Global Wireless Charging Market size was valued at USD 29.20 Bn in 2023 and is expected to reach USD 147.25 Bn by 2030, at a CAGR of 26 %.Wireless Charging Market Overview

Wireless charging, a revolutionary technology, has transformed how we power electronic devices. It operates on the principles of electromagnetic induction, transferring electrical energy from a transmitter to a receiver without the requirement for physical connections. The transmitter coil generates an alternating magnetic field when supplied with electrical current, which is captured and converted back into electrical current by the receiver coil within the target device. This technology has found applications across various sectors, making it versatile and adaptable. In the realm of consumer electronics, wireless charging is particularly related to smartphones, smartwatches and wireless earbuds. Many modern smartphones come equipped with wireless charging capabilities, while charging pads and stands have become pervasive, streamlining the charging process. Beyond consumer electronics, wireless charging has made substantial inroads into the electric vehicle (EV) industry. The incorporation of wireless charging in EVs offers a convenient and user-friendly alternative to traditional plug-in charging, which is especially valuable for autonomous vehicles and commercial EV fleets. Healthcare is the sector that benefits from wireless charging, particularly for medical devices such as hearing aids and implantable devices, excluding the need for invasive battery replacement procedures. Industrial automation relies on wireless charging to power sensors and monitoring devices, improving operational efficiency and reducing maintenance costs. In the setting of the Internet of Things (IoT) and smart home applications, wireless charging ensures continuous power for devices including sensors, cameras, and smart home products, eliminating the requirement for manual battery replacements. Even furniture and public infrastructure, including tables, desks, roads, and parking lots, are integrating wireless charging, paving the way for convenient urban planning for electric vehicle charging. Several factors are driving the wireless charging market's growth, including the increasing adoption of electric vehicles (EVs) and the expansion of the Internet of Things (IoT). User demand for convenience and the technology's safety and efficiency focus further fuel market adoption. While the wireless charging market is on a growth trajectory, several challenges must be addressed to unlock its full potential. Standardization, efficiency improvement, cost reduction, and regulatory frameworks are key areas of concern. The future of wireless charging holds promise, with dynamic wireless charging for EVs, material advancements, and its integration into smart cities transforming the way we power our devices and interact with our environments. As technology continues to evolve, wireless charging's role in diverse industries and sectors is set to expand, making it an integral part of our daily lives.To know about the Research Methodology :- Request Free Sample Report

Wireless Charging Market Dynamics

Integration of Electric Vehicles (EVs) to Boost Wireless Charging Market One of the key contests for widespread EV adoption has been the perceived inconvenience of recharging. Traditional plug-in charging needs drivers to actively connect their EVs to a charging station, which is a cumbersome process, especially in inclement weather. Wireless charging eliminates this inconvenience by enabling EV owners to simply park their vehicles over a charging pad. This seamless experience is a unique selling point, making EVs more appealing to consumers and facilitating broader market penetration. In urban environments, where EV charging infrastructure has been limited, wireless charging offers a practical solution. Street-level wireless charging infrastructure, such as embedded charging pads in roads or parking spaces, supports EVs in densely populated areas where traditional charging stations have not been readily available. This technology promotes EV adoption in cities, reduces range anxiety and supports urban planning for cleaner transportation which boosts Wireless Charging Market growth. As autonomous vehicles become more prevalent, wireless charging has been seamlessly integrated into the infrastructure to support self-driving EVs. Autonomous EVs have parked themselves over wireless charging pads, ensuring they are always charged and ready for service, which is vital for ride-sharing and autonomous taxi fleets. Dynamic wireless charging, which enables EVs to charge while in motion, holds tremendous promise. This technology has been extending the driving range of EVs significantly, making long-distance travel more practical. Dynamic charging is particularly relevant for commercial electric vehicles such as buses and trucks, further expanding the potential market for wireless charging solutions. Proliferation of the Internet of Things (IoT) to Boost Wireless Charging Market Growth As the IoT ecosystem expands, more IoT devices are deployed across several industries and applications. These devices include sensors, smart appliances, industrial equipment and wearable technology, among others. The sheer volume of these devices contributes to the overall IoT market growth. IoT devices find applications in a broad range of sectors such as healthcare, agriculture, manufacturing, smart cities and transportation. The diverse use cases attract new players and investments, fuelling the proliferation of IoT technologies. IoT devices offer economic and operational advantages. For businesses, they provide data-driven insights, optimize processes, reduce costs and enhance efficiency. This appeal encourages more organizations to adopt IoT solutions, leading to further proliferation. Ongoing technological advancements including improvements in sensor technology, connectivity and data analytics, make IoT devices more powerful and capable. As technology evolves, it enables the development of new and more sophisticated IoT applications that drive the Wireless Charging Market growth. The growth of the IoT demands the expansion and enhancement of network infrastructure such as 5G and low-power wide-area networks (LPWAN). These network enhancements facilitate the connectivity and data exchange required for IoT devices to operate effectively. The development of regulatory frameworks and industry standards helps create a favorable environment for IoT growth. Standards ensure interoperability and data security, introducing confidence in adopting IoT solutions.Wireless Charging Market Trend

Advanced Materials Revolutionizing Wireless Charging Efficiency and Performance GaN and SiC materials are revolutionizing wireless charging by substantially improving energy transfer efficiency. Compared with traditional materials, GaN and SiC components generate less heat and offer minimal energy loss during the charging process. This results in faster and more efficient charging, a key factor in the consumer electronics sector where users demand quick and hassle-free power replenishment. The incorporation of GaN and SiC materials enables the development of smaller and more compact wireless charging systems. These materials possess exceptional power density, allowing for the creation of sleek and portable charging devices. This trend is especially advantageous for consumer electronics, as it leads to more compact and travel-friendly chargers. Gallium Nitride (GaN) and Silicon Carbide (SiC) materials have emerged as game-changers in the wireless power transfer market, ushering in a new era of efficient and rapid charging across a wide spectrum of applications, particularly in the electric vehicle (EV) industry. The ability of GaN and SiC to handle higher power outputs efficiently is a key element, as it enables fast charging, a cornerstone in the drive for widespread EV adoption which fuels Wireless Charging Market growth. This technology not only accelerates charging but also significantly reduces EV charging times, addressing a critical need in the industry. GaN and SiC materials exhibit superior thermal performance, reducing the risk of overheating during charging processes. This improved thermal management is of utmost importance, especially in consumer electronics and EV applications, as it contributes significantly to the overall reliability and safety of wireless charging systems. The versatility and compatibility of these materials are also essential contributors to their success, allowing manufacturers to create wireless charging solutions that span a diverse range of applications, from smartphones and laptops to industrial equipment and electric vehicles. As a result, the wireless power transfer market has experienced a paradigm shift, while the wireless charging ICs market and wireless charging accessories have surged in growth, revolutionizing the way power our devices and vehicles and contributing consumers to more efficient, safer and versatile charging solutions.Market Growth Restraint

Lack of Standardization Hamper Wireless Charging Market Growth Without universal standards, there's a risk of unsuitability between wireless chargers and the devices they are meant to charge. Consumers are not indisputable that their chargers have been working with a variability of devices, leading to confusion and frustration. The absence of standards erodes consumer confidence in wireless charging technology. Users are hesitant to invest in wireless charging solutions if they are uncertain about compatibility and reliability. The wireless charging market is fragmented, with several competing standards and technologies, such as Qi, Powermat and others. This fragmentation makes it stimulating for consumers to navigate the market and choose the right products. Standardization is critical for the widespread adoption of wireless charging. It enables businesses and individuals to invest in wireless charging technology with confidence, significant that it works seamlessly with a range of devices Lack of standardization hinders interoperability, preventing different devices and chargers from communicating effectively. This has limited the functionality of wireless charging solutions.Wireless Charging Market Segment Analysis

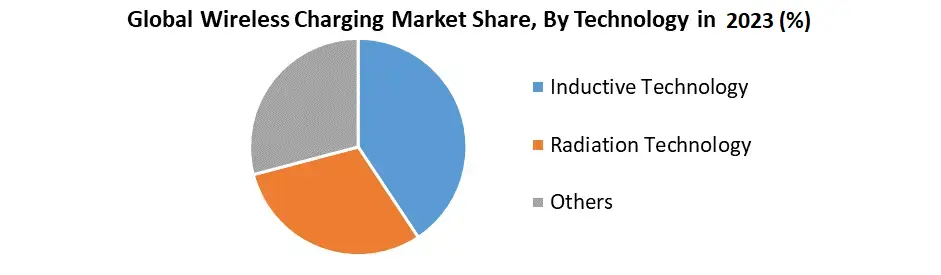

Based on Technology, the market is segmented into Inductive Technology, Radiation Technology and Others. Inductive Technology is expected to dominate the Wireless Charging Market over the forecast period. Inductive wireless charging, a prominent Wireless Charging Technology, is one of the earliest wireless charging technologies to gain traction in the consumer market. This early adoption led to larger familiarity among consumers, making it a de facto standard for Wireless Charging Technology. The Qi standard, developed by the Wireless Power Consortium, created a common platform that many device manufacturers adopted for Wireless Charging Devices. Consumers have been expecting a degree of interoperability across devices that provision the Qi standard. Inductive technology found early success in the consumer electronics sector, especially with smartphones, making it the technology of choice for Wireless Charging Devices. Major Smartphone manufacturers such as Apple and Samsung, integrated inductive wireless charging into their flagship devices. Inductive technology is known for its safety and efficiency, critical aspects for Wireless Charging Devices as well as Wireless Charging Stations. It makes relatively low levels of heat and offers efficient power transfer, which is vital for maintaining device safety and user satisfaction. Inductive wireless charging is relatively user-friendly for both Wireless Charging Devices and Wireless Charging Stations. Users are simply required to place their devices on a compatible charging pad or stand, eliminating the necessity for plugging and unplugging cables. Inductive technology's popularity also led to its integration into furniture items such as tables and nightstands, as well as accessories including wireless charging mouse pads and phone cases, making it a seamless addition to the ecosystem of Wireless Charging Devices. This seamless integration has expanded its reach, making it a popular choice for both Wireless Charging Devices and Wireless Charging Stations. Inductive wireless charging solutions are extensively available around the world, making them accessible to a global consumer base. This global accessibility is beneficial for consumers seeking compatible Wireless Charging Devices and access to Wireless Charging Stations, contributing to the technology's dominance in the market.

Wireless Charging Market Regional Insights

Asia Pacific dominated the Wireless Charging Market in 2023 and is expected to continue its dominance over the forecast period. Asia Pacific is home to some of the world's largest consumer electronics markets such as China, Japan, and South Korea. These countries have a strong demand for smartphones, wearables and other wireless charging-enabled devices. The complete size of these markets contributes to the region's domination. Many of the world's leading consumer electronics manufacturers are based in Asia Pacific. Companies including Samsung, LG and Huawei are at the forefront of wireless charging technology. Their influence and innovation fuel the market's growth. Electric vehicle adoption in Asia Pacific especially in China, has been a substantial driver for wireless charging. Wireless charging technology is seen as a suitable solution for EV charging, contributing to the region's dominance in this sector. Asia Pacific is a hub for research and development in wireless charging technology. Universities, research institutions and tech companies in the region are enthusiastically working on advancements in wireless charging, contributing to the region's dominance in innovation. Some countries in the Asia Pacific have provided government support for the development and adoption of wireless charging technology, especially in the setting of electric vehicles. Incentives and policies have fuelled the Wireless Charging industry's growth. The Asia Pacific region, with its vibrant innovation ecosystem encompassing tech startups and incubators, fosters remarkable innovation and entrepreneurship within the wireless charging space. This dynamic environment is complemented by the region's enormous and diverse population, offering substantial market potential, particularly in the wireless EV charging market and the burgeoning wireless charging market in India. The growingly middle class, accompanied by increased disposable income, is a driving force behind the increasing demand for advanced wireless charging solutions, particularly in rapidly developing countries including India and China. This confluence of factors positions the Asia Pacific as a key player in shaping the future of wireless charging, from electric vehicles to consumer electronics.Wireless Charging Market Competitive Landscape

The competitive landscape of the global Wireless Charging market entails an analysis of key companies, their size, strengths, weaknesses, barriers and threats. This comprehensive overview delves into the influence of competitive rivals, potential market entrants, customers, suppliers, and substitute products that significantly impact the Wireless Charging market's profitability. Market players operate at various levels, spanning from local to regional and global scales, shaping the dynamic Wireless Charging market analysis, where competition and innovation drive industry evolution and growth. Some of the key players are Energizer Holdings (US), convenient power (China), Integrated Device Technology (US), Murata Manufacturing (Japan), Leggett & Platt (US), Powerbyproxi Ltd. (New Zealand), Qualcomm Incorporated (US), Powermat Technologies (Israel), Texas Instruments (US), Witricity Corporation (US), Samsung Electronics (South Korea) and others. Many companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. For instance, in 2022, Qualcomm Incorporated (US) announced a new development in wireless charging technology known as Qualcomm Quick Charge for Wireless Power. This technology is designed to bring the same fast charging capabilities that Qualcomm is calling for to the wireless charging market.Qualcomm Quick Charge for Wireless Power uses a new power management system and wireless charging hardware to provide up to 15 watts of power to compatible devices. This is a substantial increase over the 5-10 watts of power that is typically accessible from wireless chargers today.Wireless Charging Market Scope: Inquiry Before Buying

Wireless Charging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 29.20 Bn. Forecast Period 2024 to 2030 CAGR: 26% Market Size in 2030: US $ 147.25 Bn. Segments Covered: by Technology Inductive Technology Radiation Technology Others by Transmission Range Short Range Medium Range Long Range by Application Healthcare Automotive Consumer Electronics Aerospace & Defense Others Wireless Charging Market, By Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Wireless Charging Key players

1. Energizer Holdings (US) 2. Convenientpower (China) 3. Integrated Device Technology (US) 4. Murata Manufacturing (Japan) 5. Leggett & Platt (US) 6. Powerbyproxi Ltd. (New Zealand) 7. Qualcomm Incorporated (US) 8. Powermat Technologies (Israel) 9. Texas Instruments (US) 10. Witricity Corporation (US) 11. Samsung Electronics (South Korea) 12. Sony Corporation (Japan) 13. Fulton Innovation LLC (US) 14. TDK Corporation (Japan) 15. Energous Corporation (US) 16. Ossia Inc. (US) 17. ZenS B.V (Netherlands)Frequently Asked Questions:

1] What segments are covered in the Global Wireless Charging Market report? Ans. The segments covered in the Global Wireless Charging Market report are based on Technology, Transmission range and Application. 2] Which region is expected to hold the highest share in the Global Wireless Charging Market? Ans. Asia Pacific is expected to hold the highest share of the Global Wireless Charging Market. 3] Who are the top key players in the Global Wireless Charging Market? Ans. Energizer Holdings (US), convenient power (China), Integrated Device Technology (US), Murata Manufacturing (Japan), Leggett & Platt (US), Powerbyproxi Ltd. (New Zealand), Qualcomm Incorporated (US), Powermat Technologies (Israel), Texas Instruments (US), Witricity Corporation (US), Samsung Electronics (South Korea) and others are the top key players in the Global Wireless Charging Market. 4] Which segment hold the largest market share in the Global Wireless Charging market by 2030? Ans. The Technology segment hold the largest market share in the Global Wireless Charging market by 2030. 5] What is the market size of the Global Wireless Charging market by 2030? Ans. The market size of the Global Wireless Charging market is USD 147.25 Bn. by 2030. 6] What was the market size of the Global Wireless Charging market in 2023? Ans. The market size of the Global Wireless Charging market was worth USD 29.20 Bn. in 2023.

1. Wireless Charging Market: Research Methodology 2. Wireless Charging Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Wireless Charging Market: Dynamics 3.1 Wireless Charging Market Trends by Region 3.1.1 North America Wireless Charging Market Trends 3.1.2 Europe Wireless Charging Market Trends 3.1.3 Asia Pacific Wireless Charging Market Trends 3.1.4 Middle East and Africa Wireless Charging Market Trends 3.1.5 South America Wireless Charging Market Trends 3.2 Wireless Charging Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Wireless Charging Market Drivers 3.2.1.2 North America Wireless Charging Market Restraints 3.2.1.3 North America Wireless Charging Market Opportunities 3.2.1.4 North America Wireless Charging Market Challenges 3.2.2 Europe 3.2.2.1 Europe Wireless Charging Market Drivers 3.2.2.2 Europe Wireless Charging Market Restraints 3.2.2.3 Europe Wireless Charging Market Opportunities 3.2.2.4 Europe Wireless Charging Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Wireless Charging Market Market Drivers 3.2.3.2 Asia Pacific Wireless Charging Market Restraints 3.2.3.3 Asia Pacific Wireless Charging Market Opportunities 3.2.3.4 Asia Pacific Wireless Charging Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Wireless Charging Market Drivers 3.2.4.2 Middle East and Africa Wireless Charging Market Restraints 3.2.4.3 Middle East and Africa Wireless Charging Market Opportunities 3.2.4.4 Middle East and Africa Wireless Charging Market Challenges 3.2.5 South America 3.2.5.1 South America Wireless Charging Market Drivers 3.2.5.2 South America Wireless Charging Market Restraints 3.2.5.3 South America Wireless Charging Market Opportunities 3.2.5.4 South America Wireless Charging Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 Global 3.5.2 North America 3.5.3 Europe 3.5.4 Asia Pacific 3.5.5 Middle East and Africa 3.5.6 South America 3.6 Analysis of Government Schemes and Initiatives For the Wireless Charging Industry 3.7 The Global Pandemic and Redefining of The Wireless Charging Industry Landscape 3.8 Price Trend Analysis 3.9 Technological Road Map 4. Global Wireless Charging Market: Global Market Size and Forecast by Segmentation for (By Value) (2023-2030) 4.1 Global Wireless Charging Market Size and Forecast, by Technology (2023-2030) 4.1.1 Inductive Technology 4.1.2 Radiation Technology 4.1.3 Others 4.2 Global Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 4.2.1 Short Range 4.2.2 Medium Range 4.2.3 Long Range 4.3 Global Wireless Charging Market Size and Forecast, by Application (2023-2030) 4.3.1 Healthcare 4.3.2 Automotive 4.3.3 Consumer Electronics 4.3.4 Aerospace & Defense 4.3.5 Others 4.4 Global Wireless Charging Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Wireless Charging Market Size and Forecast by Segmentation (By Value) (2023-2030) 5.1 North America Wireless Charging Market Size and Forecast, by Technology (2023-2030) 5.1.1 Inductive Technology 5.1.2 Radiation Technology 5.1.3 Others 5.2 North America Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 5.2.1 Short Range 5.2.2 Medium Range 5.2.3 Long Range 5.3 North America Wireless Charging Market Size and Forecast, by Application (2023-2030) 5.3.1 Healthcare 5.3.2 Automotive 5.3.3 Consumer Electronics 5.3.4 Aerospace & Defense 5.3.5 Others 5.4 North America Wireless Charging Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Wireless Charging Market Size and Forecast, by Technology (2023-2030) 5.4.1.1.1 Inductive Technology 5.4.1.1.2 Radiation Technology 5.4.1.1.3 Others 5.4.1.2 United States Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 5.4.1.2.1 Short Range 5.4.1.2.2 Medium Range 5.4.1.2.3 Long Range 5.4.1.3 United States Wireless Charging Market Size and Forecast, by Application (2023-2030) 5.4.1.3.1 Healthcare 5.4.1.3.2 Automotive 5.4.1.3.3 Consumer Electronics 5.4.1.3.4 Aerospace & Defense 5.4.1.3.5 Others 5.4.2 Canada 5.4.2.1 Canada Wireless Charging Market Size and Forecast, by Technology (2023-2030) 5.4.2.1.1 Inductive Technology 5.4.2.1.2 Radiation Technology 5.4.2.1.3 Others 5.4.2.2 Canada Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 5.4.2.2.1 Short Range 5.4.2.2.2 Medium Range 5.4.2.2.3 Long Range 5.4.2.3 Canada Wireless Charging Market Size and Forecast, by Application (2023-2030) 5.4.2.3.1 Healthcare 5.4.2.3.2 Automotive 5.4.2.3.3 Consumer Electronics 5.4.2.3.4 Aerospace & Defense 5.4.2.3.5 Others 5.4.3 Mexico 5.4.3.1 Mexico Wireless Charging Market Size and Forecast, by Technology (2023-2030) 5.4.3.1.1 Inductive Technology 5.4.3.1.2 Radiation Technology 5.4.3.1.3 Others 5.4.3.2 Mexico Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 5.4.3.2.1 Short Range 5.4.3.2.2 Medium Range 5.4.3.2.3 Long Range 5.4.3.3 Mexico Wireless Charging Market Size and Forecast, by Application (2023-2030) 5.4.3.3.1 Healthcare 5.4.3.3.2 Automotive 5.4.3.3.3 Consumer Electronics 5.4.3.3.4 Aerospace & Defense 5.4.3.3.5 Others 6. Europe Wireless Charging Market Size and Forecast by Segmentation (By Value) (2023-2030) 6.1 Europe Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.2 Europe Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 6.3 Europe Wireless Charging Market Size and Forecast, by Application (2023-2030) 6.4 Europe Wireless Charging Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.4.1.2 United Kingdom Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 6.4.1.3 United Kingdom Wireless Charging Market Size and Forecast, by Application (2023-2030) 6.4.2 France 6.4.2.1 France Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.4.2.2 France Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 6.4.2.3 France Wireless Charging Market Size and Forecast, by Application (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.4.3.2 Germany Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 6.4.3.3 Germany Wireless Charging Market Size and Forecast, by Application (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.4.4.2 Italy Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 6.4.4.3 Italy Wireless Charging Market Size and Forecast, by Application (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.4.5.2 Spain Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 6.4.5.3 Spain Wireless Charging Market Size and Forecast, by Application (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.4.6.2 Sweden Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 6.4.6.3 Sweden Wireless Charging Market Size and Forecast, by Application (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.4.7.2 Austria Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 6.4.7.3 Austria Wireless Charging Market Size and Forecast, by Application (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Wireless Charging Market Size and Forecast, by Technology (2023-2030) 6.4.8.2 Rest of Europe Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030). 6.4.8.3 Rest of Europe Wireless Charging Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Wireless Charging Market Size and Forecast by Segmentation (By Value) (2023-2030) 7.1 Asia Pacific Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.2 Asia Pacific Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.3 Asia Pacific Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4 Asia Pacific Wireless Charging Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.1.2 China Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.1.3 China Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.2.2 S Korea Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.2.3 S Korea Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.3.2 Japan Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.3.3 Japan Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.4 India 7.4.4.1 India Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.4.2 India Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.4.3 India Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.5.2 Australia Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.5.3 Australia Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.6.2 Indonesia Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.6.3 Indonesia Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.7.2 Malaysia Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.7.3 Malaysia Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.8.2 Vietnam Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.8.3 Vietnam Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.9.2 Taiwan Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.9.3 Taiwan Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.10.2 Bangladesh Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.10.3 Bangladesh Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.11.2 Pakistan Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.11.3 Pakistan Wireless Charging Market Size and Forecast, by Application (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Wireless Charging Market Size and Forecast, by Technology (2023-2030) 7.4.12.2 Rest of Asia PacificWireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 7.4.12.3 Rest of Asia Pacific Wireless Charging Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Wireless Charging Market Size and Forecast by Segmentation (By Value) (2023-2030) 8.1 Middle East and Africa Wireless Charging Market Size and Forecast, by Technology (2023-2030) 8.2 Middle East and Africa Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 8.3 Middle East and Africa Wireless Charging Market Size and Forecast, by Application (2023-2030) 8.4 Middle East and Africa Wireless Charging Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Wireless Charging Market Size and Forecast, by Technology (2023-2030) 8.4.1.2 South Africa Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 8.4.1.3 South Africa Wireless Charging Market Size and Forecast, by Application (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Wireless Charging Market Size and Forecast, by Technology (2023-2030) 8.4.2.2 GCC Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 8.4.2.3 GCC Wireless Charging Market Size and Forecast, by Application (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Wireless Charging Market Size and Forecast, by Technology (2023-2030) 8.4.3.2 Egypt Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 8.4.3.3 Egypt Wireless Charging Market Size and Forecast, by Application (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Wireless Charging Market Size and Forecast, by Technology (2023-2030) 8.4.4.2 Nigeria Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 8.4.4.3 Nigeria Wireless Charging Market Size and Forecast, by Application (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Wireless Charging Market Size and Forecast, by Technology (2023-2030) 8.4.5.2 Rest of ME&A Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 8.4.5.3 Rest of ME&A Wireless Charging Market Size and Forecast, by Application (2023-2030) 9. South America Wireless Charging Market Size and Forecast by Segmentation (By Value) (2023-2030) 9.1 South America Wireless Charging Market Size and Forecast, by Technology (2023-2030) 9.2 South America Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 9.3 South America Wireless Charging Market Size and Forecast, by Application (2023-2030) 9.4 South America Wireless Charging Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Wireless Charging Market Size and Forecast, by Technology (2023-2030) 9.4.1.2 Brazil Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 9.4.1.3 Brazil Wireless Charging Market Size and Forecast, by Application (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Wireless Charging Market Size and Forecast, by Technology (2023-2030) 9.4.2.2 Argentina Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 9.4.2.3 Argentina Wireless Charging Market Size and Forecast, by Application (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Wireless Charging Market Size and Forecast, by Technology (2023-2030) 9.4.3.2 Rest Of South America Wireless Charging Market Size and Forecast, by Transmission Range (2023-2030) 9.4.3.3 Rest Of South America Wireless Charging Market Size and Forecast, by Application (2023-2030) 10. Global Wireless Charging Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Service Segment 10.3.3 Application Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Leading Wireless Charging Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Energizer Holdings 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Convenientpower (China) 11.3 Integrated Device Technology (US) 11.4 Murata Manufacturing (Japan) 11.5 Leggett & Platt (US) 11.6 Powerbyproxi Ltd. (New Zealand) 11.7 Qualcomm Incorporated(US) 11.8 Powermat Technologies (Israel) 11.9 Texas Instruments (US) 11.10 Witricity Corporation (US) 11.11 Samsung Electronics (South Korea) 11.12 Sony Corporation (Japan) 11.13 Fulton Innovation LLC (US) 11.14 TDK Corporation(Japan) 11.15 Energous Corporation (US) 11.16 Ossia Inc. (US) 11.17 ZenS B.V (Netherlands) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary