Indoor Farming Market size was valued at USD 27.80 Bn. in 2024, and the total Global Indoor Farming Market revenue is expected to grow by 11.8% from 2025 to 2032, reaching nearly USD 67.85 Bn.Indoor Farming Market Overview

Indoor farming, also known as vertical farming or controlled environment agriculture (CEA), refers to the practice of cultivating crops in enclosed structures such as warehouses, greenhouses, or containers, using artificial lighting, climate control, and hydroponic or aeroponic systems to create optimal growing conditions. Unlike traditional outdoor farming, indoor farming allows for year-round cultivation of crops regardless of external environmental factors such as weather, temperature, or seasonal changes. Indoor farming enables year-round cultivation of crops, regardless of external weather conditions or seasonal variations, ensuring a consistent and reliable food supply.To know about the Research Methodology :- Request Free Sample Report The indoor farming market has experienced significant growth and transformation in recent years, driven by factors such as increasing demand for locally grown, fresh produce, advancements in technology, concerns about food security and sustainability, and changing consumer preferences. The indoor farming market encompasses a wide range of crops, including leafy greens, herbs, vegetables, fruits, and specialty crops. Leafy greens such as lettuce, kale, and spinach are among the most commonly grown crops in indoor farming facilities due to their fast growth rates and high demand. Consumers are increasingly seeking locally grown, fresh produce that is free from pesticides and preservatives. Indoor farming allows for the year-round production of high-quality crops close to urban centers, reducing transportation distances and ensuring freshness.

Indoor Farming Market Dynamics

Increasing Demand for Locally Grown, Fresh Produce to boost Indoor Farming Market growth Consumers are increasingly seeking locally grown, fresh produce that is free from pesticides, herbicides, and other chemicals commonly used in traditional agriculture. Indoor farming addresses this demand by enabling the year-round production of high-quality crops close to urban centers, reducing transportation distances and ensuring freshness. This growing consumer preference for locally sourced food has driven the expansion of indoor farming operations, particularly in urban areas where access to fresh produce is limited. Advancements in agricultural technologies have played a significant role in driving the growth of the indoor farming market. Innovations such as LED lighting systems, climate control sensors, hydroponic/aeroponic cultivation systems, and automation have revolutionized indoor farming operations, improving efficiency, productivity, and sustainability. These technologies allow growers to precisely control environmental conditions, optimize resource usage, and monitor crop health in real-time, resulting in higher yields, better quality produce, and reduced operational costs. Consumers are becoming more conscious of their dietary choices and are increasingly seeking healthier, fresher, and more sustainably produced food options. Indoor farming offers a solution to meet these evolving consumer preferences by providing year-round access to locally grown, pesticide-free, and nutritious produce. Indoor farming allows for the cultivation of a wide variety of specialty crops, heirloom varieties, and exotic herbs and spices that is not readily available through conventional agriculture, catering to diverse consumer tastes and preferences. The growing demand for locally grown, fresh produce, coupled with advancements in technology and operational efficiencies, has made indoor farming increasingly economically viable and attractive to investors, which significantly boosts the Indoor Farming Market growth. As the industry matures and scales up, there are significant opportunities for investment in indoor farming infrastructure, technology development, and expansion of production capacity. Governments, private investors, and venture capital firms are increasingly recognizing the potential of indoor farming as a sustainable solution to address food security challenges and are allocating funds toward supporting indoor farming initiatives and startups. High Initial Investment Costs to restrain Indoor Farming Market growth Establishing an indoor farming operation requires substantial upfront investment in infrastructure, technology, and operational expenses. The cost of setting up climate-controlled facilities, purchasing specialized equipment such as LED lighting systems, hydroponic/aeroponic cultivation systems, and automation technology, as well as hiring skilled labor is prohibitively high. This financial barrier to entry deter potential investors and entrepreneurs from entering the indoor farming market, particularly smaller players with limited access to capital. Indoor farming facilities consume significant amounts of energy to power lighting, heating, cooling, and ventilation systems. LED lighting, in particular is energy-intensive, contributing to high operational costs and environmental impact. While advancements in energy-efficient technologies and renewable energy sources are helping to mitigate energy consumption, reducing reliance on conventional energy sources remains a challenge. Energy costs constitute a significant portion of the overall operational expenses for indoor farming operations, making them vulnerable to fluctuations in energy prices and regulatory changes. Despite the potential benefits of indoor farming, consumer awareness and market acceptance of indoor-grown produce remain relatively low compared to conventionally grown produce. Some consumers perceive indoor-grown produce as less natural or less nutritious, leading to skepticism or reluctance to purchase. Educating consumers about the advantages of indoor farming, such as year-round availability, pesticide-free cultivation, and reduced environmental impact, is essential to increase Indoor Farming market demand and acceptance. Indoor farming operators face competition from traditional outdoor agriculture, which benefits from economies of scale, lower production costs, and established distribution networks. While indoor farming offers advantages such as higher yields, reduced water usage, and protection from adverse weather conditions, it struggle to compete on price with conventionally grown produce, particularly for commodity crops. Convincing consumers and retailers to pay a premium for indoor-grown produce is challenging in a competitive market environment.Indoor Farming Market Segment Analysis

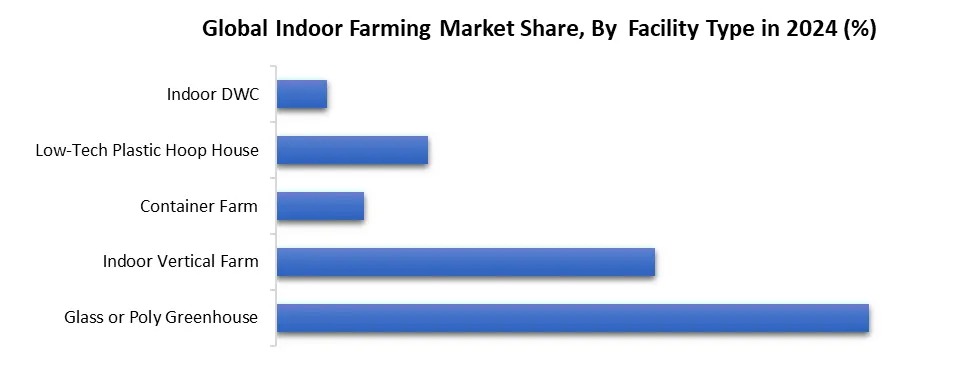

Based on the Growing System, the market is segmented into Aeroponics, Soil-Based, Aquaponics, Hydroponics, and Aquaponics, Hydroponics, Soil (hybrid). The hydroponics segment dominated the market in 2024 and is expected to hold the largest Indoor Farming Market share over the forecast period. Hydroponics is a popular cultivation method within the indoor farming industry, offering a soilless growing technique that relies on nutrient-rich water solutions to nourish plants. This segment of indoor farming involves growing plants in a controlled environment where the roots are suspended in a nutrient solution rather than being planted in soil. Hydroponics eliminates the need for soil, allowing plants to grow directly in water-based nutrient solutions, which significantly boosts the Indoor Farming Market growth. This method offers several advantages over traditional soil-based agriculture, including better control over nutrient uptake, water usage, and environmental conditions. By providing plants with precisely balanced nutrients and oxygenated water directly to their roots, hydroponics promotes faster growth, higher yields, and superior crop quality. Based on Facility Type, the market is segmented into Glass or Poly Greenhouse, Indoor, Vertical Farm, Container Farm, Low-Tech Plastic Hoop House, and Indoor DWC. The Glass or Poly Greenhouse segment dominated the market in 2024 and is expected to hold the largest Indoor Farming Market share over the forecast period. The Glass or Poly Greenhouse segment is a key component of the indoor farming industry, offering controlled environments for cultivating crops in protected structures made of either glass or polyethylene (poly) materials. This segment represents a traditional yet effective method of indoor farming, providing growers with the ability to regulate environmental conditions such as temperature, humidity, and light levels. Glass or Poly Greenhouses provide growers with the ability to control and optimize environmental conditions for crop growth. Through the use of ventilation systems, heating, cooling, and shading mechanisms, growers regulate temperature, humidity, air circulation, and light levels within the greenhouse, which is expected to boost the Indoor Farming Market growth. This level of control allows for year-round cultivation of a wide variety of crops, regardless of external weather conditions.

Indoor Farming Market Regional Insight

Increasing Demand for Locally Grown Produce to boost Indoor Farming Market growth North America dominated the market in 2023 and is expected to hold the largest Indoor Farming Market share over the forecast period. The growing consumer preference for locally grown, fresh produce has fueled the demand for indoor farming in North America. Consumers are increasingly seeking food that is grown closer to home, free from pesticides, and available year-round. Indoor farming addresses this demand by providing a sustainable and reliable source of fresh produce, particularly in urban areas where access to traditional farmland is limited. Growing consumer awareness of food quality, safety, and environmental sustainability has contributed to the rising popularity of indoor-grown produce in North America. Consumers are increasingly concerned about the use of pesticides and chemicals in conventional agriculture and are seeking out alternatives that offer healthier and more environmentally friendly options, which significantly boosts the Indoor Farming Market growth. Indoor farming provides a transparent and controlled growing environment, reassuring consumers about the safety and quality of the produce they consume. The United States has witnessed a growing trend towards locally grown, fresh produce, driven by consumer preferences for sustainable, healthy food options. Indoor farming addresses this demand by providing year-round access to locally cultivated crops, particularly in urban areas where access to fresh produce is limited.Greenhouse crop production has held sway in the United States' indoor farming sector. Tomato cultivation has been a cornerstone, favored for its efficiency under controlled conditions. Recent shifts driven by declining technology expenses, LEDs, alongside a surge in local food demand, have spurred the adoption of alternative growing methods. Specifically, fully enclosed vertical systems are witnessing a notable uptick in popularity. The geographical distribution of farms across the United States reveals notable patterns. Greenhouses are prominently clustered in rural regions of the Northeast, South, and Southwest, which is expected to boost the North America Indoor Farming Market growth. In the Midwest, 42% of surveyed farms operate indoors in vertical setups, with half of them situated in urban locales. Container farms exhibit a notable prevalence in the Southwest, while the West boasts the highest proportion of urban farms among respondents.

Indoor Farming Market Scope: Inquire before buying

Global Indoor Farming Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 27.80 Bn. Forecast Period 2025 to 2032 CAGR: 11.8% Market Size in 2032: USD 67.85 Bn. Segments Covered: by Growing System Aeroponics Soil-Based Aquaponics Hydroponics Aquaponics, Hydroponics, Soil (hybrid) by Component Hardware Software Services by Facility Type Glass or Poly Greenhouse Indoor Vertical Farm Container Farm Low-Tech Plastic Hoop House Indoor DWC by Crop Type Tomatoes Flowers Herbs Microgreens Leafy Greens Others Indoor Farming Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Indoor Farming Key Players Includes

North America: 1. AeroFarms - Newark, New Jersey, USA 2. Plenty Unlimited Inc. - South San Francisco, California, USA 3. Bowery Farming - New York City, New York, USA 4. BrightFarms - Irvington, New York, USA 5. Gotham Greens - Brooklyn, New York, USA 6. LumiGrow - U.S. 7. Illumitex - U.S. 8. Argus Control System Limited - Canada Europe: 9. Infarm - Berlin, Germany 10. GrowUp Farms - London, United Kingdom 11. Jones Food Company - Scunthorpe, United Kingdom 12. LettUs Grow - Bristol, United Kingdom 13. UrbanFarmers AG - Basel, Switzerland 14. Richel Group - France 15. Agrilution - Germany Asia-Pacific: 16. Spread Co. Ltd. - Kyoto, Japan 17. Sky Greens - Singapore 18. UrbanKisaan - Hyderabad, India 19. SananBio - Beijing, China 20. Crop One Holdings – SingaporeFrequently asked Questions:

1. What are the key drivers of growth in the indoor farming market? Ans: The indoor farming market is driven by increasing demand for locally grown, fresh produce, advancements in technology, concerns about food security and sustainability, and changing consumer preferences. 2. Which crops are commonly grown in indoor farming facilities? Ans: Indoor farming facilities cultivate a wide variety of crops, including leafy greens, herbs, vegetables, fruits, and specialty crops. Leafy greens such as lettuce, kale, and spinach are among the most commonly grown crops due to their fast growth rates and high demand. 3. What are some notable trends and patterns in the indoor farming market, particularly in North America? Ans: Trends include a shift towards locally grown produce, increased adoption of alternative growing methods such as vertical farming, and geographic clustering of farms in rural and urban regions across the United States. 4. What are the challenges facing the indoor farming market? Ans: Challenges include high initial investment costs, energy consumption, consumer awareness and acceptance, competition from traditional agriculture, and convincing consumers to pay a premium for indoor-grown produce. 5. What are the different growing systems and facility types used in indoor farming? Ans: Growing systems include hydroponics, aeroponics, soil-based, aquaponics, and hybrids. Facility types include glass or poly greenhouses, indoor facilities, vertical farms, container farms, and low-tech plastic hoop houses.

1. Indoor Farming Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Indoor Farming Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Indoor Farming Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Indoor Farming Market: Dynamics 3.1. Indoor Farming Market Trends by Region 3.1.1. North America Indoor Farming Market Trends 3.1.2. Europe Indoor Farming Market Trends 3.1.3. Asia Pacific Indoor Farming Market Trends 3.1.4. Middle East and Africa Indoor Farming Market Trends 3.1.5. South America Indoor Farming Market Trends 3.2. Indoor Farming Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Indoor Farming Market Drivers 3.2.1.2. North America Indoor Farming Market Restraints 3.2.1.3. North America Indoor Farming Market Opportunities 3.2.1.4. North America Indoor Farming Market Challenges 3.2.2. Europe 3.2.2.1. Europe Indoor Farming Market Drivers 3.2.2.2. Europe Indoor Farming Market Restraints 3.2.2.3. Europe Indoor Farming Market Opportunities 3.2.2.4. Europe Indoor Farming Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Indoor Farming Market Drivers 3.2.3.2. Asia Pacific Indoor Farming Market Restraints 3.2.3.3. Asia Pacific Indoor Farming Market Opportunities 3.2.3.4. Asia Pacific Indoor Farming Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Indoor Farming Market Drivers 3.2.4.2. Middle East and Africa Indoor Farming Market Restraints 3.2.4.3. Middle East and Africa Indoor Farming Market Opportunities 3.2.4.4. Middle East and Africa Indoor Farming Market Challenges 3.2.5. South America 3.2.5.1. South America Indoor Farming Market Drivers 3.2.5.2. South America Indoor Farming Market Restraints 3.2.5.3. South America Indoor Farming Market Opportunities 3.2.5.4. South America Indoor Farming Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Indoor Farming Industry 3.8. Analysis of Government Schemes and Initiatives For Indoor Farming Industry 3.9. Indoor Farming Market Trade Analysis 3.10. The Global Pandemic Impact on Indoor Farming Market 4. Indoor Farming Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 4.1.1. Aeroponics 4.1.2. Soil-Based 4.1.3. Aquaponics 4.1.4. Hydroponics 4.1.5. Aquaponics, Hydroponics, Soil (hybrid) 4.2. Indoor Farming Market Size and Forecast, by Component (2024-2032) 4.2.1. Hardware 4.2.2. Software 4.2.3. Services 4.3. Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 4.3.1. Glass or Poly Greenhouse 4.3.2. Indoor Vertical Farm 4.3.3. Container Farm 4.3.4. Low-Tech Plastic Hoop House 4.3.5. Indoor DWC 4.4. Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 4.4.1. Tomatoes 4.4.2. Flowers 4.4.3. Herbs 4.4.4. Microgreens 4.4.5. Leafy Greens 4.4.6. Others 4.5. Indoor Farming Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Indoor Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 5.1.1. Aeroponics 5.1.2. Soil-Based 5.1.3. Aquaponics 5.1.4. Hydroponics 5.1.5. Aquaponics, Hydroponics, Soil (hybrid) 5.2. North America Indoor Farming Market Size and Forecast, by Component (2024-2032) 5.2.1. Hardware 5.2.2. Software 5.2.3. Services 5.3. North America Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 5.3.1. Glass or Poly Greenhouse 5.3.2. Indoor Vertical Farm 5.3.3. Container Farm 5.3.4. Low-Tech Plastic Hoop House 5.3.5. Indoor DWC 5.4. North America Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 5.4.1. Tomatoes 5.4.2. Flowers 5.4.3. Herbs 5.4.4. Microgreens 5.4.5. Leafy Greens 5.4.6. Others 5.5. North America Indoor Farming Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 5.5.1.1.1. Aeroponics 5.5.1.1.2. Soil-Based 5.5.1.1.3. Aquaponics 5.5.1.1.4. Hydroponics 5.5.1.1.5. Aquaponics, Hydroponics, Soil (hybrid) 5.5.1.2. United States Indoor Farming Market Size and Forecast, by Component (2024-2032) 5.5.1.2.1. Hardware 5.5.1.2.2. Software 5.5.1.2.3. Services 5.5.1.3. United States Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 5.5.1.3.1. Glass or Poly Greenhouse 5.5.1.3.2. Indoor Vertical Farm 5.5.1.3.3. Container Farm 5.5.1.3.4. Low-Tech Plastic Hoop House 5.5.1.3.5. Indoor DWC 5.5.1.4. United States Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 5.5.1.4.1. Tomatoes 5.5.1.4.2. Flowers 5.5.1.4.3. Herbs 5.5.1.4.4. Microgreens 5.5.1.4.5. Leafy Greens 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 5.5.2.1.1. Aeroponics 5.5.2.1.2. Soil-Based 5.5.2.1.3. Aquaponics 5.5.2.1.4. Hydroponics 5.5.2.1.5. Aquaponics, Hydroponics, Soil (hybrid) 5.5.2.2. Canada Indoor Farming Market Size and Forecast, by Component (2024-2032) 5.5.2.2.1. Hardware 5.5.2.2.2. Software 5.5.2.2.3. Services 5.5.2.3. Canada Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 5.5.2.3.1. Glass or Poly Greenhouse 5.5.2.3.2. Indoor Vertical Farm 5.5.2.3.3. Container Farm 5.5.2.3.4. Low-Tech Plastic Hoop House 5.5.2.3.5. Indoor DWC 5.5.2.4. Canada Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 5.5.2.4.1. Tomatoes 5.5.2.4.2. Flowers 5.5.2.4.3. Herbs 5.5.2.4.4. Microgreens 5.5.2.4.5. Leafy Greens 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 5.5.3.1.1. Aeroponics 5.5.3.1.2. Soil-Based 5.5.3.1.3. Aquaponics 5.5.3.1.4. Hydroponics 5.5.3.1.5. Aquaponics, Hydroponics, Soil (hybrid) 5.5.3.2. Mexico Indoor Farming Market Size and Forecast, by Component (2024-2032) 5.5.3.2.1. Hardware 5.5.3.2.2. Software 5.5.3.2.3. Services 5.5.3.3. Mexico Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 5.5.3.3.1. Glass or Poly Greenhouse 5.5.3.3.2. Indoor Vertical Farm 5.5.3.3.3. Container Farm 5.5.3.3.4. Low-Tech Plastic Hoop House 5.5.3.3.5. Indoor DWC 5.5.3.4. Mexico Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 5.5.3.4.1. Tomatoes 5.5.3.4.2. Flowers 5.5.3.4.3. Herbs 5.5.3.4.4. Microgreens 5.5.3.4.5. Leafy Greens 5.5.3.4.6. Others 6. Europe Indoor Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.2. Europe Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.3. Europe Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.4. Europe Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 6.5. Europe Indoor Farming Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.5.1.2. United Kingdom Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.5.1.3. United Kingdom Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.5.1.4. United Kingdom Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 6.5.2. France 6.5.2.1. France Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.5.2.2. France Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.5.2.3. France Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.5.2.4. France Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.5.3.2. Germany Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.5.3.3. Germany Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.5.3.4. Germany Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.5.4.2. Italy Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.5.4.3. Italy Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.5.4.4. Italy Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.5.5.2. Spain Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.5.5.3. Spain Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.5.5.4. Spain Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.5.6.2. Sweden Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.5.6.3. Sweden Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.5.6.4. Sweden Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.5.7.2. Austria Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.5.7.3. Austria Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.5.7.4. Austria Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 6.5.8.2. Rest of Europe Indoor Farming Market Size and Forecast, by Component (2024-2032) 6.5.8.3. Rest of Europe Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 6.5.8.4. Rest of Europe Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7. Asia Pacific Indoor Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.2. Asia Pacific Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.3. Asia Pacific Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.4. Asia Pacific Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5. Asia Pacific Indoor Farming Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.1.2. China Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.1.3. China Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.1.4. China Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.2.2. S Korea Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.2.3. S Korea Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.2.4. S Korea Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.3.2. Japan Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.3.3. Japan Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.3.4. Japan Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.4. India 7.5.4.1. India Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.4.2. India Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.4.3. India Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.4.4. India Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.5.2. Australia Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.5.3. Australia Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.5.4. Australia Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.6.2. Indonesia Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.6.3. Indonesia Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.6.4. Indonesia Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.7.2. Malaysia Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.7.3. Malaysia Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.7.4. Malaysia Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.8.2. Vietnam Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.8.3. Vietnam Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.8.4. Vietnam Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.9.2. Taiwan Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.9.3. Taiwan Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.9.4. Taiwan Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 7.5.10.2. Rest of Asia Pacific Indoor Farming Market Size and Forecast, by Component (2024-2032) 7.5.10.3. Rest of Asia Pacific Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 7.5.10.4. Rest of Asia Pacific Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 8. Middle East and Africa Indoor Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 8.2. Middle East and Africa Indoor Farming Market Size and Forecast, by Component (2024-2032) 8.3. Middle East and Africa Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 8.4. Middle East and Africa Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 8.5. Middle East and Africa Indoor Farming Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 8.5.1.2. South Africa Indoor Farming Market Size and Forecast, by Component (2024-2032) 8.5.1.3. South Africa Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 8.5.1.4. South Africa Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 8.5.2.2. GCC Indoor Farming Market Size and Forecast, by Component (2024-2032) 8.5.2.3. GCC Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 8.5.2.4. GCC Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 8.5.3.2. Nigeria Indoor Farming Market Size and Forecast, by Component (2024-2032) 8.5.3.3. Nigeria Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 8.5.3.4. Nigeria Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 8.5.4.2. Rest of ME&A Indoor Farming Market Size and Forecast, by Component (2024-2032) 8.5.4.3. Rest of ME&A Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 8.5.4.4. Rest of ME&A Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 9. South America Indoor Farming Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 9.2. South America Indoor Farming Market Size and Forecast, by Component (2024-2032) 9.3. South America Indoor Farming Market Size and Forecast, by Fcility Type(2024-2032) 9.4. South America Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 9.5. South America Indoor Farming Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 9.5.1.2. Brazil Indoor Farming Market Size and Forecast, by Component (2024-2032) 9.5.1.3. Brazil Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 9.5.1.4. Brazil Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 9.5.2.2. Argentina Indoor Farming Market Size and Forecast, by Component (2024-2032) 9.5.2.3. Argentina Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 9.5.2.4. Argentina Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Indoor Farming Market Size and Forecast, by Growing System (2024-2032) 9.5.3.2. Rest Of South America Indoor Farming Market Size and Forecast, by Component (2024-2032) 9.5.3.3. Rest Of South America Indoor Farming Market Size and Forecast, by Fcility Type (2024-2032) 9.5.3.4. Rest Of South America Indoor Farming Market Size and Forecast, by Crop Type (2024-2032) 10. Company Profile: Key Players 10.1. AeroFarms 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Plenty Unlimited Inc. 10.3. Bowery Farming 10.4. BrightFarms 10.5. Gotham Greens 10.6. LumiGrow 10.7. Illumitex 10.8. Argus Control System Limited 10.9. Infarm 10.10. GrowUp Farms 10.11. Jones Food Company 10.12. LettUs Grow 10.13. UrbanFarmers AG 10.14. Richel Group 10.15. Agrilution 10.16. Spread Co. Ltd. 10.17. Sky Greens 10.18. UrbanKisaan 10.19. SananBio 10.20. Crop One Holdings 11. Key Findings 12. Industry Recommendations 13. Indoor Farming Market: Research Methodology 14. Terms and Glossary