Global AI in Industrial Machinery Market size was valued at USD 5.9 Billion in 2023 and the total AI in Industrial Machinery Market revenue is expected to grow at a CAGR of 24.2 % from 2023 to 2030, reaching nearly USD 26.90 Billion.AI in Industrial Machinery Market Overview

AI in Industrial Machinery Market is used to implement AI technologies and algorithms in the design and operation of industrial machinery and equipment manufacturing. The goal is to increase automation, optimize processes, to boost AI in Industrial Machinery Market Growth. The effectiveness of integrating AI capabilities like machine learning, computer vision, and predictive analytics into industrial systems. AI is a powerful source of disruption and a tool to achieve a competitive advantage in industrial manufacturing. The manufacturing companies that neglect to recognize the importance of AI are expected to lose their competitive edge. The main reasons for implementing AI technologies in industrial Machinery environments are driven by the need to assist in making decisions or acting, automate manual and Reduce cost and improve reliability, and decision-making through revolutionizing AI in industrial Machinery market.To know about the Research Methodology :- Request Free Sample Report The rapid growth of the AI in Industrial Machinery market stems from the increasing need for improved operational efficiency and superior quality standards within manufacturing domains. A pivotal force driving this surge is the notable achievements seen in AI adoption, particularly in enhancing quality control and predictive maintenance practices. For instance, the automotive industry has been a pivotal area where AI's impact is palpable. Integrating AI into manufacturing processes has substantially increased accuracy rates in quality control, as seen in Jabil's implementation, achieving a staggering 97% accuracy in automated optical inspection. This level of precision minimizes defects, ensuring adherence to stringent industry standards and reducing costly reworks. Predictive maintenance powered by AI analytics, such as yield-energy-throughput (YET) models, has transformed machinery upkeep. Predicting potential failures by analyzing historical performance data has slashed downtime by 30-50% and extended machine life by 20-40%. These tangible outcomes have spurred a surge in AI adoption across industrial machinery. Among this growth, major key players have significantly influenced market dynamics. Companies like Siemens, General Electric, and IBM have emerged as frontrunners, holding substantial market shares. Siemens, for instance, has showcased dominance through its AI-driven solutions for predictive maintenance, ensuring optimal machinery performance and reliability. General Electric's AI-powered quality control systems have revolutionized defect detection, minimizing production errors. IBM's contributions, particularly in AI-enabled data governance and analytics, have been instrumental in facilitating seamless integration and efficient utilization of AI across manufacturing operations. As a result of these innovations and the dominance of key players, the AI in Industrial Machinery market continues to witness robust expansion, projected to reach a market value $xx billion in 2023, propelled by the relentless pursuit of quality enhancement and operational excellence within manufacturing industries. Rising demand for Industrial Machinery to boost the market growth AI in Industrial Machinery Market has been Rising the demand and progress in manufacturing in recent years, making factories less labor-dependent and more efficient than ever. The introduction of AI in Industrial Machinery Market is a milestone for the machinery and manufacturing sector. Industrial machinery is totally dependent on programming to make own decisions based on AI-based data. The applications of AI in Industrial Machinery Market are numerous from advanced predictions through quality assurance to waste reduction. AI in Industrial Machinery is used for planning, scheduling, optimization, robotics, and machine vision. Also, AI provides manufacturers with increased capacity and space for business growth, but it also gives us hope for a greener and more comfortable AI in Industrial Machinery Future. The AI in Industrial Machinery manufacturing industry has always been available to embrace innovative technologies. Drones and industrial robots have been a part of the Industrial Machinery Market. The following automation revolution is just around with the implementation of AI if organizations can keep inventories lean and reduce the cost, there is a high probability that the manufacturing industry will encounter an empowering development. The use of AI in the industrial machinery industry is incredible. AI in Industrial Machinery Market robot collaboration enables manufacturers to deliver generative products faster. AI in Industrial Machinery Market changing the way manufacturers design products. The AI solution for industrial machinery offers insights into the best design. AI offers benefits to manufacturing companies. These factors are driving the market growth during the forecast period. For instance, BMW uses AI for product quality, General Motors uses AI for intelligent maintenance, and Nissan uses AI for manufacturing to design Ultra- Modern cars. And many biggest brands are using AI for manufacturing operations. Revolutionizing Manufacturing Through AI: Enhancing Quality, Efficiency, and Maintenance AI's integration in product inspection and quality control, exemplified by Jabil's success achieving 97% accuracy through AI-driven automated optical inspection, revolutionizes traditional methods. High-resolution cameras, empowered by AI recognition, swiftly detect defects during production, crucially optimizing machinery settings such as injection molding parameters. industries like automotive and aerospace benefit significantly from this precision. BMW Group's utilization of AI for real-time component image assessment showcases its efficacy in ensuring adherence to quality norms and facilitating immediate corrective actions. Collaborating with industrial robots, AI streamlines tasks, reducing manual labor while boosting accuracy and efficiency. Canon's Assisted Defect Recognition, employing machine learning and computer vision, adeptly identifies manufacturing component defects often overlooked by human observation. Similarly, at Jabil, AI aids in tasks like trade compliance code identification, ensuring precision and averting regulatory issues. AI's predictive maintenance prowess, analyzing historical machine performance data to predict failures and their causes, significantly slashes downtime by 30-50% and extends machine life by 20-40%. Employing AI-driven analytics like yield-energy-throughput (YET) optimizes machine efficiency, curbing energy consumption and maximizing productivity. However, successful AI implementation hinges on efficient data utilization—a challenge stemming from either insufficient or overwhelming data volumes hindering its efficacy. Jabil's strategy revolves around digitalizing processes to visualize and optimize them. Crucial to this approach is the governance of consistent, transparent, and trustworthy data, necessitating the expertise of data scientists and active involvement of business stakeholders. While integrating AI into manufacturing is a journey demanding time for algorithm training and visible results, its potential is boundless, akin to the limitless power of the human brain. As AI evolves, manufacturing processes will witness heightened productivity, smoother operations, and endless future possibilities.

AI in Industrial Machinery Market Trends

AI Development and Future Trends in Industrial Machinery Market AI in Industrial Machinery Market is expecting significant growth driven by market trends and opportunities. AI has become deeply embedded across industrial and other applications, with initial use cases using AI in industrial machinery and representing their applications, and expanding the main production. Industrial machinery is changing alongside society, and digitalization is rapidly driving market growth. AI technologies with IoT devices create a powerful combination known as AIoT. AI in the industrial machinery market has been a rising demand for robots. AI in Industrial Machinery Market has continued enhancement in computer visualization and has long been used for quality assurance by detecting product defects in real-time. But now that manufacturing involves more information than ever integrated with the fact that plant managers do not want to pay employees to enter information AI with computer vision can rationalize how information gets apprehended. Knowledge-based work is being automated in the AI in the Industrial Machinery market revolution; by developing new methods of automating jobs in manufacturing, are designing how humans and machines live, work, and interact to construct a more robust digital economy. The AspenTech, Industrial AI Research found that 83% of big industrial firms think AI generates superior outcomes, but just 20% have used it. Artificial intelligence will not be widely used in the industrial sector without significant investment in acquiring domain knowledge. Together, they make up what is known as AI in Industrial Machinery Market which is the application of machine learning techniques to traditionally non-academic settings. AI is automating Factories Robotics combined with AI can relieve you of highly specialized tasks. AI in Industrial Machinery Market is using smart technology to lower production costs, protect human workers, and increase efficiency. AI in Industrial Machinery Market can easily reduce labor costs while improving productivity and efficiency at their plants. Among the other applications. The best example of factory automation is Siemens. The company has partnered with Google to increase shop floor productivity through the use of computer vision, cloud-based analytics, and AI algorithms. AI for Quality Assessment AI is most needed in quality control in the industrial machinery market. Even industrial robots are capable of making mistakes, although these are much less common than humans, allowing defective products to roll off the assembly shipped to consumers can be costly. AI and machine learning (ML) combine human intelligence with powerful technologies to bring about revolutionary changes in manufacturing operations. AI in Industrial Machinery Market can detect minor flaws in industrial machinery or products that robots may overlook. Products are analyzed by AI software to detect defects automatically using hardware such as cameras and Internet of Things sensors. The computer automatically makes decisions about what to do with defective products. Manufacturers ensure high-quality products with a shorter time to make by conducting extensive quality testing with Ai in the industrial machinery market. AI helps speed up sustainable development goals in the industrial machinery market The AI in Industrial Machinery Market uses AI to reduce GHG emissions by 2.6 to 5.3 gigatonnes of CO2 and provide USD 1.3 trillion to USD 26 trillion in value through additional revenues and cost savings. Companies will use AI and analytics to measure their own carbon footprints and find ways to reduce carbon emissions. Including reading waste, such by reducing plastic pollution in the ocean, and developing eco-friendly products and manufacturing methods. AI in industrial machinery can use AI and Analytics to ensure workers’ safety thanks to advancements in the industrial machinery marketAI Impacts on Manufacturing Industry

Global manufacturing companies are heavily investing AI in Industrial Machinery Market. The main focus is reducing production costs, manufacturing companies are rushing to use AI in their processes.it is expected that investment is increasing by USD 2.9 bn in 2020 to 14 billion in 2029. AI in Industrial Machinery Market Restraint The AI in Industrial Machinery Market is the high implementation cost associated with adopting and integrating AI technology into existing industrial machinery systems. As industrial machinery generates vast amounts of sensitive data that need to protect from potential cyber threats and unauthorized access The compatibility and smooth integration of AI with current infrastructure can make the process of integrating it with legacy systems difficult and time-consuming. The ethical issues surrounding AI adoption, such as potential job losses and workforce effects, make it more difficult for it to gain general acceptance. AI in Industrial Machinery Market manufacturing industry is under pressure. Labor costs are rising while customer demand for faster, more customized products continues to grow at the same time, the industry is being disrupted by a new technological wave. Artificial intelligence (AI). AI revolutionizes manufacturing and the impact is only going to increase in the forecast period. AI in Industrial Machinery Market has the potential to revolutionize how to produce goods and services. Making factories smarter and more efficient.

AI in Industrial Machinery Market Regional Insights

North American region dominated the AI in Industrial Machinery Market in 2022 and is expected to continue the dominance over the forecast period. The technology developments in the North American region are booming, driven by increasing industrialization and the development of AI-based technologies development in the industrial machinery sector. The AI in industrial machinery has Rapid advancement in technology are expected to drive the innovation in AI in Industrial Machinery Market during the forecast period. Implementing AI in manufacturing facilities is getting popular among manufacturers. According to the MMR report, more than half of the European manufacturers of AI in Industrial Machinery Market size is (51%) are implementing Al solutions, with Japan (30%) and the US (28%). This popularity is driven by the fact that manufacturing data is good for AI machine learning. Industrial manufacturing is full of analytical data which is easier for machines to analyse. Industrial machinery is responsible for nearly 24% of global carbon emissions and the manufacturing sectors with expensive inefficiencies that make work more difficult for labours. Industrial machinery has highly adopted advanced technologies such as machine learning, and cloud computing.AI in Industrial Machinery Market Segment Analysis

Based on Components, the market is segmented by Hardware, Software, and Services. Among these segments, Software held the largest AI in Industrial Machinery Market share in 2022. and is expected to dominate the market over the forecast period. Increasing demand for software they are enabling the capability of AI in industrial machinery market. For developing AI Application software provides algorithms and frameworks and developed AI applications in industrial machinery.Based on Technology, the is categorized into various sectors intelligence systems, machine learning, machine perception and natural language processing. Among these technologies, machine learning dominated the market and held the largest AI in Industrial Machinery Market revenue share in 2022. Machine learning algorithms enable industrial machinery to analyze vast amounts of data, learn from patterns, and make intelligent decisions. This dominance is due to the ability of machine learning to drive automation, optimize processes, and improve overall efficiency in industrial settings, making it a fundamental and widely adopted technology in the market. Based on Applications, the segment is categorized into various applications are cybersecurity, energy management, HMI, maintenance, Motion Planning, Safety, and Quality control among this application. Among these applications, cybersecurity is currently dominating the AI in Industrial Machinery Market. With the increasing digitalization of industrial machinery, the need for robust cybersecurity measures has become paramount. AI-based cybersecurity solutions offer advanced threat detection, prevention, and response capabilities, addressing the growing concerns of cyberattacks. The dominance of cybersecurity in the market is driven by the critical importance of protecting industrial systems and sensitive data from evolving cyber threats.

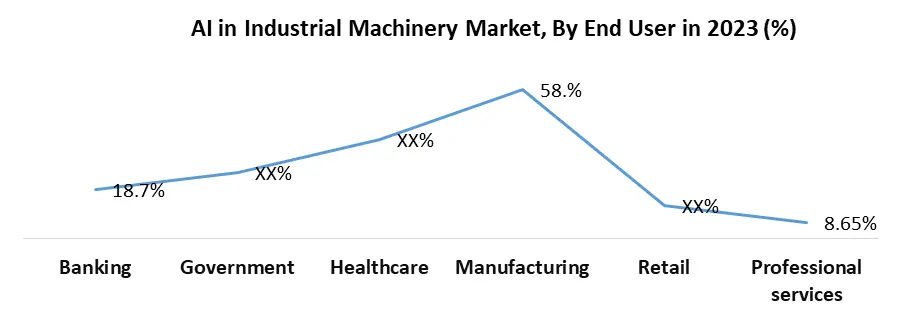

Based on End User, the segment is categorized into various sectors such as Banking, Government, Healthcare, Manufacturing, Retail, and Professional Services. Among these industries manufacturing sector held the largest share in AI in Industrial Machinery Market. And expect to dominate the market in 2022. Increasing demand AI-powered machinery for automation, process optimization, predictive maintenance, and quality control in the industrial machinery industry. The dominance of the manufacturing segment is attributed to the significant impact AI has in streamlining operations and driving innovation in the manufacturing industry.

AI in Industrial Machinery Market Competitive Landscape

The AI in Industrial Machinery Industry is highly competitive, with numerous players offering a wide range of products and services. The AI in Industrial Machinery Market is driven by factors such as the increasing demand for energy-efficient power electronics, the growth of renewable energy sources, and the rising trend of artificial intelligence machinery. Smaller players in the industry are leveraging their agility and flexibility to introduce innovative products and gain a foothold in the market. They are also partnering with other players to expand their reach and offer more comprehensive solutions. Additionally, some companies are focusing on specific niche markets or applications to differentiate themselves from larger players. The market penetration of AI in Industrial Machinery Market is infancy. machine building is restructuring its business models to accommodate this new technology, while end users are working on operation-specific use cases for their machinery. AI in Industrial Machinery companies offers a range of AI in Industrial Machinery Market with positioned as reliable and has huge market demand. New Technology launches, acquisitions and Research and development activities are strategies adopted by key players in the AI in Industrial Machinery Market. The strategies adopted by the major player, such as expansion of product portfolio, mergers & acquisitions, geographical expansion, and collaborations, to enhance the AI in Industrial Machinery Market penetration. AI in Industrial Machinery Industry is dominated by vendors as they have huge production plants and facilities around the world. Fanuc, a Japanese automation company, uses AI robotic workers to operate its factories. The robots can manufacture critical Application for computer numerical control and motors, run all production Floor machinery continuously, and enable continuous monitoring of all operations. October, 2023: Mitsubishi Electric Unveils AI-Powered Predictive Maintenance Solution for Industrial Equipment. Leveraging AI to forecast equipment failures from sensor data, enhancing operational efficiency and preventing downtimes. September, 2023: ABB and Microsoft Forge Alliance to Innovate AI-Powered Industrial Automation Solutions. A partnership aiming to merge ABB's industrial prowess with Microsoft's Azure AI platform for more intelligent factory solutions.

AI in Industrial Machinery Market Scope : Inquire Before Buying

Global AI in Industrial Machinery Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.9 Bn. Forecast Period 2024 to 2030 CAGR: 24.2% Market Size in 2030: US $ 26.9 Bn. Segments Covered: by Components Hardware Software Services by Application Cybersecurity Energy management HMI Maintenance Motion planning Safety Quality control by EndUser Banking Government Healthcare Manufacturing Retail Professional services AI in Industrial Machinery Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)AI in Industrial Machinery Market Key players

1. General Electric Company 2. ABB Ltd. 3. Mitsubishi Electric Corporation 4. Schneider Electric SE 5. Honeywell International Inc. 6. Rockwell Automation, Inc. 7. Fanuc Corporation 8. IBM Corporation 9. Microsoft Corporation 10. Intel Corporation 11. Rockwell Automation 12. GE 13. Mythic 14. VIDIA 15. Uptake 16. Veo Robotics 17. Automation Anywhere 18. Machina Labs, Inc. 19. Bosch Rexroth AG 20. Yaskawa Electric Corporation 21. KUKA AG 22. FANUC Corporation 23. Omron Corporation 24. Cognex Corporation 25. Intel Corporation 26. NVIDIA Corporation 27. Google LLC 28. Amazon Web Services, Inc. Frequently Asked Questions: 1] What is the growth rate of the Global Market? Ans. The Global Market is growing at a significant rate of 24.2 % during the forecast period. 2] Which region is expected to dominate the Global Market? Ans. North America is expected to dominate the Market during the forecast period. 3] What is the expected Global Market size by 2030? Ans. The Market size is expected to reach USD 26.9 Bn by 2030. 4] Which are the top players in the Global Market? Ans. Some of the top players operating in the Market are General Electric Company, Siemens AG, ABB Ltd, Mitsubishi Electric Corporation, Schneider Electric SE. 5] Which sector is the key driver in the Market? Ans. Increasing demand for industrial machinery in the manufacturing sector is the key driver in the Market.

1. AI in Industrial Machinery Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. AI in Industrial Machinery Market: Dynamics 2.1 AI in Industrial Machinery Market Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 AI in Industrial Machinery Market Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 AI in Industrial Machinery Market Restraints 2.4 AI in Industrial Machinery Market Opportunities 2.5 AI in Industrial Machinery Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power of Suppliers 2.6.2 Bargaining Power of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives for AI in Industrial Machinery Industry 2.11 The Global Pandemic and Redefining AI in Industrial Machinery Industry Landscape 2.12 Price Trend Analysis 2.13 Technological Road Map 2.14 Global AI in Industrial Machinery Trade Analysis (2017-2022) 2.14.1 Global Import of AI in Industrial Machinery 2.14.1.1 Ten Largest Importer 2.14.2 Global Export of AI in Industrial Machinery 2.14.2.1 Ten Largest Exporters 2.15 AI in Industrial Machinery Production Capacity Analysis 2.15.1 Chapter Overview 2.15.2 Key Assumptions and Methodology 2.15.3 AI in Industrial Machinery Manufacturers: Global Installed Capacity 2.15.4 Analysis by Size of Manufacturer 2.15.5 Analysis by Demand Side 2.15.6 Analysis by Supply Side 3. AI in Industrial Machinery Market: Global Market Size and Forecast by Segmentation (Value and Volume) 3.1 Global AI in Industrial Machinery Market, by Components (2023-2030) 3.1.1 Hardware 3.1.2 Software 3.1.3 Services 3.2 Global AI in Industrial Machinery Market, by Application (2023-2030) 3.2.1 Cybersecurity 3.2.2 Energy management 3.2.3 HMI 3.2.4 Maintenance 3.2.5 Motion planning 3.2.6 Safety 3.2.7 Quality control 3.3 Global AI in Industrial Machinery Market, by End-use (2023-2030) 3.3.1 Banking 3.3.2 Government 3.3.3 Healthcare 3.3.4 Manufacturing 3.3.5 Retail 3.3.6 Professional services 3.4 Global AI in Industrial Machinery Market, by Region(2023-2030) 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Middle East and Africa 3.4.5 South America 4. North American AI in Industrial Machinery Market Size and Forecast by Segmentation (Value and Volume) 4.1 North America AI in Industrial Machinery Market, by Components (2023-2030) 4.1.1 Hardware 4.1.2 Software 4.1.3 Services 4.2 North America AI in Industrial Machinery Market, by Application (2023-2030) 4.2.1 Cybersecurity 4.2.2 Energy management 4.2.3 HMI 4.2.4 Maintenance 4.2.5 Motion planning 4.2.6 Safety 4.2.7 Quality control 4.3 AI in Industrial Machinery Market, by End-use (2023-2030) 4.3.1 Banking 4.3.2 Government 4.3.3 Healthcare 4.3.4 Manufacturing 4.3.5 Retail 4.3.6 Professional services 4.4 North America AI in Industrial Machinery Market, by Country (2023-2030) 4.4.1 United States 4.4.1.1 United States AI in Industrial Machinery Market, by Components (2023-2030) 4.4.1.1.1 Cybersecurity 4.4.1.1.2 Energy management 4.4.1.1.3 HMI 4.4.1.1.4 Maintenance 4.4.1.1.5 Motion planning 4.4.1.1.6 Safety 4.4.1.1.7 Quality control 4.4.1.2 United States AI in Industrial Machinery Market, by Application (2023-2030) 4.4.1.2.1 Cybersecurity 4.4.1.2.2 Energy management 4.4.1.2.3 HMI 4.4.1.2.4 Maintenance 4.4.1.2.5 Motion planning 4.4.1.2.6 Safety 4.4.1.2.7 Quality control 4.4.1.3 United States AI in Industrial Machinery Market, by End-use (2023-2030) 4.4.1.3.1 Banking 4.4.1.3.2 Government 4.4.1.3.3 Healthcare 4.4.1.3.4 Manufacturing 4.4.1.3.5 Retail 4.4.1.3.6 Professional services 4.4.2 Canada 4.4.2.1 Canada AI in Industrial Machinery Market, by Components (2023-2030) 4.4.2.1.1 Hardware 4.4.2.1.2 Software 4.4.2.1.3 Services 4.4.2.2 Canada AI in Industrial Machinery Market, by Application (2023-2030) 4.4.2.2.1 Cybersecurity 4.4.2.2.2 Energy management 4.4.2.2.3 HMI 4.4.2.2.4 Maintenance 4.4.2.2.5 Motion planning 4.4.2.2.6 Safety 4.4.2.2.7 Quality control 4.4.2.3 AI in Industrial Machinery Market, by End-use (2023-2030) 4.4.2.3.1 Banking 4.4.2.3.2 Government 4.4.2.3.3 Healthcare 4.4.2.3.4 Manufacturing 4.4.2.3.5 Retail 4.4.2.3.6 Professional services 4.4.3 Mexico 4.4.3.1 Mexico AI in Industrial Machinery Market, by Components (2023-2030) 4.4.3.1.1 Hardware 4.4.3.1.2 Software 4.4.3.1.3 Services 4.4.3.2 Mexico AI in Industrial Machinery Market, by Application (2023-2030) 4.4.3.2.1 Cybersecurity 4.4.3.2.2 Energy management 4.4.3.2.3 HMI 4.4.3.2.4 Maintenance 4.4.3.2.5 Motion planning 4.4.3.2.6 Safety 4.4.3.2.7 Quality control 4.4.3.3 AI in Industrial Machinery Market, by End-use (2023-2030) 4.4.3.3.1 Banking 4.4.3.3.2 Government 4.4.3.3.3 Healthcare 4.4.3.3.4 Manufacturing 4.4.3.3.5 Retail 4.4.3.3.6 Professional services 5. Europe AI in Industrial Machinery Market Size and Forecast by Segmentation (Value and Volume) 5.1 Europe AI in Industrial Machinery Market, by Components (2023-2030) 5.2 Europe AI in Industrial Machinery Market, by Application (2023-2030) 5.3 Europe AI in Industrial Machinery Market, by End-use (2023-2030) 5.4 Europe AI in Industrial Machinery Market, by Country (2023-2030) 5.4.1 United Kingdom 5.4.1.1 United Kingdom AI in Industrial Machinery Market, by Components (2023-2030) 5.4.1.2 United Kingdom AI in Industrial Machinery Market, by Application (2023-2030) 5.4.1.3 United Kingdom AI in Industrial Machinery Market, by End-use (2023-2030) 5.4.2 France 5.4.2.1 France AI in Industrial Machinery Market, by Components (2023-2030) 5.4.2.2 France AI in Industrial Machinery Market, by Application (2023-2030) 5.4.2.3 France AI in Industrial Machinery Market, by End-use (2023-2030) 5.4.2.4 5.4.3 Germany 5.4.3.1 Germany AI in Industrial Machinery Market, by Components (2023-2030) 5.4.3.2 Germany AI in Industrial Machinery Market, by Application (2023-2030) 5.4.3.3 Germany AI in Industrial Machinery Market, by End-use (2023-2030) 5.4.4 Italy 5.4.4.1 Italy AI in Industrial Machinery Market, by Components (2023-2030) 5.4.4.2 Italy AI in Industrial Machinery Market, by Application (2023-2030) 5.4.4.3 Italy AI in Industrial Machinery Market, by End-use (2023-2030) 5.4.5 Spain 5.4.5.1 Spain AI in Industrial Machinery Market, by Components (2023-2030) 5.4.5.2 Spain AI in Industrial Machinery Market, by Application (2023-2030) 5.4.5.3 Spain AI in Industrial Machinery Market, by End-use (2023-2030) 5.4.6 Sweden 5.4.6.1 Sweden AI in Industrial Machinery Market, by Components (2023-2030) 5.4.6.2 Sweden AI in Industrial Machinery Market, by Application (2023-2030) 5.4.6.3 Sweden AI in Industrial Machinery Market, by End-use (2023-2030) 5.4.7 Austria 5.4.7.1 Austria AI in Industrial Machinery Market, by Components (2023-2030) 5.4.7.2 Austria AI in Industrial Machinery Market, by Application (2023-2030) 5.4.7.3 Austria AI in Industrial Machinery Market, by End-use (2023-2030) 5.4.8 Rest of Europe 5.4.8.1 Rest of Europe AI in Industrial Machinery Market, by Components (2023-2030) 5.4.8.2 Rest of Europe AI in Industrial Machinery Market, by Application (2023-2030). 5.4.8.3 Rest of Europe AI in Industrial Machinery Market, by End-use (2023-2030) 6. Asia Pacific AI in Industrial Machinery Market Size and Forecast by Segmentation(Value and Volume) 6.1 Asia Pacific AI in Industrial Machinery Market, by Components (2023-2030) 6.2 Asia Pacific AI in Industrial Machinery Market, by Application (2023-2030) 6.3 Asia Pacific AI in Industrial Machinery Market, by End-use (2023-2030) 6.4 Asia Pacific AI in Industrial Machinery Market, by Country (2023-2030) 6.4.1 China 6.4.1.1 China AI in Industrial Machinery Market, by Components (2023-2030) 6.4.1.2 China AI in Industrial Machinery Market, by Application (2023-2030) 6.4.1.3 China AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.2 South Korea 6.4.2.1 S Korea AI in Industrial Machinery Market, by Components (2023-2030) 6.4.2.2 S Korea AI in Industrial Machinery Market, by Application (2023-2030) 6.4.2.3 S Korea AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.3 Japan 6.4.3.1 Japan AI in Industrial Machinery Market, by Components (2023-2030) 6.4.3.2 Japan AI in Industrial Machinery Market, by Application (2023-2030) 6.4.3.3 Japan AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.4 India 6.4.4.1 India AI in Industrial Machinery Market, by Components (2023-2030) 6.4.4.2 India AI in Industrial Machinery Market, by Application (2023-2030) 6.4.4.3 India AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.5 Australia 6.4.5.1 Australia AI in Industrial Machinery Market, by Components (2023-2030) 6.4.5.2 Australia AI in Industrial Machinery Market, by Application (2023-2030) 6.4.5.3 Australia AI in Industrial Machinery Market, by End-Use (2023-2030) 6.4.6 Indonesia 6.4.6.1 Indonesia AI in Industrial Machinery Market, by Components (2023-2030) 6.4.6.2 Indonesia AI in Industrial Machinery Market, by Application (2023-2030) 6.4.6.3 Indonesia AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.7 Malaysia 6.4.7.1 Malaysia AI in Industrial Machinery Market, by Components (2023-2030) 6.4.7.2 Malaysia AI in Industrial Machinery Market, by Application (2023-2030) 6.4.7.3 Malaysia AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.8 Vietnam 6.4.8.1 Vietnam AI in Industrial Machinery Market, by Components (2023-2030) 6.4.8.2 Vietnam AI in Industrial Machinery Market, by Application (2023-2030) 6.4.8.3 Vietnam AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.9 Taiwan 6.4.9.1 Taiwan AI in Industrial Machinery Market, by Components (2023-2030) 6.4.9.2 Taiwan AI in Industrial Machinery Market, by Application (2023-2030) 6.4.9.3 Taiwan AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.10 Bangladesh 6.4.10.1 Bangladesh AI in Industrial Machinery Market, by Components (2023-2030) 6.4.10.2 Bangladesh AI in Industrial Machinery Market, by Application (2023-2030) 6.4.10.3 Bangladesh AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.11 Pakistan 6.4.11.1 Pakistan AI in Industrial Machinery Market, by Components (2023-2030) 6.4.11.2 Pakistan AI in Industrial Machinery Market, by Application (2023-2030) 6.4.11.3 Pakistan AI in Industrial Machinery Market, by End-use (2023-2030) 6.4.12 Rest of Asia Pacific 6.4.12.1 Rest of Asia Pacific AI in Industrial Machinery Market, by Components (2023-2030) 6.4.12.2 Rest of Asia Pacific AI in Industrial Machinery Market, by Application (2023-2030) 6.4.12.3 Rest of Asia Pacific AI in Industrial Machinery Market, by End-use (2023-2030) 7. Middle East and Africa AI in Industrial Machinery Market Size and Forecast by Segmentation (Value and Volume) 7.1 Middle East and Africa AI in Industrial Machinery Market, by Components (2023-2030) 7.2 Middle East and Africa AI in Industrial Machinery Market, by Application (2023-2030) 7.3 Middle East and Africa AI in Industrial Machinery Market, by End-use (2023-2030) 7.4 Middle East and Africa AI in Industrial Machinery Market, by Country (2023-2030) 7.4.1 South Africa 7.4.1.1 South Africa AI in Industrial Machinery Market, by Components (2023-2030) 7.4.1.2 South Africa AI in Industrial Machinery Market, by Application (2023-2030) 7.4.1.3 South Africa AI in Industrial Machinery Market, by End-use (2023-2030) 7.4.2 GCC 7.4.2.1 GCC AI in Industrial Machinery Market, by Components (2023-2030) 7.4.2.2 GCC AI in Industrial Machinery Market, by Application (2023-2030) 7.4.2.3 GCC AI in Industrial Machinery Market, by End-use (2023-2030) 7.4.3 Egypt 7.4.3.1 Egypt AI in Industrial Machinery Market, by Components (2023-2030) 7.4.3.2 Egypt AI in Industrial Machinery Market, by Application (2023-2030) 7.4.3.3 Egypt AI in Industrial Machinery Market, by End-use (2023-2030) 7.4.4 Nigeria 7.4.4.1 Nigeria AI in Industrial Machinery Market, by Components (2023-2030) 7.4.4.2 Nigeria AI in Industrial Machinery Market, by Application (2023-2030) 7.4.4.3 Nigeria AI in Industrial Machinery Market, by End-use (2023-2030) 7.4.5 Rest of ME&A 7.4.5.1 Rest of ME&A AI in Industrial Machinery Market, by Components (2023-2030) 7.4.5.2 Rest of ME&A AI in Industrial Machinery Market, by Application (2023-2030) 7.4.5.3 Rest of ME&A AI in Industrial Machinery Market, by End-use (2023-2030) 8. South America AI in Industrial Machinery Market Size and Forecast by Segmentation (Value and Volume) 8.1 South America AI in Industrial Machinery Market, by Components (2023-2030) 8.2 South America AI in Industrial Machinery Market, by Application (2023-2030) 8.3 South America AI in Industrial Machinery Market, by End-use (2023-2030) 8.4 South America AI in Industrial Machinery Market, by Country (2023-2030) 8.4.1 Brazil 8.4.1.1 Brazil AI in Industrial Machinery Market, by Components (2023-2030) 8.4.1.2 Brazil AI in Industrial Machinery Market, by Application (2023-2030) 8.4.1.3 Brazil AI in Industrial Machinery Market, by End-use (2023-2030) 8.4.2 Argentina 8.4.2.1 Argentina AI in Industrial Machinery Market, by Components (2023-2030) 8.4.2.2 Argentina AI in Industrial Machinery Market, by Application (2023-2030) 8.4.2.3 Argentina AI in Industrial Machinery Market, by End-use (2023-2030) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America AI in Industrial Machinery Market, by Components (2023-2030) 8.4.3.2 Rest Of South America AI in Industrial Machinery Market, by Application (2023-2030) 8.4.3.3 Rest Of South America AI in Industrial Machinery Market, by End-use (2023-2030) 9. Global AI in Industrial Machinery Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Manufacturing Locations 9.3.6 Production Capacity 9.3.7 Production for 2022 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading AI in Industrial Machinery Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 General Electric Company 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 ABB Ltd. 10.3 Mitsubishi Electric Corporation 10.4 Schneider Electric SE 10.5 Honeywell International Inc. 10.6 Rockwell Automation, Inc. 10.7 Fanuc Corporation 10.8 IBM Corporation 10.9 Microsoft Corporation 10.10 Intel Corporation 10.11 Rockwell Automation 10.12 GE 10.13 Mythic 10.14 VIDIA 10.15 Uptake 10.16 Veo Robotics 10.17 Automation Anywhere 10.18 Machina Labs, Inc. 10.19 Bosch Rexroth AG 10.20 Yaskawa Electric Corporation 10.21 KUKA AG 10.22 FANUC Corporation 10.23 Omron Corporation 10.24 Cognex Corporation 10.25 Intel Corporation 10.26 NVIDIA Corporation 11. Key Findings 12. Industry Recommendations 13. AI in Industrial Machinery Market: Research Methodology 14. Terms and Glossary