Global Bioengineering Technology Market size was valued at USD 239.1 Bn in 2022 and the Bioengineering Technology Market revenue is expected to grow at a CAGR of 12.3 % from 2023 to 2029, reaching nearly USD 538.56 Bn.Bioengineering Technology Market Overview

Bioengineering Technology is the study of applied engineering practices in general biology that focuses on general theory, which is applied to various areas of natural science to solve problems. The field supports several branches that specialize in a specific element of biology and engineering cohesion, such as agriculture, pharmaceuticals, natural resources, and foodstuffs, among others. As such, its practices are useful across different sectors, including health care, technology, and the environment.Bioengineering Technology Market Snapshot

To know about the Research Methodology :- Request Free Sample Report Bioengineering, also known as “biomedical engineering”, main goal to improve human health, enhance medical diagnosis and treatment, and address biological and biomedical issues through the use of technology and engineering approaches. Bioengineering Technology Market report provides different opportunities for investors due to its potential to drive innovation and solutions in the healthcare and biotechnology sectors. Investing in bioengineering companies or startups provides investors access to cutting-edge technologies and solutions that have the potential to disrupt traditional healthcare practices and generate substantial returns on investment. Developing medical devices and equipment is needed for the healthcare process, the investment makes innovation in medical devices and demand for advanced technology is expected to create lucrative opportunities for market growth. Miniaturization, material innovations, personalized medicine, and additive manufacturing are key engineering trends that biomedical researchers are eager to incorporate into their designs. These technologies of new design options, as well as R&D advances, are expected to drive market growth and boost their market share and brand reputation. Advancements in biotechnology and genetic engineering have been driving the growth of the global bioengineering technology market. Researchers and scientists are continuously developing new techniques and tools that allow them to manipulate biological systems at the molecular level. This includes techniques such as gene editing using CRISPR-Cas9, synthetic biology, and the development of genetically modified organisms (GMOs). Increasing demand for personalized medicine and regenerative therapies as well as a shift toward sustainable and eco-friendly solutions with the adoption of the bio-based product responsible for market growth. Abbott, Agfa, Dräger, Fresenius Medical Care, GE Healthcare, Johnson & Johnson and KLS Martin are some top biomedical engineering key players that use such technology to sustain their market position across the globe. According to SynBioBeta, a professional network for biological engineers, investment in synthetic biology companies raised about $4.6 billion in the first quarter of 2021. Emerging biotechnology platforms such as cell therapy 2.0, next-generation gene therapies for DNA and RNA, precision medicine, drug discovery from machine learning and new delivery methods are expected to influence the market. Bioengineering Technology Market: A Comprehensive Analysis of the Top Players, Key Drivers, Trends, and Opportunities Bundle Reports 1. Bioinformatics Market- (Single User- 4600) 2. Nano-biotechnology Market- (Single User- 4600) 3. Genetic Engineering Market- (Single User- 4600) 4. Smart Medical Devices Market- (Single User- 4600) 5. Biochemical Market- (Single User- 4600)

What does a bundle report provide?

1. Accessing the in-depth insight from the ‘Bioengineering Technology Market report will provide customers with a comprehensive understanding of the market dynamics, key trends, and future prospects in the Bioengineering Technology industry. 2. Also, the report offers a detailed analysis of its history, current state, key players and what the future may hold. Benefits and challenges of Bioengineering, its impact on society as a healthcare environment and the economy, and the ethical and environmental concerns during the forecast period, including demand, drivers, growth stimulators, spending patterns, and modernization trends across different regions. 3. Recent developments, industry challenges, regional highlights, and major programs, provide a holistic view of the market. The ‘Bioengineering Technology Market’ report stands out from other reports in the market due to several factors: 1. Exclusive Market Insights: The report provides exclusive and in-depth insights into the Bioengineering Technology Market, presenting a comprehensive analysis of market trends, growth drivers, challenges, and opportunities. It delves into specific aspects of the market, offering valuable information not readily available in other reports. 2. Unbiased and Objective Analysis: The report maintains an unbiased and objective approach to analyzing the Bioengineering Technology Market. It avoids promotional or biased content, ensuring that the information and conclusions presented are based solely on rigorous research and analysis. 3. Extensive Primary Research: The report incorporates extensive primary research, including interviews and surveys with industry experts, key stakeholders, and market participants. This primary research adds depth and credibility to the report's findings and enhances its uniqueness in comparison to reports relying solely on secondary research. 4. Strategy & Corporate Finance: Growth strategies, transformations, and assessment of market landscape 5. Emerging Market Trends: The report identifies and explores emerging trends and developments within the Bioengineering Technology Market. 6. Regional and Global Perspective: The report offers a comprehensive analysis of the Bioengineering Technology Market at both regional and global levels. It assesses market dynamics, consumer behaviour, and regulatory frameworks across different regions, providing a nuanced understanding of the market's regional variations and global impact. 7. Impact of COVID-19: The report addresses the specific impact of the COVID-19 pandemic on the Bioengineering Technology Market. It examines the changing consumer behaviour, supply chain disruptions, and evolving industry strategies during the pandemic. This analysis sets the report apart by providing timely and relevant insights for businesses navigating the post-pandemic landscape. 8. Strategic Recommendations: The report goes beyond data analysis by providing strategic recommendations and actionable insights for businesses operating in or entering the Bioengineering Technology Market. These recommendations offer practical guidance for market players to optimize their operations, capitalize on growth opportunities, and overcome challenges. 9. Visual Representation and Data Visualization: The report utilizes visual elements such as charts, graphs, and info graphics to enhance data presentation and interpretation. This visual representation not only improves the overall readability of the report but also facilitates a better understanding of complex market trends and statistical data. 10. Customizable Format: The report offers customizable options to cater to specific client requirements. It can be tailored to focus on specific market segments, regions, or other variables of interest. This flexibility sets it apart by providing clients with tailored insights aligned with their business objectives.Report 1: The Growth Potential and Future Development in Bioinformatics Market

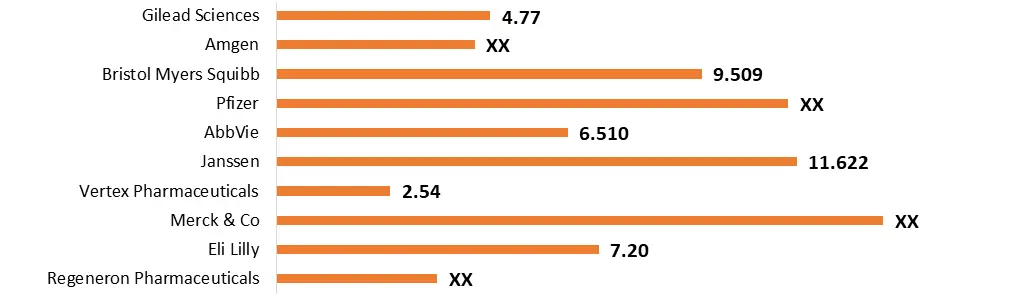

Bioinformatics Market size was valued at USD 10.2 Bn in 2022 and is expected to reach USD 24.03 Bn by 2029, at a CAGR of 13.02 %. The new shift toward personalized medicine due to the increase in polypharmacy patients across the world is expected to influence the demand for personalized medicine. Advancements in AI, data integration, and ethical considerations are expected to improve bioinformatics' impact on healthcare, agriculture, and the environment, making it a convincing investment opportunity for the industry. The increasing need for new tools for better drug development is a new trend for product and service segment growth. The pharmaceutical industry spent $83 billion dollars on R&D in 2022. The amount of money that drug companies provide to R&D is determined by the amount of revenue they expect to earn from a new drug, the expected cost of developing that drug, and policies that influence the supply of and demand for drugs. The R&D performed by businesses in the United States is funded primarily by the performing companies themselves ($377.8 billion, or 86%), while the remainder ($63.2 billion, or 14%) is paid for by others, such as the federal government, customers, and the affiliates and owners of foreign-owned companies operating in the United States.Big Pharma Players Investments on R& D in North America in 2022 (USD Bn)

Report 2: The Growth Potential and Future Scenarios of Nano-biotechnology Market/Industry

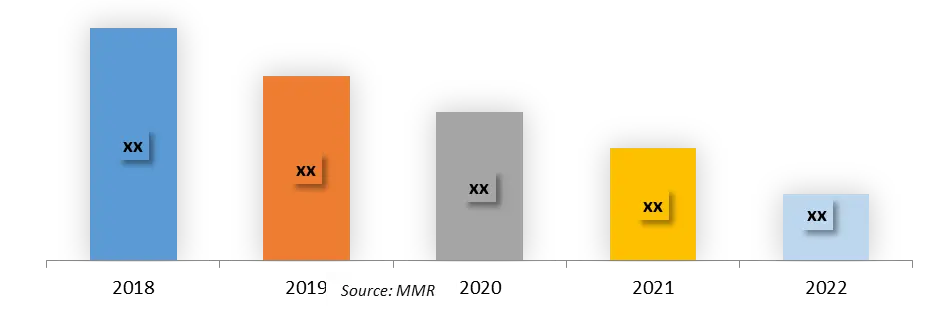

The Nano-biotechnology Market size was valued at USD 32.18 Billion in 2022 and the total Nano-biotechnology revenue is expected to grow at a CAGR of 11.8 % from 2023 to 2029, reaching nearly USD 70.26 Billion. Nanoparticles are being used to deliver drugs directly to cancer cells, thereby minimizing the side effects associated with traditional chemotherapy. Nanobiotechnology is gathering substantial investment through businesses and governments globally. In the healthcare sector, nanobiotechnology is transforming the way diseases are diagnosed and treated. The Nanobiotechnology industry is competitive, with both established players and stratus leadership positions. Large pharmaceutical companies invested in nanobiotechnology startups and research to expand their product portfolios and stay ahead in the market. Medical devices segments are expected to grow at a significant CAGR during the forecast period owing to increasing R&D activities by various companies for the development of innovative products using nanoshells or nanoparticles for diagnosis & treatment options in several healthcare areas such as cardiology, oncology & cancer research among others. Academic institutions, private companies and governments of various regions are heavily invested in the nanobiotechnology field for new discoveries. U.S. investments and competitiveness in nanotechnology R&D and challenges to U.S. competitiveness in nanomanufacturing. DARPA invests in high-risk, high-reward research projects, including nanotechnology initiatives, to drive technological breakthroughs that have potential military applications.Nano-biotechnol0gy Market value in Europe in 2018 and 2022 (in billion U.S. dollars)

Report 3: The Growth Potential and Future Development of Genetic Engineering Market

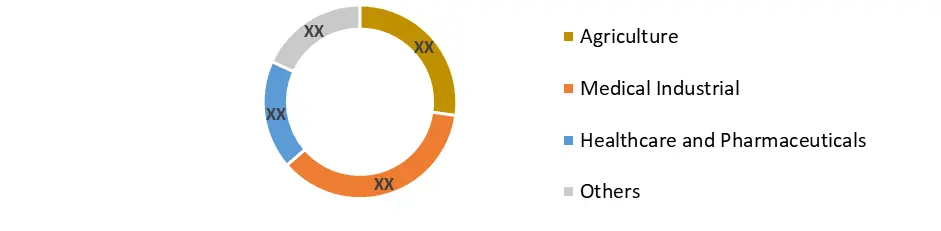

Global Genetic Engineering Market size was valued at USD 1.03 Bn in 2022 and is expected to reach USD 4.56 Bn by 2029, at a CAGR of 23.7 %. Techniques in Genetic engineering include Recombinant DNA Technology, Gene Editing with CRISPR-Cas9, PCR (Polymerase Chain Reaction), Gene Synthesis, and Gene Silencing. These powerful technologies have the potential to boost the Genetic Engineering Market. North America will be the global leader in the genetic engineering industry. Investment by pharma in gene editing companies also increased in 2021. The adoption of GMOs by farmers has been steadily increasing in various countries and is a key development industry trend. The gene-splicing segment accounted for the largest Genetic Engineering Market share in 2022. It is known as recombinant DNA technology, which involves cutting and joining DNA fragments. The U.K. government launched Project Innovate to support financial technologies by facilitating testing with real consumers and improving communication with regulators.Genetic Engineering Market Share, by Application (in 2022) in %

Report 4: The Growth Potential and Future Scenarios of Smart Medical Devices Market/Industry

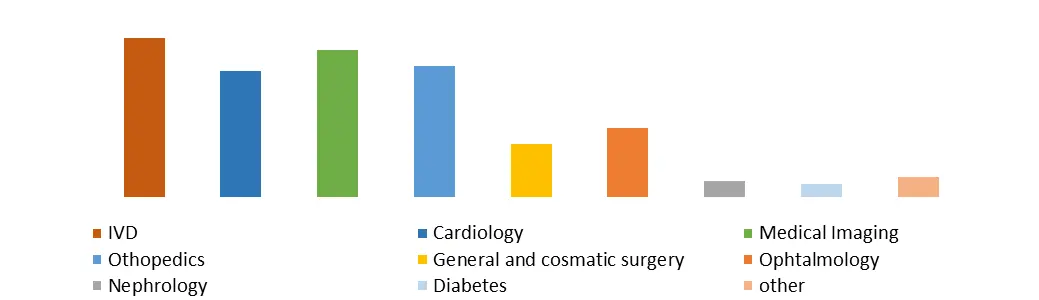

Smart Medical Devices Market size was valued at USD 34.6 Bn in 2022 and is expected to reach USD 63.25 Bn by 2029, at a CAGR of 9 %. Smart Medical devices that have the capability to aggregate, analyze, and store data. There are many life-changing technologies that have advanced medical treatments, such as artificial organs, prosthetics, and robotic surgery equipment, to assist medical providers in treating patients. Financial incentives, supportive regulatory frameworks, and investment in healthcare infrastructure encourage the integration of smart medical devices into healthcare systems. Remote patient monitoring and telemedicine services expansion to create a major opportunity for the smart medical devices market growth. This is due to the increasing adoption of telemedicine and remote healthcare solutions, accelerated by the COVID-19 pandemic, which has created a demand for smart medical devices that facilitate virtual consultations and remote health monitoring. Smart wearable devices, home healthcare devices, and diagnostic tools equipped with connectivity and data transmission capabilities are leading the market.Distribution of the Global Revenue of Medical Technology Industry in 2022, By Category

Report 5: The Growth Potential and Future Development of the Biochemical Market

Biochemical Market size was valued at USD 83.70 Bn in 2022 and is expected to reach USD 143.45 Bn by 2029, at a CAGR of 8 %. The key industries utilizing biochemical include pharmaceuticals, agriculture, food and beverages, cosmetics, and bioenergy. In the pharmaceutical sector, it is used for drug development and formulation, while in agriculture, used as bio-based pesticides and fertilizers. Government policies and regulations play a major role in shaping the growth of the biochemical market. The policy framework was developed to guide the identification of the project, formulation, monitoring appraisal, approval, and financing. Between 2012 and 2017, 4467.8 million INR, 62.52 Million USD) support was granted by the MNRE. Asia Pacific dominated the largest global Biochemical Market share in 2022. The growing use of biofuel across the industry such as the market is driven by rapid industrialization, increasing population, and rising disposable income. Investment in biochemical production capacity is starting to increase from a very low base. Rapid technical progress is also being made in regions such as the US, Asia and Brazil, with a particular focus on facilities using readily available sugar and starch feedstocks.Biochemical Market Share by Consumption Volume of Biodiesel in India & China (Mn tons)

Bioengineering Technology Market Scope : Inquire Before Buying

Bioengineering Technology Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 239.1 Bn. Forecast Period 2023 to 2029 CAGR: 12.3% Market Size in 2029: US $ 538.56 Bn. Segments Covered: by Product Biomedical Engineering Genetic Engineering Biotechnology Tissue Engineering Biomechanics Engineering Biomaterial Biomechanical Engineering Nano-biotechnology Bioinformatics Biochemical Synthetic Biology Other Bioengineering Technology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Bioengineering Technology Key Players:

1. Thermo Fisher Scientific 2. Agilent Technologies 3. Illumina, Inc 4. Synthetic Genomics 5. CRISPR Therapeutics 6. Intuitive Surgical 7. Ginkgo Bioworks 8. Bio-Rad Laboratories 9. Becton Dickinson (BD) 10. AmgenFrequently Asked Questions:

1] What is the growth rate of the Global Bioengineering Technology Market? Ans. The Global Bioengineering Technology Market is growing at a significant rate of 12.3% during the forecast period. 2] Which region is expected to dominate the Global Bioengineering Technology Market? Ans. North America is expected to dominate the Bioengineering Technology Market growth potential during the forecast period. 3] What is the expected Global Bioengineering Technology Market size by 2029? Ans. The Bioengineering Technology Market size is expected to reach USD 538.56 Bn by 2029. 4] Which are the top players in the Global Bioengineering Technology Market? Ans. The major top players in the Global Bioengineering Technology Market are Thermo Fisher Scientific, Agilent Technologies and others. 5] What are the factors driving the Global Bioengineering Technology Market growth? Ans. The increasing demand for personalized medicine and regenerative therapies is the primary driver for the Bioengineering Technology Market growth.

1. Bioengineering Technology Market: Research Methodology 2. Bioengineering Technology Market: Executive Summary 3. Bioengineering Technology Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Bioengineering Technology Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Bioengineering Technology Market Size and Forecast by Segments (by Value USD) 5.1. Bioengineering Technology Market Size and Forecast, by Application (2022-2029) 5.1.1. Biomedical Engineering 5.1.2. Genetic Engineering 5.1.3. Biotechnology 5.1.4. Tissue Engineering 5.1.5. Biomechanics Engineering 5.1.6. Biomaterial 5.1.7. Biomechanical Engineering 5.1.8. Nano-biotechnology 5.1.9. Bioinformatics 5.1.10. Biochemical 5.1.11. Synthetic Biology 5.1.12. Other 5.2. Bioengineering Technology Market Size and Forecast, by Region (2022-2029) 5.2.1. North America 5.2.2. Europe 5.2.3. Asia Pacific 5.2.4. Middle East and Africa 5.2.5. South America 6. North America Bioengineering Technology Market Size and Forecast (by Value USD) 6.1. North America Bioengineering Technology Market Size and Forecast, by Application (2022-2029) 6.1.1. Biomedical Engineering 6.1.2. Genetic Engineering 6.1.3. Biotechnology 6.1.4. Tissue Engineering 6.1.5. Biomechanics Engineering 6.1.6. Biomaterial 6.1.7. Biomechanical Engineering 6.1.8. Nano-biotechnology 6.1.9. Bioinformatics 6.1.10. Biochemical 6.1.11. Synthetic Biology 6.1.12. Other 6.2. North America Bioengineering Technology Market Size and Forecast, by Country (2022-2029) 6.2.1. United States 6.2.2. Canada 6.2.3. Mexico 7. Europe Bioengineering Technology Market Size and Forecast (by Value USD) 7.1. Europe Bioengineering Technology Market Size and Forecast, by Application (2022-2029) 7.1.1. Biomedical Engineering 7.1.2. Genetic Engineering 7.1.3. Biotechnology 7.1.4. Tissue Engineering 7.1.5. Biomechanics Engineering 7.1.6. Biomaterial 7.1.7. Biomechanical Engineering 7.1.8. Nano-biotechnology 7.1.9. Bioinformatics 7.1.10. Biochemical 7.1.11. Synthetic Biology 7.1.12. Other 7.2. Europe Bioengineering Technology Market Size and Forecast, by Country (2022-2029) 7.2.1. UK 7.2.2. France 7.2.3. Germany 7.2.4. Italy 7.2.5. Spain 7.2.6. Sweden 7.2.7. Austria 7.2.8. Rest of Europe 8. Asia Pacific Bioengineering Technology Market Size and Forecast (by Value USD) 8.1. Asia Pacific Bioengineering Technology Market Size and Forecast, by Application (2022-2029) 8.1.1. Biomedical Engineering 8.1.2. Genetic Engineering 8.1.3. Biotechnology 8.1.4. Tissue Engineering 8.1.5. Biomechanics Engineering 8.1.6. Biomaterial 8.1.7. Biomechanical Engineering 8.1.8. Nano-biotechnology 8.1.9. Bioinformatics 8.1.10. Biochemical 8.1.11. Synthetic Biology 8.1.12. Other 8.2. Asia Pacific Bioengineering Technology Market Size and Forecast, by Country (2022-2029) 8.2.1. China 8.2.2. S Korea 8.2.3. Japan 8.2.4. India 8.2.5. Australia 8.2.6. Indonesia 8.2.7. Malaysia 8.2.8. Vietnam 8.2.9. Taiwan 8.2.10. Bangladesh 8.2.11. Pakistan 8.2.12. Rest of Asia Pacific 9. Middle East and Africa Bioengineering Technology Market Size and Forecast (by Value USD) 9.1. Middle East and Africa Bioengineering Technology Market Size and Forecast, by Application (2022-2029) 9.1.1. Biomedical Engineering 9.1.2. Genetic Engineering 9.1.3. Biotechnology 9.1.4. Tissue Engineering 9.1.5. Biomechanics Engineering 9.1.6. Biomaterial 9.1.7. Biomechanical Engineering 9.1.8. Nano-biotechnology 9.1.9. Bioinformatics 9.1.10. Biochemical 9.1.11. Synthetic Biology 9.1.12. Other 9.2. Middle East and Africa Bioengineering Technology Market Size and Forecast, by Country (2022-2029) 9.2.1. South Africa 9.2.2. GCC 9.2.3. Egypt 9.2.4. Nigeria 9.2.5. Rest of ME&A 10. South America Bioengineering Technology Market Size and Forecast (by Value USD) 10.1. South America Bioengineering Technology Market Size and Forecast, by Application (2022-2029) 10.1.1. Biomedical Engineering 10.1.2. Genetic Engineering 10.1.3. Biotechnology 10.1.4. Tissue Engineering 10.1.5. Biomechanics Engineering 10.1.6. Biomaterial 10.1.7. Biomechanical Engineering 10.1.8. Nano-biotechnology 10.1.9. Bioinformatics 10.1.10. Biochemical 10.1.11. Synthetic Biology 10.1.12. Other 10.2. South America Bioengineering Technology Market Size and Forecast, by Country (2022-2029) 10.2.1. Brazil 10.2.2. Argentina 10.2.3. Rest of South America 11. Company Profile: Key players 11.1. Thermo Fisher Scientific 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Agilent Technologies 11.3. Illumina, Inc 11.4. Synthetic Genomics 11.5. CRISPR Therapeutics 11.6. Intuitive Surgical 11.7. Ginkgo Bioworks 11.8. Bio-Rad Laboratories 11.9. Becton Dickinson (BD) 11.10. Amgen 12. Key Findings 13. Industry Recommendation