Global Chemical Surface Treatment Market size was valued at USD 6.95 Bn in 2023 and is expected to reach USD 10.66 Bn by 2030, at a CAGR of 6.3%.Chemical Surface Treatment Market Overview

Chemical surface treatment involves modifying the surface of aluminum through various chemical processes, commonly serving as a pretreatment for subsequent finishing operations like anodizing or powder coating. Methods include pickling, chemical polishing, and chromatin/phosphating, used before powder coating help to increase demand for the Chemical Surface Treatment solution from several sectors such as construction, and automotive which drives the Chemical Surface Treatment Market growth. For stainless steel, finishing processes weaken its natural corrosion resistance, necessitating re-establishment through chemical treatments such as pickling. For instance, tarnished welding on a tank constructed of 4301 stainless steel indicates a critical loss of corrosion resistance, necessitating the removal of such tarnishing via pickling to restore optimal corrosion resistance efficiently and economically.To know about the Research Methodology :- Request Free Sample Report The chemical surface treatment industry incorporates a diverse range of processes aimed at modifying the surface properties of materials to enhance their performance or aesthetics. This dynamic sector caters to various industries including automotive, aerospace, electronics, and construction. Key treatments include cleaning, etching, passivation, and conversion coating, each tailored to specific materials and applications. These treatments not only improve adhesion, corrosion resistance, and durability but also enable better paint adhesion and solderability. The Chemical Surface Treatment Market is witnessing significant growth due to the burgeoning demand for high-performance materials in manufacturing, stringent regulatory requirements, and the growing emphasis on sustainability. Technological advancements such as nanotechnology and eco-friendly formulations are reshaping the landscape, offering more efficient and environmentally sustainable solutions.

Chemical Surface Treatment Market Trend

Integration of Nanotechnology The integration of nanotechnology has emerged as a significant trend in the chemical surface treatment market, particularly in the synthesis, functionalization, and surface treatment of nanoparticles. Controlling the surface chemical composition and mastering its modification at the nanometer scale are pivotal aspects for achieving high-added value applications with nanoparticles. Surface functionalization plays a crucial role in altering characteristics such as wetting, adhesion, dispersion in matrices, and catalytic properties. This integration facilitates the creation of specific surface sites on nanoparticles, enabling selective molecular attachment and promising applications across various domains including nanofabrication, nanopatterning, self-assembly, nanosensors, bioprobes, drug delivery, pigments, photocatalysis, and LEDs. Novel synthesis methods and approaches are continually being developed to enhance nanoparticle performance for targeted applications. The utilization of nanotechnology in chemical surface treatment not only improves the efficiency and effectiveness of surface modification processes but also opens up new avenues for innovation and advancement in materials science and engineering.Chemical Surface Treatment Market Dynamics

Increasing Demand for Corrosion-Resistant Materials Across Various Industries to Boost Market Growth Among the primary consumers of surface treatment chemicals is the automotive sector, which relies heavily on these compounds to provide a protective coating to vehicles. This coating serves as a crucial barrier against corrosion and wear, thereby bolstering the durability of automotive components. These chemicals are instrumental in priming surfaces for subsequent finishing layers, ensuring optimal adhesion and longevity of the final coating which drives Chemical Surface Treatment Market growth. In the aerospace industry, surface treatment chemicals are utilized to improve the finish of components manufactured using additive processes, by removing prior layers to achieve the desired final condition. In the coil industry, these chemicals are employed to remove oil and grease from coils, utilizing either acidic or alkaline-based cleaners tailored to the nature of contamination or substrate on the coil surface. The metalworking industry extensively relies on surface treatment chemicals for applications such as decoration, reflectivity enhancement, hardness improvement, and corrosion prevention, ultimately extending the lifespan of metals and finding extensive usage in cleaning stainless steel. Similarly, in the wood industry, the demand for surface treatment chemicals is rapidly increasing to enhance the durability of wooden products and mitigate issues like degradation, fungal rot, decay, and termite infestation which boost Chemical Surface Treatment Market growth. The expansion of various industries such as automotive, aerospace, metal, glass, and wood across different regions such as North America, South America, Europe, the Middle East & Africa, and Asia-Pacific is driving the need for high-performance materials that withstand harsh environmental conditions and prolonged usage. There is a growing awareness among industries about the benefits of utilizing surface treatment chemicals, including protection against corrosion and damages caused by changing environmental effects. This awareness has led to increased adoption of these chemicals to prolong the lifespan and maintain the integrity of materials used in diverse applications. Environmental Concerns Associated with Certain Treatment Processes and Chemicals to hamper Market Growth Many traditional surface treatment processes involve the use of hazardous chemicals that pose risks to human health and the environment. For instance, processes such as chromate conversion coating and solvent-based degreasers contain toxic substances such as chromium, cadmium, and volatile organic compounds (VOCs). These chemicals contaminate soil, water, and air during manufacturing, application, and disposal, leading to environmental pollution and adverse health effects for workers and nearby communities which hamper the Chemical Surface Treatment Market growth. As a result, there is increasing regulatory scrutiny and public pressure to phase out or minimize the use of these harmful substances, driving the need for greener alternatives in the surface treatment industry. The disposal of waste generated from chemical surface treatment processes presents significant challenges. Waste streams containing hazardous chemicals are managed and treated according to strict environmental regulations to prevent contamination of landfills, water bodies, and ecosystems, which drives the Chemical Surface Treatment Market growth. Proper disposal methods require specialized infrastructure and processes, which are costly for businesses to implement and maintain. The long-term environmental impact of chemical waste disposal, such as groundwater contamination and soil degradation, underscores the importance of sustainable waste management practices in the surface treatment sector.Chemical Surface Treatment Market Segment Analysis

By Material type, the market is segmented into Metals, Plastics, Glass, Ceramics and Others. Metal Material Type dominated the Chemical Surface Treatment Market in 2023 and is expected to continue its dominance over the forecast period. Metals are widely utilized in manufacturing due to their versatility, strength, and conductivity, making them essential materials for industries such as automotive, aerospace, electronics, construction, and metalworking. Metals are susceptible to corrosion, oxidation and other forms of degradation when exposed to environmental factors such as moisture, chemicals, and temperature fluctuations. Chemical surface treatment plays a crucial role in addressing these challenges by enhancing the corrosion resistance, adhesion properties, and overall durability of metal surfaces. Processes such as cleaning, etching, conversion coating, anodizing, and electroplating are commonly used to modify the surface properties of metals, ensuring optimal performance and longevity in various applications. The versatility of metals allows for a wide range of surface treatment options to meet diverse industry requirements. For instance, in the automotive sector, surface treatment chemicals are used to protect vehicle bodies from corrosion, improve paint adhesion, and enhance overall durability. In the aerospace industry, surface treatment chemicals are crucial for improving the durability and performance of aircraft components, including corrosion protection, surface cleaning, and enhancing bonding properties which drive the Chemical Surface Treatment Market growth. Similarly, in the electronics industry, surface treatment chemicals play a vital role in enhancing the performance and reliability of electronic components, including PCB manufacturing, semiconductor fabrication, and electronic device assembly. The metalworking industry relies on surface treatment chemicals to improve the aesthetic appearance, corrosion resistance, and mechanical properties of metal parts, including metal finishing, plating, anodizing, and passivation of metal surfaces.

Chemical Surface Treatment Market Regional Insights

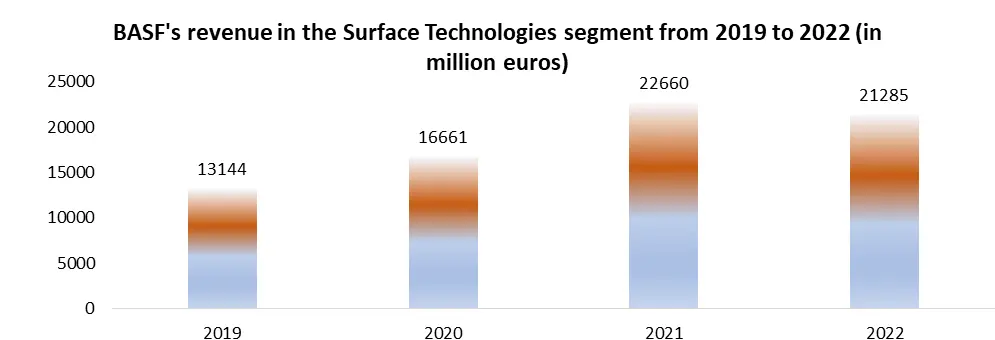

Asia Pacific held the largest Chemical Surface Treatment Market in 2023 and is expected to continue its dominance over the forecast period. The rapid industrialization and urbanization across countries in the Asia Pacific, such as China, India, Japan, South Korea, and Southeast Asian nations, have significantly boosted the demand for surface treatment chemicals across various sectors. As these economies continue to develop, there is a growing need for high-performance materials with enhanced durability, corrosion resistance, and aesthetic appeal, driving the adoption of surface treatment solutions in industries including automotive, aerospace, electronics, construction, and manufacturing. The burgeoning automotive and electronics industries in Asia Pacific, particularly in countries such as China and South Korea, are major consumers of surface treatment chemicals for enhancing the performance, longevity, and aesthetic quality of their products. With Asia Pacific being the world's largest automotive market and a major hub for electronic manufacturing, the demand for surface treatment chemicals in these sectors is expected to remain robust, fueling market growth in the region. The availability of abundant raw materials, skilled labor, and favorable government policies in the Asia Pacific has facilitated the establishment and growth of the chemical surface treatment industry. The region boasts a rapid chemical manufacturing infrastructure, with key players investing in research and development to innovate and develop advanced surface treatment solutions tailored to meet the evolving needs of diverse industries. The presence of a large number of small and medium-sized enterprises (SMEs) in Asia Pacific provides a competitive landscape and fosters innovation, driving continuous advancements in surface treatment technologies and processes. The supportive government initiatives aimed at promoting domestic manufacturing, boosting investments in infrastructure development, and enhancing trade relations have contributed to the overall growth and attractiveness of the chemical surface treatment market in Asia Pacific. The region's strategic geographical location also makes it a key manufacturing and trading hub, attracting investments from multinational companies looking to capitalize on the growing market opportunities in Asia Pacific. Chemical Surface Treatment Market Competitive Landscape The Competitive Landscape of the Chemical Surface Treatment market covers the number of key companies, company size, their strengths, weaknesses, barriers and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers and substitute products that drive the profitability of the companies in the Chemical Surface Treatment industry. The global Chemical Surface Treatment industry includes several market players at the country, regional and global levels. Some of the key companies in the Chemical Surface Treatment Industry are Henkel AG & Co. KGaA (Dusseldorf, Germany), Chemetall GmbH (Frankfurt, Germany), PPG Industries, Inc. (Pittsburgh, Pennsylvania, USA),Nippon Paint Holdings Co., Ltd. (Osaka, Japan),Akzo Nobel N.V. (Amsterdam, Netherlands), Sherwin-Williams Company (Cleveland, Ohio, USA) and Others. BASF has recently opened its largest surface treatment facility in Pinghu, China in 2022. BASF's Chemetall brand has inaugurated its largest surface treatment facility in Pinghu, China, meeting local demand for high-performance solutions. Spanning 60,000 square meters, it's BASF's first site in the Dushan Port Economic Development Zone. Uta Holzenkamp, BASF's Coatings Division President, emphasizes strategic proximity to customers. The move aligns with BASF's commitment to China's chemical market growth. With Asia Pacific as the fastest-growing surface treatment market, BASF's localization strategy aims to strengthen its position. The Pinghu site boasts advanced technology, process automation, and digitalization for efficient manufacturing. It offers a wide portfolio of surface treatment solutions for various industries. BASF's revenue in the Surface Technologies segment, which includes its Chemical Surface Treatment offerings, reflects the company's significant presence and success in providing surface treatment solutions across various industries across the globe.

Chemical Surface Treatment Market Scope: Inquire before buying

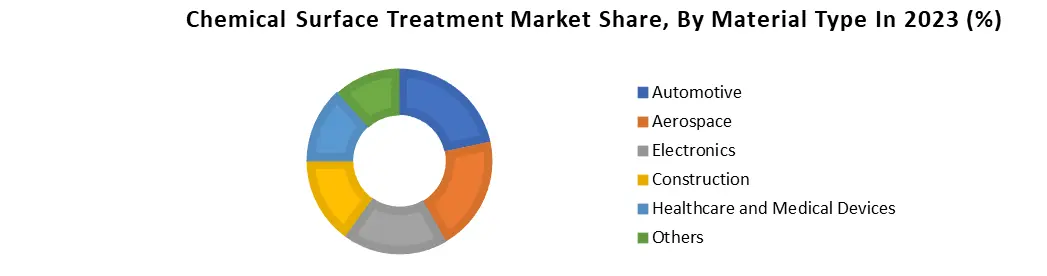

Global Chemical Surface Treatment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.95 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 10.66 Bn. Segments Covered: by Material Type Metals Plastics Glass Ceramics Others by Chemical Type Conversion Coatings Cleaners Anodizing Chemicals Passivation Chemicals Pickling Solutions Others by End User Automotive Aerospace Electronics Construction Healthcare and Medical Devices Others Chemical Surface Treatment Market by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Chemical Surface Treatment Key Players

Global 1. Henkel AG & Co. KGaA (Dusseldorf, Germany) 2. Chemetall GmbH (Frankfurt, Germany) 3. PPG Industries(Pittsburgh, Pennsylvania, USA) 4. Nippon Paint Holdings Co., Ltd. (Osaka, Japan) 5. Akzo Nobel N.V. (Amsterdam, Netherlands) North America 1. Sherwin-Williams Company (Cleveland, Ohio, USA) 2. DuPont de Nemours, Inc. (Wilmington, Delaware, USA) 3. Axalta Coating Systems Ltd. (Philadelphia, Pennsylvania, USA) 4. 3M Company (St. Paul, Minnesota, USA) Europe 1. BASF SE (Ludwigshafen, Germany) 2. Croda International Plc (Snaith, United Kingdom) Asia Pacific 1. Kansai Paint Co., Ltd. (Osaka, Japan) 2. Asian Paints Limited (Mumbai, India) 3. Berger Paints India Limited (Kolkata, India) 4. Nippon Steel Corporation (Tokyo, Japan) Frequently Asked Questions: 1] What is the growth rate of the Global Chemical Surface Treatment Market? Ans. The Global Chemical Surface Treatment Market is growing at a significant rate of 6.95% during the forecast period. 2] Which region is expected to dominate the Global Chemical Surface Treatment Market? Ans. Asia Pacific is expected to dominate the Chemical Surface Treatment Market during the forecast period. 3] What is the expected Global Chemical Surface Treatment Market size by 2030? Ans. The Chemical Surface Treatment Market size is expected to reach USD 10.66 Billion by 2030. 4] Which are the top players in the Global Chemical Surface Treatment Market? Ans. The major top players in the Global Chemical Surface Treatment Market are Henkel AG & Co. KGaA (Dusseldorf, Germany), Chemetall GmbH (Frankfurt, Germany),PPG Industries, Inc. (Pittsburgh, Pennsylvania, USA), Nippon Paint Holdings Co., Ltd. (Osaka, Japan),Akzo Nobel N.V. (Amsterdam, Netherlands), Sherwin-Williams Company (Cleveland, Ohio, USA) and Others. 5] What are the factors driving the Global Chemical Surface Treatment Market growth? Ans. The increasing demand for corrosion protection and technological advancements are expected to drive market growth during the forecast period.

1. Chemical Surface Treatment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Chemical Surface Treatment Market: Dynamics 2.1. Chemical Surface Treatment Market Trends by Region 2.1.1. North America Chemical Surface Treatment Market Trends 2.1.2. Europe Chemical Surface Treatment Market Trends 2.1.3. Asia Pacific Chemical Surface Treatment Market Trends 2.1.4. Middle East and Africa Chemical Surface Treatment Market Trends 2.1.5. South America Chemical Surface Treatment Market Trends 2.2. Chemical Surface Treatment Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Chemical Surface Treatment Market Drivers 2.2.1.2. North America Chemical Surface Treatment Market Restraints 2.2.1.3. North America Chemical Surface Treatment Market Opportunities 2.2.1.4. North America Chemical Surface Treatment Market Challenges 2.2.2. Europe 2.2.2.1. Europe Chemical Surface Treatment Market Drivers 2.2.2.2. Europe Chemical Surface Treatment Market Restraints 2.2.2.3. Europe Chemical Surface Treatment Market Opportunities 2.2.2.4. Europe Chemical Surface Treatment Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Chemical Surface Treatment Market Drivers 2.2.3.2. Asia Pacific Chemical Surface Treatment Market Restraints 2.2.3.3. Asia Pacific Chemical Surface Treatment Market Opportunities 2.2.3.4. Asia Pacific Chemical Surface Treatment Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Chemical Surface Treatment Market Drivers 2.2.4.2. Middle East and Africa Chemical Surface Treatment Market Restraints 2.2.4.3. Middle East and Africa Chemical Surface Treatment Market Opportunities 2.2.4.4. Middle East and Africa Chemical Surface Treatment Market Challenges 2.2.5. South America 2.2.5.1. South America Chemical Surface Treatment Market Drivers 2.2.5.2. South America Chemical Surface Treatment Market Restraints 2.2.5.3. South America Chemical Surface Treatment Market Opportunities 2.2.5.4. South America Chemical Surface Treatment Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Chemical Surface Treatment Industry 2.8. Analysis of Government Schemes and Initiatives For Chemical Surface Treatment Industry 2.9. Chemical Surface Treatment Market Trade Analysis 2.10. The Global Pandemic Impact on Chemical Surface Treatment Market 3. Chemical Surface Treatment Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 3.1.1. Metals 3.1.2. Plastics 3.1.3. Glass 3.1.4. Ceramics 3.1.5. Others 3.2. Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 3.2.1. Conversion Coatings 3.2.2. Cleaners 3.2.3. Anodizing Chemicals 3.2.4. Passivation Chemicals 3.2.5. Pickling Solutions 3.2.6. Others 3.3. Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 3.3.1. Automotive 3.3.2. Aerospace 3.3.3. Electronics 3.3.4. Construction 3.3.5. Healthcare and Medical Devices 3.3.6. Others 3.4. Chemical Surface Treatment Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Chemical Surface Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 4.1.1. Metals 4.1.2. Plastics 4.1.3. Glass 4.1.4. Ceramics 4.1.5. Others 4.2. North America Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 4.2.1. Conversion Coatings 4.2.2. Cleaners 4.2.3. Anodizing Chemicals 4.2.4. Passivation Chemicals 4.2.5. Pickling Solutions 4.2.6. Others 4.3. North America Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 4.3.1. Automotive 4.3.2. Aerospace 4.3.3. Electronics 4.3.4. Construction 4.3.5. Healthcare and Medical Devices 4.3.6. Others 4.4. North America Chemical Surface Treatment Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 4.4.1.1.1. Metals 4.4.1.1.2. Plastics 4.4.1.1.3. Glass 4.4.1.1.4. Ceramics 4.4.1.1.5. Others 4.4.1.2. United States Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 4.4.1.2.1. Conversion Coatings 4.4.1.2.2. Cleaners 4.4.1.2.3. Anodizing Chemicals 4.4.1.2.4. Passivation Chemicals 4.4.1.2.5. Pickling Solutions 4.4.1.2.6. Others 4.4.1.3. United States Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Automotive 4.4.1.3.2. Aerospace 4.4.1.3.3. Electronics 4.4.1.3.4. Construction 4.4.1.3.5. Healthcare and Medical Devices 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 4.4.2.1.1. Metals 4.4.2.1.2. Plastics 4.4.2.1.3. Glass 4.4.2.1.4. Ceramics 4.4.2.1.5. Others 4.4.2.2. Canada Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 4.4.2.2.1. Conversion Coatings 4.4.2.2.2. Cleaners 4.4.2.2.3. Anodizing Chemicals 4.4.2.2.4. Passivation Chemicals 4.4.2.2.5. Pickling Solutions 4.4.2.2.6. Others 4.4.2.3. Canada Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Automotive 4.4.2.3.2. Aerospace 4.4.2.3.3. Electronics 4.4.2.3.4. Construction 4.4.2.3.5. Healthcare and Medical Devices 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 4.4.3.1.1. Metals 4.4.3.1.2. Plastics 4.4.3.1.3. Glass 4.4.3.1.4. Ceramics 4.4.3.1.5. Others 4.4.3.2. Mexico Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 4.4.3.2.1. Conversion Coatings 4.4.3.2.2. Cleaners 4.4.3.2.3. Anodizing Chemicals 4.4.3.2.4. Passivation Chemicals 4.4.3.2.5. Pickling Solutions 4.4.3.2.6. Others 4.4.3.3. Mexico Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Automotive 4.4.3.3.2. Aerospace 4.4.3.3.3. Electronics 4.4.3.3.4. Construction 4.4.3.3.5. Healthcare and Medical Devices 4.4.3.3.6. Others 5. Europe Chemical Surface Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.2. Europe Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.3. Europe Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 5.4. Europe Chemical Surface Treatment Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.4.1.2. United Kingdom Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.4.1.3. United Kingdom Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.4.2.2. France Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.4.2.3. France Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.4.3.2. Germany Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.4.3.3. Germany Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.4.4.2. Italy Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.4.4.3. Italy Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.4.5.2. Spain Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.4.5.3. Spain Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.4.6.2. Sweden Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.4.6.3. Sweden Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.4.7.2. Austria Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.4.7.3. Austria Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 5.4.8.2. Rest of Europe Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 5.4.8.3. Rest of Europe Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Chemical Surface Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.2. Asia Pacific Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.3. Asia Pacific Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Chemical Surface Treatment Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.1.2. China Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.1.3. China Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.2.2. S Korea Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.2.3. S Korea Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.3.2. Japan Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.3.3. Japan Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.4.2. India Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.4.3. India Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.5.2. Australia Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.5.3. Australia Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.6.2. Indonesia Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.6.3. Indonesia Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.7.2. Malaysia Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.7.3. Malaysia Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.8.2. Vietnam Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.8.3. Vietnam Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.9.2. Taiwan Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.9.3. Taiwan Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Chemical Surface Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 7.2. Middle East and Africa Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 7.3. Middle East and Africa Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Chemical Surface Treatment Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 7.4.1.2. South Africa Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 7.4.1.3. South Africa Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 7.4.2.2. GCC Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 7.4.2.3. GCC Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 7.4.3.2. Nigeria Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 7.4.3.3. Nigeria Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 7.4.4.2. Rest of ME&A Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 7.4.4.3. Rest of ME&A Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 8. South America Chemical Surface Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 8.2. South America Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 8.3. South America Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 8.4. South America Chemical Surface Treatment Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 8.4.1.2. Brazil Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 8.4.1.3. Brazil Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 8.4.2.2. Argentina Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 8.4.2.3. Argentina Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Chemical Surface Treatment Market Size and Forecast, by Material Type (2023-2030) 8.4.3.2. Rest Of South America Chemical Surface Treatment Market Size and Forecast, by Chemical Type (2023-2030) 8.4.3.3. Rest Of South America Chemical Surface Treatment Market Size and Forecast, by End User (2023-2030) 9. Global Chemical Surface Treatment Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Chemical Surface Treatment Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Henkel AG & Co. KGaA (Dusseldorf, Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Chemetall GmbH (Frankfurt, Germany) 10.3. PPG Industries, Inc. (Pittsburgh, Pennsylvania, USA) 10.4. Nippon Paint Holdings Co., Ltd. (Osaka, Japan) 10.5. Akzo Nobel N.V. (Amsterdam, Netherlands) 10.6. Sherwin-Williams Company (Cleveland, Ohio, USA) 10.7. DuPont de Nemours, Inc. (Wilmington, Delaware, USA) 10.8. Axalta Coating Systems Ltd. (Philadelphia, Pennsylvania, USA) 10.9. 3M Company (St. Paul, Minnesota, USA) 10.10. BASF SE (Ludwigshafen, Germany) 10.11. Croda International Plc (Snaith, United Kingdom) 10.12. Kansai Paint Co., Ltd. (Osaka, Japan) 10.13. Asian Paints Limited (Mumbai, India) 10.14. Berger Paints India Limited (Kolkata, India) 10.15. Nippon Steel Corporation (Tokyo, Japan) 11. Key Findings 12. Industry Recommendations 13. Chemical Surface Treatment Market: Research Methodology 14. Terms and Glossary