The Australia Home Healthcare Market size was valued at USD 4.71 Billion in 2023. The total Australia Home Healthcare Market revenue is expected to grow at a CAGR of 9.45 % from 2023 to 2030, reaching nearly USD 8.86 Billion in 2030.Australia Home Healthcare Market

Home healthcare includes a wide range of medical and non-medical services delivered at a patient's home to treat an illness and injury or to aid with daily tasks. In the developing landscape of Germany's Home Healthcare Market, new investment opportunities develop across multiple segments. Providers who meet the increased need for Skilled Nursing Services, such as complex care management and wound care, are poised for financial success. The increasing need for physiotherapy, occupational therapy, and speech therapy services is driven by the growing need for Rehabilitation Therapy, particularly in post-surgical recovery and chronic disease management. The increased focus on end-of-life care at home provides new opportunities for specialized providers and technological solutions within Hospice and Palliative Care. At the same time, the resilient core market sector of Unskilled Care Services, which provides support with daily activities, offers significant prospects for scalable service models. Strategic investments in Technology-Enabled Solutions, such as telehealth platforms, remote monitoring tools, and AI-powered care planning, have enormous potential for revenue growth. The growing aging population in Australia, which already reaches 4.5 million people aged 65 and more, is expected to reach 6.1 million by 2030, driving up demand for home-based care. The rising prevalence of chronic diseases, such as diabetes and heart disease, highlights the need for accessible and convenient home healthcare solutions. The growing use of telehealth, wearables, and AI tools opens up opportunities for creative care delivery and cost savings. The government provides financing and policy support for home healthcare services through initiatives such as the National Disability Insurance Scheme (NDIS) and My Aged Care.To know about the Research Methodology :- Request Free Sample Report 1. In 2023, 6.7% of Australians aged over 65 provided or received unpaid care in their homes. 2. According to the MMR Research report, 770,000 Australians are expected to require some form of home care by 2030, with the highest demand among those aged 85 and over. The increasing prevalence of chronic diseases Medication management is still essential in Australia, where more than 16 million people 64% suffer from at least one chronic illness, making rigorous medication adherence necessary. However, nearly half of patients struggle to adhere to their recommended medications. Innovative home healthcare solutions are emerging, such as blister packing, prescription reminders, virtual consultations with pharmacists, and smart pill dispensers, to simplify schedules and improve adherence. Wearable technologies and sensors enable remote monitoring of vital signs, blood sugar levels, and other health indicators in real-time, allowing for early detection of complications. Personalized Care Plans are moving the focus away from one-size-fits-all treatments and toward plans that are customized according to illness kinds, patient goals, and social conditions. Nutritional counseling, mental health assistance, and community engagement are among the services available, all of which contribute to overall wellness. Home Healthcare reduces the financial burden of chronic disease management by lowering hospital readmissions, improving quality of life, and generating possible cost savings. In Australia, efforts such as the National Telehealth Strategy and several Chronic Disease Management Programs demonstrate a commitment to advancing customized and cost-effective home-based treatment.

Financial Constraints Hurdles in Australia The challenges in the Australian home healthcare market come from payment uncertainties and financial limits, which limit service offers, particularly for advanced chronic disease treatment. It leads to unfulfilled patient needs and service gaps. Financial restrictions reduce the sector's demand for capable professionals, resulting in staff shortages and potentially lower service quality. Complex funding mechanisms result in unequal access, preventing low-income people from getting home-based care. Additionally, financial constraints inhibit innovation by limiting investments in technology, training, and research. Overcoming these issues is essential for increasing service availability, attracting qualified professionals, encouraging equal access, and stimulating innovation in the home healthcare sector in Australia. 1. Over 60% of Australian home care providers are experiencing financial difficulties as a result of insufficient funding and reimbursement mechanisms. 2. The workforce shortage in home care is estimated to reach 140,000 by 2030, partly due to financial challenges and low wages in the sector.

Australia Home Healthcare Market Segment Analysis

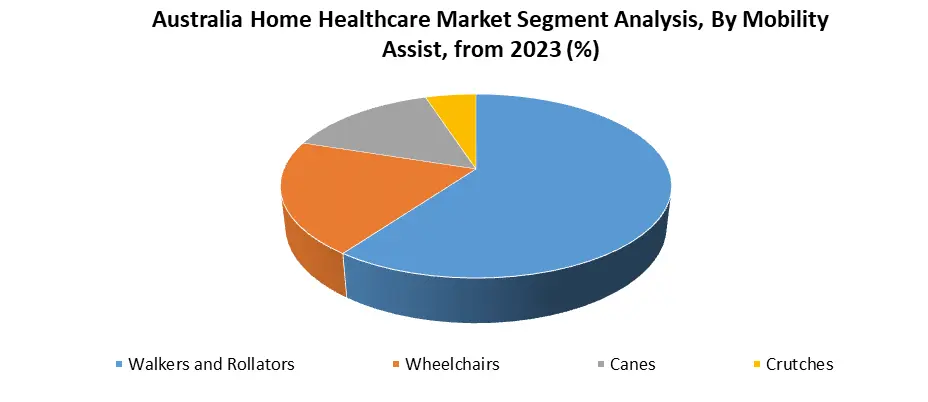

By Mobility Assist, the Walkers and Rollators segment accounts for an estimated 60% of the overall Australian Home Healthcare Market. Manufacturers and retailers in the walkers and rollators sector are seeing increased demand, leading to better sales and revenue. To suit varying user needs, there is a trend toward product variety with a wide range of features and sizes. To remain competitive, manufacturers invest in innovation, introducing new features such as lightweight designs and electrical alternatives. Increasing distribution channels through internet platforms, pharmaceutical alliances, and direct-to-consumer sales tactics are going to broaden market reach. Healthcare professionals' informed suggestions, taking into consideration the benefits and downsides of various walkers and rollators, help patients choose the best alternative. Patient education on safe use and maintenance is essential for preventing falls and increasing user trust. Interaction with manufacturers enables healthcare professionals to give important perspectives into the development of user-centric products and functionalities.

Australia Home Healthcare Market Scope: Inquire Before Buying

Australia Home Healthcare Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.71 Bn. Forecast Period 2024 to 2030 CAGR: 9.45% Market Size in 2030: US $ 8.86 Bn. Segments Covered: by Device Type Testing, Screening, and Monitoring Device Blood Glucose Monitors Blood Glucose Monitors Blood Pressure Monitors Heart Rate Monitors Temperature Monitors Sleep Apnea Monitors Coagulation Monitors Ovulation and Pregnancy Test Kits Pulse Oximeters Home Hemoglobin A1C Test Kit by Therapeutic Home Healthcare Devices Oxygen Delivery Systems Nebulizers Ventilators Sleep Apnea Therapeutic Devices Wound Care Products IV Equipment Dialysis Equipment Insulin Delivery Devices Inhalers Other Therapeutic Products (ostomy devices, automated external defibrillators (AEDs) by Mobility Assist Walkers and Rollators Wheelchairs Canes Crutches by Service Type Skilled Nursing Services Rehabilitation Therapy Services Hospice and Palliative Care Services Unskilled Care Services Respiratory Therapy Services Infusion Therapy Services Pregnancy Care Services Key Players in the Australia Home Healthcare Market

1. Bupa 2. Medibank Private 3. Australian Unity 4. Allianz 5. NIB Health Funds 6. HCF 7. BaptistCare 8. TLC Healthcare 9. Shebah 10. Mable FAQs: 1. How does the Australian government support home healthcare initiatives? Ans. The Australian government has implemented various policies and funding programs to support home healthcare. These initiatives aim to enhance accessibility, improve patient outcomes, and reduce the burden on traditional healthcare facilities. Funding mechanisms and subsidies contribute to the affordability of home-based services. 2. How is technology influencing home healthcare in Australia? Ans. Technological advancements, including telehealth, remote patient monitoring, and smart devices, play a pivotal role in shaping home healthcare in Australia. These technologies enhance communication between patients and healthcare providers, enable real-time health monitoring, and contribute to more efficient and effective care delivery. 3. What is the projected market size & and growth rate of the Australian home Healthcare Market? Ans. The Australia Home Healthcare Market size was valued at USD 4.71 Billion in 2023. The total Australia Home Healthcare market revenue is expected to grow at a CAGR of 9.45 % from 2023 to 2030, reaching nearly USD 8.86 Billion by 2030.

1. Australia Home Healthcare Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 1.4. 2. Australia Home Healthcare Market: Dynamics 2.1. Australia Home Healthcare Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Regulatory Landscape of Germany's Home Healthcare Market 2.6. Technological Advancements in the German Home Healthcare Market 2.7. Chronic Disease Rates in Australia 2.8. Data on Australians aged 65 and over providing or receiving unpaid care within their households 2.9. Wound Care and Medication Management Opportunities 2.10. Impact of NDIS and My Aged Care on Home Healthcare 2.11. Factors Influencing Consumer Choices in Home Healthcare 2.12. Preferences of the Aging Population 2.13. My Aged Care Program: Funding and Policy Support 2.14. Government Role in Shaping Home Healthcare Landscape in Australia 2.15. Factors Driving the Growth of the Home Healthcare Market in Australia 2.16. Key Opinion Leader Analysis for the German Home Healthcare Industry 2.17. Australia Home Healthcare Market Price Trend Analysis (2022-23) 3. Australia Home Healthcare Market: Market Size and Forecast by Segmentation for (by Value in USD Billion) (2023-2030) 3.1. Australia Home Healthcare Market Size and Forecast, by Device Type (2023-2030) 3.1.1. Testing, Screening, and Monitoring Device 3.1.2. Blood Glucose Monitors 3.1.3. Blood Glucose Monitors 3.1.4. Blood Pressure Monitors 3.1.5. Heart Rate Monitors 3.1.6. Temperature Monitors 3.1.7. Sleep Apnea Monitors 3.1.8. Coagulation Monitors 3.1.9. Ovulation and Pregnancy Test Kits 3.1.10. Pulse Oximeters 3.1.11. Home Hemoglobin A1C Test Kit 3.2. Australia Home Healthcare Market Size and Forecast, by Therapeutic Home Healthcare Devices (2023-2030) 3.2.1. Oxygen Delivery Systems 3.2.2. Nebulizers 3.2.3. Ventilators 3.2.4. Sleep Apnea Therapeutic Devices 3.2.5. Wound Care Products 3.2.6. IV Equipment 3.2.7. Dialysis Equipment 3.2.8. Insulin Delivery Devices 3.2.9. Inhalers 3.2.10. Other Therapeutic Products (ostomy devices, automated external defibrillators (AEDs) 3.3. Australia Home Healthcare Market Size and Forecast, by Mobility Assist (2023-2030) 3.3.1. Walkers and Rollators 3.3.2. Wheelchairs 3.3.3. Canes 3.3.4. Crutches 3.4. Mobility Scooters Australia Home Healthcare Market Size and Forecast, Service Type (2023-2030) 3.4.1. Skilled Nursing Services 3.4.2. Rehabilitation Therapy Services 3.4.3. Hospice and Palliative Care Services 3.4.4. Unskilled Care Services 3.4.5. Respiratory Therapy Services 3.4.6. Infusion Therapy Services 3.4.7. Pregnancy Care Services 3.5. Mobility Scooters Australia Home Healthcare Market Size and Forecast, Indication Type (2023-2030) 3.5.1. Cardiovascular Disorders & Hypertension 3.5.2. Diabetes 3.5.3. Respiratory Diseases 3.5.4. Pregnancy 3.5.5. Mobility Disorders 3.5.6. Hearing Disorders 3.5.7. Cancer 3.5.8. Wound Care 3.5.9. Other Indications (sleep disorders, kidney disorders, neurovascular diseases, and HIV) 4. Australia Home Healthcare Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading Australia Home Healthcare Market Companies, by Market Capitalization 4.6. Market Trends and Challenges in Australia 4.6.1. Technological Advancements 4.6.2. Affordability and Accessibility 4.6.3. Shortage of Skilled Professionals 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players in the Market 4.7.4. Challenges 4.7.5. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. Bupa 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Potential Impact of Emerging Technologies 5.1.8. Market Share Analysis and Strategic Initiatives 5.1.9. Regulatory Accreditations and Certifications Received by Them 5.1.10. Strategies Adopted by Key Players 5.1.11. Recent Developments 5.2. Medibank Private 5.3. Australian Unity 5.4. Allianz 5.5. NIB Health Funds 5.6. HCF 5.7. BaptistCare 5.8. TLC Healthcare 5.9. Shebah 5.10. Mable 6. Industry Recommendations 7. Australia Home Healthcare Market: Research Methodology