Business Process Automation (BPA) Market size was valued at US$ 9.9 Bn. in 2021 and the total revenue is expected to grow at 12.2% through 2022 to 2029, reaching nearly US$ 24.86 Bn.Business Process Automation (BPA) Market Overview:

Business process automation software is used in complex corporate procedures automated with the help of technology, it helps to enhance quality save expanses improve service delivery.To know about the Research Methodology :- Request Free Sample Report Impact of COVIDE 19 on the Business Process Automation (BPA) Market: The COVIDE 19 pandemics have been hitting the market this largely effects on manufacturing industry. This is attributed to the sharp decrease in the construction, automotive, and industrial sectors. Manufacturing companies have extended the closing of all their operations at their workplaces and manufacturing areas until reopening instructions are received from the government authorities. In addition, due to a reduction in labour in light of social disaffection norms amid the COVID-19 pandemic, the thermal spray coating industry witnessed a significant decrease the production.

Business Process Automation (BPA) Market Dynamics:

Driver: Increased need for optimizing resource utilization through automated business process The BPA helps effective ways to diver systems within organizations, improve data quality and reduce data entry efforts through workflow automation. Furthermore, they reduce the time required to create and modify business rules. They improve operational performance by automating and standardizing activities within enterprises. The rising popularity of these solutions can be attributed to the increasing need for streamlining business flows, adapting business processes, and continuously improving workflows to become more responsive to customers’ dynamic requirements. Maintenance and support service systems also help to drive the business process automation by achieving flexibility in business operation maintenance and support service. This service directly deals with customer issues that impact customer satisfaction. The support and maintenance service provides a single point of contact for resolving customer issues Insistent growth in cyber-attacks and security issues restraints the business process automation market Organizations now have plenty of data as a result of digital transformation. Business procedures and data flow are currently of the highest importance in enterprises due to the globalization of firms. Sharing crucial business information worries businesses, and this worry is growing rapidly in the market. The reliable execution of corporate processes is seriously threatened by security risks like malware, hacker assaults, or data theft. Any such malware or attack could harm a company's reputation, earnings, or shareholder value. There were 945 documented data breaches and about 4.5 billion compromised data records globally in the first half of 2018, according to the Breach Level Index 2018 study. Industries, where BPA is used, include social media and healthcare Barriers to adopting advanced systems over a traditional system are the major challenge Business process automation is becoming incredibly popular across sectors due to simplifying their workflow for a better and more efficient operational process. The major factor in the Lower adoption of BPA by organisations is they consider this system as risky, complex and costly they are still unaware of BPA solutions and service benefits. However, there are several organisations that stick to manual process planning such as manual addressing inquiries of customers marketing and seals engagement for generating leads payroll calculations and tactical recruitments. Thus, the resistance to change is a major challenging factor that restricts the adoption of BPA solutions in organizationsBusiness Process Automation (BPA) Market Segment Analysis:

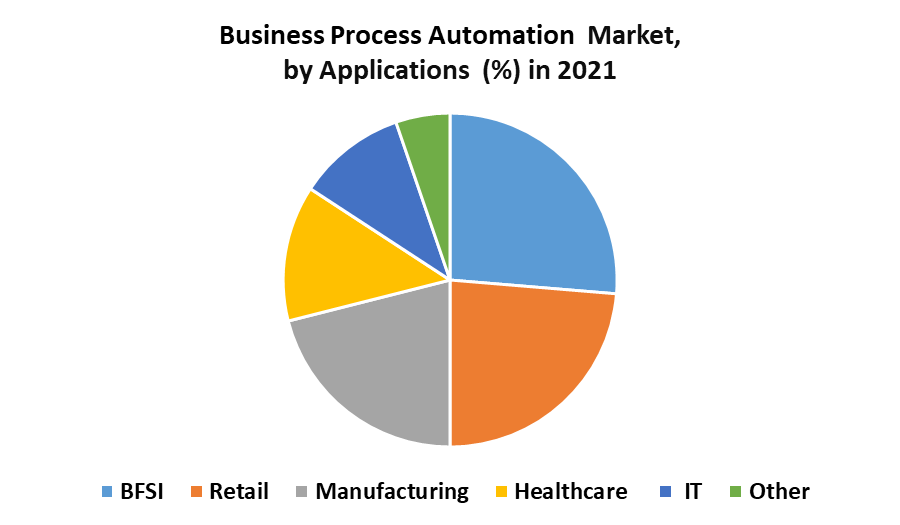

By Product, Due to the increasing adoption of robotic technology and a rise in the global sale of robots for business process automation, the programmable logic controller (PLC) segment is anticipated to develop at the quickest rate in the global business process automation market during the forecast period. Robots are made up of PLCs, which are used because of their quickness, flexibility, low power consumption, reliability owing to the lack of moving parts, and ease of maintenance due to modular assembly. By Application, Robotic process automation (RPA), artificial intelligence, and machine learning are some of the key automation technologies driving the efficient digital transformation in the banking and financial industry. Other technologies that have proven to be disruptive in the banking sector include biometrics and blockchain. These automated methods have contributed to some of the biggest innovations in the sector. We've covered a handful of them below that we believe are crucial. KYC, risk analysis, and compliance, core financial and banking operations, processing of mortgage loans and credit applications, customer request and support services, and fraud detection. Business process automation is significantly enhancing a number of banking processes, such as account opening, approvals, collection, receivables, underwriting, general ledger, and account closure. Banks can still perform a with BPA. By Deployment Type, Business process automation and cloud solutions are more efficient, cost-effective, and agile than the permission bases solution. Cloud based allow organisations to expand while saving money, increasing efficiency, and keeping cash for the main business management workflow using cloud service without having to be able to work from a single place team may communicate with the help of the cloud.

Business Process Automation (BPA) Market Regional Insights:

Due to high organizational awareness of the advantages and the availability of talent to create creative solutions across all technology segments, North America has always been technologically ahead in terms of the adoption of cutting-edge technologies. Businesses in North America have stayed ahead of the curve to improve sales and marketing methods in the BPA industry, another technical sector. The adoption of digital business strategies by enterprises and the transition from on premises to cloud-based solutions and services are both responsible for this increase. Throughout the forecasting period, the tendency is anticipated to persist. Because there are so many companies in North America offering BPA solutions, the market there is advanced. Additionally, its solid financial standing enables it to make significant adoption-related investments. Asia pacific region is advanced and dynamic adoption of new technologies. Additionally, regional businesses are steadily increasing their IT spending, which is anticipated to cause a spike in the adoption of BPA Business Functions. Regarding the implementation of BPA Business Functions and services in the area, China, India, Japan, and ANZ are the top four nations. Many companies in Asia pacific are deploying BPA systems as a result of the business functions offered by BPA that automate the creation, monitoring, and analysis of marketing campaigns as well as the assignment and administration of quotas. Resources are wasted because administrative duties are handled manually and there is a lack of visibility into incentive compensations, and the rise in attrition encourages organizations in this region to invest in advanced BPA Business Functions. The objective of the report is to present a comprehensive analysis of the Business Process Automation (BPA) market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Business Process Automation (BPA) market dynamics, structure by analyzing the market segments and project the Business Process Automation (BPA) market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Business Process Automation (BPA) market make the report investor’s guide.Business Process Automation (BPA) Market Scope: Inquiry Before Buying

Global Business Process Automation (BPA) Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 9.9 Bn. Forecast Period 2022 to 2029 CAGR: 12.2 % Market Size in 2029: US $ 24.86 Bn. Segments Covered: by Product • Programmable Logic Controller (PLC) • Distributed Control System (DCS) • SCADA • Human Machine Interface (HMI) • Safety Automation • Advanced Process Control (APC) • Manufacturing Execution System (MES) by Application • BFSI • Manufacturing • IT • Telecommunication • Retail And Customer Good • Healthcare by Deployment Type • Cloud •On-premise Business Process Automation (BPA) Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaBusiness Process Automation (BPA) Market Key Players

• IBM (US) • Pegasystems (US) • Appian (US) • Kissflow(India) • LAserfiche (US) • Nintex (US) • Oracle (US) • Software AG (Germany) • Salesforce (US) • Microsoft (US) • Bizagi (UK) • OpenText (Canada) • TIBCO (US) • Creatio (US) • Genpact (US) • DXC Technology (UK) • Newgen Software (India) • Bonitasoft (France) • Kofax (US) • FlowForma (Ireland) • AuraQuantic (US) • AgilePoint (US) • Automation Hero (US) • Quickbase (US) • Cortex (UK). Frequently Asked Questions: 1. What is the forecast period considered for the Business Process Automation (BPA) market report? Ans. The forecast period for the Business Process Automation (BPA) market is 2021-2029. 2. Which key factors are hindering the growth of the Business Process Automation (BPA) market? Ans. Insistent growth in cyber-attacks and security issues restraints the business process automation market 3. What is the compound annual growth rate (CAGR) of the Business Process Automation (BPA) market for the forecast period? Ans. 12.2 % CAGR of the business process automation market for the forecast period 4. What are the key factors driving the growth of the Business Process Automation (BPA) market? Ans. The BPA helps effective ways to diver systems within organizations, improve data quality and reduce data entry efforts through workflow automation. 5. Which are the worldwide major key players covered for the Business Process Automation (BPA) market report? Ans.IBM (US), Pegasystems (US), Appian (US), Kissflow(India),LAserfiche (US),Nintex (US) this are the major key players covered for the BPA

1 Business Process Automation (BPA) Market: Research Methodology 2 Business Process Automation (BPA) Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Business Process Automation (BPA) Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3 Business Process Automation (BPA) Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4 Business Process Automation (BPA) Market Segmentation 4.1. Business Process Automation (BPA) Market, by Product (2021-2029) • Programmable Logic Controller (PLC) • Distributed Control System (DCS) • SCADA • Human Machine Interface (HMI) • Safety Automation • Advanced Process Control (APC) • Manufacturing Execution System (MES) 4.2. Business Process Automation (BPA) Market, by Application (2021-2029) • BFSI • Manufacturing • IT • Telecommunication • Retail and Customer Good • Healthcare 4.3. Business Process automation Market, by Deployment (2021-2029) • Cloud • On-premise 5 North America Business Process Automation (BPA) Market (2021-2029) 5.1 North American Business Process Automation (BPA) Market, By Product (2021-2029) •Programmable Logic Controller (PLC) •Distributed Control System (DCS) •SCADA •Human Machine Interface (HMI) •Safety Automation •Advanced Process Control (APC) •Manufacturing Execution System (MES) 5.2 North America Business Process Automation (BPA) Market, By Application (2021-2029) • BFSI • Manufacturing • IT • Telecommunication • Retail and Customer Good • Healthcare 5.3 North America Business process automation, by Deployment (2021-2029) • Cloud • On premise 5.4 North America Business Process Automation (BPA) Market, by Country (2021-2029) • United States • Canada • Mexico 6 European Business Process Automation (BPA) Market (2021-2029) 6.1. European Business Process Automation (BPA) Market, By Product (2021-2029) 6.2. European Business Process Automation (BPA) Market, By Application (2021-2029) 6.3. European Business process automation, by Deployment (2021-2029) 6.4. European Business Process Automation (BPA) Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7 Asia Pacific Business Process Automation (BPA) Market (2021-2029) 7.1. Asia Pacific Business Process Automation (BPA) Market, By Product (2021-2029) 7.2. Asia Pacific Business Process Automation (BPA) Market, By Application (2021-2029) 7.3. Asia Pacific Business Process Automation (BPA) Market, By Deployment (2021-2029) 7.4. Asia Pacific Business Process Automation (BPA) Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8 Middle East and Africa Business Process Automation (BPA) Market (2021-2029) 8.1. Middle East and Africa Business Process Automation (BPA) Market, By Product (2021-2029) 8.2. Middle East and Africa Business Process Automation (BPA) Market, By Application (2021-2029) 8.3. Middle East and Africa Business Process Automation (BPA) Market, By Deployment (2021-2029) 8.4. Middle East and Africa Business Process Automation (BPA) Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9 South America Business Process Automation (BPA) Market (2021-2029) 9.1. South America Business Process Automation (BPA) Market, By Product (2021-2029) 9.2. South America Business Process Automation (BPA) Market, By Application (2021-2029) 9.2. South America Business Process Automation (BPA) Market, By Deployment (2021-2029) 9.3 South America Business Process Automation (BPA) Market, by Country (2021-2029) • Brazil • Argentina • Rest Of South America 10 Company Profile: Key players 10.1 IBM(US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Pegasystems (US) 10.3 Appian (US) 10.4 Kissflow(India) 10.5 LAserfiche (US) 10.6 Nintex (US) 10.7 Oracle (US) 10.8 Software AG (Germany) 10.9 Salesforce (US) 10.10 Microsoft (US) 10.11 Bizagi (UK) 10.12 OpenText (Canada) 10.13 TIBCO (US) 10.14 Creatio (US) 10.15 Genpact (US) 10.16 DXC Technology (UK) 10.17 Newgen Software (India) 10.18 Bonitasoft (France) 10.19 Kofax (US) 10.20 FlowForma (Ireland) 10.21 AuraQuantic (US) 10.22 AgilePoint (US) 10.23 Automation Hero (US) 10.24 Quickbase (US) 10.25 Cortex (UK). 10.26 Others