The Global Water Electrolysis Market size was valued at USD 6.23 Billion in 2022 and the total Water Electrolysis revenue is expected to grow at a CAGR of 6.1% from 2023 to 2029, reaching nearly USD 9.43 Billion during the Forecast PeriodWater Electrolysis Market Industry & Technology Overview:

Water electrolysis is one of the most promising methods for green hydrogen generation. It has the advantage of being able to produce hydrogen using only renewable energy. Presently, significant societal shifts have prompted green hydrogen producers and select petroleum companies to establish hydrogen refueling stations across Japan and Germany. Green hydrogen provides a sustainable solution for future energy demands and decarburization. Electrolysis is one of the best approach that uses electricity to split water into hydrogen and oxygen, and it takes place in a unit called an electrolyzer. Electrolyzers can range in size from small, appliance-size equipment that is well-suited for small-scale distributed hydrogen production to large-scale, central production facilities that could be tied directly to renewable or other non-greenhouse-gas-emitting forms of electricity production. Electrolysis is a promising option for carbon-free hydrogen production from renewable and nuclear resources. Hydrogen produced via electrolysis can result in zero greenhouse gas emissions, depending on the source of the electricity used. Electrolysis is a leading hydrogen production pathway to achieve the Hydrogen Energy Earthshot goal of reducing the cost of clean hydrogen by 80% to $1 per 1 kilogram in 1 decade. In November 23, 2023, BASF has received funding approval for a 54-megawatt water electrolysis plant, which is expected to produce up to 8,000 metric tons of hydrogen per year, resulting in an annual reduction in CO2 emissions of up to 72,000 metric tons.To know about the Research Methodology :- Request Free Sample Report The water electrolysis market is expected to play a crucial role in producing carbon-free hydrogen from nuclear and renewable sources, with applications in various industries such as the food business, metallurgical industry, and power plants with increase in water electrolysis market demand. As refineries are under increasing pressure to meet environmental legislation and reduce carbon emissions, they are expected to be one of the leading adopters of water electrolysis technology, further driving global Water Electrolysis industry growth. Additionally, the market is witnessing increased investment from governments toward green hydrogen projects, particularly in regions like South America, the Middle East, and Africa, which are expected to present lucrative opportunities for market development. The key market competitor in the water electrolysis market include ThyssenKrupp AG, Linde AG, Air Products and Chemical Inc., Siemens AG, ProtonOnsite, Teledyne Energy Inc., AREVA H2Gen, Hydrogenics Corporation, Erre Due SpA, and Peak Scientific. These companies are working on expanding market demand by investing in research and development activities to meet the increasing demand for environment-friendly technologies and the production of low-carbon hydrogen. BP led a $12.5 million Series A investment in Advanced Ionics, a developer of a new category of hydrogen electrolyzers for expanding green hydrogen production. The investment is to be accelerate the growth and deployment of Advanced Ionics' Symbion electrolyzer technology for heavy industry. The company's water vapor electrolyzer technology addresses two of the biggest obstacles to expanding green hydrogen production cost and electricity requirements. The electrolyzer stack requires less than 35 kWh per kilogram of produced hydrogen, compared to more than 50 kWh per kilogram for typical electrolyzers. This lower electricity requirement could make green hydrogen accessible for less than $1 per kilogram at scale. The funds procured from this financing round will enable Advanced Ionics to expand its workforce and expedite the delivery of its next-generation electrolyzer systems to early adopters. The company is already demonstrating the efficacy of its product through a pilot program with global energy company Repsol Foundation. In addition to bp Ventures' investment, bp will also be exploring pilot opportunities with Advanced Ionics. Other investors in Advanced Ionics include Aster, and angel investor collectives Clean Energy Venture Group and SWAN Impact Network.

Water Electrolysis Market Trends:

1. Over the years, there has been a consistent annual growth rate of 18% in the publication of patent families linked to water electrolysis globally. Notably, these figures have exceeded those associated with hydrogen sources derived from solid, liquid, and oil-based origins. 2. The trend for water electrolyzers is shifting towards becoming the primary method for hydrogen production in the Net Zero Emissions by 2050 Scenario. While contemporary hydrogen production relies largely on unabated fossil fuel technologies, the envisioned transition emphasizes the pivotal role of low-emissions hydrogen. In this scenario, electrolysis, powered by renewable electricity, emerges as the primary route for hydrogen production. 3. The shift aligns with the aim to decarbonize challenging sectors like heavy industry and long-distance transport, reflecting the evolving trend towards cleaner and more sustainable methods of hydrogen generation through water electrolysis.Water Electrolysis Market Dynamics

Rising Demand for Hydrogen Production is Driving Forces and Global Implications of Water Electrolysis Market As per analysis, Increased investments in large-capacity green hydrogen projects, particularly in regions like Asia, Europe, and Australia, are propelling the demand for electrolyzers, fueled by the expanding uses of hydrogen across various sectors. Additionally, the rising demand for electrolyzer-based green ammonia for fertilizer production, aligned with sustainable farming practices, underscores the market's relevance in supporting environmentally friendly solutions. Technological advancements geared toward sustainable hydrogen production, supported by both governmental initiatives and private investments, are further bolstering market growth. Moreover, the market benefits from a regulatory environment emphasizing environmental protection and pollution control, positioning water electrolysis as a crucial player in providing sustainable energy solutions. The surge in private investment specifically targeting sustainable hydrogen production aligns with the market's trajectory, reflecting its importance in meeting the increasing demand for clean and renewable energy sources like hydrogen. Overall, these factors collectively highlight water electrolysis technology as a vital driver in addressing the global need for cleaner energy alternatives and sustainable production methods. These aspects boost the water electrolysis market demand. On August 25, 2023, Diversified renewable energy company ACME Group has signed a land agreement with Tata Steel Special Economic Zone (TSSEZL) for a green hydrogen and green ammonia project from water electrolysis at the Gopalpur Industrial Park in Odisha. The agreement allocates 343 acres for the project, which aims to set up a 1.3 MTPA green ammonia production facility. The green ammonia will be produced from green hydrogen, with the production facilities powered by renewable energy. ACME Group plans to partner with Japan’s IHI Corporation for this project and intends to export the green ammonia to markets in the West and East from the existing Gopalpur port facilities. This initiative aligns with the company's vision to become a leading green energy provider, producing 10 million tons/year of green ammonia and hydrogen by 2032. H2 Production Flow:Cumulative Installed Power-To-Hydrogen Capacity and Number of Projects in EU, EFTA, UK (MW)

Some Examples of The Production of Hydrogen with Renewable Energies 1. Utsira: This project aimed at achieving energy self-sufficiency on an island in southern Norway involves two 600 kW wind turbines, an electrolyzer producing 10 Nm³/N, a storage capacity of 2,400 Nm³ at 200 bars pressure, and a 55 kW fuel cell. 2. HARI (Integration of Hydrogen with Renewables): Implemented by the Centre for Renewable Energy Systems Technology (CREST) at Loughborough University, UK, this project demonstrates the design, execution, and functioning of a hydrogen-based energy storage system using renewable energy sources. 3. Wind2H2: NREL conducted a project on the hydrogen economy utilizing wind-powered electrolyzers, specifically in connection with a planned demonstration on a Norwegian island. The research highlights the storage unit's size dependency on the Wind Energy Conversion System (WECS) and the system's operational mode. In independent operation, the storage unit significantly impacts investment costs. According to preliminary economic analyses, a standalone wind/H2 system has an investment cost four times higher than a comparable wind/diesel system. Comparative Table Summarizing Different Types of Hydrogen Production Methods:

The Capital Barrier for Green Ventures for Water Electrolysis Market Growth One primary restraint is the substantial initial capital investment required to establish electrolysis plants. For instance, the Hybrit initiative in Sweden, aiming to produce fossil-free steel through large-capacity electrolyzer plants, faced significant financial barriers, showcasing the immense capital needed for such ventures. Another obstacle lies in the energy-intensive nature of electrolysis, demanding substantial electricity input. Companies like ITM Power engaged in green hydrogen production, highlighting the challenge of high energy requirements, which escalates operational costs and affects cost-effectiveness. Dependence on intermittent renewable energy sources, such as solar or wind power, introduces inconsistency in hydrogen production. In Germany, projects aiming for large-scale hydrogen production from renewables face challenges due to intermittency in energy supply, impacting reliable and consistent hydrogen output. Technological scalability limitations also impede growth. Companies like Nel ASA are striving to scale up electrolyzer production; however, achieving larger capacities without compromising efficiency remains a challenge. The competition from established methods like steam methane reforming (SMR) poses a significant hurdle due to lower production costs. Despite environmental benefits, electrolysis-based hydrogen struggles to compete with SMR-produced hydrogen. Inadequate infrastructure for hydrogen transportation and storage is another challenge, highlighted by projects such as the European H2Haul initiative, emphasizing the need for comprehensive infrastructure development. Supply chain complexities, lack of standardization in regulations, limited public awareness, and geopolitical uncertainties further contribute to the hurdles impeding the widespread adoption of water electrolysis technology in the hydrogen market. The evolution of the water electrolysis sector is propelled by key focal points aimed at enhancing its overall efficiency and effectiveness. One primary objective involves reducing the capital cost associated with both the electrolyzer unit and the overall system. Innovations and advancements within the industry are directed at streamlining manufacturing processes, optimizing materials, and refining system designs to minimize costs. This cost reduction drive aims to make electrolysis technology more economically viable and accessible for various applications, thereby fostering its widespread adoption. Current Sources of Hydrogen:

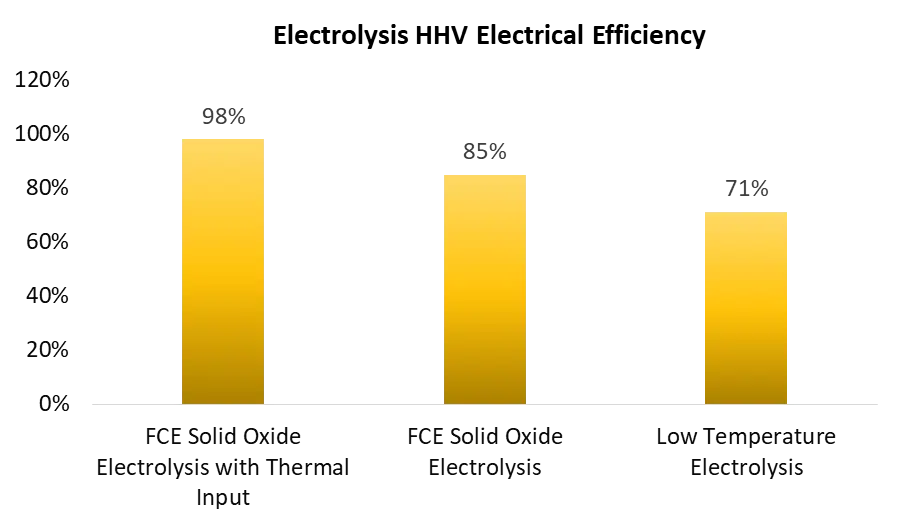

Type of Hydrogen Technology Source Products CO2 Emissions Cost(S/kg H2) Brown Hydrogen Gasification Brown coal H2 + CO2 High 1.2-2.1 Black Hydrogen Gasification Black coal H2 + CO2 High 1.2-2.1 Grey Hydrogen Reforming Natural gas H2 + CO2 (Released) Medium 1-2.1 Blue Hydrogen Reforming + CCS Natural gas H2 + CO2 (Captured 85-95%) Low 1.5-2.9 Green Hydrogen Electrolysis Water H2 + O2 Minimal 3.6-5.8 Another critical focus area involves augmenting the energy efficiency of the electrolysis process. Efforts are concentrated on improving the conversion of electricity to hydrogen across a broad spectrum of operating conditions. This pursuit aims to increase the overall efficiency of electrolyzer units, ensuring optimal hydrogen production while minimizing energy consumption. Advancements in electrode materials, system design enhancements, and sophisticated control mechanisms are pivotal in achieving higher energy efficiencies across varying operational parameters, contributing to the industry's technological advancement. Additionally, there is an increasing emphasis on comprehending the degradation processes inherent in electrolyzer cells and stacks. Researchers and industry experts are dedicated to studying these degradation mechanisms meticulously to develop effective mitigation strategies. The goal is to prolong the operational life of electrolyzer units by identifying degradation factors, implementing preventive measures, and innovating new materials or designs that exhibit greater resilience. Enhancing durability and longevity is fundamental in ensuring the sustained performance and reliability of electrolysis technology in meeting the burgeoning demand for clean hydrogen production. The U.S. Department of Energy and others come to an end effort to bring down the cost of renewable-based electricity production and develop more efficient fossil-fuel-based electricity production with carbon utilization, capture, and storage. Wind-based electricity production is growing rapidly in the United States and globally is poised for significant expansion of water electrolysis market. Significance Amplified by Global Emphasis on Water Electrolysis Market Analysis The German government has taken significant steps by intensifying efforts in updating its National Hydrogen Strategy 2.0 (NWS) engaging a total of six ministries and the chancellery to reaffirm hydrogen's pivotal role in the energy transition. With targets adjusted to match evolving conditions, the strategy aims for an accelerated hydrogen ramp-up, setting a goal of at least 10 gigawatts of water electrolyzer capacity by 2030. Notably, plans include the creation of 1,800-kilometer hydrogen network by 2027/2028, using repurposed gas pipelines, backed by EU funding. The strategy emphasizes hydrogen applications across industries and supports various hydrogen types, including green, low-carbon, blue, turquoise, and orange, aligning with the pursuit of a hydrogen economy while nurturing fair global hydrogen markets. Leveraging existing structures, the strategy outlines the role of institutions and highlights the need for a diverse workforce and technology options for the heating sector. Despite ambitious goals, criticisms from the opposition about central control persist, urging for more robust integration into EU initiatives and faster approvals to achieve widespread green hydrogen use. On October 11, 2023, Ovivo UK Ltd, in collaboration with sister company EnviroChemie declared their successful bid for the design and supply contract of the Purified Water treatment plant for a colossal green hydrogen production facility in Saudi Arabia. Green hydrogen, generated through electrolysis powered by renewable energy, is at the heart of this project, where water molecules are split into oxygen and hydrogen using an electric current. As the global push toward sustainable energy intensifies among governments, businesses, and individuals, water is increasingly recognized as a crucial component in green hydrogen production. Hydrogen, being emissions-free compared to fossil fuels, holds immense potential for various applications, such as fueling vehicles, heating structures, and providing backup power. However, ensuring the success of this technology demands specific prerequisites, including access to Green Electricity and exceptionally high-quality feed water. Water treatment solutions, Ovivo UK actively contributes to advancing hydrogen production with its H2PW™ technology, contributing to a more sustainable future. The fundamental system involves a preliminary treatment process for the green hydrogen feed water, succeeded by multi-pass, high-efficiency demineralisation stages. Water plays a pivotal role throughout multiple stages of hydrogen production, and this project focuses on delivering a large-scale H2PWTM Purified Water treatment plant to supply 4GW of hydrogen electrolysers, equivalent to the energy required for 8 million households. This innovative plant employs optimized technologies to minimize waste and energy consumption while ensuring water purification, thereby preventing contamination build-up and extending the lifespan of hydrogen cells. Once operational, this water treatment facility will enable the daily production of up to 600 tons of green hydrogen, catering to the global transportation sector. Ovivo remains steadfast in utilizing its expertise to offer cutting-edge water treatment solutions that align with the evolving needs of its partners in hydrogen power production, who share a similar appreciation for the value of water in this transformative endeavor. Industry's Forward Momentum is Expanding Horizons for Water Electrolysis Market Demand Governments worldwide are increasingly emphasizing the shift towards renewable energy sources, elevating the significance of green hydrogen in achieving climate goals across diverse sectors like transportation and industry. This surge in demand has spurred considerable investments in water electrolysis technologies. For instance, Nouryon's commitment to expanding its production facility for green hydrogen using electrolysis in the Netherlands is emblematic of the market's burgeoning potential amid rising green hydrogen requirements. Technological advancements play a pivotal role in the market's growth by enhancing electrolyzer efficiency, scalability, and cost-effectiveness. Innovations like Siemens Energy's Silyzer electrolysis technology and high-capacity electrolysis systems developed by ITM Power in the UK signify the industry's forward momentum. These advancements not only attract substantial investments but also foster partnerships, creating a conducive environment for Water Electrolysis industry growth. The relentless pursuit of improved electrolysis technology is a driving force behind the market's promising prospects, catering to the increasing demand for hydrogen production on a larger scale of water electrolysis market share. Solid Oxide Electrolysis Efficiency:

Water Electrolysis Market Segmentation Analysis:

Based on Technology Type: the Water Electrolysis Market has been divided into Alkaline Electrolysis, PEM (Proton Exchange Membrane) Electrolysis, Solid Oxide Electrolysis, and Anion Exchange Membrane (AEM) Electrolyzers. Among these, the Alkaline Electrolysis sub-segment is projected to generate the maximum revenue of water electrolyser market through the forecast period. The most frequently used method of electrolysis is the alkaline electrolysis, which is a type of water electrolysis that uses an alkaline electrolyte, typically potassium hydroxide (KOH) or sodium hydroxide (NaOH). Alkaline electrolysis is a well-established technology and has been used for many years for the production of hydrogen. It is known for its relatively low cost and high efficiency, and it is the most common method for large-scale hydrogen production. Alkaline electrolysis is a well-established technology that has been used in the industrial sector for over a century, primarily for producing relatively pure hydrogen and other gases, such as chlorine. Some advantages of alkaline electrolysis include lower capital costs compared to PEM electrolyzers, higher hydrogen production capacity, and lower energy consumption. These factors are anticipated to boost the growth of the Alkaline Electrolysis sub-segment during the forecast timeframe. Despite its advantages, the dominance of alkaline electrolysis in the market is still a matter of debate, and the technology is facing competition from PEM electrolysis, which is expected to outperform alkaline electrolysis in the future. Proton Exchange Membrane (PEM) electrolysis, which works in an acidic environment and uses a solid polymer electrolyte membrane. This method is gaining attention due to its potential for high efficiency and flexibility in operation. However, it typically requires the use of precious metals such as iridium or platinum to protect the electrodes from corrosion. Despite the ongoing research and development in the field of electrolysis, alkaline and PEM electrolysis remain the most widely used methods for water electrolysis.Water Electrolysis Market Regional Outlook:

Water Electrolysis Europe Market Europe region dominated the water electrolysis market in the year 2022, and is expected to continue its dominance during the forecast period. Europe has emerged as a significant player in the water electrolysis market due to several factors that have contributed to its dominance in this sector: Europe has implemented ambitious policies and strategies supporting renewable energy and the transition to a low-carbon economy. The European Union's (EU) initiatives like the European Green Deal and the Hydrogen Strategy emphasize the development of green hydrogen, thus driving the demand for water electrolysis technology. The increasing focus on renewable energy sources, such as wind and solar power, has provided a conducive environment for the growth of water electrolysis technology. Electrolyzers play a crucial role in converting surplus renewable electricity into hydrogen through electrolysis. Europe has seen substantial investment in research, development, and deployment of hydrogen technologies. Public and private sector investments, along with funding from the European Commission, have accelerated innovation and market growth in the water electrolysis industry. Additionally, collaborative efforts among European countries, industries, and research institutions have fostered the development of large-scale electrolyzer projects. These partnerships facilitate knowledge sharing, technological advancements, and the scaling up of electrolysis technology for industrial use. Various industries across Europe, including energy, transportation, and manufacturing, are increasingly exploring hydrogen as a clean energy source. Electrolysis is pivotal in producing green hydrogen, aligning with Europe's decarbonization goals and meeting the rising demand for clean fuels. It has established regulatory frameworks and incentives that support the growth of the hydrogen economy, creating an attractive market for water electrolysis technologies. Regulations promoting clean energy and carbon reduction have further propelled the adoption of electrolyzers. European companies and research institutions have positioned themselves as leaders in electrolysis technology. Collaborations and partnerships between European entities and international counterparts contribute to knowledge exchange and technology transfer, fostering advancements in water electrolysis. These factors collectively position Europe as a dominant force in the water electrolysis market, driving innovation, deployment, and commercialization of electrolysis technology, particularly in the context of producing green hydrogen as a clean and sustainable energy carrier. The German Federal Ministry for Economic Affairs and Climate Action and the State of Rhineland-Palatinate will provide up to USD 135.54 Million in funding for the project. In cooperation with Siemens Energy, BASF's water electrolysis project, known as Hy4Chem-EI, is now entering the next phase of construction. The proton exchange membrane (PEM) electrolyzer will be one of the largest of its kind in Germany once operational, producing CO2-free hydrogen using electricity from renewable sources. BASF plans to use the hydrogen as a raw material in the manufacture of products with a reduced carbon footprint and to supply hydrogen for mobility in the Rhine-Neckar Metropolitan Region to support the ramp-up of a hydrogen economy in the area. The water electrolysis plant is expected to begin operating in 2025, with funding from the German Federal Ministry for Economic Affairs and Climate Protection and the State of Rhineland-Palatinate. As of August 2022, Hydrogen Europe identified 143 power-to-hydrogen sites operational in the EU, EFTA, and the UK, with a combined capacity of 162 MWel or 29 kilotons per year. However, these installations constitute a small fraction, merely 0.25%, of the total hydrogen production capacity in Europe as of 2020, which was 11.5 megatons. To put this into perspective, the cumulative operational power-to-hydrogen capacity in Europe is only slightly higher than the world's most extensive operational power-to-hydrogen facility: the 150 MW alkaline plant in China, operated by Ningxia Baofeng Energy Group. Capacity of Planned Large-Scale Hydrogen Electrolysis Projects worldwide by 2026, by region (in gigawatts)Competitive Landscape: On January 12, 2021, Sunfire, a leader in green hydrogen solutions, has acquired Switzerland-based IHT Industrie Haute Technology SA, expanding its portfolio to include high-pressure alkaline water electrolysis. With the takeover, Sunfire gains 100% ownership of IHT, focusing on their mature alkaline electrolyzer technology, suitable for environments lacking water steam, like energy and hydrogen mobility sectors. IHT's technology, developed on the Lurgi principle offers a robust lifespan of over 20 years and operational advantages. Sunfire's existing SOEC-based electrolysis complements IHT's high-pressure alkaline electrolysis, offering versatile solutions for green hydrogen production across various applications. In 2021, Ecopetrol, a prominent global oil company based in Colombia, initiated collaboration with H2B2, subsequently integrating the company into its group of strategic partners. This move aligns with Ecopetrol's strategy to drive decarbonization efforts and foster the advancement of green hydrogen energy. Additionally, H2B2 has extended its presence into the Indian market by forming a joint venture with the GR Promoter Group establishing GreenH. In Electrolysis.

Water Electrolysis Market Scope: Inquire Before Buying

Global Water Electrolysis Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 6.23 Bn. Forecast Period 2023 to 2029 CAGR: 6.1% Market Size in 2029: US $ 9.43 Bn. Segments Covered: by Technology Type Alkaline Electrolysis PEM (Proton Exchange Membrane) Electrolysis Solid Oxide Electrolysis Anion Exchange Membrane (AEM) Electrolyzers by End User Chemicals Electronics & Semiconductor Power Plants Petroleum Pharmaceuticals Water Electrolysis Market by Region:

1. North America (United States, Canada, and Mexico) 2. Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) 3. Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) 4. Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) 5. South America (Brazil, Argentina Rest of South America)Water Electrolysis Market Key Players

1. Nel ASA 2. Siemens Energy AG 3. Cummins Inc. 4. ITM Power plc 5. McPhy Energy S.A. 6. Plug Power Inc. 7. Toshiba Energy Systems & Solutions Corporation 8. Enapter AG 9. Giner ELX 10. Areva H2Gen 11. Green Hydrogen Systems 12. Kobelco Eco-Solutions Co., Ltd. 13. Next Hydrogen 14. ERGOSUP 15. Ceres Power Holdings plc FAQs: 1. What are the growth drivers for the Water Electrolysis market? Ans: The primary growth drivers for the Water Electrolysis market include Increasing focus on renewable energy sources for hydrogen production. Government initiatives and policies promoting green hydrogen. Additionally, Growing demand for clean fuels in various industries like transportation and power generation. 2. What is the major restraint for the Water Electrolysis market growth? Ans. One significant restraint for the Water Electrolysis market growth is the high initial capital investment required for establishing electrolysis facilities, hindering widespread adoption. Additionally, limitations in grid infrastructure for accommodating renewable energy sources can pose challenges in scaling up electrolysis operations. Regulatory complexities and the need for supportive policies also impede rapid market expansion. 3. Which region is expected to lead the global Water Electrolysis market during the forecast period? Ans. Europe is expected to lead the global Water Electrolysis market during the forecast period. 4. What is the projected market size & and growth rate of the Water Electrolysis Market? Ans. The Water Electrolysis Market size was valued at USD 6.23 Billion in 2022 and the total Water Electrolysis revenue is expected to grow at a CAGR of 6.1% from 2023 to 2029, reaching nearly USD 9.43 Billion By 2029. 5. What segments are covered in the Water Electrolysis Market report? Ans. The segments covered in the Water Electrolysis market report are Technology Type, end user, and Region.

1. Water Electrolysis Market: Research Methodology 2. Water Electrolysis Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Water Electrolysis Market: Dynamics 3.1. Water Electrolysis Market Trends by Region 3.2. Water Electrolysis Market Dynamics by Region 3.2.1. Water Electrolysis Market Drivers 3.2.2. Water Electrolysis Market Restraints 3.2.3. Water Electrolysis Market Opportunities 3.2.4. Water Electrolysis Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Analysis of Government Schemes and Initiatives for Water Electrolysis Industry 3.7. The Global Pandemic Impact on Water Electrolysis Market 4. Water Electrolysis Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 4.1.1. Alkaline Electrolysis 4.1.2. PEM (Proton Exchange Membrane) Electrolysis 4.1.3. Solid Oxide Electrolysis 4.1.4. Anion Exchange Membrane (AEM) Electrolyzers 4.2. Water Electrolysis Market Size and Forecast, by End User (2022-2029) 4.2.1. Chemicals 4.2.2. Electronics & Semiconductor 4.2.3. Power Plants 4.2.4. Petroleum 4.2.5. Pharmaceuticals 4.3. Water Electrolysis Market Size and Forecast, by Region (2022-2029) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Water Electrolysis Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. North America Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 5.1.1. Alkaline Electrolysis 5.1.2. PEM (Proton Exchange Membrane) Electrolysis 5.1.3. Solid Oxide Electrolysis 5.1.4. Anion Exchange Membrane (AEM) Electrolyzers 5.2. North America Water Electrolysis Market Size and Forecast, by End User (2022-2029) 5.2.1. Chemicals 5.2.2. Electronics & Semiconductor 5.2.3. Power Plants 5.2.4. Petroleum 5.2.5. Pharmaceuticals 5.3. Water Electrolysis Market Size and Forecast, by Country (2022-2029) 5.3.1. United States 5.3.1.1. United States Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 5.3.1.1.1. Alkaline Electrolysis 5.3.1.1.2. PEM (Proton Exchange Membrane) Electrolysis 5.3.1.1.3. Solid Oxide Electrolysis 5.3.1.1.4. Anion Exchange Membrane (AEM) Electrolyzers 5.3.1.2. United States Water Electrolysis Market Size and Forecast, by End User (2022-2029) 5.3.1.2.1. Chemicals 5.3.1.2.2. Electronics & Semiconductor 5.3.1.2.3. Power Plants 5.3.1.2.4. Petroleum 5.3.1.2.5. Pharmaceuticals 5.3.2. Canada 5.3.2.1. Canada Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 5.3.2.1.1. Alkaline Electrolysis 5.3.2.1.2. PEM (Proton Exchange Membrane) Electrolysis 5.3.2.1.3. Solid Oxide Electrolysis 5.3.2.1.4. Anion Exchange Membrane (AEM) Electrolyzers 5.3.2.2. Canada Water Electrolysis Market Size and Forecast, by End User (2022-2029) 5.3.2.2.1. Chemicals 5.3.2.2.2. Electronics & Semiconductor 5.3.2.2.3. Power Plants 5.3.2.2.4. Petroleum 5.3.2.2.5. Pharmaceuticals 5.3.3. Mexico 5.3.3.1. Mexico Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 5.3.3.1.1. Alkaline Electrolysis 5.3.3.1.2. PEM (Proton Exchange Membrane) Electrolysis 5.3.3.1.3. Solid Oxide Electrolysis 5.3.3.1.4. Anion Exchange Membrane (AEM) Electrolyzers 5.3.3.2. Mexico Water Electrolysis Market Size and Forecast, by End User (2022-2029) 5.3.3.2.1. Chemicals 5.3.3.2.2. Electronics & Semiconductor 5.3.3.2.3. Power Plants 5.3.3.2.4. Petroleum 5.3.3.2.5. Pharmaceuticals 6. Europe Water Electrolysis Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Europe Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.2. Europe Water Electrolysis Market Size and Forecast, by End User (2022-2029) 6.3. Europe Water Electrolysis Market Size and Forecast, by Country (2022-2029) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.3.1.2. United Kingdom Water Electrolysis Market Size and Forecast, by End User (2022-2029) 6.3.2. France 6.3.2.1. France Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.3.2.2. France Water Electrolysis Market Size and Forecast, by End User (2022-2029) 6.3.3. Germany 6.3.3.1. Germany Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.3.3.2. Germany Water Electrolysis Market Size and Forecast, by End User (2022-2029) 6.3.4. Italy 6.3.4.1. Italy Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.3.4.2. Italy Water Electrolysis Market Size and Forecast, by End User (2022-2029) 6.3.5. Spain 6.3.5.1. Spain Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.3.5.2. Spain Water Electrolysis Market Size and Forecast, by End User (2022-2029) 6.3.6. Sweden 6.3.6.1. Sweden Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.3.6.2. Sweden Water Electrolysis Market Size and Forecast, by End User (2022-2029) 6.3.7. Austria 6.3.7.1. Austria Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.3.7.2. Austria Water Electrolysis Market Size and Forecast, by End User (2022-2029) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 6.3.8.2. Rest of Europe Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7. Asia Pacific Water Electrolysis Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.2. Asia Pacific Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3. Asia Pacific Water Electrolysis Market Size and Forecast, by Country (2022-2029) 7.3.1. China 7.3.1.1. China Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.1.2. China Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.2. S Korea 7.3.2.1. S Korea Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.2.2. S Korea Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.3. Japan 7.3.3.1. Japan Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.3.2. Japan Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.4. India 7.3.4.1. India Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.4.2. India Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.5. Australia 7.3.5.1. Australia Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.5.2. Australia Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.6. Indonesia 7.3.6.1. Indonesia Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.6.2. Indonesia Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.7. Malaysia 7.3.7.1. Malaysia Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.7.2. Malaysia Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.8. Vietnam 7.3.8.1. Vietnam Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.8.2. Vietnam Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.9. Taiwan 7.3.9.1. Taiwan Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.9.2. Taiwan Water Electrolysis Market Size and Forecast, by End User (2022-2029) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 7.3.10.2. Rest of Asia Pacific Water Electrolysis Market Size and Forecast, by End User (2022-2029) 8. Middle East and Africa Water Electrolysis Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 8.2. Middle East and Africa Water Electrolysis Market Size and Forecast, by End User (2022-2029) 8.3. Middle East and Africa Water Electrolysis Market Size and Forecast, by Country (2022-2029) 8.3.1. South Africa 8.3.1.1. South Africa Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 8.3.1.2. South Africa Water Electrolysis Market Size and Forecast, by End User (2022-2029) 8.3.2. GCC 8.3.2.1. GCC Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 8.3.2.2. GCC Water Electrolysis Market Size and Forecast, by End User (2022-2029) 8.3.3. Nigeria 8.3.3.1. Nigeria Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 8.3.3.2. Nigeria Water Electrolysis Market Size and Forecast, by End User (2022-2029) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 8.3.4.2. Rest of ME&A Water Electrolysis Market Size and Forecast, by End User (2022-2029) 9. South America Water Electrolysis Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 9.1. South America Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 9.2. South America Water Electrolysis Market Size and Forecast, by End User (2022-2029) 9.3. South America Water Electrolysis Market Size and Forecast, by Country (2022-2029) 9.3.1. Brazil 9.3.1.1. Brazil Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 9.3.1.2. Brazil Water Electrolysis Market Size and Forecast, by End User (2022-2029) 9.3.2. Argentina 9.3.2.1. Argentina Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 9.3.2.2. Argentina Water Electrolysis Market Size and Forecast, by End User (2022-2029) 9.3.3. Argentina 9.3.3.1. Argentina Water Electrolysis Market Size and Forecast, by End-User (2022-2029) 9.3.3.2. Argentina Water Electrolysis Market Size and Forecast, by End-User (2022-2029) 9.3.4. Rest Of South America 9.3.4.1. Rest Of South America Water Electrolysis Market Size and Forecast, by Technology Type (2022-2029) 9.3.4.2. Rest Of South America Water Electrolysis Market Size and Forecast, by End User (2022-2029) 10. Global Water Electrolysis Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Market Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Water Electrolysis Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Nel ASA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Siemens Energy AG 11.3. Cummins Inc. 11.4. ITM Power plc 11.5. McPhy Energy S.A. 11.6. Plug Power Inc. 11.7. Toshiba Energy Systems & Solutions Corporation 11.8. Enapter AG 11.9. Giner ELX 11.10. Areva H2Gen 11.11. Green Hydrogen Systems 11.12. Kobelco Eco-Solutions Co., Ltd. 11.13. Next Hydrogen 11.14. ERGOSUP 11.15. Ceres Power Holdings plc 12. Key Findings 13. Industry Recommendations 14. Research Methodology