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 8.1 Middle East and Africa Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 8.2 Middle East and Africa Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 8.3 Middle East and Africa Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 8.4 Middle East and Africa Carbon Capture, Utilization and Storage Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 8.4.1.2 South Africa Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 8.4.1.3 South Africa Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 8.4.2.2 GCC Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 8.4.2.3 GCC Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 8.4.3.2 Egypt Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 8.4.3.3 Egypt Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 8.4.4.2 Nigeria Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 8.4.4.3 Nigeria Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 8.4.5.2 Rest of ME&A Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 8.4.5.3 Rest of ME&A Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 9. South America Carbon Capture, Utilization and Storage Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 9.1 South America Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 9.2 South America Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 9.3 South America Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 9.4 South America Carbon Capture, Utilization and Storage Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 9.4.1.2 Brazil Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 9.4.1.3 Brazil Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 9.4.2.2 Argentina Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 9.4.2.3 Argentina Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Carbon Capture, Utilization and Storage Market Size and Forecast, By Service (2023-2030) 9.4.3.2 Rest Of South America Carbon Capture, Utilization and Storage Market Size and Forecast, By Technology (2023-2030) 9.4.3.3 Rest Of South America Carbon Capture, Utilization and Storage Market Size and Forecast, By End-User (2023-2030) 10. Global Carbon Capture, Utilization and Storage Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2023 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Carbon Capture, Utilization and Storage Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Halliburton 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Mitsubishi Heavy Industries Ltd 11.3 exxon mobil corporation 11.4 Fluor Corporation 11.5 Honeywell International Inc 11.6 Schlumberger Limited 11.7 C-Capture Ltd 11.8 Tandem Technical 11.9 Elysian Carbon Management 11.10 Carbon GeoCapture 11.11 Royal Dutch Shell PLC 11.12 Siemens AG 11.13 Total Energies SE 11.14 Equinor ASA 11.15 Aker Solutions 11.16 royal dutch shell plc 11.17 Linde Plc 11.18 TotalEnergies SE 11.19 Carbicrete 11.20 Carbon Centric 11.21 Hitachi Ltd 11.22 JGC Holdings Corporation 11.23 Japan CCS 11.24 Carbon EX 11.25 Tanda (Shenzhen) 11.26 Powered Carbon 11.27 SINOTECH 11.28 Zero Carbon Ventures 11.29 Octavia Carbon 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary