Global Bioinformatics Market size was valued at USD 11.12 Bn in 2023 and is expected to reach USD 24.98 Bn by 2030, at a CAGR of 13.2 %.Bioinformatics Market Overview

Bioinformatics is an interdisciplinary field that incorporates computer science and biology to research, develop, and apply computational tools. This approach is used to manage and process large sets of biological data. Its primary objective is to understand complex biological processes, genetic variations, and molecular interactions by harnessing the power of computational tools and algorithms. The integration of biological data with computational techniques has revolutionized various areas of research, including genomics, proteomics, systems biology, and drug discovery. Bioinformatics utilizes modern computer science that includes cloud computing, statistics, mathematics, and even pattern recognition, reconstruction, machine learning, simulation and iterative approaches, and molecular modeling/algorithms. The development of new personalized medicine, drug discovery, precision agriculture, synthetic biology, and environmental biotechnology are driving key factors for the Bioinformatics Market. Advancements in AI, data integration, and ethical considerations are expected to improve bioinformatics' impact on healthcare, agriculture, and the environment, making it a convincing investment opportunity with significant social and scientific impact.To know about the Research Methodology :- Request Free Sample Report Bioinformatics Market Dynamics: Growth Driver, Opportunity, Restrain Factor Advancements in Genomics and Next-Generation Sequencing (NGS) to Boost Market Growth Genomics provides key benefits to the healthcare system through clinical research and drug development, personalizing treatment regimens, and improving patient outcomes. The advancement in genomics is a key driver for the Bioinformatics Market growth. Also, it has the potential to reshape drug discovery and development moving the life sciences industry. Genomic data, the most personal of all human data, is part of the overall explosion in health data, which is enabled by the exponential growth in computing power and the commercialization of wearable technologies such as smartphones, fitness trackers and heart rate monitors. Managing this data is expected to change the way such information is gathered, stored, analyzed and used with privacy, reliability, and security posing prickly challenges. The significant progress in genomics research and the adoption of NGS technologies has increased biological data generation. For instance, Genomics England, a company set up by the UK’s Department of Health & Social Care, is carrying out the 100,000 Genomes Project, which aims to sequence 100,000 genomes from around 70,000 people with rare diseases, plus their families, as well as from patients with cancer. In 2022-2023, the global next-generation sequencing (NGS) market was $12.46 billion. This growth is driven by advancements in platform technology, increasing applications of sequencing, growth in partnerships and collaborations, increasing adoption of NGS among research laboratories and academic institutes, and the decline in the cost of sequencing.

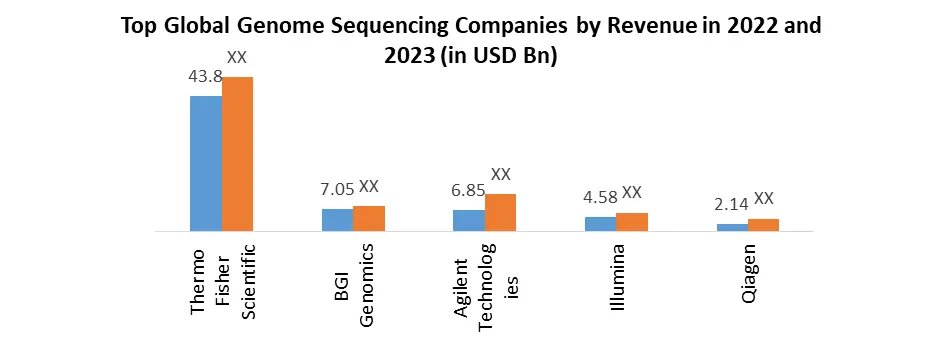

Top Global Genome Sequencing Companies by Revenue that Use Wider Technology Help to Drive NGS Growth:

In 2022-23, the pharmaceutical industry spent $83 billion dollars on R&D. The amount of money that drug companies provide to R&D is determined by the amount of revenue they expect to earn from a new drug, the expected cost of developing that drug, and policies that influence the supply of and demand for drugs. Demand growth for genomic sequencers from medical researchers has been augmented by demand from healthcare providers as applications have expanded from research labs to clinical providers. Governments and consumers are the next source of strong demand growth. This is a technology with high barriers to entry where market leaders boost their market share. The advent of personalized medicine for pharmaceutical companies to reconsider their current business model. The blockbuster model gives way to drug therapies tailored to individual patients. This has required that drugs move through the pipeline faster, are more effective, safer and less costly to develop. Personalized medicine is in essence precision medicine and predictive medicine. Companies that produce the tools and technology, such as companion diagnostics, that facilitate better information, better outcomes and lower costs will become increasingly valuable.

Companies Applications Sectors Key Developments Thermo Fisher Scientific Leaders in serving science and products used in genomic sequencing including instruments, reagents, and software with the application are: 1. Cancer Research 2. Drug Development 3. Agricultural Biotechnology Oncomine Dx Target Test, which is the first NGS-based companion diagnostic to aid in therapy selection for patients with RET mutations/fusions in thyroid cancers. BGI Genomics The company offers sequencing services and products for genome sequencing, genotyping, and genetic diagnosis. 1. Cancer Research 2. Drug Development 3. Agricultural Biotechnology Their plan is to provide the BGI/Natera Signatera Assay worldwide. The assay is designed to provide access to personalized ctDNA testing for patients and healthcare providers as well as to support cancer research and drug development. Agilent Technologies Agilent's products application: 4. Cancer Research 5. Drug Development 6. Agricultural Biotechnology The company announced a partnership with Mytide Therapeutics with a focus on automation, reliability and data quality issues across the peptide industry. Illumina Leader in sequencing services and sells both instruments and reagents for genome sequencing and applications are: 1. Diagnostics, 2. Cancer Research, 3. Drug Development 4. Agricultural Biotechnology Revolutionary NovaSeq X series platform, which it claims will be able to sequence over 20,000 genomes per year. Qiagen Leading providers of genomic sequencing services, products and solutions including instruments, reagents, and software applications are: 1. Diagnostics 2. Drug development Launch of the QIAstat-Dx Viral Vesicular Panel, a new syndromic test that is designed to combat the global health emergency of monkeypox. Increase in Demand for Personalized Medicine and Pharmacogenomics to Create Lucrative Opportunity for the Market The new shift toward personalized medicine due to the increase in polypharmacy patients across the world is expected to influence the demand for personalized medicine and drive the market growth potential. The implementation of personalized medicine requires a confluence of multiple factors such as regulation, patient education, integral property, refreshment, R& D incentives and competitive effectiveness research. Full implementation of personalized medicine is expected to pose a challenge to the Bioinformatics Market growth over the forecast period. Also, big data analytics and AI integration into bioinformatics and data-intensive research as well as a solution are expected to create lucrative opportunities for the market growth potential. Pharmacogenomics presents an opportunity for rapid translation of associated genetic polymorphisms into diagnostic measures or tests to guide therapy as part of a move towards personalized medicine. The rising importance of personalized medicine and pharmacogenomics is expected to drive the demand for bioinformatics solutions globally. However, bioinformatics has the potential to identify drug targets, prediction of drug responses based on genetic variations, and optimization of drug candidates. Pharmaceutical companies are incorporating bioinformatics approaches to develop targeted therapies for precision medicine. This trend is expected to influence the Bioinformatics Market growth. Data Security and Privacy Concerns Bioinformatics deals with sensitive and personal information, such as genomic data, health records, and patient information. As the volume of data being generated and shared in the healthcare and life sciences sectors grows and increasing concern about data security and privacy. This leads the key challenge for the market. However, the lack of standardization and interoperability among different bioinformatics platforms and databases is another challenge for the Bioinformatics Market expansion. The high costs associated with the required infrastructure and bioinformatics tools is restraining factor for the Bioinformatics Industry growth. The field of bioinformatics heavily relies on computational resources, high-performance computing clusters, and specialized software and algorithms.

Bioinformatics Market Segment Analysis

By Product and Services Based on products and services, the bioinformatics platform segment dominated the largest Bioinformatics Market share in 2023. Bioinformatics is the application of computer technology to the understanding and effective use of biological data, which has become a frontline applied science and is of vital importance to today’s biological studies. The increasing need for new tools for better drug development is a new trend for segment growth. An increase in platform application is expected to drive in need from the life science firm for the identification and modification of structures. This change helps in the drug-designing process and evaluation of their therapeutic effects. Another factor is that efficiency and safety in drug development and discovery lead to an increase in the need for better tools in drug development.By Application Based on application, the genomic segment held the largest Bioinformatics Market share in 2023 and is expected to grow at a significant CAGR over the forecast period. Bioinformatics plays a vital role in studying genetic variations, identifying disease-related biomarkers, and enabling personalized medicine approaches. This segment growth is due to the extensive use of bioinformatics tools and algorithms in analyzing and interpreting genomic data. Also, the high adoption of NGS technologies, which generate massive amounts of genomic data. The recent introduction of instruments capable of producing millions of DNA sequence reads in a single run is rapidly changing the landscape of genetics. These technologies have provided an inexpensive, genome-wide sequence readout as an endpoint to applications ranging from chromatin immunoprecipitation, mutation mapping and polymorphism discovery to noncoding RNA discovery. Advances in DNA sequencing technology have propelled genomics segment growth in the Bioinformatics Market during the forecast period.

Bioinformatics Market Regional Analysis

North America dominated the largest Bioinformatics Market share in 2023 due to the research and development investment for advanced research infrastructure. They invest heavily in bioinformatics R&D, leading to innovative developments in precision medicine, drug discovery, and agricultural biotechnology. The regional market growth is driven by well-established pharmaceutical and Biotechnology Companies and strong government support for genomics and personalized medicine. The R&D performed by businesses in the United States is funded primarily by the performing companies themselves ($377.8 billion, or 86%), while the remainder ($63.2 billion, or 14%) is paid for by others, such as the federal government, customers, and the affiliates and owners of foreign-owned companies operating in the United States. The United States, in particular, has a dominant position in the region, housing several key bioinformatics companies and academic institutions. Janssen, Eli Lilly and Co, AbbVie Inc, Merck & Co Inc, and Pfizer Inc are the top 5 pharma companies in the US in 2022 that majorly hold market share.Europe is another significant player in the global Bioinformatics Market, influenced by strong support for research and a thriving life sciences industry. Countries such as the United Kingdom, Germany, and France are at the forefront of bioinformatics advancements in the region. European countries allocate substantial funding for life sciences research, including bioinformatics, through initiatives like Horizon Europe and national research programs. Also, the rich network of biobanks and data repositories that facilitate research and collaboration among researchers across the continent. Renowned research institutions and universities contribute to cutting-edge bioinformatics research and the training of skilled professionals. Such all factors are expected to drive the regional market growth during the forecast period. However, advancements in healthcare infrastructure, rising investments in biotechnology, and the increasing adoption of genomics technologies are expected to boost the Asia Pacific Regional Market Size. Competitive Landscape: The dynamic Global Bioinformatics Market growth is driven by AI integration, personalized medicine applications, and cloud-based solutions. Key players including Illumina, Thermo Fisher Scientific, and DNAnexus lead the industry, emphasizing research and development, strategic collaborations, and data security to stay competitive. However, the market poses challenges related to data privacy and market consolidation. To thrive, companies must focus on innovation, user-friendly interfaces, and customer support while exploring new markets and adopting competitive pricing strategies. Overall, the report provides bioinformatics companies need to remain adaptable and customer-centric to seize opportunities and drive advancements in life sciences. Bioinformatics Industry participants are involved in the R&D of genetic and proteomic sequencing to improve DNA, and RNA sequencing capabilities to further reduce the costs of genome sequencing. The development of next-generation sequencing technologies is expected to drive the bioinformatics industry over the forecast period.

Bioinformatics Market Scope Table: Inquire Before Buying

Global Bioinformatics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 11.12 Bn. Forecast Period 2024 to 2030 CAGR: 13.2% Market Size in 2030: US $ 24.98 Bn. Segments Covered: by Product and Services Knowledge Management Tools Bioinformatics Platforms Bioinformatics Services by Application Metabolomics Molecular Phylogenetics Transcriptomics Proteomics Chemoinformatics Genomics Others by End User Sector Pharmaceutical and Biotechnology Companies Medical Biotechnology Animal Biotechnology Agriculture Biotechnology Academic and Research Institutes Healthcare Providers Others Bioinformatics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bioinformatics Key Players are:

North America 1. Thermo Fisher Scientific Inc. (USA) 2. Agilent Technologies Inc. (US) 3. Illumina Inc. (US) 4. Waters Corporation (US) 5. NeoGenomics Laboratories (US) 6. Perkin Elmer Inc. (US) 7. Seven Bridges Genomics, Inc. (US) 8. Station X, Inc. (US) 9. Active Motif, Inc. (US) 10. Bio-Rad Laboratories, Inc. (US) Europe 11. Eurofins Scientific (Luxembourg) 12. QIAGEN N.V.(Netherlands) 13. Fios Genomics (UK) 14. Source BioScience (UK) 15. Genedata AG (Switzerland) 16. Eurofins Scientific SE (Luxembourg) 17. Genomatix Software GmbH (Germany) 18. Dassault Systèmes Biovia Corp. (France) 19. Sophia Genetics SA (Switzerland) Asia Pacific 20. BGI Genomics Co., Ltd. (China) 21. Others Frequently Asked Questions: 1] What is the growth rate of the Global Bioinformatics Market? Ans. The Global Bioinformatics Market is growing at a significant rate of 13.2 % during the forecast period. 2] Which region is expected to dominate the Global Bioinformatics Market? Ans. North America region is expected to held the Bioinformatics Market growth potential during the forecast period. 3] What is the expected Global Bioinformatics Market size by 2030? Ans. The Bioinformatics Market size is expected to reach USD 24.98 Bn by 2030. 4] Which are the top players in the Global Bioinformatics Market? Ans. The top player of the Bioinformatics manufacturers is Thermo Fisher Scientific Inc., Eurofins Scientific, QIAGEN N.V. and others. 5] What are the factors driving the Global Bioinformatics Market growth? Ans. The increasing technological advancements Bioinformatics and R & D activities is expected to drive the industry expansion. 6] Which country held largest Global Bioinformatics Market share in 2023? Ans. United States held largest bioinformatics market share in 2023.

1. Bioinformatics Market: Overview 1.1. Market Definition and Scope 1.1.1. Key Benefits of Investors 1.1.2. Key Market Segment 1.1.3. Top Investment pockets 1.1.4. Key Growth Strategies 2. Bioinformatics Market: Research Methodology 2.1. Primary Research 2.2. Secondary Research 2.3. Analytical and Statistic Tools and Models 3. Bioinformatics Market: Executive Summary 4. Bioinformatics Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.4. Market Structure 4.4.1. Market Leaders 4.4.2. Market Followers 4.4.3. Emerging Players 4.5. Consolidation of the Market 5. Bioinformatics Market: Dynamics 5.1. Drivers 5.1.1. Advancements in Genomics and Next-Generation Sequencing (NGS) 5.1.2. Need for integrated data 5.1.3. Drug discovery and development 5.1.4. Demand for Personalized Medicine and Pharmacogenomics 5.2. Market Trends by Region 5.2.1. North America 5.2.2. Europe 5.2.3. Asia Pacific 5.2.4. Middle East and Africa 5.2.5. South America 5.3. Market Drivers by Region 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 5.4. Market Restraints 5.4.1. Data Security and Privacy Concerns 5.4.2. Computational Infrastructure and Resources 5.4.3. Data Quality and Reliability 5.4.4. Lack of Standardization 5.5. Market Opportunities 5.5.1. Artificial Intelligence and Machine Learning Integration 5.5.2. Cloud-Based Solutions: Cloud-based bioinformatics platforms 5.5.3. Non-Invasive Diagnostics and Liquid Biopsies 5.5.4. Microbiome Research 5.5.5. Emerging Markets 5.6. Market Challenges 5.6.1. Rapid Technological Advancements 5.6.2. Big Data Management 5.7. PORTER’s Five Forces Analysis 5.8. PESTLE Analysis 5.9. Value Chain Analysis 5.10. Bioinformatics In the Drug Development Process 5.11. Patent Analysis 5.12. Case Studies 5.13. Regulatory Landscape by Region 5.13.1. North America 5.13.2. Europe 5.13.3. Asia Pacific 5.13.4. Middle East and Africa 5.13.5. South America 6. Bioinformatics Market Size and Forecast by Segments (by Value USD and Volume units) 6.1. Bioinformatics Market Size and Forecast, by Product & Services (2023-2030) 6.1.1. Knowledge Management Tools 6.1.2. Bioinformatics Platforms 6.1.3. Bioinformatics Services 6.2. Bioinformatics Market Size and Forecast, by Application (2023-2030) 6.2.1. Metabolomics 6.2.2. Molecular Phylogenetics 6.2.3. Transcriptomics 6.2.4. Proteomics 6.2.5. Chemoinformatics 6.2.6. Genomics 6.2.7. Others 6.3. Bioinformatics Market Size and Forecast, By End-User Sector (2023-2030) 6.3.1. Pharmaceutical and Biotechnology Companies 6.3.1.1. Medical Biotechnology 6.3.1.2. Animal Biotechnology 6.3.1.3. Agriculture Biotechnology 6.3.2. Academic and Research Institutes 6.3.3. Healthcare Providers 6.3.4. Others 6.4. Bioinformatics Market Size and Forecast, by Region (2023-2030) 6.4.1. North America 6.4.2. Europe 6.4.3. Asia Pacific 6.4.4. Middle East and Africa 6.4.5. South America 7. North America Bioinformatics Market Size and Forecast (by Value USD and Volume units) 7.1. North America Bioinformatics Market Size and Forecast, by Product & Services (2023-2030) 7.1.1. Knowledge Management Tools 7.1.2. Bioinformatics Platforms 7.1.3. Bioinformatics Services 7.2. North America Bioinformatics Market Size and Forecast, by Application (2023-2030) 7.2.1. Metabolomics 7.2.2. Molecular Phylogenetics 7.2.3. Transcriptomics 7.2.4. Proteomics 7.2.5. Chemoinformatics 7.2.6. Genomics 7.2.7. Others 7.3. North America Bioinformatics Market Size and Forecast, By End-User Sector (2023-2030) 7.3.1. Pharmaceutical and Biotechnology Companies 7.3.1.1. Medical Biotechnology 7.3.1.2. Animal Biotechnology 7.3.1.3. Agriculture Biotechnology 7.3.2. Academic and Research Institutes 7.3.3. Healthcare Providers 7.3.4. Others 7.4. North America Bioinformatics Market Size and Forecast, by Country (2023-2030) 7.4.1. United States 7.4.2. Canada 7.4.3. Mexico 8. Europe Bioinformatics Market Size and Forecast (by Value USD and Volume units) 8.1. Europe Bioinformatics Market Size and Forecast, by Product & Services (2023-2030) 8.1.1. Knowledge Management Tools 8.1.2. Bioinformatics Platforms 8.1.3. Bioinformatics Services 8.2. Europe Bioinformatics Market Size and Forecast, by Application (2023-2030) 8.2.1. Metabolomics 8.2.2. Molecular Phylogenetics 8.2.3. Transcriptomics 8.2.4. Proteomics 8.2.5. Chemoinformatics 8.2.6. Genomics 8.2.7. Others 8.3. Europe Bioinformatics Market Size and Forecast, By End-User Sector (2023-2030) 8.3.1. Pharmaceutical and Biotechnology Companies 8.3.1.1. Medical Biotechnology 8.3.1.2. Animal Biotechnology 8.3.1.3. Agriculture Biotechnology 8.3.2. Academic and Research Institutes 8.3.3. Healthcare Providers 8.3.4. Others 8.4. Europe Bioinformatics Market Size and Forecast, by End-use Industry (2023-2030) 8.4.1. Manufacturing 8.4.2. Logistics and Warehousing 8.4.3. Retail 8.4.4. Construction 8.4.5. Food and beverage 8.4.6. Ecommerce 8.4.7. Chemicals 8.4.8. Other 8.5. Europe Bioinformatics Market Size and Forecast, by Country (2023-2030) 8.5.1. UK 8.5.2. France 8.5.3. Germany 8.5.4. Italy 8.5.5. Spain 8.5.6. Sweden 8.5.7. Austria 8.5.8. Rest of Europe 9. Asia Pacific Bioinformatics Market Size and Forecast (by Value USD and Volume units) 9.1. Asia Pacific Bioinformatics Market Size and Forecast, by Product & Services (2023-2030) 9.1.1. Knowledge Management Tools 9.1.2. Bioinformatics Platforms 9.1.3. Bioinformatics Services 9.2. Asia Pacific Bioinformatics Market Size and Forecast, by Application (2023-2030) 9.2.1. Metabolomics 9.2.2. Molecular Phylogenetics 9.2.3. Transcriptomics 9.2.4. Proteomics 9.2.5. Chemoinformatics 9.2.6. Genomics 9.2.7. Others 9.3. Asia Pacific Bioinformatics Market Size and Forecast, By End-User Sector (2023-2030) 9.3.1. Pharmaceutical and Biotechnology Companies 9.3.1.1. Medical Biotechnology 9.3.1.2. Animal Biotechnology 9.3.1.3. Agriculture Biotechnology 9.3.2. Academic and Research Institutes 9.3.3. Healthcare Providers 9.3.4. Others 9.4. Asia Pacific Bioinformatics Market Size and Forecast, by Country (2023-2030) 9.4.1. China 9.4.2. S Korea 9.4.3. Japan 9.4.4. India 9.4.5. Australia 9.4.6. Indonesia 9.4.7. Malaysia 9.4.8. Vietnam 9.4.9. Taiwan 9.4.10. Bangladesh 9.4.11. Pakistan 9.4.12. Rest of Asia Pacific 10. Middle East and Africa Bioinformatics Market Size and Forecast (by Value USD and Volume units) 10.1. Middle East and Africa Bioinformatics Market Size and Forecast, by Product & Services (2023-2030) 10.1.1. Knowledge Management Tools 10.1.2. Bioinformatics Platforms 10.1.3. Bioinformatics Services 10.2. Middle East and Africa Bioinformatics Market Size and Forecast, by Application (2023-2030) 10.2.1. Metabolomics 10.2.2. Molecular Phylogenetics 10.2.3. Transcriptomics 10.2.4. Proteomics 10.2.5. Chemoinformatics 10.2.6. Genomics 10.2.7. Others 10.3. Middle East and Africa Bioinformatics Market Size and Forecast, By End-User Sector (2023-2030) 10.3.1. Pharmaceutical and Biotechnology Companies 10.3.1.1. Medical Biotechnology 10.3.1.2. Animal Biotechnology 10.3.1.3. Agriculture Biotechnology 10.3.2. Academic and Research Institutes 10.3.3. Healthcare Providers 10.3.4. Others 10.4. Middle East and Africa Bioinformatics Market Size and Forecast, by Country (2023-2030) 10.4.1. South Africa 10.4.2. GCC 10.4.3. Egypt 10.4.4. Nigeria 10.4.5. Rest of ME&A 11. South America Bioinformatics Market Size and Forecast (by Value USD and Volume units) 11.1. South America Bioinformatics Market Size and Forecast, by Product & Services (2023-2030) 11.1.1. Knowledge Management Tools 11.1.2. Bioinformatics Platforms 11.1.3. Bioinformatics Services 11.2. South America Bioinformatics Market Size and Forecast, by Application (2023-2030) 11.2.1. Metabolomics 11.2.2. Molecular Phylogenetics 11.2.3. Transcriptomics 11.2.4. Proteomics 11.2.5. Chemoinformatics 11.2.6. Genomics 11.2.7. Others 11.3. South America Bioinformatics Market Size and Forecast, By End-User Sector (2023-2030) 11.3.1. Pharmaceutical and Biotechnology Companies 11.3.1.1. Medical Biotechnology 11.3.1.2. Animal Biotechnology 11.3.1.3. Agriculture Biotechnology 11.3.2. Academic and Research Institutes 11.3.3. Healthcare Providers 11.3.4. Others 11.4. South America Bioinformatics Market Size and Forecast, by Country (2023-2030) 11.4.1. Brazil 11.4.2. Argentina 11.4.3. Rest of South America 12. Company Profile: Key players 12.1. Thermo Fisher Scientific Inc. 12.1.1. Company Overview 12.1.2. Financial Overview 12.1.3. Business Portfolio 12.1.4. SWOT Analysis 12.1.5. Business Strategy 12.1.6. Recent Developments 12.2. Eurofins Scientific 12.3. QIAGEN N.V. 12.4. Agilent Technologies Inc. 12.5. Illumina Inc. 12.6. Waters Corporation 12.7. NeoGenomics Laboratories 12.8. Perkin Elmer Inc. 12.9. Fios Genomics 12.10. Source BioScience 12.11. BGI Genomics Co., Ltd. 12.12. Genedata AG 12.13. Eurofins Scientific SE 12.14. Seven Bridges Genomics, Inc. 12.15. Sophia Genetics SA 12.16. Station X, Inc. 12.17. Genomatix Software GmbH 12.18. Dassault Systèmes Biovia Corp. 12.19. Active Motif, Inc. 12.20. Bio-Rad Laboratories, Inc. 13. Key Findings 14. Industry Recommendation