Welded Pipes Market size was valued at USD 255.21 Bn. in 2023 and the total Welded Pipes revenue is expected to grow by 5.8 % from 2024 to 2030, reaching nearly USD 378.70 Bn.Welded Pipes Market Overview:

Pipe welding is a method of joining two pipes together that is used to transport gas, water, construction materials, oil, and other liquids over long distances. Electric Fusion Welding pipes are another name for these pipes. Infrastructure spending on projects like airports, metros, and greenhouse structures, as well as improved infrastructure spending driven by rapid urbanization, are driving the welded pipes market growth. It is used in shipbuilding because advances in welding technology have enabled the market to produce perfectly watertight and oil-tight joints. As the cost of raw materials continues to rise sharply, the cost of welding pipes rises as well, and profit declines dramatically. Because of the uncertainty in the energy sector, which is one of the largest consumers of welded pipes, demand for welded pipes has been decreasing. These are the most significant challenges confronting the welded pipes market. The growing demand for the product in some industrial inputs, such as oil and gas, has prompted the expansion and construction of numerous welded pipelines. Because of the increasing competition and primarily to survive in this business, pipeline contractors and engineers must stay current. The use of these pipes in the automotive, marine, and medical industries is expanding. The construction industry's demand is driving the market's consistent revenue growth. For welding purposes, carbon, magnesium, and molybdenum are used. The need for structural and functional requirements of industries is a critical demand-driving factor in the welded pipes market. As the number of commercial and residential buildings increases, so does the demand for such welding pipes. The new instructions in emerging economies will increase welded pipes market opportunities. The intensive architectural application will boost adoption. All of these factors are expected to grow the market's overall value during the forecast period.To know about the Research Methodology:-Request Free Sample Report

Welded Pipes Market Dynamics:

Welded Pipes Market Driver Booming oil & gas production to impact the market One of the major growth drivers for the welded pipes market is increased oil and gas production as a result of transportation industry demand. Welded pipes and tubes are primarily consumed by the oil and gas industry. In this industry, welded pipes are used to transport gas and liquid. They are typically made from low alloy or carbon steel. Inside diameter, ductility, yield strength, and pressure rating are all important factors to consider when choosing pipes for specific applications. The oil and gas industry in the United States is a major end-user of welded pipes and tubes. The product is used in crude oil processing upstream, midstream, and downstream. Because of developments in the oil and gas industry in the United States, the welded pipes market is expected to grow steadily during the forecast period. The United States has always been a leading producer of oil and gas, and with the recent discovery of unconventional oil and gas resources, the country's oil reserves have risen to more than 68 billion barrels and natural gas reserves to 432 trillion cubic feet in 2019. In 2019, the country's share of global oil production was 17.5%, while its share of global gas production was 23.2%. These percentages are expected to rise in the forecast years. Crude oil production in the United States increased to 17,3045 thousand barrels per day in 2019 from 11,801 thousand barrels per day in 2014. The country's upcoming forecast, including the Alaska LNG liquefaction plant worth USD 43 billion and the Cameron LNG Liquefaction Plant worth USD 33 billion, are expected to increase demand for oil and gas equipment, including steel pipes and tubes. These all aspects are boosting the growth of the welded pipes market and are expected to do the same in the forecast period. The demand for pipe is expected to grow during the forecast period The pipe's demand is expected to grow. Global demand for more cost-effective transportation will increase. The cost of transporting fluids per unit weight per unit distance drops about by an order of magnitude for each mode of transport: air, surface, ship, and pipe. Furthermore, due to the too-short design life of many underground pipes already in use, robust pipes with longer life will be in demand. To develop the welding pipes market, pipeline design life should be greatly improved. Fluctuating raw material cost Steel tube and tubing prices are directly related to raw material prices such as iron ore, metal nickel scraping, chromium, nikel, and several other alloying components. The production cost of heat-resistant stainless steel and nickel alloy tubes is high because they contain a high amount of nikel and carbon steel. The 400 series stainless steel material is among the lowest-cost steel available, followed by alloys such as tantalum, Inconel, monel, and hastelloy, which cost very high due to their high nickel, chromium, and moly content. It is difficult to keep track of raw material costs because they move irregularly and without visible trends. Companies that manufacture welded pipes cannot predict the risk of volatile raw material pricing. The price of raw materials, which are necessary to manufacture welded pipes, will rise, raising the price of the finished goods. Steel is the most common raw material used in the production of welded pipes. Steel prices have been shifting in the global market due to market circumstances, international steel pricing, and other factors. The availability of raw materials is determined by global and local demand, as well as government laws. The varying prices of raw materials required to create welded pipes, such as iron and steel, have an impact on manufacturing costs. As a result, changing raw material costs are projected to limit the global welded pipes market's growth over the forecast period. Competitive dynamics and key developments pipe manufacturers are ready to provide welded pipes that are suited to certain industries. To that purpose, manufacturers are altering the alloy composition and offering alternative geometries, allowing them to meet a diverse range of needs and consolidate their market share in welded pipes market. It is important to note that an increasing number of welded pipe manufacturers are also focusing on specialized applications in biochemistry and medical equipment. Top companies in the welded pipes market have increased their R&D efforts to meet the particular demands of these end-use industries. In the near future, such a plan might help launch them to a highly competitive platform.Welded Pipes Market Segment Analysis:

Based on the Material, the welded pipes are segmented into carbon steel, stainless steel and alloy steel. Stainless steel held the largest market share during the forecast period. Stainless steel materials used to make welded pipes are made up of several iron-based alloys. End-use sectors, particularly construction in the stainless steel welded pipes market, are eager to capitalize on the unique combination of properties that stainless steel possesses. Stainless steel pipes provide exceptional resistance to high temperatures, stress corrosion cracking, and a high strength-to-weight ratio. Different qualities are employed depending on the application area, influencing the stainless steel used. As a result of the fast-growing usage of these in demanding applications such as marine, medical equipment, and automotive, the stainless steel welded pipes market has gained sales or revenues over the years. The increasing usage of stainless steel welded pipes in construction has resulted in reliable income growth in welded pipe market. Stainless steel has corrosion resistance, great ductility, a beautiful look, and requires little maintenance. Stainless steel includes chromium, which gives it corrosion resistance at high temperatures. Because of its flat surface, stainless steel can endure corrosive or chemical conditions. Stainless steel goods are long-lasting and have great corrosion fatigue resistance driving the welded steel pipe market. Stainless steel welded pipes are highly used in the applicationBased on the Product Type, welded pipe market is segmented into Process pipes, mechanical tube, heat exchanger tubes, and structural tubes. Heat exchanger tubes held the largest market share during the forecast period. Plate heat exchangers and shell and tube heat exchangers are the two most common types of heat exchangers. Shell and tube heat exchangers have steel tubes within a carbon steel shell and are suited for applications requiring exceptionally high flow rates, temperatures, and pressure loads driving welded pipe market. These are used in a variety of industries including chemical processing, food processing, pharmaceutical, oil refining, nuclear power generation, refrigeration, and aerospace to chill, heat, or re-heat fluids or gases. These tubes are perfect for high-temperature and high-pressure applications. Thanks to the demand for welded pipe market is expected to dominate in all these industries during the forecast period. Tubing in TEMA diameters is often composed of low-carbon steel, copper, Admiralty, Copper-Nickel, stainless steel, Hastalloy, Inconel, titanium, and a few other materials. Tubing ranging from 5/8" to 1-1/2" is commonly used in these designs. Tubes are often drawn, seamless, or welded. Superior grain structure at the weld is characteristic of high-quality ERW (electro-resistance welded) tubes. For particular applications, extruded tube with low fins and inside rifling is specified. Surface improvements are used to increase the available metal surface or to help in fluid turbulence, resulting in an increase in the effective Heat Transfer rate. Finned tubing is indicated when the heat transfer coefficient of the shell side fluid is much lower than that of the tube side fluid. Finned tubing has an outer diameter in the finned region that is approximately smaller than the outside diameter in the unfinned, or landing area for the tube sheets. This allows the assembly to take place by sliding the tubes between the baffles and tube supports while reducing fluid bypass these characteristics of welded tubes drive the demand for the welding pipe market globally more details about each product are detailed covered in the report.

Product Name Executive Standard Steel Code / Steel Grade Industrial Pipes ASTM A312, A358, A778JIS G3459 TP304, TP304L, TP316L, SUS304TP Tubes for Boiler and Heat-Exchanger, General Service Tubing ASTM A249, A269, JIS G3463 TP304, TP304L, TP316L, SUS304TB Mechanical and Structural Tubes ASTM A554, JIS G3446 MT304, MT304L, MT316L, MT430 Grade 201, 202 as per mill's STD SUS304 Square Tubes ASTM A554 MT304, MT304L, MT316L, MT430 Grade 201, 202 as per mill's STD Rectangular Tubes ASTM A554 MT304, MT304L, MT316L, MT430 Grade 201, 202 as per mill's STD Sanitary Tubing ASTM A270 JIS G3447 TP304, TP304L, TP316L, SUS304TBS Large Gauge Pipes for Ordinary Piping JIS G3448 SUS304TPD Large Diameter Pipes JIS G3468 SUS304TPY Based on the Application, The discovery of new places for crude oil and natural gas has increased the demand for high-strength materials that may be utilized for pipelines and their connecting. Welded pipes must withstand internal fluid pressure as well as harsh exterior circumstances. Welding of high-strength pipeline materials is another problem for engineers working on pipe and oil and gas transportation lines. Effective welding processes for these materials are required to improve dependability and profitability in this business. To fully comprehend the challenges surrounding the welding of these high-strength steels, the chemical composition and mechanical characteristics of these materials are thoroughly explored. The purpose of this review paper is to critically examine the concerns and challenges related with the weldability of high strength pipeline materials. The present state of weld corrosion, hydrogen embrittlement, residual stress, weld mending, and deteriorating heat affected zone research is also summarized. Current development trends are examined in order to forecast future orientations. The findings of this review effort highlight the importance of shifting the research focus from the presently utilized grades X65, X70, and X80 to the advanced grades X90, X100, and X120. HSLA steels are the materials most adapted to the needs of the oil and gas pipeline sector. The American Petroleum Institute (API), International Organization for Standards (ISO), and other national authorities specify chemical composition, mechanical qualities, and other important issues like as welding, cutting, and manufacture of oil and gas pipeline materials. Many national authorities use API standards as a guideline when developing their own requirements for these products. API standards are widely accepted and utilized across the globe.

Welded Pipes Market Regional Insights:

North America in welded pipe market is expected to dominate the market during the forecast period. In pipeline advancements over the next five years, North-East Asia, North America, and Europe all exhibit steady demand growth. China declared in 2019 that it will grow its present 112,000 km network of energy pipelines to 169,000 km by 2020 and up to 240,000 km by 2025. Japan intends to build a 1,500-kilometer pipeline to import Russian gas. North America has almost 31,000 miles of pipelines planned, with 15,279 miles actually under construction as of 2020. The development of a 600-mile Atlantic Coast pipeline is one of the active projects in the United States. Nord Stream 2 is also scheduled to be finished by 2021. As of 2020, the Middle East and Africa have 4,423 miles of pipeline under construction, with another 4,794 miles planned for the future. Because of increased real estate expenditure by construction corporations, North America has seen significant development in the construction sector. Commercial building construction, such as offices and complexes, has increased in quantity, as corporate centers have become very overcrowded, requiring the demand for additional structures. The early adoption of several new waste management solutions, as well as a solid foundation of wealthy industry participants offering a diverse variety of products, have had a significant impact on the welded pipes market. Furthermore, the large demand for hydraulic and instrumentation tubes from the mechanical and engineering sectors increases the need for welded pipes. Because of its large pool of well-known vendors, the United States is the world's largest-growing region in the welded pipe marketWelded Pipes Market Scope: Inquire before buying

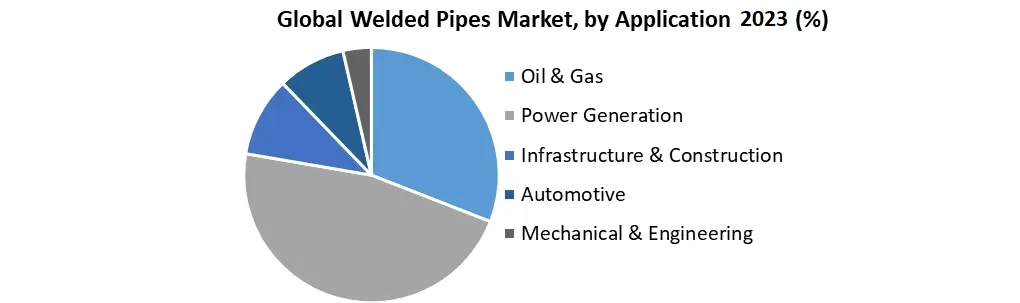

Welded Pipes Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 255.21 Bn. Forecast Period 2024 to 2030 CAGR: 5.8% Market Size in 2030: US $ 378.70 Bn. Segments Covered: by Material 1. Carbon Steel 2. Stainless Steel 3. Alloy Steel by Product 1. Process Pipes 2. Mechanical Tubes 3. Heat Exchanger Tubes 4. Structural Tubes 5. Hydraulic & Instrumentation Tubes by Application 1. Oil & Gas 2. Power Generation 3. Infrastructure & Construction 4. Automotive 5. Mechanical & Engineering by Welding Type 1. Spiral Seam Welding 2. Straight Seam Welding Welded Pipes Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Welded Pipes Market, Key Players are

1. Marcegaglia 2. Sosta GmbH & Co. KG 3. ArcelorMittal S.A. 4. Nippon Steel 5. Hyundai Steel Co., Ltd 6. Sandvik AB 7. Shanghai Metal Corporation 8. FROCH ENTERPRISE CO., LTD. 9. F.E.R. Fischer Edelstahlrohre GmbH 10. YC Inox 11. JFE Steel Corporation 12. CSM TUBE spa 13. Guangzhou Pearl River Petroleum Steel Pipe Co., Ltd. 14. Guangdong Lizz Steel Pipe Co, Ltd. 15. Foshan Zhongde Stainless Steel Co., Ltd. Frequently Asked Questions: 1] What is welded pipe? Ans. Welding is a process of connecting two pipes. Arc welding procedures such as MIG welding and TIG welding are utilized for pipe welding. 2] What is the most popular Weld? Ans. The most common welding procedure is shielded metal arc welding (Stick). It is the most adaptable and requires the least amount of equipment. The tiny light electrode and holder can be utilized in small spaces or hundreds of feet distant from the welding power supply.3] 3] What industries need welding? Ans. Welders are employed in a wide range of sectors, including aerospace and construction. Welding employment is also prevalent in the shipbuilding, petrochemical, and manufacturing industries, among many others where metals must be joined together. 4] Which is better seamless or welded pipe? Ans. A seamless tube is manufactured by extruding and drawing a billet, whereas welded tube is formed by rolling a strip and welding it to make a tube. Welded tube is significantly less costly than seamless tube and comes in vast continuous lengths. 5] What are the two advantages of welding pipes? Ans. A correctly welded system has an interior shape and surface that is smooth and streamlined. A welded pipe is significantly easier to repair than one way with screwed fittings. With welding, a repair may typically be completed while the pipe is still in place. Disassembling, repairing, and reassembling a screwed pipe system is required.

1. Global Welded Pipes Market: Research Methodology 2. Global Welded Pipes Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Welded Pipes Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Welded Pipes Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Welded Pipes Market Segmentation 4.1 Global Welded Pipes Market, by Material (2023-2030) • Carbon Steel • Stainless Steel • Alloy Steel 4.2 Global Welded Pipes Market, by Product (2023-2030) • Process Pipes • Mechanical Tubes • Heat Exchanger Tubes • Structural Tubes • Hydraulic & Instrumentation Tubes4.3 Global Welded Pipes Market, by Application (2023-2030) • Oil & Gas • Power Generation • Infrastructure & Construction • Automotive • Mechanical & Engineering 4.4 Global Welded Pipes Market, by Welding Type (2023-2030) • Spiral Seam Welding • Straight Seam Welding 5. North America Welded Pipes Market(2023-2030) 5.1 North America Welded Pipes Market, by Material (2023-2030) • Carbon Steel • Stainless Steel • Alloy Steel 5.2 North America Welded Pipes Market, by Product (2023-2030) • Process Pipes • Mechanical Tubes • Heat Exchanger Tubes • Structural Tubes5.3 North America Welded Pipes Market, by Application (2023-2030) • Oil & Gas • Power Generation • Infrastructure & Construction • Automotive • Mechanical & Engineering 5.4 North America Welded Pipes Market, by Welding Type (2023-2030) • Spiral Seam Welding • Straight Seam Welding 5.5 North America Welded Pipes Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Welded Pipes Market (2023-2030) 6.1. European Welded Pipes Market, by Material (2023-2030) 6.2. European Welded Pipes Market, by Product (2023-2030) 6.3. European Welded Pipes Market, by Application (2023-2030) 6.4. European Welded Pipes Market, by Welding Type (2023-2030) 6.5. European Welded Pipes Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Welded Pipes Market (2023-2030) 7.1. Asia Pacific Welded Pipes Market, by Material (2023-2030) 7.2. Asia Pacific Welded Pipes Market, by Product (2023-2030) 7.3. Asia Pacific Welded Pipes Market, by Application (2023-2030) 7.4. Asia Pacific Welded Pipes Market, by Welding Type (2023-2030) 7.5. Asia Pacific Welded Pipes Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Welded Pipes Market (2023-2030) 8.1 Middle East and Africa Welded Pipes Market, by Material (2023-2030) 8.2. Middle East and Africa Welded Pipes Market, by Product (2023-2030) 8.3. Middle East and Africa Welded Pipes Market, by Application (2023-2030) 8.4. Middle East and Africa Welded Pipes Market, by Welding Type (2023-2030) 8.5. Middle East and Africa Welded Pipes Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Welded Pipes Market (2023-2030) 9.1. South America Welded Pipes Market, by Material (2023-2030) 9.2. South America Welded Pipes Market, by Product (2023-2030) 9.3. South America Welded Pipes Market, by Application (2023-2030) 9.4. South America Welded Pipes Market, by Welding Type (2023-2030) 9.5. South America Welded Pipes Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Marcegaglia 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Sosta GmbH & Co. KG 10.3 ArcelorMittal S.A. 10.4 Nippon Steel 10.5 Hyundai Steel Co., Ltd 10.6 Sandvik AB 10.7 Shanghai Metal Corporation 10.8 FROCH ENTERPRISE CO., LTD. 10.9 F.E.R. Fischer Edelstahlrohre GmbH 10.10 YC Inox 10.11 JFE Steel Corporation 10.12 CSM TUBE spa 10.13 Guangzhou Pearl River Petroleum Steel Pipe Co., Ltd. 10.14 Guangdong Lizz Steel Pipe Co, Ltd. 10.15 Foshan Zhongde Stainless Steel Co., Ltd.