North America Image Sensor Market is expected to reach US$ 8.62 Bn. by 2027 at a CAGR of 7.88 during the forecast period.To know about the Research Methodology :- Request Free Sample Report

North America Image Sensor Market Overview:

The rising need for trivial pixel devices proposing high resolution with a cost-effective technique is expected to fuel the market growth during the forecast period. The Image Sensor Market has been fronting a key change in the last few years. The mechanical improvements & strong usage of images through several applications have driven the change of image sensors in the North America market. With the rising Research &Development investments, sensing tools have become cheap, compressed, & power-efficient, posing openings to the industry companies. The rising mobile phone segment, especially smartphones, is anticipated to spur the segment development during the forecast period.Global Smartphone Shipments 2019 (in Mn)

Advanced Driver Assistance Systems is estimated to be the important driver for sector growth during the forecast period. Depending on the mechanism vision, the system responds to the condition met while driving. Also, smarter & compressed cameras can also support in handling traffic inducing the demand for traffic surveillance cameras which is estimated to further considerably raise the market development.

North America Image Sensor Market Dynamics:

Rising Investment in R&D of Driverless Cars:

Automotive sensors have seen increasing popularity in current years, due to rising applications in the automotive & transportation industry. The demand for image sensors has improved drastically in the last few years. The arrival of sensor-based & AI-driven automobiles have unlocked an enormous potential for market development. Variations in product offerings have permitted applications through diverse fields. Also, the economic nature of these products has managed to a wider acceptance through the world. The growing use of image sensors in numerous vehicles with passenger cars, transport vehicles, commercial, & personal vehicles will generate numerous opportunities for market development.Latest Technologies:

Ambient light sensors are the modern technology that is used by many companies in North America. These technologies are comprised of different laptops & cellphones to sense the ecological lighting situations, permitting for adjustment of the screen's backlight to comfortable levels for the watcher. The range of easy levels is reliant on the room's light. Clearly, a screen's brightness needs to increase as the ambient light rises. What is less obvious is the need to cut the brightness in lesser light conditions for relaxed viewing & to save battery life.North America Image Sensor Market Segment Analysis:

Application Segment Overview:

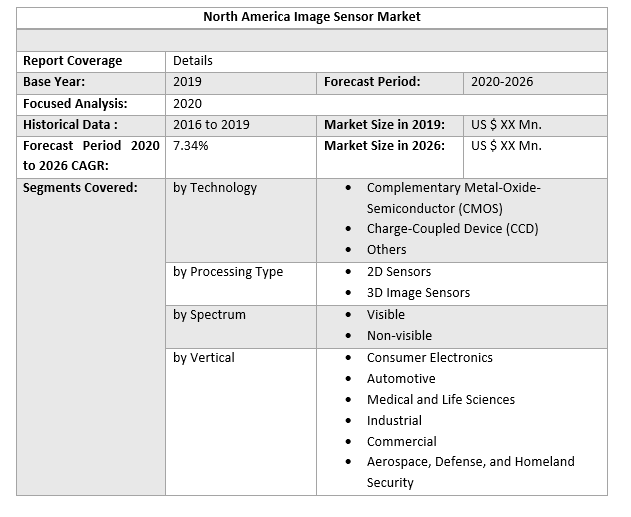

Consumer electronics is estimated to be the key application sector having the maximum penetration & accounted for over 50 percent of the total revenue share in 2019. Its revenue development is also estimated to be at a CAGR of 3.3 percent from 2017 to 2022. These devices are extensively organized in consumer electronics, for instance, in smartphones or cameras. They are also used in communication devices, entertainment products, IT & home appliances. Due to the improved R&D, sensing devices have become inexpensive, compact, & consume less power, which helps as an attractive opportunity for industry contributors. Customer preference towards wearable devices is anticipated to increase the image sensor market during the forecast period. Growing preference for multimedia devices is fast supported by development in mobile devices. Multimedia-enabled products deliver more features with more data safety over the Internet. These products are powerfully supported by sensing technology in the United States along with emerging areas like India, Latin America, & China. The use of sensing devices for health monitoring, indoor steering, & related niche applications is anticipated to offer significant development opportunities for the development of the image sensor market. The North America Image Sensor Market report covers 2D Sensors, 3D Image Sensors with detailed analysis North America Image Sensor Market with the classifications of the market on the Converter Spectrum, Processing Type, Spectrum, Vertical & region. Analysis of past market dynamics from 2016 to 2019 is given in the North America Image Sensor Market report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The North America Image Sensor Market report has profiled key players in the market from different regions. However, the North America Image Sensor Market report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Types, labor cost, availability of advanced Plastic Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the North America Image Sensor Market report.North America Image Sensor Market Scope: Inquire before buying

North America Image Sensor Market, By Country

• US • CanadaNorth America Image Sensor Market, Key Players:

• STMicroelectronics • Espros Photonics Corporation • Imasenic • Andanta • BAE Systems Inc. • Insightness • Integrated Detector Electronics AS • Multix • ON Semiconductor • IR Nova • Emberion • E2V • Omnivision • Samsung • Canon • Aptina Imaging • Nikon • Toshiba • EM Microelectronics • Melexis • SK Hynix.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: North America Image Sensor Market Size, by Market Value (US$ Mn) 3.1. North America Market Segmentation 3.2. North America Market Segmentation Share Analysis, 2019 3.2.1. North America 3.2.2. By Country 3.3. Geographical Snapshot of the North America Image Sensor Market 3.4. Geographical Snapshot of the North America Image Sensor Market, By Manufacturer share 4. North America Image Sensor Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Types 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the North America Image Sensor Market 5. Supply Side and Demand Side Indicators 6. North America Image Sensor Market Analysis and Forecast, 2019-2026 6.1. North America Image Sensor Market Size & Y-o-Y Growth Analysis. 7. North America Image Sensor Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 7.1.1. Complementary Metal-Oxide-Semiconductor (CMOS) 7.1.2. Charge-Coupled Device (CCD) 7.1.3. Others 7.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 7.2.1. 2D Sensors 7.2.2. 3D Image Sensors 7.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 7.3.1. Visible 7.3.2. Non-visible. 7.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 7.4.1. Consumer Electronics 7.4.2. Automotive 7.4.3. Medical and Life Sciences 7.4.4. Industrial 7.4.5. Commercial 7.4.6. Aerospace, Defense, and Homeland Security 8. North America Image Sensor Market Analysis and Forecasts, By Country 8.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 8.1.1. US 8.1.2. Canada 9. US Image Sensor Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 9.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 9.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 9.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 10. Canada Image Sensor Market Analysis and Forecasts, 2019-2026 10.1. Market Size (Value) Estimates & Forecast By Technology, 2019-2026 10.2. Market Size (Value) Estimates & Forecast By Processing Type, 2019-2026 10.3. Market Size (Value) Estimates & Forecast By Spectrum, 2019-2026 10.4. Market Size (Value) Estimates & Forecast By Vertical, 2019-2026 11. Competitive Landscape 11.1. Geographic Footprint of Major Players in the North America Image Sensor Market 11.2. Competition Matrix 11.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Services and R&D Investment 11.2.2. New Type Launches and Type Enhancements 11.2.3. Market Consolidation 11.2.3.1. M&A by Regions, Investment and Verticals 11.2.3.2. M&A, Forward Integration and Backward Integration 11.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 11.3. Company Profile : Key Players 11.3.1. PSC Group 11.3.1.1. Company Overview 11.3.1.2. Financial Overview 11.3.1.3. Geographic Footprint 11.3.1.4. Type Portfolio 11.3.1.5. Business Strategy 11.3.1.6. Recent Developments 11.3.2. STMicroelectronics 11.3.3. Espros Photonics Corporation 11.3.4. Imasenic 11.3.5. Andanta 11.3.6. BAE Systems Inc. 11.3.7. Insightness 11.3.8. Integrated Detector Electronics AS 11.3.9. Multix 11.3.10. ON Semiconductor 11.3.11. IR Nova 11.3.12. Emberion 11.3.13. E2V 11.3.14. Omnivision 11.3.15. Samsung 11.3.16. Canon 11.3.17. Aptina Imaging 11.3.18. Nikon 11.3.19. Toshiba 11.3.20. EM Microelectronics 11.3.21. Melexis 11.3.22. SK Hynix 12. Primary Key Insights.