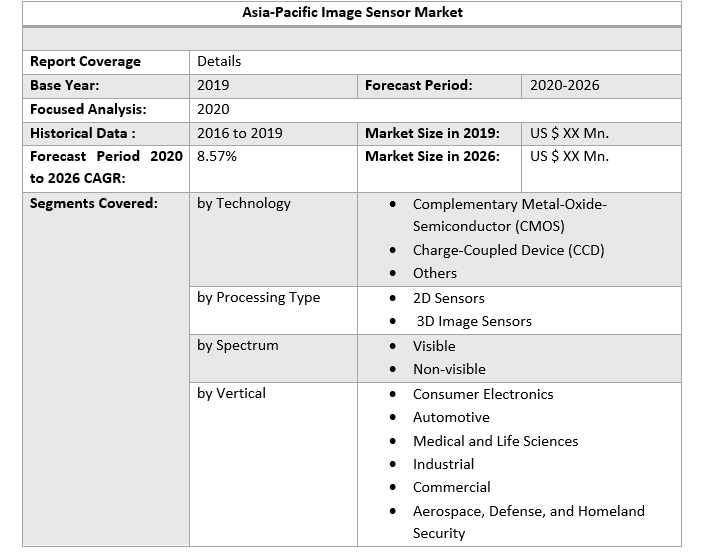

Asia Pacific Image Sensor Market is expected to reach US$ 23.79 Bn by 2026, at a CAGR of 9.31% during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Asia-Pacific Image Sensor Market Overview:

The increasing requirement for trivial pixel devices offering high resolution with low-cost technique is projected to boost the market development during the forecast period. The Image Sensor Market has been facing a major change in the past few years. The automated improvements and sturdy usage of images over many applications have motivated the change of image sensors in the Asia-Pacific market. With the increasing R&D investments, detecting tools have become inexpensive, dense, & power-efficient, posing openings to the industry firms. The increasing mobile phone segment, mainly smartphones, is expected to spur the sector growth during the forecast period.Asia-Pacific Image Sensor Market Segment Analysis:

Consumer electronics is expected to be the main application segment having a high penetration & accounted for over 50 percent of the global revenue share in the year 2019. Its revenue growth is also expected to be at a CAGR of 3.3 % between the years 2019 to 2026. These devices are widely planned in consumer electronics, for example, in smartphones or cameras. Rising consumer electronics demand to increase the Image sensor market growth: With growing need for cost-effective manufacturing of automobiles & consumer electronics, the electronic manufacturing services industry has added huge momentum over the past 20 years. Steady growth in the consumption of mobile phones, handy electronics & connected devices overall has aided the development of some small EMS companies to meet the worldwide demand. Massive opportunities in the aerospace, industrial & medical devices sector have also increased the electronic manufacturing facilities industry. The communication & consumer electronics sectors have motivated EMS suppliers to pursue main expansion plans & technological expansions. The huge development potential for consumer electronics in Asia-Pacific can be presumed from Foxconn’s new statement according to which it is scheduling to increase its semiconductor manufacturing operations in China. Demand for these trivial equipment is increasing exponentially & a development effort by a key EMS supplier shows the same, signalling progress prospects for upcoming EMS companies who wish to enter the sector. Foxconn is also representing the trend among corporations in the EMS industry fluctuating from a single key income foundation to making more various consumer electronic products. Nearly 50 percent of Foxconn’s revenue originates from Apple, which is an enormous reliance on a single unit for a manufacturer of this level. The corporation earlier this year decided to join forces with camera manufacturer RED Digital Cinema to manufacture reasonable & specialized quality film cameras with 8K resolution. It is also in the process of building manufacturing services in China & United States to create large-screen display panels. It is expected that worldwide, nearly 2 Mn televisions with 8K display would be transported by 2021 itself, & with a number of EMS companies situated in the region, the sector will produce additional rewards for the Asia-Pacific EMS market. Owing to the enhanced R&D, sensing devices have become cheap, compressed, & consume a smaller amount of power, which aids as a striking opportunity for industry suppliers. Buyer inclination towards wearable devices is expected to rise the image sensor market over the forecast period. The rising inclination for multimedia devices is reinforced by growth in mobile devices. Multimedia-enabled products offer more features with more data safety over the Internet. These devices are strongly reinforced by sensing skill in the United States along with developing regions such as India, Latin America, and China. The usage of sensing devices for health nursing, indoor steering, and connected niche applications is expected to offer major development opportunities for the evolution of the Image sensor market. The Asia-Pacific Image Sensor Market report has profiled key players in the market from different regions. However, the Asia-Pacific Image Sensor Market report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Types, labor cost, availability of advanced Plastic Type, trusted vendors are analyzed and the Asia-Pacific Image Sensor Market report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing &Covid 19 impact on demand side are covered in the Asia-Pacific Image Sensor Market report.Asia-Pacific Image Sensor Market , Key Highlights:

• Asia-Pacific Image Sensor Market analysis and forecast, in terms of value. • Comprehensive study and analysis of market drivers, restraints and opportunities influencing the growth of the Asia-Pacific Image Sensor Market • Asia-Pacific Image Sensor Market segmentation on the basis of type, source, end-user, and region (country-wise) has been provided. • Asia-Pacific Image Sensor Market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of study. • Asia-Pacific Image Sensor Market analysis and forecast for five major regions namely North America, Europe, Asia Pacific, the Middle East & Africa (MEA) and Latin America along with country-wise segmentation. • Profiles of key industry players, their strategic perspective, market positioning and analysis of core competencies are further profiled. • Competitive developments, investments, strategic expansion and competitive landscape of the key players operating in the Asia-Pacific Image Sensor Market are also profiled.Asia-Pacific Image Sensor Market Scope: Inquire before buying

Asia-Pacific Image Sensor Market, by Country

• China • India • Japan • ASEAN • Rest of Asia-PacificAsia-Pacific Image Sensor Market, Key Players:

• STMicroelectronics • Espros Photonics Corporation • Imasenic • Andanta • BAE Systems Inc. • Insightness • Integrated Detector Electronics AS • Multix • ON Semiconductor • IR Nova • Emberion • E2V • Omnivision • Samsung • Canon • Aptina Imaging • Nikon • Toshiba • EM Microelectronics • Melexis • SK Hynix

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Asia-Pacific Image Sensor Market Size, by Market Value (US$ Mn) 3.1. Asia-Pacific Market Segmentation 3.2. Asia-Pacific Market Segmentation Share Analysis, 2019 3.2.1. Asia-Pacific 3.2.2. By Country 3.3. Geographical Snapshot of the Asia-Pacific Image Sensor Market 3.4. Geographical Snapshot of the Asia-Pacific Image Sensor Market, By Manufacturer share 4. Asia-Pacific Image Sensor Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Types 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Asia-Pacific Image Sensor Market 5. Supply Side and Demand Side Indicators 6. Asia-Pacific Image Sensor Market Analysis and Forecast, 2019-2026 6.1. Asia-Pacific Image Sensor Market Size & Y-o-Y Growth Analysis. 7. Asia-Pacific Image Sensor Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 7.1.1. Complementary Metal-Oxide-Semiconductor (CMOS) 7.1.2. Charge-Coupled Device (CCD) 7.1.3. Others 7.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 7.2.1. 2D Sensors 7.2.2. 3D Image Sensors 7.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 7.3.1. Visible 7.3.2. Non-visible. 7.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 7.4.1. Consumer Electronics 7.4.2. Automotive 7.4.3. Medical and Life Sciences 7.4.4. Industrial 7.4.5. Commercial 7.4.6. Aerospace, Defense, and Homeland Security 8. Asia-Pacific Image Sensor Market Analysis and Forecasts, By Country 8.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 8.1.1. China 8.1.2. India 8.1.3. Japan 8.1.4. ASEAN 8.1.5. Rest of Asia-Pacific 9. China Image Sensor Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 9.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 9.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 9.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 10. Japan Image Sensor Market Analysis and Forecasts, 2019-2026 10.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 10.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 10.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 10.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 11. India Image Sensor Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 11.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 11.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 12. ASEAN Image Sensor Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 12.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 12.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 13. Rest of Asia-Pacific Image Sensor Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 13.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 13.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 14. Competitive Landscape 14.1. Geographic Footprint of Major Players in the Asia-Pacific Image Sensor Market 14.2. Competition Matrix 14.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Services and R&D Investment 14.2.2. New Type Launches and Type Enhancements 14.2.3. Market Consolidation 14.2.3.1. M&A by Regions, Investment and Verticals 14.2.3.2. M&A, Forward Integration and Backward Integration 14.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 14.3. Company Profile : Key Players 14.3.1. PSC Group 14.3.1.1. Company Overview 14.3.1.2. Financial Overview 14.3.1.3. Geographic Footprint 14.3.1.4. Type Portfolio 14.3.1.5. Business Strategy 14.3.1.6. Recent Developments 14.3.2. STMicroelectronics 14.3.3. Espros Photonics Corporation 14.3.4. Imasenic 14.3.5. Andanta 14.3.6. BAE Systems Inc. 14.3.7. Insightness 14.3.8. Integrated Detector Electronics AS 14.3.9. Multix 14.3.10. ON Semiconductor 14.3.11. IR Nova 14.3.12. Emberion 14.3.13. E2V 14.3.14. Omnivision 14.3.15. Samsung 14.3.16. Canon 14.3.17. Aptina Imaging 14.3.18. Nikon 14.3.19. Toshiba 14.3.20. EM Microelectronics 14.3.21. Melexis 14.3.22. SK Hynix 15. Primary Key Insights.