Agrifood Technology Market size was valued at USD 25.17 billion in 2024, and the total Global Agrifood Technology Market revenue is expected to grow at a CAGR of 8.1% from 2025 to 2032, reaching nearly USD 46.90 billion.Agrifood Technology Market Overview

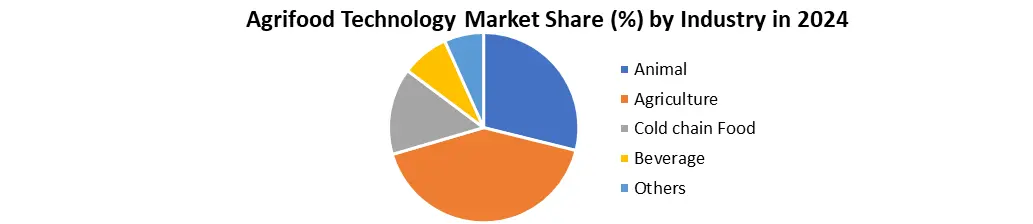

Agrifood technology refers to the application of advanced technologies and innovations in agriculture and food production price chains. Its purpose is to increase productivity, stability and efficiency from farm to thorns. Global agrifood technology market has been undergoing a significant transformation, driven by the integration of innovative technologies like artificial intelligence the Internet of Things, robotics, biotechnology as well as blockchain across the agricultural and food value chain. Technologies are allowing farmers and food producers to improve productivity, optimize resource usage, ensure food safety and promote sustainability. In 2024, the market was valued at approximately USD 19.8 billion and was fuelled by rising global food demand, increasing pressure on natural resources, the urgent need for effective and climate-resilient farming practices. Growth includes the adoption of precision farming, consumer demand for traceable and safe food, labor shortages in agriculture and helpful government policies promoting digital agriculture. The growth of smart farming skills in emerging economies the use of blockchain for endwise food traceability and the growing tendency of vertical and urban farming to meet the food demands of urban populations. The agriculture segment led the market, accounted for around 42% of the market share, due to widespread adoption of smart equipment, sensors and AI-based crop monitoring tools. Europe dominated the global market, supported by a strong technological infrastructure, early adoption of agritech solutions, and the presence of major players. Major Key companies in the market include BASF SE, Yara International ASA, CNH Industrial N.V., John Deere as well as Trimble Inc. firms are central the charge through inventions in digital platforms, autonomous machinery, and precision solutions. The rising demand for maintainable tech-enabled agriculture is expected to continue driving robust market growth.To know about the Research Methodology :- Request Free Sample Report

Agrifood Technology Market Dynamics:

Data-Driven Transformation in Agriculture to Drive the Market Growth Over the past five decades, the agricultural industry has undergone a remarkable evolution. The agrifood technology market is driven by technological advancements in machinery that have revolutionized farming, enabling larger-scale operations and increased productivity. Innovations in seeds, irrigation methods, and fertilizers have further propelled growth and yield improvements. Yet, the agriculture sector finds itself on the brink of yet another transformative phase, driven by the integration of data and connectivity. This new era is marked by the infusion of artificial intelligence, analytics, connected sensors, and emerging technologies, promising to elevate yields, optimize resource utilization, and foster sustainability in crop cultivation and animal management, which increases demand for Agrifood Technology Market. Central to this transition is the necessity for robust connectivity infrastructure increases Agrifood technology market demand. Without it, the potential benefits remain unrealized. Successful implementation of connectivity in agriculture could contribute an estimated $500 billion in additional value to the global gross domestic product by 2030, offering a substantial 7 to 9 per cent enhancement from the projected total. This surge in value creation can improve existing pressures on farmers and emerges as one of seven sectors expected to add $2 trillion to $3 trillion in extra value to the global GDP over the next decade. The convergence of data-driven technologies and connectivity presents a pivotal opportunity to address these challenges head-on. By leveraging advanced tools, agriculture can navigate constraints, optimize resource utilization, and meet the demands of a growing population while safeguarding the environment and meeting evolving consumer preferences. The path forward lies in a seamless integration of technology, connectivity, and sustainable practices to ensure the energy and resilience of the agricultural industry. Precision Farming and Intelligent Food Processing to Boost the Market Growth The growth of the Agrifood Technology Market is driven by the integration of technology across both agricultural practices and food processing. Within agriculture, the adoption of advanced farm management systems and the implementation of smart and precision farming techniques are pivotal. Similarly, in food processing, the shift towards smart food processing is propelled by the incorporation of mechanization and automation. The momentum driving the Agrifood Technology Market forward lies in the evolution towards smart food processing, facilitated by the integration of Advanced Manufacturing technologies, IoT, sensors, and Robotics into food processing operations. This transformation encompasses resource management, processing automation using Robotics, and the implementation of intelligent packaging embedded with sensors for monitoring variables like temperature in food products. The End-Users of these technologies are expansive, covering processes like packaging, palletizing, logistics, and even intricate tasks such as deboning, portioning, and assembling food items like sandwiches and pizzas. Sensors, particularly crucial, assume a central role by monitoring temperatures, ensuring the integrity of the cold chain for frozen goods to increase the Agrifood technology market demand. In the context of food security, technology aligns with objectives such as resilient manufacturing, waste reduction, and the production of safe and compliant goods. Furthermore, technology aids in navigating resource scarcity and significantly contributes to the mitigation of food waste and losses. Technology adoption gains impetus from its capacity to uphold product quality and value. This entails leveraging cost-effective process technologies to sustain and enhance quality and shelf life. Photonics technology, for example, comes into play for optimizing harvesting and monitoring post-harvest treatment, especially within the fruit and vegetable value chain. Beyond this, considerations of nutrition and well-being propel technology uptake tied to product quality. Photonics, once again, proves valuable in enhancing nutritional content and preserving its value. The vigilant monitoring and control of storage temperatures through sensors and IoT are instrumental in this regard. Moreover, technologies like sensors hold significance in ensuring ingredient precision and compositional accuracy to align with specific dietary prerequisites.Agrifood Technology Market Segments

Based on Technology, Biotechnology and Genetic Engineering are expected to dominate the Agrifood Technology Market during the forecast period. Biotechnology empowers farmers with a suite of tools that enhance production efficiency and cost-effectiveness. One notable advancement is the engineering of biotechnology crops with the ability to withstand specific herbicides, streamlining weed control practices. This End-User of biotechnology within agriculture yields benefits that span farmers, producers, and consumers alike, fostering a safer and more productive ecosystem. Insect pest control and weed management have both witnessed significant improvements through biotechnology interventions. For Example, genetically modified insect-resistant cotton has precipitated a substantial reduction in the reliance on persistent synthetic pesticides. This shift not only safeguards groundwater and the environment from contamination but also curtails the risk associated with pesticide usage. Similarly, herbicide-tolerant soybeans, cotton, and corn have paved the way for the utilization of reduced-risk herbicides that swiftly degrade in soil, posing no harm to wildlife or humans. These crops are particularly compatible with conservation-focused agricultural systems like no-till or reduced tillage, which play a pivotal role in preserving topsoil integrity against erosion. Agricultural biotechnology's impact extends to safeguarding crops against menacing diseases. For example, the advent of genetically engineered papayas resistant to the papaya ringspot virus averted a crisis in the Hawaiian papaya industry. This remarkable feat not only rescued the industry but also served as a testament to biotechnology's potential in overcoming complex challenges. Similar research endeavours continue for crops like potatoes, squash, and tomatoes, intending to confer resistance to viral diseases that traditionally pose formidable control hurdles. Based on Industry, the market is segmented into Animal, Agriculture, Cold Chain Food and Beverage, Others. The agriculture segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Inspired by rapid adopting accurate agriculture, IOT-based smart farming and AI-managed crop management systems. In both developed and developing sectors, farmers and agricultural businesses are rapidly investing in advanced technologies to improve crop yields, resource efficiency and stability. Increased global food demand, climate change and lack of labor have intensified changes towards automation and data-operated farming practices. Technologies such as drones, GPS-directed tractors, remote sensors and digital farm management platforms have become integral in modern agriculture, which are capable of making real-time monitoring and future decisions. In addition, the increasing awareness of assistant government policies, agricultural-technical subsidies, and environmental stability further enhanced the development of this segment. Companies like John Dere, CNH Industrial and BASF SE have played an important role in furthering agricultural innovations through smart equipment, digital equipment and organic crop protection. The agricultural section has become the backbone of the Agricultural Technology Ecosystem, making it a leading contribution in market development in 2024.

Agrifood Technology Market Regional Analysis

Europe is expected to dominate the Agrifood Technology Market during the forecast period. In the European Agrifood Technology Market, an examination of technological advancements can be facilitated through the analysis of patenting activities specific to various sectors. To achieve this, a regional assessment of the Agrifood Technology market was conducted, focusing on the agri-food Technology Industry. This analysis involved the selection of patents within the domains of food, agriculture, and bioeconomy, utilizing a classification framework developed by Fraunhofer ISI et al. in 2016. This classification system provides a structured approach for categorizing patents within the realms of food, agriculture, and bioeconomy, enabling the identification of patents and patent areas using the International Patent Codes (IPC codes) that pertain to the sector's advancements. This method allows for a comprehensive representation of patenting activities within the agri-food sector at both the European Union (EU) and global levels, facilitating the observation of trends in distribution and developmental trajectories within this sector. Notably, in the year 2017, patent leadership in the agri-food Technology Market domain was exhibited by Germany, France, and the Netherlands. When considering the Europe Agrifood Technology Market perspective, the highest proportion of agri-food-related patents within the global patent landscape was attributed to Germany, followed by France, the Netherlands, Italy, and Belgium. This graphical representation reaffirms the dominant role of Germany in acquiring patents within the agri-food sector. It is also pertinent to acknowledge the robust research positioning of the Netherlands in the agri-food landscape. In the realm of European Agri-FoodTech startups, an impressive $3.4 billion in funding was secured across 419 deals during the year 2023, signifying a remarkable year-over-year growth of 70%. With approximately 93 billion euros in annual global agri-food sales, Nestlé is the top agri-food firm in Europe. The other top three businesses are Danone, Unilever, and Ferrero, each of which has worldwide agri-food revenues above 30 billion euros. All of these businesses are multinational companies with operations in various countries. They create a vast variety of dairy products, packaged meals, drinks, and confections, among other food and drink items. With 10% of the EU's GDP coming from the agri-food industry, Europe is one of the world's most prosperous regions. These industry leaders contribute significantly to the sector by creating employment and money. Additionally, they make investments in R&D, which helps to maintain the agri-food industry's competitiveness in the world Agrifood Technology Market. Agrifood Technology Market Competitive Landscape Major key players like BASF SE, Yara International ASA, and CNH Industrial N.V. form the backbone of the agrifood technology market. BASF SE is an international leader in crop protection, digital farming as well as agricultural biotechnology. In 2024, the Agricultural Solutions segment generated almost USD 9.3 billion, accounting for around 8.5% of the global agrifood technology market. BASF continues to invest heavily in R&D over 900 million to advance sustainable farming through its Xarvio Digital Farming Solutions. Yara International ASA focuses on crop nutrition and digital precision agriculture. Revenue is nearly USD 18.6 billion in 2024 and a 6.2% market share. Yara is a pioneer in platforms such as Atfarm and FarmWeather, helping farmers optimize fertilizer use while reducing environmental impact. CNH Industrial N.V. dominates the smart agricultural machinery segment. Through brands such as Case IH and New Holland, CNH is focused on autonomous tractors, AI-based machinery, as well as precision equipment, pushing the limits of connected and automated farming. These players knowingly inspire global agri-efficiency and sustainability. Agrifood Technology Market Trends

Trends Description AI & Machine Learning Integration Used for predictive analytics, yield forecasting, and crop health monitoring. IoT-Enabled Smart Farming Sensors, drones, and GPS for real-time field monitoring and data collection. Blockchain in Food Traceability Ensures transparency in the food supply chain from farm to table. Agrifood Technology Key Development

• In 12 March 2024 BASF SE Europe (Germany) Launched the Xarvio FIELD MANAGER 2024 update, enhancing AI-driven crop optimization features. • In 8 January 2024 Yara International ASA (Europe) Announced a strategic partnership with IBM to integrate AI into its Atfarm platform. • In 15 February 2024 Corteva Agriscience (North America) Acquired Biotalys’ biofungicide platform, expanding into sustainable crop protection. • In 19 June 2024 XAG Co., Ltd. (Asia-Pacific) Released XAG P150 Pro drone, offering automated seeding and pesticide spraying features. • In 28 April 2024 John Deere (North America) Introduced precision sprayer with See & Spray™ technology, targeting individual weeds using AI.Agrifood Technology Market Scope: Inquire before buying

Agrifood Technology Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 25.17 Bn. Forecast Period 2025 to 2032 CAGR: 8.1% Market Size in 2032: USD 46.9 Bn. Segments Covered: by Industry Animal Agriculture Cold Chain Food and Beverage Others by Technology Internet of Things (IoT) and Sensors Artificial Intelligence (AI) and Machine Learning Robotics and Automation Biotechnology and Genetic Engineering Blockchain and Traceability Data Analytics and Farm Management Software Vertical Farming Systems by End Users Farmers and Growers Food Manufacturer Distributors and Retailers Agrifood Technology Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Agrifood Technology Market Key Players are:

North America 1. Corteva Agriscience (USA) 2. John Deere (USA) 3. Trimble Inc. (USA) 4. Indigo Agriculture (USA) 5. AGCO Corporation (USA) Europe 6. BASF SE (Germany) 7. Yara International ASA (Norway) 8. CNH Industrial N.V. (UK/Italy) 9. DeLaval (Sweden) 10. Ag Leader Technology (UK) Asia-Pacific 11. Kubota Corporation (Japan) 12. Taranis (Israel) 13. Mahindra & Mahindra (India) 14. Raven Industries (subsidiary of CNH) (India) 15. XAG Co., Ltd. (China) South America 16. Raízen (Brazil) 17. Grupo Los Grobo (Argentina) 18. Solinftec (Brazil) 19. Jacto (Brazil) 20. Aegro (Brazil) Middle East & Africa 21. Aerobotics (South Africa) 22. AgriEdge (UAE) 23. Twiga Foods (Kenya) 24. Farmcrowdy (Nigeria) 25. Zenvus (Nigeria)Frequently Asked Question

1: What was the value of the Agrifood Technology Market in 2024? Ans: The market was valued at USD 25.17 Billion in 2024. 2: Which region dominated the Agrifood Technology Market in 2024? Ans: Europe dominated due to strong tech infrastructure and early agritech adoption. 3: Which industry segment led the market in 2024? Ans: The agriculture segment led with about 42% market share. 4: What major technology is used for food traceability? Ans: Blockchain ensures transparency in the food supply chain. 5: Which company launched the updated Xarvio FIELD MANAGER in March 2024? Ans: BASF SE launched the updated Xarvio FIELD MANAGER.

1. Agrifood Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Agrifood Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Technology Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Agrifood Market: Dynamics 3.1. Region wise Trends of Agrifood Market 3.1.1. North America Agrifood Market Trends 3.1.2. Europe Agrifood Market Trends 3.1.3. Asia Pacific Agrifood Market Trends 3.1.4. Middle East and Africa Agrifood Market Trends 3.1.5. South America Agrifood Market Trends 3.2. Agrifood Market Dynamics 3.2.1. Global Agrifood Market Drivers 3.2.1.1. Demand for Supply Chain Transparency 3.2.1.2. Government Agri-Tech Support 3.2.1.3. Precision Farming Adoption 3.2.2. Global Agrifood Market Restraints 3.2.3. Global Agrifood Market Opportunities 3.2.3.1. Agritech Startups Funding 3.2.3.2. Expansion in Emerging Economies 3.2.4. Global Agrifood Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Global satellite policy shifts 3.4.2. Location-based service demand 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Agrifood Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Agrifood Market Size and Forecast, By Industry (2024-2032) 4.1.1. Animal 4.1.2. Agriculture 4.1.3. Cold Chain 4.1.4. Food and Beverage 4.1.5. Others 4.2. Agrifood Market Size and Forecast, By Technology (2024-2032) 4.2.1. Internet of Things (IoT) and Sensors 4.2.2. Artificial Intelligence (AI) and Machine Learning 4.2.3. Robotics and Automation 4.2.4. Biotechnology and Genetic Engineering 4.2.5. Blockchain and Traceability 4.2.6. Data Analytics and Farm Management Software 4.2.7. Vertical Farming Systems 4.3. Agrifood Market Size and Forecast, By End-User (2024-2032) 4.3.1. Farmers and Growers 4.3.2. Food Manufacturer 4.3.3. Distributors and Retailers 4.4. Agrifood Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Agrifood Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Agrifood Market Size and Forecast, By Industry (2024-2032) 5.1.1. Animal 5.1.2. Agriculture 5.1.3. Cold Chain 5.1.4. Food and Beverage 5.1.5. Others 5.2. North America Agrifood Market Size and Forecast, By Technology (2024-2032) 5.2.1. Internet of Things (IoT) and Sensors 5.2.2. Artificial Intelligence (AI) and Machine Learning 5.2.3. Robotics and Automation 5.2.4. Biotechnology and Genetic Engineering 5.2.5. Blockchain and Traceability 5.2.6. Data Analytics and Farm Management Software 5.2.7. Vertical Farming Systems 5.3. North America Agrifood Market Size and Forecast, By End-User (2024-2032) 5.3.1. Farmers and Growers 5.3.2. Food Manufacturer 5.3.3. Distributors and Retailers 5.4. North America Agrifood Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Agrifood Market Size and Forecast, By Industry (2024-2032) 5.4.1.1.1. Animal 5.4.1.1.2. Agriculture 5.4.1.1.3. Cold Chain 5.4.1.1.4. Food and Beverage 5.4.1.1.5. Others 5.4.1.2. United States Agrifood Market Size and Forecast, By Technology (2024-2032) 5.4.1.2.1. Internet of Things (IoT) and Sensors 5.4.1.2.2. Artificial Intelligence (AI) and Machine Learning 5.4.1.2.3. Robotics and Automation 5.4.1.2.4. Biotechnology and Genetic Engineering 5.4.1.2.5. Blockchain and Traceability 5.4.1.2.6. Data Analytics and Farm Management Software 5.4.1.2.7. Vertical Farming Systems 5.4.1.3. United States Agrifood Market Size and Forecast, By End-User (2024-2032) 5.4.1.3.1. Farmers and Growers 5.4.1.3.2. Food Manufacturer 5.4.1.3.3. Distributors and Retailers 5.4.2. Canada 5.4.2.1. Canada Agrifood Market Size and Forecast, By Industry (2024-2032) 5.4.2.1.1. Animal 5.4.2.1.2. Agriculture 5.4.2.1.3. Cold Chain 5.4.2.1.4. Food and Beverage 5.4.2.1.5. Others 5.4.2.2. Canada Agrifood Market Size and Forecast, By Technology (2024-2032) 5.4.2.2.1. Internet of Things (IoT) and Sensors 5.4.2.2.2. Artificial Intelligence (AI) and Machine Learning 5.4.2.2.3. Robotics and Automation 5.4.2.2.4. Biotechnology and Genetic Engineering 5.4.2.2.5. Blockchain and Traceability 5.4.2.2.6. Data Analytics and Farm Management Software 5.4.2.2.7. Vertical Farming Systems 5.4.2.3. Canada Agrifood Market Size and Forecast, By End-User (2024-2032) 5.4.2.3.1. Farmers and Growers 5.4.2.3.2. Food Manufacturer 5.4.2.3.3. Distributors and Retailers 5.4.2.4. Mexico Agrifood Market Size and Forecast, By Industry (2024-2032) 5.4.2.4.1. Animal 5.4.2.4.2. Agriculture 5.4.2.4.3. Cold Chain 5.4.2.4.4. Food and Beverage 5.4.2.4.5. Others 5.4.2.5. Mexico Agrifood Market Size and Forecast, By Technology (2024-2032) 5.4.2.5.1. Internet of Things (IoT) and Sensors 5.4.2.5.2. Artificial Intelligence (AI) and Machine Learning 5.4.2.5.3. Robotics and Automation 5.4.2.5.4. Biotechnology and Genetic Engineering 5.4.2.5.5. Blockchain and Traceability 5.4.2.5.6. Data Analytics and Farm Management Software 5.4.2.5.7. Vertical Farming Systems 5.4.2.6. Mexico Agrifood Market Size and Forecast, By End-User (2024-2032) 5.4.2.6.1. Farmers and Growers 5.4.2.6.2. Food Manufacturer 5.4.2.6.3. Distributors and Retailers 6. Europe Agrifood Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Agrifood Market Size and Forecast, By Industry (2024-2032) 6.2. Europe Agrifood Market Size and Forecast, By Technology (2024-2032) 6.3. Europe Agrifood Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Agrifood Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Agrifood Market Size and Forecast, By Industry (2024-2032) 6.4.1.2. United Kingdom Agrifood Market Size and Forecast, By Technology (2024-2032) 6.4.1.3. United Kingdom Agrifood Market Size and Forecast, By End-User (2024-2032) 6.4.2. France 6.4.2.1. France Agrifood Market Size and Forecast, By Industry (2024-2032) 6.4.2.2. France Agrifood Market Size and Forecast, By Technology (2024-2032) 6.4.2.3. France Agrifood Market Size and Forecast, By End-User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Agrifood Market Size and Forecast, By Industry (2024-2032) 6.4.3.2. Germany Agrifood Market Size and Forecast, By Technology (2024-2032) 6.4.3.3. Germany Agrifood Market Size and Forecast, By End-User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Agrifood Market Size and Forecast, By Industry (2024-2032) 6.4.4.2. Italy Agrifood Market Size and Forecast, By Technology (2024-2032) 6.4.4.3. Italy Agrifood Market Size and Forecast, By End-User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Agrifood Market Size and Forecast, By Industry (2024-2032) 6.4.5.2. Spain Agrifood Market Size and Forecast, By Technology (2024-2032) 6.4.5.3. Spain Agrifood Market Size and Forecast, By End-User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Agrifood Market Size and Forecast, By Industry (2024-2032) 6.4.6.2. Sweden Agrifood Market Size and Forecast, By Technology (2024-2032) 6.4.6.3. Sweden Agrifood Market Size and Forecast, By End-User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Agrifood Market Size and Forecast, By Industry (2024-2032) 6.4.7.2. Austria Agrifood Market Size and Forecast, By Technology (2024-2032) 6.4.7.3. Austria Agrifood Market Size and Forecast, By End-User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Agrifood Market Size and Forecast, By Industry (2024-2032) 6.4.8.2. Rest of Europe Agrifood Market Size and Forecast, By Technology (2024-2032) 6.4.8.3. Rest of Europe Agrifood Market Size and Forecast, By End-User (2024-2032) 7. Asia Pacific Agrifood Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Agrifood Market Size and Forecast, By Industry (2024-2032) 7.2. Asia Pacific Agrifood Market Size and Forecast, By Technology (2024-2032) 7.3. Asia Pacific Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Agrifood Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.1.2. China Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.1.3. China Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.2.2. S Korea Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.2.3. S Korea Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.3.2. Japan Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.3.3. Japan Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.4. India 7.4.4.1. India Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.4.2. India Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.4.3. India Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.5.2. Australia Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.5.3. Australia Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.6.2. Indonesia Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.6.3. Indonesia Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.7.2. Philippines Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.7.3. Philippines Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.8.2. Malaysia Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.8.3. Malaysia Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.9.2. Vietnam Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.9.3. Vietnam Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.10.2. Thailand Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.10.3. Thailand Agrifood Market Size and Forecast, By End-User (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Agrifood Market Size and Forecast, By Industry (2024-2032) 7.4.11.2. Rest of Asia Pacific Agrifood Market Size and Forecast, By Technology (2024-2032) 7.4.11.3. Rest of Asia Pacific Agrifood Market Size and Forecast, By End-User (2024-2032) 8. Middle East and Africa Agrifood Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Agrifood Market Size and Forecast, By Industry (2024-2032) 8.2. Middle East and Africa Agrifood Market Size and Forecast, By Technology (2024-2032) 8.3. Middle East and Africa Agrifood Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Agrifood Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Agrifood Market Size and Forecast, By Industry (2024-2032) 8.4.1.2. South Africa Agrifood Market Size and Forecast, By Technology (2024-2032) 8.4.1.3. South Africa Agrifood Market Size and Forecast, By End-User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Agrifood Market Size and Forecast, By Industry (2024-2032) 8.4.2.2. GCC Agrifood Market Size and Forecast, By Technology (2024-2032) 8.4.2.3. GCC Agrifood Market Size and Forecast, By End-User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Agrifood Market Size and Forecast, By Industry (2024-2032) 8.4.3.2. Nigeria Agrifood Market Size and Forecast, By Technology (2024-2032) 8.4.3.3. Nigeria Agrifood Market Size and Forecast, By End-User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Agrifood Market Size and Forecast, By Industry (2024-2032) 8.4.4.2. Rest of ME&A Agrifood Market Size and Forecast, By Technology (2024-2032) 8.4.4.3. Rest of ME&A Agrifood Market Size and Forecast, By End-User (2024-2032) 9. South America Agrifood Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Agrifood Market Size and Forecast, By Industry (2024-2032) 9.2. South America Agrifood Market Size and Forecast, By Technology (2024-2032) 9.3. South America Agrifood Market Size and Forecast, By End-User (2024-2032) 9.4. South America Agrifood Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Agrifood Market Size and Forecast, By Industry (2024-2032) 9.4.1.2. Brazil Agrifood Market Size and Forecast, By Technology (2024-2032) 9.4.1.3. Brazil Agrifood Market Size and Forecast, By End-User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Agrifood Market Size and Forecast, By Industry (2024-2032) 9.4.2.2. Argentina Agrifood Market Size and Forecast, By Technology (2024-2032) 9.4.2.3. Argentina Agrifood Market Size and Forecast, By End-User (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Agrifood Market Size and Forecast, By Industry (2024-2032) 9.4.3.2. Rest of South America Agrifood Market Size and Forecast, By Technology (2024-2032) 9.4.3.3. Rest of South America Agrifood Market Size and Forecast, By End-User (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Corteva Agriscience (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. John Deere (USA) 10.3. Trimble Inc. (USA) 10.4. Indigo Agriculture (USA) 10.5. AGCO Corporation (USA) 10.6. BASF SE (Germany) 10.7. Yara International ASA (Norway) 10.8. CNH Industrial N.V. (UK/Italy) 10.9. DeLaval (Sweden) 10.10. Ag Leader Technology (UK) 10.11. Kubota Corporation (Japan) 10.12. Taranis (Israel) 10.13. Mahindra & Mahindra (India) 10.14. Raven Industries (subsidiary of CNH) (India) 10.15. XAG Co., Ltd. (China) 10.16. Raízen (Brazil) 10.17. Grupo Los Grobo (Argentina) 10.18. Solinftec (Brazil) 10.19. Jacto (Brazil) 10.20. Aegro (Brazil) 10.21. Aerobotics (South Africa) 10.22. AgriEdge (UAE) 10.23. Twiga Foods (Kenya) 10.24. Farmcrowdy (Nigeria) 10.25. Zenvus (Nigeria) 11. Key Findings 12. Analyst Recommendations 13. Agrifood Technology Market: Research Methodology