Zonisamide Market was valued at US$ 353.26 Mn. in 2022. Global Zonisamide Market size is expected to grow at a CAGR of 3.9 % through the forecast period.Zonisamide Market Overview:

Zonisamide inhibits seizure through multiple mechanisms of action Epilepsy is a chronic non-communicable brain disease that affects people of all ages. About 50 million people in the world suffer from epilepsy and making it one of the most common neurological disorders in the world. About 80% of epilepsy patients live in low- and middle-income countries. It is estimated that up to 70% of epilepsy patients can lead a seizure-free life with proper diagnosis and treatment. Parkinson’s disease therapeutic market of valued at US$ 4.69 Bn in 2021 and it will reach US$ 6.73 Bn by 2027. The Parkinson's disease therapeutics market is expected to grow at a CAGR of 6.2%%through the forecast period. Zonisamide was originally discovered and developed by Dainippon Pharmaceutical. Zonisamide comes under the Gabapentin category. Gabapentin Market was valued at US$ 1.51 Bn in 2021. Gabapentin Market size is expected to grow at a CAGR of 1.7 % through the forecast period. On 3 January 2000 Zonisamide got FDA approval.To know about the Research Methodology :- Request Free Sample Report 2022 is considered as a base year to forecast the market from 2023 to 2029. 2022’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years' trends are considered while forecasting the market through 2029. 2020 is a year of exception and analysis, especially with the impact of lockdown by region.

Zonisamide Market Dynamics:

Zonisamide Market Drivers: 1) The increase in epilepsy cases will drive the market: Epilepsy is one of the most common neurological disorders in the world. Presently, around 50 million patients are living with epilepsy world and about 2.4 million new cases are diagnosed annually. Moreover, the majority of epileptic cases are idiopathic, with no identifiable cause. At present, only symptomatic treatment through medication, surgery, and implantable devices are available, but there is no cure for epilepsy. This underscores the need for untapped markets for better therapies that offer favorable growth opportunities for players in the market. 2) Effective results of the Second generation of antiepileptic drugs: Second-generation antiepileptic drugs are a segment of drugs that are expected to hold a large market share during the forecast period. Zonisamide is a second-generation drug. Second-generation antiepileptic drugs are expected to retain the largest market share due to several important benefits, including reduced drug interactions, reduced life-threatening side effects, and reduced adverse cognitive function. 3) Rise of geriatric population: The increasing prevalence of stroke, dementia, and brain tumor cases in the geriatric population because increasing incidences of epilepsy. About 25% of new epilepsy cases occur in the elderly. The percentage is expected to rise to 50% through the forecast period. The total population of persons over 65 age was around 715 million and it is expected to reach around 1.5 Bn population through the forecast period. East and Southeast Asia have most persons with age over 65. The population of persons with age over 65 is around 261 million in East and Southeast Asia.Zonisamide Market Restraints:

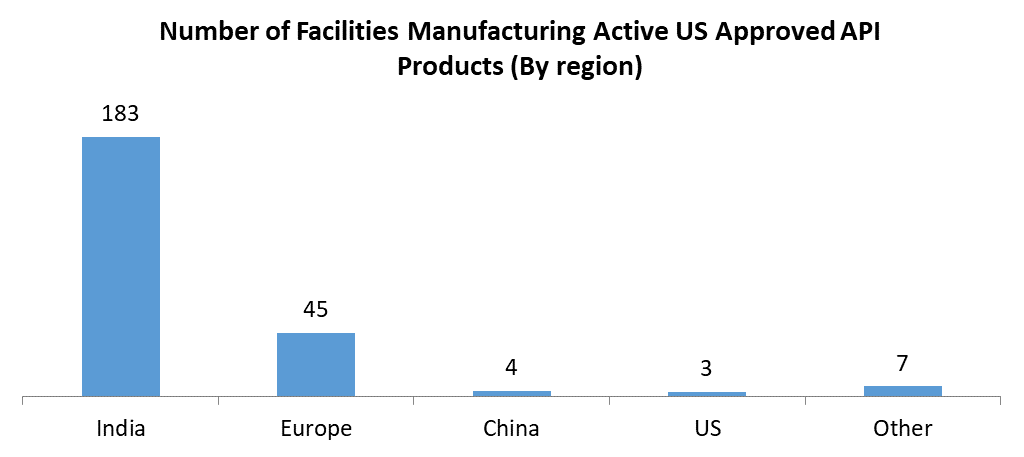

Despite the increasing incidence of epilepsy, seizures, and other chronic illnesses in emerging markets, certain factors are limiting the growth of the Zonisamide market. One of the main impediments to market growth is the sharp increase in drug supply shortages. Patients are storing these medicines because of the shortage of medicines in pharmacies. This is alarming all over the world when investigating the supply chain of medicines. Around 80% of APIs which are used in the manufacturing of essential medicines in the US have no manufacturing facilities within the country. US is heavily dependent on India and China for Crucial APIs Out of 342 manufacturing facilities that are manufacturing US-approved API products, half of them are based in India. India accounts for around 65% of the market share for US-approved API products.

Zonisamide Market Segment Analysis:

Based on Strength, the Zonisamide Market is segmented into 25 mg, 50 mg, and 100 mg. 50 mg tablet dominates the market segment. The average dose of zonisamide is 100mg.50 mg is prescribed twice a day or 100 mg once a day. In pediatrics, the common dosage is 2mg/kg. Which the physicians prescribe the drug to the patients. 50 mg tablet is well suited and well tolerated by the patients and it is also preferred by the physicians while prescribing. Based on the Application, the Zonisamide Market is segmented into Adult, Pediatric, and Geriatric. The geriatric segment is dominating the market and it is expected to grow fast through the forecast period. With increasing age, the prevalence and incidence of epilepsy and seizures increase accordingly. New-onset epilepsy in the elderly often has underlying etiologies such as cerebrovascular disease, primary neurodegenerative disease, intracerebral tumors, and traumatic brain injury. In addition, acute symptomatic seizures cannot be classified as epilepsy. Epilepsy usually manifests itself in the elderly as a common symptom secondary to metabolic or toxic factors. The pediatric segment shows moderate growth in the Zonisamide market. About 0.7% of children aged between 0 to 17 years have active epilepsy.Zonisamide Market Regional Insights:

North America Segment is dominated the Zonisamide market with 30% share in 2022. This is because of the increasing number of epileptic patients in the North America region. Around 3 million people in North America are suffering from Epilepsy. The antiepileptic drug Market in North America was valued at US$ 7.97 Bn in 2021. North America dominates the epilepsy treatment market with a favorable government initiative to improve the healthcare system, a well-developed healthcare infrastructure, and increased extensive R & D activities in the region. The Asia Pacific region is expected to grow during the forecasted period especially due to increased government funding and support to improve treatment facilities in emerging markets and increased disposable income for people in the region. India's pharmaceutical exports were US $ 24.44 billion in FY 2021. India is the 12th largest pharmaceutical exporter in the world. The national pharmaceutical sector accounts for 6.6% of total commodity exports. FDI inflows into India's pharmaceutical and pharmaceutical sector reached US $ 1.26 in 2021. India is the world's largest supplier of generics. The Indian pharmaceutical sector supplies more than 50% of the global demand for various vaccines, 40% of the US generic drug demand, and 25% of the UK's total drug demand. In the world, India ranks third in pharmaceutical production and 14th in value. The domestic pharmaceutical industry includes a network of 3,000 pharmaceutical companies and approximately 10,500 production units. In 2021, the Government of India announced that 13 major sector pharmaceutical PLI programs, including active ingredients, pharmaceutical intermediates, and major starting materials, will be allocated 197,000 rupees (the US $ 26,578.3 million) during the forecast period. South America, the Middle East, and Africa markets are currently in their early stages. However, the development of medical infrastructure and the increased prevalence of epilepsy disease in these regions are expected to drive demand in the Zonisamide market during the forecast period. The objective of the report is to present a comprehensive analysis of the global Zonisamide Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Zonisamide Market dynamic, structure by analyzing the market segments and projecting the Zonisamide Market size. Clear representation of competitive analysis of key players by Strength, price, financial position, product portfolio, growth strategies, and regional presence in the Zonisamide Market make the report investor’s guide.Zonisamide Market Scope: Inquiry Before Buying

Zonisamide Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 353.26 Mn. Forecast Period 2023 to 2029 CAGR: 3.9% Market Size in 2029: US$ 461.74 Mn. Segments Covered: by Strength 25 mg 50 mg 100 mg by Application Adult Pediatric Geriatric Zonisamide Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South AmericaZonisamide Market Key Players

1. Concordia 2. Eisai 3. Zydus Pharmaceuticals 4. Sun Pharma 5. Wockhardt 6. Mylan 7. APOTEX 8. Teva 9. Glenmark 10. Bluepharma 11. Invagen Pharmaceuticals 12. Intas Pharmaceuticals Frequently Asked Questions: 1] What segments are covered in the Global Zonisamide Market report? Ans. The segments covered in the Zonisamide Market report are based on Strength Application and Region. 2] Which region is expected to hold the highest share in the Global Zonisamide Market? Ans. The North America region is expected to hold the highest share in the Zonisamide Market. 3] What is the market size of the Global Zonisamide Market by 2029? Ans. The market size of the Zonisamide Market by 2029 is expected to reach US$ 461.74 Mn. 4] What is the forecast period for the Global Zonisamide Market? Ans. The forecast period for the Zonisamide Market is 2023-2029. 5] What was the market size of the Global Zonisamide Market in 2022? Ans. The market size of the Zonisamide Market in 2022 was valued at US$ 353.26 Mn.

1. Global Zonisamide Market Size: Research Methodology 2. Global Zonisamide Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Zonisamide Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Zonisamide Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Zonisamide Market Size Segmentation 4.1. Global Zonisamide Market Size, by Strength (2022-2029) • 25 mg • 50 mg • 100 mg 4.2. Global Zonisamide Market Size, by Application (2022-2029) • Adult • Pediatric • Geriatric 5. North America Zonisamide Market (2022-2029) 5.1. North America Zonisamide Market Size, by Strength (2022-2029) • 25 mg • 50 mg • 100 mg 5.2. North America Zonisamide Market Size, by Application (2022-2029) • Adult • Pediatric • Geriatric 5.3. North America Zonisamide Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Zonisamide Market (2022-2029) 6.1. European Zonisamide Market, by Strength (2022-2029) 6.2. European Zonisamide Market, by Application (2022-2029) 6.3. European Zonisamide Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Zonisamide Market (2022-2029) 7.1. Asia Pacific Zonisamide Market, by Strength (2022-2029) 7.2. Asia Pacific Zonisamide Market, by Application (2022-2029) 7.3. Asia Pacific Zonisamide Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Zonisamide Market (2022-2029) 8.1. Middle East and Africa Zonisamide Market, by Strength (2022-2029) 8.2. Middle East and Africa Zonisamide Market, by Application (2022-2029) 8.3. Middle East and Africa Zonisamide Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Zonisamide Market (2022-2029) 9.1. South America Zonisamide Market, by Strength (2022-2029) 9.2. South America Zonisamide Market, by Application (2022-2029) 9.3. South America Zonisamide Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Concordia 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Eisai 10.3. Zydus Pharmaceuticals 10.4. Sun Pharma 10.5. Wockhardt 10.6. Mylan 10.7. APOTEX 10.8. Teva 10.9. Glenmark 10.10. Bluepharma 10.11. Invagen Pharmaceuticals 10.12. Intas Pharmaceuticals